|

|

市場調査レポート

商品コード

1390174

放射線遮蔽用ガラスの世界市場-2023年~2030年Global Radiation Shielding Glass Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 放射線遮蔽用ガラスの世界市場-2023年~2030年 |

|

出版日: 2023年12月05日

発行: DataM Intelligence

ページ情報: 英文 204 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

放射線遮蔽用ガラスの世界市場は、2022年に10億米ドルに達し、2023-2030年の予測期間中にCAGR 6.5%で成長し、2030年には17億米ドルに達すると予測されています。

放射線遮蔽用ガラスの市場は、主にヘルスケア産業が牽引しています。医療技術の発展に伴い、画像診断サービスの需要が高まっています。これには放射線治療、CTスキャン、X線撮影などが含まれ、いずれも放射線遮蔽材料を必要とします。放射線科、がんセンター、画像診断施設に放射線遮蔽用ガラスが導入された背景には、患者やヘルスケアスタッフを電離放射線から守る必要性があります。

放射線遮蔽用ガラスは、航空宇宙産業や航空業界で、乗務員や乗客を高高度の宇宙放射線から守るために使用されています。放射線遮蔽用ガラスは、長距離飛行中の危険な電離放射線から乗客を守り、人の安全を優先するため、航空機の窓に広く使用されるようになってきています。

アジア太平洋は、世界の放射線遮蔽用ガラス市場の1/3以上を占める成長地域の一つです。この地域では病院、診断センター、がん治療施設の数が増加しているため、放射線遮蔽用ガラスの需要が高まっています。放射線室、がんセンター、その他の医療画像診断施設において、患者や医療スタッフを放射線被曝から守るために、このガラスが必要とされています。

力学

研究施設と原子力の成長

放射線遮蔽用ガラスの市場は、研究施設や原子力発電所の成長によっても牽引されています。各国がエネルギー源の多様化と二酸化炭素排出量の削減を目指す中、原子力発電施設の建設と運営は拡大しています。鉛ガラスのような放射線遮蔽材料は、原子力発電所では原子炉格納構造物、制御室、電離放射線から一般市民や従業員を守るための覗き窓などに必要とされています。

放射線遮蔽ソリューションは、粒子加速器や核物理学や放射性医薬品開発に特化した研究所などの研究施設にも必要です。放射線遮蔽用ガラスは、原子力技術の進歩や放射線防護の必要性から、ますます需要が高まっています。

医療における画像技術の利用拡大

放射線遮蔽用ガラスの世界市場は、透視検査、CTスキャン、X線検査などの医療用画像技術の利用拡大から大きな影響を受けています。これらの技術は診断や治療に役立つため、現代のヘルスケアには欠かせないものです。画像診断サービスの需要が高まるにつれ、患者や医療スタッフ、一般市民を電離放射線から守る放射線遮蔽製品がますます必要になってきています。

放射線遮蔽用ガラスは、電離放射線を効率的に減衰させ、クリアな視界を確保する透明なバリアです。放射線科、がん治療センター、画像診断施設で使用されています。医療用画像の向上と世界のヘルスケアインフラの成長により、ヘルスケア産業における放射線遮蔽用ガラスのニーズは今後も続くと予想されます。

例えば、2022年10月6日、メディカル・イメージング・ソリューションズ・インターナショナル(MISI)は、カナディアン・ホスピタル・スペシャリティーズ・リミテッド(CHS)の子会社であるCHS USA Inc.に完全買収されました。この買収により、CHSの米国における画像診断の市場シェアはさらに拡大します。ヘルスケア業界において、MISIとCHSは信頼できる優れた製品で有名です。

創造性と美的想像力の制限

放射線遮蔽用ガラスは一般的に通常のガラスよりも厚く密度が高いため、建築用途におけるデザインの自由度や美観が制限される可能性があります。建築家やインテリアデザイナーは、建物の中に視覚的に魅力的で開放的な空間を作り出そうとすることが多いが、放射線遮蔽用ガラスを使用することでその選択肢が制限されることがあります。一部の放射線遮蔽用ガラスの厚みや不透明度は、透明性と洗練されたデザインを優先する現代の建築動向に合致しない場合があります。

また、鉛ガラスの色や光学的透明度は鉛の含有量によって影響を受けるため、用途によっては魅力が半減します。高級接客業、小売業、高級住宅開発など、雰囲気やデザインが重要視される分野では、このような美観上の制約が課題となる可能性があります。放射線遮蔽用ガラス業界にとって、安全性と美観のバランスを取ることは依然として難しいが、生産者は常にこの制約を回避するための新しいアイデアを打ち出しています。

原材料の初期コストの高さ

放射線遮蔽用ガラスの市場を阻んでいる主な要因のひとつは、専門材料の初期コストの高さです。放射線遮蔽用ガラス、特に有鉛ガラスには鉛などの重金属が含まれているため、原材料費が高くつく。また、放射線遮蔽用ガラスの取り付けには専門的な人手と知識が必要なため、複雑な手順が必要となり、全体的なコストに拍車をかけています。

さらに、放射線遮蔽用ガラスは重量があるため、構造物の変更が必要となる場合があり、その場合は設置費用が高くなります。高いコストと中断の可能性を考えると、古い施設のアップグレードはかなりの障壁となります。したがって、放射線遮蔽用ガラスを導入するためのコストと実用性が、その普及を阻む障壁となっている可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 研究施設と原子力の成長

- 医療における画像技術の利用拡大

- 抑制要因

- 創造的・審美的想像力の制限

- 原材料の初期コストの高さ

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

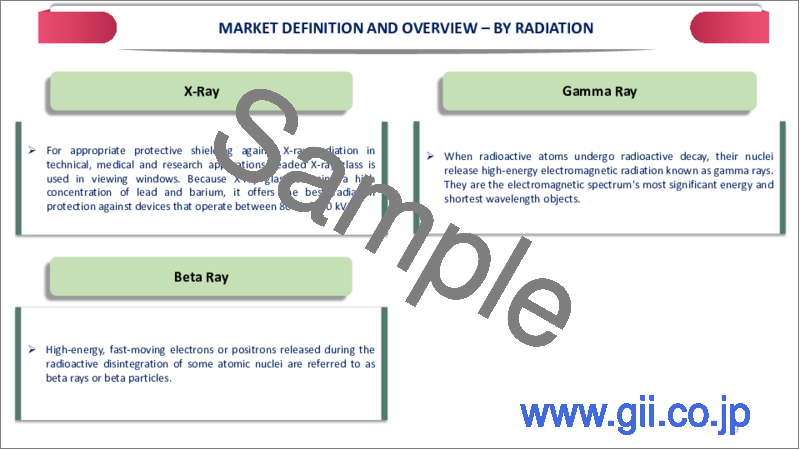

第7章 放射線別

- X線

- ガンマ線

- ベータ線

- その他

第8章 ガラス別

- 鉛ガラス

- 無鉛ガラス

- 合わせガラス

- その他

第9章 厚さ別

- 5.0mm以下

- 5mm~10mm

- 10mm~14mm

- 14mm~20mm

- 20mm以上

第10章 用途別

- 原子力発電所

- 医療施設

- 産業施設

- 航空宇宙

- 自動車

- 建設

- その他

第11章 エンドユーザー別

- 研究機関

- エネルギー産業

- 製造業および建設業

- 画像診断センター

- 病院および診療所

- 防衛・軍事

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- Corning Incorporated

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Schott AG

- Ray-Bar Engineering Corporation

- Mayco Industries

- Radiation Protection Products, Inc.

- A&L Shielding

- Technical Glass Products

- Nippon Electric Glass Co., Ltd.

- Raybloc(X-ray Protection)Ltd

- MarShield

第15章 付録

Overview

Global Radiation Shielding Glass Market reached US$ 1.0 billion in 2022 and is expected to reach US$ 1.7 billion by 2030, growing with a CAGR of 6.5% during the forecast period 2023-2030.

The market for radiation shielding glass is mostly driven by the healthcare industry. Diagnostic imaging services are in greater demand as medical technology develops. The includes radiation treatment, CT scans and X-rays, all of which need radiation-shielding materials. The introduction of radiation shielding glass in radiology departments, cancer centers and diagnostic imaging facilities is motivated by the need to shelter patients and healthcare staff from ionizing radiation.

Radiation shielding glass is used in the aerospace and aviation industries to guard crew members and passengers from cosmic radiation at higher altitudes. Radiation shielding glass is being more widely used in airplane windows to protect passengers from dangerous ionizing radiation during long-haul flights and to prioritize human safety.

Asia-Pacific is among the growing regions in the global radiation shielding glass market covering more than 1/3rd of the market. Radiation shielding glass is in high demand due to the growing number of hospitals, diagnostic centers and cancer treatment facilities in the area. In order to protect patients and medical staff from radiation exposure in radiology rooms, cancer centers and other medical imaging facilities, this glass is necessary.

Dynamics

Growth of Research Facilities and Nuclear Power

The market for radiation shielding glass is also being driven by the growth of research centers and nuclear power plants. The building and running of nuclear power facilities have expanded as nations look to diversify their energy sources and cut carbon emissions. Radiation shielding materials, such as leaded glass, are needed at nuclear power plants for reactor containment structures, control rooms and viewing windows to safeguard the public and employees from ionizing radiation.

Radiation shielding solutions are also necessary for research facilities, such as particle accelerators and laboratories dedicated to nuclear physics and radiopharmaceutical development. Radiation shielding glass is becoming more and more in demand due to the ongoing advancements in nuclear technology and the necessity of radiation protection in these applications.

Growing Use of Imaging Technologies in Medicine

The global market for radiation shielding glass is greatly impacted by the growing use of medical imaging technologies including fluoroscopy, CT scans and X-rays. The technologies are essential to modern healthcare since they help with diagnosis and therapy. Radiation shielding products are becoming more and more necessary to shelter patients, medical staff and the public from ionizing radiation as the demand for diagnostic imaging services rises.

Radiation shielding glass is a transparent barrier that efficiently attenuates ionizing radiation while permitting clear visibility. It is utilized in radiology departments, cancer treatment centers and diagnostic imaging facilities. The need for radiation shielding glass in the healthcare industry is anticipated to continue due to improvements in medical imaging and the growth of healthcare infrastructure globally.

For Instance, On 6 October 2022, Medical Imaging Solutions International ("MISI") was fully acquired by CHS USA Inc., a subsidiary of Canadian Hospital Specialties Limited (CHS). With this purchase, CHS's market share in diagnostic imaging in US will grow even further. Within the healthcare sector, MISI and CHS are renowned for their dependable and superior goods.

Restricted Creative and Aesthetic Imagination

Radiation shielding glass is typically thicker and denser than regular glass, which can limit design flexibility and aesthetics in architectural applications. Architects and interior designers often seek to create visually appealing and open spaces in buildings, but the use of radiation-shielding glass can restrict their options. The thickness and opacity of some radiation shielding Glasss may not align with modern architectural trends, which prioritize transparency and sleek design.

In addition, the color and optical clarity of lead glass can be impacted by lead content, which reduces its appeal for some uses. In sectors including luxury hospitality, retail or high-end residential development where ambiance and design are crucial, this aesthetic restriction may be a challenge. For the radiation shielding glass industry, striking a balance between safety and aesthetics continues to be difficult, but producers are always coming up with new ideas to get around this restriction.

High Initial Cost of Raw Materials

The high initial cost of these specialist materials is one of the main barriers to the market for radiation shielding glass. Because radiation shielding glass, especially leaded glass, contains heavy metals like lead, which raises the cost of raw materials, it is more expensive to make. The complicated procedure of installing radiation shielding glass also adds to the overall cost because it calls for specialized manpower and knowledge.

Furthermore, the weight of radiation shielding glass may need structural changes in structures, which would raise the cost of installation. Given the high costs and potential interruptions, upgrading older facilities can provide a considerable barrier. Therefore, the cost and practicality of implementing radiation shielding glass may serve as a barrier to its widespread use.

Segment Analysis

The global radiation shielding glass market is segmented based on radiation, glass, thickness, application, end-user and region.

Growing Application of X-ray Technology

The X-Ray segment is among the growing in the global radiation shielding glass market covering more than 1/3rd of the market. The growing application of X-ray technology is one of the main drivers of the growth in the globally radiation shielding glass industry. The increasing importance of diagnostic imaging in the medical field. As medical institutions and providers look to improve their diagnostic skills, X-ray imaging is still a vital tool in medical diagnostics and is in high demand.

In order to protect patients and employees, radiology departments, hospitals and diagnostic imaging facilities are directly driving up demand for radiation shielding glass. The growth of applications for non-destructive and industrial testing. X-ray technology finds widespread application in a wide range of industrial applications, including material testing, weld inspections and quality control.

Geographical Penetration

Rising Radiation Treatment and Medical Imaging Center in Asia-Pacific

Asia-Pacific has been a dominant force in the global radiation shielding glass market and the primary driver driving expansion is the rising number of radiation treatment and medical imaging centers in nations like China, India and Japan. The safety of patients and medical personnel, there is an increased requirement for radiation shielding glass in radiology rooms, cancer centers and diagnostic imaging facilities as the healthcare infrastructure grows to meet the demands of rising populations.

The growing demand for radiation shielding materials, such as glass, results from the Asia-Pacific development and expansion of nuclear power plants and research centers. Radiation shielding technologies are essential for guaranteeing worker and public safety as nations in the area strive to satisfy their energy demands and advance scientific research.

Lead glass and other radiation-shielding materials are used in control rooms, observation windows and reactor containment structures as part of these initiatives. The demand for radiation shielding glass is also being fueled by the expanding manufacturing and industrial sectors in the Asia-Pacific, which include the semiconductor, aerospace and automotive sectors.

Radiation protection becomes necessary while these businesses use increasingly sophisticated materials and technology to ensure worker safety and equipment integrity. Radiation shielding systems are growing in popularity in R&D centers and production processes as a consequence.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly impacted the global market for radiation shielding glass The pandemic affected the supply and demand for radiation shielding glass by upsetting supply networks and creating general economic instability. Lockdowns, lowered operations and budgetary limits caused interruptions in several businesses that depend on radiation-shielding materials, such as healthcare, manufacturing and construction.

As a result, during the pandemic, the demand for radiation-shielding glass temporarily slowed down in several locations. The COVID-19 pandemic particularly had a significant effect on the healthcare industry. While diagnostic and treatment facilities saw a rise in demand for medical-grade radiation shielding glass, other industries experienced setbacks and budget cuts.

The market was further hampered by certain enterprises deferring investments in radiation protection devices due to uncertainty in the world's economic situation. Radiation shielding glass producers faced supply-side difficulties like labor interruptions, lockdowns and shortages of materials, which impacted their ability to produce their products and occasionally resulted in price changes.

The use of radiation shielding glass became more and more in demand, especially for medical and scientific uses, as the globe adjusted to the epidemic and healthcare became a primary priority. The illustrated how resilient the market is and how crucial radiation shielding materials are, even in the face of hitherto unheard-of globally difficulties.

Russia-Ukraine War Impact Analysis

The globally market for radiation shielding glass has been greatly affected by the conflict between Russia and Ukraine, especially the fighting in Eastern Ukraine. Various businesses and facilities that produce materials and glass for radiation shielding are located in Ukraine in particular. Supply chains have been interrupted, manufacturing has been impacted and market uncertainty has been brought about by the ongoing conflict and political unrest in the area.

Additionally, the various enterprises in the impacted regions were forced to cease or scale back their activities, which might result in shortages and changes in prices on the international market. In addition, the situation has affected international ties and commercial routes by causing unrest and uncertainty in nearby areas.

Import and export of radiation shielding glass and associated products may be hampered by trade restrictions and sanctions put in place by different nations in reaction to the war. The has not only made things difficult for producers, but it has also raised the lead times and prices of procuring these resources, which has an effect on the supply chain as a whole and could have an effect on market pricing.

By Radiation

- X-Ray

- Gamma Ray

- Beta Ray

- Others

By Glass

- Leaded Glass

- Lead-free Glass

- Laminated Glass

- Others

By Thickness

- Below 5.0mm

- 5mm-10mm

- 10mm-14mm

- 14mm-20mm

- Above 20mm

By Application

- Nuclear Power Plants

- Medical Facilities

- Industrial Facilities

- Aerospace and Aviation

- Automotive

- Construction

- Others

By End-User

- Research Institutions

- Energy Industry

- Manufacturing and Construction

- Diagnostic Imaging Centers

- Hospitals and Clinics

- Defense and Military

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On February 03, 2023, Mo-Sci, a prominent developer and manufacturer of advanced high-tech glass, completed the acquisition of 3M's Advanced Materials business (formerly known as 3M Ceradyne), located in Seattle, Washington. The acquisition encompasses more than 350 specialized equipment pieces and all associated intellectual property.

- On January 24, 2023, Premier Imaging Medical Systems was acquired by Radon Medical Imaging, a well-known business that specializes in the upkeep and repair of medical imaging equipment. Premier Imaging Medical Systems is well-known for selling brand-new, pre-owned and reconditioned imaging and biomedical equipment in addition to providing services for equipment maintenance.

Competitive Landscape

The major global players in the market include: Corning Incorporated, Schott AG, Ray-Bar Engineering Corporation, Mayco Industries, Radiation Protection Products, Inc., A&L Shielding, Technical Glass Products, Nippon Electric Glass Co., Ltd., Raybloc (X-ray Protection) Ltd and MarShield.

Why Purchase the Report?

- To visualize the global radiation shielding glass market segmentation based on radiation, glass, thickness, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of radiation shielding glass market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global radiation shielding glass market report would provide approximately 77 tables, 89 figures and 204 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Radiation

- 3.2. Snippet by Glass

- 3.3. Snippet by Thickness

- 3.4. Snippet by Application

- 3.5. Snippet by End-User

- 3.6. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growth of Research Facilities and Nuclear Power

- 4.1.1.2. Growing Use of Imaging Technologies in Medicine

- 4.1.2. Restraints

- 4.1.2.1. Restricted Creative and Aesthetic Imagination

- 4.1.2.2. High Initial Cost of Raw Materials

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Radiation

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Radiation

- 7.1.2. Market Attractiveness Index, By Radiation

- 7.2. X-Ray*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Gamma Ray

- 7.4. Beta Ray

- 7.5. Others

8. By Glass

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Glass

- 8.1.2. Market Attractiveness Index, By Glass

- 8.2. Leaded Glass*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Lead-free Glass

- 8.4. Laminated Glass

- 8.5. Others

9. By Thickness

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 9.1.2. Market Attractiveness Index, By Thickness

- 9.2. Below 5.0mm*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. 5mm-10mm

- 9.4. 10mm-14mm

- 9.5. 14mm-20mm

- 9.6. Above 20mm

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Nuclear Power Plants*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Medical Facilities

- 10.4. Industrial Facilities

- 10.5. Aerospace and Aviation

- 10.6. Automotive

- 10.7. Construction

- 10.8. Others

11. By End-User

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.1.2. Market Attractiveness Index, By End-User

- 11.2. Research Institutions*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Energy Industry

- 11.4. Manufacturing and Construction

- 11.5. Diagnostic Imaging Centers

- 11.6. Hospitals and Clinics

- 11.7. Defense and Military

- 11.8. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Radiation

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Glass

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Radiation

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Glass

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. UK

- 12.3.8.3. France

- 12.3.8.4. Russia

- 12.3.8.5. Spain

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Radiation

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Glass

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Radiation

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Glass

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. Australia

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Radiation

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Glass

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. Corning Incorporated*

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. Schott AG

- 14.3. Ray-Bar Engineering Corporation

- 14.4. Mayco Industries

- 14.5. Radiation Protection Products, Inc.

- 14.6. A&L Shielding

- 14.7. Technical Glass Products

- 14.8. Nippon Electric Glass Co., Ltd.

- 14.9. Raybloc (X-ray Protection) Ltd

- 14.10. MarShield

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us