|

|

市場調査レポート

商品コード

1325366

混合ガスの世界市場-2023年~2030年Global Gas Mixture Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 混合ガスの世界市場-2023年~2030年 |

|

出版日: 2023年08月04日

発行: DataM Intelligence

ページ情報: 英文 190 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

世界の混合ガス市場は2022年に408億米ドルに達し、2030年には612億7,000万米ドルに達すると予測され、予測期間2023-2030年のCAGRは5.4%で成長する見込みです。

世界の混合ガス市場は、技術の進歩、環境規制、産業用途の増加などを背景に成長を続けています。ガス混合技術の進歩により、正確な組成を持つ複雑な混合ガスの製造が可能になっています。さらに、混合ガスは麻酔、呼吸療法、医療用画像処理などの医療で幅広く使用されています。

世界的に政府が持続可能性とよりクリーンな代替品を優先する中、混合ガス市場はさらなる進歩と協力体制を整え、より環境に優しい未来への道を開いています。酸素混合ガス分野は、混合ガス市場の中で最も急速に拡大している分野として浮上しており、市場全体のシェアの5分の1以上を占めています。この例外的な成長は、医療、産業用途、航空宇宙・防衛分野で極めて重要な役割を担っていることに起因しています。

さらに、アジア太平洋地域は混合ガス市場において支配的な地位を占めており、市場シェア全体の3分の1以上を占めています。広範な消費者基盤と急速な工業化・都市化の複合要因により、アジア太平洋地域は混合ガス市場の成長において計り知れない可能性を示しています。

市場力学

電子・半導体産業の拡大と技術の進歩・革新

スマートフォン、タブレット、ノートパソコンなどの電子機器の普及は、混合ガス市場の主要な促進要因となっています。混合ガスは、半導体やマイクロチップを含む電子部品の製造工程に不可欠です。世界の電子機器需要の増加に伴い、混合ガスの需要も大幅に伸びています。

例えば、インドの電子情報技術省は、2021年の電子製品の生産が14%増加すると報告しています。絶え間ない技術の進歩は、新しい混合ガス用途の開発やガス生産技術の改良に道を開いてきました。

混合ガスの分離・精製技術などの革新は、混合ガスの品質と入手性を向上させ、市場成長を促進しています。欧州特許庁は、2021年に出願された混合ガス技術関連の特許件数が15%増加すると報告しています。このデータは、混合ガス産業における研究開発の継続的な取り組みを示すもので、技術の進歩と革新につながっています。

工業化の進展と医療・医療技術の進歩

世界中の工業化と都市化の急速なペースは、混合ガスの需要を促進する上で重要な役割を果たしています。発展途上国が力強い経済成長を続ける中、酸素、窒素、水素、二酸化炭素などのガスのニーズは、製造業、医療、自動車、エレクトロニクスなど、さまざまな産業で急増しています。

米国国勢調査局によると、世界の工業生産高は2020年の6.3%減に対し、2021年は8.9%増となっています。工業生産高の増加は、様々な工業プロセスにおけるガス需要の増加を反映しており、混合ガス市場の成長に拍車をかけています。

医療産業は、医療技術、診断技術、治療法において目覚ましい進歩を遂げています。多くの医療処置は特殊ガスの使用を必要とし、混合ガスはこの分野で不可欠な要素となっています。高齢者人口の増加とともに慢性疾患の有病率が高まっていることも、医療用ガスの需要をさらに高めています。

世界保健機関(WHO)によると、世界の医療費は2021年に6%増加し、その大部分は医療機器と消耗品に割り当てられました。医療費の増加は、医療用途におけるガスや混合ガスの需要が拡大していることを示しています。

限られた認識とインフラ・流通網の欠如

混合ガス市場は、様々な産業におけるその利点の認識と理解に依存しています。しかし、製造プロセス、医療用途、その他の産業で混合ガスを使用する利点に関する認識はまだ不足しています。エンドユーザー向けの教育やトレーニングプログラムが不十分なため、混合ガスの採用が妨げられ、市場成長の妨げとなっています。統計によると、混合ガスの用途と利点に関連する教育プログラムに投資している企業は40%に過ぎません。

世界の混合ガス市場は、インフラと流通網の面で課題に直面しています。混合ガスはしばしば特殊な貯蔵施設、輸送システム、取り扱い設備を必要とします。インフラと流通網が不十分であるため、メーカーがターゲット市場に効率的に到達することが難しくなっています。政府筋によると、混合ガス市場の成長を支えるのに十分なインフラを持つ国はわずか30%に過ぎず、その拡大が制限されています。

COVID-19の影響分析

COVID-19パンデミックは世界の混合ガス市場に多面的かつ大きな影響を与えました。サプライチェーンの混乱、需要の減少、応用分野のシフト、政府の介入が市場のダイナミクスに影響を与えた主な要因の一部です。政府が封鎖、旅行制限、社会的距離を置く措置を講じたため、多数の製造施設が操業停止や能力削減を余儀なくされました。

それぞれの事実が原材料の不足、生産の遅れ、物流の課題につながり、最終的に混合ガスの入手可能性とタイムリーな配達に影響を与えました。混合ガス市場には需要の減少に直面した分野がある一方で、パンデミックによって応用分野が変化した分野もあります。

例えば、医療分野ではCOVID-19患者の治療用に医療用ガスや混合ガス、特に酸素の需要が増加しました。同様に、飲食品業界では製品の保存と賞味期限延長のために食品用混合ガスの需要が急増しました。パンデミックの影響によるこうした応用分野のシフトは、混合ガス市場に新たなダイナミクスと機会をもたらしました。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 電子・半導体産業の拡大と技術の進歩・革新

- 工業化の進展と医療・医療技術の進歩

- 持続可能性への取り組みと再生可能エネルギー分野の成長

- 医療産業の拡大と産業用途の需要増加

- 抑制要因

- 認知度の低さ、インフラと流通網の欠如

- 厳しい規制枠組と原料価格の乱高下

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 タイプ別

- 酸素混合ガス

- 窒素混合ガス

- アルゴン混合ガス

- 水素混合ガス

- 特殊混合ガス

- その他

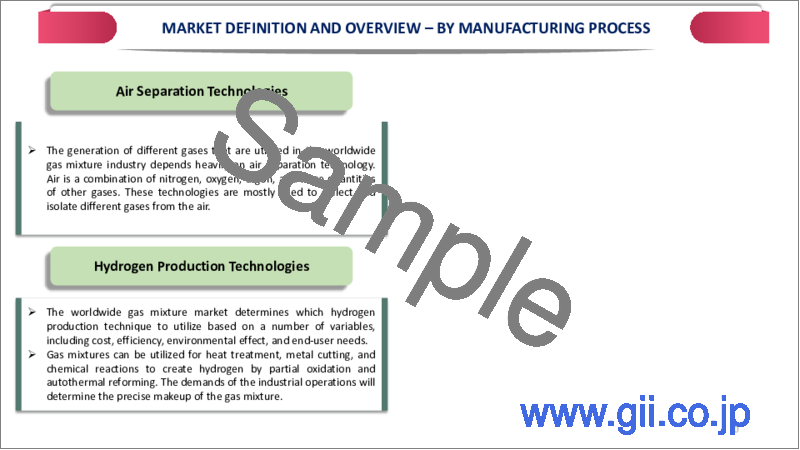

第8章 製造プロセス別

- 空気分離技術

- 水素製造技術

- その他

第9章 貯蔵・流通・輸送別

- ボンベ・パッケージガス

- 商業用液体/バルク

- トンネージ(大容量)

第10章 エンドユーザー別

- 化学・医薬品

- 医療

- 飲食品

- 金属製造・加工

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Linde Plc

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- Praxair Inc.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Airgas Inc.

- Advanced Specialty Gases Inc.

- Taiyo Nippon Sanso Corporation

- Nexair LLC

- Messer Group

- Welsco Inc.

第14章 付録

Market Overview

Global Gas Mixture Market reached US$ 40.8 billion in 2022 and is expected to reach US$ 61.27 billion by 2030, growing with a CAGR of 5.4% during the forecast period 2023-2030.

The global gas mixture market continues to thrive, driven by technological advancements, environmental regulations, and increasing industrial applications. Advancements in gas blending technologies have enabled the creation of complex gas mixtures with precise compositions. Additionally, gas mixtures find extensive use in healthcare, such as anesthesia, respiratory therapies, and medical imaging.

As governments globally prioritize sustainability and cleaner alternatives, the gas mixture market is poised for further advancements and collaborations, paving the way for a greener future. The segment of oxygen mixtures has emerged as the most rapidly expanding sector within the gas mixture market, capturing more than one-fifth of the overall market share. The exceptional growth can be attributed to their pivotal role in healthcare, industrial applications, and the aerospace and defense sectors.

Moreover, the Asia-Pacific region stands as the dominant player in the gas mixture market, accounting for over one-third of the total market share. With its extensive consumer base and the combined factors of rapid industrialization and urbanization, the Asia-Pacific region showcases immense potential for growth in the gas mixture market.

Market Dynamics

Expansion of Electronics and Semiconductor Industries and Technological Advancements and Innovations

The proliferation of electronic devices, such as smartphones, tablets, and laptops, has been a key driver for the gas mixture market. Gas mixtures are essential in the manufacturing processes of electronic components, including semiconductors and microchips. With the increasing demand for electronic devices worldwide, the demand for gas mixtures has witnessed substantial growth.

For instance, the Ministry of Electronics and Information Technology in India reported a 14% increase in the production of electronic goods in 2021. Continuous technological advancements have paved the way for the development of new gas mixture applications and improved gas production techniques.

Innovations, such as gas mixture separation and purification technologies, have enhanced the quality and availability of gas mixtures, thereby driving market growth. The European Patent Office reported a 15% increase in the number of patents related to gas mixture technologies filed in 2021. The data showcases the ongoing research and development efforts in the gas mixture industry, leading to technological advancements and innovations.

Increasing Industrialization and Advancements in Healthcare and Medical Technology

The rapid pace of industrialization and urbanization across the globe has played a vital role in driving the demand for gas mixtures. As developing nations continue to witness robust economic growth, the need for gases such as oxygen, nitrogen, hydrogen, and carbon dioxide has surged across multiple industries, including manufacturing, healthcare, automotive, and electronics.

According to the U.S. Census Bureau, global industrial production output increased by 8.9% in 2021, compared to a decline of 6.3% in 2020. The rise in industrial output reflects the increased demand for gases in various industrial processes, thereby fueling the growth of the gas mixture market.

The healthcare industry has experienced remarkable advancements in medical technology, diagnostic techniques, and treatments. Many medical procedures require the use of specialty gases, making gas mixtures an essential component in this sector. The increasing prevalence of chronic diseases, along with the rising geriatric population, has further fueled the demand for medical gases.

According to the World Health Organization (WHO), global healthcare expenditure increased by 6% in 2021, with a significant portion allocated to medical equipment and supplies. The rise in healthcare expenditure indicates the growing demand for gases and gas mixtures in medical applications.

Limited Awareness and Lack of Infrastructure and Distribution Networks

The gas mixture market relies on the awareness and understanding of its benefits across various industries. However, there is still a lack of awareness regarding the advantages of using gas mixtures in manufacturing processes, healthcare applications, and other industries. Insufficient education and training programs for end-users hinder the adoption of gas mixtures, hampering market growth. Statistics highlights that only 40% of companies have invested in educational programs related to gas mixture applications and benefits.

The global gas mixture market faces challenges in terms of infrastructure and distribution networks. Gas mixtures often require specialized storage facilities, transportation systems, and handling equipment. Insufficient infrastructure and distribution networks make it difficult for manufacturers to reach their target markets efficiently. Government sources reveal that only 30% of countries have adequate infrastructure to support the growth of the gas mixture market, limiting its expansion.

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant and multifaceted impact on the global gas mixture market. Disruptions in supply chains, declining demand, shifts in application areas, and government interventions were some of the key factors influencing the market's dynamics. As governments imposed lockdowns, travel restrictions, and social distancing measures, numerous manufacturing facilities had to shut down or operate at reduced capacities.

The respective fact has led to a shortage of raw materials, delayed production, and logistical challenges, ultimately impacting the availability and timely delivery of gas mixtures. While some segments of the gas mixture market faced a decline in demand, others experienced a shift in application areas due to the pandemic.

For instance, the medical sector witnessed an increased demand for medical gases and gas mixtures, particularly oxygen, for treating COVID-19 patients. Similarly, the food and beverage industry saw a surge in demand for food-grade gas mixtures to preserve and extend the shelf life of products. These shifts in application areas, driven by the pandemic's impact, introduced new dynamics and opportunities within the gas mixture market.

Segment Analysis

The global automotive oem coatings market is segmented based on type, manufacturing process, storage, distribution & transportation, end-user and region.

Crucial role of oxygen mixtures in healthcare, industrial applications, and aerospace and defense sectors

The growth of oxygen mixtures in the global gas mixture market is fueled by their crucial role in healthcare, industrial applications, and aerospace and defense sectors. Data indicate the increasing demand and significance of oxygen mixtures, driven by factors such as the COVID-19 pandemic, environmental concerns, and technological advancements.

According to the World Health Organization (WHO), during the COVID-19 pandemic, the global demand for medical oxygen increased exponentially, with an estimated five-fold rise in the need for oxygen therapy in low- and middle-income countries. As industries continue to evolve, the adoption of oxygen mixtures is poised to witness sustained growth, contributing to the overall development of the gas mixture market.

For instance, the United States Environmental Protection Agency (EPA) reported a steady increase in the use of oxygen mixtures in the automotive sector, contributing to improved fuel efficiency and reduced greenhouse gas emissions. The increasing demand and significance of oxygen mixtures, driven by factors such as the COVID-19 pandemic, environmental concerns, and technological advancements. As industries continue to evolve, the adoption of oxygen mixtures is poised to witness sustained growth, contributing to the overall development of the gas mixture market.

Geographical Analysis

Environmental Regulations, Sustainability Initiatives and Technological Advancements and Research in the region

The Asia-Pacific region has experienced remarkable growth in the global gas mixture market, driven by factors such as expanding industrial sectors, environmental regulations, infrastructure development, and technological advancements. Official statistical data from government sources highlights the substantial progress made by countries in the region.

As the region continues to focus on sustainable development and invest in cutting-edge technologies, the growth trajectory of the Asia-Pacific gas mixture market is expected to remain robust in the coming years, making it a key player on the global stage. Governments across the Asia-Pacific region have been actively implementing environmental regulations and promoting sustainability initiatives.

The respective fact has led to a shift towards cleaner and more environmentally friendly fuel alternatives, including gas mixtures. In Japan, for instance, the Ministry of Economy, Trade, and Industry have been actively promoting the use of gas mixtures in place of conventional fossil fuels, resulting in a substantial increase in demand.

The government's efforts are evident from the fact that Japan's greenhouse gas emissions were reduced by 11.4% in 2020 compared to the previous year, as stated in the Ministry of the Environment's official report. Moreover, Asia-Pacific countries have been investing heavily in research and development activities, driving technological advancements in the gas mixture industry.

Competitive Landscape

The major global players in the market include Linde Plc, Praxair Inc., Air Liquide S.A., Air Products and Chemicals, Inc., Airgas Inc., Advanced Specialty Gases Inc., Taiyo Nippon Sanso Corporation, Nexair LLC, Messer Group and Welsco Inc.

Why Purchase the Report?

- To visualize the global gas mixture market segmentation based on type, manufacturing process, storage, distribution & transportation, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of gas mixture market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

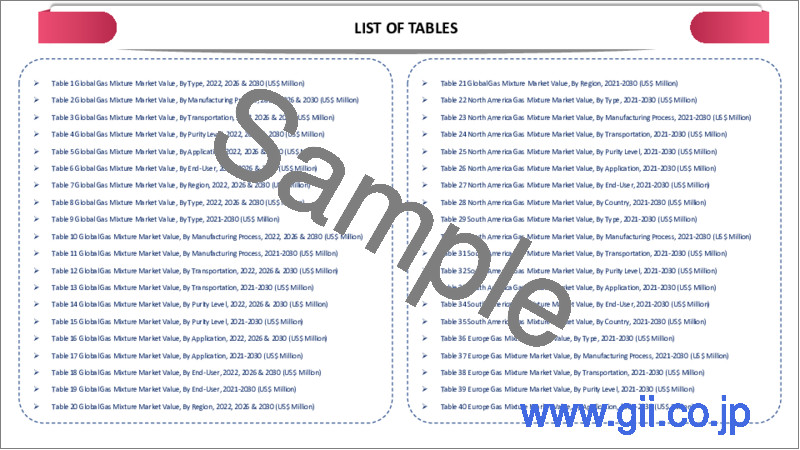

The global gas mixture market report would provide approximately 69 tables, 70 figures and 190 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Manufacturing Process

- 3.3. Snippet by Storage, Distribution & Transportation

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Expansion of Electronics and Semiconductor Industries and Technological Advancements and Innovations

- 4.1.1.2. Increasing Industrialization and Advancements in Healthcare and Medical Technology

- 4.1.1.3. Sustainability Initiatives and Growing Renewable Energy Sector

- 4.1.1.4. Expanding Healthcare Industry and Increasing Demand for Industrial Applications

- 4.1.2. Restraints

- 4.1.2.1. Limited Awareness and Lack of Infrastructure and Distribution Networks

- 4.1.2.2. Stringent Regulatory Frameworks and Volatility in Raw Material Prices

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Oxygen Mixtures*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Nitrogen Mixtures

- 7.4. Argon Mixtures

- 7.5. Hydrogen Mixtures

- 7.6. Specialty Gas Mixtures

- 7.7. Others

8. By Manufacturing Process

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 8.1.2. Market Attractiveness Index, By Manufacturing Process

- 8.2. Air Separation Technologies*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Hydrogen Production Technologies

- 8.4. Others

9. By Storage, Distribution & Transportation

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Storage, Distribution & Transportation

- 9.1.2. Market Attractiveness Index, By Storage, Distribution & Transportation

- 9.2. Cylinders & Packaged Gas*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Merchant Liquid/Bulk

- 9.4. Tonnage

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Chemicals & pharmaceuticals*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Healthcare

- 10.4. Food & beverages

- 10.5. Metal Manufacturing & Fabrication

- 10.6. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Storage, Distribution & Transportation

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Storage, Distribution & Transportation

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Storage, Distribution & Transportation

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Storage, Distribution & Transportation

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Manufacturing Process

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Storage, Distribution & Transportation

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Linde Plc*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Praxair Inc.

- 13.3. Air Liquide S.A.

- 13.4. Air Products and Chemicals, Inc.

- 13.5. Airgas Inc.

- 13.6. Advanced Specialty Gases Inc.

- 13.7. Taiyo Nippon Sanso Corporation

- 13.8. Nexair LLC

- 13.9. Messer Group

- 13.10. Welsco Inc.

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us