|

|

市場調査レポート

商品コード

1382535

BaaS(Biometrics-as-a-Service)の世界市場:2023年~2030年Global Biometrics-as-a-Service (BaaS) Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| BaaS(Biometrics-as-a-Service)の世界市場:2023年~2030年 |

|

出版日: 2023年11月17日

発行: DataM Intelligence

ページ情報: 英文 204 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

BaaS(Biometrics-as-a-Service)の世界市場は、2022年に15億米ドルとなり、2023年~2030年の予測期間中にCAGR19.4%で成長し、2030年までに43億米ドルに達すると予測されています。

テロ活動の増加や重要なデータや情報の盗難の増加により、国家安全保障に対する懸念が高まり、バイオメトリクスの世界需要が急速に高まると予想されます。モバイル機器の利用増加、政府のデータセキュリティ規制、ヘルスケア分野における効果的な不正検知・防止ソリューションの需要が、ヘルスケア市場におけるサービスとしてのバイオメトリクスの主な促進要因となっています。

ヘルスケア専門家は、機密性の高い健康情報、保険、財務データ、個人識別情報など、さまざまな個人データを扱う。ヘルスケア情報がHIPAA(Healthcare Insurance Portability and Accountability Act:ヘルスケア保険の相互運用性と説明責任に関する法律)によって課される厳しい管理基準の対象である理由の1つはここにあります。その結果、機密情報を保護し、ヘルスケア専門家が適切な相手と情報を共有したり、話し合ったりしていることを確認することが重要になります。

2022年には、アジア太平洋地域が世界のBaaS(Biometrics-as-a-Service)市場の1/4弱を占め、最も急成長する地域になると予想されています。テロリストの脅威の増大と政府のセキュリティ支出の増加が、アジア太平洋地域における入退室管理システムの売上を促進させる2つの重要な要因です。さらに、中国の経済成長はセキュリティソリューションに対する高い需要を生み出しています。国民IDカード、電子パスポート、コネクテッドガジェットなどのバイオメトリクスプロジェクトへの政府投資は、市場成長に影響を与えると予想されます。

ダイナミクス

バイオメトリクスとクラウドの統合の拡大

バイオメトリクスをクラウドと接続することは、現在サプライヤーにとって重要な重点分野であり、クラウドで強化された機能や技術をサービスプロバイダーのバイオメトリクスインフラ全体に吸収させることができます。例えば、SkyBiometryは2019年7月、クラウドベースの顔検出・認識アルゴリズムの最新版を更新し、アルゴリズムの精度を大幅に向上させ、より多様な顔の特徴を検出できるようにする大きな進化を遂げました。

富士通はまた、ImageWare Systems(IWS)と協力し、Biometric-as-a-Serviceソリューションを提供しています。富士通のクラウドIaaS(Infrastructure-as-a-Service)やSaaS(Software-as-a-Service)とIWSのバイオメトリクス認証技術を組み合わせることで、企業はBYODの労働環境やモバイル取引のセキュリティ強化サービスに備えることができます。

高まるプライバシー保護へのシフト

よりプライバシーを重視し、セキュリティ上の危険性を低減する方向への企業言説のモデルシフトは、世界産業の主要な促進要因の1つです。最終消費者は、旧来の技術に頼るのではなく、統合されたソリューションをますます求めるようになっています。モバイルデバイスの人気上昇に伴い、消費者向けバイオメトリックは近年急速に成長しています。

バイオメトリックシステムが承認されたことにより、民生用電子機器部門は主にセキュリティデバイスとアクセスコントロールデバイスで占められており、市場成長に寄与しています。例えば、人気のメッセージングアプリであるWhatsAppは、アンドロイドプラットフォームに新しいプライバシーオプションを追加しました。同社によると、ユーザーは最終的に指紋センサーによる生体認証を使ってアカウントを保護できるようになるといいます。

プライバシーに関する懸念と規制

バイオメトリクス業界において、プライバシーは大きな問題です。指紋、顔の特徴、その他の個人識別情報のようなバイオメトリクス情報は、非常にデリケートです。ユーザーは、このデータが悪用されたり、誤用されたりして、プライバシーが損なわれることを懸念しています。様々なバイオメトリックシステムや技術間の互換性のなさが、BaaSの採用を妨げています。

既存のシステムとの相互作用が懸念される場合、企業はBaaSソリューションに取り組むことをためらい、その結果、追加費用や複雑さが生じる可能性があります。欧州連合(EU)の一般データ保護規則(GDPR)や他国の同等の法律のような厳しいデータ保護法の施行は、バイオメトリック・データの責任ある使用と保存を保証するための要件を組織に課します。法規制の遵守は、BaaSシステムの複雑さとコストを増大させる。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- バイオメトリクスとクラウドの統合の進展

- プライバシー重視へのシフト

- 抑制要因

- プライバシーに関する懸念と規制

- 機会

- 影響分析

- 促進要因

第5章 業界分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 モダリティ別

- ユニモーダル

- マルチモーダル

第8章 テクノロジー別

- 指紋認識

- 音声認識

- 署名認識

- 虹彩認証

- 手のひら認識

- 顔認識

- 行動認識

- その他

第9章 企業規模別

- 中小企業

- 大企業

第10章 導入形態別

- オンプレミス

- クラウドベース

第11章 エンドユーザー別

- 小売

- ヘルスケア・ライフサイエンス

- BFSI

- 通信・IT

- 防衛

- 政府機関

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- Accenture PLC

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Aware Inc.

- BioEnable Technologies Pvt. Ltd

- BioID Technology

- Fujitsu Limited

- Nuance Communications Inc.

- Precise Biometrics AB

- SIC Biometrics, Inc.

- NEC Corp.

- ImageWare Systems Inc.

第15章 付録

Overview

Global Biometrics-as-a-Service (BaaS) Market reached US$ 1.5 billion in 2022 and is expected to reach US$ 4.3 billion by 2030, growing with a CAGR of 19.4% during the forecast period 2023-2030.

The increasing number of terrorist operations and growing theft of critical data and information, is expected to drive the global biometrics demand at a rapid pace, raising concerns about national security. The rising use of mobile devices, government data-security regulations and the demand for effective fraud detection and prevention solutions in the healthcare sector are the primary factors driving biometrics as a service in the healthcare market.

Healthcare professionals handle a variety of personal data, including sensitive health information, insurance, financial data and personal identifying information. Its is one of the reasons why healthcare information is subject to the stringent administrative standards imposed by the Healthcare Insurance Portability and Accountability Act (HIPAA). As a result, it is important to secure sensitive information and ensure that healthcare professionals are sharing or discussing it with the appropriate person.

In 2022, Asia-Pacific is expected to be the fastest growing region having less than 1/4th of the global biometrics-as-a-service (BaaS) market. Increased terrorist threats and rising government security spending are the two key factors driving access control system sales in Asia-Pacific. Furthermore, China's growing economy creates a high demand for security solutions. Government investments in biometric projects such as national ID cards, e-passports and connected gadgets are expected to have an impact on market growth.

Dynamics

Growing Integrating of Biometrics with Cloud

Connecting biometrics with the cloud, which is now the key focus area for suppliers, allows cloud-enhanced capabilities and technologies to be absorbed on a service provider's whole biometrics infrastructure. SkyBiometry, for example, updated the latest version of its cloud-based face detection and recognition algorithm in July 2019 with major advancements that make the algorithm considerably more accurate and enable for a broader variety of facial traits to be detected.

Fujitsu also collaborated with ImageWare Systems (IWS) to offer Biometric-as-a-Service solutions. Enterprises can be prepared for a BYOD working environment and security-enhanced services for mobile transactions by combining Fujitsu's cloud Infrastructure-as-a-Service (IaaS) and Software-as-a-Service (SaaS) with IWS' biometrics authentication technology.

Growing Shift Towards More Privacy

A model shift in corporate discourse towards more privacy and fewer security hazards is one of the primary drivers of the global industry. End consumers are increasingly seeking integrated solutions instead of relying on old techniques. With the rising popularity of mobile devices, consumer biometric applications have grown quickly in recent years.

Due to the approval of biometric systems, the consumer electronics sector is dominated primarily by security and access control devices. As a result, it contributes to market growth. For example, WhatsApp, a popular messaging app, has added a new privacy option to the Android platform. Users will ultimately be able to safeguard their accounts using biometric authentication via fingerprint sensors, according to the company.

Privacy Concerns and Regulations

In the biometrics industry, privacy is a major problem. Biometric information like fingerprints, facial features and other personal identifiers, is extremely sensitive. Users are concerned regarding the misuse or mishandling of this data, which could hamper their privacy. Incompatibility between various biometric systems and technologies hinder the BaaS adoption.

Businesses will be hesitant to engage in BaaS solutions if they are concerned about the ability to interact with existing systems, which could result in additional expenses and complexity. The implementation of severe data protection legislation like the General Data Protection Regulation (GDPR) of the European Union and comparable laws in other countries, imposes requirements on organisations to ensure the responsible use and storage of biometric data. Regulation compliance increases the complexity and cost of BaaS systems.

Segment Analysis

The global biometrics-as-a-service (BaaS) market is segmented based on modality, technology, enterprise size, deployment mode, end-user and region.

Rising Adoption of Security in Retail Sector

Retail is expected to be the dominant segment with about 1/3rd of the market during the forecast period 2023-2030. Biometrics applications in the retail business are mostly for staff access control, which may help shops reduce inventory theft. With e-commerce gaining a customer experience advantage over brick and mortar businesses, retailers are adopting marketing, data and analytics solutions to improve the consumer experience.

Biometrics is also being used to improve customer experience as well as to measure and maximise retail information for both retailers and major consumer brands. In July 2019, Kairos, for example, announced a plug-and-play data visualisation and analytics solution, complete with biometric facial recognition, for retail businesses to acquire demographic and tracking information about customers. The system collects information about the customer's age, gender, emotion, dwell time and new and repeat visits.

Geographical Penetration

Rising Adoption of Technology and Awareness of Security in North America

North America is among the growing regions in the global biometrics-as-a-service (BaaS) market covering more than 1/3rd of the market. In accordance to the Federal Trade Commission, identity theft in the payment and banking sectors is common in U.S. As a result, enhanced authentication systems such as biometrics would see increased popularity. Government entities in U.S. are also implementing biometric technologies for identification and security purposes.

During the epidemic, the use of facial recognition biometrics and personal data security remains a major concern. According to a recent presentation from the agency's Office of Procurement Operations obtained by Quartz, U.S. Department of Homeland Security (DHS) plans to have face, fingerprint and iris scans of at least 259 million people in its biometrics database by 2022.

In addition, Cognizant, based in U.S., will deliver touchless authorization processing for healthcare service providers in 2020, while Infosys will launch contact-less baggage management services for a North American airline. Many residents in U.S. are still hesitant to use facial recognition technology, which is projected to drive the region's biometrics-as-a-service business.

Competitive Landscape

major global players in the market include: Accenture PLC, Aware Inc., BioEnable Technologies Pvt. Ltd, BioID Technology, Fujitsu Limited, Nuance Communications Inc., Precise Biometrics AB, SIC Biometrics, Inc., NEC Corp. and ImageWare Systems Inc.

COVID-19 Impact Analysis

Travel restrictions, business closures and decreased demand for various services all had an impact on the installation of biometric technologies, that are commonly used for control of access and identity verification. Due to concerns about virus transmission, biometric systems that rely on contact, such as fingerprint and palm print scanners, have experienced hurdles.

Many businesses began to examine contactless biometrics such as face recognition or iris scanning as safer alternatives. Many industries' digital transformation activities were expedited as a result of the epidemic. The growing interest in BaaS solutions for both security and customer convenience. Biometrics have been investigated by industries such as healthcare and finance in order to streamline processes and improve the user experience.

AI Impact

AI has resulted in numerous improvements and developments in biometric technology, making BaaS systems more accurate, safe and versatile. AI has improved biometric system security. It can detect anomalies and strange patterns in biometric data, assisting in the detection of fraudulent attempts like spoofing attacks. It is especially important in applications such as facial recognition and fingerprint recognition.

AI can adjust to changes in a user's biometric features over time, allowing for issues like as ageing, injuries and other variances. The adaptability aids in the long-term maintenance of constant user authentication. The integration of AI has broadened the use cases of BaaS across industries such as finance, healthcare, retail and government.

Russia- Ukraine War Impact

Geopolitical tensions and conflicts can cause economic insecurity and impair global supply systems. If major components for BaaS are obtained from or manufactured in the affected regions, supply chain interruptions may impair the availability and pricing of BaaS solutions. Biometric technology for access control and identity verification are gaining popularity in conflict-affected areas where security is a major concern.

To improve security, governments and organizations in these regions are investing more in BaaS systems. Wider economic consequences of geopolitical crises, such as sanctions, inflation or currency depreciation, might have an indirect impact on business technology investments, including BaaS. Concerns concerning the use of biometric technologies for monitoring and control may develop in conflict zones or places with heightened surveillance. It could lead to increased scrutiny and eventual changes in biometric data and surveillance rules.

By Modality

- Unimodal

- Multimodal

By Technology

- Fingerprint Recognition

- Voice Recognition

- Signature Recognition

- Iris Recognition

- Palm/Hand Recognition

- Face Recognition

- Behavior Recognition

- Others

By Enterprise Size

- Small & Medium Sized Enterprises

- Large Enterprises

By Deployment Mode

- On-Premise

- Cloud-based

By End-User

- Retail

- Healthcare and Life Sciences

- BFSI

- Telecom and IT

- Defense

- Government

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In April 2020, Fujitsu Frontech North America Inc., a Fujitsu Global subsidiary, completed the acquisition of Fulcrum Biometrics, LLC, a biometric hardware, software and solutions provider based in Texas. The transaction represents the company's significant commitment to strengthening its biometrics business in North America and global identity management markets, mandates imposed by new state and federal laws.

- In January 2020, Thales, a French multinational firm that designs, develops and manufactures electrical systems, powered its Biometric Matching System using groundbreaking Field-Programmable Gate Array (FPGA) technology built for huge parallel data processing. Thales can minimize the number of servers in half and significantly reduce the overall carbon footprint by using Gemalto's commercial off-the-shelf FPGA solution.

- On July 2019, Fujitsu, a Japanese multinational technology and information corporation, has partnered with ImageWare Systems (IWS) to offer Biometric-as-a-Service solutions. Enterprises can be prepared for a BYOD working environment and security-enhanced services for mobile transactions by combining Fujitsu's cloud Infrastructure-as-a-Service (IaaS) and Software-as-a-Service (SaaS) with IWS' biometrics authentication technology.

Why Purchase the Report?

- To visualize the global biometrics-as-a-service (BaaS) market segmentation based on modality, technology, enterprise size, deployment mode, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of biometrics-as-a-service (BaaS) market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

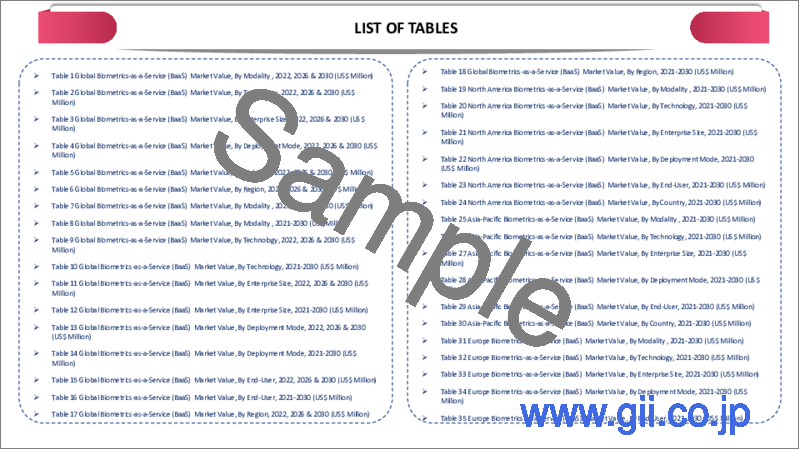

The global biometrics-as-a-service (BaaS) market report would provide approximately 77 tables, 83 figures and 204 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Modality

- 3.2. Snippet by Technology

- 3.3. Snippet by Enterprise Size

- 3.4. Snippet by Deployment Mode

- 3.5. Snippet by End-User

- 3.6. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Integrating of Biometrics with Cloud

- 4.1.1.2. Growing Shift Towards More Privacy

- 4.1.2. Restraints

- 4.1.2.1. Privacy Concerns and Regulations

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Modality

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Modality

- 7.1.2. Market Attractiveness Index, By Modality

- 7.2. Unimodal*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Multimodal

8. By Technology

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 8.1.2. Market Attractiveness Index, By Technology

- 8.2. Fingerprint Recognition *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Voice Recognition

- 8.4. Signature Recognition

- 8.5. Iris Recognition

- 8.6. Palm/Hand Recognition

- 8.7. Face Recognition

- 8.8. Behavior Recognition

- 8.9. Others

9. By Enterprise Size

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 9.1.2. Market Attractiveness Index, By Enterprise Size

- 9.2. Small & Medium Sized Enterprises*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Large Enterprises

10. By Deployment Mode

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Mode

- 10.1.2. Market Attractiveness Index, By Deployment Mode

- 10.2. On-Premise*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Cloud-based

11. By End-User

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.1.2. Market Attractiveness Index, By End-User

- 11.2. Retail*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Healthcare and Life Sciences

- 11.4. BFSI

- 11.5. Telecom and IT

- 11.6. Defense

- 11.7. Government

- 11.8. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Modality

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Mode

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Modality

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Mode

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. UK

- 12.3.8.3. France

- 12.3.8.4. Italy

- 12.3.8.5. Russia

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Modality

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Mode

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Modality

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Mode

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. Australia

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Modality

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Mode

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. Accenture PLC*

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. Aware Inc.

- 14.3. BioEnable Technologies Pvt. Ltd

- 14.4. BioID Technology

- 14.5. Fujitsu Limited

- 14.6. Nuance Communications Inc.

- 14.7. Precise Biometrics AB

- 14.8. SIC Biometrics, Inc.

- 14.9. NEC Corp.

- 14.10. ImageWare Systems Inc.

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us