|

|

市場調査レポート

商品コード

1396644

無水カフェインの世界市場-2023年~2030年Global Anhydrous Caffeine Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 無水カフェインの世界市場-2023年~2030年 |

|

出版日: 2023年12月15日

発行: DataM Intelligence

ページ情報: 英文 199 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の無水カフェイン市場は、2022年に13億米ドルに達し、2023年から2030年の予測期間にCAGR 8.3%で成長し、2030年には26億米ドルに達すると予測されています。

無水カフェインは、その刺激特性により、エネルギー、注意力、認知機能を一時的に高めることができます。人々が生産性と精神の明瞭さを重視するようになったため、無水カフェインを含む製品の需要が増加しています。無水カフェインは、プレワークアウト・サプリメントやスポーツ・パフォーマンス製品によく使われています。また、アスリートやフィットネス愛好家に人気の代謝を高める効果もあります。

カフェインは代謝率を高め、脂肪の酸化を促進するため、減量や脂肪燃焼のサプリメントとしてよく使われます。世界的に体重管理とフィットネスが高まっているため、無水カフェインを含む製品の需要も高まっています。無水カフェインは、エナジードリンク、コーヒー風味スナック、機能性飲料など、さまざまな飲食品に配合されています。

アジア太平洋は、世界の無水カフェイン市場の1/3以上を占める成長地域の一つであり、この地域では、覚醒度や認知能力を向上させるなど、カフェインの利点に対する意識が高まっており、無水カフェインを含む製品の需要を促進しています。現在、消費者は健康志向を高め、全体的な幸福感を高める製品を求めるようになっており、エナジードリンク、栄養補助食品、機能性食品のようなカフェイン入り製品の需要は増加傾向にあります。

力学

エナジードリンク消費の増加

エナジードリンクの消費の増加は、無水カフェインメーカーとその製品の成長にプラスの影響を与えると予想されます。エナジードリンクは、素早くエネルギーを補給し、覚醒度を向上させたい消費者に人気の選択肢となっており、無水カフェインはこれらの飲料の主要成分となっています。エナジードリンクは、望ましい刺激効果をもたらすために、主成分としてカフェインを含むことが多いです。

例えば、2022年1月25日、スターバックスは、スターバックスBAYAエナジーでエナジードリンクのカテゴリーにデビューします。この新製品は、スターバックスとペプシコの北米コーヒー・パートナーシップのコラボレーションによって開発されたもので、ペプシコはRTDコーヒーとエネルギー製品の開発に注力しています。

企業間のコラボレーションが市場を押し上げる

企業間のコラボレーションにより、研究開発への取り組みが強化され、新商品や改良商品の創出につながります。各社は科学的専門知識を結集し、無水カフェインの革新的な配合、抽出方法、用途を開発します。共同作業の結果、より幅広い無水カフェイン製品が開発され、さまざまな消費者の嗜好や市場セグメントに対応できるようになり、この多様化によって企業は新しい顧客を獲得し、市場でのプレゼンスを拡大することができます。

例えば、2021年7月27日、ネスレとスターバックス・コーポレーションは、東南アジア、オセアニア、ラテンアメリカの特定市場にスターバックスのレディ・トゥ・ドリンク・コーヒー飲料を導入するための共同取り組みを発表しました。この提携は、2022年までにこれらのコーヒー製品を消費者に提供することを目指しています。ネスレは、成長機会を活用し、特に若い層を中心に急速に発展する消費者層にアピールすることで、RTDコーヒー分野でのプレゼンス拡大を計画しています。

技術の進歩

抽出・精製プロセスの技術的向上により、コーヒー豆やその他の供給源から無水カフェインをより多く得ることができるようになっています。超臨界流体抽出や選択的吸着などの高度な抽出法により、原料からカフェインをより効率的に分離できるようになっています。持続可能で環境に優しい技術の革新は、無水カフェイン産業に影響を与えています。水ベースのプロセスなど環境にやさしい抽出法は、溶媒の使用を減らし、環境への影響を最小限に抑えます。

例えば、2023年3月16日、スターバックスのニュース記事によると、スターバックスはマストレナIIエスプレッソマシンや新しいスターバックスコールドブリューワーを含む最先端のコーヒー抽出機器を導入し、これらの新しいマシンは高品質のコーヒー飲料を確保し、抽出プロセスを合理化する業界をリードする技術を提供しています。スターバックスは、Starbucks Safety Lyftのようなプログラムを通じてパートナーの安全へのコミットメントを拡大しており、このイニシアチブは遅番勤務のパートナーに自宅までの送迎を提供し、彼らの安全と幸福を確保しています。

無水カフェインの過剰摂取による健康への懸念の高まり

無水カフェインはその興奮作用から、活力を与える効果を求める人々によって誤用・乱用されています。無水カフェインを過剰に摂取すると、カフェインの毒性が高まり、心拍数の上昇、不安、落ち着きのなさ、さらに深刻な健康上の合併症などの症状が現れます。無水カフェインは有害であるため、少量のカフェインでも身体に大きな影響を及ぼし、この高い効力により、健康への悪影響につながる過剰摂取を防ぐためには、正確な摂取量の管理が重要になります。

無水カフェインに関連する高い効力と潜在的な健康リスクは、さまざまな管轄区域で規制上の懸念を引き起こしています。規制機関は、誤用を防止し消費者を保護するために、安全な使用量の上限と表示要件を定めることに注力しています。無水カフェインの摂取は、特に過剰に摂取した場合、様々な副作用を引き起こす可能性があり、これらの副作用には、動悸、心拍数の増加、神経過敏、不眠、胃腸障害、重度の場合は発作や心血管イベントが含まれます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- エナジードリンク消費の増加

- 企業間のコラボレーションが市場を押し上げる

- 技術の進歩

- 抑制要因

- 無水カフェインの過剰摂取による健康懸念の高まり

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- 天然

- 合成

第8章 形状別

- 粉末

- 粒状

第9章 原料別

- 茶葉

- コーヒー豆

- カカオ豆

- 合成原料

- ガラナ豆

- その他

第10章 用途別

- 飲料

- 医薬品

- 栄養補助食品

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Spectrum Chemical Manufacturing Corp.

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Cambridge Commodities Limited

- BASF SE

- CSPC Pharmaceutical Group Limited

- LobaChemie Pvt. Ltd.

- Foodchem International Corporation

- PureBulk

- Fooding Group Limited

- Jayanti

- Bakul Group of Companies

第14章 付録

Overview

Global Anhydrous Caffeine Market reached US$ 1.3 billion in 2022 and is expected to reach US$ 2.6 billion by 2030, growing with a CAGR of 8.3% during the forecast period 2023-2030.

Anhydrous caffeine can provide a temporary boost in energy, alertness and cognitive function due its stimulant properties. As people have become more focused on productivity and mental clarity, the demand for products containing anhydrous caffeine has increased. Anhydrous caffeine is commonly used for pre-workout supplements and sports performance products. It also increases metabolism which is popularly used by athletes and fitness enthusiasts.

Caffeine is often used as a supplement in weight loss and fat-burning because it is used to increase metabolic rate and promote fat oxidation. Globally weight management and fitness have risen so the demand for products containing anhydrous caffeine also increases. It is incorporated with various food and beverage products like energy drinks, coffee-flavored snacks and functional beverages.

Asia-Pacific is among the growing regions in the global anhydrous caffeine market covering more than 1/3rd of the market and the region has rising awareness about the benefits of caffeine like it improves alertness and cognitive performance, which is driving demand for products that contain anhydrous caffeine. Nowadays consumers becoming more health-conscious and seek products that enhance their overall well-being, the demand for caffeinated products like energy drinks, dietary supplements and functional foods is on the rise.

Dynamics

Increasing Consumption of Energy Drinks

The increasing consumption of energy drinks is expected to have a positive impact on the growth of anhydrous caffeine manufacturers and their products. Energy drinks have become a popular choice for consumers seeking a quick energy boost and improved alertness and anhydrous caffeine is a key ingredient in these beverages. Energy drinks often contain caffeine as a primary ingredient to provide the desired stimulating effects.

For instance, on 25 January 2022, Starbucks is making its debut in the energy drink category with Starbucks BAYA Energy, a ready-to-drink beverage. Crafted from caffeine naturally found in coffee fruit and fortified with antioxidant vitamin C for immune support, Starbucks BAYA Energy offers consumers a boost of feel-good energy and this new product was developed through the collaboration of Starbucks and PepsiCo's North American Coffee Partnership, which focuses on creating RTD coffee and energy products.

Collaboration Between Companies Boost the Market

Collaboration allows companies to increase their research and development efforts, which leads to the creation of new and improved products. Companies combine their scientific expertise to develop innovative formulations, extraction methods and applications for anhydrous caffeine. Collaborative efforts can result in the development of a wider range of anhydrous caffeine products, catering to different consumer preferences and market segments and this diversification can help companies capture new customers and expand their market presence.

For instance, on 27 July 2021, Nestle and Starbucks Corporation announced a collaborative effort to introduce Starbucks Ready-to-Drink coffee beverages to specific markets in Southeast Asia, Oceania and Latin America. The partnership aims to bring these coffee products to consumers by 2022. Nestle plans to expand its presence in the RTD coffee sector capitalizing on growth opportunities and appealing to a rapidly developing consumer base particularly younger demographics.

Technology Advancement

Technological improvements in extraction and purification processes have led to higher yields of anhydrous caffeine from coffee beans and other sources. Advanced extraction methods, such as supercritical fluid extraction and selective adsorption enable more efficient separation of caffeine from raw materials. Innovations in sustainable and green technologies are influencing the anhydrous caffeine industry. Environmentally friendly extraction methods such as water-based processes reduce the use of solvents and minimize environmental impact.

For instance, on 16 March 2023, according to Starbucks news stories, Starbucks is introducing cutting-edge coffee brewing equipment, including the Mastrena II espresso machines and the new Starbucks Cold Brewer and these new machines offer industry-leading technology to ensure high-quality coffee beverages and streamline the brewing process. Starbucks is extending its commitment to partner safety through programs like Starbucks Safety Lyft and this initiative provides rides home for partners working late shifts, ensuring their security and well-being.

Excessive Consumption of Anhydrous Caffeine has Risen Health Concerns

Due to its stimulant properties, anhydrous caffeine is misused or abused by individuals seeking its energizing effects. Overconsumption of anhydrous caffeine in excessive amounts results in increased caffeine toxicity, leading to symptoms like rapid heart rate, anxiety, restlessness and even more severe health complications. Anhydrous caffeine is harmful, which means that even small amounts of caffeine significant impact on the body and this high potency makes accurate dosage control critical to prevent overconsumption, which can lead to adverse health effects.

The high potency and potential health risks associated with anhydrous caffeine have raised regulatory concerns in various jurisdictions. Regulatory agencies are focused on establishing safe usage limits and labeling requirements to prevent misuse and protect consumers. Anhydrous caffeine consumption can lead to various adverse effects, especially when taken in excessive amounts and these effects may include palpitations, increased heart rate, nervousness, insomnia, gastrointestinal disturbances and in severe cases, seizures and cardiovascular events.

Segment Analysis

The global anhydrous caffeine market is segmented based on type, form, source, application and region.

Adoption of Tea Leaves Boosts the Market

Anhydrous caffeine when added to tea leaves enhances the caffeine content of the resulting tea, which can be particularly relevant for tea varieties with naturally lower caffeine levels such as white tea or herbal tea. By adding anhydrous caffeine, tea manufacturers can create tea blends with higher caffeine content to cater to consumers seeking a stronger energy boost. It also provides flexibility for creating tea blends with specific concentrations of caffeine. Thus, tea leaves as a source hold a significant share in the global Anhydrous caffeine market and expected to cover more than 34.5% in the forecast period.

For instance, on 24 August 2023, according to a paper published in the National Library of Medicine Caffeine is present in energy drinks, soft drinks, gums and medications. Consumption patterns vary globally, with average daily caffeine intake ranging from around 76 mg to over 400 mg per person. tea leaves, anhydrous caffeine can contribute to the overall caffeine content of tea beverages. Different types of tea leaves contain varying amounts of caffeine, with factors like steeping time and water temperature affecting the caffeine extraction during brewing.

Geographical Penetration

Adoption of Caffeine in Medication in North America Boosts the Market

North America is among the largest regions in the global Anhydrous Caffeine market covering more than 1/3rd of the market and the users in the region seeking functional beverages that offer energy-boosting and performance-enhancing benefits. Anhydrous caffeine is a natural stimulant that improves alertness and cognitive function, making it a sought-after ingredient in products targeting health-conscious consumers.

For instance, a study from North Carolina, U.S., was presented on July 25, 2023, according to the journal published by Elsevier. The study analyses the use of 3D printing technology to develop customized oral dosage forms for medication, with a focus on dose titration. Due to its well-known effects and potential side effects, anhydrous caffeine was employed as the medication. Polyvinyl alcohol, glycerol and starch were combined to make a filament that was then used to 3D print caffeine tablets with concentrations of 25, 50 and 100 mg.

Competitive Landscape

The major global players in the market include: Spectrum Chemical Manufacturing Corp., Cambridge Commodities Limited, BASF SE, CSPC Pharmaceutical Group Limited, LobaChemie Pvt. Ltd., Foodchem International Corporation, PureBulk, Fooding Group Limited, Jayanti and Bakul Group of Companies.

COVID-19 Impact Analysis

The global lockdowns, travel restrictions and disruptions to international trade during the pandemic have affected supply chains and this could lead to delays in the import and export of anhydrous caffeine, potentially impacting the availability of the product. The closure of restaurants, cafes and other food service establishments during lockdowns resulted in reduced demand for products containing anhydrous caffeine, such as energy drinks and supplements. On the other hand, increased consumption of at-home beverages and products could have partially offset this decline.

Social distancing measures and lockdowns affected manufacturing facilities, potentially leading to production slowdowns or shutdowns. Reduced workforce availability and adherence to safety protocols could impact the production of anhydrous caffeine and products containing it. Transportation disruptions, including limited air freight and border closures, could have affected the movement of anhydrous caffeine and related products across regions, potentially causing delays in distribution.

Russia-Ukraine War Impact

If the conflict disrupts transportation routes, especially those used for importing raw materials or exporting finished products, it could lead to supply chain disruptions and this might result in delays or shortages of anhydrous caffeine, affecting the availability of products that contain it. Trade tensions and export restrictions could impact the flow of anhydrous caffeine and related products between countries. Export bans, tariffs or other trade barriers could lead to increased costs and reduced access to key markets.

Geopolitical tensions often lead to market uncertainties and fluctuations in currency exchange rates and this could impact the cost of anhydrous caffeine imports, potentially leading to price volatility for products that contain it. In times of geopolitical uncertainty, consumers might adjust their spending habits and preferences. If the situation leads to economic uncertainties or changes in consumer sentiment, it could affect the demand for products containing anhydrous caffeine.

By Type

- Natural

- Synthetic

By Form

- Powder

- Granular

By Source

- Tea Leaves

- Coffee Beans

- Cacao Beans

- Synthetic Sources

- Guarana Beans

- Others

By Application

- Beverages

- Pharmaceuticals

- Dietary Supplements

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In July 2022, Kudos specializes in manufacturing specialty chemicals used as ingredients in beverages and pharmaceuticals. The company possesses a manufacturing facility located near Chandigarh. The approved resolution plan mandates that UPL invest Rs. 237 crores in Kudos over two years and this acquisition is expected to enable UPL to enhance its offering of value-added products to customers, leveraging synergies with its existing business operations.

- In May 2021, Caffeine Anhydrous, Inc., a manufacturing company specializing in caffeine anhydrous, has successfully increased its production capacity by 50% to cater to the growing demand for its product. The expansion aims to ensure that the company can meet the rising needs of its customers effectively.

Why Purchase the Report?

- To visualize the global anhydrous caffeine market segmentation based on type, form, source, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of anhydrous caffeine market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

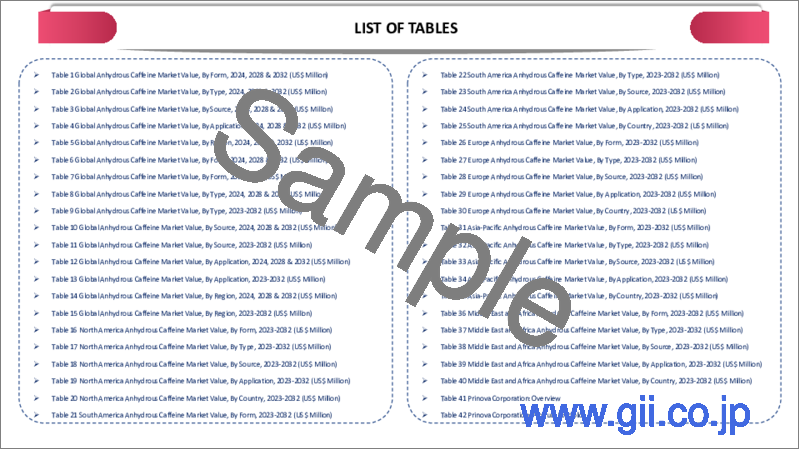

The global anhydrous caffeine market report would provide approximately 69 tables, 69 figures and 199 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Form

- 3.3. Snippet by Source

- 3.4. Snippet by Application

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Consumption of Energy Drinks

- 4.1.1.2. Collaboration Between Companies Boost the Market

- 4.1.1.3. Technology Advancement

- 4.1.2. Restraints

- 4.1.2.1. Excessive Consumption of Anhydrous Caffeine has Risen Health Concerns

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Natural*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Synthetic

8. By Form

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 8.1.2. Market Attractiveness Index, By Form

- 8.2. Powder*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Granular

9. By Source

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 9.1.2. Market Attractiveness Index, By Source

- 9.2. Tea Leaves*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Coffee Beans

- 9.4. Cacao Beans

- 9.5. Synthetic Sources

- 9.6. Guarana Beans

- 9.7. Others

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Beverages*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Pharmaceuticals

- 10.4. Dietary Supplements

- 10.5. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Spectrum Chemical Manufacturing Corp.*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Cambridge Commodities Limited

- 13.3. BASF SE

- 13.4. CSPC Pharmaceutical Group Limited

- 13.5. LobaChemie Pvt. Ltd.

- 13.6. Foodchem International Corporation

- 13.7. PureBulk

- 13.8. Fooding Group Limited

- 13.9. Jayanti

- 13.10. Bakul Group of Companies

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us