|

|

市場調査レポート

商品コード

1316299

遠隔患者モニタリングの世界市場-2023年~2030年Global Remote Patient Monitoring Market - 2023-2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 遠隔患者モニタリングの世界市場-2023年~2030年 |

|

出版日: 2023年07月27日

発行: DataM Intelligence

ページ情報: 英文 185 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

市場概要

世界の遠隔患者モニタリング市場は、2022年に482億米ドルに達し、2030年には3,389億米ドルに達するなど、有利な成長が予測されています。世界の遠隔患者モニタリング市場は、予測期間中(2023~2030年)に28.8%のCAGRを示すと予測されています。

遠隔患者モニタリング(RPM)は、従来の病院やヘルスケアのセットアップの外で患者データを収集するために医療モノのインターネット(IoMT)の進歩を使用するホスピタリティプロセスです。RPMは、人々が自分の健康に対して責任を持ち、責任を負うような環境を作ることで、患者の行動を改善します。

遠隔患者モニタリング装置の応用例としては、バイオメトリック患者モニターやバーチャルケアプラットフォームなどがあります。遠隔患者モニタリング機器に見られる最近の動向は、クラウドベースの患者モニタリングプラットフォームの利用であり、ヘルスケアプロバイダーはリアルタイムで患者データにアクセスでき、遠隔地から患者をよりよくモニタリングできます。

世界の遠隔患者モニタリングは、慢性疾患の増加、高齢者人口の増加、ヘルスケアサービスの利用可能性の拡大、患者転帰の改善、ケアへのアクセスの増加、効率性の向上といった需要の高まりといった要因によって牽引されています。

市場力学

技術の進歩が遠隔患者モニタリング市場の成長を促進

遠隔患者モニタリング市場では、遠隔患者モニタリングシステムの成長を促進する技術主導型の進歩が増加しています。遠隔患者モニタリングは、遠隔地からのヘルスケアへのアクセスを提供する能力を持ち、また、結果を改善するコスト削減にも役立ちます。

モノのインターネット(IoT)、クラウドコンピューティング、人工知能などの技術の進歩により、コネクテッドヘルスのソリューションが増加しています。例えば、ブルートゥースベースのヘッドセットは、心拍数、体温、血圧などのバイタルサインの測定に使用されています。これにより、医師やヘルスケアの専門家は、どこからでも遠隔で患者を監視できるようになります。

さらに、スマートフォンのアプリを使うことで、患者の遠隔モニタリングは効率的かつ容易になりつつあります。例えば、My medicalアプリは、個人医療記録やフィットネス・トラッキング・データを含む様々なソースからの健康情報を追跡します。このように、患者にカスタマイズされたプランを提供するのに役立つため、技術の進歩が遠隔患者モニタリング市場の成長を促進しています。

遠隔患者モニタリング市場におけるウェアラブル使用の増加が成長を促進

患者モニタリングデバイス、スマートインプラント、バイオセンサーにおけるウェアラブルは、患者の慢性疾患のモニタリングに使用され、これには連続体温モニタリング、グルコースモニタリング、パルスオキシメトリ、血圧モニタリングなどが含まれます。ウェアラブルには、モノのインターネットなどの次世代先端技術が搭載されています。

例えば、Apple Watch Series 4は、転倒検知機能とECG機能を備えており、心臓の健康状態を評価し心房細動を検出するための市販の診断ツールとしての使用が最近FDAによって許可されました。さらに、Dexcom G6やFreeStyle Libreなどのグルコースモニタリングデバイスは、糖尿病患者が指を刺すことなく血糖値をモニターするのに役立ちます。

これらの機器には専用のスマートフォンアプリが付属していることが多く、ユーザーは便利にデータを見ることができます。さらに、これらの機器はモノのインターネットに接続されているため、医師は患者の状態を遠隔で監視・管理することができます。ウェアラブル・バイオセンサーは、血圧や心電図などの重要な兆候を収集します。これらは遠隔患者モニタリング市場の成長を促進する主な要因です。

RPMのインストールとトレーニングプロセスに伴う高コストが市場成長の妨げに

遠隔患者モニタリングシステムの導入コストには、トレーニングや設置のコストが含まれ、システムの複雑さによって数百ドルから数千ドルの幅があります。例えば、バイタルサインを伝達するだけの基本的なシステムのコストはおよそ500ドル以下であるのに対し、幅広いシステムを備えた高度なシステムのコストは10,000ドル以上となる場合があります。

さらに、RPMシステムの保守と更新にかかる費用も、全体的な費用に組み込む必要があります。時間の経過とともに、定期的なメンテナンス、ソフトウェアのアップグレード、テクニカルサポートサービスに追加費用が発生する可能性があります。さらに、システムの拡張性とカスタマイズオプションは、その価格帯に影響を与える可能性があります。

リアルタイムのデータ分析や予知保全機能など、より高度な機能は、より高いコストにつながる可能性があります。しかし、広範なソリッドRPMシステムに投資することで、運転効率の向上、ダウンタイムの減少、資産管理の改善など、長期的に大きなメリットが得られることは特筆に値します。

COVID-19影響分析

COVID-19の大流行により、RPMシステムの需要が高まっています。医療提供者は、患者を遠隔監視する方法を発見し、通院の必要性を減らしています。その結果、RPM技術の需要と採用が増加し、遠隔医療インフラが拡大し、患者の遠隔医療が促進されました。

RPMシステムは、COVID-19症例の早期発見と治癒を可能にし、慢性疾患の遠隔管理を支援することで医療システムの負担を軽減し、患者の安全性を高め、技術革新を促進しました。その結果、RPMシステムは、ケアの継続性と曝露リスクの軽減によって、パンデミック時のヘルスケア提供に大きな変革をもたらし、世界の遠隔患者モニタリング市場にプラスの影響を与えました。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 慢性疾患の増加

- 高齢者人口の増加とヘルスケアサービスの拡充に対するニーズの高まり

- 抑制要因

- 低所得国における遠隔モニタリングソリューションの欠如

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターの5フォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 製品タイプ別

- デバイス

- バイタルサインモニター

- 血圧モニター

- パルスオキシメーター

- 心拍モニター(ECG)

- 体温モニター

- 呼吸数モニター

- 脳モニター(EEG)

- 特殊モニター

- 麻酔モニター

- 血糖値モニター

- 心臓リズムモニター

- 胎児心臓モニター

- プロトロンビンモニター

- マルチパラメータモニタ(MPM)

- サービス&ソフトウェア

第8章 アプリケーション別

- 心血管疾患

- 神経疾患

- 呼吸器疾患

- がん

- 糖尿病

- 睡眠障害

- 体重管理とフィットネスモニター

- 感染症

第9章 エンドユーザー別

- 支払者

- プロバイダー

- 患者

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Medtronic Plc

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 最近の動向

- Koninklijke Philips N.V

- GE Healthcare

- Abbott Laboratories

- BioTelemetry Inc.

- Siemens Healthineers AG

- Boston Scientific Corporation

- Welch Allyn

- OMRON Healthcare Co., Ltd.

- Transtek

第13章 付録

Market Overview

The global remote patient monitoring market reached US$ 48.2 billion in 2022 and is projected to witness lucrative growth by reaching up to US$ 338.9 billion by 2030. The global remote patient monitoring market is expected to exhibit a CAGR of 28.8% during the forecast period (2023-2030).

Remote patient monitoring (RPM) is the healthcare process that uses Internet of medical things (IoMT) advancements for collecting patient data outside the traditional hospital and healthcare setup. It improves patient behaviour by creating the surrounding by which people are accountable and responsible for their health.

Some of the applications of remote patient monitoring devices are Biometric Patient Monitors and Virtual Care Platforms. The recent trends that are seen in remote patient monitoring devices are the use of cloud-based patient monitoring platforms allowing healthcare providers to access patient data in real-time and providing them with the ability to better monitor patients from remote locations.

The global remote patient monitoring is driven by the factors such as increasing prevalance of chronic disease, increase in the geriatric population and growing demands expansion in healthcare service avaliability, improved patient outcomes, increased access to care, increased efficiency.

Market Dynamics

Technological Advancements is Driving the Growth of Remote Patient Monitoring Market

The remote patient monitoring market has seen a rise in technology-driven advancements that are driving the growth of remote patient monitoring systems. Remote patient monitoring has the ability to provide access to healthcare from remote locations and also it helps reduce costs improving the results.

Solutions for connected health have increased due to the advancements in technologies such as the Internet of Things (IoT), Cloud Computing, and artificial intelligence. For instance, Bluetooth-based headsets are being used to measure vital signs such as heart rate, body temperature, and blood pressure. It helps doctors and healthcare practitioners to monitor patients remotely from any location.

Furthermore, with the use of smartphone apps, remote patient monitoring is becoming efficient and easier. For instance, My medical app tracks health information from different sources which includes personal medical records and fitness tracking data. Thus, it is useful to provide a customized plan for the patient and thus technological advancements are driving the growth of the remote patient monitoring market.

Increase in the Use of Wearables in Remote Patient Monitoring Market is Driving the Growth

Wearables in patient monitoring devices, smart implants and biosensors are used for monitoring chronic disease in the patient which includes continuous temperature monitoring, glucose monitoring, pulse oximetry and blood pressure monitoring. The wearables have next-generation advanced technologies such as the Internet of Things.

For instance, the Apple Watch Series 4, with its Fall Detection and ECG features, has recently been cleared by the FDA for use as an over-the-counter diagnostic tool for assessing cardiac health and detecting atrial fibrillation. Additionally, glucose monitoring devices such as the Dexcom G6 and FreeStyle Libre help diabetics to monitor their blood sugar levels without having to prick their fingers.

These devices often come with dedicated smartphone apps that allow users to conveniently view their data. Furthermore, these devices are connected to the Internet of Things, allowing physicians to remotely monitor and manage the conditions of their patients. Wearable biosensors collect important signs such as blood pressure, and electrocardiography. These are major factors which are driving the growth of the remote patient monitoring market.

High Cost Associated with the Installation and Training Process for RPM to Hamper the Market Growth

The cost of installing an remote patient monitoring system includes the cost of training and installation, which can range from a few hundred dollars to several thousand dollars depending on the system's complexity. A basic system that just communicates vital signs, for instance, may cost approximately or less than $500, whereas an advanced system with a wide range of systems may cost more than $10,000.

In addition, the cost of maintaining and updating the RPM system should be incorporated into the overall expenses. Over time, regular maintenance, software upgrades, and technical support services may incur additional costs. Furthermore, the scalability and customization options of the system can influence its price range.

More advanced features, such as real-time data analysis and predictive maintenance capabilities, may contribute to a higher cost. It is worth mentioning that however, that investing in an extensive solid RPM system can result in substantial long-term benefits such as greater operational efficiency, decreased downtime, and improved asset management.

COVID-19 Impact Analysis

The COVID-19 pandemic has increased the demand for RPM systems. Healthcare providers have found ways to remotely monitor patients,reducing the need for hospital visits. It has thus led to the increase in demand and adoption of RPM technology, expansion of telehealthcare infrastructure and facilitated remote patient healthcare.

RPM systems enabled early detection and cure of COVID-19 cases, helping managethe chronic conditions remotely reducing the burden on healthcare systems, enhancing the safety of the patient and driving innovation in technology. As a result, RPM systems have significantly transformed the delivery of healthcare during the pandemic by continuity of care and reduction of exposure risks and positively impacting the global remote patient monitoring market.

Segment Analysis

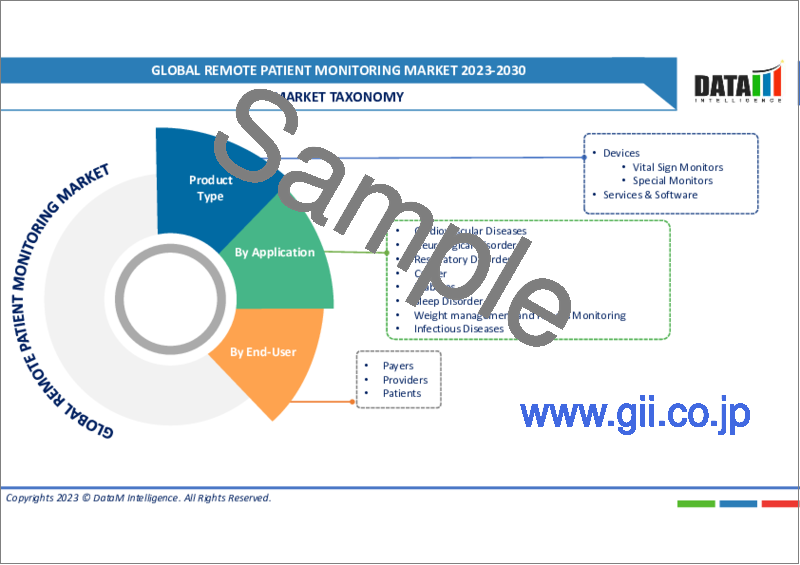

The global remote patient monitoring market is segmented based on product type, application, end-user and region.

Device Segment to Dominate the Market Owing to the Growing Adoption of Connected Devices

The device segment is expected to dominate the remote patient monitoring market with the market share of about 40.3% over the forecast period. The factors driving the device segment include increasing need for home healthcare, the increasing prevalence of chronic diseases and the growing adoption of connected devices.

For instance, in April, 26 2023, CardieX received FDA 510(K) clearance for a world-first vascular biometric monitor- the CONNEQT pulse, has received 510(k) clearance from the U.S. Food and Drug Administration (FDA). Pulse is the only vital signs monitor targated at home, clinician, and clinical trial use measurements of both brachial blood pressure (the pressure at your arm) and central blood pressure (the pressure at your aorta/heart) in addition to multiple other vascular health biomarkers.

Geographical Analysis

North America's Region Dominating the Market Owing to the Increase in Adoption of Connected Healthcare Technology

Remote patient monitoring system is becoming increasingly popular in North America and the region is dominating the industry in a variety of ways with market share of about 41.1%. The North American region has dominated and is expected to dominate the remote patient monitoring system due to the increasing adoption of connected healthcare technology and the presence of top and leading market players in the region.

For instance, Medtronic recently announced the launch of its new Carelink Connected Remote Monitoring System which allows patients and healthcare providers to stay connected and collaborate in real-time. Similarly, Philips Healthcare has long been investing in services and technology related to remote monitoring systems.

The key drivers of market growth in the North American region include increasing demand for home healthcare services, increasing internet penetration, favourable government initiatives and the geriatric population. Moreover, the region has seen a rise in the no of hospitals introducing telehealth solutions, with the U.S. leading the way in the segment. For instance, Medicare and Medicaid Services (CMS) initiatives encourage doctors and other healthcare practitioners to embrace telehealth technologies.

Furthermore, the Department of Veterans Affairs in the United States has initiated a number of projects to boost the use of telehealth services, and the US government has provided incentives to institutions that use telehealth services. These measures have expanded telehealth usage in North America, adding to the overall growth of the market.

This has spurred the growth of the home healthcare services market, allowing the elderly to obtain quality healthcare services in the comfort of their own homes. With efforts such as the Department of Defence, the United States has been at the forefront of this expansion. Veterans Affairs and CMS are at the forefront of the telehealth sector.

Competitive Landscape

The major global players include: Medtronic Plc, Koninklijke Philips N.V, GE Healthcare, Abbott Laboratories, BioTelemetry Inc., Siemens Healthineers AG Boston Scientific Corporation, Welch Allyn, OMRON Healthcare Co., Ltd., Transtek among others.

Why Purchase the Report?

- To visualize the global remote patient monitoring market segmentation based on product type, application, end-user, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of remote patient monitoring market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global remote patient monitoring market report would provide approximately 61 tables, 61 figures and 185 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product Type

- 3.2. Snippet by Application

- 3.3. Snippet by End-User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing prevalence of chronic diseases

- 4.1.1.2. Increase in the geriatric population and growing need demands expansion in healthcare service availability

- 4.1.2. Restraints

- 4.1.2.1. Lack of remote monitoring solution in low-income countries

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's 5 Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Scenario Post COVID-19

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 7.1.2. Market Attractiveness Index, By Product Type

- 7.2. Devices*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.2.1. Vital Sign Monitors

- 7.2.2.1.1. Blood Pressure Monitors

- 7.2.2.1.2. Pulse Oximeters

- 7.2.2.1.3. Heart Rate Monitor (ECG)

- 7.2.2.1.4. Temperature Monitor

- 7.2.2.1.5. Respiratory Rate Monitor

- 7.2.2.1.6. Brain Monitor (EEG)

- 7.2.2.2. Special Monitors

- 7.2.2.2.1. Anesthesia Monitors

- 7.2.2.2.2. Blood Glucose Monitors

- 7.2.2.2.3. Cardiac Rhythm Monitors

- 7.2.2.2.4. Fetal Heart Monitors

- 7.2.2.2.5. Prothrombin Monitors

- 7.2.2.2.6. Multi-Parameter Monitors (MPM)

- 7.3. Services & Software

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Cardiovascular Diseases*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Neurological Disorders

- 8.4. Respiratory Disorders

- 8.5. Cancer

- 8.6. Diabetes

- 8.7. Sleep Disorder

- 8.8. Weight management and Fitness Monitoring

- 8.9. Infectious Diseases

9. By End-User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 9.1.2. Market Attractiveness Index, By End User

- 9.2. Payers*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Providers

- 9.4. Patients

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.7.1. U.S.

- 10.2.7.2. Canada

- 10.2.7.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Medtronic Plc*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Recent Developments

- 12.2. Koninklijke Philips N.V

- 12.3. GE Healthcare

- 12.4. Abbott Laboratories

- 12.5. BioTelemetry Inc.

- 12.6. Siemens Healthineers AG

- 12.7. Boston Scientific Corporation

- 12.8. Welch Allyn

- 12.9. OMRON Healthcare Co., Ltd.

- 12.10. Transtek

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us