|

|

市場調査レポート

商品コード

1297817

創薬サービスの世界市場-2023年~2030年Global Drug Discovery Services Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 創薬サービスの世界市場-2023年~2030年 |

|

出版日: 2023年06月15日

発行: DataM Intelligence

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

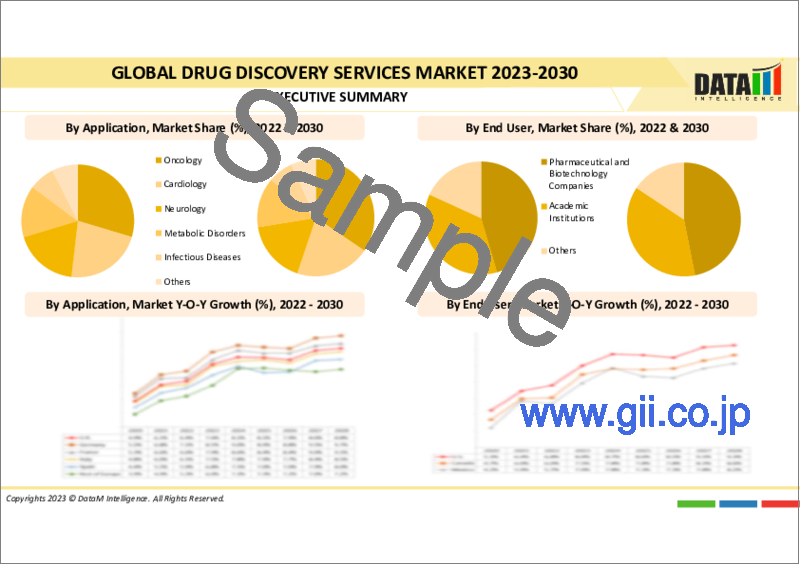

世界の創薬サービス市場は、2022年に137億米ドルに達し、2030年には399億米ドルに達するなど、有利な成長が予測されています。世界の創薬市場は予測期間中(2023-2030年)に14.8%のCAGRを示すと予測されています。

世界の創薬サービス市場は、多くの大きな進展により、近年著しい成長と開拓を見せています。がん、神経疾患、心血管疾患などの慢性疾患の有病率の上昇により、新規の医薬品や治療法に対する強い需要が生まれています。その結果、製薬会社が医薬品開発サービスを専門の開発業務受託機関(CRO)に委託するケースが増加しています。

世界の創薬サービス市場は、主にがんなどの慢性疾患の有病率が上昇し、先進的な薬物療法や治療法に対する大きなニーズが生まれたことで活性化しています。例えば、肺がんの有病率の増加は、オシメルチニブやクリゾチニブのようなチロシンキナーゼ阻害剤(TKI)のような標的治療薬の開発をもたらし、重要な薬剤研究努力を促しています。

市場力学

技術と調査ツールの進歩が世界の創薬サービス市場の成長を促進

特に3Dバイオプリンティングの領域における技術と調査ツールの進歩が、世界の創薬サービス市場を推進しています。例えば、2023年1月、Molecular DevicesとAdvanced Solutions Life Sciencesは、創薬のための3D生物学自動化ツールを開発するために協力関係を結びました。この提携の一環として、Molecular DevicesはAdvanced SolutionsのBioAssemblyBot 400(BAB 400)バイオプリンティングプラットフォームを販売します。

BAB 400は6軸インテリジェントロボットアームで、生命科学者がより高いスループットと精度で3Dモデルシステムを作成することを可能にします。この方法は、バイオプリンティング工程を自動化することにより、手動工程に関連する一般的な問題を排除し、創薬における生産性と信頼性の向上をもたらします。今回の提携は、最先端のバイオプリンティング技術が創薬サービス市場に組み込まれたことを意味し、この分野のイノベーションをさらに推進するものです。

老年人口の増加が世界の創薬サービス市場の成長を牽引

世界の創薬サービス市場は、高齢者人口の増加によって牽引される可能性が高いです。高齢者人口は慢性疾患や加齢に関連した疾患の罹患率が高く、新規の医薬品や治療法に対する需要が高まっています。その結果、製薬会社や研究機関は、高齢者の特別なヘルスケアニーズに対応する医薬品の開発に力を注いでいます。

例えば、世界保健機関(WHO)の2022年報告によると、2030年までに地球上の約6人に1人が60歳以上になります。この期間内に、60歳以上の高齢者が世界人口に占める割合は、2020年の10億人から14億人に増加すると予想されています。2050年には、60歳以上の人口は3倍以上の21億人に達します。したがって、上記の要因から、世界の創薬サービス市場は予測期間中に拡大すると予想されます。

創薬と動物使用を規定する厳しい規制が創薬サービス世界市場の成長を妨げる

医薬品開発における動物の使用を制限する厳しい規制は、研究実践に困難をもたらします。マウス、ラット、魚類、両生類、爬虫類などの動物は日常的に研究に使用されているが、倫理的な懸念から各国は動物の安全性と使用に関する法律を制定しています。このため、企業は動物の使用を減らすために別の方法を用いるようになっています。しかし、この側面は予測期間中、世界の創薬サービス市場の成長を阻害すると予測されています。

COVID-19影響分析

世界の創薬サービス市場は、COVID-19の大流行によって良い意味で大きな影響を受けています。この流行により、医薬品開発研究に対する政府の資金援助や製薬会社の投資が増加しました。その結果、創薬サービスに対する需要は、特にターゲット同定、リード最適化、前臨床開発の分野で増加しました。

さらに、パンデミックは創薬研究の進め方に多くの変化をもたらしました。例えば、創薬における人工知能や機械学習の利用がより重視されるようになっています。これらの技術は創薬のスピードアップに役立つと同時に、医薬品開発コストの削減にもつながるからです。

ロシア・ウクライナ紛争分析

ロシアとウクライナの紛争は、世界の創薬サービス産業に大きな障害をもたらしています。これらの問題には、エネルギー価格の上昇やサプライチェーンの混乱、研究所の避難や移転による研究の遅れ、組織のデータや知的財産に対するサイバー攻撃のリスク増大などが含まれます。その結果、市場は近い将来減速すると予想されます。

しかし、新薬に対する需要は依然として高いため、長期的には市場は回復すると予測されます。その深刻な結果にもかかわらず、戦争はウクライナで流行している疾病の調査を促進し、創薬企業間の協力を促進し、新規治療法につながる可能性があります。このように、戦争が市場に与える全体的な影響は、課題と機会が混在しています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 慢性疾患の増加

- 研究開発費の増加

- 抑制要因

- 創薬プロセスの高コスト

- 機会

- 3Dバイオプリンティング別高度な薬剤モデルの作成

- 影響分析

- 促進要因

第5章 産業分析

- ポーターの5フォース分析

- サプライチェーン分析

- アンメットニーズ

- 規制分析

第6章 COVID-19分析

第7章 ロシア・ウクライナ戦争分析

第8章 プロセスタイプ別

- プロファイリングとリード最適化

- スクリーニング

- アッセイ開発

- 細胞工学

- その他

第9章 サービスタイプ別

- 計算化学

- 医化学

- ADMEおよびDMPK

- 生化学

- その他

第10章 用途別

- 腫瘍

- 神経

- 代謝・炎症性疾患

- 免疫腫瘍

- その他

第11章 エンドユーザー別

- 製薬・バイオテクノロジー企業

- クリニック

- 学術機関

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 製品ベンチマーク

- 企業シェア分析

- 主な発展と戦略

第14章 企業プロファイル

- Piramal Pharma Solutions

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Biopta

- Charles River Laboratories International

- Domainex

- Evotec AG

- Albany Molecular Research Inc.

- GenScript

- Pharmaceutical Product Development, LLC(PPD)

- WuXi AppTec

- Merck & Co., Inc.

第15章 付録

Market Overview

The Global Drug Discovery Services Market reached US$ 13.7 billion in 2022 and is projected to witness lucrative growth by reaching up to US$ 39.9 billion by 2030. The global drug discovery market is expected to exhibit a CAGR of 14.8% during the forecast period (2023-2030).

The global drug discovery services market has shown tremendous growth and development in recent years, owing to a number of major developments. The rising prevalence of chronic diseases such as cancer, neurological disorders, and cardiovascular disease has produced a strong demand for novel medications and therapies. This has resulted in an increase in pharmaceutical companies outsourcing drug development services to specialized contract research organizations (CROs).

The global drug discovery services market is being fueled primarily by the rising prevalence of chronic diseases such as cancer, which has created a significant need for advanced medication and therapies. For instance, the increasing prevalence of lung cancer has prompted significant drug research efforts, resulting in the development of targeted treatments such as tyrosine kinase inhibitors (TKIs) such as osimertinib and crizotinib.

Market Dynamics

The Advancements in Technology and Research Tools is Propelling the Growth of the Global Drug Discovery Services Market

Technological and research tool advancements, notably in the realm of 3D bioprinting, are propelling the global drug discovery services market. For instance, in January 2023, Molecular Devices and Advanced Solutions Life Sciences have formed a collaboration to develop 3D biology automation tools for drug discovery. As part of this collaboration, Molecular Devices will market Advanced Solutions' BioAssemblyBot 400 (BAB 400) bioprinting platform.

BAB 400 is a six-axis intelligent robotic arm that allows life scientists to create 3D model systems with greater throughput and precision. This method eliminates common issues associated with manual processes by automating the bioprinting process, resulting in increased productivity and dependability in drug discovery. This collaboration signifies the incorporation of cutting-edge bioprinting technology into the drug discovery services market, propelling innovations in the sector even further.

The Increasing Geriatric Population is Driving the Growth of the Global Drug Discovery Services Market

The global drug discovery services market is likely to be driven by the expanding elderly population. The elderly population has a greater incidence of chronic diseases and age-related ailments, which increases the demand for novel medications and therapies. As a result, pharmaceutical companies and research institutions are concentrating their efforts on developing medications that address the special healthcare needs of the aged.

For instance, according to World Health Organization (WHO) 2022 report, by 2030, about one out of every six people on the planet will be 60 or older. Within this time span, the share of the world population aged 60 and up is expected to increase from 1 billion in 2020 to 1.4 billion. In 2050, the number of persons aged 60 and up will more than treble, approaching 2.1 billion. Hence, owing to the above factors, the global drug discovery services market is expected to drive over the forecast period.

Stringent Regulations Governing Drug Discovery and Animal Usage is Hampering the Growth of the Global Drug Discovery Services Market

The strict limits limiting the use of animals in drug development present difficulties for research practices. Animals such as mice, rats, fish, amphibians, and reptiles are routinely used in research, but ethical concerns have pushed nations to enact animal safety and use legislation. This has prompted businesses to use alternate methods to reduce the use of animals. This aspect, however, is projected to impede the growth of the worldwide drug discovery services market during the forecast period.

COVID-19 Impact Analysis

The global drug discovery services market has been significantly impacted by the COVID-19 pandemic in a positive way. The epidemic has increased government financing for drug development research, as well as pharmaceutical company investment. As a result, demand for drug discovery services has increased, notably in the areas of target identification, lead optimization, and preclinical development.

Furthermore, the pandemic has caused a number of modifications in the way drug research is conducted. For example, a larger emphasis has been placed on the use of artificial intelligence and machine learning in drug discovery. This is because these technologies can help to speed drug discovery while also lowering drug development costs

Russia-Ukraine Conflict Analysis

The war between Russia and Ukraine has posed considerable obstacles to the global drug discovery services industry. These issues include growing energy prices and supply chain disruptions, research delays caused by lab evacuation or relocation, and an increased risk of cyberattacks on organizations' data and intellectual property. As a result, the market is expected to slow down in the near future.

However, the market is projected to rebound in the long run as demand for new drugs remains high. Despite its severe consequences, the war has promoted research into diseases prevalent in Ukraine and fostered collaboration among drug discovery companies, potentially leading to novel treatments. Thus, the overall impact of the war on the market is a mix of challenges and opportunities.

Segment Analysis

The global drug discovery services market is segmented based on process type, service type, application type, end user, and region.

The Pharmaceutical & Biotechnology companies Segment is expected to hold a Dominant Position for the Global Drug Discovery Services Market over the Forecast Period

The pharmaceutical & Biotechnology companies segment accounted for the highest market share accounting for approximately 34.8% of the drug discovery services market in 2022. Pharmaceutical & biotech companies, which are at the forefront of the research and commercialization of novel treatments, are positioned to dominate the global drug discovery services industry. Their significant investments in R&D, and collaborations with CROs will fuel demand for drug discovery services market.

For instance in November 2022, IQVIA, a leading global provider of advanced analytics, technological solutions, and clinical research services to the life sciences industry, announced today a long-term partnership with Clalit, Israel's largest health services organization, to open the country's first Prime Site. Thus, owing to the above factors, the market segment is expected to hold the largest market share for global drug discovery services market over the forecast period.

Geographical Analysis

North America holds a Dominant Position in the Global Drug Discovery Services Market

North America is estimated to hold around 38.6% of the total market share throughout the forecast period, owing to the rising prevalence chronic diseases, strong presence of pharmaceutical and biotechnology companies, significant investment in R&D activities, and favorable government initiatives supporting drug discovery and development are some of the key are the factors expected to drive the drug discovery services market in North America region over the forecast period.

Chronic diseases, such as cardiovascular disease, cancer, diabetes, and respiratory disorders, are a significant burden in North America. For instance, according to Centers for Disease Control and Prevention 2022 report, chronic diseases impact 6 out of 10 persons in the U.S. alone, and they are not only primary causes of mortality and disability, but also key contributors to the country's astounding yearly healthcare expenses of $4.1 trillion. Hence, owing to the above factors, the market is expected to drive over the forecast period.

Competitive Landscape

The major global players in the market include: Piramal Pharma Solutions, Biopta, Charles River Laboratories International, Domainex, Evotec AG, Albany Molecular Research Inc., GenScript, Pharmaceutical Product Development, LLC (PPD), WuXi AppTec, and Merck & Co., Inc., among others.

Why Purchase the Report?

- To visualize the global drug discovery services market segmentation based on the process type, service type, application type, end user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of drug discovery services market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global drug discovery services market report would provide approximately 49 tables, 53 figures, and 195 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Process Type

- 3.2. Snippet by Service Type

- 3.3. Snippet by Application Type

- 3.4. Snippet by End User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. The Rising Prevalence of Chronic Diseases

- 4.1.1.2. The Increasing R&D Expenditure

- 4.1.2. Restraints

- 4.1.2.1. The High Cost of Drug Discovery Process

- 4.1.3. Opportunity

- 4.1.3.1. 3D-bioprinting to create advanced drug models

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's 5 Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Unmet Needs

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Scenario Post COVID-19

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturers' Strategic Initiatives

- 6.6. Conclusion

7. Russia-Ukraine War Analysis

8. By Process Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process Type

- 8.1.2. Market Attractiveness Index, By Process Type

- 8.2. Profiling & Lead Optimization*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Screening

- 8.4. Assay Development

- 8.5. Cell Engineering

- 8.6. Others

9. By Service Type

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 9.1.2. Market Attractiveness Index, By Service Type

- 9.2. Computational Chemistry*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Medical Chemistry

- 9.4. ADME & DMPK

- 9.5. Biochemistry

- 9.6. Others

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Oncology*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Neurology

- 10.4. Metabolic & Inflammatory Disease

- 10.5. Immuno-Oncology

- 10.6. Others

11. By End User

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 11.1.2. Market Attractiveness Index, By End User

- 11.2. Pharmaceutical & Biotechnology companies*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Clinics

- 11.4. Academic Institutes

- 11.5. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process Type

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application Type

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User Type

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.7.1. The U.S.

- 12.2.7.2. Canada

- 12.2.7.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process Type

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application Type

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User Type

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.7.1. Germany

- 12.3.7.2. The U.K.

- 12.3.7.3. France

- 12.3.7.4. Italy

- 12.3.7.5. Spain

- 12.3.7.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process Type

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application Type

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User Type

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.7.1. Brazil

- 12.4.7.2. Argentina

- 12.4.7.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process Type

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application Type

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User Type

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.7.1. China

- 12.5.7.2. India

- 12.5.7.3. Japan

- 12.5.7.4. Australia

- 12.5.7.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process Type

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application Type

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User Type

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Product Benchmarking

- 13.3. Company Share Analysis

- 13.4. Key Developments and Strategies

14. Company Profiles

- 14.1. Piramal Pharma Solutions*

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. Biopta

- 14.3. Charles River Laboratories International

- 14.4. Domainex

- 14.5. Evotec AG

- 14.6. Albany Molecular Research Inc.

- 14.7. GenScript

- 14.8. Pharmaceutical Product Development, LLC (PPD)

- 14.9. WuXi AppTec

- 14.10. Merck & Co., Inc.

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us