|

|

市場調査レポート

商品コード

1382533

手のひら静脈バイオメトリクスの世界市場:2023年~2030年Global Palm Vein Biometrics Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 手のひら静脈バイオメトリクスの世界市場:2023年~2030年 |

|

出版日: 2023年11月17日

発行: DataM Intelligence

ページ情報: 英文 203 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

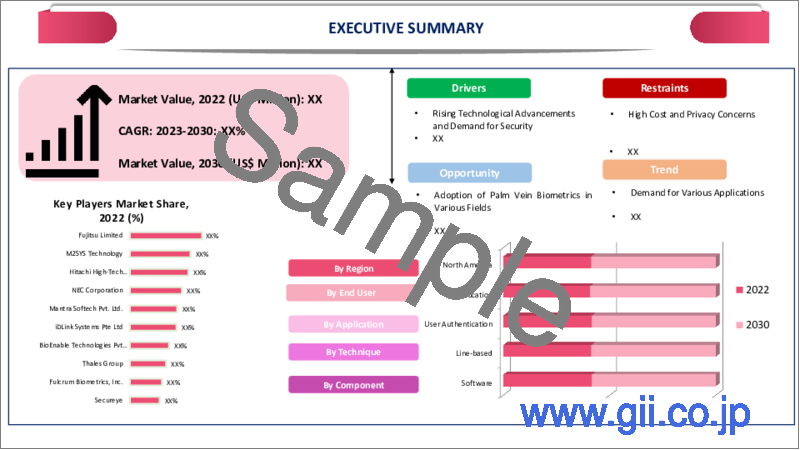

手のひら静脈バイオメトリクスの世界市場は、2022年に6億米ドルに達し、2023年~2030年の予測期間中に23.1%のCAGRで成長し、2030年までに23億米ドルに達すると予測されています。

サイトやシステムへのアクセスを制限する必要性は、時代とともに拡大しています。多くの組織は現在、パスワードやカードによる本人確認に頼っています。しかし、典型的な手法には大きな障害があります。例えば、カードの紛失や盗難はセキュリティ上の問題を引き起こします。正しい暗証番号とカードの組み合わせを持っていれば、誰でも制限されたエリアやデータにアクセスできてしまいます。その結果、セキュリティ目的でのバイオメトリクスの利用が増え、市場成長の原動力となる可能性が高いです。

日本ではすでに、静脈バイオメトリクスが銀行のATMカードの代わりにデジタルIDとして活用されています。銀行は、この技術が高精度で、ATMカードを持ち歩いたり暗証番号を覚えたりする必要がないため、顧客にとって便利であることに気づいています。現在、日本の銀行の約80%が何らかのバイオメトリクス認証を導入しており、最も多いのは静脈認証です。

これだけ多くのバイオメトリクス認証ソリューションが利用可能になれば、不正行為の可能性をさらに抑えるために、企業は多要素認証を選ぶかもしれません。このような変化は、市場の成長にも影響を与えると予想されます。例えば富士通は、新しいアクセスコントロール認証アプローチにおいて、手のひら静脈スキャン技術を顔認証システムと統合する意向です。

2022年には、アジア太平洋地域が世界の手のひら静脈バイオメトリクス市場の約1/4を占める急成長地域になると予想されています。バイオメトリクス技術に対する意識の高まり、人口基盤の増加、工業企業の拡大が、手のひら静脈バイオメトリクス市場の需要拡大を促進しています。さらに、可処分所得の高さが市場拡大に有益な影響を与えています。

ダイナミクス

技術の進歩

COVID-19の流行は非接触技術の展開を加速させています。手のひら静脈認証は非接触であるため、ヘルスケア、金融、入退室管理などさまざまな分野で衛生的で安全な認証方法となっています。手のひら静脈認証システムは、継続的な研究開発活動の結果、より高速かつ高精度になっています。継続的な進歩は技術の競合を高め、その潜在的な用途を広げます。

従来の手のひら静脈認証のセンサーは近赤外線を使用しなければなりません。2023年、富士通は、通常の携帯電話のカメラで手のひらを撮影するだけで、その人の静脈パターンを抽出できる新技術を発表し、大きな飛躍を遂げました。これは、物理センサーで得られる静脈パターンに匹敵します。ユーザーはどこからでもスマートフォンに登録でき、オフィスや店舗、会場に入る際に生体認証サービスを素早く利用できます。

セキュリティに対する意識の高まりと需要

物理的なアクセス制御とデジタル認証の両方を含むプライバシーへの懸念が、手のひら静脈バイオメトリクスの成長の主な原動力となっています。暗証番号やパスワードのような旧来の技術ではセキュリティ侵害や詐欺が起こりやすいため、組織はより強固で安全な本人確認方法を求めています。手のひら静脈認証技術は、非常に高い精度と信頼性で人を識別することができます。

例えば、キーヨは2023年にハンドヘルド手のひら静脈スキャナー「Keyo Wave+」を発表したが、これはスマートフォンサイズの画面、SOC2に準拠したデータの暗号化、特注のアプリケーションを扱う機能を備えています。声明によると、カウンタートップや壁に設置し、数十億人規模に拡大することも可能だといいます。同社はまた、手のひら静脈バイオメトリクスの採用に際して、大規模な技術チームを持たない顧客を支援するため、コード不要の統合ツールも提供しています。

プライバシーに関する懸念と製品のコスト

手のひら静脈バイオメトリクス業界では、プライバシーに関する懸念が大きな障害となっています。個人は自分のバイオメトリクスデータの収集と使用についてより警戒心を強めており、手のひら静脈データの保存と悪用の可能性から、データ漏洩や個人情報盗難に関する懸念が生じます。バイオメトリックデータは置き換えることができず、もし漏洩すれば長期的なプライバシーとセキュリティの問題を引き起こす可能性があります。

手のひら静脈バイオメトリクスデバイスを使用する企業や組織は、強力なセキュリティ対策と明確なデータ取り扱い慣行によってこれらの懸念に対処しなければならないです。特に中小組織(SME)にとっては、手のひら静脈バイオメトリクスデバイスを採用するための費用が、採用の大きな障害となる可能性があります。

この技術には、専用のデバイス、ソフトウェア、およびインフラストラクチャの購入が必要です。さらに、継続的なメンテナンスとサポート料金が総所有コストを増加させる可能性があります。予算の制約の結果、多くの組織は手のひら静脈バイオメトリクスの採用をためらうかもしれません。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 技術の進歩

- セキュリティに対する意識の高まりと需要

- 抑制要因

- プライバシーへの懸念と製品コスト

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 コンポーネント別

- ハードウェア

- ソフトウェア

第8章 タイプ別

- パームプリント

- 手のひら静脈バイオメトリクス

第9章 技術別

- ラインベース

- 部分空間ベース

- テクスチャーベース

第10章 用途別

- セキュリティ

- ユーザー認証

- 勤怠管理

- その他

第11章 エンドユーザー別

- ホームセキュリティ

- ヘルスケア

- BFSI

- 軍事・防衛

- 教育

- 政府機関

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- Fujitsu Limited

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- M2SYS Technology

- Hitachi, Ltd.

- NEC Corporation

- Safran

- Mantra Infotech

- IDLink Systems

- BioEnable

- Matrix Security Solutions

- IdentyTech Solutions America Inc.

第15章 企業概要付録

Overview

Global Palm Vein Biometrics Market reached US$ 0.6 billion in 2022 and is expected to reach US$ 2.3 billion by 2030, growing with a CAGR of 23.1% during the forecast period 2023-2030.

The need to limit access to sites and systems has expanded throughout time. Many organisations currently rely on passwords or cards to validate people's identities for access. The typical technique, however, presents significant obstacles. Card loss or theft, for example, poses security problems. Anyone with the correct PIN and card combination could gain access to restricted areas or data. As a result, the increased use of biometrics for security purposes is likely to drive market growth.

In Japan, vein biometrics have already been utilised as a digital ID in place of ATM cards in banks. Banks have realised that the technology is highly precise and handy for clients because they don't need to carry ATM cards or memorise PINs. Currently, around 80% of Japanese banks have some type of biometric authentication, the most frequent being vein recognition.

With so many biometric identification solutions available, businesses may opt for multifactor authentication to further limit the likelihood of fraud. Such changes are also expected to have an impact on market growth. Fujitsu, for example, intends to merge its palm vein scanning technology with a facial recognition system in a new access control authentication approach.

In 2022, Asia-Pacific is expected to be the fastest growing region having about 1/4th of the global palm vein biometrics market. Rising biometric technology awareness, a growing population base and an expanding number of industrial enterprises are driving growth in demand for palm vein biometric market. Furthermore, a high amount of disposable income has a beneficial impact on market expansion.

Dynamics

Growing Technological Advancements

The epidemic of COVID-19 has accelerated the deployment of contactless technologies. Palm vein identification is non-contact, making it a sanitary and secure method of verification in a variety of areas such as healthcare, finance and access control. Palm vein recognition systems are becoming faster and more accurate as a result of ongoing research and development activities. Continuous advancement increases the competitiveness of technology and broadens its potential uses.

Sensors in traditional palm vein authentication must employ near-infrared light. In 2023, Fujitsu has made a significant leap with the launch of a new technology that can extract a person's vein pattern merely by photographing their palm using a normal phone camera. It is comparable to the vein pattern obtained by the physical sensor. Users can register on their smartphones from anywhere and quickly use biometric authentication services while entering offices, stores or venues.

Rising Awareness and Demand for Security

Privacy concerns, including both physical access control and digital authorization, have been a major driver of palm vein biometrics growth. Organisations are looking for more robust and secure ways of identity verification as old techniques such as PINs and passwords prove prone to security breaches and fraud. Palm vein recognition technology can identify people with great accuracy and reliability.

For example, Keyo announced the Keyo Wave+ handheld palm vein scanner in 2023, which has a smartphone-sized screen, SOC2-compliant encryption of data and the ability to handle bespoke applications. According to the statement, it may also be installed on a countertop or wall and scaled to billions of people. The company also provides no-code integration tools to assist customers that do not have significant technical teams in adopting palm vein biometrics.

Privacy Concerns and Costs of Product

Concerns about privacy are a major impediment in the palm vein biometric industry. Individuals are becoming more wary about the gathering and use of their biometric data. Concerns regarding data breaches and identity theft arise from the storing and potential exploitation of palm vein data. Biometric data cannot be replaced and if it is compromised, it can cause long-term privacy and security problems.

Companies and organisations that use palm vein biometric devices must address these concerns by having strong security measures and clear data handling practises. The expense of adopting palm vein biometric devices, particularly for small and medium-sized organisations (SMEs), can be a substantial obstacle to adoption.

The technology necessitates the purchase of specialised devices, software and infrastructure. Furthermore, continuous maintenance and support charges might increase the total cost of ownership. As a result of budget constraints, many organisations may be hesitant to employ palm vein biometrics.

Segment Analysis

The global palm vein biometrics market is segmented based on component, type, technique, application, end-user and region.

Rising Awareness of Security and Verfifcation

BFSI is expected to be the dominant segment with about 1/3rd of the global palm vein biometrics market during the forecast period 2023-2030. With the increasing number of security breaches, the BFSI sector has seen a growth in the demand for highly secure verification and identity systems. Several banks and financial institutions have combined biometrics technologies to enable secure access to customers. For example, Bank of Tokyo-Mitsubishi, a Japanese commercial bank, deployed a palm vein biometric system to provide its customers with a secure and cost-effective option.

Many BFSI organisations are implementing palm vein biometrics, which is driving the market demand. For example, Gesa Credit Union, a financial services institution, is collaborating with financial technology company Fiserv to use palm recognition technology. Fiserv is a provider of financial services technology solutions that includes Verifast: a DNA account management platform and integrated services. Biometric verification using palm authentication.

Geographical Penetration

Rising Technology Advancements and Product Innovations in North America

In 2022, North America is among the growing regions in the global palm vein biometrics market covering more than 35% of the market. Organisations in the region are also showing an increasing interest in implementing systems that employ biometric traits to identify persons. For example, Atlantic Health System in New Jersey uses Patient Secure's biometric palm vein scanning solution to speed up patient intake and improve record accuracy.

Many BFSI organisations are implementing palm vein biometrics, which is supporting the region's market expansion. For example, Gesa Credit Union, a financial services organisation established in U.S., is collaborating with financial technology company Fiserv to use palm recognition technology. Fiserv is a provider of financial services technology solutions that includes Verifast: a DNA account processing platform and integrated services, including biometric verification using palm authentication.

Competitive Landscape

major global players in the market include: Fujitsu Limited, M2SYS Technology, Hitachi, Ltd., NEC Corporation, Safran, Mantra Infotech, IDLink Systems, BioEnable, Matrix Security Solutions and IdentyTech Solutions America Inc.

COVID-19 Impact Analysis

The COVID-19 pandemic, driven by the new coronavirus SARS-CoV-2, has significantly impacted the global landscape. Among its numerous consequences, the pandemic has had a profound impact on the use and growth of biometric technologies such as palm vein biometrics. Biometrics has been critical in delivering seamless authentication for remote workers, decreasing dependency on traditional authentication techniques like as passwords.

Cyberattacks and fraud attempts have increased as a result of the pandemic. By analyzing user vein for abnormalities or suspect patterns, palm vein biometrics has been used to detect fraudulent activities such as account takeovers and phishing assaults. During the epidemic, some organizations have investigated the use of palm vein biometrics for health monitoring.

AI Impact

AI systems can accurately analyze and interpret patterns of palm vein of the user. Machine learning and deep learning approaches allow computers to recognize subtle patterns and variations in user behavior, lowering the number of false positives and false negatives. As AI allows for real-time processing of palm vein biometric data, user authentication and fraud detection may happen instantly, offering quick security actions when anomalies or suspicious activity are found.

Artificial intelligence-powered palm vein biometrics systems can continuously learn and adapt to changing user vein pattern, as well as recognize modifications or departures from established patterns, making them useful in detecting fraudulent activities that may alter over time. Palm vein biometric systems powered by AI can adapt to variances in the user's palm vein patterns over time. The self-learning algorithms increase accuracy while decreasing false rejection rates.

Russia- Ukraine War Impact

Cyberattacks and cyber dangers frequently increase during times of geopolitical crisis. Palm vein biometrics, which examine user veins for signs of hazardous activity, can be immensely valuable in identifying and mitigating such dangers. Conflict-affected areas are more conscious of security risks and the importance of protecting personal information.

As a result of the disruption created by conflict and security concerns, more people work remotely and perform digital transactions. Palm vein biometrics, which provide continuous authentication without the use of physical tokens or passwords, can help protect remote access and online transactions. Concerns have been raised concerning government surveillance and the privacy of individuals' digital activity in countries directly affected by conflict or political instability.

By Component

- Hardware

- Software

By Type

- Palm Print

- Palm Vein Biometrics

By Technique

- Line-based

- Subspace-based

- Texture-based

By Application

- Security

- User Authentication

- Time and Attendance

- Others

By End-User

- Home Security

- Healthcare

- BFSI

- Military and Defense

- Education

- Government

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In 2023, Imprivata, the premier digital ID firm in healthcare, for example, developed PatientSecure, a biometric palm vein authentication product that healthcare relies on for positive patient identification. Imprivata required a contactless solution for their device in the midst of the pandemic, so they collaborated with Keyo on a design that supports the patient identification routines that HDOs have grown to rely on while lowering the danger of transmission.

Why Purchase the Report?

- To visualize the global palm vein biometrics market segmentation based on component, type, technique, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of palm vein biometrics market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global palm vein biometrics market report would provide approximately 61 tables, 58 figures and 203 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Component

- 3.2. Snippet by Type

- 3.3. Snippet by Technique

- 3.4. Snippet by Application

- 3.5. Snippet by End-User

- 3.6. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Technological Advancements

- 4.1.1.2. Rising Awareness and Demand for Security

- 4.1.2. Restraints

- 4.1.2.1. Privacy Concerns and Cost of Products

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Component

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 7.1.2. Market Attractiveness Index, By Component

- 7.2. Hardware*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Software

8. By Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 8.1.2. Market Attractiveness Index, By Type

- 8.2. Palm Print*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Palm Vein Biometrics

9. By Technique

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technique

- 9.1.2. Market Attractiveness Index, By Technique

- 9.2. Line-based*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Subspace-based

- 9.4. Texture-based

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Security*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. User Authentication

- 10.4. Time and Attendance

- 10.5. Others

11. By End-User

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.1.2. Market Attractiveness Index, By End-User

- 11.2. Home Security*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Healthcare

- 11.4. BFSI

- 11.5. Military and Defense

- 11.6. Education

- 11.7. Government

- 11.8. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technique

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technique

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. UK

- 12.3.8.3. France

- 12.3.8.4. Italy

- 12.3.8.5. Russia

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technique

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technique

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. Australia

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technique

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. Fujitsu Limited*

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. M2SYS Technology

- 14.3. Hitachi, Ltd.

- 14.4. NEC Corporation

- 14.5. Safran

- 14.6. Mantra Infotech

- 14.7. IDLink Systems

- 14.8. BioEnable

- 14.9. Matrix Security Solutions

- 14.10. IdentyTech Solutions America Inc.

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us