|

|

市場調査レポート

商品コード

1352153

古紙管理の世界市場-2023年~2030年Global Waste Paper Management Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 古紙管理の世界市場-2023年~2030年 |

|

出版日: 2023年09月27日

発行: DataM Intelligence

ページ情報: 英文 221 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の古紙管理市場は、2022年に432億米ドルに達し、2023-2030年の予測期間中にCAGR 2.6%で成長し、2030年には527億米ドルに達すると予測されています。

古紙管理は、環境的に責任ある持続可能な方法で紙廃棄物を体系的に取り扱い、収集、処理、処分することを含みます。紙廃棄物が環境に与える悪影響を最小限に抑え、資源を節約し、リサイクルを促進してバージン原料の必要性を減らすことを目的としています。

世界中で企業や教育機関の数が増加していることが、紙製品の需要と消費を促進しています。木材と竹は紙の生産に使われる主原料であり、その需要が高まっています。そのため、紙需要の増加に伴って森林伐採が増加します。古紙管理システムの需要を喚起している森林破壊の増加は、こうした各国の政府努力によって防がれています。

さらに、紙や紙製品の生産者は、環境に優しい廃棄物管理技術を使用しており、これは着実に古紙管理の世界市場の拡大を加速させています。古紙管理のリサイクルタイプは、市場シェアの50%以上を占めています。

同様に、アジア太平洋地域は古紙管理市場を独占しており、1/3以上の最大市場シェアを獲得しています。同地域の成長は、中国とインドが大きな市場シェアを占めていることに加え、同州の急速な工業化と都市化によるもので、これらすべてが同地域での市場拡大を加速させると予想されています。

ダイナミクス

高まる政府の取り組み

政府の取り組みは、紙廃棄物の環境への影響を減らすことを目的とした政策、規制と政策を実施することにより、紙廃棄物管理において極めて重要な役割を果たしています。こうした取り組みには、回収、リサイクル、廃棄、持続可能な慣行の促進など、廃棄物管理の様々な側面が含まれます。

政府は廃棄物の転換率やリサイクル率の目標を設定し、企業や個人に紙廃棄物の削減やリサイクルの促進を促しています。また、拡大生産者責任(EPR)プログラムを設け、適切な廃棄やリサイクルを含む製品のライフサイクル全体を管理する責任をメーカーに課しています。例えば、インドの全都市を「ゴミのない都市」にするため、ナレンドラ・モディ首相は2021年10月1日、「スワチ・バーラト・ミッション-都市(SBM-U 2.0)」ミッションの第2段階を開始しました。

インドでは、年間120~240万トン近くの新聞、240~430万トンの段ボールとミックスペーパー、130万トン以上のガラス、260万トン以上の金属くず、4~620万トンのその他のリサイクル可能な材料が、家庭、旅回りの廃棄物業者(raddiwalas)、廃棄物回収業者によって回収されています。インドでは、紙と段ボールのリサイクル率は30~60%です。

環境への関心と持続可能性への取り組み

環境への関心の高まりと持続可能性への取り組みの熱心な追求が、古紙管理市場の強力な推進力として浮上しています。過剰な紙廃棄物が生態系や気候変動に与える悪影響に対する意識が高まるにつれ、こうした悪影響を軽減する手法を採用する必要性が高まっています。

社会のエコロジー意識が高まるにつれ、企業や消費者はエコロジカル・フットプリントを抑制する解決策を積極的に模索しています。このような考え方の変化により、リサイクル、再利用、責任ある廃棄を優先する効率的な古紙管理戦略の需要が高まっています。企業は、環境への配慮が社会の価値観に合致するだけでなく、経済的なメリットももたらすことを認識するようになっています。

このような懸念に応えるため、古紙管理技術やプロセスにおける技術革新が盛んになっています。廃棄される紙素材から最大限の価値を引き出すために、高度な回収・選別・リサイクル技術が開発されています。さらに、持続可能なパッケージング・ソリューションと循環型経済モデルが支持を集め、古紙を再び生産サイクルに組み込むことを企業に促しています。

循環型経済の実践の拡大

増大する循環型経済実践の勢いは、古紙管理市場に大きな影響を及ぼしています。廃棄物の最小化と資源効率の最大化を目指す循環型経済モデルは、産業界が紙の消費と廃棄に取り組む方法を再構築しつつあります。

古紙管理の文脈では、循環経済の原則が、使用済みの紙を単なる廃棄物としてではなく、生産サイクルに再統合できる貴重な資源として捉えることを企業に促しています。このような視点の転換により、古紙を回収し、加工して新たな紙製品に生まれ変わらせ、バージン原料の必要性を減らすクローズド・ループ・リサイクル・システムなどの革新的なアプローチが生み出されています。

eコマースと包装業界の台頭

eコマースとパッケージング産業の急成長は、古紙管理市場に大きな影響を及ぼしています。オンラインショッピングの普及に伴い、包装資材、特に紙ベースの包装資材の消費量も増加しています。この上昇により、効率的な古紙管理ソリューションに対する差し迫ったニーズが生まれています。

eコマース・プラットフォームや包装業界は、段ボール箱、包装資材、保護資材など、大量の紙廃棄物を発生させています。このような古紙の流入は、廃棄物管理部門にとって課題であると同時にチャンスでもあります。こうした大量の廃棄物を処理する必要性から、紙素材に特化した高度な収集・選別・再生インフラへの投資が進められています。

汚染と品質への懸念

汚染と品質に関する懸念は、古紙管理市場における顕著な抑制要因であり、紙素材のシームレスなリサイクルを妨げています。古紙の流れの中にプラスチック、接着剤、インク、紙以外の材料などの汚染物質が存在すると、再生紙製品の品質が著しく低下します。汚染物質はリサイクルプロセスを中断させ、最終製品の品質低下と操業コストの上昇を招きます。

汚染に対処するには、清潔で高品質な紙のみがリサイクルに使用されるよう、選別と洗浄の工程を確実に行う必要があります。これらの工程は資源を大量に消費するだけでなく、高度な技術と熟練した労働力を必要とします。さらに、汚染された古紙が不適切に処理されることで、バッチ全体がリサイクルできなくなり、埋立廃棄物の一因となることもあります。

インフラと物流の限界

古紙の効果的な管理には、収集、輸送、リサイクル施設の複雑なネットワークが必要です。しかし、インフラの不備や老朽化は、これらのプロセスの円滑な流れを妨げています。リサイクル施設や集積所の不足はシステムのボトルネックとなり、古紙処理の遅延や非効率を引き起こします。さらに、最新のリサイクル技術の不足は、多様な種類の古紙を効果的に処理する能力を制限する可能性があります。

物流の課題も大きな役割を果たしています。交通網が未発達な地域では、古紙を回収してリサイクルセンターまで運ぶのに必要なコストと労力は相当なものになります。そのため、消費者も廃棄物処理業者も、リサイクル活動への積極的な参加を躊躇してしまいます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 環境への懸念と持続可能性への取り組み

- 高まる政府の取り組み

- 循環型経済の実践の拡大

- eコマースと包装業界の台頭

- 抑制要因

- 汚染と品質への懸念

- インフラと物流のげんぁお

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- リユース(再利用)

- リプレース(置換)

- リサイクル(再生)

- 回収

- その他

第8章 製紙グレード別

- オイル用段ボール

- ミックスペーパー

- 新聞紙

- 高級脱墨紙

- パルプ代替品

- その他

第9章 供給源別

- 住宅用

- 産業用

- 商業用

第10章 サービス別

- 収集・輸送

- 保管

- 分別

- 加工

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- WM Intellectual Property Holdings, L.L.C.

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 最近の動向

- Zero Waste Energy LLC

- Premier Waste Management Limited

- Sappi Papier Holding GmbH

- International Paper Co.

- Harris Waste Management Group Inc.

- Reliable Paper Recycling

- WestRock Company

- DS Smith plc

- Kenburn Waste Management Limited

第14章 付録

Overview

Global Waste Paper Management Market reached US$ 43.2 billion in 2022 and is expected to reach US$ 52.7 billion by 2030, growing with a CAGR of 2.6% during the forecast period 2023-2030.

Waste paper management involves the systematic handling, collection, processing and disposal of paper waste in an environmentally responsible and sustainable manner. It aims to minimize the negative impact of paper waste on the environment, conserve resources and promote recycling to reduce the need for virgin materials.

Increasing numbers of businesses and educational institutions throughout the world are driving the demand for and consumption of paper products. Wood and bamboo are the primary raw materials used in paper production, which raises their demand. Deforestation therefore rises as a result of increased paper demand. The rise in deforestation, which is what fuels the demand for waste paper management systems, is prevented by these government efforts in various nations.

Additionally, producers of paper and paper goods are using environmentally friendly waste management techniques, which is steadily accelerating the expansion of the global market for waste paper management. The recycling type of waste paper management accounts for over 50% of the market share.

Similarly, the Asia-Pacific dominates the waste paper management market, capturing the largest market share of over 1/3rd. The growth in the region is due to the significant market shares that China and India hold, as well as the province's rapid industrialization and urbanization, all of which are expected to hasten market expansion in the area.

Dynamics

Growing Government Initiatives

Government initiatives play a pivotal role in paper waste management by implementing policies, regulations and programs aimed at reducing the environmental impact of paper waste. These efforts encompass various aspects of waste management, including collection, recycling, disposal and promoting sustainable practices.

Governments often set targets for waste diversion and recycling rates, encouraging businesses and individuals to reduce paper waste and increase recycling. They also establish Extended Producer Responsibility (EPR) programs, which hold manufacturers accountable for managing the entire lifecycle of their products, including proper disposal and recycling. For instance, to render all Indian cities "garbage free," Prime Minister Narendra Modi began the second phase of the Swachh Bharat Mission-Urban (SBM-U 2.0) Mission on October 1, 2021.

Nearly 1.2-2.4 million tons of newspapers, 2.4-4.3 million tonnes of cardboard and mixed paper, more than 1.3 million tonnes of glass, more than 2.6 million tonnes of metal waste and 4-6.2 million tonnes of other recyclable materials are annually recovered by households, itinerant waste dealers (raddiwalas) and waste collectors in India. In India, recycling rates range from 30 to 60 percent for paper and cardboard.

Environmental Concerns and Sustainability Initiatives

The upsurge in environmental concerns and the fervent pursuit of sustainability initiatives have emerged as powerful driving forces behind the waste paper management market. With heightened awareness about the detrimental impact of excessive paper waste on ecosystems and climate change, there is a growing urgency to adopt practices that mitigate these adverse effects.

As societies become more ecologically conscious, businesses and consumers are actively seeking solutions to curb their ecological footprint. This shift in mindset has fostered a demand for efficient waste paper management strategies that prioritize recycling, reuse and responsible disposal. Companies are increasingly recognizing that their environmental stewardship not only aligns with societal values but also holds economic merit.

In response to these concerns, innovation has flourished in waste paper management technologies and processes. Advanced collection, sorting and recycling techniques are being developed to extract maximum value from discarded paper materials. Additionally, sustainable packaging solutions and circular economy models are gaining traction, encouraging businesses to incorporate waste paper back into their production cycles.

Growing Circular Economy Practices

The momentum behind growing circular economy practices is exerting a significant influence on the waste paper management market. The circular economy model, which aims to minimize waste and maximize resource efficiency, is reshaping the way industries approach paper consumption and disposal.

In the context of waste paper management, circular economy principles encourage businesses to view used paper not as a mere discard, but as a valuable resource that can be reintegrated into the production cycle. This shift in perspective has led to innovative approaches, such as closed-loop recycling systems, where waste paper is collected, processed and transformed into new paper products, reducing the need for virgin raw materials.

Rise in E-commerce and Packaging Industries

The surge in the e-commerce and packaging industries is exerting a substantial influence on the waste paper management market. As online shopping becomes increasingly prevalent, there is a corresponding rise in the consumption of packaging materials, particularly paper-based packaging. This upswing has created a pressing need for efficient waste paper management solutions.

E-commerce platforms and packaging industries are generating significant volumes of paper waste, including cardboard boxes, packaging inserts and protective materials. This influx of waste paper presents both a challenge and an opportunity for the waste management sector. The need to handle this mounting waste has prompted investments in advanced collection, sorting and recycling infrastructure tailored to paper materials.

Contamination and Quality Concerns

Contamination and quality concerns present a notable restraint in the waste paper management market, impeding the seamless recycling of paper materials. The presence of contaminants such as plastics, adhesives, inks and non-paper materials within waste paper streams significantly degrades the quality of recycled paper products. Contaminated materials can disrupt the recycling process, leading to lower-quality end products and increased operational costs.

Addressing contamination requires robust sorting and cleaning processes to ensure that only clean and high-quality paper is used in recycling. These processes are not only resource-intensive but also demand advanced technologies and skilled labor. Moreover, the improper disposal of contaminated waste paper can render entire batches unrecyclable, contributing to landfill waste.

Infrastructure and Logistics Limitations

The effective management of waste paper involves a complex network of collection, transportation and recycling facilities. However, inadequate or outdated infrastructure hampers the smooth flow of these processes. Insufficient recycling facilities and collection points can lead to bottlenecks in the system, causing delays and inefficiencies in waste paper processing. Moreover, the lack of modern recycling technologies can limit the capacity to handle diverse types of waste paper effectively.

Logistical challenges also play a significant role. In regions with underdeveloped transportation networks, the cost and effort required to collect and transport waste paper to recycling centers can be substantial. This can deter both consumers and waste management companies from participating actively in recycling efforts.

Segment Analysis

The global waste paper management market is segmented based on type, paper grade, source, service and region.

Rising Importance of Sustainability

Recycling types in the waste paper management market are experiencing a boost due to a convergence of environmental consciousness, economic incentives and technological advancements making it 41.1% of the global share. As sustainability becomes a paramount concern, businesses and industries are recognizing the benefits of adopting specific recycling methods tailored to their paper waste streams.

According to the American Forest and Paper Association, in 2021, the rate of recycled paper increased to 68%, matching the previous record-high rate. Old corrugated containers (OCC), generally known as cardboard boxes, had a remarkable recycling rate of 91.4%. The paper value chain reached a 71.4% recycling rate.

Closed-loop recycling is gaining traction because it allows industries to maintain quality consistency in their paper products while reducing the demand for virgin materials. This aligns with consumer preferences for eco-friendly products and reduces the ecological footprint of manufacturing.

Open-loop recycling addresses the increasing demand for versatile paper products, especially in the packaging sector. By repurposing mixed paper waste into functional packaging materials, businesses save costs and reduce waste, both of which contribute to improved bottom lines and greener practices.

Geographical Penetration

Rapid Economic Growth and Industrialization

Asia-Pacific waste paper management market held the largest market share of 48.3% in 2022 in the waste paper management market analysis.

The rapid economic growth and industrialization in countries like China, India and Southeast Asian nations have led to increased consumption, including paper products. As industries expand, the demand for paper-based packaging materials, office supplies and printed materials rises, consequently driving the demand for effective waste paper management.

Urbanization is accompanied by higher population densities and increased commercial activities. Urban areas generate significant quantities of paper waste from offices, households and retail sectors. Managing this waste requires advanced waste paper management infrastructure to prevent environmental issues.

Indeed, government initiatives play a crucial role in driving the increased demand for the waste paper management market in the Asia-Pacific. Governments in this region have recognized the environmental and economic importance of effective waste paper management and have taken active measures to address the growing challenges posed by paper waste.

To meet present expectations, the Indian recycling sector requires close to 14 million tonnes of waste paper. Domestic recycling only contributes 30% of the total and domestic recycling rates are half the worldwide average. Therefore, it is likely that there will still be a high demand for waste paper from outside.

Competitive Landscape

The major global players in the market include WM Intellectual Property Holdings, L.L.C., Zero Waste Energy LLC, Premier Waste Management Limited, Sappi Papier Holding GmbH, International Paper Co., Harris Waste Management Group Inc., Reliable Paper Recycling, WestRock Company, DS Smith plc and Kenburn Waste Management Limited

COVID-19 Impact Analysis

Construction, manufacturing, lodging and tourism businesses were severely impacted during the COVID-19 pandemic. Manufacturing operations were suspended or limited. This caused the demand for and production of various pieces of equipment required to make waste paper management systems to fall, which in turn restrained the expansion of the waste paper management market. On the other hand, businesses are progressively returning to their normal levels of production and services. This is anticipated to result in waste paper handling businesses restarting at full capacity, which will help the market recover by the end of 2021.

Russia-Ukraine War Impact Analysis

Communities, economies and the environment have all been irreparably impacted by the conflict between Ukraine and Russia. Transporting goods has become extremely difficult as a result of how much this protracted war has impacted the world's supply lines. According to media sources, Asia-Pacific and European paper sector has been so badly damaged that there is a two-month waiting period for international shipments.

A decline in the paper industry's production output could lead to a decreased supply of waste paper available for recycling. As paper mills produce less paper, the amount of paper waste generated from manufacturing and consumption also diminishes, affecting the volume of recyclable material in the waste paper management market.

By Type

- Reuse

- Replace

- Recycle

- Recover

- Others

By Paper Grade

- Old Corrugated Containers

- Mixed Paper

- Newspaper

- High Grade De-Inked Paper

- Pulp Substitute

- Others

By Source

- Residential

- Industrial

- Commercial

By Service

- Collection and Transportation

- Storage

- Segregation

- Processing

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In October 2020, a local provider of solid waste, recycling and resource management services called Casella Waste Systems, Inc. acquired Willimantic Waste Paper Co., Inc. Ambrosia is a closed-loop firm that turns food waste into commodities and products that are circular in nature. The agreement hastened RTS's "commitment to sustainable waste management solutions". Three acquisitions have been made by the business since its founding in 2015 total.

- In January 2023, UPM Specialty Papers introduced a new "LinerLoop compatible" label to encourage closed loop recycling of release papers used in self-adhesive labels and tapes, aligning with the challenging EU regulatory requirements for waste reduction. The first industrial-scale closed-loop recycling system for silicone coated release papers, UPM LinerLoop, accepts release papers that bear the label.

- In July 2023, the debut of the paper recycling service was announced by Russell Richardson & Sons Ltd, a growing company in confidential waste and paper recycling solutions with headquarters in South Yorkshire. This service is intended to make it easier for neighborhood businesses to manage their paper and cardboard waste and was created to fulfill the growing demands of companies looking for effective and ecologically responsible recycling alternatives.

Why Purchase the Report?

- To visualize the global waste paper management market segmentation based on type, paper grade, source, service and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of waste paper management market-level with all segments.

- The PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

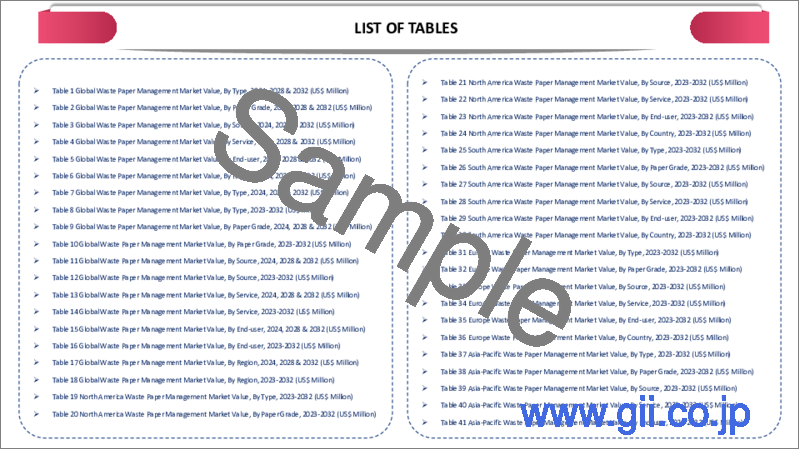

The global waste paper management market report would provide approximately 69 tables, 73 figures and 221 Pages.

Target Audience: 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet By Type

- 3.2. Snippet By Material

- 3.3. Snippet By Service

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Environmental Concerns and Sustainability Initiatives

- 4.1.1.2. Growing Government Initiatives

- 4.1.1.3. Growing Circular Economy Practices

- 4.1.1.4. Rise in E-commerce and Packaging Industries

- 4.1.2. Restraints

- 4.1.2.1. Contamination and Quality Concerns

- 4.1.2.2. Infrastructure and Logistics Limitations

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers' Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Reuse

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Replace

- 7.4. Recycle

- 7.5. Recover

- 7.6. Others

8. By Paper Grade

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Paper Grade

- 8.1.2. Market Attractiveness Index, By Paper Grade

- 8.2. Oil Corrugated Containers*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Mixed Paper

- 8.4. Newspaper

- 8.5. High Grade De-Inked Paper

- 8.6. Pulp Substitute

- 8.7. Others

9. By Source

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 9.1.2. Market Attractiveness Index, By Source

- 9.2. Residential*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Industrial

- 9.4. Commercial

10. By Service

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 10.1.2. Market Attractiveness Index, By Service

- 10.2. Collection and Transportation*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Storage

- 10.4. Segregation

- 10.5. Processing

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Paper Grade

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Paper Grade

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Paper Grade

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Paper Grade

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Paper Grade

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. WM Intellectual Property Holdings, L.L.C.*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Recent Developments

- 13.2. Zero Waste Energy LLC

- 13.3. Premier Waste Management Limited

- 13.4. Sappi Papier Holding GmbH

- 13.5. International Paper Co.

- 13.6. Harris Waste Management Group Inc.

- 13.7. Reliable Paper Recycling

- 13.8. WestRock Company

- 13.9. DS Smith plc

- 13.10. Kenburn Waste Management Limited

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us