|

|

市場調査レポート

商品コード

1382532

世界のガラス市場:2023年~2030年Global Glass Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 世界のガラス市場:2023年~2030年 |

|

出版日: 2023年11月17日

発行: DataM Intelligence

ページ情報: 英文 226 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

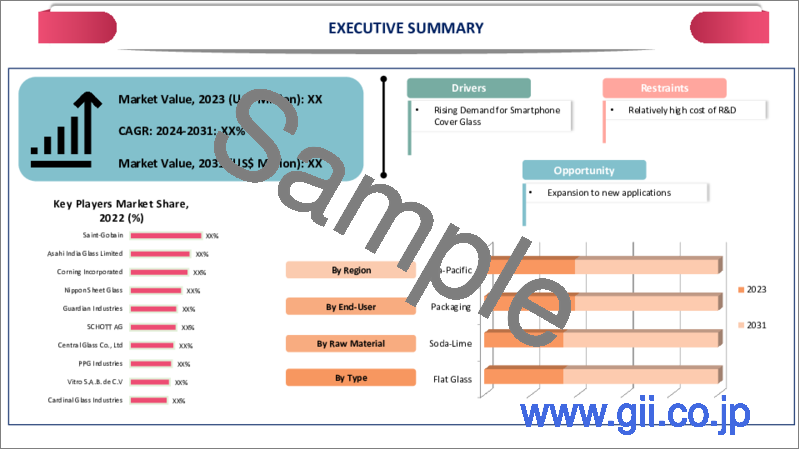

世界のガラス市場は2022年に2,607億米ドルとなり、2023年~2030年の予測期間中にCAGR4.8%で成長し、2030年までに3,791億米ドルに達すると予測されます。

世界のガラス市場は多様でダイナミックであり、様々な用途があります。この市場には、包装、電子機器、建築など様々な産業で利用されるガラス製品の製造と流通が含まれます。持続可能性とエネルギー効率の高いガラスに対する需要の高まりは、市場を促進する2つの主要要因です。

さらに、スマートガラス技術の利用向上やガラス製造への先端技術導入への投資拡大も、世界のガラス市場の成長に寄与する顕著な要因となっています。

エネルギー集約型産業のひとつにガラス産業があります。エネルギー効率は一貫して向上していますが、製造工程が高温に依存するため、利用可能な技術の進歩には制約があります。欧州では、再生可能な電力で加熱できる新しい炉がパイロットプロジェクトでテストされ、水素の利用が研究されています。

欧州には多くのガラス工場があり、世界市場の26.7%近くを占めています。しかし、こうした地域の中小企業が排出量を削減するために必要な投資は極めて困難であり、特に水素パイプラインのような重要なインフラには多額の費用がかかります。そのため政府は、この市場における先進的なガラス製造の開拓を改善するための支援を行っており、今後の成長が期待されています。

ダイナミクス

エネルギー効率の高いガラスと持続可能性への需要の高まり

エネルギー効率の高いガラスとして知られる低放射ガラス(Low-E)は、窓やファサードを介した熱伝導を低減します。このことは、建物の冷暖房に必要なエネルギーが少なくて済むことを意味し、エネルギー消費量とエネルギーコストの削減につながります。住宅と商業施設の両方でエネルギー効率が優先されるようになり、エネルギー使用量を最小限に抑えるガラスソリューションの需要はますます高まっています。

企業もエネルギー効率の高いガラスの採用に投資しています。例えば2020年には、欧州連合(EU)が資金を提供する「スイッチ2セーブ」プロジェクトが、巨大な窓やガラスのファサードによく合う、リーズナブルな価格のスマートガラスシステムを開発しています。1年間の実験の結果、予備的な知見では、これらのエネルギースマートな複層ガラスユニット(IGU)は、グレージングを多用する構造物の一次エネルギー使用量を最大70%削減できます。エレクトロクロミック(EC)とサーモクロミック(TC)の窓ガラス技術は、スマートガラスソリューション「Switch2Save」の賢いスイッチングプロトコルと組み合わされています。

ガラス製造における技術の進歩

スマートガラス、セルフクリーニングガラス、軽量ガラスなどの技術的進歩は、ガラス市場に寄与する主要な要因です。一般にスマートガラスと呼ばれるスイッチング可能なガラスは、電流やその他の刺激に反応して光透過特性を変化させることができるタイプのガラスです。この技術は、エネルギー効率、プライバシー、美観、快適性において大きな利点を提供するため、今後5年間に進歩し、普及が進むと予想されています。

現在、スマートグラスには3つの主なカテゴリーがあります - ①エレクトロクロミック ②ポリマー分散液晶(PDLC)③浮遊粒子デバイス(SPD)。スマートガラス技術の性能、サイズ、手頃な価格は、継続的な進歩により改善され、より広い市場が開かれると予想されます。スマートガラスは、窓、ドア、天窓だけでなく、室内の間仕切りにも利用できます。多くのプロジェクトでは、最大サイズの制限が引き続き重要な課題となっています。

環境への懸念

英国サウサンプトン大学の研究者によると、ガラスはプラスチックやアルミニウムよりも高い温度で溶融しなければなりません。バージンガラスの環境負荷は、その原料成分の溶融過程で温室効果ガスが放出されることによってさらに増大します。国際エネルギー機関(IEA)によれば、板ガラスと容器のセクターから年間60メガトン以上のCO2が排出されています。意外に思われるかもしれませんが、ブロックの調査によれば、ペットボトルの方がガラス製よりも環境への害が少ないです。

さらに、ガラスをリサイクルしても、ガラス製造時に最もエネルギーを消費する再溶解工程がなくならないことも、主な問題のひとつです。製造工程で使用されるエネルギーの75%を占めています。ガラスは平均12~20回再利用される可能性があるにもかかわらず、一般的に使い捨てに分類されます。埋め立て地に一度だけ捨てられたガラスは、分解に100万年かかることもあります。世界的に見ると、ガラスのリサイクル率は大きく異なっています。米国の2018年の平均リサイクル率は31.3%であるのに対し、EUでは74%、英国では76%です。したがって、上記の要因はガラス市場の成長を妨げる潜在的な要因です。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- エネルギー効率の高いガラスと持続可能性への需要の高まり

- ガラス製造技術の進歩

- 抑制要因

- 環境への懸念

- 事業機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 タイプ別

- 板ガラス

- 容器ガラス

- 繊維ガラス

- 特殊ガラス

- その他

第8章 原料別

- ソーダ石灰ガラス

- ホウケイ酸ガラス

- 溶融シリカ

- アルミノケイ酸塩ガラス

- その他

第9章 用途別

- 建築用ガラス

- 自動車用ガラス

- 電子機器およびディスプレイ用ガラス

- 食品および飲料の包装

- 医薬品包装

- ソーラーパネル

- 光学ガラス

- その他

第10章 エンドユーザー別

- 建築・建設

- 自動車

- 電気・電子機器

- パッケージング

- 太陽エネルギー

- 航空宇宙

- ヘルスケア

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Saint-Gobain

- 会社概要

- 製品ポートフォリオと概要

- 財務概要

- 主な発展

- Asahi India Glass Limited

- Corning Incorporated

- Nippon Sheet Glass

- Guardian Industries

- SCHOTT AG

- Central Glass Co., Ltd

- PPG Industries

- Vitro S.A.B. de C.V

- Cardinal Glass Industries

第14章 付録

Overview

Global Glass Market reached US$ 260.7 billion in 2022 and is expected to reach US$ 379.1 billion by 2030, growing with a CAGR of 4.8% during the forecast period 2023-2030.

The global glass market is diverse and dynamic and has many different applications. It includes the manufacturing and distribution of glass goods utilized in a variety of industries, including packaging, electronics, construction and more. Sustainability and rising demand for energy-efficient glass are two key market-driving drivers.

Furthermore, improving the use of smart glass technology and growing investments in the adoption of advanced technologies for glass manufacturing are other prominent factors contributing to the growth of the global glass market.

One of the energy-intensive industries is the glass industry. Although it has consistently increased its energy efficiency, the production process' reliance on high temperatures places restrictions on how far the available technologies may advance. New furnaces that could be heated with renewable electricity are tested in Europe in pilot projects and research looks into the usage of hydrogen.

Many locations throughout Europe have glassworks which has made it contribute nearly 26.7% to the global market. However, the investments required to reduce emissions for smaller businesses in these areas are extremely difficult, particularly for vital infrastructure like hydrogen pipelines. Thus government is providing support to improve the development of advanced glass manufacturing in the market leading to future growth prospects.

Dynamics

Increasing Demand for Energy-Efficient Glass and Sustainability

Low-emissivity (Low-E) glass, often known as energy-efficient glass, helps reduce heat transfer via windows and facades. The implies that less energy is needed in buildings for heating and cooling, which lowers energy consumption and lowers energy costs. Glass solutions that might help minimize energy usage are becoming more and more in demand as energy efficiency becomes a priority for both residential and commercial structures.

Companies are also investing in adopting energy-efficient glasses. For instance, in 2020, The Switch2Save project, financed by the European Union, is creating reasonably priced smart glass systems that fit well with huge windows and glass facades. After a year of the experiment, preliminary findings indicate that these energy-smart insulating glass units (IGUs) can reduce a structure with a lot of glazing by up to 70% in terms of primary energy use. Electrochromic (EC) and thermochromic (TC) window technologies are combined with clever switching protocols in the Switch2Save smart glass solutions.

Technological Advancements in Glass Manufacturing

Technological advancements such as smart glass, self-cleaning glass and lightweight glass are major factors contributing to the market of glass. Switchable glass, commonly referred to as smart glass, is a type of glass that can alter its light transmission characteristics in response to an electric current or other stimulus. Since this technology offers considerable advantages for energy efficiency, privacy, aesthetics and comfort, it is anticipated to advance and become more prevalent during the next five years.

Currently, there are three main categories of smart glasses: 1) electrochromic 2) Polymer Dispersed Liquid Crystal (PDLC); and 3) Suspended Particle Device (SPD). The performance, size and affordability of Smart Glass technologies are anticipated to improve with continued advancements, opening up a wider market. Smart Glass can be utilized for interior partitions as well as windows, doors and skylights. Maximum size restrictions continue to be the key challenge for many projects.

Environmental Concerns

According to a researcher from University of Southampton in UK, glass has to melt at temperatures higher than plastic and aluminum. The environmental impact of virgin glass is further increased by the release of greenhouse gases during the melting process of its raw components. Over 60 megatonnes of CO2 are released annually by the flat-glass and container sectors, according to the International Energy Agency. It might come as a surprise, but according to Brock's research, plastic bottles are less harmful to the environment than glass ones.

Furthermore, The fact that recycling glass does not eliminate the remelting process-which uses the most energy during glass production-is one of its main issues. It makes up 75% of the energy used in the production process. Glass is generally classified as single-use even though it may be reused an average of 12-20 times. Glass that has been thrown away once-and-for-all all all in landfills may take up to a million years to degrade. Globally, glass recycling rates differ greatly. The average recycling rate in U.S. was 31.3% in 2018, compared to 74% and 76% in the EU and UK. Thus the above factors are the potential factors hampering the growth of the glass market.

Segment Analysis

The global glass market is segmented based on type, raw material, application, end-user and region.

Growing Investment Drives the Flat Glass Segmental Growth

Flat glass is a growing market based on types and is expected to cover more than 40.9% market share in the forecast period. Research & development investments result in innovations in flat glass manufacturing. Innovations in float glass production methods, coating technologies and the development of energy-efficient and smart glass are instances of these developments. Customers seeking exceptional glass products are drawn to advanced technology, fueling the segment's expansion.

For instance, in August 2022, Mexican glass manufacturer Vitro explored the development of a flat and container glass plant. The Mexican container and float glass manufacturer intends to invest US$ 400 million in a free zone framework in a 350,000m2 flat glass production and a 150,000m2 container glass facility.

Geographical Penetration

Partnership Among Key Players Supplements the Regional Market Growth

Europe has been a dominant force in the global glass market and is expected to reach up to 40.1% in 2022 in terms of revenue. Collaborations between important stakeholders frequently involve the exchange of technology and research capabilities. It can result in the development of innovative glass products and manufacturing techniques, with the potential to open up new markets and applications.

For instance, in February 2023, AGC and Saint-Gobain will collaboratively design a pilot flat glass production that will lower each company's direct CO2 emissions. AGC's patterned glass production plant in Barevka, Czech Republic, will be completely rebuilt and modernized. The line's objective is to be 50% electrified and 50% fueled by a mix of oxygen and gas. The is a technological breakthrough when compared to current technology utilized in natural gas-fired flat glass furnaces.

COVID-19 Impact Analysis

Manufacturing of float glass has been impacted by COVID-19, much like the rest of the glass industry. Difficulties with the supply chain and possible closures as a result of state orders to stay at home and shelter in place have affected the industry. With a few exceptions, the majority of float manufacturing facilities in U.S. seem to be still in operation as of right present. When the coronavirus first started to spread and stay-at-home restrictions were put into place, the majority of American corporations with float facilities issued statements about worker safety and material supply. Companies pledged communication about disruptions brought on by the pandemic, reassured clients that there was a sufficient supply of raw glass and highlighted worker safety precautions.

Nevertheless, COVID-19 has had consequences, mostly because of the economic effects of the pandemic.

Russia-Ukraine War Impact Analysis

Commodity and energy price volatility can be caused by geopolitical tensions and trade disruptions. Energy price fluctuations, such as natural gas, can have an impact on glass producers' production costs. The European glass industry is energy-intensive and energy prices account for a considerable portion of production costs. Geopolitical events can have an impact on energy prices, thereby raising production costs.

The conflict between Russia and Ukraine may disrupt supply chains, reducing the availability of raw materials, particularly minerals and chemicals required in glass manufacture. If European glass manufacturers rely on regional imports, disruptions could result in supply shortages and price instability.

By Type

- Flat Glass

- Container Glass

- Fiber Glass

- Specialty Glass

- Others

By Raw Material

- Soda-Lime Glass

- Borosilicate Glass

- Fused Silica

- Aluminosilicate Glass

- Others

By Application

- Architectural Glass

- Automotive Glass

- Electronics and Display Glass

- Food and Beverage Packaging

- Pharmaceutical Packaging

- Solar Panels

- Optical Glass

- Others

By End-User

- Building and Construction

- Automotive

- Electrical & Electronics

- Packaging

- Solar Energy

- Aerospace

- Healthcare

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On August 19, 2023, By enhancing the circularity of electric light-duty vehicles, the ZEvRA (Zero Emission Electric Vehicles Enabled by Harmonised Circularity) project was started with Sisecam as one of its partners to contribute to a sustainable and competitive future. The Horizon Europe program of the European Union provided funding for this creative endeavor for EUR 250,000.

- On 03 March 2023, During Research and development (R&D) tests at the Herzogenrath factory in Germany, Saint-Gobain became the first company in the world to produce a test batch of flat glass utilizing more than 30% hydrogen. Saint-Gobain has demonstrated for the first time in the world that it is technically feasible to produce flat glass containing a large amount of hydrogen. It will complement existing decarbonized energy sources and cut the site's direct CO2 emissions (scope 1) by up to 70%.

- By 06 February 2023, AGC and Saint-Gobain, two of the top flat glass producers in the world concerning comes to sustainability, announce that they are working together to design a groundbreaking pilot flat glass line that will drastically cut its direct CO2 emissions. AGC's patterned glass production line in Barevka, Czech Republic, will be completely renovated as part of this R&D project to create a high-performing, cutting-edge line that aims to be 50% electrified and 50% fueled by a combination of oxygen and gas. Compared to the technology now employed in natural gas-fired flat glass furnaces, this represents a technological advance.

Competitive Landscape

The major global players in the market include: Saint-Gobain, Asahi India Glass Limited, Corning Incorporated, Nippon Sheet Glass, Guardian Industries, SCHOTT AG, Central Glass Co., Ltd, PPG Industries, Vitro S.A.B. de C.V, Cardinal Glass Industries and others.

Why Purchase the Report?

- To visualize the global glass market segmentation based on type, raw material, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of glass market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

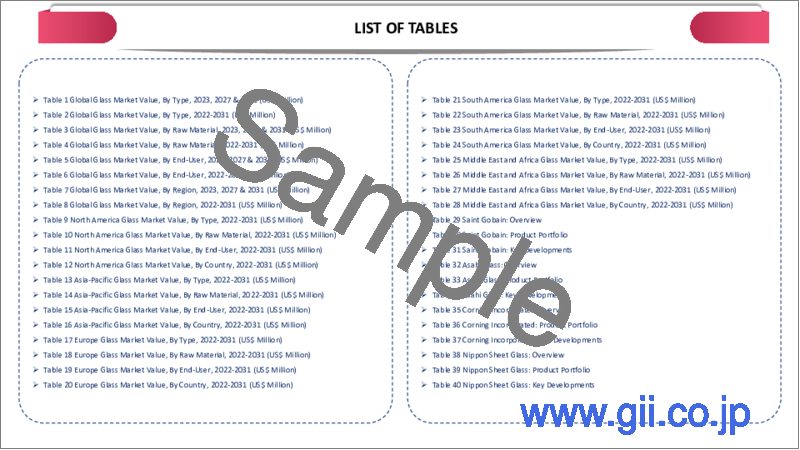

The global glass market report would provide approximately 69 tables, 81 figures and 226 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Raw Material

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Demand for Energy-Efficient Glass and Sustainability

- 4.1.1.2. Technological Advancements in Glass Manufacturing

- 4.1.2. Restraints

- 4.1.2.1. Environmental Concerns

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Flat Glass*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Container Glass

- 7.4. Fiber Glass

- 7.5. Specialty Glass

- 7.6. Others

8. By Raw Material

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Raw Material

- 8.1.2. Market Attractiveness Index, By Raw Material

- 8.2. Soda-Lime Glass*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Borosilicate Glass

- 8.4. Fused Silica

- 8.5. Aluminosilicate Glass

- 8.6. Others

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Architectural Glass*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Automotive Glass

- 9.4. Electronics and Display Glass

- 9.5. Food and Beverage Packaging

- 9.6. Pharmaceutical Packaging

- 9.7. Solar Panels

- 9.8. Optical Glass

- 9.9. Others

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Building and Construction*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Automotive

- 10.4. Electrical & Electronics

- 10.5. Packaging

- 10.6. Solar Energy

- 10.7. Aerospace

- 10.8. Healthcare

- 10.9. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Raw Material

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Raw Material

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Russia

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Raw Material

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Raw Material

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Raw Material

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Saint-Gobain*

- 13.1.1. Company Overview

- 13.1.2. Type Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Asahi India Glass Limited

- 13.3. Corning Incorporated

- 13.4. Nippon Sheet Glass

- 13.5. Guardian Industries

- 13.6. SCHOTT AG

- 13.7. Central Glass Co., Ltd

- 13.8. PPG Industries

- 13.9. Vitro S.A.B. de C.V

- 13.10. Cardinal Glass Industries

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us