|

|

市場調査レポート

商品コード

1336748

不溶性硫黄の世界市場-2023年~2030年Global Insoluble Sulfur Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 不溶性硫黄の世界市場-2023年~2030年 |

|

出版日: 2023年08月22日

発行: DataM Intelligence

ページ情報: 英文 181 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

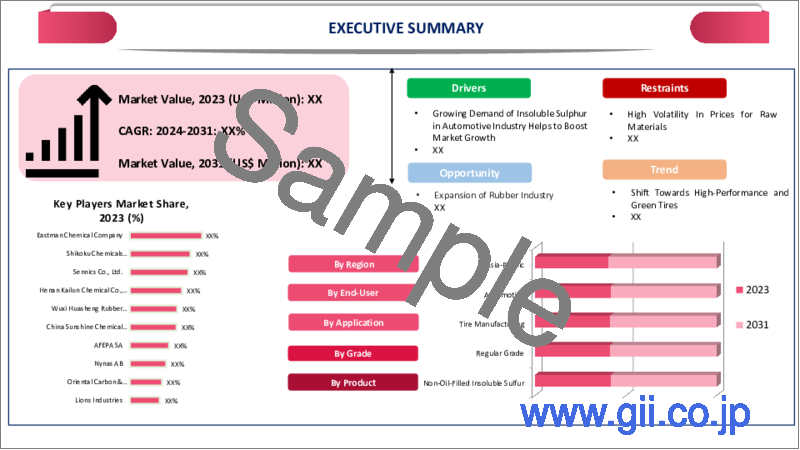

世界の不溶性硫黄市場は、2022年に9億9,500万米ドルに達し、2023年から2030年にかけてCAGR 3.5%で成長し、2030年には13億390万米ドルに達すると予測されています。

ゴム産業の拡大、タイヤの性能と安全性への注目の高まり、ゴム配合技術の開発、持続可能で環境に優しいソリューションへの動きはすべて、不溶性硫黄の必要性に寄与しています。不溶性硫黄は、高品質なゴム製品へのニーズが世界的に高まり続ける中、自動車、製造、インフラ開発など、さまざまな分野の需要を満たす上で重要な役割を果たしています。

高安定性グレードは市場の3分の2以上のシェアを占めており、高安定性製品グレードは、高い熱安定性を反映するなど、高分散グレードと共通の特徴を有しています。しかし、この形態は機能性を向上させるために他の添加剤と組み合わされることが多いです。例えば、製品の熱安定性は、エステル、フェノール、カルボン酸を含む無灰安定剤を添加することによって改善されます。

市場力学

ゴム・タイヤ産業からの需要拡大

タイヤ製造には不溶性硫黄が多量に使用されます。世界中で走行する自動車の数が増加しているため、簡単でメンテナンスの少ないタイヤ交換の必要性が高まっています。熾烈な市場競争において優位に立つため、世界中のタイヤメーカーは、より低燃費のタイヤを提供するよう、当局や顧客から大きな圧力を受けています。また、技術的な障害にも直面しています。

さらに、不溶性硫黄はゴムの成形に最適な化学物質でもあります。また、ラテックス、ゴム・タイヤ、ゴム・パイプ、ゴム・シューズ、ケーブル、電線など、ゴム化学の生産に一般的に利用されています。不溶性硫黄の世界市場は、各種のゴム産業用途における不溶性ゴムの需要増加により、急成長が見込まれています。

例えば、2018年2月、Eastman Chemical Companyは、ラジアルタイヤの特性を向上させるためにゴム配合に使用されるノンブルーミング加硫剤CrystexCure Proを発表しました。さらに、特殊アスファルトとナフテン系オイルのメーカーであるNynasは、Nytexの名前で商品ラインを発表しました。これらの製品は様々な粘度で市販されており、硫黄と同様に強靭なゴムとの使用に適しています。

新製品の革新と研究開発努力の増加

製品の革新は、不溶性硫黄市場で人気を集め続けている重要な動きです。市場での地位を向上させるため、不溶性硫黄市場の大手企業は新商品の創出に注力しています。例えば、ウズベキスタンのNTCSグループは2021年3月、ゴム加硫用のポリマー不溶性硫黄の生産を開始しました。粒状硫黄の硫黄濃度は97~98%です。

イーストマン・ケミカル・カンパニーのタイヤ添加剤部門は2021年11月、米国の非公開会社ワンロック・キャピタル・パートナーズLLCに非公開の金額で買収されました。ワンロックは、イーストマン・ケミカル・カンパニーの買収を通じて、企業子会社から強力な独立企業への効率的な移行に必要な戦略的・運営的リソースを提供できることを歓迎しています。フレクシスは、同社が使用する予定の名称です。

不溶性硫黄業界の厳しい規則と規制

不溶性硫黄業界では、製造工程における危険な化学物質の使用に対する懸念の高まりから、厳しい規則や規制が導入されています。原料として使用される特定の化学物質は、硫黄、二硫化炭素、炭化水素油など、こうした規制や規則の対象となっています。さらに、タイヤのようなゴム製品について定められた法律やガイドラインも、制限として重要な役割を果たしています。

原材料、化学物質、工業方法、技術の使用は、環境衛生問題を減らすために重要であるにもかかわらず、これらの厳しい規則や規制によって制限されることになります。その結果、生産者は必要な措置を取らざるを得なくなり、生産コストや必要な資本が増加する可能性があります。これは、製品のコストを引き上げることによって、不溶性市場に影響を与えると思われます。

エネルギー消費量の増加、原料としての化石燃料の使用、大気中や水中へのCO2排出、廃棄物、合成ゴムの製造と使用は、環境に悪影響を及ぼします。これらの化合物は生分解が難しいため、廃水が水中に投入されると、海の酸素供給能力が低下し、海洋生物を死に至らしめる毒素の濃度が高まる可能性があります。

COVID-19の影響分析

COVID-19の流行は不溶性硫黄市場に相反する影響を与えました。世界の操業停止とサプライチェーンの混乱により、当初はゴム製品、特にタイヤの需要が減少しました。不溶性硫黄の主要ユーザーである自動車業界や建設業界は低迷しました。しかし、景気が上向き始め、規制が緩和され始めると、市場は需要を回復しました。

市場の回復を後押ししたのは、信頼性の高い輸送手段への需要、インフラ・プロジェクトへの関心の高まり、環境に優しいゴムコンパウンドへの関心の高まりでした。メーカー各社は、安全対策を施し、遠隔操作にデジタル技術を活用することで、新たな常態に適応しました。パンデミックはまた、環境に優しいタイヤ製造における不溶性硫黄の需要増加という持続可能性を浮き彫りにしました。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 業界分析影響要因

- 促進要因

- タイヤ製造業界からの製品需要の増加

- ゴム・タイヤ産業からの需要増加

- 抑制要因

- 原材料価格の高騰

- 不溶性硫黄業界の厳しい規則と規制

- 機会

- 世界の路上走行車の増加

- 新製品の革新と研究開発 (R&D) 努力の増加

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 製品別

- 非油充填不溶性硫黄

- 油充填不溶性硫黄

第8章 グレード別

- レギュラーグレード

- 高安定性グレード

- 特殊グレード

- 高分散グレード

第9章 用途別

- タイヤ製造

- フットウェア

- 産業用途

- ケーブル・ワイヤー

- パイプ

- その他

第10章 エンドユーザー別

- 自動車

- 医療

- 消費財

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Eastman Chemical Compan

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- Shikoku Chemicals Corporation

- Sinorgchem Co., Ltd.

- Henan Kailun Chemical Co., Ltd

- Wuxi Huasheng Rubber Technical Co., Ltd

- China Sunshine Chemical Co. Ltd.

- Sennics Co

- Nynas AB

- Oriental Carbon & Chemicals Limited

- Lions Industries

第14章 付録

Market Overview

Global Insoluble Sulfur Market reached US$ 995.0 million in 2022 and is expected to reach US$ 1,303.9 million by 2030, growing with a CAGR of 3.5% during the forecast period 2023-2030.

The expansion of the rubber industry, the growing focus on tire performance and safety, technical developments in rubber compounding and the move towards sustainable and environmentally friendly solutions all contribute to the need for insoluble sulfur. Insoluble sulfur plays a critical role in satisfying the demands of different sectors, including automotive, manufacturing and infrastructure development, as the need for high-quality rubber goods continues to grow globally.

The high stability grade segment holds more than 2/3rd share in the market and the high stability product grade shares traits with the high dispersion grade, including a reflection of high thermal stability. However, this form is frequently combined with other additives to improve their functionality. For example, the product's thermal stability is improved by adding ashless stabilizing agents including esters, phenols and carboxylic acid.

Market Dynamics

Growing Demand from the Rubber and Tires Industry

Tire manufacturing includes extensive usage of insoluble sulfur. The increasing number of automobiles on the road throughout the world has increased the need for simple and low-maintenance tire replacements. In order to obtain a competitive edge in the fiercely competitive market, tire producers throughout the world are under great pressure from authorities and customers to provide more fuel-efficient tires. They are also confronted with technological obstacles.

Additionally, it is a perfect molding chemical for rubber. Additionally, it is commonly utilized in the production of rubber chemistry, which includes latex, rubber tires, rubber pipes, rubber shoes, cables and wires. The global market for insoluble sulfur is anticipated to grow quickly due to the rise in demand for insoluble rubber in a variety of rubber industry applications.

For instance, in February 2018, Eastman Chemical Company unveiled CrystexCure Pro, a non-blooming vulcanizing agent used in rubber formulation to improve the properties of radial tires. Additionally, Nynas, a producer of specialty bitumen and naphthenic oil, unveiled a line of goods under the Nytex name. These products are offered commercially in a variety of viscosities and are well suited for use with tough forms of rubber as well as sulfur.

Innovation in New Products and an Increase in R&D Efforts

Product innovation is an important development that continues to gain popularity in the market for insoluble sulfur. To improve their market position, the major players in the insoluble sulfur market are concentrating on creating new goods. For instance, in March 2021, the Uzbek company NTCS Group began producing polymer-insoluble sulfur for rubber vulcanization that was of higher quality than its counterparts. Granulated sulfur has a sulfur concentration of 97-98%.

The tire additives division of Eastman Chemical Company was acquired by One Rock Capital Partners, LLC, a US-based private equity firm, for an undisclosed sum in November 2021. One Rock is delighted to be available to provide the strategic and operational resources necessary for an efficient transition from a corporate subsidiary to a powerful, independent corporation through the acquisition of Eastman Chemical Company. Flexsys is the name that the company is expected to utilize.

Strict Rules and Regulations of the Insoluble Sulfur Industry

Strict rules and regulations have been introduced to the insoluble sulfur industry as a result of growing concern about the usage of dangerous chemicals in its manufacturing process. Specific chemicals used as raw materials are covered by these regulations and rules, such as sulfur, carbon disulfide and hydrocarbon oil. Additionally, the laws and guidelines established for rubber goods like tires also play a significant role as limitations.

The use of raw materials, chemicals, industrial methods and technology will be restricted by these strict rules and regulations, even though they are crucial for reducing environmental health issues. As a result, producers will be compelled to take the necessary actions, which may increase production costs and the amount of capital needed. This will have an impact on the insoluble market by raising the cost of its products.

The increase in energy consumption, the use of fossil fuels as raw materials, CO2 emissions into the air and water and waste products and the manufacture and use of synthetic rubber have a detrimental effect on the environment. Due to the difficulty of these compounds in biodegrading, when wastewater is thrown into the water, it can reduce the ocean's capacity for oxygen and increase the concentration of toxins that can kill marine creatures.

COVID-19 Impact Analysis

The COVID-19 epidemic had a conflicting effect on the insoluble sulfur market. The demand for rubber goods, particularly tires, initially decreased as a result of the worldwide lockdowns and supply chain disruptions. Major users of insoluble sulfur, the automobile and construction industries, saw a downturn. However, when economies began to improve and regulations began to loosen, the market saw a recovery in demand.

The market's recovery was aided by the demand for dependable transportation, increasing attention on infrastructure projects and rising interest in environmentally friendly rubber compounds. By giving safety precautions and using digital technology for remote operations, manufacturers adapted to the new normal. The pandemic also highlighted sustainability in the increased demand for insoluble sulfur in environmentally friendly tire manufacture.

Segment Analysis

The global insoluble sulfur market is segmented based on product, grade, application, end-user and region.

Rising Demand for a Steady Power Supply in the Industrial Industry

The tire manufacturing segment holds more than 56.7% share of the global insoluble sulfur market. The production of vehicles directly influences the demand for tires and, subsequently, insoluble sulfur. The automotive industry's growth, driven by factors such as population growth, economic development and rising consumer demand for vehicles, leads to increased tire production. This drives the demand for insoluble sulfur as a key additive in tire manufacturing.

Additionally, the demand for insoluble sulfur is influenced by technological developments in the tire manufacturing sector. Tyre manufacturers spend in research & development to create cutting-edge tire technology as they work to fulfill performance, durability and sustainability standards. Due to its critical role as a vulcanizing agent in the creation of high-performance tires with improved characteristics, insoluble sulfur is used more frequently.

Geographical Analysis

North America Growing Demand for Insoluble Sulfur in Automotive Industry

The demand for insoluble sulfur in North America is mostly driven by the automotive industry. Major automakers are based in the area and there is a considerable demand for tires and rubber goods. Insoluble sulfur is increasingly needed as a critical component in tire production and rubber compounding as the automotive industry expands.

Some of the major vehicle manufacturers in the world are based in North America. In the area, businesses with sizable presences include General Motors, Ford and Fiat Chrysler Automobiles. Due to the volume of cars these producers generate, there is a strong need for tires and rubber components.

U.S. rubber imports from China, Germany, Thailand and Japan have increased rapidly in North America, giving the country a boost in the rubber business. This is a result of the nation's tire manufacturing industry using a lot of rubber. Additionally, the U.S. is the market leader for commercial vehicles, big trucks and buses, which frequently employ high-performance tires. In the region of North America, this is anticipated to lead to higher product consumption.

Competitive Landscape

The major global players include: Eastman Chemical Company, Shikoku Chemicals Corporation, Sinorgchem Co., Ltd., Henan Kailun Chemical Co., Ltd, Wuxi Huasheng Rubber Technical Co., Ltd, China Sunshine Chemical Co. Ltd., Sennics Co, Nynas AB, Oriental Carbon & Chemicals Limited and Lions Industries.

Why Purchase the Report?

- To visualize the global insoluble sulfur market segmentation based on product, grade, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of insoluble sulfur market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global insoluble sulfur market report would provide approximately 72 tables, 71 figures and 181 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product

- 3.2. Snippet by Grade

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Industry Analysis Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Product Demand from the Tire Manufacturing Industries

- 4.1.1.2. Growing Demand from the Rubber and Tires Industry

- 4.1.2. Restraints

- 4.1.2.1. High Volatility In Prices for Raw Materials

- 4.1.2.2. Strict Rules and Regulations of the Insoluble Sulfur Industry

- 4.1.3. Opportunity

- 4.1.3.1. Increasing Number of On-Road Vehicles Across the Globe

- 4.1.3.2. Innovation in New Products and an Increase in R&D Efforts

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2. Market Attractiveness Index, By Product

- 7.2. Non-Oil-Filled Insoluble Sulfur*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Oil-Filled Insoluble Sulfur

8. By Grade

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 8.1.2. Market Attractiveness Index, By Grade

- 8.2. Regular Grade*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. High Stability Grade

- 8.4. Special Grade

- 8.5. High Dispersion Grade

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Tire Manufacturing*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Footwear

- 9.4. Industrial Application

- 9.5. Cable and Wire

- 9.6. Pipes

- 9.7. Others

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Automotive*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Medical

- 10.4. Consumer Goods

- 10.5. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Eastman Chemical Compan*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Shikoku Chemicals Corporation

- 13.3. Sinorgchem Co., Ltd.

- 13.4. Henan Kailun Chemical Co., Ltd

- 13.5. Wuxi Huasheng Rubber Technical Co., Ltd

- 13.6. China Sunshine Chemical Co. Ltd.

- 13.7. Sennics Co

- 13.8. Nynas AB

- 13.9. Oriental Carbon & Chemicals Limited

- 13.10. Lions Industries

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us