|

|

市場調査レポート

商品コード

1348004

バサルト繊維の世界市場-2023年~2030年Global Basalt Fiber Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| バサルト繊維の世界市場-2023年~2030年 |

|

出版日: 2023年09月11日

発行: DataM Intelligence

ページ情報: 英文 181 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のバサルト繊維市場は、2022年に2億8,011万米ドルに達し、2023-2030年の予測期間中に12.2%のCAGRで成長し、2030年には7億130万米ドルに達すると予測されています。

持続可能で環境に優しい素材への世界のシフトがバサルト繊維の需要を促進しています。バサルト繊維は、従来の合成繊維よりも環境に優しい代替素材です。自動車産業は、その軽量かつ強靭な特性からバサルト繊維に関心を寄せています。メーカーは軽量化と燃費向上のため、ボディパネルや内装などの部品への利用を模索しています。

バサルト繊維固有の耐火性と優れた断熱性は、耐火衣料や断熱材など高温耐性を必要とする用途に魅力的です。建設業界では、バサルト繊維はコンクリート構造物の補強に使用され、より高い引張強度と耐久性を提供しています。世界のインフラ整備は続いており、こうした材料の需要は増加すると予想されます。

北米では、その汎用性と環境に優しい特性により、バサルト繊維の需要が急増しています。この地域の製造業は革新的な材料を求めていました。同地域における環境意識の高まりは、バサルト繊維のような持続可能な素材への嗜好につながっています。北米企業はこの動向を利用し、製品の環境に優しい性質を強調し、市場での競争力を獲得しました。

バサルト繊維市場の参入企業は、その利点、用途、適切な使用方法について潜在顧客に投資しています。規制機関や業界団体は、バサルト繊維の生産、試験、用途に関する基準やガイドラインを策定しています。これらの基準を満たすことで、消費者の信頼と市場の受容が高まり、市場の成長が促進されます。

例えば、2021年3月、バサルト繊維商品の著名なメーカーであるMafic USAは、ステンレス鋼と特殊合金の著名なプロバイダーであるUlbrich Stainless Steels &Special Metalsとの提携を発表しました。この戦略的提携は、バサルト繊維とステンレス鋼の融合による独創的な製品の創出を促進することを目的としています。

ダイナミクス

持続可能な材料の需要増大

持続可能な製品に対する消費者の意識と嗜好は、この市場の成長の強力な触媒です。消費者は環境への配慮に基づいて意識的に購入を決定しており、産業界はこうした需要を満たすために持続可能な素材であるバサルト繊維を製品に組み込む傾向にあり、バサルト繊維市場の成長を後押ししています。

世界のバサルト繊維市場は、新たな用途の開拓や製造プロセスの改善を目的とした研究開発活動の活発化からも恩恵を受けています。技術の進歩やメーカーの革新、新しい製品の配合や製造技術により、より費用対効果が高く汎用性の高いバサルト繊維製品が生まれ、市場成長がさらに拡大する可能性があります。

例えば、2022年1月、ベルギーに本社を置く著名なバサルト繊維製品メーカーであるBasaltex社は、航空宇宙および自動車セクター向けに調整されたバサルト繊維テキスタイルの新鮮なコレクションを発表しました。これらの斬新な繊維製品は、軽量、優れた強度、高温への耐性を誇り、航空宇宙・自動車用途の複合材料に非常に適しています。

自動車・航空宇宙産業の成長

両産業の持続可能で環境に優しい素材へのシフトは、バサルト繊維の市場成長に有利です。自動車・航空宇宙メーカーは、二酸化炭素排出量を削減し、環境規制に沿うよう努力しており、温室効果ガスの排出が少ないバサルト繊維の製造工程は魅力的な提案です。

燃費効率と排出量削減を追求することで、自動車分野では軽量製品に対する大きな需要が高まっています。バサルト繊維の強度対重量比と耐久性は、性能を犠牲にすることなく車両の軽量化を目指すメーカーにとって魅力的な選択肢となっています。ボディパネルや内装材を含む自動車部品への採用は、バサルト繊維市場の拡大に貢献しています。

国際自動車工業協会によると、2021年の世界の自動車生産台数は2020年の7億7,711万7,725台に比べ約3%増の8億1,459万9,988台に達しました。2021年には、中国、米国、日本、インド、韓国、ドイツ、メキシコといった主要な自動車製造国が生産台数を伸ばすと思われます。

航空宇宙分野では、燃費効率と安全性を確保しつつ、過酷な条件にも耐えられる軽量素材が重視されています。バサルト繊維の高温や疲労に対する耐性は、その卓越した強度とともに航空宇宙産業の要求に合致しています。バサルト繊維は、航空機の構造から内装部品まで幅広い用途に使用されており、航空宇宙市場での需要を牽引しています。

インフラ整備ニーズの拡大

インフラ整備のニーズは世界的に拡大しており、バサルト繊維市場は、製品の配合や製造プロセスの改善を目的とした研究開発への投資が増加するとみられます。これにより、性能特性が強化された高度なバサルト繊維ベースの材料が開発され、市場開拓がさらに推進される可能性があります。

バサルト繊維は軽量であるため、インフラ全体の重量を最小限に抑えながら構造性能を最適化することを目的とした革新的な建設設計に特に適しています。これは、自然災害の力に耐えるために高い柔軟性と耐久性を持つ材料が必要とされる、地震が発生しやすい地域では特に関連性が高く、市場の成長をさらに後押ししています。

バサルト繊維の強度、耐腐食性、難燃性などの優れた機械的特性は、コンクリートやその他の建設資材の補強材として魅力的な選択肢となっています。インフラ整備プロジェクトでの採用は、バサルト繊維市場の拡大に直接寄与しています。

教育・芸術用途の拡大

非塗工紙の教育・芸術用途への採用拡大が、世界の非塗工紙市場の成長に拍車をかけています。これらは非塗工紙特有の利点と、非塗工紙に対する需要の増加により非塗工紙を受け入れています。非塗工紙は印刷技術との親和性が高く、書きやすいため、教科書、ワークブック、練習帳に最適です。教育機関がこうした利点を選ぶことで、市場は拡大しています。

個人用および教育用ノートの人気は、筆記やスケッチに適した滑らかな表面を提供する非塗工紙の需要を牽引しています。非塗工紙は表面の質感と色の多様性から、視覚的なプレゼンテーション、ポスター、パンフレット、その他の創造的なプロジェクトに好まれます。出版業界、特に小説、文学作品、詩集などでは、非塗工紙の触感が重視され、市場での需要が高まっています。

芸術家は、インク、鉛筆、水彩など様々な芸術的メディアを吸収する能力があるため、非塗工紙を好むことが多いです。芸術家コミュニティが創作用に高品質の紙を求めるようになり、市場は拡大しています。教育現場では、非塗工紙が注釈やメモに対応できることから学習効果が高まり、需要に寄与しています。

コート紙との競合激化

コート紙の台頭は市場競争に直結し、非コート紙から需要を奪う可能性があります。コート紙の滑らかで光沢のある表面は、印刷品質と色の鮮やかさを向上させ、視覚に訴える素材を求める産業や用途を引き付けることができます。コート紙は、光沢のあるプロフェッショナルな外観でマーケティング資料を表示できるため、広告や販促資料として好まれます。

コート紙の表面はインクの持ちが良いため、画像や文字が鮮明になります。この利点は高品質印刷を優先するセクターを引き付け、非塗工紙市場に影響を与える可能性があります。コート紙はより正確で鮮やかな色を再現できるため、正確な色表現が重要な産業で好まれる可能性があり、これが市場の成長をさらに抑制する要因となっています。

バサルト繊維の認知度の低さ

消費者の認識は、バサルト繊維市場の需要と採用を促進する上で重要な役割を果たしています。バサルト繊維は高い強度対重量比と優れた熱安定性を提供します。しかし、認知度が低いため、潜在的な消費者や産業界はこれらの利点を十分に認識しておらず、これがバサルト繊維市場の成長をさらに抑制しています。

どのような製品であれ、市場成長は顧客の知識と認知に大きく影響されます。潜在的な購買層がバサルト繊維の特性や機能を知らない場合、より馴染みのある素材を使うことがデフォルトとなりますが、バサルト繊維は特定の用途において優れた性能を発揮する可能性があります。これは、バサルト繊維の生産者と、そのユニークな特性から恩恵を受ける可能性のある産業の双方にとって、機会を逃すことにつながります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 業界分析影響要因

- 促進要因

- 持続可能な材料の需要増大

- 自動車・航空宇宙産業の成長

- インフラ整備ニーズの拡大

- 教育・芸術用途の拡大

- 抑制要因

- バサルト繊維の認知度の低下

- 塗工紙との競合の増加

- 事業機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- ロービング

- チョップドストランド

- 生地

- メッシュ・グリッド

- マット

- その他

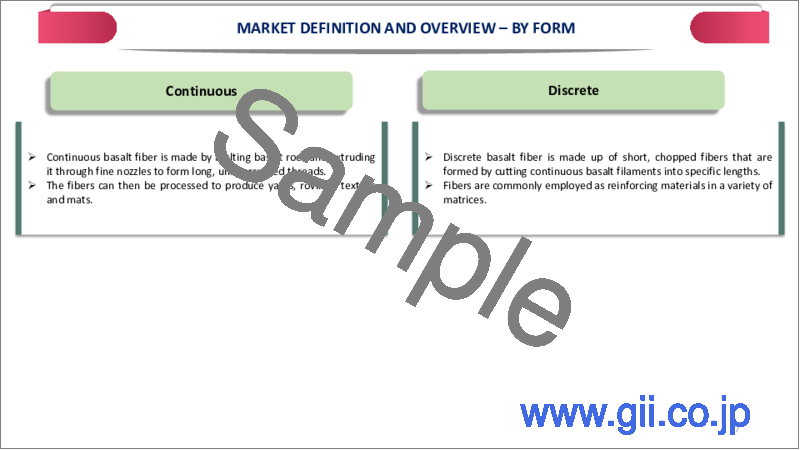

第8章 形状別

- 連続

- 離散

第9章 用途別

- 複合材料

- 複合材料以外

第10章 エンドユーザー別

- 建設・インフラ

- 自動車・輸送

- 電気・電子

- 風力エネルギー

- 船舶

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Kamenny Vek

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- MAFIC

- Technobasalt-Invest

- INCOTELOGY GmbH

- Sudaglass Fiber

- Permali Gloucester Ltd.

- GMV

- Jilin Huayang Group Co., Ltd.

- ARMBAS

- Arrow Technical Textiles Pvt. Ltd.

Overview

The Global Basalt Fiber Market reached US$ 280.11 million in 2022 and is expected to reach US$ 701.3 million by 2030, growing with a CAGR of 12.2% during the forecast period 2023-2030.

The global shift towards sustainable and eco-friendly materials is driving demand for basalt fiber. Basalt fibers are a more environmentally friendly alternative to traditional synthetic fibers. The automotive sector is interested in basalt fiber due to its lightweight and strong properties. Manufacturers are exploring its use in components like body panels, and interiors to reduce weight and enhance fuel efficiency.

Basalt fiber's inherent fire-resistant properties and good thermal insulation make it attractive for applications requiring high-temperature resistance including fireproof clothing, and insulation materials. In the construction industry, basalt fibers are used to reinforce concrete structures, providing higher tensile strength and durability. Global infrastructure development continued, and the demand for such materials is expected to rise.

North America is experiencing a surge in demand for basalt fiber due to its versatility and eco-friendly properties. The region's manufacturing industries sought innovative materials. Growing environmental awareness in the region is leading to a preference for sustainable materials like basalt fiber. North American companies capitalized on this trend, emphasizing the eco-friendly nature of their products to gain a competitive edge in the market.

Basalt fiber market players are investing in potential customers about its benefits, applications, and proper usage. Regulatory bodies and industry organizations are establishing standards and guidelines for the production, testing, and application of basalt fiber. Meeting these standards enhances consumer confidence and market acceptance and drives market growth.

For instance, in March 2021, Mafic USA, a prominent manufacturer of basalt fiber commodities, announced a collaboration with Ulbrich Stainless Steels & Special Metals, a distinguished provider of stainless steel and specialized alloys. This strategic alliance is designed to foster the creation of inventive products by amalgamating basalt fiber and stainless steel.

Dynamics

Growing Demand for Sustainable Materials

Consumer awareness and preferences for sustainable products are strong catalysts in this market's growth. Consumers make conscious purchasing decisions based on environmental considerations, industries are inclined to incorporate sustainable material basalt fiber into their products to meet these demands and drive basalt market growth.

The global basalt fiber market is also benefiting from increased research and development activities aimed at exploring new applications and improving manufacturing processes. Technology advances and manufacturers innovate, new product formulations and production techniques could result in more cost-effective and versatile basalt fiber products, further expanding its market growth.

For instance, in January 2022, Basaltex, a prominent manufacturer of basalt fiber goods headquartered in Belgium, introduced a fresh collection of basalt fiber textiles tailored for the aerospace and automotive sectors. These novel textiles boast attributes of low weight, remarkable strength, and resilience to elevated temperatures, rendering them exceptionally suitable for crafting composites destined for aerospace and automotive applications.

Rising Automotive and Aerospace Sectors

Both industries' shift towards sustainable and eco-friendly materials favors basalt fiber's market growth. Automotive and aerospace manufacturers strive to reduce their carbon footprint and align with environmental regulations, the production process of basalt fiber, which generates fewer greenhouse gas emissions is an attractive proposition.

Pursuing fuel efficiency and reduced emissions are leading to significant demand for lightweight products in the automotive sector. Basalt fiber's strength-to-weight ratio and durability make it an attractive choice for manufacturers aiming to reduce vehicle weight without sacrificing performance. This adoption in automotive components including body panels, and interior elements contributes to expanding the basalt fiber market.

According to the International Organization of Motor Vehicle Manufacturers, in 2021, the global production of motor vehicles witnessed growth reached approximately 801,459,988 units compared to 777,117,725 units in 2020, signifying a rise of over 3%. In 2021, the leading motor vehicle manufacturing countries such as China, U.S., Japan, India, South Korea, Germany, and Mexico.

The aerospace sector places a premium on lightweight materials that can withstand extreme conditions while ensuring fuel efficiency and safety. Basalt fiber's resistance to high temperatures, and fatigue, along with its exceptional strength, aligns with aerospace industry requirements. It is used in applications ranging from aircraft structures to interior components, thus driving its demand in the aerospace market.

Increasing Need for Infrastructure Development

The need for infrastructure development expands globally, the basalt fiber market is likely to see increased investments in research and development aimed at improving product formulations and manufacturing processes. This could lead to the development of advanced basalt fiber-based materials that offer enhanced performance characteristics, further propelling the market growth.

The lightweight nature of basalt fiber makes it particularly suitable for innovative construction designs that aim to optimize structural performance while minimizing the overall weight of the infrastructure. This is especially relevant in seismic-prone areas where materials with high flexibility and durability are needed to withstand the forces of natural disasters, which further drives market growth.

Basalt fiber's exceptional mechanical properties, including its strength, corrosion resistance, and fire-retardant characteristics, position it as an attractive option for reinforcing concrete and other construction materials. This adoption in infrastructure development projects directly contributes to the expansion of the basalt fiber market.

Increasing Educational and Artistic Applications

The expanding adoption of uncoated paper in educational and artistic applications is fueling the growth of the global uncoated paper market. These embrace uncoated paper for its specific benefits, and the increasing demand for uncoated paper. Uncoated paper's compatibility with printing technologies and its ease of writing make it an ideal choice for textbooks, workbooks, and exercise books. The market is expanding as educational institutions opt for these advantages.

The popularity of notebooks for personal and educational use drives the demand for uncoated paper, which provides a smooth surface for writing and sketching. Uncoated paper's surface texture and color versatility make it a preferred choice for visual presentations, posters, brochures, and other creative projects. The publishing industry, particularly for novels, literary works, and poetry collections values the tactile experience of uncoated paper, boosting its demand in the market.

Artists often prefer uncoated paper due to its ability to absorb various artistic mediums like ink, pencil, and watercolor. The market is growing as the artistic community seeks quality paper for their creations. In educational settings, uncoated paper's ability to accommodate annotations and notes enhances the learning experience, contributing to its demand.

Increasing Competition from Coated Paper

The rise of coated paper as a viable alternative is leading to direct market competition, potentially diverting demand away from uncoated paper. Coated paper's smooth and glossy surface enhances print quality and color vibrancy, which can attract industries and applications seeking visually appealing materials. Coated paper's ability to display marketing materials with a glossy and professional look leads to its preference for advertising and promotional materials.

Coated paper's surface provides better ink holdout, resulting in sharper images and text. This advantage may attract sectors that prioritize high-quality printing, impacting the uncoated paper market. Coated paper's ability to reproduce colors more accurately and vibrantly can make it a preferred choice for industries where accurate color representation is crucial, which further restraints market growth.

Limited Awareness of Basalt Fiber

Consumer awareness plays a key role in driving the basalt fiber market demand and adoption. Basalt fiber offers a high strength-to-weight ratio and superior thermal stability. However, due to limited awareness, potential consumers and industries are not fully aware of these benefits, which further restrains the basalt fiber market growth.

The market growth for any product is heavily influenced by customer knowledge and perception. When potential buyers are unaware of basalt fiber's properties and capabilities, they default to using more familiar materials, basalt fiber could offer superior performance in certain applications. This leads to missed opportunities for both the producers of basalt fiber and the industries that could benefit from its unique properties.

Segment Analysis

The global basalt fiber market is segmented based on type, form, usage, end-user, and region.

Increasing Adaption of Mesh and Grid and Developments

The dominance of mesh and grid products is holding the largest share of 28.2% of the global basalt fiber market. This segment's significant market presence underscores its key role in various industries that rely on basalt fiber for structural reinforcement and enhanced performance.

The market demand for mesh and grid products is fueled by their ability to provide increased stability, and structural integrity to diverse applications. Their adoption addresses the ever-growing need for lightweight yet robust materials in sectors where performance and efficiency are paramount.

Basalt fiber market players recognize the significance of mesh and grid products and continue to invest in development to enhance their performance and broaden their refined manufacturing processes. This innovation is expected to reinforce the basalt fiber market's growth.

For instance, in May 2021, Sudaglass Fiber Technology launched an innovative series of basalt fiber offerings tailored for application within the concrete reinforcement sector. This fresh lineup encompasses an assortment of basalt fiber bars and grids, all meticulously engineered to offer robust reinforcement solutions characterized by exceptional strength and corrosion resistance. These products are designed to bolster the durability and structural integrity of concrete constructions.

Geographical Penetration

Increasing Demand for Fiber-based Products in North America

North America emerged as a dominant region, wielding substantial influence on the global basalt fiber market. The region's robust industrial infrastructure, coupled with a penchant for innovation and technological advancements, is contributing nearly 1/3rd of the market.

North America is harnessing the potential of the basalt fiber market to its advantage with a focus on diverse applications spanning construction, automotive, and aerospace. This is leading to a surge in demand for basalt fiber-based products, further reinforcing the region's stronghold in the market. The global basalt fiber market continues to evolve, region's strategic positioning and proactive approach position it to maintain its leadership position and drive the basalt fiber market.

COVID-19 Impact Analysis

The pandemic disrupted supply chains across various industries, including the basalt fiber market. Restrictions on movement and production shutdowns in different regions affected the availability of raw materials and components, leading to delays in manufacturing and delivery. Economic challenges faced by businesses and investors due to the pandemic led to reduced capital expenditure and investment in new technologies, including those related to basalt fiber production. This limited the potential for market expansion and innovation.

However, the pandemic highlighted the importance of sustainability, driving industries to consider eco-friendly alternatives. Basalt fiber, being a naturally derived material with low environmental impact, gained attention as an option for reducing carbon footprints. Despite the challenges, the pandemic prompted increased investment in research and development. This could lead to innovations in basalt fiber technology, improving its properties, cost-effectiveness, and applicability across a wider range of industries.

Russia-Ukraine War Impact

Manufacturing facilities located in regions directly affected by the conflict might face disruptions due to damage, closure, or reduced production capacity. This could result in supply shortages, delayed orders, and increased lead times for basalt fiber products. The uncertainty and potential economic impact of the conflict could lead to reduced construction activity in affected regions. As the construction industry is a major consumer of basalt fiber materials, decreased demand for construction-related products could dampen market growth.

Businesses that heavily rely on materials sourced from conflict-affected regions might explore alternative suppliers to mitigate risks. This could lead to opportunities for basalt fiber producers in other regions to capture new customers. Geopolitical events can drive technological advancements, the conflict might spur research and innovation in the basalt fiber field, leading to improvements in manufacturing processes, product properties, and cost-effectiveness.

By Type

- Roving

- Chopped Strands

- Fabric

- Mesh and Grid

- Mats

- Others

By Form

- Continuous

- Discrete

By Usage

- Composites

- Non-Composites

By End-User

- Construction and Infrastructure

- Automotive and Transportation

- Electrical and Electronics

- Wind Energy

- Marine

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In December 2021, Technobasalt-Invest, a Ukrainian enterprise specializing in basalt fiber items, disclosed a partnership with BelAZ, a prominent Belarusian firm renowned for producing colossal mining dump trucks. This joint effort is geared towards innovating and fabricating novel composite materials, utilizing basalt fiber, tailored for deployment within the mining domain.

- In April 2021, Kamenny Vek initiated the manufacturing of basalt direct roving with a diameter of 22 microns and a tex count of 2400, as well as basalt assembled roving with a diameter of 18 microns and tex counts of 4800 and 3000.

- In July 2020, Mafic U.S. started the activities of the largest basalt fiber production facility globally, located in Shelby, North Carolina. This establishment positions the company well to cater to the substantial demand emanating from its extensive consumer base.

Competitive Landscape

The major global players include: Kamenny Vek, MAFIC, Technobasalt-Invest, INCOTELOGY GmbH, Sudaglass Fiber, Permali Gloucester Ltd., GMV, Jilin Huayang Group Co., Ltd., ARMBAS, Arrow Technical Textiles Pvt. Ltd.

Why Purchase the Report?

- To visualize the global basalt fiber market segmentation based on type, form, usage, end-user, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of basalt fiber market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

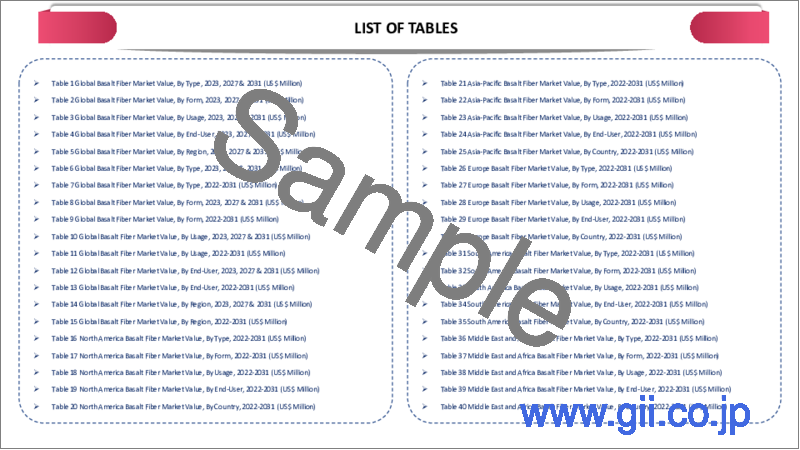

The global basalt fiber market report would provide approximately 69 tables, 71 figures, and 181 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Form

- 3.3. Snippet by Usage

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Industry Analysis Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Demand for Sustainable Materials

- 4.1.1.2. Rising Automotive and Aerospace Sectors

- 4.1.1.3. Increasing Need for Infrastructure Development

- 4.1.1.4. Increasing Educational and Artistic Applications

- 4.1.2. Restraints

- 4.1.2.1. Limited Awareness of Basalt Fiber

- 4.1.2.2. Increasing Competition from Coated Paper

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Roving*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Chopped Strands

- 7.4. Fabric

- 7.5. Mesh and Grid

- 7.6. Mats

- 7.7. Others

8. By Form

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 8.1.2. Market Attractiveness Index, By Form

- 8.2. Continuous*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Discrete

9. By Usage

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 9.1.2. Market Attractiveness Index, By Usage

- 9.2. Composites*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Non-Composites

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Construction and Infrastructure*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Automotive and Transportation

- 10.4. Electrical and Electronics

- 10.5. Wind Energy

- 10.6. Marine

- 10.7. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Kamenny Vek*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. MAFIC

- 13.3. Technobasalt-Invest

- 13.4. INCOTELOGY GmbH

- 13.5. Sudaglass Fiber

- 13.6. Permali Gloucester Ltd.

- 13.7. GMV

- 13.8. Jilin Huayang Group Co., Ltd.

- 13.9. ARMBAS

- 13.10. Arrow Technical Textiles Pvt. Ltd.

LIST NOT EXHAUSTIVE

- 13.11. About Us and Services

- 13.12. Contact Us