|

|

市場調査レポート

商品コード

1372102

セラミックアーマーの世界市場-2023年~2030年Global Ceramic Armor Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| セラミックアーマーの世界市場-2023年~2030年 |

|

出版日: 2023年10月18日

発行: DataM Intelligence

ページ情報: 英文 199 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のセラミック装甲市場は2022年に20億米ドルに達し、2023-2030年の予測期間中にCAGR 7.8%で成長し、2030年には37億米ドルに達すると予測されています。

セラミック装甲は主に装甲車や個人の盾に使用され、その高い圧縮強度と硬度から弾丸の貫通に抵抗します。セラミックプレートは一般に軟質防弾チョッキのインサートとして使用されます。軍事・防衛分野に多くの機会があることから、セラミック装甲は新興産業となっています。

セラミック装甲は弾道脅威に対して高い防御力を発揮するため、航空機装甲の生産に頻繁に採用されています。予測期間中、これはセラミック装甲の市場を煽ると予想されます。さらに、車両装甲の製造におけるセラミック装甲の使用は、悪天候、耐腐食性、車両移動の容易さに対する安全装置を提供します。

セラミック装甲の防護服用途は、市場シェアの40%以上を占めています。同様に、北米がセラミック装甲市場を独占し、1/3以上の最大市場シェアを獲得しています。同地域のセラミックアーマー市場の開拓は、武装サービスにフルボディアーマーを提供するためのExtremity ProtectionプログラムやSoldier Protection System-Torsoのような政府の軍事プログラムによって促進されると予想されます。

ダイナミクス

軍事・防衛費

国防に必要な資金は、いくつかの国によって確保されています。SIPRIと呼ばれる団体によると、2020年の世界の軍事費は1兆9,800億米ドルを超えました。これは以前より増加しています。この資金の大部分は、軍の装備をより良いものにするために使われます。その中には、兵士の安全を守る装備品や頑丈な車両などが含まれます。ここでセラミック装甲が重要なのは、重くなりすぎることなく強力な防護を提供できるからです。

兵士や警察は世界的にボディアーマーを使用して安全を確保しています。セラミック・プレートはこの防護服の重要な部分です。防衛への投資が多い国は、防護服の購入も多いです。特に、防衛の重要な支払者である米国は軍隊および法の執行機関のための人間の鎧をたくさん購入します。米国は、2023年のWorld Population Reviewのレポートに基づき、8,167億米ドルと、自国の軍隊に最も多額の投資を行っています。

防衛産業が盛んな国の中には、セラミック装甲を含む軍装品を他国に販売するところもあります。それが世界のセラミック装甲市場の成長を支えています。セラミック製装甲を製造する企業を含む防衛産業は、各国が防衛費を支出すればするほど大きくなります。それは、これらの企業が拠点を置く場所での雇用とビジネスの拡大を意味します。

技術の進歩

技術の継続的な進歩は、アルミナ、炭化ホウ素、炭化ケイ素のような高度なセラミックの出現につながりました。セラミックスは、従来の金属製装甲材料と比較すると、際立って軽量です。例えば、アルミナセラミックスは、単位体積当たりの重量が鋼鉄の約3分の1です。

技術の進歩は、優れた弾道性能を発揮する先進的なセラミックスをもたらしました。高い硬度と驚異的な破壊靭性により、徹甲弾や榴散弾などの高速弾丸を効果的に阻止する能力を有しています。

主要プレーヤーは、市場でのビジネスを強化するために様々な戦略を採用しています。例えば、医療用および非医療用窒化ケイ素セラミックのOEMメーカーであるSINTX Technologies, Inc.は、オハイオ州デイトンのB4C, LLCと資産売買契約を締結し、弾道装甲プレートの製造に必要な機械と科学的手順を購入したと発表しました。これとは別に、SINTXとPrecision Ceramics USA Inc.は、防衛装甲用途のセラミック複合材を製造する技術ライセンス契約に合意しました。

政府機関、防衛機関、民間企業は、次世代セラミック装甲の先駆けとなるべく、研究開発努力に多額の投資を行っています。この投資は、弾道性能を高めるだけでなく、セラミック装甲の耐久性と汎用性を向上させることを目的としています。

商用アプリケーションの増加

法執行機関や警備サービスは、個人防護のためにセラミック装甲を採用することが増えています。これにはセラミックベースの防弾チョッキやヘルメットの利用が含まれます。セラミック装甲が提供する軽量特性と高レベルの弾道保護が、この採用の主な理由です。

自動車部門は、車両保護強化のためのセラミック装甲に強い関心を示しています。高性能セラミック装甲は車両を補強し、弾道攻撃や爆発、安全保障上の脅威に対する耐性を高めることができます。セラミック装甲は、貴重な資産や著名な個人を輸送する場面で特に重要です。

警備会社、銀行、高額資産の輸送に携わる企業などの商業団体は、資産と人員の両方を守るためにセラミック装甲に投資しています。例えば、セラミック装甲を装備した装甲車は、現金輸送サービスに利用されています。セラミック装甲は、沿岸のパトロールや海賊からの保護に使用される装甲ボートや船舶など、海上での用途も見出されています。船舶は、セラミック装甲部品を組み込んで、そのセキュリティ能力を強化することができます。

コストの課題

セラミック装甲を作るには、プレス、成形、焼結などの精密で複雑な製造技術が必要です。この工程は専門的な設備と専門知識を要求するため、全体的な生産コストがかさみます。

進化する脅威に対処するためのセラミック装甲材料の継続的な強化および革新は、研究開発への継続的な投資を必要とします。研究開発費は全体的な費用に寄与します。セラミック装甲の信頼性と有効性を確保するためには、独立機関によってしばしば実施される広範な試験と認証手続きを受けなければならないです。評価には費用も時間もかかります。

重量と嵩の問題

セラミック装甲の重量増加は、兵士や法執行要員を含む個人の機動性や敏捷性を低下させる可能性があります。ダイナミックな戦闘シナリオや都市環境での脅威に対応する際に課題をもたらす可能性があります。

重くかさばるセラミック装甲を長時間着用すると、不快感や疲労につながる可能性があります。この不快感は、現場で活動する人員の効率や持久力に影響を与える可能性があります。セラミック装甲の輸送と保管は、特に軍事目的または安全保障目的のために大量になると、物流が複雑になる可能性があります。セラミック装甲システムの重量と嵩の高さは、特殊な車両と施設を必要とします。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 軍事・防衛費

- 技術の進歩

- 抑制要因

- コストの課題

- 商業用途の増加

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 素材別

- アルミナ

- 炭化ホウ素

- 炭化ケイ素

- セラミックマトリックス複合材料

- ホウ化チタン

- 窒化アルミニウム

第8章 用途別

- ボディアーマー

- 航空機用装甲

- 船舶用装甲

- 車両用装甲

第9章 エンドユーザー別

- 防衛

- 国土安全保障

- 一般市民

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- BAE Systems plc

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 最近の動向

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Ceradyne, Inc.

- Safariland, LLC

- CoorsTek Inc.

- Morgan Advanced Materials plc

- DuPont de Nemours, Inc.

- ArmorWorks Enterprises, LLC

- MKU Limited

第13章 付録

Overview

Global Ceramic Armor Market reached US$ 2.0 billion in 2022 and is expected to reach US$ 3.7 billion by 2030, growing with a CAGR of 7.8% during the forecast period 2023-2030.

Ceramic armor is primarily used in armored vehicles and personal shields to resist bullet penetration because of its high compressive strength and hardness. ceramic plates are generally used as inserts in soft ballistic vests. With many opportunities in the military and defense sectors, ceramic armor is a rising industry.

As ceramic armor offers a high level of defense against ballistic threats, it is frequently employed in the production of aircraft armor. During the projected period, this is anticipated to fuel the market for ceramic armor. Additionally, the use of ceramic armor in the creation of vehicle armor safeguards against adverse weather conditions, corrosion resistance and ease of vehicle mobility.

The body armor application of ceramic armor accounts for over 40% of the market share. Similarly, North America dominates the ceramic armor market, capturing the largest market share of over 1/3rd. The development of the ceramic armor market in the region is anticipated to be fueled by government military programs like the Extremity Protection program and Soldier Protection System-Torso for delivering full body armor to the armed services.

Dynamics

Military and Defense Expenditure

A lot of money is assembled aside by several nations for their defense requirements. According to a group called SIPRI, the globe spent more than US$1.98 trillion on the military in 2020. It was a rise from prior years. Major of this money is used to make the military's equipment better. It includes things like gear to keep soldiers safe and tough vehicles. Ceramic armor is important here because it provides strong protection without making things too heavy.

Soldiers and police globally use body armor to stay safe. Ceramic plates are a key part of this armor. Countries that invest more in defense also purchase more body armor. In particular, U.S, which is a significant spender on defense, purchases plenty of human armor for its military and law enforcement agencies. U.S. invests the largest amount in its armed forces, at US$816.7 billion, based on the World Population Review report for 2023.

Some countries with strong defense industries sell their military equipment, including ceramic armor, to other nations. It helps the global ceramic armor market grow. The defense industry, which includes companies making ceramic armor, gets bigger when countries spend more on defense. It means more jobs and more business in places where these companies are based.

Technological Advancements

The continuous progression in technology has led to the emergence of advanced ceramics like alumina, boron carbide and silicon carbide. The ceramics are notably lightweight when compared to conventional metallic armor materials. For instance, alumina ceramics weigh approximately one-third of steel per unit volume.

Technological strides have resulted in advanced ceramics demonstrating superior ballistic performance. It possess the capability to effectively halt high-velocity projectiles, such as armor-piercing bullets and shrapnel, due to their high hardness and impressive fracture toughness.

The key players are adopting various strategies to enhance their business in the market. For instance, SINTX Technologies, Inc., an original equipment manufacturer (OEM) of silicon nitride ceramic for medical and non-medical applications, announced today that it has signed an asset purchase agreement with B4C, LLC of Dayton, Ohio, to purchase the machinery and scientific procedures necessary to produce ballistic armor plates. Separately, SINTX and Precision Ceramics USA Inc. agreed to a technical license agreement to produce a ceramic composite for defense armor applications.

Government entities, defense agencies and private enterprises are making substantial investments in research and development endeavors to usher in the next generation of ceramic armor. The investments aim to not only enhance ballistic performance but also improve the durability and versatility of ceramic armor.

Increase in Commercial Applications

Law enforcement agencies and security services are increasingly adopting ceramic armor for personal protection. It encompasses the utilization of ceramic-based bulletproof vests and helmets. The lightweight characteristics and high-level ballistic protection offered by ceramic armor are key reasons behind this adoption.

The automotive sector has expressed a keen interest in ceramic armor for enhancing vehicle protection. High-performance ceramic armor can reinforce vehicles, making them more resilient against ballistic attacks, explosions or security threats. It is particularly relevant in scenarios involving the transportation of valuable assets or high-profile individuals.

Commercial entities, including security firms, banks and companies engaged in the transportation of high-value assets, are investing in ceramic armor to safeguard both assets and personnel. For instance, armored vehicles equipped with ceramic armor are utilized in cash-in-transit services. Ceramic armor finds application in maritime contexts, such as armored boats or ships employed in coastal patrol and protection against piracy. The vessels may incorporate ceramic armor components to bolster their security capabilities.

Cost Challenges

Crafting ceramic armor necessitates precise and complex manufacturing techniques, including pressing, shaping and sintering. The procedures demand specialized equipment and expertise, which adds to the overall production costs.

The ongoing enhancement and innovation of ceramic armor materials to address evolving threats require continuous investments in research and development. The R&D expenditures contribute to the overall expense. To ensure the reliability and efficacy of ceramic armor, it must undergo extensive testing and certification procedures, often conducted by independent agencies. The assessments can be both costly and time-intensive.

Weight and Bulkiness Issues

The added weight of ceramic armor can diminish the mobility and agility of individuals, including soldiers and law enforcement personnel. It can pose challenges in dynamic combat scenarios or when responding to threats in urban environments.

Prolonged wearing of heavy and bulky ceramic armor can lead to discomfort and fatigue. It discomfort can impact the efficiency and endurance of personnel operating in the field. Transporting and storing ceramic armor, especially in significant quantities for military or security purposes, can present logistical complexities. The weight and bulkiness of ceramic armor systems necessitate specialized vehicles and facilities.

Segment Analysis

The global ceramic armor market is segmented based on material, application, end-user and region.

Increased Efficiency of Body Armor

The body armor segment held 40.1% of the global market share. The demand for advanced ceramic body armor stems from the necessity to provide soldiers with lighter, more efficient and better-protected gear. Continuous technological innovations have resulted in the development of more comfortable and flexible ceramic body armor solutions, crucial for user acceptance and comfort. Progress in materials and designs is propelling market growth.

In June 2023, NT Cera introduced their cutting-edge ceramics for use in defense applications. The business creates, produces and distributes high-performance personal and vehicle protective ceramics for business partners who supply U.S. military, law enforcement and security agencies. Its flexible solutions are exceptionally light, provide the highest level of ballistic survivability and are combat-tested, safeguarding men and women across five continents and more than 60 nations.

Beyond military and law enforcement, the civilian body armor market encompasses security personnel, private individuals concerned about personal safety and professionals in high-risk fields. It broad range of applications contributes to the overall demand for body armor.

Geographical Penetration

Substantial Investments and Increasing R&D

The North American ceramic armor market holds the largest market share and is expected to reach up to 42.3% in the forecast period. The market for ceramic armor has expanded significantly in North America thanks in part to the enormous potential for buying cutting-edge body armor for military personnel and the substantial military budget. The market's list of contributors to the development includes U.S.

For the budget year 2022, U.S. Department of Defence planned US$715 billion in investment, which covered financing for all military branches, including U.S. Army. The need for cutting-edge body armor plates is increasing due to rising political unrest and aerial attacks. Ceramic armor enjoys substantial demand in North America, particularly within the military and defense sectors. It region prioritizes the protection and well-being of its military personnel, resulting in a significant need for advanced ceramic body armor and vehicle armor systems.

Beyond the realms of the military and law enforcement, the North American demand for ceramic armor extends to various commercial applications. It includes security firms, private security personnel and individuals seeking personal safety and security solutions. The growing interest in ceramic armor for these purposes contributes to market expansion.

North America serves as a center for research and development in the domain of armor materials and technology. It environment of innovation has yielded lightweight, high-performance ceramic armor solutions tailored to the specific requirements of North American clientele. Notably organizations like the Defense Advanced Research Projects Agency (DARPA) in U.S., continually invest in research endeavors aimed at advancing armor materials. Such research endeavors contribute to the progression of ceramic armor technology in the region.

Competitive Landscape

The major global players in the market include: BAE Systems Plc, Lockheed Martin Corporation, Northrop Grumman Corporation, Ceradyne, Inc., Safariland, LLC, CoorsTek Inc., Morgan Advanced Materials plc, DuPont de Nemours, Inc., ArmorWorks Enterprises, LLC and MKU Limited.

COVID-19 Impact Analysis

All significant industries were badly impacted by the coronavirus pandemic. Similarly, the global market for ceramic armor was impacted by industry closures, stringent regulations, lockdowns and the collapse of the global economy. The production capacity of ceramic armor producers was negatively impacted by factors such as a lack of labor, closed manufacturing industries, a lack of raw materials and transportation and distribution constraints.

Ceramic armor has an enormous demand in the defense industry. The defense industry's ability to make purchases was impacted by the pandemic's unstable economy, which immediately reduced demand for body armor plates. Significant global producers of armor or ballistic protection materials include U.S., Russia and China.

Due to their crumbling economies and shutdown industries, these nations experienced a shock during the pandemic, which affected the manufacture of body armor plates and other ballistic materials.

Major industry participants said that the protracted shutdown globally was to blame for the financial loss. For instance, BAE Systems, a major competitor in the global industry, reported that in the first six months of the shutdown, the company's share suffered a considerable decline of almost 22%.

Russia-Ukraine War Impact Analysis

The conflict escalated to disruptions in trade and transportation and supply chains for raw materials and components used in ceramic armor production were affected. It potentially leads to delays in manufacturing and increased costs for companies reliant on materials from the region.

globally, negative effects are anticipated, particularly in Eastern Europe, the European Union, Eastern & Central Asia and U.S. It claim has significantly disrupted trade dynamics and had a negative impact on people's lives and means of subsistence. It is anticipated that the conflict and unpredictability in Eastern Europe will negatively affect Ukraine and have severe, long-lasting impacts on Russia.

About 30 times more Chinese drones were purchased by Russia than by Ukraine in 2023 and imports of ceramics, a crucial component of body armor, increased by 69% from China to Russia, reaching US$225 million. In the same period, Ukraine's imports of ceramics from China fell by 61% to US$5 million. The market is anticipated to gain traction by the end of 2025.

By Material

- Alumina

- Boron Carbide

- Silicon Carbide

- Ceramic Matrix Composite

- Titanium Boride

- Aluminium Nitride

By Application

- Body Armor

- Aircraft Armor

- Marine Armor

- Vehicle Armor

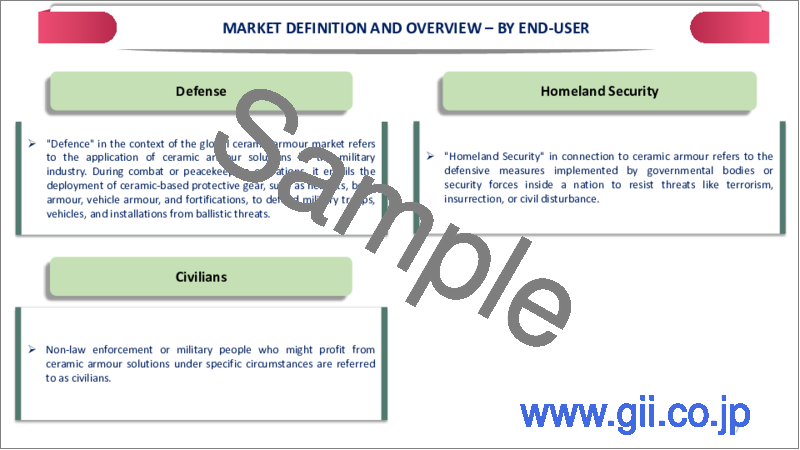

By End-User

- Defense

- Homeland Security

- Civilians

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In August 2022, Ultimate Armour Vehicle Protection Package was launched and Ceramic Pro Americas is delighted to announce it. The Ultimate Armour package is the first comprehensive exterior car protection package in the world and it is only available at Ceramic Pro Elite Dealers in Canada, U.S. and Latin America. It also comes with a lifetime limited warranty.

- In May 2021, the new Hercules Level IV Ceramic Body Armour, manufactured in the Spartan Armour Systems factory in Arizona, is introduced by Spartan Armour Systems, makers of body armor, tactical equipment and targets that are designed and constructed in U.S. An independent NIJ Certified laboratory has thoroughly tested the Hercules level IV body armor plate.

- In March 2022, the ColossusTM Armour Plate from Adept Armour, an armor system engineering company, unveils the most recent advancement in ceramic armor. It protects that of Level IV or RF3 plates. In order to create the strongest plate in its category, the Colossus was built from the ground up utilizing the most cutting-edge materials available. At just over six pounds, it weighs much less than the typical Level IV or RF3 plate.

Why Purchase the Report?

- To visualize the global ceramic armor market segmentation based on material, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of Ceramic armor market-level with all segments.

- The PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global ceramic armor Market Report would provide approximately 61 tables, 61 figures and 199 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet By Material

- 3.2. Snippet By Application

- 3.3. Snippet By End-User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Military and Defense Expenditure

- 4.1.1.2. Technological Advancements

- 4.1.2. Restraints

- 4.1.2.1. Cost Challenges

- 4.1.2.2. Increase in Commercial Applications

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers' Strategic Initiatives

- 6.6. Conclusion

7. By Material

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 7.1.2. Market Attractiveness Index, By Material

- 7.2. Alumina*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Boron Carbide

- 7.4. Silicon Carbide

- 7.5. Ceramic Matrix Composite

- 7.6. Titanium Boride

- 7.7. Aluminium Nitride

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Body Armor*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Aircraft Armor

- 8.4. Marine Armor

- 8.5. Vehicle Armor

9. By End-User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.1.2. Market Attractiveness Index, By End-User

- 9.2. Defense*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Homeland Security

- 9.4. Civilians

10. By Region

- 10.1. Introduction

- 10.2. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.2.1. Market Attractiveness Index, By Region

- 10.3. North America

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. U.S.

- 10.3.6.2. Canada

- 10.3.6.3. Mexico

- 10.4. Europe

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Germany

- 10.4.6.2. UK

- 10.4.6.3. France

- 10.4.6.4. Italy

- 10.4.6.5. Russia

- 10.4.6.6. Rest of Europe

- 10.5. South America

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. Brazil

- 10.5.6.2. Argentina

- 10.5.6.3. Rest of South America

- 10.6. Asia-Pacific

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.6.6.1. China

- 10.6.6.2. India

- 10.6.6.3. Japan

- 10.6.6.4. Australia

- 10.6.6.5. Rest of Asia-Pacific

- 10.7. Middle East and Africa

- 10.7.1. Introduction

- 10.7.2. Key Region-Specific Dynamics

- 10.7.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 10.7.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.7.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. BAE Systems plc*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Recent Developments

- 12.2. Lockheed Martin Corporation

- 12.3. Northrop Grumman Corporation

- 12.4. Ceradyne, Inc.

- 12.5. Safariland, LLC

- 12.6. CoorsTek Inc.

- 12.7. Morgan Advanced Materials plc

- 12.8. DuPont de Nemours, Inc.

- 12.9. ArmorWorks Enterprises, LLC

- 12.10. MKU Limited

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us