|

|

市場調査レポート

商品コード

1382527

表面保護フィルムの世界市場:2023年~2030年Global Surface Protection Films Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 表面保護フィルムの世界市場:2023年~2030年 |

|

出版日: 2023年11月17日

発行: DataM Intelligence

ページ情報: 英文 222 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

表面保護フィルムの世界市場は、2022年に13億米ドルに達し、2023年~2030年の予測期間中にCAGR5.1%で成長し、2030年までは20億米ドルに達すると予測されています。

自動車、エレクトロニクス、建築、航空宇宙、製造業など、複数の産業や用途で表面保護フィルムが使用されています。これは、環境要因、汚れ、紫外線、傷、擦り傷に対する防御を提供します。この市場を牽引しているのは、建設業界における表面保護ニーズの高まり、高価値製品を保護するための費用対効果の高い技術へのニーズ、自動車やエレクトロニクス分野での出荷時や組み立て時の損傷を回避するための使用拡大といった要因です。

アジア太平洋地域は、2022年に48.4%以上を占める表面保護フィルムの世界市場で大きなシェアを占めています。自動車、エレクトロニクス、建設、航空宇宙など、中国の堅調な産業・製造部門が表面保護フィルムの大幅な需要につながっています。フィルムは、生産、輸送、ハンドリングのさまざまな段階で、製品やマテリアルを損傷から守るために重要です。

ダイナミクス

発展途上地域における高度表面保護フィルムの採用増加

表面保護フィルムは、傷、擦り傷、汚れ、紫外線、環境要因など、様々な形態のダメージから表面を保護するために頻繁に使用されます。保護層は、製造、輸送、使用中の製品や素材の品質と美観の維持を保証します。アジア、ラテンアメリカ、アフリカなどの発展途上地域では、急速な工業化とインフラ整備が進んでいます。これらの地域が主要な製造・消費拠点となるにつれ、表面保護フィルムの需要は増加傾向にあります。

企業もまた、この製品の市場動向を押し上げるために投資を行っています。例えば、2020年6月17日、Tredegar Corporationの事業部門であり、表面保護フィルムの世界的リーダーであるTredegar Surface Protectionによって、最先端の表面保護フィルムを作成するための最先端の生産ラインが稼働しました。優れた品質と安定した供給で知られるトレデガー サーフェス プロテクションは、ディスプレイやその他の基材に使用される光学フィルムのデリケートな表面を、生産、変換、輸送の各工程で保護するために不可欠な製品です。

自動車用途で高まる需要

塗装保護フィルム(PPF)としても知られる表面保護フィルムは、自動車の塗装を傷や欠け、環境損傷から保護するために使用されます。PPFは、自動車所有者が自動車の美観と再販価値を維持しようと努力する中で、高い需要があります。

例えば、2021年7月21日、ULTRAFITは傷、欠け、汚れ、紫外線から自動車のデリケートな部分を保護する自動車保護コーティングを製造する世界的なブランドです。10年以上の経験と研究により新しいソリューションを発明し、自動車保護を次のレベルに引き上げることで、業界のギャップをカバーする方法を常に模索しています。

ULTRAFITは、フロントガラス保護フィルム「WinCrest」で、2019年の自動車フィルム市場を変革しました。この10年以上、世界中のフロントガラス保護フィルムの顧客は、施工後ほどなくしてフィルムが層状に割れる剥離の問題を抱えていました。独自の技術を持つULTRAFIT WinCrestシリーズは、そのような問題に終止符を打ち、失望する顧客の数をゼロにすることで施工業者を支援しました。

高い製造コスト

高品質な表面保護フィルムの開発には、特殊な材料と製造工程が必要とされることが多いです。これらの材料は、接着性、耐久性、環境要素への耐性に関する特定の基準を満たさなければならないです。材料の入手や加工にコストがかかり、製造価格が上昇することもあります。

市場競争力を維持し、拡大する市場ニーズを満たすために、メーカーは研究開発(R&D)に投資し、フィルムの品質と性能を向上させなければならないです。自己修復機能や耐紫外線性の向上といった新機能を生み出すには資金が必要であり、それが製造コスト上昇の一因となる可能性があります。

激しい市場競争

メーカー各社は、競争の激しいマーケットプレースで顧客を獲得するために価格競争を繰り広げることがあります。これは、価格を下げることで消費者に利益をもたらす一方で、メーカーの利益率を低下させ、業界の繁栄に不可欠な研究開発や技術革新への投資を困難にします。

メーカーによっては、資金を節約して競争力を維持するために、表面保護フィルムの品質を妥協する場合もあります。その結果、製品の信頼性や性能に懸念が生じ、業界の評判が低下する可能性があります。

激しい競争は、生産者が競争のために価格設定を下げざるを得なくなる可能性があるため、マージンの圧縮を引き起こす可能性があります。これは業界の収益性に影響を及ぼし、製品オプションの拡大や製品品質の向上に費やす企業の能力を制限する可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 発展途上地域における高度表面保護フィルムの採用増加

- 自動車用途での需要の高まり

- 抑制要因

- 高い製造コスト

- 激しい市場競争

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 厚さ別

- 25ミクロン以下

- 25~50ミクロン

- 50~100ミクロン

- 100~150ミクロン

- 150ミクロン以上

第8章 材料別

- ポリエチレン(PE)

- ポリエチレンテレフタレート(PET)

- ポリプロピレン(PP)

- ポリウレタン(PU)

- ポリ塩化ビニル(PVC)

- その他

第9章 技術別

- 接着ラミネーション

- 共押出ラミネーション

第10章 色別

- 透明

- 半透明

- 着色または着色

- 不透明

第11章 用途別

- 金属板

- ガラスと鏡

- 塗装済み表面

- プラスチックシート

- PVCプロファイル

- 家具表面

- カーペット保護

- その他

第12章 エンドユーザー別

- 建築・インテリア

- 電気・電子機器

- 自動車

- 産業用

- ヘルスケア

- その他

第13章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第14章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第15章 企業プロファイル

- DUNMORE

- 会社概要

- 製品ポートフォリオと概要

- 財務概要

- 主な発展

- Tradegar Surface Protection

- Nitto Denko Corporation

- Ecoplast Ltd

- POLIFILM GROUP

- Chargeurs

- Bischof+Klein SE & Co. KG

- Aristo Flexi Pack

- 3M

第16章 付録

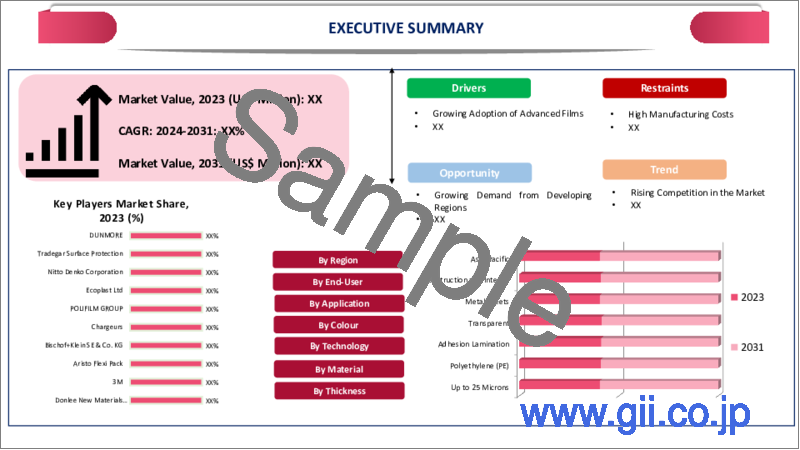

Overview

Global Surface Protection Films Market reached US$ 1.3 billion in 2022 and is expected to reach US$ 2.0 billion by 2030, growing with a CAGR of 5.1% during the forecast period 2023-2030.

Multiple industries and applications, such as the automotive, electronics, building, aerospace and manufacturing industries, use surface protection films. It offer defense against environmental factors, filth, UV rays, scratches and abrasions. The market is driven by factors such as the growing need for surface protection in the construction industry, the need for cost-effective techniques to safeguard high-value products and the expanding use of these products to avoid damage during shipping and assembly in the automotive and electronics sectors.

Asia-Pacific holds a major share of the global surface protection films market covering more than 48.4% in 2022. China's robust industrial and manufacturing sectors, including automotive, electronics, construction and aerospace, have led to a substantial demand for surface protection films. The films are crucial for safeguarding products and materials from damage during various stages of production, transportation and handling.

Dynamics

Rising Adoption of Advanced Surface Protection Films in Developing Regions

Surface protection films are frequently used to safeguard surfaces from various forms of damage, including scratches, abrasions, dirt, UV radiation and environmental factors. The protective layer ensures that products and materials maintain their quality and aesthetics during manufacturing, transportation and use. Developing regions, such as parts of Asia, Latin America and Africa, are witnessing rapid industrialization and infrastructure development. As these regions become major manufacturing and consumer hubs, the demand for surface protection films is on the rise.

Companies are also investing to boost the market trend of the product. For instance, On June 17, 2020, A cutting-edge production line for creating cutting-edge surface protection films was put into operation by Tredegar Surface Protection, an operating division of Tredegar Corporation and a world leader in surface protection films. Tredegar Surface Protection, known for its superior quality and consistent supply, is essential in safeguarding the delicate surfaces of optical films utilized in displays and other substrates during the production, conversion and transportation processes.

Growing Demand in Automotive Applications

Surface protection films, also known as paint protection films (PPF), are used to protect the paint on a vehicle from scratches, chips and environmental damage. PPF is in high demand as automobile owners strive to retain the beauty and resale value of their vehicles.

For instance, on July 21, 2021, ULTRAFIT is a global brand that produces automotive protection coatings that shield sensitive vehicle regions from scratches, chipping, stains and UV radiation. With over a decade of experience and research, ULTRAFIT is constantly looking for methods to cover industry gaps by inventing new solutions and taking automobile protection to the next level.

With their windshield protective film, WinCrest, ULTRAFIT transformed the automobile film market in 2019. For more than a decade, windshield protection film customers globally have had delamination problems, with the film splitting into layers not long after installation. The ULTRAFIT WinCrest series, with its proprietary technology, put an end to such issues, assisting installers in reducing the number of disappointed clients to zero.

High Manufacturing Costs

The employment of specific materials and manufacturing procedures is frequently required in the development of high-quality surface protection films. Specific standards for adhesion, durability and resistance to environmental elements must be met by these materials. The materials may be more expensive to obtain and process, increasing production prices.

Manufacturers must invest in research and development (R&D) to improve the quality and performance of their films to remain competitive and fulfill the market's growing needs. Creating new features such as self-healing capabilities or increased UV resistance necessitates financial resources, which might contribute to higher manufacturing costs.

Intense Market Competition

Manufacturers can engage in price wars to attract clients in highly competitive marketplaces. While this benefits consumers by cutting prices, it reduces manufacturers' profit margins, making it difficult to invest in R&D and innovation, which are crucial for the industry to thrive.

Some manufacturers may compromise the quality of their surface protection films to conserve funds and remain competitive. The may pose concerns about the products' dependability and performance, thereby harming the industry's reputation.

Intense rivalry can cause margin compression because producers may be obliged to decrease their pricing to compete. The can have an impact on industry profitability and limit companies' capacity to spend in extending their product options or enhancing product quality.

Segment Analysis

The global surface protection films market is segmented based on thickness, material, technology, colour, application, end-user and region.

Expanding Industrial Demand Drives Growth in the Polyurethane (PU) Film Market

PU film surface protection films are a growing market based on material and are expected to cover more than 43.9% market share in the forecast period. The growing demand for surface protection films in a variety of industries, including automotive, electronics, construction and aerospace, has greatly fueled the PU film market. The demand for PU-based protection solutions grows in tandem with the expansion of these industries.

For instance, on August 30, 2022, In Asia-Pacific, RODIM, a BASF paint-related product brand, launched its new invisible Thermoplastic Polyurethane (TPU) Paint Protection Film (PPF). Therefore, the polyurethane segment holds the majority of market shares in the global segmental share.

Geographical Penetration

North America's Thriving Automotive Sector Boosts Its Dominance in the Global Surface Protection Film Market

The automotive sector in North America, particularly in U.S. and Mexico, is thriving. For instance, on July 29, 2021, Lubrizol announced the next stage of its multi-million dollar investment in thermoplastic polyurethane (TPU) capacity and capabilities to serve the fast-developing global Paint Protection Films (PPF) market.

This comes on top of more than US$ 20 million in capacity, application and testing capabilities and industry insights over the last three years. Therefore, North America dominates the global surface protection film market with more than one-third of the market share.

COVID-19 Impact Analysis

The manufacture and distribution of surface protection films were impacted by the disruption of global supply networks caused by the COVID-19 pandemic. There were delays and shortages as a result of the difficulties many manufacturers had locating components and raw materials.

The demand for surface protection films fell in sectors like electronics, construction and automotive which are big users of the film-as a result of lockdowns, lower consumer spending and unstable economic conditions. The drop in demand affected the market for surface protection films.

The types of surface protection films that were in demand changed as a result of the pandemic. For instance, in response to worries about health and safety, there has been a rise in interest in antimicrobial or easily cleaned films. Demand for films used in the healthcare industry also increased.

Russia-Ukraine War Impact Analysis

Price volatility in the global market can be caused by supply chain interruptions and geopolitical tensions. The cost of surface protection films may fluctuate due to changes in raw material prices and transportation expenses.

Companies in the surface protection film industry may be more exposed to geopolitical risk, particularly if they operate in Ukraine, Russia or other nearby nations. Decisions about investments and corporate strategy may become questionable as a result.

Economic instability brought on by geopolitical events may have an impact on consumer and business spending trends. The need for surface protection coatings may decline if companies start to spend less on them.

By Thickness

- Up to 25 Microns

- 25-50 Microns

- 50-100 Microns

- 100-150 Microns

- Above 150 Microns

By Material

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Others

By Technology

- 200 Series

- 300 Series

- 400 Series

- Duplex Series

- Others

By Colour

- Transparent

- Translucent

- Colored 0r Tinted

- Opaque

By Application

- Metal Sheets

- Glass and Mirror

- Prepainted Surfaces

- Plastic Sheets

- PVC Profiles

- Furniture Surfaces

- Carpet Protection

- Others

By End-User

- Construction and Interior

- Electrical and Electronics

- Automotive

- Industrial

- Healthcare

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On July 10th, 2018, Pregis LLC introduced a low-cost, transient surface protection film made especially for newly developed items with custom coatings or those that are fingerprint-resistant. For plastic and painted metal surfaces with light matte, high gloss or brushed finishes, Pregis PolyMask 23107C is perfect. The unique adhesive, when coated onto a linear low-density polyethylene film, combines the benefits of solvent-based rubber chemistry and emulsion-based acrylic chemistry. In the end, you have a material that resists micro-transfer to your substrate and has a smooth initial tack and excellent cohesive strength.

- On June 17, 2020, A cutting-edge production line for creating cutting-edge surface protection films was put into operation by Tredegar Surface Protection, an operating division of Tredegar Corporation and a world leader in surface protection films. Tredegar Surface Protection, known for its superior quality and consistent supply, is essential in safeguarding the delicate surfaces of optical films utilized in displays and other substrates during the production, conversion and transportation processes.

- By August 13, 2020, Globally, Lubrizol has undertaken several investments in its thermoplastic polyurethane (TPU) business to support the rapid expansion of surface protection applications. The company's surface protection and paint protection film (PPF) capabilities are expanded by these investments, which also help PPF producers, brand owners and their supply chains.

Competitive Landscape

major global players in the market include: DUNMORE, Tradegar Surface Protection, Nitto Denko Corporation, Ecoplast Ltd, POLIFILM GROUP, Chargeurs, Bischof+Klein SE & Co. KG, Aristo Flexi Pack and 3M.

Why Purchase the Report?

- To visualize the global surface protection films market segmentation based on thickness, material, technology, colour, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of surface protection films market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global surface protection films market report would provide approximately 82 tables, 99 figures and 222 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

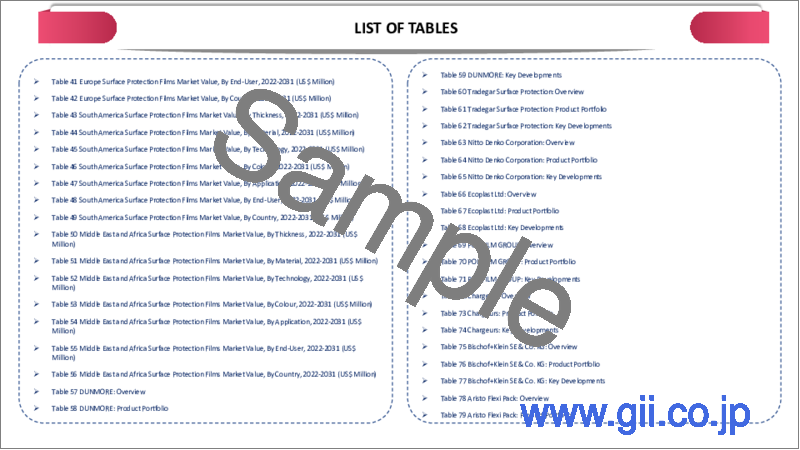

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Thickness

- 3.2. Snippet by Material

- 3.3. Snippet by Technology

- 3.4. Snippet by Colour

- 3.5. Snippet by Application

- 3.6. Snippet by End-User

- 3.7. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rising Adoption of Advanced Surface Protection Films in Developing Regions

- 4.1.1.2. Growing Demand in Automotive Applications

- 4.1.2. Restraints

- 4.1.2.1. High Manufacturing Costs

- 4.1.2.2. Intense Market Competition

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Thickness

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 7.1.2. Market Attractiveness Index, By Thickness

- 7.2. Up to 25 Microns*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. 25-50 Microns

- 7.4. 50-100 Microns

- 7.5. 100-150 Microns

- 7.6. Above 150 Microns

8. By Material

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 8.1.2. Market Attractiveness Index, By Material

- 8.2. Polyethylene (PE)*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Polyethylene Terephthalate (PET)

- 8.4. Polypropylene (PP)

- 8.5. Polyurethane (PU)

- 8.6. Polyvinyl Chloride (PVC)

- 8.7. Others

9. By Technology

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 9.1.2. Market Attractiveness Index, By Technology

- 9.2. Adhesion Lamination*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Coextrusion Lamination

10. By Colour

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Colour

- 10.1.2. Market Attractiveness Index, By Colour

- 10.2. Transparent*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Translucent

- 10.4. Colored 0r Tinted

- 10.5. Opaque

11. By Application

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.1.2. Market Attractiveness Index, By Application

- 11.2. Metal Sheets*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Glass and Mirror

- 11.4. Prepainted Surfaces

- 11.5. Plastic Sheets

- 11.6. PVC Profiles

- 11.7. Furniture Surfaces

- 11.8. Carpet Protection

- 11.9. Others

12. By End-User

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.1.2. Market Attractiveness Index, By End-User

- 12.2. Construction and Interior*

- 12.2.1. Introduction

- 12.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 12.3. Electrical and Electronics

- 12.4. Automotive

- 12.5. Industrial

- 12.6. Healthcare

- 12.7. Others

13. By Region

- 13.1. Introduction

- 13.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 13.1.2. Market Attractiveness Index, By Region

- 13.2. North America

- 13.2.1. Introduction

- 13.2.2. Key Region-Specific Dynamics

- 13.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 13.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 13.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 13.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Colour

- 13.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 13.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.2.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.2.9.1. U.S.

- 13.2.9.2. Canada

- 13.2.9.3. Mexico

- 13.3. Europe

- 13.3.1. Introduction

- 13.3.2. Key Region-Specific Dynamics

- 13.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 13.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 13.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 13.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Colour

- 13.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 13.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.3.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.3.9.1. Germany

- 13.3.9.2. UK

- 13.3.9.3. France

- 13.3.9.4. Russia

- 13.3.9.5. Spain

- 13.3.9.6. Rest of Europe

- 13.4. South America

- 13.4.1. Introduction

- 13.4.2. Key Region-Specific Dynamics

- 13.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 13.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 13.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 13.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Colour

- 13.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 13.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.4.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.4.9.1. Brazil

- 13.4.9.2. Argentina

- 13.4.9.3. Rest of South America

- 13.5. Asia-Pacific

- 13.5.1. Introduction

- 13.5.2. Key Region-Specific Dynamics

- 13.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 13.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 13.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 13.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Colour

- 13.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 13.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.5.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.5.9.1. China

- 13.5.9.2. India

- 13.5.9.3. Japan

- 13.5.9.4. Australia

- 13.5.9.5. Rest of Asia-Pacific

- 13.6. Middle East and Africa

- 13.6.1. Introduction

- 13.6.2. Key Region-Specific Dynamics

- 13.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 13.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 13.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 13.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Colour

- 13.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 13.6.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

14. Competitive Landscape

- 14.1. Competitive Scenario

- 14.2. Market Positioning/Share Analysis

- 14.3. Mergers and Acquisitions Analysis

15. Company Profiles

- 15.1. DUNMORE*

- 15.1.1. Company Overview

- 15.1.2. Type Portfolio and Description

- 15.1.3. Financial Overview

- 15.1.4. Key Developments

- 15.2. Tradegar Surface Protection

- 15.3. Nitto Denko Corporation

- 15.4. Ecoplast Ltd

- 15.5. POLIFILM GROUP

- 15.6. Chargeurs

- 15.7. Bischof+Klein SE & Co. KG

- 15.8. Aristo Flexi Pack

- 15.9. 3M

LIST NOT EXHAUSTIVE

16. Appendix

- 16.1. About Us and Services

- 16.2. Contact Us