|

|

市場調査レポート

商品コード

1325387

鍛造ビレットの世界市場-2023年~2030年Global Forging Billets Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 鍛造ビレットの世界市場-2023年~2030年 |

|

出版日: 2023年08月04日

発行: DataM Intelligence

ページ情報: 英文 207 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

鍛造ビレットの世界市場は、2022年に16億米ドルに達し、2023-2030年の予測期間にCAGR 9.2%で成長し、2030年には21億米ドルに達すると予測されています。鋼は鍛造ビレットに最も一般的に使用される金属であり、アルミニウム、チタン、ニッケル合金のような他の金属も採用されています。原材料、特に鋼の入手可能性とコストは、世界の鍛造ビレット市場において重要な要因です。

アルミニウムは、予測期間中、世界の鍛造ビレット市場の1/4以下を占めると予想されます。アルミニウムビレットは、その耐食性品質と長寿命、車両衝突時の柔軟な固有強度により、クラッチレバー、エンジンマウント、ルーフコンソールなどの様々な部品を製造するために自動車産業で採用されています。また、体積エネルギー密度が高いことから、スペースシャトルの固体ロケットブースターモーターの主推進剤の製造にも利用されています。

市場力学

発電と再生可能エネルギーへの投資の増加

エネルギー、インフラ、発電などへの投資の増加が、市場拡大の原動力となっています。米国上院は2021年に1兆米ドルに相当する大規模インフラ計画を制定しました。これによると、政府は道路、橋、電気自動車(EV)ネットワーク、公共交通機関、高速インターネット、安全な飲料水などに大規模な投資を行っています。

再生可能エネルギー発電への投資の増加は、予測期間中の需要を押し上げると予想されます。例えば、米国上院は2021年9月に5,500億米ドルのクリーンエネルギー投資法案を成立させました。この法案には、クリーンエネルギー発電のための730億米ドルの条項が含まれています。

技術の進歩とエネルギー効率の向上

他の製造方法と比較すると、鍛造ビレットは機械的品質が高いです。鍛造部品は、その卓越した強度、靭性、構造的完全性により、信頼性の高い高性能部品を必要とする産業で非常に求められています。コンピューター支援設計(CAD)、シミュレーション・ソフトウェア、自動化された鍛造工程などの鍛造技術の進歩は、すべて世界の鍛造ビレット市場の成長に貢献しています。

これらの改良は製造の生産性を高め、コストを節約し、鍛造部品の品質を向上させる。他の金属成形手順と比較すると、鍛造は非常にエネルギー効率の高い製造工程です。鍛造は、その低エネルギー使用と最小限の材料廃棄により、環境的に効率的なソリューションです。多くの産業でエネルギー効率と持続可能性が重視されるようになったことで、鍛造部品の需要が高まり、その結果、鍛造ビレットの需要も高まっています。

環境規制と技術の進歩

環境規制と持続可能性に関する懸念は、鍛造ビレット市場の成長を妨げます。景気後退や減速は規制に影響を及ぼし、鍛造ビレットの需要を減少させる可能性があります。厳しい排出、廃棄物管理、資源消費に関する法律を遵守することは、操業コストを上昇させ、環境保護対策へのさらなる投資を必要とする可能性があります。

鍛造産業は常に進化しており、技術開発は機会にも制約にもなり得る。競争力を維持するために、企業は設備の更新や先進的な鍛造技術の導入に費用をかけなければならないです。しかし、企業によっては、新技術の導入にかかる費用と複雑さが成長の障壁となることもあります。

COVID-19影響分析

パンデミックの需給不均衡は、原材料、特に鉄鋼の価格変動をもたらしました。原材料の価格変動は鍛造ビレットの生産コストに影響を与えました。各国の規制が徐々に緩和され、経済活動が回復するにつれ、鍛造用鋼片の需要も回復に向かっています。鍛造用鋼片の主要ユーザーである自動車産業や建設産業は回復の兆しを見せています。

地域や業種によって回復の速度は異なります。COVID-19以降、深刻な問題に対応し、新たな作業方法を確立するため、鋼片・建設企業は、作業員、業務、供給網の保護を優先することが期待されます。例えば、除菌剤を提供すること、社会的距離を保つこと、会社の全従業員に予防接種を受けさせることなどは、すべて労働者の健康と安全を促進するのに役立ちます。

ロシア・ウクライナ紛争の影響

この紛争は、特に欧州を中心とした地域の鍛造ビレット市場に大きな影響を与える可能性があります。紛争地帯に近く、ウクライナやロシアとの経済的なつながりがあるため、その地域の鍛造ビレットの需要と供給の動向に影響を与える可能性があります。地政学的な懸念により、企業はサプライチェーンと調達戦略を見直す可能性があります。その結果、サプライヤーとの関係が調整され、鍛造ビレットの代替サプライヤーを探すことになるかもしれないです。

鉄鋼、鉄鉱石精鉱、鉄鉱石ペレット、石炭、商業用銑鉄、商業用HBI、DRIはすべて、ロシアとウクライナの主要サプライヤーです。中欧以外では、中東、北アフリカ、トルコ、米国が、特に銑鉄、DRI、HBIで影響を受けています。トルコ、イタリア、ブルガリア、英国の鉄鋼再圧延業者は、社内・独立を問わず、スラブやビレットを入手できない状況にあります。銑鉄価格は世界中で大幅に上昇している(SEブラジルFOBで920~950米ドル/トン)。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 航空宇宙産業からの需要増加

- 軽量・低燃費部品に対する需要と投資の増加

- 発電・再生可能エネルギー発電への投資の増加

- 技術進歩とエネルギー効率の向上

- 抑制要因

- 原材料価格の高騰と変動性

- 環境規制と技術の進歩

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

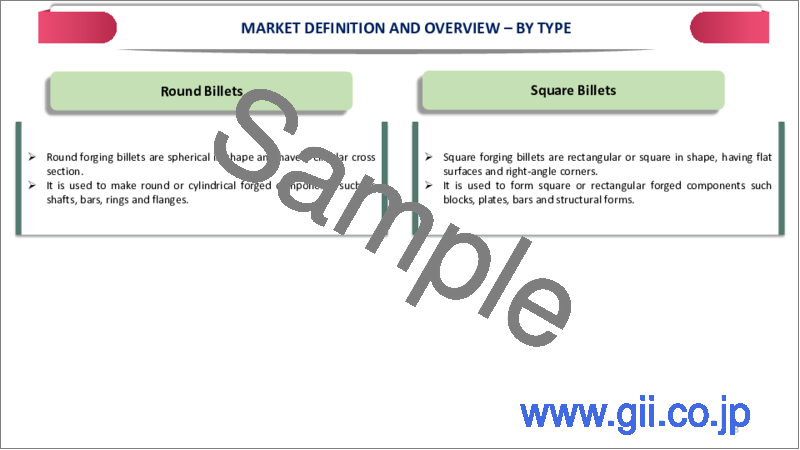

第7章 タイプ別

- 丸型ビレット

- 角型ビレット

第8章 製品別

- 軸

- フランジ

- ディスク

- 鍛造部品

- リング

- バルブ

- その他

第9章 材質別

- 炭素鋼

- 合金鋼

- ステンレス

- アルミニウム

- その他

第10章 プロセス別

- オープンダイ

- クローズドダイ

- その他

第11章 エンドユーザー別

- 自動車

- 航空宇宙

- 石油・ガス

- 発電

- 建設

- 鉄道

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- Alleima

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 最近の動向

- Ellwood City Forge

- UBE STEEL

- Deutsche Nickel

- Alcoa

- AMETEK

- Emirates Global Aluminium

- Hindalco

- Matalco

- Vista Metals

第15章 付録

Market Overview

Global Forging Billets Market reached US$ 1.6 billion in 2022 and is expected to reach US$ 2.1 illion by 2030, growing with a CAGR of 9.2% during the forecast period 2023-2030. Steel is the most commonly used metal for forging billets; other metals like aluminum, titanium and nickel alloys are also employed. The availability and cost of raw materials, particularly steel, are important factors in the global forging billets market.

Aluminum is expected to account for less than 1/4th of the global forging billets market during the forecast period. Aluminum billets are employed in the automobile industry to manufacture various parts such as clutch levers, engine mounts and roof consoles due to its corrosion-resistant qualities and longevity, as well as their flexible inherent strength during vehicle crashes. Owing to its high volumetric energy density, it is also utilized to make primary propellants for solid rocket booster motors in space shuttles.

Market Dynamics

Rising Investments in Power Generations and Renewble Energy

Rising investments in energy, infrastructure and power generation, among other things, are driving market expansion. U.S. Senate enacted a large infrastructure program worth US$ 1 trillion in 2021. According to this, the government is investing extensively in roads, bridges, Electric Vehicle (EV) networks, public transportation, high-speed internet and safe drinking water.

The rising investment in renewable energy and power generation is expected to boost the demand during the forecast period. For example, U.S. Senate enacted a US$ 550.00 billion clean energy investment bill in September 2021. The bill includes a US$ 73.00 billion provision for clean energy generation.

Growing Technological Advancements and Energy-efficiency

When compared to other manufacturing methods, forging billets have greater mechanical qualities. Forged components are extremely demanded in industries which need reliable and high-performance parts due to their remarkable strength, toughness and structural integrity. Forging technology advancements like as computer-aided design (CAD), simulation software and automated forging processes all contribute to the global forging billets market's growth.

The improvements increase manufacturing productivity, save costs and improve the quality of forged components. When compared to other metal shaping procedures, forging is a very energy-efficient manufacturing process. Forging is an environmentally efficient solution due to its low energy usage and minimal material waste. The increased emphasis on energy efficiency and sustainability in numerous industries promotes demand for forged components and, as a result, forging billets.

Environmental Regulations and Technological Advancements

Environmental regulations and concerns about sustainability hampers the growth of the forging billets market. Economic downturns or slowdowns can have an influence on regulations, reducing demand for forged billets. Compliance with stringent emissions, waste management and resource consumption laws can raise operational costs and necessitate further investments in environmental protection measures.

The forging industry is always evolving and technological developments can be both an opportunity and a constraint. To remain competitive, businesses must spend in upgrading their equipment and implementing advanced forging techniques. However, for some firms, the expense and complexity of deploying new technologies can act as barrier for the growth.

COVID-19 Impact Analysis

The pandemic's supply-demand imbalances produced price changes in raw goods, particularly steel. The price volatility of raw materials influenced the cost of production for forging billets. As countries gradually relaxed restrictions and restored economic activity, demand for forging billets began to recover. Automotive and construction industries, which are key users of forging billets, showed signs of recovery.

The rate of recovery differed between areas and industries. Billets and construction firms are expected to prioritize the protection of their workers, operations and supply networks in order to respond to serious issues and establish new methods of working following COVID-19. For example, providing sanitizers, keeping social distance and ensuring that every employee in the firm is vaccinated can all help to promote the health and safety of the workforce.

Russia- Ukraine War Impact

The dispute has the potential to have a greater influence on the regional forging billets market, notably in Europe. Proximity to the conflict zone, as well as economic linkages to Ukraine and Russia, can have an impact on the local demand and supply trends for forging billets in that region. Owing to the geopolitical concerns, companies may rethink their supply chains and sourcing strategy. It may result in supplier relationship adjustments and a hunt for alternative suppliers of forging billets.

Steel, iron ore concentrates, iron ore pellets, coal, merchant pig iron, merchant HBI and DRI are all major suppliers from Russia and Ukraine. Aside from Central Europe, the Middle East, North Africa, Turkey and U.S. are all affected, particularly for pig iron, DRI and HBI. Steel re-rollers in Turkey, Italy, Bulgaria and UK, both in-house and independent, are unable to obtain slabs and billets. Pig iron prices have risen significantly over the world (920-950 US$/ton FOB SE Brazil).

Segment Analysis

The global forging billets market is segmented based on type, product, material, process, end-user and region.

The Rising Penetration of EVs Drives the Automotive Segment

Automotive end-user is expected to hold about 1/4th of the global forging billets market during the forecast period 2023-2030. Automotive parts produced through forging are stronger than those produced by casting or machining. However, increased EV adoption is expected to have a negative influence on product demand because it reduces the quantity of forged components utilized in comparison to the internal combustion engine.

Several manufacturers are focusing on employing more than 40% aluminum in the building of light trucks and autos. Aluminum engine mounts, running boards, tailgate frames and roof consoles are less resistant to corrosion and last longer in the case of a vehicle collision. Aluminum's use in the vehicle industry greatly cuts CO2 emissions, driving the segment's growth.

Geographical Analysis

The Growing Demand in Aerospace and Defense Industry in North America

North America is anticipated to have a significant growth holding around 1/4th of the global forging billets market during the forecast period 2023-2030. North America has a strong presence of aerospace and defense industry, with significant manufacturers and suppliers based there. Owing to their high strength and reliability requirements, forged components, particularly those manufactured from billets, are frequently employed in aerospace and defense applications.

The aerospace sector's demand adds to North America forging billets market. The region's countries are investing in renewable energy, which is likely to drive product demand. For example, the Canadian government announced in April 2022 its intention to invest US$ 230.1 million in a clean energy project in rural and isolated locations.

Competitive Landscape

The major global players include Alleima, Ellwood City Forge, UBE STEEL, Deutsche Nickel, Alcoa, AMETEK, Emirates Global Aluminium, Hindalco, Matalco and Vista Metals.

Why Purchase the Report?

- To visualize the global forging billets market segmentation based on type, product, material, process, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of forging billets market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global forging billets market report would provide approximately 77 tables, 86 figures and 207 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Product

- 3.3. Snippet by Material

- 3.4. Snippet by Process

- 3.5. Snippet by End-User

- 3.6. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rising Demand from Aerospace Industry

- 4.1.1.2. Rising Demand & Investments for Lightweight and Fuel-efficient Components

- 4.1.1.3. Rising Investments in Power Generations and Renewable Energy

- 4.1.1.4. Growing Technological Advancements and Energy-efficiency

- 4.1.2. Restraints

- 4.1.2.1. High Costs and Volatility in Raw Material Prices

- 4.1.2.2. Environmental Regulations and Technological Advancements

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Round Billets*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Square Billets

8. By Product

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 8.1.2. Market Attractiveness Index, By Product

- 8.2. Axes*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Flanges

- 8.4. Discs

- 8.5. Forged Parts

- 8.6. Rings

- 8.7. Valves

- 8.8. Others

9. By Material

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 9.1.2. Market Attractiveness Index, By Material

- 9.2. Carbon Steel*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Alloy Steel

- 9.4. Stainless Steel

- 9.5. Aluminum

- 9.6. Others

10. By Process

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 10.1.2. Market Attractiveness Index, By Process

- 10.2. Open Die*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Closed Die

- 10.4. Others

11. By End-User

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.1.2. Market Attractiveness Index, By End-User

- 11.2. Automotive*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Aerospace

- 11.4. Oil & Gas

- 11.5. Power Generation

- 11.6. Construction

- 11.7. Railways

- 11.8. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. UK

- 12.3.8.3. France

- 12.3.8.4. Italy

- 12.3.8.5. Russia

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. Australia

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Recent Developments

- 14.2. Ellwood City Forge

- 14.3. UBE STEEL

- 14.4. Deutsche Nickel

- 14.5. Alcoa

- 14.6. AMETEK

- 14.7. Emirates Global Aluminium

- 14.8. Hindalco

- 14.9. Matalco

- 14.10. Vista Metals

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us