|

|

市場調査レポート

商品コード

1345453

PSMA PETイメージングの世界市場-2023年~2030年Global PSMA PET Imaging Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| PSMA PETイメージングの世界市場-2023年~2030年 |

|

出版日: 2023年09月06日

発行: DataM Intelligence

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

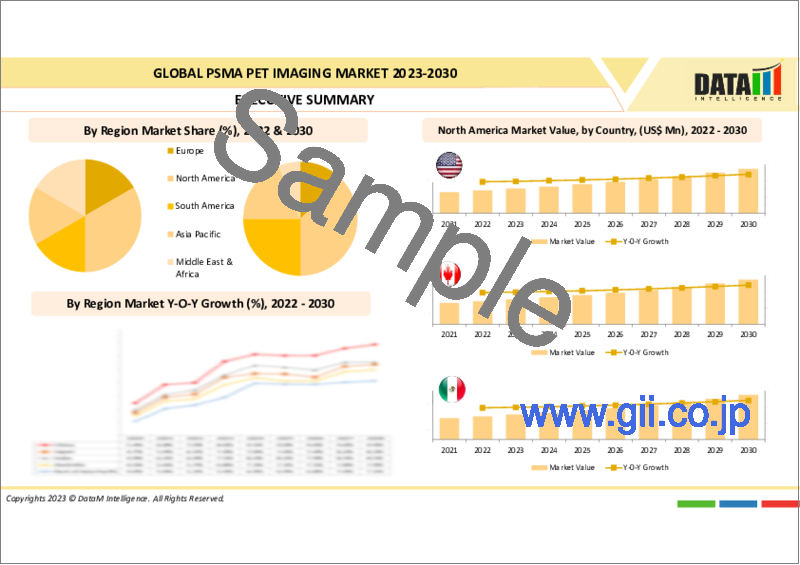

世界のPSMA PETイメージング市場は、2022年に15億米ドルに達し、2023-2030年の予測期間中にCAGR 3%で成長し、2030年には20億米ドルに達すると予測されています。

世界のPSMA PETイメージング市場は、前立腺がん検出のための採用の増加、臨床試験の増加など、そのダイナミクスに影響を与える様々な要因によって、今後数年間で大きな成長が見込まれています。PSMA PETの開発に対する政府の投資は、世界市場を引き続き牽引し、押し上げるでしょう。世界のPSMA PETイメージング市場は、その影響を軽減することにますます重点を置いています。

PSMA(前立腺特異的膜抗原)PET(陽電子放射断層撮影)イメージング技術は、男性の前立腺がんを検出するために使用される、発展途上の技術です。前立腺がんは、世界で4番目に多く診断されるがんとされています。FDA認可のPSMA PETイメージング技術には、ガリウム-68(Ga-68)PSMA PETイメージングとフッ素-18(F-18)PSMA PETイメージングの2つがあります。同様に、北米は白斑治療市場を独占しており、同地域の有利な償還政策、先進医療インフラ、大手企業の存在により、最大の市場シェアを獲得しています。

前立腺がんの有病率の増加、認知度の向上と早期診断、臨床試験の増加、非侵襲的診断技術に対する需要の増加、早期診断のためのPSMA PETイメージングの採用増加、PSMA PETイメージング技術の進歩が、予測期間中に世界のPSMA PETイメージング市場を牽引すると期待される主な要因です。

ダイナミクス

臨床試験の増加が市場の成長を促進すると予測される

臨床試験の増加は、予測期間における市場の成長を促進すると予想されます。臨床試験は、安全性と有効性について患者の信頼を高めます。臨床試験で良好な結果が得られれば、画像診断技術に対する投資家の信頼と患者の信用が高まります。このような信頼性の向上は、さらなる研究開発や臨床試験の実施に必要な資金を呼び込み、企業がより革新的な技術に投資することを可能にし、市場を牽引します。

さらに、臨床試験は、さまざまな臨床シナリオにおけるPSMA PETイメージングの有効性を実証するために不可欠なプラットフォームとなります。この検証は、規制当局の承認と受け入れを得るために極めて重要です。臨床試験では、PSMA PETイメージングの新たな用途や適応が探索されます。このような用途の拡大は、市場を大きく牽引する可能性があります。臨床試験で良好な結果が得られれば、PSMA PETイメージングが臨床ガイドラインや標準治療に組み込まれ、日常臨床での採用が増加する可能性があります。

例えば、2023年6月14日、クラリティ・ファーマシューティカルズとシーメンス・ヘルティニアーズ社のPETNETソリューションズ社は、世界の陽電子放射断層撮影(PET)放射性医薬品ネットワークであり、米国におけるPETイメージング用放射性医薬品の主要メーカーであることから、前立腺がんイメージング用の次世代診断用放射性医薬品であるクラリティの64Cu SAR-bisPSMAを対象としたマスターサービス契約および臨床供給契約を締結しました。64Cu SAR-bisPSMAは、米国で2023年末までに重要な第III相臨床試験に入ることが期待されている治験用PET薬剤であり、2024年には2回目の第III相臨床試験に入る可能性もあります。

FDA承認の増加も市場の成長を促進する見込み

FDA承認の増加も、予測期間中の市場成長を促進すると予想されます。PSMA PETイメージング技術に対する規制当局の承認の増加は、患者やヘルスケアプロバイダーが利用できる選択肢を改善します。この画像診断拡大の選択肢は、前立腺がんのより良い画像診断に対する個人のニーズを満たすため、市場成長を高めることができます。また、FDA承認などの規制当局の承認は、承認された画像診断技術に対する患者の信頼を高めます。

さらに、FDA承認のPSMA PET製品や放射性医薬品は、より信頼性が高いと認識されることが多く、患者からの信頼が向上するため、ヘルスケアプロバイダーや医療機関での採用が増加します。FDAの承認により、PSMA PET検査の保険償還に関する保険業者や政府医療機関との話し合いが容易になり、患者にとってPSMA PET検査がより利用しやすくなります。

例えば、2023年5月30日、米国食品医薬品局(FDA)は、最適化された高親和性ラジオハイブリッド前立腺特異的膜抗原(PSMA)標的陽電子放出断層撮影(PET)イメージング薬剤Flotufolastat fluorine-18(Posluma)を承認しました。Flotufolastat F-18は、転移が疑われる前立腺がん患者で、初回確定療法の候補となる患者、または血清前立腺特異抗原(PSA)値の上昇により再発が疑われる患者におけるPSMA陽性病変のPETイメージングに適応されます。本薬は、独自のラジオハイブリッド技術により開発された、FDAが承認した最初で唯一のPSMA標的イメージング薬剤です。

PSMA PETイメージングの厳しい価格設定が市場成長の妨げになる見込み

PSMA PETイメージングの厳しい価格設定は、予測期間における市場成長の妨げになると予想されます。PSMA PET放射性医薬品およびイメージング装置の開発・製造には、より専門的な施設や厳格な品質管理が必要となるため、コストが高くなる可能性があります。こうした厳しいコストはエンドユーザーに転嫁される可能性があり、価格上昇の一因となっています。

さらに、地域によっては、償還政策がPSMA PETイメージングの費用を十分にカバーしない場合があり、患者にとって利用しにくくなり、市場の成長が制限される可能性があります。厳しいコストは多くの前立腺がん患者にとって手の届かないものであり、市場成長の妨げになると予想されます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 臨床試験の増加

- FDA承認の増加

- 抑制要因

- PSMA PETイメージングに対する厳しい価格設定

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ紛争分析

- DMI意見

第6章 COVID-19分析

第7章 技術別

- ガリウム-68(Ga-68)PSMA PETイメージング

- フッ素-18(F-18)PSMA PETイメージング

第8章 エンドユーザー別

- 病院

- 専門クリニック

- 画像診断センター

- 研究・学術センター

- その他

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第10章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第11章 企業プロファイル

- Novartis Pharmaceuticals Corporation

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- Lantheus company

- RadioMedix

- Clarity Pharmaceuticals

- Blue Earth Diagnostics, Inc.

- Siemens Medical Solutions USA, Inc.

- Eckert & Ziegler

- Telix Pharmaceuticals

- Canon Medical Systems, USA

- Jubilant Draximage Radiopharmacies, Inc.

第12章 付録

Overview

Global PSMA PET Imaging Market reached US$ 1.5 billion in 2022 and is expected to reach US$ 2.0 billion by 2030, growing with a CAGR of 3% during the forecast period 2023-2030.

The global PSMA PET imaging market is expected to experience significant growth in upcoming years, with various factors influencing its dynamics such as increasing adoption for prostate cancer detection, rising clinical trials, and others. Government investments in the development of PSMA PET will continue to drive and boost the global market. The global PSMA PET imaging market is placing increasing emphasis on reducing its impact.

The prostate-specific membrane antigen (PSMA) positron emission tomography (PET) imaging technique is an evolving technique, which is used to detect prostate cancer in men. Prostate cancer is considered the fourth most commonly diagnosed cancer in the world. There are two FDA-approved PSMA PET imaging technologies, such as Gallium-68 (Ga-68) PSMA PET imaging, and Fluorine-18 (F-18) PSMA PET imaging. Similarly, North America dominates the vitiligo treatment market, capturing the largest market share owing to the region's favorable reimbursement policies, advanced healthcare infrastructure, and presence of major players.

Owing to the increasing prevalence of prostate cancer, growing awareness and early diagnosis, rising clinical trials, increasing demand for non-invasive diagnostic techniques, increasing adoption of PSMA PET imaging for early diagnosis, and advancements in PSMA PET imaging techniques are the major factors expected to drive the global PSMA PET imaging market over the forecast period.

Dynamics

Increasing Clinical Trials is Expected to Drive the Growth of the Market

The increasing number of clinical trials is expected to drive the growth of the market over the forecast period. Clinical trials build trust in patients about safety and efficacy. The positive results from clinical trials can boost investor confidence and patient trust in the imaging technique. This increased confidence can attract funding for further research and development and conduct more clinical trials, allowing companies to invest in more innovative technologies and driving the market.

Further, clinical trials can provide an essential platform for demonstrating the efficacy of PSMA PET imaging in various clinical scenarios. This validation is crucial for gaining regulatory approvals and acceptance. Clinical trials explore new applications and indications for PSMA PET imaging. This expansion of applications can significantly drive the market. Positive outcomes in clinical trials can lead to the incorporation of PSMA PET imaging into clinical guidelines and standard of care, increasing its adoption in routine clinical practice.

For instance, on June 14, 2023, Clarity Pharmaceuticals, and PETNET Solutions Inc, a Siemens Healthineers Company, a global positron emission tomography (PET) radiopharmaceutical network and the leading manufacturer of radiopharmaceuticals for PET imaging in the US have entered into a Master Service Agreement and a Clinical Supply Agreement covering Clarity's 64Cu SAR-bisPSMA, a next-generation diagnostic radiopharmaceutical product for prostate cancer imaging. 64Cu SAR-bisPSMA is an investigational PET agent anticipated to be entering a pivotal Phase III trial in the US before the end of 2023 and, potentially, a second Phase III trial in 2024.

Rising FDA Approvals is Also Expected to Drive the Growth of the Market

The rising FDA approvals are also expected to drive the growth of the market over the forecast period. The increasing regulatory approvals for PSMA PET imaging techniques improve the options available to patients and healthcare providers. This diagnostic imaging expansion choice can increase the market growth as it meets the needs of individuals for better imaging of prostate cancer. The regulatory approvals such as FDA approvals also increase the patient's trust about the approved diagnostic imaging technologies.

Additionally, FDA-approved PSMA PET products and radiopharmaceuticals are often perceived as more credible and improve trust in patients, leading to increased adoption among healthcare providers and institutions. FDA approvals can facilitate discussions with insurance providers and government health agencies regarding reimbursement for PSMA PET procedures, making it more accessible to patients.

For instance, On May 30, 2023, the U.S. Food and Drug Administration (FDA) approved the optimized, high-affinity radiohybrid prostate-specific membrane antigen (PSMA)-targeted positron-emission tomography (PET) imaging agent flotufolastat fluorine-18 (Posluma). Flotufolastat F-18 is indicated for PET imaging of PSMA-positive lesions in patients with prostate cancer with suspected metastasis who are candidates for initial definitive therapy or with suspected recurrence based on elevated serum prostate-specific antigen (PSA) level. It is the first and only FDA-approved, PSMA-targeted imaging agent developed with proprietary radiohybrid technology.

Stringent Pricing of the PSMA PET Imaging is Expected to Hamper the Market Growth

The stringent pricing of PSMA PET imaging is expected to hamper the growth of the market over the forecast period. Developing and manufacturing PSMA PET radiopharmaceuticals and imaging equipment can be more expensive due to the need for more specialized facilities and rigorous quality control. These stringent costs may be passed on to end-users, contributing to higher prices.

Moreover, in some regions, reimbursement policies may not adequately cover the costs of PSMA PET imaging, making it less accessible to patients and potentially limiting market growth. The stringent cost may be unaffordable for many prostate cancer patients which is expected to hamper the market growth.

Segment Analysis

The global PSMA PET imaging market is segmented based on technology, end-user, and region.

The Gallium-68 (Ga-68) PSMA PET Imaging Segment Accounted for Approximately 45.6% of the PSMA PET Imaging Market Share

The Gallium-68 (Ga-68) PSMA PET Imaging Segment is expected to hold the largest market share over the forecast period. Ga-68 PSMA PET imaging is highly sensitive in detecting small lesions and metastases, even at low prostate-specific antigen levels, making it useful for early diagnosis and staging. It also provides precise information about the extent and location of prostate cancer, aiding in accurate staging, re-staging, and treatment planning by minimizing unnecessary interventions.

For instance, on October 13, 2022, Telix Pharmaceuticals Limited announced that Health Canada has approved Illuccix [kit for the preparation of gallium (68Ga) gozetotide injection] for use in staging and re-staging intermediate and high-risk prostate cancer and localizing tumor tissue in recurrent prostate cancer. Illuccix after radiolabeling with gallium (68Ga), is indicated for use with the positron emission tomography (PET) of prostate-specific membrane antigen (PSMA) positive lesions in men with prostate cancer. It helps in risk stratification, guiding treatment decisions, and minimizing unnecessary interventions.

Furthermore, Ga-68 PSMA PET imaging usually offers a non-invasive technique and can be used to monitor the response to prostate cancer treatments such as surgery, radiation therapy, and chemotherapy. Ga-68 PSMA PET can be used in theranostics, where the same PSMA-targeted molecule can be labeled with different isotopes for both imaging (diagnosis) and therapy.

For instance, on March 23, 2022, Novartis announced that the FDA approved Locametz (kit for the preparation of gallium Ga 68 gozetotide injection). Locametz (gallium Ga 68 gozetotide), a diagnostic kit for radiopharmaceutical injectable preparation is indicated for positron emission tomography (PET) of PSMA-positive lesions in adult patients with prostate cancer with suspected metastasis who are candidates for initial definitive therapy with suspected recurrence based on elevated serum prostate-specific antigen level and for selection of patients with metastatic prostate cancer, for whom lutetium Lu 177 vipivotide tetraxetan PSMA-directed therapy is indicated.

Geographical Penetration

North America Accounted for Approximately 39.4% of the Market Share in 2022, Owing to the Strong Presence of Major Players and Well-Established Healthcare Infrastructure

North America region is expected to hold the largest market share over the forecast period owing to the strong presence of major players and well-established healthcare infrastructure. The region is well known for its advanced and well-established healthcare infrastructure including hospitals, diagnostic imaging centers, specialty clinics, research and academic centers, and others. The presence of well-established healthcare infrastructure helps to provide better insurance coverage for prostate cancer patients for advanced diagnosis with PSMA PET imaging.

Moreover, North America is a home for many pharmaceutical and medical device companies, which are actively involved in performing clinical trials and research activities by favorable investments. These major players in the region collaborating and expanding the diagnostic techniques for PSMA PET.

For instance, on November 14, 2022, Lantheus Holdings, Inc. and POINT Biopharma Global Inc. announced a strategic collaboration and license agreements that leverage the complementary strengths of both companies in radiopharmaceutical oncology and look to enhance the potential impact that these compelling therapeutic candidates could provide to patients. This collaboration expands Lantheus's radiopharmaceutical portfolio with two late-stage therapeutic candidates PNT2002, a PSMA-targeted 177Lu-based therapy for metastatic castration-resistant prostate cancer (mCRPC).

Competitive Landscape

The major global players in the PSMA PET imaging market include: Novartis Pharmaceuticals Corporation, Lantheus company, RadioMedix, Clarity Pharmaceuticals, Blue Earth Diagnostics, Inc., Siemens Medical Solutions USA, Inc., Eckert & Ziegler, Telix Pharmaceuticals, Canon Medical Systems, USA, and Jubilant Draximage Radiopharmacies, Inc., among others.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic in late 2019 created unprecedented challenges for pharmaceutical and medical device industries worldwide, including the global PSMA PET imaging market. During the pandemic, many clinical trials, research activities, and regulatory approvals have been temporarily postponed due to the redirected focus on the COVID-19 pandemic and its related restrictions.

The onset of the pandemic in early 2020 led to widespread lockdowns and restrictions, impacting regular diagnostic imaging, appointments, and consultations for prostate cancer patients worldwide. Many hospitals are focused on COVID-19 cases, which reduces the diagnostic imaging for prostate cancer patients.

Moreover, the COVID-19 pandemic severely disrupted global supply chains, impacting the transportation of raw materials and medical devices. Movement restrictions and border closures delayed shipments and caused imaging delays in prostate cancer patients. Additionally, some countries faced shortages of PSMA PET related raw materials for diagniosis due to disruptions in their supply chain networks.

Russia-Ukraine Conflict Analysis

The Russia-Ukraine conflict is estimated to have a moderate impact on the global PSMA PET imaging market. Many clinical trials and research activities are temporarily disrupted. The conflict has less impact mainly due to the absence of key market players in this region.

By Technology

- Gallium-68 (Ga-68) PSMA PET Imaging

- Fluorine-18 (F-18) PSMA PET Imaging

By End-User

- Hospitals

- Specialty Clinics

- Diagnostic Imaging Centers

- Research and Academic Centers

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On May 30, 2023, Blue Earth Diagnostics announced that the U.S. FDA has approved a new positron emission tomography imaging agent for prostate cancer. Brand-named Posluma is indicated for PET scans of prostate-specific membrane antigen (PSMA)-positive lesions in men with the disease. The imaging agent is targeted toward individuals with metastasized prostate cancer who are either candidates for therapy or have a suspected recurrence based on elevated PSA levels.

- On February 24, 2022- Palette Life Sciences, a global medical device company dedicated to improving prostate radiation therapy outcomes, announced the signing of an Agreement with Lantheus Holdings, Inc. to support the promotion of PYLARIFY (piflufolastat F 18) in the United States. PYLARIFY injection is a fluorinated small molecule PSMA-targeted PET imaging agent that enables visualization of lymph nodes, bone, and soft tissue metastases to determine the presence of recurrent and/or metastatic prostate cancer.

- On May 27, 2021, the FDA approved Pylarify (piflufolastat F 18) a drug for positron emission tomography (PET) imaging of prostate-specific membrane antigen (PSMA) positive lesions in men with prostate cancer. With the approval of Pylarify, certain men with prostate cancer will have greater access to PSMA-targeted PET imaging that can aid healthcare providers in assessing prostate cancer.

Why Purchase the Report?

- To visualize the global PSMA PET imaging market segmentation based on technology, end-user and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of PSMA PET imaging market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global PSMA PET imaging market report would provide approximately 61 tables, 58 figures, and 186 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Technology

- 3.2. Snippet by End-User

- 3.3. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Clinical Trials

- 4.1.1.2. Rising FDA Approvals

- 4.1.2. Restraints

- 4.1.2.1. Stringent Pricing for the PSMA PET imaging

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine Conflict Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Technology

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 7.1.2. Market Attractiveness Index, By Technology

- 7.2. Gallium-68 (Ga-68) PSMA PET Imaging *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Fluorine-18 (F-18) PSMA PET Imaging

8. By End-User

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 8.1.2. Market Attractiveness Index, By End-User

- 8.2. Hospitals *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Specialty Clinics

- 8.4. Diagnostic Imaging Centers

- 8.5. Research and Academic Centers

- 8.6. Others

9. By Region

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 9.1.2. Market Attractiveness Index, By Region

- 9.2. North America

- 9.2.1. Introduction

- 9.2.2. Key Region-Specific Dynamics

- 9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1. U.S.

- 9.2.5.2. Canada

- 9.2.5.3. Mexico

- 9.3. Europe

- 9.3.1. Introduction

- 9.3.2. Key Region-Specific Dynamics

- 9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1. Germany

- 9.3.5.2. UK

- 9.3.5.3. France

- 9.3.5.4. Italy

- 9.3.5.5. Spain

- 9.3.5.6. Rest of Europe

- 9.4. South America

- 9.4.1. Introduction

- 9.4.2. Key Region-Specific Dynamics

- 9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1. Brazil

- 9.4.5.2. Argentina

- 9.4.5.3. Rest of South America

- 9.5. Asia-Pacific

- 9.5.1. Introduction

- 9.5.2. Key Region-Specific Dynamics

- 9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1. China

- 9.5.5.2. India

- 9.5.5.3. Japan

- 9.5.5.4. Australia

- 9.5.5.5. Rest of Asia-Pacific

- 9.6. Middle East and Africa

- 9.6.1. Introduction

- 9.6.2. Key Region-Specific Dynamics

- 9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10. Competitive Landscape

- 10.1. Competitive Scenario

- 10.2. Market Positioning/Share Analysis

- 10.3. Mergers and Acquisitions Analysis

11. Company Profiles

- 11.1. Novartis Pharmaceuticals Corporation *

- 11.1.1. Company Overview

- 11.1.2. Product Portfolio and Description

- 11.1.3. Financial Overview

- 11.1.4. Key Developments

- 11.2. Lantheus company

- 11.3. RadioMedix

- 11.4. Clarity Pharmaceuticals

- 11.5. Blue Earth Diagnostics, Inc.

- 11.6. Siemens Medical Solutions USA, Inc.

- 11.7. Eckert & Ziegler

- 11.8. Telix Pharmaceuticals

- 11.9. Canon Medical Systems, USA

- 11.10. Jubilant Draximage Radiopharmacies, Inc.

LIST NOT EXHAUSTIVE

12. Appendix

- 12.1. About Us and Services

- 12.2. Contact Us