|

|

市場調査レポート

商品コード

1336660

合成紙の世界市場-2023年~2030年Global Synthetic Paper Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 合成紙の世界市場-2023年~2030年 |

|

出版日: 2023年08月22日

発行: DataM Intelligence

ページ情報: 英文 181 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

世界の合成紙市場は、2022年に7億6,600万米ドルに達し、2023-2030年の予測期間中にCAGR 9.1%で成長し、2030年には13億8,944万米ドルに達すると予測されています。

世界の合成紙市場は、その環境に優しい性質、多目的な用途、技術進歩に後押しされて上昇基調にあります。コストやリサイクルインフラといった課題への対処が必要ではありますが、市場の潜在力は依然として高く、製紙業界にとってより環境に優しく持続可能な未来への道を開いています。

合成紙市場の主要製品セグメントは高密度ポリエチレンで、市場シェア全体の50%近くを占めています。同時に、アジア太平洋地域が市場シェアの3分の1以上を占め、圧倒的な存在感を示しています。新興国では急速な工業化と都市化が進んでおり、包装、ラベリング、その他の分野で合成紙の需要増加が見込まれています。

市場力学

持続可能性と環境に優しい実践

近年、持続可能性と環境保全への世界の注目が合成紙の需要に大きな影響を与えています。消費者や企業の環境意識が高まるにつれ、環境に優しい素材への需要が急増しています。合成紙はリサイクル可能であるため、全体的な環境フットプリントを削減することができ、この要件に適合しています。

さらに、木材パルプのような伝統的な紙資源に依存しないため、森林の保護や森林破壊の減少にも役立ちます。国連環境計画(UNEP)の2020年以降のデータによると、合成紙の消費量は、その環境に優しい特性により、毎年平均8%増加しています。

政府の取り組みと規制

世界各国の政府は、合成紙を含む環境に優しい素材の使用を促進するためのイニシアチブをとっています。プラスチック廃棄物を削減し、持続可能な代替品を促進するため、多くの国が包装やラベル用途において従来のプラスチックよりも合成紙の採用を推奨する規制を実施しています。

例えば、2019年に導入された欧州連合の単一使用プラスチック指令は、単一使用包装に合成紙のような生分解性で堆肥化可能な材料の使用を奨励しています。同様に、様々な国が小売業や外食産業における使い捨てプラスチックに規制を課しており、合成紙メーカーに大きなビジネスチャンスをもたらしています。

高い製造コストと認識・受容の欠如

合成紙の製造には複雑な工程と特殊な原材料の使用が伴うため、従来の紙の製造に比べてコストが高くなります。製造コストは大きな抑制要因であり、エンドユーザーの価格上昇を招き、特に価格に敏感な業界では市場浸透を制限しています。

合成紙の人気は高まっているもの、その利点や用途に関する消費者や企業の認知度は依然として低いです。多くのエンドユーザーは、親しみやすさや新しい技術を採用することへのためらいから、依然として従来の紙を好んでいます。このような認識と受容の不足が、市場の成長可能性を妨げています。

COVID-19の影響分析

COVID-19の大流行は世界の合成紙市場に大きな影響を与え、サプライチェーンを混乱させ、需要を変動させ、消費者行動を変化させました。しかし、業界は回復力と適応力を発揮し、eコマース、持続可能な包装、製薬分野での新たな機会を活用しました。

合成紙市場の回復には、技術の進歩や革新とともに政府の支援が貢献しました。世界がパンデミック(世界的大流行)によってもたらされた課題を克服し続ける中、合成紙業界は、パンデミック後の時代において持続可能で耐久性のある包装ソリューションに対する消費者の嗜好の進化に対応し、成長の態勢を維持しています。

目次

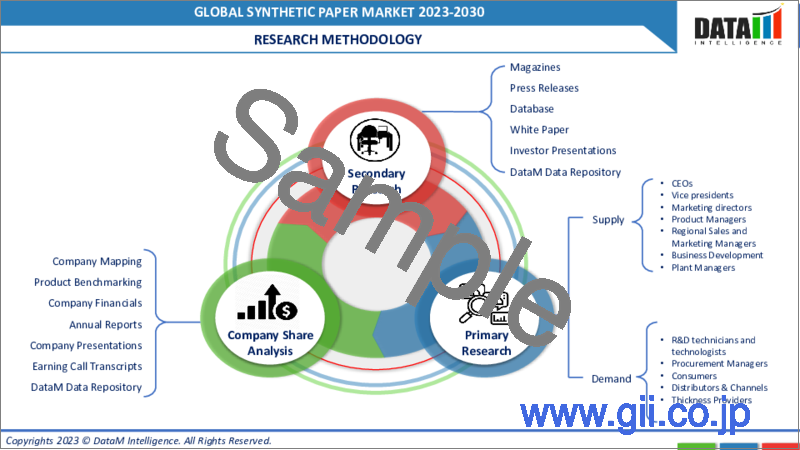

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 持続可能性と環境に優しい実践

- 政府の取り組みと規制

- 合成紙の多用途性と様々な産業への幅広い応用

- 合成紙の製造技術の進歩

- 抑制要因

- 環境持続性への関心の高まり

- 製造コストの高さ、認識と受容の欠如

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 製品別

- 高密度ポリエチレン(HDPE)

- 二軸延伸ポリプロピレン(BOPP)

- その他

第8章 製造プロセス別

- 繊維合成紙

- フィルム合成紙

- フィルムラミネート合成紙

第9章 用途別

- ラベル

- ラベル以外

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Arjobex SAS

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- Yupo Corporation

- PPG Industries

- Taghleef Industries Group

- Transcendia

- American Profol Inc

- Afga-Gevaert Group

- Seiko Epson Corporation

- Nan Ya Plastics Corporation

- Relyco Sales, Inc

第13章 付録

Market Overview

Global Synthetic Paper Market reached US$ 766.0 million in 2022 and is expected to reach US$ 1,389.44 million by 2030, growing with a CAGR of 9.1% during the forecast period 2023-2030.

The global synthetic paper market is on an upward trajectory, fueled by its eco-friendly nature, versatile applications, and advancements in technology. While challenges such as costs and recycling infrastructure need to be addressed, the market's potential remains strong, paving the way for a greener and more sustainable future for the paper industry.

The leading product segment in the synthetic paper market is high-density polyethylene, commanding nearly 50% of the total market share. Concurrently, Asia-Pacific emerges as the dominant player, capturing more than one-third of the market share. As emerging economies witness rapid industrialization and urbanization, the demand for synthetic paper is expected to rise in packaging, labeling, and other sectors.

Market Dynamics

Sustainability and Eco-Friendly Practices

In recent years, the global focus on sustainability and environmental conservation has significantly impacted the demand for synthetic paper. As consumers and businesses become more environmentally conscious, the demand for eco-friendly materials has surged. The synthetic paper fits this requirement as it is recyclable, reducing the overall environmental footprint.

Additionally, it does not rely on traditional paper sources like wood pulp, which helps conserve forests and reduces deforestation. According to data from the United Nations Environment Programme (UNEP) after 2020, the consumption of synthetic paper has increased by an average of 8% annually, driven by its eco-friendly properties.

Government Initiatives and Regulations

Governments across the globe have taken initiatives to promote the use of eco-friendly materials, including synthetic paper. In an effort to reduce plastic waste and promote sustainable alternatives, many countries have implemented regulations favoring the adoption of synthetic paper over conventional plastics in packaging and labeling applications.

For instance, the European Union's Single-Use Plastics Directive, introduced in 2019, has encouraged the use of biodegradable and compostable materials like synthetic paper in single-use packaging. Similarly, various countries have imposed restrictions on single-use plastics in retail and foodservice industries, creating significant opportunities for synthetic paper manufacturers

High Cost of Production and Lack of Awareness and Acceptance

The production of synthetic paper involves complex processes and the use of specialized raw materials, making it more expensive compared to conventional paper production. The cost of production is a significant restraint, leading to higher prices for end-users and limiting market penetration, especially in price-sensitive industries.

Despite the growing popularity of synthetic paper, there remains a lack of awareness among consumers and businesses about its benefits and applications. Many end-users continue to prefer traditional paper due to familiarity and hesitancy to adopt newer technologies. This lack of awareness and acceptance hampers the market's growth potential.

COVID-19 Impact Analysis

The COVID-19 pandemic had a profound impact on the global synthetic paper market, disrupting supply chains, fluctuating demand, and altering consumer behavior. However, the industry displayed resilience and adaptability, capitalizing on emerging opportunities in e-commerce, sustainable packaging, and the pharmaceutical sector.

Government support, along with technological advancements and innovations, contributed to the recovery of the synthetic paper market. As the world continues to navigate the challenges posed by the pandemic, the synthetic paper industry remains poised for growth, catering to evolving consumer preferences for sustainable and durable packaging solutions in a post-pandemic era.

Segment Analysis

The global synthetic paper market is segmented based on product, manufacturing process, application and region.

Exceptional Printability and Durability

High-density polyethylene is a thermoplastic polymer derived from petroleum and is widely used across various industries due to its exceptional strength, chemical resistance, and low water absorption properties. In the synthetic paper industry, HDPE has emerged as the preferred raw material for its exceptional printability and durability, making it an ideal alternative to conventional paper and other synthetic substrates.

The packaging and labeling industry has been a major driver of the global synthetic paper market. HDPE-based synthetic paper's exceptional durability, water resistance, and printability have found extensive applications in packaging materials, labels, and tags. This trend is anticipated to grow further as e-commerce and retail industries continue to expand.

Geographical Analysis

Growing Environmental Consciousness

Growing environmental consciousness has played a pivotal role in the adoption of synthetic paper in the Asia-Pacific. Countries in the region have witnessed alarming levels of plastic waste, leading to stringent regulations on single-use plastics. As a result, the demand for recyclable and eco-friendly alternatives like synthetic paper has soared.

Data from the United Nations Environment Programme (UNEP) reveals that after 2020, the Asia-Pacific region experienced an annual growth rate of over 25% in the consumption of synthetic paper. Numerous countries in the region have introduced incentives and subsidies to promote the production and utilization of synthetic paper, fostering a conducive business environment.

Competitive Landscape

The major global players in the market include: Arjobex SAS, Yupo Corporation, PPG Industries, Taghleef Industries Group, Transcendia, American Profol Inc, Afga-Gevaert Group, Seiko Epson Corporation, Nan Ya Plastics Corporation and Relyco Sales, Inc.

Why Purchase the Report?

- To visualize the global synthetic paper market segmentation based on product, manufacturing process, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of synthetic paper market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global synthetic paper market report would provide approximately 64 tables, 56 figures and 181 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product

- 3.2. Snippet by Manufacturing Process

- 3.3. Snippet by Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Sustainability and Eco-Friendly Practices

- 4.1.1.2. Government Initiatives and Regulations

- 4.1.1.3. Versatility of Synthetic Paper and Its Extensive Application Across Various Industries

- 4.1.1.4. Advancements in Synthetic Paper Manufacturing Technologies

- 4.1.2. Restraints

- 4.1.2.1. Growing Concern for Environmental Sustainability

- 4.1.2.2. High Cost of Production and Lack of Awareness and Acceptance

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2. Market Attractiveness Index, By Product

- 7.2. High-density polyethylene (HDPE)*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Biaxially Oriented Polypropylene (BOPP)

- 7.4. Others

8. By Manufacturing Process

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 8.1.2. Market Attractiveness Index, By Manufacturing Process

- 8.2. Fiber Synthetic Paper*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Film Synthetic Paper

- 8.4. Film-Laminate Synthetic Paper

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Labels*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Non-Labels

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Russia

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Arjobex SAS*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Yupo Corporation

- 12.3. PPG Industries

- 12.4. Taghleef Industries Group

- 12.5. Transcendia

- 12.6. American Profol Inc

- 12.7. Afga-Gevaert Group

- 12.8. Seiko Epson Corporation

- 12.9. Nan Ya Plastics Corporation

- 12.10. Relyco Sales, Inc

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us