|

|

市場調査レポート

商品コード

1396680

ダクトの世界市場-2023年~2030年Global Duct Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ダクトの世界市場-2023年~2030年 |

|

出版日: 2023年12月15日

発行: DataM Intelligence

ページ情報: 英文 191 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

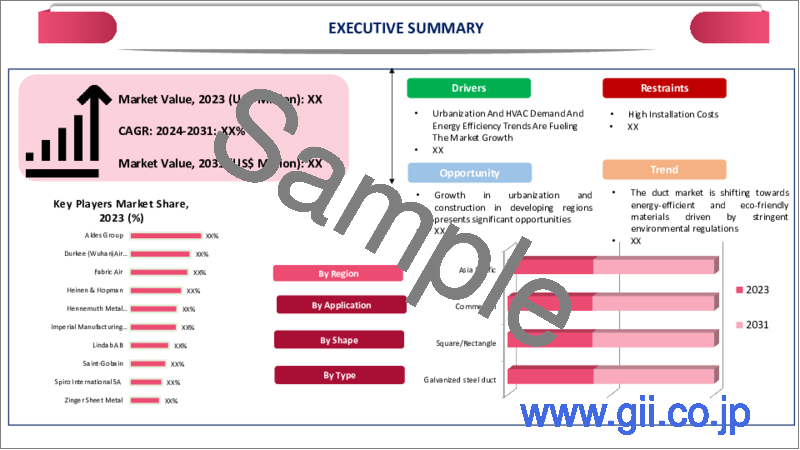

世界のダクト市場は2022年に121億米ドルに達し、2030年には215億米ドルに達すると予測され、予測期間2023-2030年のCAGRは7.4%で成長する見込みです。

世界のダクト市場は、変貌する産業における熟練したHVAC技術者のニーズの高まりにより成長を遂げています。気候制御と室内空気の質に重要なHVACシステムは、現代のエネルギー効率と環境に配慮した基準を満たすために進化しています。HVACダクトの需要増加は、高度なHVAC技術で冷暖房システムを維持するための要件が原動力となっています。

米国エネルギー情報局(EIA)の報告によると、米国の暖房は主に商業ビルで使用されており、総エネルギー使用量の32%を占めています。商業ビルにおけるエネルギー需要の高まりは、ダクトを含む効率的なHVACシステムの必要性を強調し、ダクト市場の拡大を促進しています。

アジア太平洋がこの市場を独占しているのは、産業と商業の堅調な成長、建設とインフラ・プロジェクトの増加によるもので、効率的なHVACシステムが必要とされ、空気流通におけるダクトの需要に寄与しています。さらに、中国やインドのような人口の多い国でのHVACソリューションに対する需要の高まりが、アジア太平洋地域のダクト市場をリードする地位を確固たるものにしています。

力学

都市化が世界のダクト市場成長の原動力

世界のダクト市場は、住宅・商業ビルのダクト市場を促進する都市化の進展によって牽引されると予想されます。世界化の進展に見られるように、都市化の進展の影響は大きく、大都市や中小都市におけるダクトシステムの需要増加をさらに促進しています。国連の報告書によると、2050年までに都市人口は25億人増加し、インフラと不動産に対する大規模な需要の機会を生み出すと予想されています。

この急増により、洗練された都市環境や資産への投資機会が広がっています。不動産は個人と企業の双方に付加価値を与え、スマートなアパートメント、オフィス複合施設、レジャー施設などによる都市ルネッサンスをもたらしています。都市化は不動産需要の増加を促し、さまざまな分野に影響を与え、生活水準やヘルスケア、経済発展の進歩に貢献しています。都市化は不動産セクターをポジティブに変化させ、投資と開発にとって有利な分野となっています。

HVAC需要とエネルギー効率動向

先進的なHVACシステムの需要は、世界のダクト市場の主要な促進要因になると予想されます。米国空調請負業者協会(ACCA)の報告書によると、米国のHCVACサービス市場は2019年の256億米ドルから2030年には358億米ドルに増加すると予想されており、これはHVACシステムに対する非の打ちどころのない需要です。この拡大には、エネルギー効率の高いHVACシステムに対するニーズの高まりと、HVAC設置の顕著な急増につながる建設業界の繁栄が拍車をかけています。

さらに、今後の規制により、2023年までに住宅用セントラル空調およびヒートポンプ・システムのエネルギー効率基準が義務付けられる予定です。消費者がより効率的で環境に優しい冷暖房ソリューションを積極的に求める中、こうした規制は米国内だけでなく世界的にHVACサービス分野の成長を促しています。その結果、この力学が世界のダクト市場と関連HVACサービスの成長を促進しています。

高い設置コスト

ダクト市場は、初期設置コストの高さという抑制要因に直面しています。特に大規模ビルでのダクトの設置は、経済的に負担が大きいです。コストには材料、労働力、設備が含まれるため、企業や住宅所有者にとっては多額の投資となります。この出費は、ダクトシステムを選択する潜在的な顧客を遠ざけ、解決策の遅れや代替策を招き、ダクト市場の成長に影響を与える可能性があります。

この制約に対処するため、業界は費用対効果の高い設置方法を模索したり、ダクトシステムをより利用しやすくするための融資オプションを提供したりする必要があるかもしれないです。高い設置コストに対処することは、より広く受け入れられ、多様な用途でダクトシステムの可能性をフルに発揮するために極めて重要です。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 世界のダクト市場成長の原動力となる都市化

- HVAC需要とエネルギー効率の動向

- 抑制要因

- 高い設置コスト

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- 亜鉛メッキ鋼板ダクト

- アルミダクト

- フレキシブルダクト

- ファブリックダクト

- PVCケーブルダクト

- ポリエチレンダクト

- ガラス繊維ダクト

- その他

第8章 形状別

- 丸型

- ハーフラウンド

- 正方形/長方形

- 三角形

- その他

第9章 用途別

- 公共施設

- 商業施設

- 産業施設

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Lindab

- 会社概要

- 製品ポートフォリオと概要

- 財務概要

- 主な発展

- Saint-Gobain Performance Plastics(ISOVER)

- CMS Group of Companies

- Imperial Manufacturing Group

- FabricAir

- THERMAFLEX

- Durkeesox(Wuhan)Air Dispersion System Co., LTD

- Aldes Group

- KAD AIR CONDITIONING(BIN DASMAL GROUP)

- DMI Companies

第13章 付録

Overview

Global Duct Market reached US$ 12.1 billion in 2022 and is expected to reach US$ 21.5 billion by 2030, growing with a CAGR of 7.4% during the forecast period 2023-2030.

The global duct market is experiencing growth due to the rising need for skilled HVAC technicians in a transforming industry. HVAC systems, crucial for climate control and indoor air quality, are evolving to meet contemporary energy-efficient and environmentally conscious standards. The increasing demand for HVAC ducts is driven by the requirement for maintaining cooling and heating system with advanced HVAC technologies.

According to the report of U.S. Energy Information Administration (EIA), the space heating in U.S. is majorly used in commercial buildings which makes of 32% of total energy usage. The escalating energy demand in commercial buildings emphasizes the necessity for efficient HVAC systems, including ducts, fostering the expansion of the duct market.

The Asia-Pacific dominates this market due to robust industrial and commercial growth, increased construction and infrastructure projects, necessitating efficient HVAC systems and contributing to the demand for ducts in air distribution. Moreover, the rising demand for HVAC solutions in populous countries like China and India solidifies Asia-Pacific's position as the leading duct market.

Dynamics

Urbanization Fueling Global Duct Market Growth

The duct market globally is expected to be driven with the growing urbanization which is fostering the residential and commercial buildings duct market. The impact of growing urbanization is significant, which can be seen with the growing globalization, further fuels to the rise in demand of duct systems in the big and smaller cities. According to the report of United Nations, by 2050 urban population is expected to grow by 2.5 billion which will creating an opportunity for the massive demand for infrastructure and real estate.

The surge has opened up opportunities for investment in sophisticated urban environments and assets. Real estate is adding value to both individuals and businesses, leading to an urban renaissance with smart apartments, office complexes and leisure facilities. Urbanization is driving an increased demand for real estate, influencing multiple sectors and contributing to advancements in living standards, healthcare and economic development.. Urbanization has positively transformed the real estate sector, making it a lucrative field for investment and development.

HVAC Demand and Energy Efficiency Trends

The advanced HVAC system demand expected to be the major driver in the global duct market . According to a report by the Air Conditioning Contractors of America (ACCA), the HCVAC services market in U.S. is expected to rise from US$25.6 billion in 2019 to US$35.8 billion in 2030 which the impeccable demand for HVAC systems. The expansion is fueled by the escalating need for energy-efficient HVAC systems and the thriving construction industry, leading to a notable surge in HVAC installations.

Furthermore, forthcoming regulations will require energy efficiency standards for residential central air-conditioning and heat pump systems by 2023. The regulations are fueling the growth of the HVAC services sector, both within U.S. and globally, as consumers actively seek more efficient and environmentally friendly heating and cooling solutions. Consequently, this dynamic is fostering the growth of the globally duct market and associated HVAC services.

High Installation Costs

The duct market faces a restraint in the form of high initial installation costs. Setting up ducts, particularly in large buildings, can be financially burdensome. The costs encompass materials, labor and equipment, making it a substantial investment for businesses and homeowners. The expense can deter potential customers from opting for duct systems, leading to delayed or alternative solutions and impacting the growth of the duct market.

To address this constraint, the industry may need to explore cost-effective installation methods or provide financing options to make duct systems more accessible, potentially mitigating this barrier to entry and stimulating market growth. Addressing the high installation costs is crucial for fostering wider acceptance and realizing the full potential of duct systems in diverse applications.

Segment Analysis

The global duct market is segmented based on type, shape, application and region.

Galvanized Steel Dominates Duct Market Due to Rust Resistance and Affordability

Galvanized steel holds the largest share in the duct market, primarily employed in constructing ductwork due to it's durability and rust resistance. Commonly referred to as galvanized sheet metal, it is the predominant material chosen for fabricating duct systems, providing protection against corrosion and eliminating the need for additional painting expenses. Galvanized steel ducts offer soundproofing and high insulation, ensuring optimal performance.

The material presents significant advantages, including cost reduction, prolonged lifespan, toughness and low maintenance requirements. The robust and sturdy nature of galvanized steel ducts minimizes damage during transportation, installation and assembly. With cathode protection from galvanized coatings, the ducts guarantee full-time protection, ease of inspection and resilience against corrosion, establishing galvanized steel as the leading choice in the duct market.

Geographical Penetration

Asia-Pacific Dominates Duct Market Due to Real Estate Boom and Sustainability Focus

Asia-Pacific dominates the duct market, driven growing commercialization and real estate investment in the region. In 2022, APAC markets, excluding China, began recovering from COVID restrictions. The region's attractiveness for ductwork lies in its dynamic real estate and construction industry. Singapore leads in investment and city development prospects, drawing substantial overseas investments that would typically target China, Hong Kong and Japan.

Southeast Asian emerging markets like Indonesia, the Philippines and Vietnam are on the rise, with their rapid economic growth and expanding consumer classes. APAC's focus on sustainability, including net zero carbon emissions, contributes to ductwork demand as businesses adhere to international standards. Despite challenges like falling real estate transaction volumes, high inflation and rising construction costs, the Asia-Pacific remains the largest share in the duct market due to its economic potential and investment opportunities.

COVID-19 Impact Analysis

The COVID-19 pandemic has reverberated through the duct market by affecting the construction sector. As construction projects were delayed or halted due to lockdowns and labor shortages, the demand for ductwork saw disruptions. The was exacerbated by supply chain interruptions and restrictions on manufacturing activities. Moreover, uncertainty surrounding the pandemic led to reduced investment in commercial and residential real estate, further impacting the duct market.

The construction sector, including ductwork, has the potential to be a catalyst for economic recovery by creating jobs. Recovery measures that promote sustainability and digitalization in the construction industry can lead to long-term growth. International labor standards and social dialogue are essential for a human-centered recovery in the construction and duct market, mitigating the adverse effects of the pandemic.

Russia-Ukraine War Impact Analysis

The Russia-Ukraine war has had a profound impact on the duct market, particularly concerning the production of key materials and the distribution of products. Ukraine, a significant steel producer, played a crucial role in the global duct market. However, the war disrupted steel and iron production in Ukraine, hampering the supply chain for duct materials.

Exports of bulk iron ore, essential for manufacturing duct components, have ceased from Ukrainian ports. With logistical challenges, limited export routes and transportation difficulties due to the war, the duct market faced disruptions in the supply of critical materials. The conflict also led to the seizure of steel mills and factories by Russian and separatist forces, further affecting production capacity. The war's impact on Ukrainian steel industry has sent ripples throughout the global duct market, causing uncertainties in material availability and affecting supply chains.

By Type

- Galvanized Steel Duct

- Aluminum Duct

- Flexible Duct

- Fabric Duct

- PVC Cable Duct

- Polyethylene Duct

- Fiberglass Duct

- Others

By Shape

- Round

- Half Round

- Square/Rectangular

- Triangular

- Others

By Application

- Public Facilities

- Commercial Facilities

- Industrial Facilities

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

Competitive Landscape

The major global players in the market include: Lindab, Saint-Gobain Performance Plastics (ISOVER), CMS Group of Companies, Imperial Manufacturing Group, FabricAir, Thermaflex, Durkeesox (Wuhan)Air Dispersion System Co., LTD, Aldes Group, Kad Air Conditioning (Bin Dasmal Group), DMI Companies.

Why Purchase the Report?

- To visualize the global duct market segmentation based on type, shape, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of duct market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Type mapping available as excel consisting of key Types of all the major players.

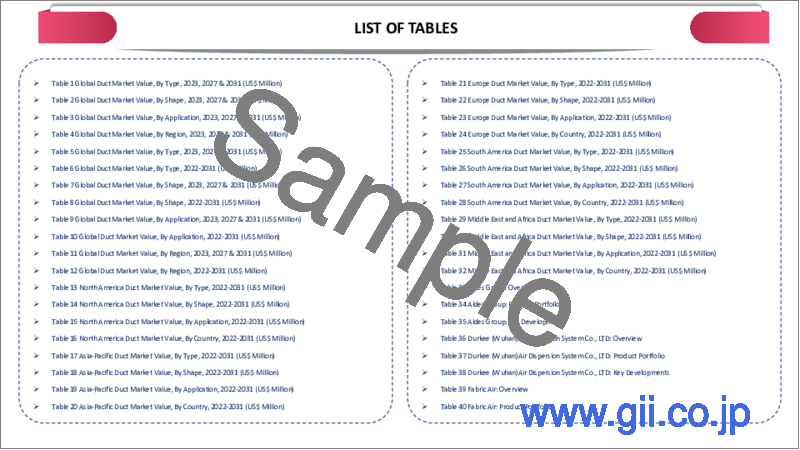

The global duct market report would provide approximately 61 tables, 65 figures and 191 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Shape

- 3.3. Snippet by Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Urbanization Fueling Global Duct Market Growth

- 4.1.1.2. HVAC Demand and Energy Efficiency Trends

- 4.1.2. Restraints

- 4.1.2.1. High Installation Costs

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Galvanized Steel Duct*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Aluminum Duct

- 7.4. Flexible Duct

- 7.5. Fabric Duct

- 7.6. PVC Cable Duct

- 7.7. Polyethylene Duct

- 7.8. Fiberglass Duct

- 7.9. Others

8. By Shape

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 8.1.2. Market Attractiveness Index, By Shape

- 8.2. Round*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Half Round

- 8.4. Square/Rectangular

- 8.5. Triangular

- 8.6. Others

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Public Facilities*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Commercial Facilities

- 9.4. Industrial Facilities

- 9.5. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.5.1. Germany

- 10.3.5.2. UK

- 10.3.5.3. France

- 10.3.5.4. Italy

- 10.3.5.5. Russia

- 10.3.5.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Shape

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Lindab*

- 12.1.1. Company Overview

- 12.1.2. Type Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Saint-Gobain Performance Plastics (ISOVER)

- 12.3. CMS Group of Companies

- 12.4. Imperial Manufacturing Group

- 12.5. FabricAir

- 12.6. THERMAFLEX

- 12.7. Durkeesox (Wuhan)Air Dispersion System Co., LTD

- 12.8. Aldes Group

- 12.9. KAD AIR CONDITIONING (BIN DASMAL GROUP)

- 12.10. DMI Companies

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us