|

|

市場調査レポート

商品コード

1360040

法務AIソフトウェアの世界市場-2023年~2030年Global Legal AI Software Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 法務AIソフトウェアの世界市場-2023年~2030年 |

|

出版日: 2023年10月11日

発行: DataM Intelligence

ページ情報: 英文 190 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

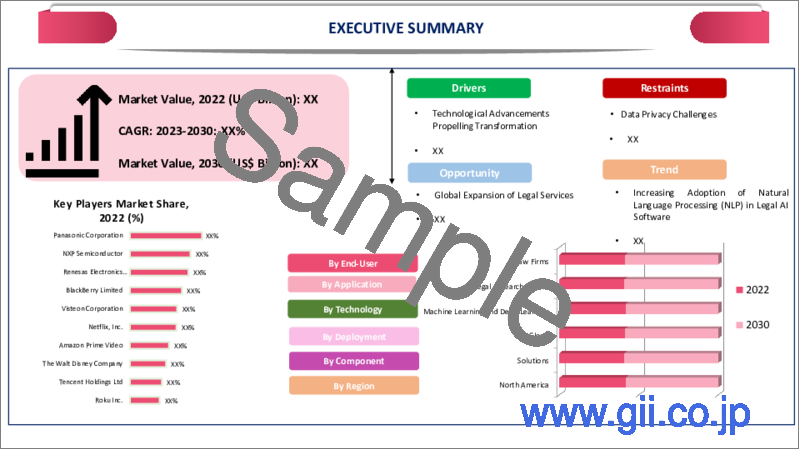

世界の法務AIソフトウェア市場は、2022年に5億米ドルに達し、2023年から2030年の予測期間中にCAGR 28.7%で成長し、2030年には37億米ドルに達すると予測されています。

法律文書、契約書、判例、規制文書は、法律部門が生成する数多くの種類のデータのほんの一部に過ぎず、これらのデータは法務AIソフトウェアによって効率的に処理・分析できるため、法律事務所や法務部門にとって有用なツールとなります。法務AIソフトウェアは、契約書のレビューや法務調査など、手作業で時間のかかる多くの作業を自動化し、法務担当者の効率向上と大幅なコスト削減につながります。

例えば、2023年4月25日、法務プロセス自動化のリーダーであるLuminanceは、Nexa LawのブランドであるNexaConnexと提携し、LuminanceのAI技術をNexaConnexの法務サービスに統合しました。NexaConnexは英国で急成長中の法務サービスプロバイダーで、さまざまな分野の中堅法律事務所をサポートしています。このパートナーシップは、NexaConnexが法律事務所のクライアントの1社に対し、複雑で時間的制約のある開示業務を効率化するためにルミナンスのAIを使用し、大幅な時間短縮を実現したことから始まりました。

アジア太平洋地域は、世界の法務AIソフトウェア市場の2/5以上を占める成長地域の一つであり、同地域は著しい経済成長と国境を越えたビジネス活動の増加を経験しているため、契約管理、デューデリジェンス、コンプライアンスなどの法務業務量が増加し、これらのプロセスを合理化するAIソリューションの需要が高まっています。

ダイナミクス

自動化需要の増大

定型的な業務やプロセスを自動化することで、法律専門家は法的分析や戦略策定など、より価値の高い業務に集中できるようになり、法律事務所や法務部門における効率性と生産性の向上につながります。自動化により、文書レビュー、契約分析、法務調査などの業務における手作業の必要性を最小限に抑えることができるため、業務コストの削減につながり、予算の最適化を目指す法務組織にとって魅力的です。

GlobalSCAPE, Inc.とPonemon社の調査によると、データプライバシー規制を無視した場合のコストは近年大幅に増加しています。組織におけるコンプライアンス違反の年間平均支出額は1,482万米ドルで、コンプライアンスを維持するよりも2.71倍高いです。各業界が扱う機密情報の量がコンプライアンスコストの違いに影響しており、報道機関では年間平均770万米ドル、金融サービス企業では3,090万米ドルを超えます。

企業間のコラボレーションが市場を活性化

法的なケースや問題はより複雑化しており、多分野にまたがる専門知識が必要とされています。現在、多くの法律事務所や法務部門は世界な規模で業務を展開し、複数の法域でクライアントにサービスを提供し、案件を管理しています。コラボレーション・ツールは、異なる地域に所在するチーム間のコミュニケーションや情報共有を促進し、国境を越えた効率的な業務を支援します。

例えば、2022年10月19日、Siskind Susser, P.C.は法律ソフトウエア会社と提携し、入国管理手続きを支援することを目的とした新しいクラウドベースのAIケース管理技術を発表しました。移民法事務所Siskind Susser, P.C.の弁護士とイノベーションの専門家によって設立されたVisalaw.Aiは、法務テクノロジー・データ企業であるFastcaseと協業契約を締結し、同社のNextChapter社が最先端の移民法ケース管理と文書自動化システムの開発を支援します。

機械学習とビッグデータ分析の進歩による市場促進

法律分野のAIソフトウェアは、機械学習アルゴリズムの進歩の恩恵を受けており、これらのアルゴリズムは、膨大な種類の法律事件、契約書、その他の文書のデータセットから学習し、予測を立て、弁護士の仕事を支援します。法務AIソフトウェアは、ビッグデータ分析の力を活用し、法律文書や事件履歴のパターン、動向、洞察を明らかにすることができ、この技術は、弁護士がデータ駆動型の意思決定を行うのに役立ちます。

例えば、2023年8月9日、テクノロジー・クライアントに重点を置く国際法律事務所、ガンダーソン・デトマーは、独自の社内生成AIチャット・アプリ「ChatGD」を発表しました。ChatGDは、弁護士がMicrosoft Azureを通じてOpenAIのモデルを使って安全に文書を照会・操作できるAIアプリケーションです。

不正確な結果

法務AIはまだ、複雑な法律業務を完全に自動化できるわけではありません。文書レビュー、法的調査、契約分析を支援することはできますが、特に斬新な法的問題を含むケースでは、人間の監視と判断が不可欠です。法務AIの学習に使用するデータの質と量は極めて重要です。学習データが偏って不足していたり、古かったりすると、結果が不正確になったり、偏ったものになったりする可能性があります。

法務AIは、法的意思決定においてしばしば重要となる、法律文書や事件の広範な文脈やニュアンスの理解に苦戦する可能性があります。AIには、人間の弁護士が持つ創造性や直感が欠けているため、創造的な問題解決や戦略的な法的思考を必要とする業務では効果が低いです。法律分野でのAIの使用は、特にプライバシー、偏見、透明性に関する倫理的懸念を引き起こします。AIのアルゴリズムは、過去の法的データに存在するバイアスを不注意に永続させる可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 自動化需要の増大

- 企業間のコラボレーションが市場を活性化

- 機械学習とビッグデータ分析の進歩による市場促進

- 抑制要因

- 不正確な結果

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 コンポーネント別

- サービス

- ソリューション

第8章 展開方式別

- オンプレミス

- クラウド

第9章 用途別

- 法務調査

- 契約書の精査と管理

- 電子請求

- 案件予測

- その他

第10章 エンドユーザー別

- 法律事務所

- 企業の法務部門

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- International Business Machines

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- Thomson Reuters Corporation Reuters

- Open Text Corporation India Private Limited

- Neota Logic Inc.

- Cognitiv+

- Casetext, Inc.

- Klarity Intelligence, Inc.

- CaseMine

- Kira Inc.

- Reed Elsevier Inc.

第14章 付録

Overview:

Global Legal AI Software Market reached US$ 0.5 billion in 2022 and is expected to reach US$ 3.7 billion by 2030, growing with a CAGR of 28.7% during the forecast period 2023-2030.

Legal documents, contracts, case law and regulatory documents are merely a few of the numerous kinds of data that the legal sector produces and this data can be processed and analyzed by legal AI software effectively, making it a useful tool for law offices and legal departments. Legal AI software automates many manual and time-consuming tasks, such as contract review and legal research and this leads to increased efficiency and significant cost savings for legal professionals.

For instance, on 25 April 2023, Luminance, a leader in legal process automation, partnered with NexaConnex, a brand of Nexa Law, to integrate Luminance's AI technology into the NexaConnex legal service offering. NexaConnex, a fast-growing legal services provider in UK, supports mid-market law firms in various sectors. The partnership was initiated when NexaConnex used Luminance's AI to streamline a complex and time-sensitive disclosure exercise for one of its law firm clients, resulting in significant time savings.

Asia-Pacific is among the growing regions in the global Legal AI Software market covering more than 2/5th of the market and the region is experiencing significant economic growth and increased cross-border business activities and this has led to a higher volume of legal work, including contract management, due diligence and compliance, driving the demand for AI solutions to streamline these processes.

Dynamics:

Growing Demand for Automation

Automation of routine tasks and processes allows legal professionals to focus on higher-value tasks, such as legal analysis and strategy development and this leads to increased efficiency and productivity within law firms and legal departments. Automation helps reduce operational costs by minimizing the need for manual labor in tasks like document review, contract analysis and legal research, this cost reduction is appealing to legal organizations seeking to optimize their budgets.

According to GlobalSCAPE, Inc. and Ponemon studies the cost of disregarding data privacy regulations has significantly increased in recent years. Average annual expenditures for non-compliance for organizations are US$ 14.82 million, which is 2.71 times more expensive than keeping compliance. The amount of sensitive or confidential information handled by each industry affects the differences in compliance costs that range from US$ 7.7 million on average annually for media organizations to over US$ 30.9 million for financial services companies.

Collaboration Between Companies Boosts the Market

Legal cases and issues are becoming more complex, requiring multidisciplinary expertise. Many law firms and legal departments now operate on a global scale, serving clients and managing cases in multiple jurisdictions. Collaboration tools facilitate communication and information sharing among teams located in different regions, helping them work efficiently across borders.

For instance, on 19 October 2022, Siskind Susser, P.C. is partnering with a legal software company to launch a new cloud-based AI case management technology aimed at aiding immigration processes. Visalaw.Ai, founded by lawyers and innovation professionals at the immigration law firm Siskind Susser, P.C., has entered into a collaboration agreement with Fastcase, a legal technology and data company, to assist its NextChapter company in developing a state-of-the-art immigration case management and document automation system.

Advancements in Machine Learning and Big Data Analytics Boosts the Market

AI software in the legal field benefits from advancements in machine learning algorithms and these algorithms learn from vast varieties of datasets of legal cases, contracts and other documents to make predictions and assist lawyers in their work. Legal AI software can harness the power of big data analytics to uncover patterns, trends and insights within legal documents and case histories, this technology helps lawyers make data-driven decisions.

For instance, on 9 August 2023, Gunderson Dettmer, an international law firm with a focus on technology clients launched its proprietary internal generative AI chat app called ChatGD and this move makes Gunderson Dettmer the first US-based firm to develop an internal tool using generative AI technology. ChatGD is an AI application that allows attorneys to query and manipulate documents securely using OpenAI's models through Microsoft Azure.

Inaccurate Results

Legal AI is not yet capable of completely automating complex legal tasks. It can assist with document review, legal research and contract analysis, but human oversight and judgment are still essential, particularly in cases involving novel legal issues. The quality and quantity of the data used to train legal AI are extremely important. Results may be inaccurate or prejudiced if the training data is biased lacking or out of date.

Legal AI may struggle with understanding the broader context or nuances of legal documents and cases, which are often critical in legal decision-making. AI lacks the creativity and intuition that human lawyers possess, making it less effective in tasks requiring creative problem-solving or strategic legal thinking. The use of AI in the legal field raises ethical concerns, especially regarding privacy, bias and transparency. AI algorithms may inadvertently perpetuate biases present in historical legal data.

Segment Analysis:

The global legal AI software market is segmented based on component, deployment type, application, end-user and region.

Legal AI Software Provides Services that Automates Tasks

As laws and regulations become more intricate, legal professionals require advanced tools to manage and interpret vast volumes of legal information efficiently. Legal AI software provides the means to process this complexity. Legal AI can automate routine and time-consuming tasks, such as document review and contract analysis and this automation reduces operational costs and allows legal professionals to focus on higher-value tasks.

For instance, on 8 May 2023, Law Bot Pro is a groundbreaking app developed by a law student, Mandaar Mukesh Giri, aimed at providing easy and accessible legal information to the public. The app features an intelligent chatbot that answers legal questions in plain language, making legal knowledge more understandable. The app's chatbot is designed to simplify legal information, making it accessible to individuals with varying levels of legal knowledge.

Geographical Penetration:

Automation of Repetitive Tasks Boosts the Market

North America is dominating the global Legal AI Software market and the region has a vast and complex legal landscape, with a high volume of legal cases, contracts and regulatory compliance requirements. Legal AI software helps law firms and legal departments manage this workload more efficiently. Law firms in North America are under pressure to reduce costs while maintaining the quality of their legal services. Legal AI solutions automate repetitive tasks, allowing legal professionals to focus on higher-value work.

For instance, on 21 June 2023, Aderant, a provider of legal business management solutions, introduced MADDI, an AI-powered virtual associate designed to automate routine tasks and provide actionable insights in the legal industry. MADDI is pre-trained on Aderant applications, making it easier for law firms to adopt and ensuring quick time-to-value. MADDI's continuous learning capabilities are expected to drive firm-wide growth and optimization.

Competitive Landscape

The major global players in the market include: International Business Machines, Thomson Reuters Corporation Reuters Corporation, Open Text Corporation India Private Limited, Neota Logic Inc., Cognitiv+, Casetext, Inc., Klarity Intelligence, Inc., CaseMine, Kira Inc. and Reed Elsevier Inc..

COVID-19 Impact Analysis:

The pandemic forced law firms and legal departments to expedite their digital transformation efforts. Remote work and the need for efficient, accessible legal services led to a greater adoption of AI-powered legal solutions. Legal professionals needed tools that could facilitate remote collaboration, document sharing and secure communication. Legal AI software with collaboration features became essential.

The pandemic generated an increase in legal workloads due to contract disputes, regulatory changes and legal issues related to the crisis. Legal AI software helped manage these additional demands. Many businesses faced financial challenges during the pandemic, making cost control a priority. Legal AI software helped reduce legal operational costs through automation. Legal AI tools ensured the continuity of legal services, enabling lawyers to work on cases and projects despite lockdowns and disruptions.

The pandemic emphasized the importance of data privacy and security as remote work increased the vulnerability of sensitive legal information. Legal AI solutions had to enhance security measures. Legal AI software had to adapt to changing legal needs, such as handling force majeure clauses in contracts or addressing new regulatory requirements related to the pandemic.

AI Impact

AI-powered legal software can automate time-consuming tasks like document review, legal research and contract analysis and this significantly reduces the time and effort required for these activities, allowing legal professionals to focus on more strategic and value-added tasks. Automation of legal processes leads to cost savings for law firms and legal departments. AI leads to perform tasks 24/7 without the need for breaks or overtime, making it a cost-effective solution.

AI algorithms analyze a large volume of legal data with a high degree of accuracy and this reduces the risk of errors and ensures that legal documents and contracts are reviewed thoroughly. AI can extract valuable insights from legal data, helping lawyers and organizations make informed decisions. It can identify patterns, trends and anomalies in legal documents, which can be crucial in litigation, compliance and risk management.

For instance, on 7 September 2023, Microsoft introduced a Copilot Copyright Commitment to address concerns raised by customers regarding potential intellectual property (IP) infringement claims when using its AI-powered Copilot services and this commitment assures customers that they can use Microsoft's Copilot services and the generated output without worrying about copyright claims.

Russia- Ukraine War Impact

The conflict may lead to increased geopolitical uncertainty, affecting international business transactions and trade agreements. Legal AI software can quickly adapt to changing regulations and trade policies will be in higher demand. The war may result in contractual disputes, invoking force majeure clauses and necessitating legal review and arbitration. Legal AI tools capable of analyzing force majeure clauses and providing relevant case law and guidance will be valuable.

As sanctions and export control regulations evolve organizations will need Legal AI software to ensure compliance and these tools can help in identifying sanctioned entities, tracking regulatory changes and managing compliance risks. Companies operating in affected regions may face intellectual property challenges. Legal AI solutions that assist in patent, trademark and copyright protection will be crucial.

By Component

- Services

- Solution

By Deployment Type

- On-Premise

- Cloud

By Application

- Legal Research

- Contract Review and Management

- E-Billing

- Case Prediction

- Others

By End-User

- Law Firms

- Corporate Legal Departments

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In March 2023, PricewaterhouseCoopers International Limited (PwC) is collaborating with tech startup Harvey to introduce an artificial intelligence (AI) chatbot service for its 4,000 lawyers across 100+ countries. The AI assistant, integrated through a 12-month contract, aims to assist PwC lawyers in tasks such as contract analysis, regulatory compliance, due diligence and other legal advisory services.

- In May 2023, Reed Elsevier Inc. launched Lexis+ AI in beta, utilizing generative AI to transform the legal research and document drafting process. The solution guides users in drafting legal documents or client emails by creating a first draft and allowing users to modify language and tone using prompts. Lexis+ AI has been developed with a focus on privacy and follows RELX responsible AI principles.

- In July 2023, Berlin-based startup Legal OS, backed by Google, has publicly launched its generative AI platform designed for in-house legal teams. The platform offers business teams, such as sales and marketing, a legal assistant that can operate within their existing workflows.t aims to provide in-house teams with on-demand legal expertise, enabling immediate support for tasks like contract negotiation and review through chat interfaces embedded in communication tools, email or browsers.

Why Purchase the Report?

- To visualize the global legal AI software market segmentation based on component, deployment type, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of legal AI software market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

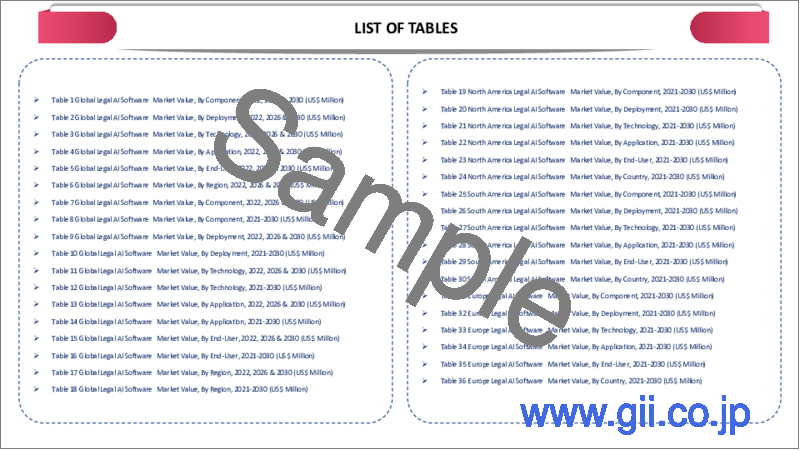

The global legal AI software market report would provide approximately 69 tables, 66 figures and 190 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Component

- 3.2. Snippet by Deployment Type

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Demand for Automation

- 4.1.1.2. Collaboration Between Companies Boosts the Market

- 4.1.1.3. Advancements in Machine Learning and Big Data Analytics Boosts the Market

- 4.1.2. Restraints

- 4.1.2.1. Inaccurate Results

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Component

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 7.1.2. Market Attractiveness Index, By Component

- 7.2. Services*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Solution

8. By Deployment Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 8.1.2. Market Attractiveness Index, By Deployment Type

- 8.2. On-Premise*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Cloud

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Legal Research*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Contract Review and Management

- 9.4. E-Billing

- 9.5. Case Prediction

- 9.6. Others

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Law Firms*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Corporate Legal Departments

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. International Business Machines*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Thomson Reuters Corporation Reuters

- 13.3. Open Text Corporation India Private Limited

- 13.4. Neota Logic Inc.

- 13.5. Cognitiv+

- 13.6. Casetext, Inc.

- 13.7. Klarity Intelligence, Inc.

- 13.8. CaseMine

- 13.9. Kira Inc.

- 13.10. Reed Elsevier Inc.

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us