|

|

市場調査レポート

商品コード

1347999

ビル管理システムの世界市場-2023年~2030年Global Building Management Systems Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ビル管理システムの世界市場-2023年~2030年 |

|

出版日: 2023年09月11日

発行: DataM Intelligence

ページ情報: 英文 187 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のビル管理システム(BMS)市場は、2022年に142億米ドルに達し、2030年には476億米ドルに達すると予測され、予測期間2023-2030年のCAGRは13.6%で成長する見込みです。

環境の持続可能性と省エネルギーが高まる中、BMSは建物内のエネルギー使用量を監視、制御、最適化する機能を提供し、運用コストを削減するだけでなく、規制や企業の持続可能性目標にも合致します。ビル管理システムは、様々なビル・システムの集中監視と制御を可能にし、より効率的な資源利用、エネルギー浪費の削減、メンテナンス・コストの削減につながります。

ビル管理システムのプラットフォームは、遠隔監視・制御機能を提供し、施設管理者がどこからでもビルやシステムを管理できるようにします。モノのインターネット(Internet of Things)デバイスやスマートセンサーの普及により、ビル管理システムは照明、HVAC、セキュリティ、稼働率など、さまざまなシステムからリアルタイムのデータを収集できるようになっています。

アジア太平洋は、世界のビル管理システム市場の約1/4を占める急成長地域です。同地域の多くの国々で急速な都市化が進み、新しいビルやインフラ・プロジェクトの建設が進んでいるため、こうした近代的な建築物を効率的に管理・運営するビル管理システムの需要が高まっています。

ダイナミクス

スマートシティ構想に対する需要の増大

スマートシティは、建物のエネルギー消費、居住パターン、環境条件など、都市生活のさまざまな側面をデータ収集・監視するための相互接続システムとセンサーに依存しています。ビル管理システムは、こうしたデータを集約・分析し、ビルの運用と資源利用を最適化する上で重要な役割を果たします。

スマートシティへの取り組みは、水、電力、資材といった資源の効率的な利用を重視しています。例えば、高度なポンプソリューションと水技術の世界的リーダーであるグルンドフォスは、2022年4月1日、より接続性が高く、強靭で持続可能な都市を構築するためのインテリジェントソリューションに対する需要の高まりに対応するため、フィリピンで新しいNKおよびNKEシリーズのエンドサクションポンプを発売しました。

新しいポンプは、エネルギー効率、接続性、耐久性に重点を置いて設計されています。様々な都市におけるスマートシティ構想のイントロダクションは、水やエネルギー効率の高いソリューションなど、都市の持続可能性を高めるインテリジェント技術の必要性をさらに強調しています。

企業間の協力的パートナーシップの拡大

ビルには多くの場合、異なるメーカーのシステムが導入されており、それらを連携させる必要があります。協業パートナーシップは、スムーズな通信と統合を可能にする相互運用可能なソリューションの構築に重点を置き、互換性を確保し、顧客にとっての統合の複雑さを軽減します。協業パートナーシップは、ハードウェア設計、ソフトウェア開発、データ分析、ユーザー体験のいずれにおいても、企業が互いの強みを活用することを可能にします。

例えば、2022年12月7日、セムテック・コーポレーションのLoRaデバイスとLoRaWAN標準は、スマートビルのエネルギー消費を削減するために設計されたNordic PropeyeのHVAC最適化ソリューションに統合されました。このソリューションは当初欧州で発売されたが、商業ビルのエネルギー効率、空気品質、二酸化炭素排出量の改善への圧力が高まっている米国市場向けに適合されました。

技術進歩

最新の乗組員管理ソフトウェアは、高度なアルゴリズムと人工知能を活用して、乗組員のスケジューリング、ペアリング、割り当てを自動化します。これらのテクノロジーは、乗組員の稼働率を最適化し、運用コストを削減し、スケジュールの競合による混乱を最小限に抑えます。フライトスケジュール、乗務員の稼働状況、規制要件などのリアルタイムのデータソースとの統合により、正確で最新の乗務員管理が可能になり、航空会社が十分な情報を得た上で意思決定を行い、変更や混乱に迅速に対応できるようになります。

IoTベースのビル管理システムで世界をリードする75F社によると、クラウド技術は様々な業界に大きな進歩をもたらし、より効率的かつ効果的な運営を可能にしています。商業ビル管理システム業界は、他の分野に比べてクラウド・ネイティブ技術の採用が遅れています。何十年も使われてきた伝統的なビル管理システムは、急速に変化する技術環境の中で必要とされる柔軟性や適応性に欠けていることが多いです。

改修と導入の遅れ

既存の建物やインフラにビル管理システムを組み込むのは、複雑で時間がかかります。古いビルを最新のビル管理システム技術で改修するには、大幅な改造と投資が必要になる場合があります。BMSを導入し設定するための初期投資は、ハードウェア、ソフトウェア、センサー、コントローラー、その他のコンポーネントのコストを含め、かなりの額になる可能性があります。中小企業やビル所有者にとっては、コストがシステム導入の障害になることもあります。

ビル管理システムは、ビルとその居住者の特定のニーズに合わせてカスタマイズする必要があります。カスタマイズは、追加コストや導入の遅れにつながる可能性があります。一度ビル管理システムを導入すると、ベンダーの変更やコンポーネントのアップグレードに課題が生じる可能性があります。ビル管理システムの中には、独自のプロトコルやソフトウェアを使用しているものもあり、他のシステムとの統合やプロバイダーの変更が難しい場合があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- スマートシティ構想に対する需要の増大

- 企業間の協力関係の拡大

- 技術進歩

- 抑制要因

- 改修と導入の遅れ

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 ソフトウェア別

- セキュリティ管理

- 設備管理

- エネルギー管理

- インフラ管理

- 緊急管理

第8章 サービス別

- プロフェッショナルサービス

- マネージドサービス

第9章 用途別

- 住宅用

- 商業用

- 産業用

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Siemens

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- ABB

- Azbil Corporation

- Delta Controls

- Robert Bosch GmbH

- Legrand

- United Technologies

- Johnson Controls

- Honeywell International Inc.

- Eagle Technology

第13章 付録

Overview

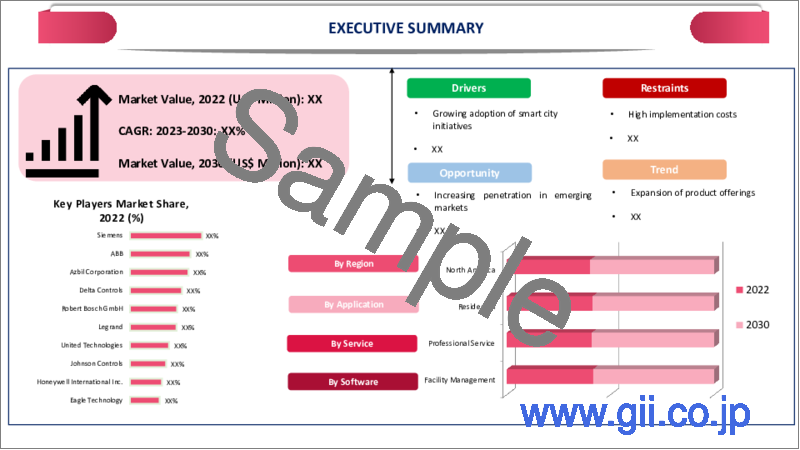

Global Building Management Systems Market reached US$ 14.2 billion in 2022 and is expected to reach US$ 47.6 billion by 2030, growing with a CAGR of 13.6% during the forecast period 2023-2030.

The rising growth in environmental sustainability and energy conservation, BMS offers the ability to monitor, control and optimize energy usage within buildings, this not only reduces operational costs but also aligns with regulatory and corporate sustainability goals. Building management systems allow for centralized monitoring and control of various building systems, which leads to more efficient resource utilization, reduced energy wastage and lower maintenance costs.

Building management systems platforms offer remote monitoring and control capabilities, allowing facility managers to manage buildings and systems from anywhere, this is particularly important for large or geographically dispersed facilities. The proliferation of Internet of Things devices and smart sensors enables building management systems to gather real-time data from various systems, such as lighting, HVAC, security and occupancy; this data-driven approach enhances decision-making and automation.

Asia-Pacific is the fastest growing regions in the global building management systems market covering about 1/4th of the market. The region rapid urbanization in many countries across the region has led to the construction of new buildings and infrastructure projects and this creates a substantial demand for building management systems to efficiently manage and operate these modern structures.

Dynamics

Rising Demand for Smart City Initiatives

Smart cities rely on interconnected systems and sensors to collect data and monitor various aspects of urban life, including building energy consumption, occupancy patterns and environmental conditions. Building management systems play an important role in aggregating and analyzing this data to optimize building operations and resource utilization.

Smart city initiatives emphasize the efficient use of resources such as water, electricity and materials. For instance, on 01 April 2022 Grundfos, a global leader in advanced pump solutions and water technologies, launched its new NK and NKE range of end-suction pumps in the Philippines to address the increasing demand for intelligent solutions in building more connected, resilient and sustainable cities.

The new pumps are designed with a focus on energy efficiency, connectivity and durability. The introduction of smart city initiatives in various cities further emphasizes the need for intelligent technology to enhance urban sustainability, including water- and energy-efficient solutions.

Rising Collaborative Partnerships Between Companies

Buildings often have systems from different manufacturers that need to work together. Collaborative partnerships focus on creating interoperable solutions that can communicate and integrate smoothly, ensuring compatibility and reducing integration complexities for customers. Collaborative partnerships allow companies to leverage each other's strengths, whether it's in hardware design, software development, data analysis or user experience.

For instance, on 7 December 2022, Semtech Corporation's LoRa devices and the LoRaWAN standard were integrated into Nordic Propeye's HVAC optimization solution, designed to reduce energy consumption in smart buildings. The solution, initially launched in Europe been adapted for the U.S. market, where there is increasing pressure to improve energy efficiency, air quality and carbon emissions in commercial buildings.

Advancement in Technology

Modern crew management software leverages advanced algorithms and artificial intelligence to automate crew scheduling, pairing and assignment, these technologies optimize crew utilization, reduce operational costs and minimize disruptions due to scheduling conflicts. Integration with real-time data sources, such as flight schedules, crew availability and regulatory requirements, allows for accurate and up-to-date crew management and this helps airlines make informed decisions and respond promptly to changes and disruptions.

According to 75F, a world's leading IoT-based building management system, Cloud technology brought significant advancements to various industries, enabling them to operate more efficiently and effectively. The commercial building management systems industry has been slower in adopting cloud-native technology compared to other sectors. Traditional Building Management Systems which have been in use for decades, often lack the flexibility and adaptability needed in the rapidly changing technological landscape.

Retrofitting and Delay in Implementation

Integrating a building management system into an existing building or infrastructure can be complex and time-consuming. Retrofitting older buildings with modern building management systems technology may require significant modifications and investments. The initial investment in installing and configuring a BMS can be substantial, this includes the cost of hardware, software, sensors, controllers and other components. For smaller businesses or building owners, the cost can be an obstacle to adoption of the systems.

Building management systems needs to be tailored to the specific needs of a building and its occupants. Customization can lead to additional costs and delays in implementation. Once a building management system is installed, there can be challenges in switching vendors or upgrading components. Some Building Management Systems may use proprietary protocols or software, making it difficult to integrate with other systems or change providers.

Segment Analysis

The global building management systems market is segmented based software, service, application and region.

Adoption of IoT for Security Facilities

Security management segment is expected to hold around 1/3rd of the global market share during the forecast period 2023-2030. The growth of Internet of Things devices and sensors in buildings has led to greater connectivity and automation. As more devices become interconnected, the need for securing these systems and preventing potential cyber threats becomes paramount, the rise in cyberattacks targeting buildings and critical infrastructure has raised awareness about the vulnerability of building management systems to hacking and unauthorized access.

Organizations are realizing the importance of implementing robust security measures to safeguard their systems and data. According to Nozomi Networks, in the rapidly evolving landscape of smart buildings and IoT adoption, there are critical considerations for enhancing security and ensuring operational resilience.

As building owners integrate IoT systems and sensors into their building management systems to improve operational efficiency and energy consumption, they must also address the increasing cyber risks associated with interconnected devices.

Geographical Penetration

Adoption of Digital Building Solutions in North America

North America is the dominant region in the global building management systems market holding more than 1/3rd of the market in 2022. The region has an emphasis on Internet of Things technology allows for seamless integration of various building systems and devices. Building management systems leverage IoT for collecting real-time data, which enables data-driven decisions for better building performance.

For instance, on 17 July 2023, Johnson Controls, a global leader in smart, sustainable buildings, acquired FM Systems, a prominent provider of digital workplace management and Internet of Things solutions for facilities and real estate professionals. The acquisition adds complementary cloud-based software capabilities to Johnson Controls' OpenBlue digital buildings software portfolio. The transaction involves a base purchase price of US$ 455 million, along with potential additional payments based on post-closing earnout milestones.

Competitive Landscape

The major global players in the market include: Siemens, ABB, Azbil Corporation, Delta Controls, Robert Bosch GmbH, Legrand, United Technologies, Johnson Controls, Honeywell International Inc. and Eagle Technology.

COVID-19 Impact Analysis

Many buildings experienced rapid shifts in occupancy due to lockdowns, remote work policies and social distancing measures. Building management systems had to quickly adapt to monitor and manage spaces with reduced occupancy, ensuring that systems such as lighting, HVAC and security were adjusted accordingly to save energy and maintain operational efficiency. Building management systems became crucial in implementing health and safety protocols within buildings.

Increase in remote work, facility managers needed the ability to monitor and control building systems remotely. Building management systems with cloud-based platforms and remote access capabilities became essential for maintaining building operations while minimizing physical presence. Many organizations faced financial challenges during the pandemic, leading to a focus on cost-saving measures.

Building management systems played a role in optimizing energy consumption, identifying inefficiencies and ensuring that energy-intensive systems were operating efficiently. As buildings were temporarily vacated or had reduced occupancy, it provided an opportunity for facility managers to undertake building management systems retrofitting, upgrades or maintenance activities that might have been challenging during normal operation.

AI Impact

AI-driven predictive maintenance analyzes data from sensors and equipment to predict when components are likely to fail and this proactive approach allows facility managers to perform maintenance tasks before breakdowns occur, reducing downtime and saving costs. AI algorithms can analyze historical energy usage patterns, occupancy data, weather forecasts and other variables to optimize heating, cooling, lighting and ventilation systems for maximum energy efficiency without compromising occupant comfort.

AI can provide real-time analysis of temperature, humidity, lighting and other environmental factors, adjusting systems to maintain optimal comfort levels for occupants. Personalized settings can be learned over time. AI algorithms can optimize building operations by dynamically adjusting HVAC, lighting and other systems based on occupancy patterns, weather forecasts and energy prices.

For instance, on 21 August 2023, CBRE, a global leader in real estate services, has introduced its smart facilities management solutions to enhance operational reliability and efficiency across more than 20,000 client sites managed by its Global Workplace Solutions division and these sites encompass a total area of 1 billion square feet. The Smart FM Solutions leverage CBRE's Nexus AI-based platform, utilizing a wealth of building operations and utilization data, to provide actionable insights that optimize FM workflows and outcomes.

Russia- Ukraine War Impact

The conflict may disrupt global supply chains, affecting the availability of components and equipment used in business management systems. Delays or shortages in the supply of critical hardware and technology could impact the installation, maintenance and upgrades of business management systems in buildings. The geopolitical tensions and economic sanctions associated with the conflict could lead to economic uncertainty and fluctuations in currency exchange rates.

The conflict could prompt a renewed focus on energy security and resilience in affected countries. building management systems may need to prioritize energy efficiency measures, optimize HVAC systems and manage energy consumption to ensure the availability of resources during potential supply disruptions. In areas where tensions are high, building security and occupant safety becomes even more critical.

By Software

- Security Management

- Facility Management

- Energy Management

- Infrastructure Management

- Emergency Management

By Service

- Professional Services

- Managed Services

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On 22 June 2023, BGES Group, a prominent BMS and energy management company in UK, has expanded its presence by launching BGES Midlands and this new hub in the Midlands region aims to better serve clients and capitalize on growing opportunities in the area.

- On 4 October 2022, Evotech Technical Services introduced their myBEMS system, a cutting-edge solution that employs AI technology to utilize data from building sensors for automated HVAC (heating, ventilation and air conditioning) systems in commercial buildings.

- On 12 April 2022, CPower Energy Management is introducing a Building Management Systems-as-a-Service (BMS- in New York City, aimed at enabling grid-interactive efficient buildings and this solution offers commercial property owners and managers an intelligent building management system at no upfront cost, helping them manage energy use, lower carbon emissions and provide demand flexibility to the grid.

Why Purchase the Report?

- To visualize the global building management systems market segmentation based on software, service, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of building management systems market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global building management systems market report would provide approximately 61 tables, 58 figures and 187 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Software

- 3.2. Snippet by Service

- 3.3. Snippet by Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rising Demand for Smart City Initiatives

- 4.1.1.2. Rising Collaborative Partnerships Between Companies

- 4.1.1.3. Advancement in Technology

- 4.1.2. Restraints

- 4.1.2.1. Retrofitting and Delay in Implementation

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Software

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 7.1.2. Market Attractiveness Index, By Software

- 7.2. Security Management*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Facility Management

- 7.4. Energy Management

- 7.5. Infrastructure Management

- 7.6. Emergency Management

8. By Service

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 8.1.2. Market Attractiveness Index, By Service

- 8.2. Professional Services*

- 8.3. Introduction

- 8.4. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.5. Managed Services

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Residential*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Commercial

- 9.4. Industrial

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Russia

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Siemens*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. ABB

- 12.3. Azbil Corporation

- 12.4. Delta Controls

- 12.5. Robert Bosch GmbH

- 12.6. Legrand

- 12.7. United Technologies

- 12.8. Johnson Controls

- 12.9. Honeywell International Inc.

- 12.10. Eagle Technology

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us