|

|

市場調査レポート

商品コード

1390179

ギ酸の世界市場-2023年~2030年Global Formic Acid market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ギ酸の世界市場-2023年~2030年 |

|

出版日: 2023年12月05日

発行: DataM Intelligence

ページ情報: 英文 201 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

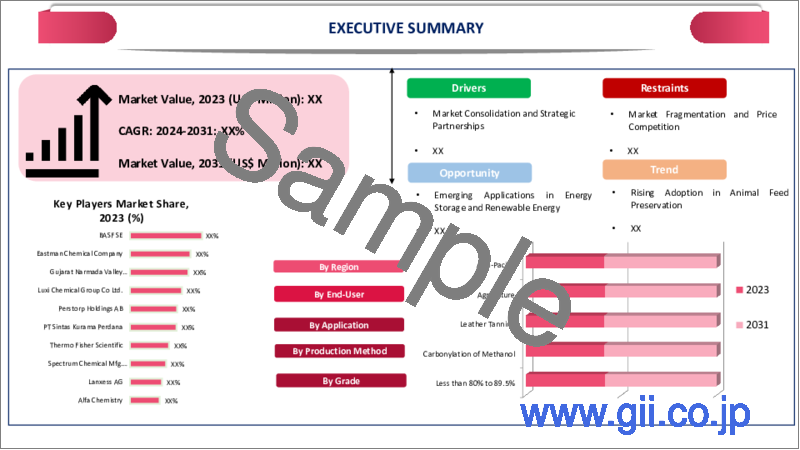

ギ酸の世界市場は2022年に11億米ドルに達し、2030年には14億米ドルに達すると予測され、予測期間2023-2030年のCAGRは3.7%で成長する見込みです。

化学産業の重要な構成要素であるギ酸は、顔料、医薬品、溶剤など幅広い商品の製造に使用されています。これらの分野の発展は、ギ酸の需要増加を部分的に満たすのに役立っています。ギ酸は他のいくつかの物質よりも環境に優しいと考えられています。より持続可能な代用品として、ギ酸の人気は高まっています。

農業はギ酸を使う農業業界はギ酸を使用しています。動物飼料の抗生物質や防腐剤として、化学ギ酸は動物の健康維持と成長促進に欠かせないです。世界人口の増加に伴い食品の消費量が増加しているため、より生産性の高い農業へのニーズが高まっており、ギ酸の需要も増加しています。

アジア太平洋は世界のギ酸市場の1/3以上を占める成長地域のひとつであり、アジア太平洋には中国やインドなど世界最大の農業経済圏が複数あります。ギ酸のような動物飼料用防腐剤や殺虫剤は、農業で頻繁に利用されています。より多くの食料生産の必要性と農業の拡大が、この地域におけるギ酸の需要を押し上げています。

力学

医薬中間体としての使用の増加

医療では、85%濃度のギ酸を使用することで、一般的なイボの治療が成功し、費用対効果が高く、安全で、副作用が少なく、コンプライアンスも高いです。その結果、ギ酸はアミドピリン、ビタミンBなどの医薬品製造の中間体として役立っています。世界の麻疹の流行は、アミドピリン医薬品の需要を押し上げています。

ユニセフの最新データによると、2021年の同時期と比較して、2022年の最初の2ヶ月間に世界的に麻疹患者が増加しました。また、米国疾病予防管理センターは、2021年にはソマリアで5,760人、ナイジェリアで5,613人、インドで4,178人の麻疹患者が発生すると予測しています。

その結果、アミドピリン、ビタミンBなどの医薬品の需要の高まりに対応するため、医薬品中間体に対する需要が高まっています。その結果、ギ酸の消費量は増加すると予想され、今後数年間の市場拡大を後押しすると思われます。

拡大する皮革・繊維産業

ギ酸はその特性から、染色やなめしなどの工程で使用されます。そのため、皮革産業や繊維産業に最適です。繊維・皮革産業の拡大は、繊維セクターへの外国投資の増加や、新しい繊維・皮革生産施設の建設などの要素に助けられています。

例えば、バングラデシュのモングラ輸出加工区(EPZ)では、中国系企業のXihe Textile Technology Bangladesh Limitedからの1,289万米ドルの投資により、間もなく衣料品製造業が誕生します。このプロジェクトは2023年までに開発が完了する予定です。

欧州共同体全国皮革鞣し業者組合連合会(Confederation of National Associations of Tanners and Dressers of the European Community)によると、欧州連合(EU)は世界の皮革鞣し市場の約56%を占めています。皮革と繊維セクターの増加により、ギ酸産業は成長しています。

変動原料コスト

ギ酸の市場は、原料コストの変動により極めて限定されています。ギ酸の生産には通常、メタノールと一酸化炭素を主原料とするメタノール・カルボニル化工程が含まれます。特定の必須成分のコストは、ギ酸の生産費全体に大きな影響を与える可能性があります。

原料コストの上昇は、ギ酸メーカーに競合価格を維持するよう圧力をかけ、利益率に影響を与える可能性があります。原料価格の変動に対する価格感応度は、ギ酸セクターにおいてサプライチェーン管理とコスト削減戦術がいかに重要であるかを浮き彫りにしています。

厳しい規制

ギ酸はその代替品の多くで市場を独占してきたにもかかわらず、その使用を制限する規制が業界の拡大を制限しています。例えば、ギ酸は腐食性のある化学物質で、目や肺、その他の臓器に触れると深刻な健康問題を引き起こす可能性があります。また、欧州連合のCLP00調和分類表示システムによれば、この物質は重度の皮膚火傷や眼障害を引き起こす可能性があります。

さらに、この物質は、各企業のREACH登録において、食べると危険、吸うと有毒、臓器への損傷、可燃性、重大な眼障害を引き起こすと分類されています。硫酸と混合された場合、ギ酸は一酸化炭素中毒の非常に致命的な原因となります。そのため、これらの制限がギ酸の市場拡大を制限しています。

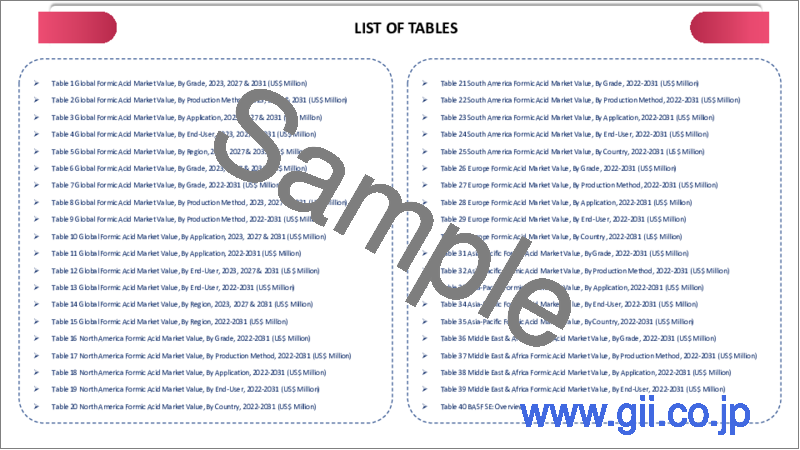

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 医薬品中間体としての用途拡大

- 皮革・繊維産業の拡大

- 抑制要因

- 変動する原料コスト

- 厳しい規制

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 グレード別

- 80%~89.5%

- 89.5%~90.5%

- 91.6%~99%

- 99%以上

第8章 製造方法別

- メタノールのカルボニル化

- ギ酸メチルの加水分解

第9章 用途別

- 皮革なめし

- 飼料・サイレージ添加物

- 医薬中間体

- 洗浄剤

- 防腐剤

- 染色

- ラテックス

- その他

第10章 エンドユーザー別

- 農業

- 皮革

- テキスタイル・アパレル

- ヘルスケア

- アミドピリン

- ビタミンB

- その他

- ゴム

- 化学品

- メタナミド

- ジエチルホルムアミド

- その他

- 紙類

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- BASF SE

- 会社概要

- 生産方式のポートフォリオと説明

- 財務概要

- 主な発展

- Eastman Chemical Company

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- Luxi Chemical Group Co Ltd.

- Perstorp Holdings AB

- PT Sintas Kurama Perdana

- Thermo Fisher Scientific

- Spectrum Chemical Mfg. Corp.

- Lanxess AG

- Alfa Chemistry

第14章 付録

Overview

Global Formic Acid Market reached US$ 1.1 billion in 2022 and is expected to reach US$ 1.4 billion by 2030, growing with a CAGR of 3.7% during the forecast period 2023-2030.

A crucial component of the chemical industry, formic acid is used to create a wide range of goods, such as pigments, medicines and solvents. The development of these sectors helps to partially meet the rising demand for formic acid. Formic acid is considered to be more environmentally friendly than several other substances. For situations where it could be a more sustainable substitute, formic acid is growing in popularity.

The agriculture industry uses formic acid. The agriculture industry uses formic acid. For an antibiotic and preservative in animal feed, chemical formic acid is vital for maintaining the health and increasing the growth of animals. Consumption of food products is rising as the world's population increases, leading to a need for improved and more productive methods of agriculture, which in turn increases the demand for formic acid.

Asia-Pacific is among the growing regions in the global formic acid market covering more than 1/3rd of the market and Asia-Pacific is located in multiple of the world's largest agricultural economies, such as China and India. Animal feed preservatives and pesticides like formic acid are frequently utilized in agriculture. The necessity for more food production and the expansion of agriculture has pushed formic acid demand in the area.

Dynamics

Increasing Use as a Pharmaceutical Intermediate

In medicine, the use of formic acid with an 85% concentration is a successful, cost-effective and safe treatment option for common warts with few adverse effects and high compliance. As a result, formic acid serves as a pharmaceutical intermediary in the production of several drugs, including amidopyrin, vitamin B and others. The global outbreak of measles is driving up demand for amidopyrin medications.

According to the latest UNICEF data, there was an increase in measles cases globally in the initial two months of 2022 compared to the same time in 2021. The Centres for Disease Control and Prevention also forecasted that in 2021, there will be, 5,760, 5,613 and 4,178 cases of measles in Somalia, Nigeria and India.

As a result, there is a rising demand for pharmaceutical intermediates to address the heightened requirement for medications like amidopyrin, vitamin B and others. Formic acid consumption is anticipated to increase as a result, which will fuel market expansion in the approaching years.

Expanding Leather and Textile Industries

Formic acid is employed in dyeing, tanning and other processes because of these characteristics. It is therefore perfect for the leather and textile industries. The expansion of the textile and leather industries is being aided by elements including rising foreign investment in the textile sector and the construction of new textile and leather production facilities.

For instance, the Mongla Export Processing Zone (EPZ) in Bangladesh will soon have a garment manufacturing industry thanks to an investment of US$ 12.89 million from the China-owned business Xihe Textile Technology Bangladesh Limited. The project will be finished in its development by 2023.

According to the Confederation of National Associations of Tanners and Dressers of the European Community, the European Union also controls around 56% of the world's leather tanning market. Because of the increasing leather and textile sectors, the formic acid industry is growing.

Variable Raw Material Costs

The market for formic acid is certainly extremely limited by the volatility of raw material costs. The production of formic acid typically involves the methanol carbonylation process, where methanol and carbon monoxide serve as the primary raw materials. The cost of certain essential components can significantly impact the overall production expenses of formic acid.

Rising raw material costs can put pressure on formic acid producers to maintain competitive prices, which might therefore have an impact on their profit margins. The price sensitivity to changes in raw material prices highlights how crucial supply chain management and cost-cutting tactics are in the formic acid sector.

Stringent Regulations

The regulation that limits its usage is limiting the industry's expansion, even though formic acid has controlled the market for many of its alternatives. For instance, formic acid is a chemical that is corrosive and when it comes into contact with the eyes, lungs and other organs, it may cause serious health issues. In addition, this substance can cause severe skin burns and eye damage, according to the CLP00 harmonized classification and labeling system for the European Union.

Additionally, this substance is categorized as being dangerous if eaten, toxic if breathed, damaging to organs, combustible and causing significant eye damage by companies in their REACH registrations. If mixed with sulfuric acid, formic acid is a very deadly cause of carbon monoxide poisoning. Therefore, these limitations are restricting the market's expansion for formic acid.

Segment Analysis

The global formic acid market is segmented based on grade, production method, application, end-user and region.

Increasing Demand for Formic Acid in Agriculture due to Rising Agriculture Productivity

The agriculture segment is among the growing regions in the global formic acid market covering more than 1/3rd of the market. The efficiency of pesticides against pests is increased when formic acid and oxalic acid are combined. The results in effective crop protection, the preservation of animal feed and other advantages. Formic acid is commonly applied in agriculture as a result of these characteristics.

The expansion of the agriculture business depends on several variables, including the prohibition of antibiotics that promote growth in animal feed, rising agricultural productivity and others. For instance, the use of antibiotics that promote animal development in feed has been outlawed in several North American and European nations, including U.S., UK and others.

Additionally, the OECD-FOA Agriculture Forecast predicts that global agricultural production will reach 304,403.61 Tons by 2026. In order to conserve the feedstock for a long time, the use of organic compounds will rise due to the prohibitions and anticipated increases in agricultural output. The is expected to increase formic acid consumption, which would speed up market expansion in the future years.

Geographical Penetration

Expanding Demand for Formic Acid in Leather and Textile Sectors in Asia-Pacific

Asia-Pacific has had a major impact on the globally formic acid market because of very closely connected industries like leather, textiles and others to the region's economic growth. The growing textile industry of the region is expected to improve the market share of formic share up to 43.4% in the forecast period. Additionally, the Asia-Pacific agriculture industry is growing, mostly as an outcome of developments in food preservation methods aimed at improving food security as well as other contributing factors.

For instance, the output of food crops increased noticeably in the Asia-Pacific area between 2020 and 2021. The U.S. Department of Agriculture's statistics show this period experienced a large increase in the overall output of food crops. As opposed to the previous record of almost 998.8 million metric Tons, the output increased by more than 1026.7 million metric Tons or 2.8%. According to data from U.S. Department of Agriculture, there were 95,619 thousand cattle in China as of 2021, a 4.6% rise from the 91,380 thousand cattle there in 2016.

In 2011, there were 53,000 thousand beef cows in China as an entire nation. By 2021, there would be 53,400 thousand, a minor increase of about 1%. The Asia-Pacific's expanding livestock and agricultural industries are hence driving up formic acid consumption. Formic acid market growth is thus being accelerated by technology.

For instance, in July 2022, in an effort to greatly increase the region's production capacity, AB Agri developed a new 240-kilo-ton feed mill in Tongchuan City, Shaanxi Province, China. The second-largest factory in AB Agri China, the new 34,000 sq m facility has distinct manufacturing lines for swine and ruminant feeds.

COVID-19 Impact Analysis

The pandemic affected international supply systems, especially those in the chemical sector. Formic acid and associated compounds were produced and transported with delays as a result of lockdowns, travel restrictions and temporary facility shutdowns in several nations. The availability of formic acid for many sectors was impacted by the supply chain disruption, which led to shortages of supplies and logistical difficulties.

Demand changes for formic acid were also brought on by the epidemic. Due to lockdowns and lower consumer spending, certain formic acid-using businesses, such as leather and textiles, witnessed a decline in demand; however, other industries, like medicines and agriculture, reported a rise in demand.

For example, formic acid is used in the production of disinfectants and sanitizers, both of which were in high demand during the pandemic. The alteration in demand patterns compelled manufacturers to alter their manufacturing strategies. Price volatility in the formic acid market was caused by the disruption of supply systems and changing demand.

Formic acid and related chemicals' prices have occasionally gone up as a result of production cost increases and supply constraints. But as the pandemic spread, market dynamics changed and prices changed in response to shifting conditions of supply and demand. To negotiate these pricing swings, businesses across a range of industries had to carefully manage their procurement practices.

Russia-Ukraine War Impact Analysis

The supply chain for agricultural products may be affected by the situation in Ukraine, a large agricultural producer. Formic acid is employed in agriculture for several functions, including crop protection and the preservation of feed. Any disturbances in the agriculture industry may have an impact on formic acid consumption in a secondary way.

Additionally, if the conflict caused supply chain interruptions or economic penalties against Russia, a significant chemical manufacturer, it may affect the availability and cost of chemicals like formic acid on the international market. Market volatility for commodities is frequently caused by geopolitical turmoil.

Chemical formic acid is used in many industrial processes, such as the tanning of leather, the production of textiles and the production of chemicals. The price of producing formic acid may be impacted by sudden changes in the price of raw materials or energy sources brought on by geopolitical conflicts. The pricing and profitability of goods in sectors that use formic acid may be impacted by these price swings, which may change the dynamics of supply and demand.

By Grade

- Less than 80% to 89.5%

- 89.5% to 90.5%

- 91.6% to 99%

- Above 99%

By Production Method

- Carbonylation of Methanol

- Hydrolysis of Methyl Formate

By Application

- Leather Tanning

- Animal Feed & Silage Additives

- Pharmaceutical Intermediate

- Cleaning Agents

- Preservatives

- Dyeing

- Latex

- Others

By End-User

- Agriculture

- Leather

- Textile and Apparels

- Healthcare

- Amidopyrin

- Vitamin B

- Others

- Rubber

- Chemical

- Methanamide

- Diethyl Formamide

- Others

- Paper

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On May 1, 2023, Indian Institute of Technology Guwahati researchers developed a catalyst that can release hydrogen gas from wood alcohol without producing any more carbon dioxide as a byproduct. The procedure yields formic acid, an important industrial chemical in addition to being simple and safe for the environment. As a result of this progress, methanol is a promising "Liquid Organic Hydrogen Carrier" (LOHC) and helps advance the idea of a hydrogen-methanol economy.

- On July 13, 2022, Ingenza, a biotechnology company and Johnson Matthey are working in collaboration to manufacture formic acid from acquired industrial CO2 emissions for application in a variety of sectors, including agriculture and the pharmaceutical industry, as well as a possible feedstock for other bioprocesses. A useful chemical called formic acid, the most basic carboxylic acid, may be created by catalytically hydrogenating CO2. However, due to CO2's high degree of stability, activation barriers must be surmounted with a lot of energy.

- On November 10, 2020, BASF increased the cost of formic acid and propionic acid. The price of formic acid in North America will increase by US$ 0.05 per pound.

Competitive Landscape

The major global players in the market include: BASF SE, Eastman Chemical Company, Gujarat Narmada Valley Fertilizers & Chemicals Limited, Luxi Chemical Group Co Ltd., Perstorp Holdings AB. PT Sintas Kurama Perdana, Thermo Fisher Scientific, Spectrum Chemical Mfg. Corp., Lanxess AG and Alfa Chemistry .

Why Purchase the Report?

- To visualize the global formic acid market segmentation based on grade, production method, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of formic acid market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Grade mapping available as Excel consisting of key Grades of all the major players.

The global formic acid market report would provide approximately 69 tables, 76 figures and 201 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Grade

- 3.2. Snippet by Production Method

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Use as a Pharmaceutical Intermediate

- 4.1.1.2. Expanding Leather and Textile Industries

- 4.1.2. Restraints

- 4.1.2.1. Variable Raw Material Costs

- 4.1.2.2. Stringent Regulations

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Grade

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 7.1.2. Market Attractiveness Index, By Grade

- 7.2. Less than 80% to 89.5% *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. 89.5% to 90.5%

- 7.4. 91.6% to 99%

- 7.5. Above 99%

8. By Production Method

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Production Method

- 8.1.2. Market Attractiveness Index, By Production Method

- 8.2. Carbonylation of Methanol*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Hydrolysis of Methyl Formate

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Leather Tanning*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Animal Feed & Silage Additives

- 9.4. Pharmaceutical Intermediate

- 9.5. Cleaning Agents

- 9.6. Preservatives

- 9.7. Dyeing

- 9.8. Latex

- 9.9. Others

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Agriculture*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Leather

- 10.4. Textile and Apparels

- 10.5. Healthcare

- 10.5.1. Amidopyrin

- 10.5.2. Vitamin B

- 10.5.3. Others

- 10.6. Rubber

- 10.7. Chemical

- 10.7.1. Methanamide

- 10.7.2. Diethyl Formamide

- 10.7.3. Others

- 10.8. Paper

- 10.9. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Production Method

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Production Method

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Russia

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Production Method

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Production Method

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Production Method

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. BASF SE*

- 13.1.1. Company Overview

- 13.1.2. Production Method Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Eastman Chemical Company

- 13.3. Gujarat Narmada Valley Fertilizers & Chemicals Limited

- 13.4. Luxi Chemical Group Co Ltd.

- 13.5. Perstorp Holdings AB

- 13.6. PT Sintas Kurama Perdana

- 13.7. Thermo Fisher Scientific

- 13.8. Spectrum Chemical Mfg. Corp.

- 13.9. Lanxess AG

- 13.10. Alfa Chemistry

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us