|

|

市場調査レポート

商品コード

1374839

ムコ多糖症治療の世界市場 - 2023年~2030年Global Mucopolysaccharidosis Treatment Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ムコ多糖症治療の世界市場 - 2023年~2030年 |

|

出版日: 2023年11月01日

発行: DataM Intelligence

ページ情報: 英文 185 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

ムコ多糖症(MPS)は、多臓器にわたり重篤な症状を呈する稀なライソゾーム貯蔵病(LSD)の一群です。MPSは様々な形で世界中に存在するが、発症率は低いです。MPSの有病型は大陸によって異なり、地域や民族的背景との関連が示唆されています。MPSの主な原因は、酵素の欠損による未分解のグリコサミノグリカン(GAG)です。臨床的特徴は、粗い顔貌、認知障害、肝脾腫、ヘルニア、脊柱後弯症、角膜混濁など、特定の酵素欠損によって異なります。

ムコ多糖症は、関連する酵素の欠損によって生化学的に区別され、MPS IからMPS IX(MPS VおよびMPS VIIIを除く)の7つのタイプに分類され、いくつかのタイプはさらにサブタイプに分類されます。MPSは全部で11の型と亜型に分類されます。MPSの臨床症状は特定の酵素欠損症によって異なるが、主な臨床的特徴は神経症状、顔面異形、心臓・弁膜症、骨格機能障害、呼吸器障害、眼障害などです。

市場力学:市場促進要因と市場抑制要因

より良い治療結果を求める規制当局別疾患承認の増加

より良い治療結果を得るための規制当局による疾患承認の増加は、予測期間中に市場が成長するための重要な要因の1つです。同市場で事業を展開する主要企業は、先進的な治療薬の承認取得に注力しており、これが予測期間中の市場成長を促進すると予想されます。

例えば、2022年8月にRegenxbio Inc.は、ハンター症候群としても知られるムコ多糖症II型(MPS II)の治療薬RGX-121について、FDAの早期承認経路を利用して2024年に生物製剤承認申請(BLA)を行う意向を発表しました。また、RGX-121の主要な臨床試験プログラムが進行中であり、患者を登録中であることも発表しました。RGX-121は、イデュロン酸-2-スルファターゼ(I2S)酵素をコードする遺伝子を導入するNAV AAV9ベクターを使用した、治験中の1回限りのAAV治療薬です。

さらに2021年6月、バイオマリン・ファーマシューティカルズ社は、遺伝的原因による希少疾患のための革新的なバイオ医薬品の開発・商業化を発表しました。同社は、ムコ多糖症IVA型(MPS IVA)(別名モルキオA症候群)患者の治療薬として、ビミジム(エロスルファーゼ・アルファ)の承認を国家医療疾病管理局(NMPA)から取得しました。ヴィミジムは、この疾患に対して承認された中国初の治療薬です。

さらに、酵素補充療法の進歩、認知度の向上と早期診断、新規治療法の出現、主要企業による新戦略の採用など、その他さまざまな要因が市場を牽引しており、予測期間中に市場はさらに拡大すると思われます。

市場力学:市場抑制要因

治療費の高騰と診断不良が、予測期間中の世界のムコ多糖症(MPS)治療市場の成長を阻害すると予想されます。Vimizin(elosulfase-alfa)はMPS IV(モルキオ症候群)の治療薬です。年間38万IJSSの費用で市場に投入されました。インドのような新興国の患者は、価格が高いため、この治療薬を購入することができません。また、この病気に関する認知度の低さ、この病気に伴う合併症、規制上の課題なども、予測期間中の市場成長率の妨げとなっています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- より良い治療結果を得るための規制当局による疾患承認の増加

- 技術の進歩

- 抑制要因

- 治療費の高騰

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 疾患タイプ別

- MPS1型(ハーラー症候群)

- MPS2型(ハンター症候群)

- MPS3型(サンフィリッポ症候群)

- MPS4型(モルキオ症候群)

- MPS6型(マロトー-ラミー症候群)

- MPS7型(スライ症候群)

- MPS9型(ナトヴィッチ症候群)

第8章 治療タイプ別

- 酵素補充療法

- 造血幹細胞移植(HSCT)

- 遺伝子治療

- その他

第9章 エンドユーザー別

- 病院

- 輸液センター

- 外来手術センター

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- BioMarin Pharmaceuticals

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- CanbridgePharma

- Cerezyme

- Leadiant Biosciences

- Lysogene

- Denali Therapeutics

- Regenxbio

- JCR Pharmaceuticals

- Orchard Therapeutics

- Inventiva

第13章 付録

Overview

Mucopolysaccharidoses (MPS) are a group of rare lysosomal storage diseases (LSD) with multiorganic and severe symptoms. MPS occur worldwide in various forms though have a low incidence. The prevalent type of MPS varies among different continents, indicating that it may be associated with region and ethnic background. Undegraded glycosaminoglycans (GAGs) induced by deficiency of enzymes are the primary cause of MPS. Clinical features differ depending on the specific enzyme deficiency including coarse facial features, cognitive retardation, hepatosplenomegaly, hernias, kyphoscoliosis, corneal clouding, etc

Mucopolysaccharidoses are differentiated biochemically by their associated enzyme deficiency and can be classified into 7 types, designated MPS I to MPS IX (excluding MPS V and MPS VIII), and some types are further categorized into subtypes. In total, MPS are classified into 11 types and subtypes. The clinical symptoms of MPS differ depending on the specific enzyme deficiency, but major clinical features are neurological symptoms, facial dysmorphism, cardiac and valvular diseases, skeletal dysfunction, respiratory problems, and ocular disorders.

Market Dynamics: Drivers and Restraints

Increasing Disease approvals by regulatory authorities for better treatment outcomes

Increasing disease approvals by regulatory authorities for better treatment outcomes is one of the significant factors that helps the market to grow during the forecast period. Key players operating in the market are focusing on obtaining approvals for their advanced therapeutics, and this is expected to drive the market growth over the forecast period.

For instance, in August 2022 Regenxbio Inc. announced its intention to file a Biologics License Application (BLA) in 2024 using the FDA's accelerated approval pathway for RGX-121 for the treatment of Mucopolysaccharidosis Type II (MPS II), also known as Hunter Syndrome. The Company also announced that a pivotal program for RGX-121 is active and enrolling patients. RGX-121 is an investigational, one-time AAV Therapeutic using the NAV AAV9 vector to deliver the gene that encodes the iduronate-2-sulfatase (I2S) enzyme.

Moreover, in June 2021, BioMarin Pharmaceuticals Pharmaceuticals Inc. a global biotechnology company announced developing and commercializing innovative biopharmaceuticals for rare diseases driven by genetic causes. It had received approval for its Vimizim (elosulfase alfa) from the National Medical Disease Administration (NMPA) for the treatment of patients with mucopolysaccharidosis type IVA (MPS IVA), also known as Morquio A syndrome. Vimizim is the first treatment in China approved for this condition.

Furthermore, the market is driven by various other factors like advancements in enzyme replacement therapy, increased awareness and early diagnosis, emerging novel therapies, adoption of new strategies by key players and others will further drive the market during the forecast period.

Market Dynamics: Restraint

High costs of therapeutics coupled with poor diagnosis are expected to hinder the growth of the global mucopolysaccharidosis (MPS) treatment market during the forecast period. Vimizin (elosulfase-alfa) is a treatment for MPS IV (Morquio Syndrome). It was launched in the market at a cost of IJSS 380,000 per year. Patients in emerging economies like India cannot afford this treatment because of the high price. Also, the lack of awareness about the disease, complications associated with the disease, regulatory challenges and among others also hampers the market growth rate during the forecast period.

Segment Analysis

The global mucopolysaccharidosis treatment is segmented based on disease type, treatment type, end-user and region.

The enzyme replacement therapy from the treatment type segment accounted for approximately 42.2% of the market share

The enzyme replacement therapy from the treatment type segment accounted for approximately 42.2% and it is expected to be dominated during the forecast period. Enzyme replacement therapy refers to the treatment of congenital enzyme deficiencies using purified human, animal or recombinant enzyme preparations.

Enzyme replacement therapy (ERT) has been the standard therapeutic option for some types of MPS because of the ability to start immediate treatment with feasibility and safety and to improve prognosis. For instance, in November 2021 GC Pharma stated that EMA Grants Orphan Drug Designation to Hunterase ICV, The World's First Enzyme Replacement Therapy for Mucopolysaccharidosis Type II Administered by ICV Injection.

Moreover, in January 2021 GC Pharma, a South Korean biopharmaceutical company, and Clinigen K.K. ("Clinigen"), headquartered in Tokyo, received Japan manufacturing and marketing approval for Hunterase ICV (intracerebroventricular) Injection 15 mg (generic name: idursulfase-beta (recombinant)) as a treatment for mucopolysaccharidosis type II (Hunter syndrome). An enzyme-replacement therapy drug for intravenous injection is already in use in Japan and other countries as a treatment for systemic symptoms of mucopolysaccharidosis type I.

Geographical Analysis

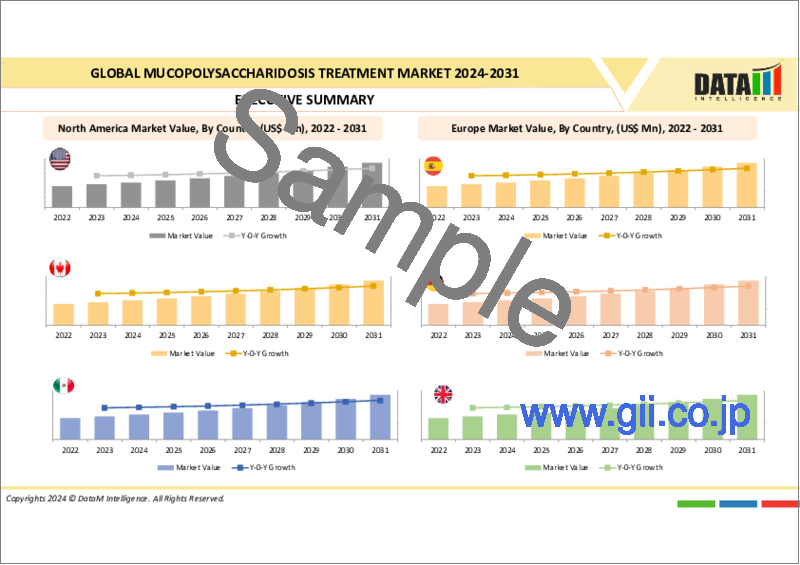

North America accounted for approximately 38.4% of the market share in 2022

North America is estimated to hold about 38.4% of the total market share throughout the forecast period, owing to the factors coupled with higher awareness among the patient population towards advanced treatment options, FDA approvals, increasing diagnostic sophistication, presence of significant clinical trials, and the presence of major clinical-stage biopharmaceutical companies are their pipeline candidates, are responsible for the highest share of the region in the global market.

For instance, in June 2023 Denali Therapeutics Inc. recently announced new interim data from the ongoing open-label, single-arm Phase 1/2 study of DNL310 in children with MPS II (Hunter syndrome). DNL310 is an investigational enzyme replacement therapy designed to cross the BBB and address the behavioural, cognitive, and physical manifestations of MPS II.

Moreover, in January 2023 Orchard Therapeutics, a global gene therapy leader, announced the U.S. Food and Drug Administration (FDA) has cleared its Investigational New Drug (IND) application for OTL-203, a hematopoietic stem cell (HSC) gene therapy being developed for the treatment of the Hurler subtype of mucopolysaccharidosis type I (MPS-IH). The company expects to initiate a global registrational trial evaluating the efficacy and safety of OTL-203 compared to the standard of care in the second half of 2023.

COVID-19 Impact Analysis

The COVID-19 pandemic has significantly impacted the mucopolysaccharidosis treatment market, leading to delays in research and clinical trials, and affecting access to healthcare, supply chain disruptions, and economic challenges. Safety concerns and restrictions have led to potential delays in the development and approval of mucopolysaccharidosis treatments. The pandemic has also impacted healthcare spending and insurance coverage.

Market Segmentation

By Disease Type

- MPS Type 1 ((Hurler syndrome)

- MPS Type 2 (Hunter syndrome)

- MPS Type 3 (Sanfilippo syndrome)

- MPS Type 4 (Morquio syndrome)

- MPS Type 6 (Maroteaux-Lamy syndrome)

- MPS Type 7 (Sly syndrome)

- MPS Type 9 (Natowicz syndrome)

By Treatment Type

- Enzyme Replacement Therapy

- Haematopoietic Stem Cell Transplantation (HSCT)

- Gene Therapy

- Others

By End User

- Hospitals

- Infusion Centers

- Ambulatory Surgical Centers

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Competitive Landscape

The major global players in the mucopolysaccharidosis treatment market include: BioMarin Pharmaceuticals, CanbridgePharma, Cerezyme, Leadiant Biosciences, Lysogene, Denali Therapeutics, Regenxbio, JCR Pharmaceuticals, Orchard Therapeutics, Inventiva and among others.

Key Developments

- In September 2023 JCR Pharmaceuticals Co., Ltd announced key results from the 52-week interim data of its global phase I/II study with JR-171 in individuals with mucopolysaccharidosis type I (MPS I, also known as Hurler, Hurler-Scheie and Scheie syndrome). JR-171 is a blood-brain-barrier ("BBB")-penetrating form of recombinant α-L-iduronidase that was developed using JCR's proprietary J-Brain Cargo technology.

- In March 2021, JCR Pharmaceuticals Co., Ltd. Announced the approval of IZCARGO (pabinafusp alfa 10 mL, intravenous drip infusion) by the Ministry of Health, Labour and Welfare (MHLW) for the treatment of mucopolysaccharidosis type II (MPS II, or Hunter syndrome).

- In September 2020 REGENXBIO Inc., a leading clinical-stage biotechnology company seeking to improve lives through the curative potential of gene therapy based on its proprietary NAV Technology Platform, announced the expansion of the RGX-121 program for the treatment of Mucopolysaccharidosis Type II (MPS II), also known as Hunter Syndrome, to gain additional insight into the neurodegenerative manifestations of the disease and evaluate RGX-121 in a broader patient population.

Why Purchase the Report?

- To visualize the global mucopolysaccharidosis treatment market segmentation-based disease type, treatment type, end-user and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development

- Excel data sheet with numerous mucopolysaccharidosis treatment market-level data points with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Disease mapping available in excel consisting of key diseases of all the major players.

The global mucopolysaccharidosis treatment market report would provide approximately 69 tables, 70 figures, and 185 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Disease Type

- 3.2. Snippet by Treatment Type

- 3.3. Snippet by End User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Driver

- 4.1.1.1. Increasing disease approvals by regulatory authorities for better treatment outcomes

- 4.1.1.2. Rise in the technology advancements

- 4.1.2. Restraints

- 4.1.2.1. High cost of treatment

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Driver

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Disease Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 7.1.2. Market Attractiveness Index, By Disease Type

- 7.2. MPS Type 1 ((Hurler syndrome) *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. MPS Type 2 (Hunter syndrome)

- 7.4. MPS Type 3 (Sanfilippo syndrome)

- 7.5. MPS Type 4 (Morquio syndrome)

- 7.6. MPS Type 6 (Maroteaux-Lamy syndrome)

- 7.7. MPS Type 7 (Sly syndrome)

- 7.8. MPS Type 9 (Natowicz syndrome)

8. By Treatment Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 8.1.2. Market Attractiveness Index, By Treatment Type

- 8.2. Enzyme Replacement Therapy *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Haematopoietic Stem Cell Transplantation (HSCT)

- 8.4. Gene Therapy

- 8.5. Others

9. By End User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 9.1.2. Market Attractiveness Index, By End User

- 9.2. Hospitals *

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Infusion Centers

- 9.4. Ambulatory Surgical Centers

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. BioMarin Pharmaceuticals

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. CanbridgePharma

- 12.3. Cerezyme

- 12.4. Leadiant Biosciences

- 12.5. Lysogene

- 12.6. Denali Therapeutics

- 12.7. Regenxbio

- 12.8. JCR Pharmaceuticals

- 12.9. Orchard Therapeutics

- 12.10. Inventiva (*LIST NOT EXHAUSTIVE)

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us