|

|

市場調査レポート

商品コード

1352123

IgA腎症治療薬の世界市場-2023年~2030年Global IgA Nephropathy Drugs Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| IgA腎症治療薬の世界市場-2023年~2030年 |

|

出版日: 2023年09月27日

発行: DataM Intelligence

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のIgA腎症治療薬市場は、2022年に1億2,010万米ドルに達し、2030年には4億3,640万米ドルに達し、予測期間(2023-2030年)のCAGRは18.1%となり、有利な成長が予測されています。

IgA腎症治療薬の市場動向は、技術の向上と研究開発の増加により、製品の発売が増加していることを示しています。IgA腎症治療薬は自己免疫疾患の一種であり、腎臓を侵し、抗体の塊が腎臓に蓄積する間に炎症や腎障害を引き起こします。免疫グロブリンA(IgA)やその他の抗体の塊は、血液をろ過する小さな血管である腎臓の糸球体を傷つけ、腎臓から血液やタンパク質が尿中に放出されます。

さらに、製品の入手可能性と腎症発症率の上昇、市場での承認製品数の増加、研究開発の増加により、IgA腎症治療薬の採用が増加していることが、IgA腎症治療薬の市場規模を押し上げています。市場は、この分野の進歩の高まりの結果、北米地域の製品に対する需要が伸びています。Novartis AG社、Chinook Therapeutics社、Everest Medicines社など、その他の競合企業も積極的に市場に参入しています。

ダイナミクス

研究開発と新製品上市の増加がIgA腎症治療薬市場の成長を促す

IgA産生の大部分は消化管や呼吸器の粘膜表面で行われますが、骨髄形質細胞も循環IgAの大部分を占めます。粘膜病原体はIgA4によって中和され、急性SARS-CoV-2感染を含むいくつかの呼吸器疾患および消化器疾患は、IgA反応性の亢進と関連しています。血清IgA値の上昇は、メタボリックシンドローム、糖尿病、IgA腎症に頻繁にみられます。

同市場では、主要企業が複数の新製品を上市しており、市場の成長につながっています。例えば、2023年2月17日、Travere Therapeutics, Inc.の報告書によると、FILSPARI(sparsentan)は米国食品医薬品局(FDA)から、急速な病勢進行のリスクがあり、尿蛋白/クレアチニン比(UPCR)が1.5g/g未満と定義されることが多い蛋白尿を有する原発性IgAN患者の治療薬として早期承認を取得しました。前述のような主張の結果、予測期間を通じて市場は主導権を握ると予測されます。

主要企業による提携と製品パイプラインの増加が市場成長の機会を創出

主要企業は、製品上市、提携、合併、パートナーシップ、臨床試験など、いくつかの戦略的イニシアチブを市場成長のために活用しています。例えば、2023年7月28日、疾患修飾の可能性がある抗APRILモノクローナル抗体であるzigakibart(BION-1301)の安全性と有効性を評価する重要な第3相臨床試験であるBEYOND試験は、IgA腎症(IgAN)の最初の患者を登録しました。

腎臓病に対する高精度医薬品の創薬、開発、販売に特化したバイオ医薬品事業を展開するChinook Therapeutics, Inc.によると、ビヨンド試験の主要評価項目は、ベースラインから40週までの尿蛋白/クレアチニン比(UPCR)の変化で示される蛋白尿の減少におけるジガキバートの有効性をプラセボと比較するものです。

IgA腎症治療薬に伴う副作用が市場成長の妨げに

IgA腎症は、医療専門家によって薬物療法と食事療法で管理されます。医療専門家は、状況によってはコルチコステロイドなどの免疫抑制剤を追加で推奨することもあります。しかし、これらの薬物には、体重増加や免疫系の悪化など、有害な副作用の可能性があります。薬剤の効果や変更の必要性を追跡するために、定期的な血液検査が行われます。免疫抑制剤の最も重要な副作用は感染症にかかりやすくなることです。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 研究開発と新製品上市の増加

- IgA腎症の発生率の増加

- 抑制要因

- IgA腎症治療薬に伴う副作用

- 機会

- 主要企業による共同研究・製品パイプラインの増加

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 タイプ別

- 原発性IgA腎症

- 二次性IgA腎症

第8章 薬剤の種類別

- アンジオテンシン変換酵素(ACE)阻害薬

- アンジオテンシン受容体拮抗薬(ARB)

- 免疫抑制剤

- オメガ3脂肪酸

- 利尿薬

- その他

第9章 投与経路別

- 経口

- 非経口

- その他

第10章 流通チャネル別

- 病院薬局

- 小売薬局

- オンライン薬局

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- その他アジア太平洋

- 中東・アフリカ

- 地域別の主な動向

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- Calliditas Therapeutics AB

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- Travere Therapeutics, Inc.

- Novartis AG

- Omeros Corporation

- Vera Therapeutics

- Chinook Therapeutics Inc.

- Otsuka Pharmaceutical

- Alembic Pharmaceuticals Limited

- Everest Medicines

- Alexion Pharmaceuticals, Inc.

第15章 付録

Overview

Global IgA nephropathy drugs market reached US$ 120.1 million in 2022 and is projected to witness lucrative growth by reaching up to US$ 436.4 million by 2030 exhibiting a CAGR of 18.1% during the forecast period (2023-2030).

The IgA nephropathy drugs market trends show rising product launches owing to the rising technologies and increasing research and development. IgA nephropathy drugs is a form of autoimmune disease that affects the kidneys and results in inflammation or kidney damage while clumps of antibodies accumulate there. Immunoglobulin A (IgA) and other antibody clumps harm the kidneys' glomeruli, which are small blood vessels that filter blood, leading the kidneys to release blood and protein into the urine.

Furthermore, rising adoption of IgA nephropathy drugs due to the rising availability of products and nephropathy incidence, an increase in the number of approved products in the market, and an increase in the research and development is driving up the IgA nephropathy drugs market size. The market is experiencing a growth demand for products from North America areas as a result of the rising advancements in this field. With significant competitors like Novartis AG, Chinook Therapeutics, Everest Medicines, and others actively operating in the market.

Dynamics

Rising research and development and novel product launches drive the growth of the IgA nephropathy drugs market

The majority of IgA production takes place at the mucosal surfaces of the gastrointestinal or respiratory tracts, however bone marrow plasma cells contribute a significant amount of the circulating IgA. Mucosal pathogens can be neutralized by IgA4, and several respiratory and gastrointestinal illnesses, including acute SARS-CoV-2 infection, have been linked to increased IgA responsiveness. Elevated serum IgA levels are a frequent occurrence in people with metabolic syndrome, diabetes, and IgA nephropathy.

Several novel products are being launched by the major players in the market leading to growth of market. For instance, on February 17, 2023, according to a report from Travere Therapeutics, Inc., FILSPARI (sparsentan) has received accelerated approval from the U.S. Food and Drug Administration (FDA) to treat people with primary IgAN who are at risk for rapid disease progression and who have proteinuria, often defined as a urine protein-to-creatinine ratio (UPCR) of less than 1.5 g/g. The market is predicted to take the lead throughout the forecast period as a consequence of the aforementioned claims.

Rising collaborations and product pipeline by key players creates opportunities for the growth of the market

Major players are utilizing several strategic initiatives such as product launch, partnerships, mergers, partnerships, clinical trials among others for the growth of the market. For instance, on July 28, 2023, the BEYOND study, an important phase 3 clinical study evaluating the safety as well as the effectiveness of zigakibart (BION-1301), a possible disease-modifying anti-APRIL monoclonal antibody, has enrolled the first patient with IgA nephropathy (IgAN).

The BEYOND study's primary efficacy outcome compares the effectiveness of zigakibart to a placebo in reducing proteinuria as shown by changes in the urine protein to creatinine ratio (UPCR) between baseline and 40 weeks, according to Chinook Therapeutics, Inc., a biopharmaceutical business focused on the discovery, development, and marketing of precision medicines for kidney diseases.

Side effects associated with IgA nephropathy drugs will hamper the growth of the market

IgA nephropathy is managed by medical professionals with drugs and dietary adjustments. The medical professional may in few circumstances additionally recommend immunosuppressants, such as corticosteroids. But these drug type have potentially harmful side effects, like weight gain or immune system deterioration. To track the effectiveness of the drugs and the need for modifications, routine blood tests are employed. A higher likelihood of infection is the most important adverse effect of immunosuppressive drugs.

Segment Analysis

The global IgA nephropathy drugs market is segmented based on type, drug type, route of administrations, distribution channel and region.

Owing to high incidence, the primary IgA nephropathy from type segment accounted for approximately 63.7% of the IgA nephropathy drugs market share

The primary IgA nephropathy category held the largest market share in 2022 and is expected to maintain its dominance over the forecast period due to a growth in its incidence worldwide, amongst the population. The most typical autoimmune form of glomerulonephritis is Immunoglobulin nephropathy (IgAN), sometimes referred to as Berger's disease. The creation of pathogenic IgA1-containing antibody complexes is driven by an elevated level of galactose-deficient IgA1 and the formation of specific anti-glycan antibodies, according to a four-hit theory for the pathogenesis of IgAN.

The buildup causes the complement system along with mesangial cells to become active, releasing cytokines or extracellular matrix proteins. Given the aforementioned, glomerular function decline in IgAN is a result of persistent inflammation and fibrosis. Adult incidence is thought to be 25/1,000,000 year. IgAN is more prevalent among Asian populations than Caucasians (31/1,000,000 annually in France), with 45/1,000,000 cases per year in Japan.

Geographical Penetration

North America accounted for approximately 40.3% of the market share in 2022, owing to the strong presence of major players and increasing healthcare infrastructure investment

Due to the rising need for IgA nephropathy drugs for development purpose in healthcare, manufacturers in North America have chances of increasing their operations. There are many producers and suppliers in North America and owing to the quick economic growth of the region, industrial production has expanded, driving the demand for IgA nephropathy treatment.

Increasing expenditure on healthcare and rising awareness among people, advancement of technologies for diagnosis and treatment, and increase in pharmaceutical business establishment across the region are also contributing to the growth of IgA nephropathy drugs market share of this region.

It is also anticipated that the main healthcare organizations' and enterprises' collaborative research projects as well as new product development, which constantly seeks to improve available drugs alternatives, will contribute to the expanding demand. Individuals are becoming more aware of various advanced products that are being utilized for providing better medications, leading to the expansion of the market in this region. The above-mentioned factors further proves the dominance of North America on a global scale.

Competitive Landscape

The major global players in the IgA nephropathy drugs market include Calliditas Therapeutics AB, Travere Therapeutics, Inc., Omeros Corporation, Vera Therapeutics, MorphoSys AG, Otsuka Pharmaceutical, Alembic Pharmaceuticals Limited, Everest Medicines, Novartis AG and Alexion Pharmaceuticals, Inc. among others.

COVID-19 Impact Analysis

Russia Ukraine Conflict Analysis

Due to the low prevalence as well as absence of major market participants in this region, it is predicted that the Russia-Ukraine conflict will not have a significant effect on the worldwide IgA nephropathy drugs market. The growth of the global IgA nephropathy drugs market, however, is anticipated to be relatively unaffected by the import and export of raw materials over the forecast period.

By Type

- Primary IgA Nephropathy

- Secondary IgA Nephropathy

By Drug Type

- Angiotensin-Converting Enzyme (ACE) Inhibitors

- Angiotensin Receptor Blockers (ARBs)

- Immunosuppressants

- Omega-3 Fatty Acids

- Diuretics

- Others

By Route of Administration

- Oral

- Parental

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On August 1, 2023, the Phase 3 NefIgArd study's China open-label extension (cOLE) has seen the last patient enrolled, according to Everest Medicines, a biopharmaceutical firm specializing in the research, production, and marketing of novel drugs and vaccines. All eligible participants who have successfully completed the NefIgArd study are eligible for an additional 9 months of Nefecon treatment as part of the cOLE study, which will assess the effectiveness and safety of prolonged and repeated Nefecon medication in patients having IgA nephropathy (IgAN).

- On March 12, 2023, positive topline results from the global, double-blind, randomized, placebo-controlled third phase clinical trial NefIgArd, which compared the effectiveness of Nefecon (TARPEYO/Kinpeygo (budesonide) extended-release capsules) to a placebo in patients having primary IgA nephropathy (IgAN), were released by Calliditas Therapeutics AB. The estimated glomerular filtration rate (eGFR) was the primary endpoint of the trial, and Nefecon demonstrated a highly statistically significant advantage over placebo across the two-year period of 9 months of treatment using Nefecon or placebo and 15 months of follow-up off drug.

- On June 17, 2023, the Phase 2b ORIGIN clinical study of atacicept for the management of IgA nephropathy (IgAN) met its primary as well as key secondary outcomes, with statistically noteworthy and clinically significant decreases in proteinuria and stabilizing of eGFR through week 36, according to Vera Therapeutics, Inc., a late-stage biotechnology business focused on creating and distributing transformative treatments for individuals with serious immunological diseases. The 60th European Renal Association (ERA) Congress featured a late-breaking presentation on the ORIGIN results for week 36.

Why Purchase the Report?

- To visualize the global IgA nephropathy drugs market segmentation based on type, drug type, route of administration, distribution channel and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of IgA nephropathy drugs market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global IgA nephropathy drugs market report would provide approximately 69 tables, 69 figures and 195 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Drug Type

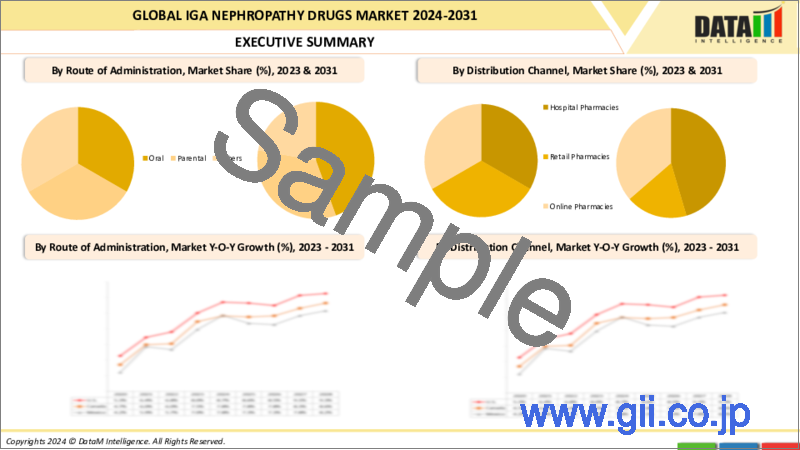

- 3.3. Snippet by Route of Administration

- 3.4. Snippet by Distribution Channel

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rising Research and Development and Novel Product Launches

- 4.1.1.2. Growing Incidence of IgA Nephropathy

- 4.1.2. Restraints

- 4.1.2.1. Side Effects Associated with IgA Nephropathy Drugs

- 4.1.3. Opportunity

- 4.1.3.1. Rising Collaborations and Product Pipeline by Key Players

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Scenario Post COVID-19

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Primary IgA Nephropathy *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Secondary IgA Nephropathy

8. By Drug Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 8.1.2. Market Attractiveness Index, By Drug Type

- 8.2. Angiotensin-Converting Enzyme (ACE) Inhibitors *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Angiotensin Receptor Blockers (ARBs)

- 8.4. Immunosuppressants

- 8.5. Omega-3 Fatty Acids

- 8.6. Diuretics

- 8.7. Others

9. By Route of Administration

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 9.1.2. Market Attractiveness Index, By Route of Administration

- 9.2. Oral *

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Parental

- 9.4. Others

10. By Distribution Channel

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.1.2. Market Attractiveness Index, By Distribution Channel

- 10.2. Hospital Pharmacies *

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Retail Pharmacies

- 10.4. Online Pharmacies

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. U.K.

- 11.3.7.3. France

- 11.3.7.4. Spain

- 11.3.7.5. Italy

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 12.4.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.4.2. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.5.1. Brazil

- 12.4.5.2. Argentina

- 12.4.5.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.7.1. China

- 12.5.7.2. India

- 12.5.7.3. Japan

Australia

- 12.5.7.4. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. Calliditas Therapeutics AB *

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. Travere Therapeutics, Inc.

- 14.3. Novartis AG

- 14.4. Omeros Corporation

- 14.5. Vera Therapeutics

- 14.6. Chinook Therapeutics Inc.

- 14.7. Otsuka Pharmaceutical

- 14.8. Alembic Pharmaceuticals Limited

- 14.9. Everest Medicines

- 14.10. Alexion Pharmaceuticals, Inc.

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us