|

|

市場調査レポート

商品コード

1401295

ポリフェニルサルホン(PPSU)の世界市場:2023年~2030年Global Polyphenylsulfone (PPSU) Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ポリフェニルサルホン(PPSU)の世界市場:2023年~2030年 |

|

出版日: 2023年12月29日

発行: DataM Intelligence

ページ情報: 英文 183 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

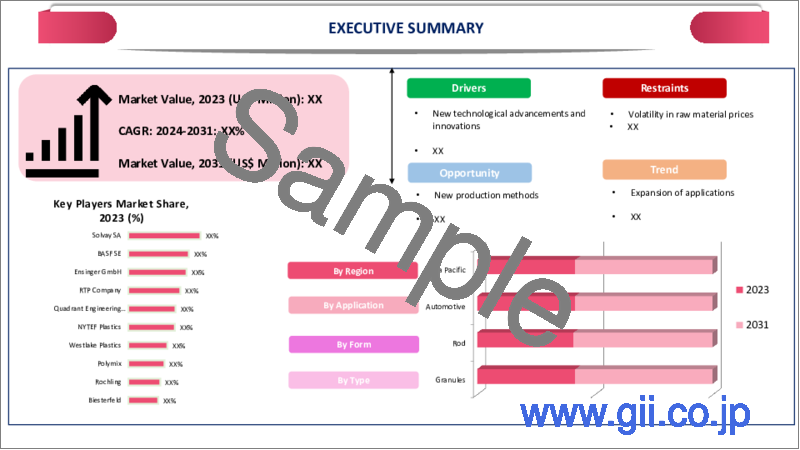

ポリフェニルサルホン(PPSU)の世界市場は、2022年に2億150万米ドルに達し、2030年には2億6,110万米ドルに達すると予測され、予測期間2023-2030年のCAGRは3.4%で成長する見込みです。

その適応性、様々な産業における用途の増加、継続的な技術改善、持続可能性と安全性の重視の高まりにより、世界のPPSU市場は今後数年で上昇すると予想されます。ダイナミックな世界のPPSU業界では、技術革新、費用対効果、市場課題への対応を優先する企業が、製品市場に存在する機会を活用し、繁栄する可能性が高いです。

PPSUのような高性能ポリマーを生産、製造、使用する数多くの有名企業が欧州に拠点を置いています。こうした市場参入企業の存在が技術革新や研究開発を促進し、欧州のPPSU市場の拡大を後押ししています。例えば、2023年には、BASFポリフェニルサルホン(PPSU)は、その卓越した強靭性と耐薬品性により、センサーの寿命が延びる。その結果、乳量計は厳しい農場環境や頻繁な洗浄に耐えることができます。そのため、欧州が大きなシェアを占めています。

市場力学

技術の進歩と革新

技術の進歩は、新素材の創造や既存の素材の新たな用途につながることが多いです。PPSUの場合、継続的な技術革新と調査によって革新的な配合が発見され、産業全体に新たな応用機会が開かれる可能性があります。様々なニーズに対応できるこれらのイノベーションは、PPSUの市場ポテンシャルを高め、その成長を促進します。

例えば、2023年4月、ユーデルPSU(ポリサルホン)とレーデルPPSU(ポリフェニルサルホン)を生産するオハイオ州マリエッタ(米国)の拠点において、ソルベイは、よく知られた国際持続可能性炭素認証(ISCC-Plus)スキームの下、独立した第三者によるマスバランス(MB)連鎖保管(CoC)認証の取得に成功しました。この材料は、ISCC-Plusのマスバランスに準拠した市場初のサルホン材料であり、現在世界中で購入可能です。

ソルベイのマスバランス認証サルホン製品群に使用されているモノマーは、2022年にISCC Plusの認定を受けたジョージア州オーガスタの施設で製造されています。マリエッタ工場での大規模な投資計画により、2024年までソルベイのPSUの生産能力だけでも25%増加し、認証されたサーキュラーサルホンポリマーの世界の供給力が高まることになります。

ヘルスケアにおける需要の高まり

医療技術の進歩に伴い、過酷な環境に耐える高度な部品が必要とされることが多いです。PPSUのような優れた特性と性能を持つ材料へのニーズは、医療技術の継続的な向上に伴って高まると予想されます。

例えば、2021年8月2日、カリフォルニア州アナハイムで8月10日から12日まで開催されるMD&M Westトレードイベント(ブース番号3086)で、Techmer PM, LLCはいくつかの革新的な技術を紹介します。そのひとつが、EUと米国の厳しいPFOA規制を満たし、ピペットチップの内容物放出を可能にする低保持ポリマー添加剤です。

また、クリントンに本社を置くコンパウンダー兼材料設計会社は、キュプロン社の銅系抗菌成分を用いて製造したコンパウンドも展示します。さらに、医療市場の高温要件を満たすポリフェニルサルホン(PPSU)樹脂のカスタム・カラー・ラインナップの拡充も紹介します。

原材料価格の変動

PPSUの生産に不可欠な原材料価格の変動は、予測不可能な製造コストにつながる可能性があります。原材料の予期せぬ高騰は製造コストを押し上げ、PPSUメーカーの利益率に影響を与える可能性があります。PPSU製品の価格変動は、このようなコスト不安定のために、競争力や顧客魅力の低下につながる可能性があります。

PPSUメーカーの利益率は、原材料価格の変動に直接影響を受ける。生産性を維持するため、メーカーは原材料コストの変動に対応して価格設定方法を変更する可能性があります。このような価格変動の結果、消費者が不安になり、PPSU需要にも影響を与える可能性があります。

規制遵守と規格

特定の性能、安全性、環境要件を満たすためには、規制遵守を維持するために必要な投資が頻繁に発生します。追加的な費用は、PPSUの生産コストを全体的に上昇させ、価格が重要視される市場での競争力を低下させる可能性があります。

国や地域によって規範や規制が異なる場合があります。PPSUを国際的に輸出するメーカーは、数多くの規則を遵守する必要があるため、生産・流通プロセスがより複雑になり、コストがかかります。また、厳格な規制は、新しい配合や複雑な配合のPPSUの採用を妨げるような厳しい基準を設けることにより、技術革新を阻害する可能性もあります。PPSUの品質向上やコスト削減につながる新素材や新技術の採用は、コンプライアンス規制によって妨げられる可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 技術の進歩と革新

- ヘルスケアにおける需要の高まり

- 抑制要因

- 原材料価格の変動

- 規制遵守と規格

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- 顆粒

- 粉末

第8章 形状別

- シート

- ロッド

第9章 用途別

- ヘルスケア

- 自動車

- 継手および配管

- 航空宇宙

- 電気機器

- 哺乳瓶

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Solvay SA

- 会社概要

- 製品ポートフォリオと概要

- 財務概要

- 主な発展

- BASF SE

- Ensinger GmbH

- RTP Company

- Quadrant Engineering Plastic Products

- NYTEF Plastics

- Westlake Plastics

- Polymix

- Rochling

- Biesterfeld

第13章 付録

Overview

Global Polyphenylsulfone (PPSU) Market reached US$ 201.5 million in 2022 and is expected to reach US$ 261.1 million by 2030, growing with a CAGR of 3.4% during the forecast period 2023-2030.

Due to its adaptability, increased applications in a variety of industries, continuous technological improvements and the growing emphasis on sustainability and safety, the global PPSU market is expected to rise in the coming years. In the dynamic global PPSU industry, companies that prioritize innovation, cost-effectiveness and addressing market issues are likely to prosper and exploit opportunities present in the product market.

Numerous well-known companies that produce, manufacture and use high-performance polymers like PPSU are based in Europe. The existence of these industry participants promotes innovation, research and development, which helps the PPSU market in Europe expand. For instance, in 2023, owing to its exceptional toughness and chemical resistance, BASF Polyphenylsulfone (PPSU) adds to the sensor's longevity. As a result, milk meters can endure severe farm conditions and frequent cleanings. Therefore, the Europe accounts for the significant market shares.

Dynamics

Technological Advancements and Innovations

Technological developments frequently lead to the creation of new materials or new uses for already-existing ones. In the case of PPSU, continued innovation and research may result in the discovery of innovative formulations, opening up new application opportunities across industries. Through their ability to meet a variety of needs, these innovations increase PPSU's market potential and propel its growth.

For instance, in April 2023, for its Marietta, Ohio (U.S.) site, which produces Udel PSU (polysulfone) and Radel PPSU (Polyphenylsulfone), Solvay has successfully obtained independent third-party mass balance (MB) chain of custody accreditation under the well-known International Sustainability and Carbon Certification (ISCC-Plus) scheme. The materials are reportedly the first ISCC-Plus mass balance compliant sulfone materials on the market and are currently available for purchase, globally.

The monomers used in Solvay's mass balance certified sulfone portfolio are made at the company's Augusta, Georgia facility, which was accredited by ISCC Plus in 2022. A considerable investment programme at Marietta will boost the global availability of certified circular sulfone polymers by increasing Solvay's total capacity alone for PSU by 25% until 2024.

Rising Demand in Healthcare

Medical technology advancements often require advanced components that can endure harsh environments. The need for materials with excellent characteristics and performance, like PPSU, is expected to increase in line with the ongoing improvements in medical technology.

For instance, on August 2, 2021, At the MD&M West trade event (Booth #3086) in Anaheim, California, August 10-12, Techmer PM, LLC will present several innovative technologies. One of them is a low-retention polymer additive that meets strict PFOA restrictions in the EU and US and enables pipette tips to release their contents.

The compounder and materials design company based in Clinton will also showcase the compounds it produces with copper-based antimicrobial ingredients from Cupron Inc. Additionally, it will present an expanded range of custom colors for Polyphenylsulfone (PPSU) resins that meet the high-temperature requirements of the medical market.

Volatility in Raw Material Prices

Unpredictable manufacturing costs can result from fluctuations in the price of essential raw materials utilized in the production of PPSU. Unforeseen rises in the cost of raw materials might drive up production costs and affect PPSU producers' profit margins. Price fluctuations for PPSU products could lead to a decrease in their competitiveness or customer appeal due to this cost instability.

The profit margins of PPSU manufacturers are directly impacted by fluctuating raw material prices. To remain productive, manufacturers may modify their pricing methods in response to fluctuating raw material costs. Consumers may become uncertain as a result of this pricing volatility, which may also have an impact on PPSU demand.

Regulatory Compliance and Standards

Meeting specific performance, safety and environmental requirements is frequently an investment necessary to maintain regulatory compliance. The additional expenses might increase the production cost of PPSU overall, lowering its competitiveness in markets where price is a key consideration.

There may be variations in the norms and regulations across different countries or regions. The production and distribution processes are made more complicated and expensive for manufacturers who export PPSU internationally since they have to make sure they comply with numerous sets of rules. Strict rules may also inhibit innovation by establishing strict standards that prevent the adoption of new or complex PPSU formulations. Adopting new materials or technologies that can improve PPSU's qualities or reduce costs could be hampered by compliance regulations.

Segment Analysis

The global Polyphenylsulfone (PPSU) market is segmented based on Type, Form, Application and region.

Revolutionizing Sterilization in Medical Environments

In medical environments where sterilization is essential for preventing infections, PPSU's capacity to endure numerous sterilization cycles without degrading is critical. Because of their endurance, medical instruments and gadgets can be used repeatedly, which lowers the need for regular replacements and increases cost-effectiveness. Therefore, the healthcare application segment captures the majority of the total segmental share.

For instance, at its plant in Panoli, India, the chemical corporation Solvay, with its headquarters in Belgium, has begun operating its new Veradel PESU (Polyethersulfone) line. Solvay is expanding its capacity in order to meet the substantial demand for this high-performance thermoplastic material, mostly from the water treatment and healthcare sectors.

Geographical Penetration

Technological Advancements and Increasing Demand Drives the Regional Growth

Owing to its superior sterilizing qualities and tolerance to harsh chemicals, PPSU is widely used in the area's well-established healthcare business. The use of PPSU in medical equipment, devices and components has greatly increased demand for the material in North America.

The objective of ongoing research and development is to improve the characteristics of PPSU while identifying novel applications. The includes advancements in formulations, manufacturing techniques and technology that raise the potential applications and capabilities of PPSU. The intensive research and technological innovation conducted in North America is a major factor propelling the PPSU market's expansion. Therefore, North America is leading the global market with more than 1/3rd of the market share.

COVID-19 Impact Analysis

Global supply chains were interrupted in the early stages of the epidemic by lockdowns, travel restrictions and logistical difficulties. It might affect PPSU manufacture since it affected raw material production and shipping.

The pandemic hastened the adoption of digital technology, e-commerce and a renewed focus on sustainability, among other market developments. The strategies and product categories being developed by PPSU producers may have been impacted by these trends.

Russia-Ukraine War Impact Analysis

Geopolitical conflicts have the potential to cause market uncertainty, which can impact investor confidence and decision-making. The growth of the PPSU market could be impacted by this uncertainty if investments are postponed or manufacturing plans are altered. Geopolitical conflicts may cause changes in trade routes and relationships, which could affect import-export trends. It can have an impact on the cost and accessibility of materials and products that are connected to PPSU.

Variations in the geopolitical landscape may also impact the market for PPSU-based products in a given location. For example, changes in the impacted regions' automotive, aerospace and healthcare industries, all of which utilize PPSU extensively may affect the demand for PPSU globally as a whole.

By Type

- Granule

- Powder

By Form

- Sheet

- Rod

By Application

- Healthcare

- Automotive

- Fittings and Plumbing

- Aerospace

- Electrical

- Baby Bottles

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In April 2023, for its Marietta, Ohio (USA) site, which produces Udel PSU (polysulfone) and Radel PPSU (Polyphenylsulfone), Solvay has successfully obtained independent third-party mass balance (MB) chain of custody accreditation under the well-known International Sustainability and Carbon Certification (ISCC-Plus) scheme.

- In May 2021, Zoom T, a Japanese producer of baby products, utilizes Ultrason P 3010 Polyphenylsulfone (PPSU) from BASF in an extrusion blow molding process for manufacturing their "next-generation" baby bottles. The material meets Zoom T's stringent specifications for its safe and feasible curved Dr. Betta brand baby bottles.

- In 2023, owing to its exceptional toughness and chemical resistance, BASF Polyphenylsulfone (PPSU) adds to the sensor's longevity. As a result, milk meters can endure severe farm conditions and frequent cleanings.

Competitive Landscape

The major global players in the market include Solvay SA, BASF SE, Ensinger GmbH, RTP Company, Quadrant Engineering Plastic Products, NYTEF Plastics, Westlake Plastics, Polymix, Rochling and Biesterfeld.

Why Purchase the Report?

- To visualize the global Polyphenylsulfone (PPSU) market segmentation based on Type, Form, Application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of Polyphenylsulfone (PPSU) market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Type mapping available as excel consisting of key products of all the major players.

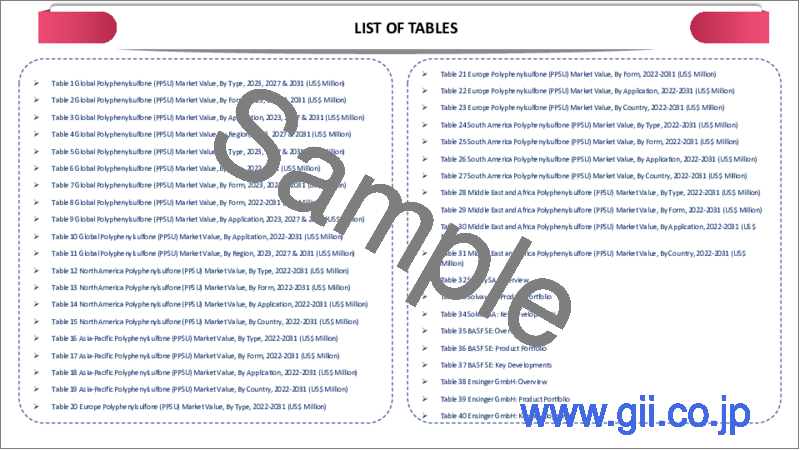

The global Polyphenylsulfone (PPSU) market report would provide approximately 61 tables, 58 figures and 183 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Form

- 3.3. Snippet by Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Technological Advancements and Innovations

- 4.1.1.2. Rising Demand in Healthcare

- 4.1.2. Restraints

- 4.1.2.1. Volatility in Raw Material Prices

- 4.1.2.2. Regulatory Compliance and Standards

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Granule*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Powder

8. By Form

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 8.1.2. Market Attractiveness Index, By Form

- 8.2. Sheet*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Rod

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Healthcare*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Automotive

- 9.4. Fittings and Plumbing

- 9.5. Aerospace

- 9.6. Electrical

- 9.7. Baby Bottles

- 9.8. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Russia

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Solvay SA*

- 12.1.1. Company Overview

- 12.1.2. Type Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. BASF SE

- 12.3. Ensinger GmbH

- 12.4. RTP Company

- 12.5. Quadrant Engineering Plastic Products

- 12.6. NYTEF Plastics

- 12.7. Westlake Plastics

- 12.8. Polymix

- 12.9. Rochling

- 12.10. Biesterfeld

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us