|

|

市場調査レポート

商品コード

1347952

統合ネットワーク管理の世界市場-2023年~2030年Global Unified Network Management Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 統合ネットワーク管理の世界市場-2023年~2030年 |

|

出版日: 2023年09月11日

発行: DataM Intelligence

ページ情報: 英文 204 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

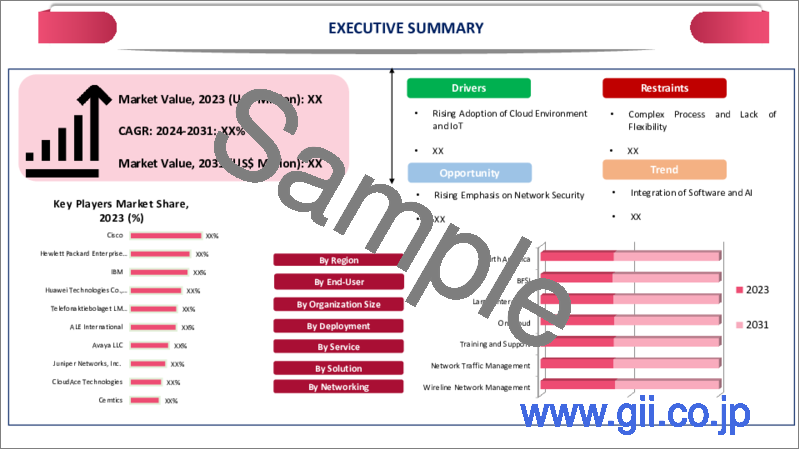

世界の統合ネットワーク管理市場は、2022年に85億米ドルに達し、2023年から2030年の予測期間中にCAGR 17.9%で成長し、2030年には214億米ドルに達すると予測されています。

現代のネットワークは、クラウドコンピューティング、仮想化、IoTデバイスなど様々な技術が統合された複雑な構造になっています。統合ネットワーク管理は、この複雑さを管理するための一元的なアプローチを提供し、円滑な運用を保証することでエラーのリスクを低減します。統合ツールは、監視、設定、トラブルシューティングに使用される単一のダッシュボードを提供することで、ネットワーク管理プロセスを合理化します。

統合ネットワーク管理は、ネットワーク・インフラストラクチャ全体の包括的なビューを提供するため、管理者は問題を迅速に特定することができ、プロアクティブなアプローチによりダウンタイムを最小限に抑え、より良いユーザー・エクスペリエンスを確保することができます。また、ネットワーク・トラフィックのモニタリングや潜在的な脅威の特定など、一元的なセキュリティ管理が可能になります。ESGの調査によると、回答者の半数にあたる47%がクラウドベースのネットワークに注目しています。

アジア太平洋地域は、世界の統合ネットワーク管理市場の1/3以上を占める成長地域のひとつであり、同地域の多くの組織は、業務の近代化を図るデジタルトランスフォーメーション・イニシアチブを進めています。この地域は国全体でクラウドベースのネットワークサービスを採用しており、統合ネットワーク管理はハイブリッド環境とマルチクラウド環境を管理しています。

ダイナミクス

複雑なネットワーク環境による市場促進

クラウドコンピューティング、IoT、SD-WANなど様々な技術の統合によりネットワークが複雑になるにつれ、統合管理ソリューションの必要性が高まっています。統合ネットワーク管理は、こうした多様な要素を効率的に管理するための一元的なアプローチを提供します。複雑なネットワークでは、ネットワーク・パフォーマンス、セキュリティ脅威、アプリケーションの使用状況を包括的に可視化することが極めて重要です。統合ネットワーク管理プラットフォームは、ネットワーク全体の可視性を維持するための高度なモニタリングとレポート機能を提供します。

例えば、2022年9月13日、リバーベッドはAlluvio IQと呼ばれるユニファイド・オブザーバビリティ・ソフトウェア・ポートフォリオの最初の製品を発表しました。このクラウドネイティブのSaaSサービスは、リモートやハイブリッドの作業環境を含む複雑なネットワークの自動化と可視性を強化するように設計されています。Microsoft Azure上で稼働するAlluvio IQは、リバーベッドのAlluvio Unified Observabilityプラットフォーム上に構築されており、AIと機械学習を用いてネットワークとアプリケーションのデータを統合することを目的としています。

ハイブリッド・マルチクラウド環境の台頭

企業は、より高いスケーラビリティと柔軟性を実現するために、ハイブリッドおよびマルチクラウド戦略を急速に採用しています。オンプレミス・インフラストラクチャ、プライベート・クラウド、パブリック・クラウド・サービスを組み合わせて活用することで、企業は変化するワークロードや需要により効果的に対応することができます。ハイブリッドおよびマルチクラウド戦略により、企業は全体的なコスト管理とリソース配分を最適化できます。

例えば、ヒューレット・パッカード・エンタープライズは2023年3月20日、大手ハイパースケール・クラウド・プロバイダーを含むハイブリッドおよびマルチクラウド環境のITインフラ、クラウドリソース、ワークロード、アプリケーションの監視、自動化、管理に特化したIT運用管理企業であるOpsRamp社の買収を発表しました。約390億米ドルと推定されるITOM市場が、今回の買収対象です。

IoTの急成長

産業オートメーション、スマートシティからヘルスケア、家電に至るまで、さまざまな業界で接続デバイスの数が継続的に急増しており、このようなデバイス展開の拡大により、効率的で一元化されたネットワーク管理ソリューションが必要とされています。IoTデバイスは膨大な量のデータを生成し、企業はこのデータを活用して洞察力を高め、情報に基づいた意思決定を行っています。統合ネットワーク管理により、企業は単一のプラットフォーム内で多様なソースからのデータを収集、分析、活用できるようになります。

例えば、2023年7月25日、先進的IoT接続プロバイダーであるソラコムは、NTNベースのNB-IoT接続とクラウドベースのIoTネットワーク管理を組み合わせて提供するため、地上波以外のネットワークサービス事業者であるSkylo Technologiesと戦略的パートナーシップを締結しました。

複雑なプロセスと柔軟性の欠如

統合ネットワーク管理ソリューションの導入は、特に大規模で多様なネットワーク環境では複雑なプロセスです。さまざまなネットワーク要素、プロトコル、テクノロジーを単一のプラットフォームに統合するには、前もってかなりの計画を立て、コンフィギュレーションとテストを行う必要があります。選択したソリューションによっては、組織は特定のベンダーのプラットフォームやツールに依存するようになり、これはベンダーロックインにつながり、柔軟性を制限し、将来的に異なるソリューションに切り替えることを困難にします。

既存のネットワーク・インフラ、ツール、システムが、統合ネットワーク管理ソリューションとシームレスに統合されません。組織は、新しいプラットフォームで動作するようにレガシーシステムを適応させるために時間とリソースを投資する必要があるかもしれません。統合ネットワーク管理ソリューションの中には、特定の組織のニーズやワークフローに対応する柔軟性に欠けるものもあります。組織は、ソリューションが提供するフレームワーク内に適合するように、プロセスを適応させる必要があるかもしれません。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 複雑なネットワーク環境による市場促進

- ハイブリッド・マルチクラウド環境の台頭

- IoTの急成長

- 抑制要因

- 複雑なプロセスと柔軟性の欠如

- 機会

- 影響分析

- 促進要因

第5章 業界分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 ネットワーク別

- 有線ネットワーク管理

- 無線ネットワーク管理

第8章 ソリューション別

- ネットワークトラフィック管理

- ネットワーク監視管理

- ネットワークセキュリティ管理

- ネットワークアプリケーション管理

- 設定・サーバー管理

- その他

第9章 サービス別

- 訓練・サポート

- コンサルティング

- マネージド/インテグレーションサービス

第10章 デプロイメント別

- オンクラウド

- オンプレミス

第11章 組織規模別

- 大企業

- 中小企業

第12章 エンドユーザー別

- BFSI

- ハイテク・通信

- 小売業・消費財

- 旅行・ホスピタリティ

- 医療

- その他

第13章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第14章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第15章 企業プロファイル

- Cisco

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- HP

- IBM

- Huawei

- Ericsson

- Alcatel-Lucent

- Avaya

- Juniper Networks

- CA Technologies

- EMC

第16章 付録

Overview

Global Unified Network Management Market reached US$ 8.5 billion in 2022 and is expected to reach US$ 21.4 billion by 2030, growing with a CAGR of 17.9% during the forecast period 2023-2030.

Modern networks have complex structures with the integration of various technologies like cloud computing, virtualizations and IoT devices. Unified network management offers a centralized approach for managing this complexity and ensures smooth operations which leads to reduce risk of errors. Unified tools streamline network management processes that providing single dashboards that are used for monitoring, configuration and troubleshooting.

Unified network management provides comprehensive views of the entire network infrastructure which enables administrators that identify the issues quickly and the proactive approach minimizes downtime and leads to ensuring better user experience. It allows for centralized security management that includes monitoring of network traffic and the network also identifies potential threats. According to the ESG survey half 47% of respondents focused on cloud-based networks.

Asia-Pacific is among the growing regions in the global unified network management market covering more than 1/3rd of the market and many organizations in the region are undergoing digital transformation initiatives that modernize their operations which leads to improves efficiency. The region adopts cloud-based network services across the country and unified network management manages hybrid and multi-cloud environments.

Dynamics

Complex Network Environments Boost the Market

As networks become more intricate due to the integration of various technologies like cloud computing, IoT and SD-WAN, the need for unified management solutions grows. Unified network management offers a centralized approach to managing these diverse elements efficiently. In complex networks, having comprehensive visibility into network performance, security threats and application usage is crucial. Unified network management platforms offer advanced monitoring and reporting capabilities to maintain visibility across the entire network.

For instance, on 13 September 2022, Riverbed introduced its first product in the Unified Observability software portfolio, called Alluvio IQ and this cloud-native SaaS service is designed to enhance automation and visibility in complex networks, including remote and hybrid work environments. Alluvio IQ, running on Microsoft Azure, is built on Riverbed's Alluvio Unified Observability platform and aims to bring together network and application data using AI and machine learning.

Rise of Hybrid and Multi-Cloud Environments

Organizations rapidly adopt hybrid and multi-cloud strategies to achieve greater scalability and flexibility. By leveraging a combination of on-premises infrastructure, private clouds and public cloud services businesses can adapt to changing workloads and demands more effectively. Hybrid and multi cloud strategies enables organizations that optimize overall cost management and resource allocations.

For instance, on 20 March 2023, Hewlett Packard Enterprise announced its acquire OpsRamp, an IT operations management company specializing in monitoring, automating and managing IT infrastructure, cloud resources, workloads and applications for hybrid and multi-cloud environments, including major hyperscale cloud providers. The ITOM market, estimated to be valued at around $39 billion, is the target for this acquisition

Rapid Growth of IoT

The number of connected devices continuously grows rapidly across various industries from industrial automation and smart cities to healthcare and consumer electronics and this growth in device deployment necessitates efficient and centralized network management solutions. IoT devices generate vast amounts of data and organizations are leveraging this data to gain insights and make informed decisions. Unified network management allows businesses to collect, analyze and act upon data from diverse sources within a single platform.

For instance, on 25 July 2023, Advanced IoT connectivity provider Soracom formed a strategic partnership with non-terrestrial network service operator Skylo Technologies to offer a combination of NTN-based NB-IoT connectivity and cloud-based IoT network management and this collaboration aims to provide highly available, affordable and deeply integrated IoT connectivity that roams between terrestrial and satellite networks.

Complex Process and Lack of Flexibility

Implementing a unified network management solution is a complex process, especially in large and diverse network environments. Integrating various network elements, protocols and technologies into a single platform requires significant upfront planning configuration and testing. Depending on the solution chosen organizations become dependent on a specific vendor's platform and tools and this can lead to vendor lock-in, limiting flexibility and making it challenging to switch to different solutions in the future

Existing network infrastructure, tools and systems do not seamlessly integrate with a unified network management solution. Organizations may need to invest time and resources in adapting their legacy systems to work with the new platform. Some unified network management solutions may lack the flexibility to cater to specific organizational needs and workflows. Organizations may need to adapt their processes to fit within the framework provided by the solution.

Segment Analysis

The global unified network management market is segmented based on networking, solution, service, deployment organization Size, end-user and region.

Adoption of Wireline Network Management Boosts the Market

The wireline network management segment is expected to be the major segment fueling the market growth with a share of about 1/3rd in 2022. Wireline network management provides deep visibility into the performance, health and status of wired network infrastructure. Unified network management solutions with integrated wireline management offer end-to-end monitoring capabilities and this ensures that network administrators can monitor data flows and traffic patterns.

For instance, on 11 August 2023, Verizon, a prominent telecommunications company in U.S., entered into a strategic partnership with HCL Technologies from India to revitalize its wireline business and enhance its network management capabilities for business customers and this collaboration aims to counter the decline in Verizon's wireline business revenue by utilizing cutting-edge technologies and expert services.

Geographical Penetration

Adoption of New Technologies in North America

North America is the largest region in the global unified network management market covering more than 1/3rd of the market. The region adopts new technologies like cloud computing, IoT and 5G and their network infrastructures become more complex. Unified network management solutions provide a centralized platform to monitor and manage diverse network components making it easier to handle complexity.

For instance, on 6 June 2023, Cisco introduced its vision for Cisco Networking Cloud, an integrated management platform experience for both on-premises and cloud operating models and this initiative aims to simplify IT for customers and partners by providing a unified platform to access and manage all Cisco networking products. Cisco Networking Cloud will leverage cloud-driven automation, rich network insights and its partner ecosystem to accelerate the delivery of unified experiences.

Competitive Landscape

The major global players in the market include: Advanced Data Systems, Cerner, Core Solutions, AdvancedMD, Kareo, Netsmart, Nextgen Healthcare, The Echo Group, Mediware and Allscripts.

COVID-19 Impact Analysis

The pandemic led to a massive shift toward remote work as organizations adopted work-from-home arrangements to ensure employee safety and this sudden change in work dynamics increased the demand for secure and reliable remote access to corporate networks, requiring unified network management solutions to accommodate and manage remote connections effectively.

The rapid transition to remote work created security challenges, including the need to secure home networks and personal devices. Unified network management solutions had to enhance security measures to protect sensitive corporate data and prevent unauthorized access from various locations. The shift from centralized office networks to distributed home networks changed network traffic patterns. Unified network management systems had to adapt to monitor and manage the new network landscape, ensuring consistent performance and security.

The pandemic altered IT priorities, with a greater focus on ensuring business continuity, remote support and secure network access. Unified network management solutions are needed to align with these priorities and provide features that addressed these concerns. IT teams needed the capability to manage and troubleshoot network issues remotely. Unified network management tools evolved to include remote management features that enabled administrators to diagnose and resolve problems without physical access.

AI Impact

AI-powered network management systems can automate routine tasks such as network configuration, provisioning and performance monitoring and these technologies frees up IT staff from manual and repetitive activities, allowing them to focus on more strategic tasks. AI can analyze historical network data and patterns to predict potential issues before they escalate into major problems and this proactive approach helps prevent network downtime and ensures smoother operations.

AI can optimize network performance by dynamically adjusting configurations based on real-time data and this ensures that network resources are allocated efficiently, leading to improved user experiences. AI algorithms can forecast future network traffic and capacity requirements based on historical data and trends, this helps IT teams plan for network expansion or upgrades.

For instance, on 9 August 2023, Syxsense, a prominent player in Unified Security and Endpoint Management solutions, introduced Cortex Copilot, a robust AI engine designed to simplify and expedite the creation of endpoint management and security workflow automation and this innovation leverages the power of generative artificial intelligence to enable IT and security administrators to automate task generation and scripting using natural language queries.

Russia- Ukraine War Impact

Geopolitical tensions lead to an increase in cyber threats and attacks, including state-sponsored hacking activities. As organizations become more vigilant about potential cyber threats originating from conflict zones, unified network management solutions may need to incorporate enhanced cybersecurity measures to safeguard network infrastructure and data. During times of conflict, there is a surge in communication and data traffic seeking to gather information more collaboratively.

As the situation evolves organizations might need to adapt to remote work arrangements, especially in areas directly affected by the conflict. Unified network management solutions would need to support remote access, collaboration tools and secure connectivity to enable uninterrupted business operations. The conflict may prompt organizations to reassess their reliance on technology vendors and suppliers from the affected regions and this could lead to a greater emphasis on diversifying supply chains.

By Networking

- Wireline Network Management

- Wireless Network Management

By Solution

- Network Traffic Management

- Network Monitoring Management

- Network Security Management

- Network Application Management

- Configuration and Server Management

- Others

By Service

- Training and Support

- Consulting

- Managed and Integration Service

By Deployment

- On-Cloud

- On-Premises

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By End-User

- BFSI

- High-Tech and Telecom

- Retail and Consumer Goods

- Travel and Hospitality

- Healthcare

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On 26 June 2023, CommScope introduced three new RUCKUS Networks solutions aimed at enhancing the deployment, management and operation of purpose-driven networks for enterprises and service providers. The AI-driven RUCKUS One cloud native platform offers network assurance, service delivery and business intelligence in a unified dashboard, simplifying network management across multi-access public and private networks.

- On 15 March 2023, Check Point Software Technologies launched Infinity Global Services, a comprehensive security solution aimed at bolstering cybersecurity practices and controls for organizations of all sizes. The service covers a wide range of security areas, offering end-to-end security services to enhance cyber resilience.

- On 22 May 2023, Power Grid Corporation of India Ltd has been tasked with developing a unified network management system for the Southern Region of India and this system will enable centralized supervision of interstate transmission systems and intrastate communication systems at the state and regional levels.

Why Purchase the Report?

- To visualize the global unified network management market segmentation based on networking, solution, service, deployment organization size, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of unified network management market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global unified network management market report would provide approximately 86 tables, 90 figures and 204 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Networking

- 3.2. Snippet by Solution

- 3.3. Snippet by Service

- 3.4. Snippet by Deployment

- 3.5. Snippet by Organization Size

- 3.6. Snippet by End-User

- 3.7. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Complex Network Environments Boost the Market

- 4.1.1.2. Rise of Hybrid and Multi-Cloud Environments

- 4.1.1.3. Rapid Growth of IoT

- 4.1.2. Restraints

- 4.1.2.1. Complex Process and Lack of Flexibility

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Networking

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Networking

- 7.1.2. Market Attractiveness Index, By Networking

- 7.2. Wireline Network Management*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Wireless Network Management

8. By Solution

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 8.1.2. Market Attractiveness Index, By Solution

- 8.2. Network Traffic Management*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Network Monitoring Management

- 8.4. Network Security Management

- 8.5. Network Application Management

- 8.6. Configuration and Server Management

- 8.7. Others

9. By Service

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 9.1.2. Market Attractiveness Index, By Service

- 9.2. Training and Support*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Consulting

- 9.4. Managed and Integration Service

10. By Deployment

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

- 10.1.2. Market Attractiveness Index, By Deployment

- 10.2. On-Cloud*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. On-Premises

11. By Organization Size

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Organization Size

- 11.1.2. Market Attractiveness Index, By Organization Size

- 11.2. Large Enterprises*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Small and Medium Enterprises

12. By End-User

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.1.2. Market Attractiveness Index, By End-User

- 12.2. BFSI*

- 12.2.1. Introduction

- 12.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 12.3. High-Tech and Telecom

- 12.4. Retail and Consumer Goods

- 12.5. Travel and Hospitality

- 12.6. Healthcare

- 12.7. Others

13. By Region

- 13.1. Introduction

- 13.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 13.1.2. Market Attractiveness Index, By Region

- 13.2. North America

- 13.2.1. Introduction

- 13.2.2. Key Region-Specific Dynamics

- 13.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Networking

- 13.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 13.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 13.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

- 13.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Organization Size

- 13.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.2.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.2.9.1. U.S.

- 13.2.9.2. Canada

- 13.2.9.3. Mexico

- 13.3. Europe

- 13.3.1. Introduction

- 13.3.2. Key Region-Specific Dynamics

- 13.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Networking

- 13.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 13.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 13.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

- 13.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Organization Size

- 13.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.3.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.3.9.1. Germany

- 13.3.9.2. UK

- 13.3.9.3. France

- 13.3.9.4. Italy

- 13.3.9.5. Russia

- 13.3.9.6. Rest of Europe

- 13.4. South America

- 13.4.1. Introduction

- 13.4.2. Key Region-Specific Dynamics

- 13.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Networking

- 13.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 13.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 13.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

- 13.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Organization Size

- 13.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.4.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.4.9.1. Brazil

- 13.4.9.2. Argentina

- 13.4.9.3. Rest of South America

- 13.5. Asia-Pacific

- 13.5.1. Introduction

- 13.5.2. Key Region-Specific Dynamics

- 13.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Networking

- 13.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 13.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 13.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

- 13.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Organization Size

- 13.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.5.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.5.9.1. China

- 13.5.9.2. India

- 13.5.9.3. Japan

- 13.5.9.4. Australia

- 13.5.9.5. Rest of Asia-Pacific

- 13.6. Middle East and Africa

- 13.6.1. Introduction

- 13.6.2. Key Region-Specific Dynamics

- 13.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Networking

- 13.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 13.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 13.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

- 13.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Organization Size

- 13.6.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

14. Competitive Landscape

- 14.1. Competitive Scenario

- 14.2. Market Positioning/Share Analysis

- 14.3. Mergers and Acquisitions Analysis

15. Company Profiles

- 15.1. Cisco*

- 15.1.1. Company Overview

- 15.1.2. Product Portfolio and Description

- 15.1.3. Financial Overview

- 15.1.4. Key Developments

- 15.2. HP

- 15.3. IBM

- 15.4. Huawei

- 15.5. Ericsson

- 15.6. Alcatel-Lucent

- 15.7. Avaya

- 15.8. Juniper Networks

- 15.9. CA Technologies

- 15.10. EMC

LIST NOT EXHAUSTIVE

16. Appendix

- 16.1. About Us and Services

- 16.2. Contact Us