|

|

市場調査レポート

商品コード

1352160

スマートオフィスの世界市場-2023年~2030年Global Smart Office Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スマートオフィスの世界市場-2023年~2030年 |

|

出版日: 2023年09月27日

発行: DataM Intelligence

ページ情報: 英文 201 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

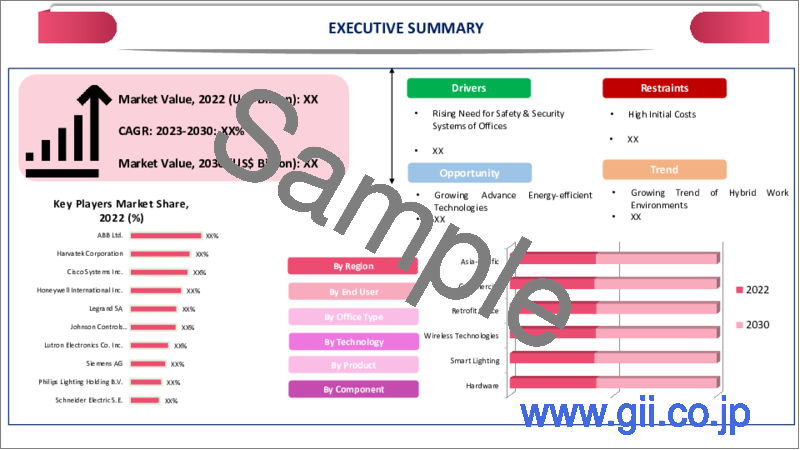

世界のスマートオフィス市場は、2022年に323億米ドルに達し、2023-2030年の予測期間中にCAGR 11.3%で成長し、2030年には904億米ドルに達すると予測されています。

スマートオフィスではIoTが大きな役割を果たしています。IoTデバイスやセンサーの普及により、データの収集や様々なオフィス機能の自動化が容易かつコスト効率よく行えるようになっています。スマートオフィスは、エネルギー効率の高いシステム、最適化されたスペース利用、予知保全を通じて、運用コストを大幅に削減することができます。企業はこうしたコスト削減の可能性に魅力を感じています。

スマートオフィスのテクノロジーは、作業を合理化し、反復的なプロセスを自動化し、従業員に効率的に働くためのツールを提供することで、生産性の向上につながります。職場環境の改善は、従業員の士気と満足度を高めます。スマートオフィスには、カスタマイズ可能な照明、快適な温度調節、さらにはウェルネス・プログラムなどのアメニティが備わっていることが多く、優秀な人材を惹きつけ、維持することができます。シスコのレポートによると、95%の企業がインテリジェント・ワークプレイス・テクノロジーによって良好な職場環境を提供していると回答しています。

予測期間中、アジア太平洋地域は世界のスマートオフィス市場の1/4弱を占め、最も高いCAGRが見込まれています。この地域の国々は急速に都市化が進んでおり、オフィススペースの需要が高まっています。人が密集する場所では、スマートオフィスがスペースの効率的な利用に役立ちます。テクノロジーの主要拠点として、この地域は市場の成長と開拓を促進する技術革新と製造業を目の当たりにしています。

ダイナミクス

安全・セキュリティシステムに対するニーズの高まり

企業にとって、従業員の安全を確保することは重要な課題です。従業員を潜在的な脅威や事故から守るため、スマートオフィスソリューションには、入退室管理システム、監視カメラ、緊急対応システムなど、さまざまな安全対策が含まれています。スマートオフィスシステムは、機器、データ、知的財産などの貴重な資産を保護するのに役立ちます。生体認証による入退室管理やリアルタイムの資産追跡などのセキュリティ対策は、盗難や損害から資産を守ることに貢献します。

2023年のマイクロソフト・セキュリティによると、マイクロソフトのEdge Secured-Coreプログラムは、デバイス要件にセキュリティ原則を組み込むデバイス認証プログラムとして紹介されています。このプログラムは、セキュアバイデザインとセキュアバイデフォルトの実践を、デバイスメーカーがより利用しやすくすることを目的としています。Edge Secured-Coreの要件を満たすデバイスは、Azure認定デバイスカタログで確認できます。

マイクロソフトは、IoTセキュリティに対するゼロ・トラスト・アプローチを推進しています。これは、すべてのリクエストを検証し、デフォルトでは何も信用しないというもので、このアプローチには、セキュアなアイデンティティ、エンドポイント、アプリケーション、データ、インフラストラクチャ、ネットワークが含まれます。

IoTの導入が市場を押し上げる

スマートオフィスにおけるIoTデバイスとセンサーは、ルーチンタスクの自動化、リソース配分の最適化、ワークフロー効率の改善を可能にし、これが生産性の向上とコスト削減につながります。IoTソリューションは、組織がエネルギー消費を削減し、スペース利用を最適化し、運用経費を最小化するのに役立ち、この費用対効果は、収益向上を目指す企業にとって説得力のある要因です。

例えば、2020年8月5日、レノボは中国の企業を対象としたエンド・ツー・エンドのIoTスマート・ビル・ワークプレイス・ソリューションを発表しました。このソリューションは、カスタマイズ、迅速な展開、包括的な運用・保守などのデジタル・サービスを提供することで、企業がよりインテリジェントで効率的なワークプレイスを構築するのを支援するよう設計されています。このソリューションは、アジャイルワークやリモートワークなど、オフィススペース活用の進化する動向に対応し、5G、ビッグデータ、AIなどのテクノロジーを活用してスマートオフィスビルを実現します。

技術進歩

スマートオフィスでは、AIを活用したソリューションが普及しつつあります。AIは、予測分析、自動化、パーソナライズされたユーザー体験を通じて生産性を高めることができます。エネルギー消費を最適化し、ルーチン・タスクを自動化し、データから洞察を得ることができます。エッジコンピューティングは、よりソースに近いところでデータを処理することでクラウドコンピューティングを補完し、待ち時間を短縮してリアルタイムの意思決定を強化するため、スマートオフィスにおけるセキュリティや自動化などのアプリケーションに不可欠となっています。

例えば、2023年8月29日、AISと通信機器プロバイダーのZTEは、タイのバンコクにあるAZセンターで、ミリ波(mmWave)ネットワークにおける世界初のダイナミック・リコンフィギュラブル・インテリジェント・サーフェス(RIS)のトライアルを実施しました。ZTEとAISの提携はミリ波通信における画期的な出来事であり、ダイナミックRIS技術は世界の通信業界に革命的な変化をもたらすと期待されています。これにより、スマートシティ、産業用IoT、その他の領域の開発に向けて、より強固なネットワーク基盤が確立されることになります。

費用対効果と定期的なメンテナンス

スマートオフィスのインフラ構築にはコストがかかります。センサー、IoTデバイス、接続性、ソフトウェアのコストは、企業にとって多額の先行投資となる可能性があります。様々なデバイス、システム、プラットフォームを統合することは複雑です。異なるテクノロジー間の互換性を確保し、円滑なコミュニケーションを図ることが課題となっています。接続デバイスが増えるにつれて、スマートオフィスはサイバー攻撃の潜在的な標的になります。

スマートオフィスでのデータ収集は、従業員のプライバシーに関する懸念を引き起こします。企業はデータ利用について透明性を保ち、プライバシー規制を遵守しなければなりません。スマートデバイスは定期的なメンテナンスとアップデートが必要です。古い技術は互換性の問題やセキュリティの脆弱性につながります。スマートオフィスのテクノロジーを効果的に使用するためには従業員のトレーニングが必要であり、このトレーニングには時間がかかり、一部のスタッフからの抵抗に直面する可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 安全・セキュリティシステムに対するニーズの高まり

- IoTの導入が市場を押し上げる

- 技術進歩

- 抑制要因

- 費用対効果と定期的なメンテナンス

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 提供別

- ハードウェア

- ソフトウェア

- サービス

第8章 製品別

- スマート照明

- インテリジェントセキュリティシステム

- エネルギー管理システム

- ネットワーク管理システム

- ビデオ会議システム

- その他

第9章 コネクティビティ技術別

- 無線技術

- 有線技術

第10章 エンドユーザー別

- 商業用

- 住宅用

- 産業用

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- ABB Ltd.

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- Harvatek Corporation

- Cisco Systems Inc.

- Honeywell International Inc.

- Legrand SA

- Johnson Controls International Plc

- Lutron Electronics Co. Inc.

- Siemens AG

- Philips Lighting Holding B.V.(Signify Holding)

- Schneider Electric S.E.

第14章 付録

Overview

Global Smart Office Market reached US$ 32.3 billion in 2022 and is expected to reach US$ 90.4 billion by 2030, growing with a CAGR of 11.3% during the forecast period 2023-2030.

The Internet of Things plays a major role in smart offices. The proliferation of IoT devices and sensors has made it easier and more cost-effective to collect data and automate various office functions. Smart offices can significantly reduce operational costs through energy-efficient systems, optimized space utilization and predictive maintenance. Businesses are drawn to these potential cost savings.

Smart office technologies can streamline tasks, automate repetitive processes and provide employees with tools to work more efficiently and lead to increased productivity. Improving the work environment boosts employee morale and satisfaction. Smart offices often feature amenities like customizable lighting, comfortable temperature control and even wellness programs, which can attract and retain top talent. A Report by Cisco as 95% of companies say that they provide a good work environment with intelligent workplace technology.

During the forecast period, Asia-Pacific is expected to have the highest CAGR in the global smart office market covering less than 1/4th of the market. The region's countries are rapidly urbanising, which is increasing demand for office space. In densely crowded places, smart offices aid in the efficient use of space. As a major hub for technology the region witnessed innovations and manufacturing which fosters the growth and development in the market.

Dynamics

Rising Need for Safety & Security Systems

Maintaining employees well and secure is an important concern for companies. To safeguard workers from potential threats and incidents, smart office solutions may include a variety of safety measures like access control systems, security cameras and emergency response systems. Smart office systems help protect valuable assets, including equipment, data and intellectual property. Security measures like biometric access control and real-time asset tracking contribute to safeguarding assets against theft or damage.

According to Microsoft Security in 2023, Microsoft's Edge Secured-Core program is introduced as a device certification program that incorporates security principles into device requirements. It aims to make secure-by-design and secure-by-default practices more accessible to device manufacturers. Devices meeting Edge Secured-Core requirements can be found in the Azure Certified Device Catalog.

Microsoft promotes a Zero Trust approach to IoT security, which involves verifying every request and not trusting anything by default and this approach encompasses secure identity, endpoints, applications, data, infrastructure and networks.

Adoption of IoT Boost the Market

IoT devices and sensors in smart offices can automate routine tasks, optimize resource allocation and improve workflow efficiency and this leads to increased productivity and cost savings. IoT solutions help organizations reduce energy consumption, optimize space utilization and minimize operational expenses, this cost-effectiveness is a compelling factor for businesses looking to enhance their bottom line.

For instance, on 5 August 2020, Lenovo unveiled an end-to-end IoT Smart Building and Workplace Solution aimed at businesses in China and this solution is designed to assist companies in creating more intelligent and efficient workplaces by offering digital services such as customization, rapid deployment and comprehensive operation and maintenance. It addresses the evolving trends in office space utilization, including agile working and remote work and leverages technologies like 5G, big data and AI to enable smart office buildings.

Technology Advancement

AI-powered solutions are becoming more prevalent in smart offices. AI can enhance productivity through predictive analytics, automation and personalized user experiences. It can optimize energy consumption, automate routine tasks and provide insights from data. Edge computing complements cloud computing by processing data closer to the source and this reduces latency and enhances real-time decision-making, making it vital for applications like security and automation in smart offices.

For instance, on 29 August 2023, AIS and ZTE, a telecommunications equipment provider, conducted the world's first dynamic Reconfigurable Intelligent Surface (RIS) trial in a millimeter-wave (mmWave) network at the AZ center in Bangkok, Thailand. The collaboration between ZTE and AIS represents a milestone in millimeter-wave communication, with dynamic RIS technology expected to bring revolutionary changes to the global communication industry. It will establish a stronger network foundation for the development of smart cities, industrial IoT and other domains.

Cost Effectiveness and Regular Maintenance

Setting up a smart office infrastructure can be expensive. The cost of sensors, IoT devices, connectivity and software can be a significant upfront investment for businesses. Integrating various devices, systems and platforms can be complex. Ensuring compatibility and smooth communication between different technologies is a challenge. As more connected devices, smart offices become potential targets for cyberattacks.

The collection of data in smart offices raises privacy concerns among employees. Businesses must be transparent about data usage and comply with privacy regulations. Smart devices require regular maintenance and updates. Outdated technology lead to compatibility problems and security vulnerabilities. Employees need to be trained to use smart office technology effectively and this training can be time-consuming and may face resistance from some staff members.

Segment Analysis

The global smart office market is segmented based on offering, product, connectivity technology, end-user and region.

Rising Awareness of Energy Management

Energy management is expected to be the dominant segment with about 1/3rd of the global market in 2022. Given its improved focus and ease of use, Energy Management Systems are widely employed all over the world. Furthermore, their growing use for energy usage tracking is gaining acceptance in a variety of businesses. It contributes to increased productivity, convenience, and efficiency for both businesses and employees.

Edge AI has grown increasingly popular in both industrialised and developing countries, owing mostly to the onset of the COVID-19 pandemic. The popularity of flexible work environments and rotating class schedules aided the establishment of the intelligent building management movement. Edge AI has also highlighted building management systems (BMS) in order to improve occupant comfort, minimise energy consumption, and increase safety.

Furthermore, increased advancements by global technology leaders are expected to drive market expansion during the forecast period. For example, in April 2022, Samsung Electronics announced a collaboration with ABB to expand the use of Samsung SmartThings in homes and other structures.

Geographical Penetration

Rise in Technology Innovation for Smart Office in North America

North America is the dominant growing region in the global smart office market covering more than 1/3rd of the market during the forecast period. The region is a hub for technology innovation, with many leading tech companies headquartered here. The environment fosters the development and adoption of cutting-edge smart office technologies and these factors boosts the growth of the market.

For instance, on 29 Wednesday 2022, in London UK Huawei is set to launch its new HUAWEI Matebook and Smart Office. As a leading global provider of information and communications technology infrastructure and smart devices, Huawei continues to innovate in the tech industry. The MateBook range will introduce two new products aimed at providing users with enhanced capabilities for expressing their ideas.

Competitive Landscape

The major global players in the market include: ABB Ltd., Harvatek Corporation, Cisco Systems Inc., Honeywell International Inc., Legrand SA, Johnson Controls International Plc, Lutron Electronics Co. Inc., Siemens AG, Philips Lighting Holding B.V. (Signify Holding) and Schneider Electric S.E.

COVID-19 Impact Analysis

The pandemic forced many businesses to rapidly adopt remote work and digital solutions to ensure business continuity and this accelerated digital transformation efforts, including the adoption of smart office technologies, to support remote collaboration and communication. Smart offices, equipped with technologies like video conferencing, cloud-based collaboration tools and IoT devices, became essential to enable remote work and maintain productivity.

The pandemic highlighted the importance of employee health and safety in the workplace. Smart offices incorporated features such as touchless access control, occupancy monitoring and air quality sensors to create safer and healthier work environments. As businesses adapted to remote work, they reconsidered their office space needs. Many adopted flexible office arrangements, including hot-desking and hoteling, which were facilitated by smart office solutions for space management and desk booking.

The use of IoT sensors for monitoring occupancy, temperature and air quality in smart offices became critical for ensuring compliance with health guidelines and these sensors also provided valuable data for optimizing office resources. The economic impact of the pandemic led to cost-cutting measures and energy efficiency became a priority. Smart offices integrated energy management systems to reduce energy consumption and operating costs.

AI Impact

AI-powered automation streamlines routine tasks, such as scheduling meetings, managing emails and controlling environmental systems like lighting and HVAC and this efficiency frees up employees to focus on higher-value tasks, ultimately increasing productivity. Automation and optimization of energy consumption, resource allocation and maintenance tasks can lead to substantial cost savings for businesses. AI-driven predictive maintenance can reduce downtime and extend the lifespan of office equipment.

AI-driven personalization can customize office environments for individual employees, optimizing factors like lighting, temperature and workspace arrangements and this enhances comfort and overall job satisfaction. AI collects and analyzes data from various sensors and devices within the smart office environment, this data-driven approach provides valuable insights that can inform strategic decisions about workspace design, resource allocation and employee well-being.

According to a report from Spiceworks, in June 2023, MLOps uses AI to automate procedures, increase productivity and minimize human error. Retail, logistics, financial services and healthcare are represented by some of the domains where it is used. By increasing productivity and cost-effectiveness, hyper-automation elevates automation to a new level. While integration of tools plays a major role for connecting different devices within organizations.

Russia- Ukraine War Impact

The war can disrupt supply chains, leading to fluctuations in the availability and cost of hardware components and data storage and this could affect the implementation and maintenance of Smart Office solutions. In regions directly affected by the conflict, data collection and reporting may be disrupted. Smart Office relies on high-quality data, so any disruptions can hinder insights generation.

During times of geopolitical instability, there is often an uptick in cyberattacks and espionage. Smart Office platforms may need to strengthen their security measures to protect sensitive data. Organizations and governments may prioritize resources for immediate humanitarian and security needs, potentially diverting investments away from AI and analytics initiatives, including Smart Office.

By Offering

- Hardware

- Software

- Services

By Product

- Smart Lighting

- Intelligent Security Systems

- Energy Management Systems

- Network Management Systems

- Audio-Video Conferencing Systems

- Others

By Connectivity Technology

- Wireless Technologies

- Wired Technologies

By End-User

- Commercial

- Residential

- Industrial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On 24 January 2023, Arthur, a prominent virtual reality (VR) office provider, unveiled its 'New Realities' update to its virtual office platform as this upgrade introduced the first generation of Mixed Reality (MR) capabilities to Arthur's virtual workplaces and these new features allow users to bring their physical desk and computer into the VR environment and utilize global passthrough functionality.

- On 14 September 2022, TD SYNNEX launched Iaconnects MobiusFlow Click-to-Run on Azure, a solution aimed at simplifying the configuration of smart building management systems. Developed by the TD SYNNEX Solutions Factory, this Internet of Things (IoT) solution helps partners efficiently implement and manage smart building architecture. It is a cloud-based solution that enables quick visualization of data and the creation of customized dashboards on IoT Central, Microsoft Azure's IoT platform.

- On 7 July 2022, Logitech and Tencent Meeting jointly launched a comprehensive smart office solution aimed at addressing the evolving needs of mixed office environments in Chinese enterprises. The solution, developed as part of their collaboration, covers various usage scenarios, including personal collaboration and various sizes of conference rooms.

Why Purchase the Report?

- To visualize the global smart office market segmentation based on offering, product, connectivity technology, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of smart office market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

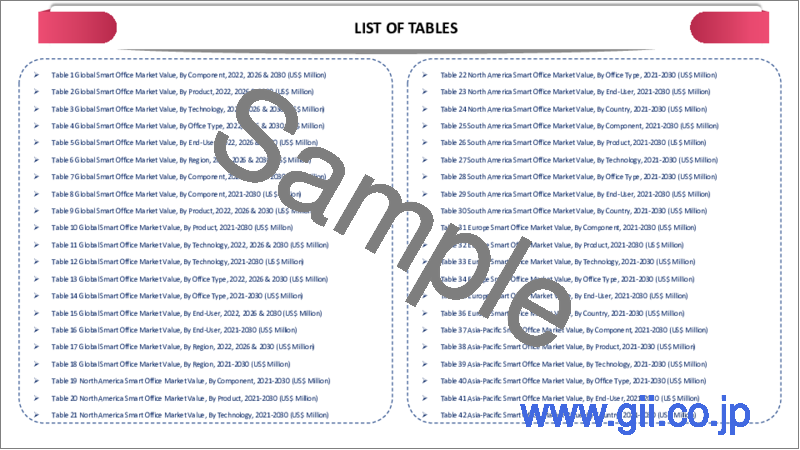

The global smart office market report would provide approximately 69 tables, 69 figures and 201 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Offering

- 3.2. Snippet by Product

- 3.3. Snippet by Connectivity Technology

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rising Need for Safety & Security Systems

- 4.1.1.2. Adoption of IoT Boost the Market

- 4.1.1.3. Technology Advancement

- 4.1.2. Restraints

- 4.1.2.1. Cost Effectiveness and Regular Maintenance

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Offering

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offering

- 7.1.2. Market Attractiveness Index, By Offering

- 7.2. Hardware*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Software

- 7.4. Services

8. By Product

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 8.1.2. Market Attractiveness Index, By Product

- 8.2. Smart Lighting*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Intelligent Security Systems

- 8.4. Energy Management Systems

- 8.5. Network Management Systems

- 8.6. Audio-Video Conferencing Systems

- 8.7. Others

9. By Connectivity Technology

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Connectivity Technology

- 9.1.2. Market Attractiveness Index, By Connectivity Technology

- 9.2. Wireless Technologies*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Wired Technologies

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Commercial*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Residential

- 10.4. Industrial

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offering

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Connectivity Technology

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offering

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Connectivity Technology

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offering

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Connectivity Technology

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offering

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Connectivity Technology

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Offering

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Connectivity Technology

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. ABB Ltd.*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Harvatek Corporation

- 13.3. Cisco Systems Inc.

- 13.4. Honeywell International Inc.

- 13.5. Legrand SA

- 13.6. Johnson Controls International Plc

- 13.7. Lutron Electronics Co. Inc.

- 13.8. Siemens AG

- 13.9. Philips Lighting Holding B.V. (Signify Holding)

- 13.10. Schneider Electric S.E.

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us