|

|

市場調査レポート

商品コード

1373396

デジタルX線撮影システムの世界市場-2023年~2030年Global Digital Radiography Systems Market -2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| デジタルX線撮影システムの世界市場-2023年~2030年 |

|

出版日: 2023年10月18日

発行: DataM Intelligence

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

デジタルX線撮影システムと呼ばれる先進的な医療画像技術は、X線画像をデジタル形式で撮影・処理するために使用されます。これらのシステムは、従来のフィルムベースのX線撮影に取って代わり、画質の向上、効率化、患者ケアの向上など、多くの利点をもたらします。デジタルX線撮影は、医療診断に不可欠なツールであり、ヘルスケア専門家が正確な診断や治療計画のために身体の内部構造を見ることを可能にします。

デジタルX線撮影システムは、一般X線撮影、X線透視、乳腺、歯科など、さまざまな医療分野で多様な用途があります。診断の精度と効率を高め、骨折、肺疾患、乳がん、歯科疾患などの早期発見のための高解像度画像を提供します。

市場力学:市場促進要因と市場抑制要因

デジタルX線撮影システムの技術的進歩が市場成長を牽引する見込み

コンピュータビジョン、機械学習(ML)、人工知能(AI)、深層学習アルゴリズムの進歩により、AIによるX線解釈が可能になっています。この技術は、肺病変の検出と局在化において医師にとって大きな利点となることが証明されています。AI支援判読の使用は、読影医のパフォーマンスや効率に悪影響を与えることなく、すべての対象所見に対する読影医の感度を向上させることが示されています。このプロセスは、医療データベースからデータや画像を高速で解析し、過去の所見と比較してパターンや異常を特定することで機能します。

画像診断におけるX線判読にAI技術を活用することで、診断に重要な情報への迅速なアクセス、重要症例の優先順位付けの改善、電子カルテ(EHR)閲覧時のエラー減少など、多くのメリットが得られます。この先端技術は、肺がん、結核、COVID-19の検出に特に役立っています。

したがって、AIによるX線読影は、怪我や病気の診断と治療の精度を高め、迅速化することで、患者ケアの質を向上させる可能性を秘めています。

さらに、整形外科疾患やがんの増加、重傷者の増加、正確で効率的な画像診断ソリューションに対する需要の高まりが、予測期間中に市場を牽引すると予想される要因となっています。

抑制要因:

予算が限られているヘルスケア施設では、デジタルX線撮影システムの購入や設置に多額の初期費用がかかるため、使用が敬遠される可能性があります。さらに、放射線量に関する懸念、インフラの課題、遠隔地や地方の医療環境における熟練者の不足も、高度なデジタルX線撮影システムへのアクセスを妨げる可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

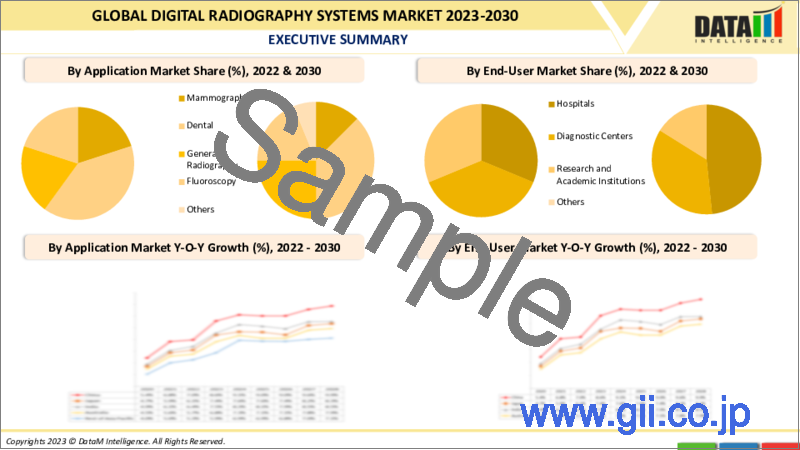

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- デジタルX線撮影システムの技術進歩

- 抑制要因

- 装置の設置コストが高い

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- 特許分析

- SWOT分析

- DMI見解

第6章 COVID-19分析

第7章 製品タイプ別

- コンピューテッドラジオグラフィー(CR)システム

- 電荷結合素子(CCD)

- フラットパネル検出器(FPD)

- ダイレクトラジオグラフィ(DR)システム

第8章 ポータビリティ別

- 固定型デジタルX線撮影装置

- ポータブルデジタルX線撮影装置

第9章 アプリケーション別

- マンモグラフィ

- 歯科用

- 一般撮影

- 心血管

- 整形外科

- 胸部撮影

- その他

- 透視検査

- その他

第10章 エンドユーザー別

- 病院

- 診断センター

- 研究・学術機関

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- GE HealthCare

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Fujifilm Medical Systems

- Hologic, Inc.

- Koninklijke Philips N.V.

- Shimadzu Corporation

- Canon Medical Systems Corporation

- Carestream Health Inc.

- Hitachi Ltd.

- Boston Imaging

- Siemens Healthineers

第14章 付録

Overview

Advanced medical imaging technologies called digital radiography systems are used to capture and process X-ray images in a digital format. These systems have taken the place of traditional film-based radiography and offer many benefits, including improved image quality, efficiency, and patient care. Digital radiography is a vital tool in medical diagnostics, enabling healthcare professionals to view internal structures of the body for precise diagnoses and treatment planning.

Digital radiography systems have diverse applications in various medical fields, including general radiography, fluoroscopy, breast health, and dentistry. They enhance the accuracy and efficiency of diagnoses and provide high-resolution images for early detection of conditions such as bone fractures, lung ailments, breast cancer, and dental problems.

Market Dynamics: Drivers and Restraints

Technological advancement in digital radiography systems is expected to drive the market growth

AI-aided X-ray interpretation is now possible due to advancements in computer vision, machine learning (ML), artificial intelligence (AI), and deep learning algorithms. This technology has proven to be a significant advantage for physicians in detecting and localizing lung lesions. The use of AI-aided interpretation has been shown to improve reader sensitivities for all target findings, without negatively affecting the reader's performance and efficiency. This process works by analyzing data and images at high speed from medical databases and comparing them with previous findings to identify patterns and anomalies.

Utilizing AI technology to interpret X-rays in diagnostic imaging offers a multitude of benefits such as quicker access to crucial information for diagnosis, better prioritization of critical cases, and a decrease in errors when reading electronic health records (EHRs). This advanced technology has been particularly useful in detecting lung cancer, tuberculosis, and COVID-19.

Therefore, AI-aided X-ray interpretation has the potential to enhance the quality of patient care by expediting and refining the accuracy of diagnosis and treatment for injuries and illnesses.

Furthermore, the increasing occurrence of orthopedic diseases and cancers, the increasing number of serious injuries, and the growing demand for accurate and efficient diagnostic imaging solutions are the factors expected to drive the market over the forecast period.

Restraint:

Healthcare facilities that have limited budgets may be discouraged from using digital radiography systems because of the significant upfront costs associated with purchasing and installing them. Additionally, concerns around radiation doses, infrastructure challenges, and a shortage of skilled personnel in remote or rural healthcare settings may also hinder access to advanced digital radiography systems.

Segment Analysis

The global digital radiography systems market is segmented based on product type, portability, application, end-user and region.

The computed radiography (CR) systems from the product type segment accounted for approximately 46.5% of the digital radiography systems market share

Computed Radiography (CR) systems are a type of digital radiography technology used for capturing and processing X-ray images. Unlike direct radiography (DR) systems that capture X-rays directly with flat-panel detectors, CR systems use a cassette-based approach. In the world of medical imaging, Digital Computed Radiography (CR) Systems are highly esteemed for their many advantages. These systems are renowned for their exceptional image quality, which allows for precise diagnostic interpretation due to the detailed and high-contrast digital images they provide.

Additionally, CR systems offer a cost-effective solution for healthcare facilities that want to transition from traditional film-based radiography to digital technology. This is especially beneficial as existing X-ray machines can be leveraged without the need for costly replacements. Furthermore, CR systems give radiologists the power to enhance images using software tools that allow for adjustments in brightness, contrast, and zoom. This feature is particularly useful as it improves the visualization of anatomical structures.

Computed Radiography (CR) Systems find wide-ranging applications in healthcare, including general radiography for routine X-rays, fluoroscopy for real-time imaging in procedures like barium studies and catheter placements, dental radiography to capture detailed oral images, and even in mammography when dedicated systems may not be readily accessible.

Furthermore, owing to its lower initial costs, the rise in the adoption of computed radiography equipment, dose management, and versatility are the factors expected to drive the market segment over the forecast period.

For instance, the HD-CR plate scanner by DURR NDT is a portable computed radiography scanner used for non-destructive testing. It is lightweight and uses multi-focus laser adjustment for high-quality imaging. It is suitable for inspections according to ISO, ASME V, and EN standards. The scanner comes with imaging plates in different resolutions and formats and has a built-in mini PC and high-resolution color display. It can be used in various settings, including in the field, production areas, and R&D labs.

Geographical Analysis

North America accounted for approximately 40.2% of the market share in 2022

North America is expected to hold the largest market share owing to increasing demand for imaging due to rising orthopedic and cancer incidences, technological advancements in the devices, and the large presence of major players with new product development and expansion.

For instance, on August 02, 2022, GE Healthcare launched its newest fixed X-ray system, the Definium 656 HD, which boasts the latest advancements in technology. This overhead tube suspension (OTS) system offers consistent, highly automated, and efficient exams that instill clinical confidence, while also simplifying workflow, improving consistency, and reducing errors to ensure the smooth operation of radiology departments.

With the highest levels of motorization, automation, assistive intelligence, and advanced applications available, healthcare providers can benefit greatly from this new addition to GE Healthcare's fixed X-ray portfolio. Hence, owing to the above factors, the North America region is expected to hold the largest market share over the forecast period.

COVID-19 Impact Analysis:

During the pandemic, the digital radiography market was greatly affected. At first, the market suffered due to lockdowns and social distancing regulations, leading to the postponement of diagnostic imaging procedures. However, as time went on, diagnostic imaging became essential in managing patient care, resulting in an increased demand for digital radiology systems. These systems are highly efficient, taking less than a minute to capture an image. To meet the growing needs, many companies adapted their products for diagnostic imaging.

Also, according to the American College of Radiology (ACR), the CT decontamination required after scanning COVID-19 patients may disrupt radiological service availability and has suggested that portable chest radiography may be considered to minimize the risk of cross-infection during the pandemic.

With the outbreak of COVID-19, companies are developing new products and ramping up their production, as in many places, digital X-rays are used as a primary tool. In February 2020, United Imaging donated medical imaging equipment worth USD 1.4 million to hospitals in China. Hence, the COVID-19 pandemic moderately impacted the digital radiography market.

Competitive Landscape

The major global players in the digital radiography systems market include: GE HealthCare, Fujifilm Medical Systems, Hologic, Inc., Koninklijke Philips N.V., Shimadzu Corporation, Canon Medical Systems Corporation, Carestream Health Inc., Hitachi Ltd., Boston Imaging, and Siemens Healthineers among others.

Key Development

- On April 28, 2022, Samsung's digital radiography and ultrasound systems United States headquarters, Boston Imaging, launched a new version of AccE GM85, called GM85 Fit. This device is designed to provide efficient and effective patient care, with a user-centric design. It has received 510(k) clearance from the U.S. Food and Drug Administration, making it available for commercial use in the USA.

- On March 11, 2022, Konica Minolta, Inc. launched AeroDR TX m01, a mobile X-ray system featuring a wireless dynamic digital radiography function in Japan. The company will roll out the product in other regions in stages.

- On May 31, 2022, Agfa launched VALORY, a new digital radiography room that promises performance excellence. The company is showcasing its innovative solutions at ECR 2022, which aim to provide smart, meaningful answers to radiology's real needs. Agfa's expanded digital radiography portfolio caters to every budget and meets the needs of every radiologist. The newly launched VALORY is available as both ceiling-suspended and floor-mounted digital radiography rooms.

Why Purchase the Report?

- To visualize the global digital radiography systems market segmentation based on product type, portability, application, end-user and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of digital radiography systems market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global digital radiography systems market report would provide approximately 69 tables, 68 figures, and 189 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product Type

- 3.2. Snippet by Portability

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Technological advancement in digital radiography systems

- 4.1.2. Restraints

- 4.1.2.1. High cost of installation of device

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Patent Analysis

- 5.6. SWOT Analysis

- 5.7. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 7.1.2. Market Attractiveness Index, By Product Type

- 7.2. Computed Radiography (CR) Systems*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.2.1. Charge-Coupled Device (CCD)

- 7.2.2.2. Flat Panel Detectors (FPD)

- 7.3. Direct Radiography (DR) Systems

8. By Portability

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 8.1.2. Market Attractiveness Index, By Material

- 8.2. Fixed Digital Radiography Systems *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Portable Digital Radiography Systems

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Mammography*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Dental

- 9.4. General Radiography

- 9.4.1. Cardiovascular

- 9.4.2. Orthopedic

- 9.4.3. Chest Imaging

- 9.4.4. Others

- 9.5. Fluoroscopy

- 9.6. Others

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Hospitals*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Diagnostic Centers

- 10.4. Research and Academic Institutions

- 10.5. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Portability

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Portability

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Spain

- 11.3.7.5. Italy

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Portability

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Portability

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Portability

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. GE HealthCare*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Fujifilm Medical Systems

- 13.3. Hologic, Inc.

- 13.4. Koninklijke Philips N.V.

- 13.5. Shimadzu Corporation

- 13.6. Canon Medical Systems Corporation

- 13.7. Carestream Health Inc.

- 13.8. Hitachi Ltd.

- 13.9. Boston Imaging

- 13.10. Siemens Healthineers

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us