|

|

市場調査レポート

商品コード

1297775

炎症性腸疾患の世界市場-2023年~2030年Global Inflammatory Bowel Disease Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 炎症性腸疾患の世界市場-2023年~2030年 |

|

出版日: 2023年06月15日

発行: DataM Intelligence

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

世界の炎症性腸疾患市場は、2022年に190億米ドルに達し、2030年には267億米ドルに達することで有利な成長が予測されています。炎症性腸疾患の世界市場は、予測期間2023-2030年にCAGR 4.4%を示すと予測されます。

炎症性腸疾患(IBD)は、消化管に炎症を引き起こす慢性疾患群です。IBDの2つの主なタイプはクローン病と潰瘍性大腸炎です。炎症性腸疾患(IBD)の治療には、抗炎症薬、免疫調節薬、生物学的製剤など、いくつかのクラスの薬剤が使用されます。

さらに、生物学的製剤や標的治療薬の登場がIBDの治療状況を一変させたこと、患者のIBDに対する認識が高まったこと、先進国や新興経済諸国における医療費の増加、FDA承認の増加が予測期間中に市場を牽引すると期待される要因です。

市場力学

IBD治療薬のFDA承認の増加が、予測期間中の世界の炎症性腸疾患市場の成長を押し上げる

2023年4月、アッヴィは、欧州委員会(EC)がRINVOQ(ウパダシチニブ、45mg[導入用量]、15mgおよび30mg[維持用量])を、従来の治療法または生物学的製剤で効果不十分、効果消失または不耐容の中等度から重度の活動性のクローン病成人患者に対する初の経口ヤヌスキナーゼ(JAK)阻害薬として承認したと発表しました。

同様に、ジェネリック医薬品およびバイオシミラーの世界的リーディングカンパニーであるサンドは、2023年3月、米国食品医薬品局(FDA)より、バイオシミラーのハイリモズ(アダリムマブ・アダズ)注射剤のクエン酸塩を含まない高濃度製剤(HCF)の承認を取得しました。

このアダリムマブのクエン酸塩を含まないHCFは、参照薬であるヒュミラ(アダリムマブ)の対象となる7つの疾患の治療薬として承認されています。これらの疾患には、関節リウマチ、若年性特発性関節炎、乾癬性関節炎、強直性脊椎炎、クローン病、潰瘍性大腸炎、尋常性乾癬が含まれます。したがって、上記の要因から、予測期間中、市場は牽引していくと予想されます。

一部のブランドIBD治療薬の特許失効が、予測期間における炎症性腸疾患世界市場の成長を妨げる

一部のブランドIBD治療薬の特許満了は、ジェネリック医薬品との競合激化を招き、価格低下と市場シェア低下をもたらす可能性があります。例えば、「ヒュミラ」の主要特許が2022年末までに失効するのに伴い、規制当局は同薬の競合バージョンを承認し、より多くのジェネリック医薬品の市場参入を示唆しています。このような競合の増加により、ヒュミラの薬価が下がることが予想されます。

さらに、アッヴィの大ヒット生物学的製剤ヒュミラの5番目のコピーが欧州で承認され、より低価格のバイオ医薬品メーカー間の競争が激化しています。マイランと協和キリン富士フイルムバイオロジクスは、欧州委員会からヒュリオと名付けられた注射薬の販売許可を得ており、アッヴィのヒュミラに関する欧州での第一特許が切れる10月16日以降に欧州で発売する予定です。

したがって、上記の要因により、予測期間中、市場は低迷すると予想されます。

COVID-19影響分析

炎症性腸疾患市場は、COVID-19の大流行により大きな混乱に見舞われています。免疫抑制とCOVID-19に対する感受性の増加に関する懸念が、IBD患者の治療決定に影響を及ぼしています。

医師と患者は免疫抑制療法のリスクとベネフィットを比較検討しなければならなかっています。場合によっては、コルチコステロイドの使用量を減らしたり、免疫抑制剤の投与量を調整したりといった治療計画が、免疫系への潜在的な影響を最小限に抑えるために変更されました。

パンデミックはIBD臨床試験に遅延や中断をもたらしました。対面での交流が制限され、COVID-19関連の研究にリソースを優先させたため、参加者の調査、施設訪問、データ収集に影響が出ました。このため、新しいIBD治療法の開発と利用が遅れています。

一方、パンデミックは対面診療に代わる遠隔診療の普及を加速させました。多くのIBD患者がヘルスケアプロバイダーとの診察やフォローアップのために遠隔医療を利用しています。遠隔診療は継続的な診療を可能にする一方で、一般的なIBD診療の一部である健康診断や侵襲的な処置には限界があります。これらの複合的要因が炎症性腸疾患の市場力学に顕著な影響を与えています。

ロシアとウクライナの紛争分析

現在進行中のロシアとウクライナの紛争はIBD市場に大きな影響を与えています。地政学的な紛争は、医薬品の生産や流通を含む世界なサプライチェーンを混乱させる可能性があります。ロシアとウクライナの戦争中にサプライチェーンの混乱が発生した場合、IBD治療薬の供給不足や遅延につながった可能性があります。

紛争時や地政学的緊張時には、ヘルスケアの優先順位がしばしば変化します。政府やヘルスケアシステムは、緊急の危機に対応するために資源や資金を配分し、IBDのような疾患への関心や資源がそがれる可能性があります。その結果、IBDの治療法や治療法の研究開発、投資が影響を受ける可能性があります。

さらに、地政学的な対立は、貿易の途絶や各国による制裁措置の発動につながる可能性があります。貿易制限や制裁は医薬品の輸出入に影響を与え、様々な市場におけるIBD治療薬の入手可能性やコストに影響を与える可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- IBD治療薬のFDA承認の増加

- 抑制要因

- 一部のブランドIBD治療薬の特許切れ

- 機会

- 新しい治療法の研究開発

- 影響分析

- 促進要因

第5章 業界分析

- ポーターの5フォース分析

- サプライチェーン分析

- アンメットニーズ

- 規制分析

第6章 COVID-19分析

第7章 ロシア・ウクライナ戦争分析

第8章 タイプ別

- クローン病

- 潰瘍性大腸炎

第9章 投与経路別

- 経口

- 直腸経路

- 皮下経路

- 静脈内投与

第10章 薬物クラス別

- アミノサリチル酸塩

- コルチコステロイド

- TNF阻害薬

- IL阻害薬

- 抗インテグリン薬

- JAK阻害剤

- その他

第11章 流通チャネル別

- 病院薬局

- 小売薬局

- オンライン薬局

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 製品ベンチマーク

- 企業シェア分析

- 主な発展と戦略

第14章 企業プロファイル

- AbbVie Inc.

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Takeda Pharmaceutical Company Limited

- Pfizer Inc

- Biogen

- Novartis AG

- Eli Lilly Company

- Merck & Co., Inc

- Johnson & Johnson

- Biocon Ltd.

- Sanofi

第15章 付録

Market Overview

The Global Inflammatory Bowel Disease Market reached US$ 19 billion in 2022 and is projected to witness lucrative growth by reaching up to US$ 26.7 billion by 2030. The Global Inflammatory Bowel Disease Market is expected to exhibit a CAGR of 4.4% during the forecast period 2023-2030.

Inflammatory Bowel Disease (IBD) is a group of chronic disorders that cause inflammation in the digestive tract. The two main types of IBD are Crohn's disease and ulcerative colitis. Several classes of drugs are used to treat Inflammatory Bowel Disease (IBD), including anti-inflammatory medications, immunomodulating drugs, and biologics.

Furthermore, the advent of biologics and targeted therapies have revolutionized the treatment landscape for IBD, increased awareness about IBD among patients, increased healthcare expenditure in developed and developing economies and increased FDA approvals are the factors expected to drive the market over the forecast period.

Market Dynamics

The Increasing FDA Approvals of IBD Drugs are Boosting the Global Inflammatory Bowel Disease Market Growth During the Forecast Period

In April 2023, AbbVie announced the European Commission (EC) approved RINVOQ (upadacitinib, 45 mg [induction dose] and 15 mg and 30 mg [maintenance doses]) as the first oral Janus Kinase (JAK) inhibitor for the treatment of adult patients with moderately to severely active Crohn's disease who have had an inadequate response, lost response or were intolerant to either conventional therapy or a biologic agent.

Similarly, in March 2023, Sandoz, a leading global company in generic pharmaceuticals and biosimilars, received approval from the US Food and Drug Administration (FDA) for a citrate-free high-concentration formulation (HCF) of its biosimilar Hyrimoz (adalimumab-adaz) injection.

This citrate-free HCF of adalimumab is approved to treat seven conditions covered by the reference medicine Humira (adalimumab). These conditions include rheumatoid arthritis, juvenile idiopathic arthritis, psoriatic arthritis, ankylosing spondylitis, Crohn's disease, ulcerative colitis, and plaque psoriasis. Thus, from the above factors, the market is expected to drive over the forecast period.

The Expiration Of Patents for Certain Branded IBD Drugs is Hampering the Growth of the Global Inflammatory Bowel Disease Market in the Forecast Period

The expiration of patents for certain branded IBD drugs can lead to increased competition from generic versions, resulting in price erosion and reduced market share. For instance, with the expiration of the key patent on Humira by the end of 2022, regulators have approved a competitor's version of the drug, signaling the entry of more generic alternatives into the market. This increased competition is expected to drive down the price of the medication.

Furthermore, a fifth copy of AbbVie's blockbuster biologic drug Humira has been approved in Europe, intensifying competition among manufacturers of more affordable biotech drugs. Mylan and Fujifilm Kyowa Kirin Biologics have received the green light from the European Commission to market their version of the injectable medicine, named Hulio, and they plan to launch it in Europe after October 16, which marks the expiration of AbbVie's primary European patent on Humira.

Hence, owing to the above factors, the market is expected to hamper over the forecast period.

COVID-19 Impact Analysis

The inflammatory bowel disease market has experienced significant disruptions due to the COVID-19 pandemic. Concerns about immunosuppression and increased susceptibility to COVID-19 have influenced treatment decisions for IBD patients.

Physicians and patients have had to weigh the risks and benefits of immunosuppressive therapies. In some cases, treatment plans, such as reducing corticosteroid use or adjusting immunosuppressive dosages, were modified to minimize the potential impact on the immune system.

The pandemic has caused delays or disruptions in IBD clinical trials. Recruitment of participants, site visits, and data collection were affected due to restrictions on in-person interactions and prioritization of resources for COVID-19-related research. This has led to delays in the development and availability of new IBD therapies.

In contrast, the pandemic has accelerated the adoption of telemedicine as an alternative to in-person visits. Many IBD patients have turned to telemedicine for consultations and follow-ups with healthcare providers. While this has provided a means for continued care, it may have limitations regarding physical examinations and invasive procedures typically part of routine IBD care. These combined factors have had a notable impact on the inflammatory bowel disease market dynamics.

Russia-Ukraine Conflict Analysis

The ongoing conflict between Russia and Ukraine has significantly impacted the IBD market. Geopolitical conflicts can potentially disrupt global supply chains, including the production and distribution of pharmaceutical products. If supply chain disruptions occurred during the Russia-Ukraine war, it could have led to shortages or delays in the availability of IBD medications.

In times of conflict or geopolitical tensions, healthcare priorities often shift. Governments and healthcare systems may allocate resources and funding to address immediate crisis needs, potentially diverting attention and resources from conditions like IBD. Consequently, research, development, and investments in IBD treatments and therapies may be affected.

Furthermore, geopolitical conflicts can lead to trade disruptions and the imposition of sanctions by different countries. Trade restrictions or sanctions can impact the import and export of pharmaceutical products, potentially affecting the availability and cost of IBD medications in various markets.

Segment Analysis

The global inflammatory bowel disease market is segmented based on type, route of administration, drug class, distribution channel, and region.

The Aminosalicylates Segment is Expected To Hold a Dominant Position in the Market Over the Forecast Period

The aminosalicylates segment accounted for the highest market share, accounting for approximately 23.2% of the inflammatory bowel disease market in 2022. Aminosalicylates are commonly used to induce and maintain remission in mild to moderate cases of IBD, particularly in ulcerative colitis. They work by reducing inflammation in the gastrointestinal tract.

Aminosalicylates are generally well-tolerated and have a favorable safety profile. They are often used as the initial treatment for IBD, and their effectiveness varies depending on the individual and the specific disease characteristics.

Two examples of aminosalicylates used in the treatment of IBD are mesalamine (5-ASA) and sulfasalazine. Mesalamine is available in various oral and rectal formulations and is commonly prescribed for mild to moderate cases of ulcerative colitis. Sulfasalazine, a combination of sulfapyridine and 5-ASA, is primarily used to treat mild to moderate ulcerative colitis cases. Both medications work by reducing inflammation in the gastrointestinal tract.

Research conducted by Crohn's & Colitis UK in 2022 suggests 1 in every 123 people in the UK have either Crohn's disease or ulcerative colitis. This amounts to a total of nearly half a million people in the UK living with IBD. Therefore, although IBD is not that common, it still impacts many people in the UK.

Therefore, there is an increase in demand for aminosalicylates drug class. Thus , the market segment is expected to hold the largest market share over the forecast period due to the above factors.

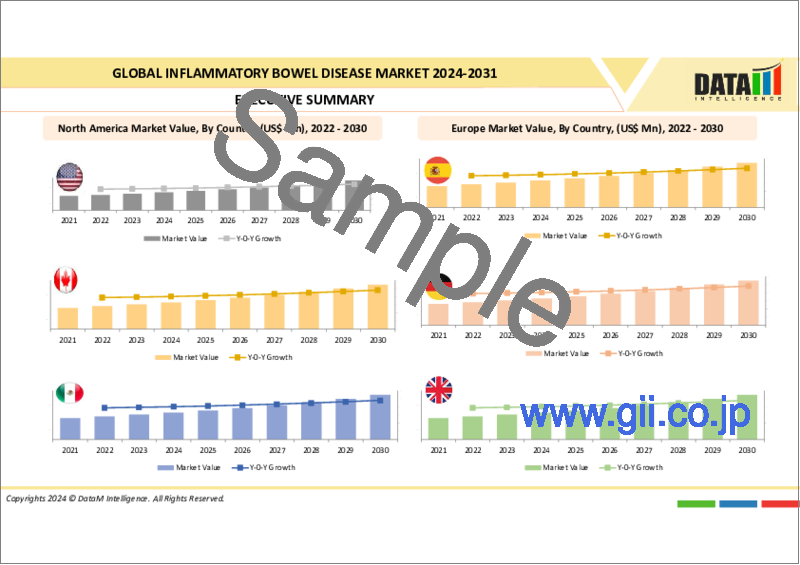

Geographical Analysis

The Growing Clinical Trials, Increasing FDA Approvals, and Better Reimbursement Policies Dominate the North American Region

North America is expected to dominate the inflammatory bowel disease market, accounting for around 40.4% of this market. For instance, Alimentiv Inc. is conducting a phase-IV open-label, randomized study involving participants with Crohn's disease (CD) in remission. The study aims to compare the effectiveness of continuing 5-ASA therapy versus withdrawing 5-ASA in maintaining CD remission over 24 months. The estimated completion date for the study is June 2026.

Furthermore, on May 9, 2023, Eli Lilly and Company has released new investigational data on mirikizumab, a potential treatment for moderately to severely active ulcerative colitis (UC). These data, presented at Digestive Disease Week (DDW) in Chicago, provide further evidence of the efficacy and safety of mirikizumab based on previous pivotal studies.

The data presented at DDW included an interim analysis of mirikizumab as induction therapy in pediatric patients with moderately to severely active UC from the Phase 2 SHINE-1 study. Additionally, a new analysis was conducted on the LUCENT-1 and LUCENT-2 studies, focusing on the association between bowel urgency remission and the impact on the quality of life in adults with UC as assessed by the Inflammatory Bowel Disease Questionnaire (IBDQ) scores.

Hence , the North American region is expected to hold the largest market share over the forecast period due to the above factors.

Competitive Landscape

The major global players in the market include: AbbVie Inc, Takeda Pharmaceutical Company Limited, Pfizer Inc, Biogen, Novartis AG, Eli Lilly Company, Merck & Co., Inc., Johnson & Johnson, Biocon Ltd., and Sanofi.

Why Purchase the Report?

- To visualize the global inflammatory bowel disease market segmentation based on the type, route of administration, drug class, distribution channel, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous inflammatory bowel disease market-level data points with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Inflammatory Bowel Disease Market Report Would Provide Approximately 69 Tables, 68 Figures And 195 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Route of Administration

- 3.3. Snippet by Drug Class

- 3.4. Snippet by Distribution Channel

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. The increasing FDA approvals of IBD drugs

- 4.1.2. Restraints

- 4.1.2.1. The expiration of patents for certain branded IBD drugs

- 4.1.3. Opportunity

- 4.1.3.1. Research and development of new therapies

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's 5 Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Unmet Needs

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Post COVID-19 & Future Scenario

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturers' Strategic Initiatives

- 6.6. Conclusion

7. Russia-Ukraine War Analysis

8. By Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 8.1.2. Market Attractiveness Index, By Type

- 8.2. Crohn's Disease*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Ulcerative colitis

9. By Route of Administration

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 9.1.2. Market Attractiveness Index, By Route of Administration

- 9.2. Oral Route*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Rectal Route

- 9.4. Subcutaneous Route

- 9.5. Intravenous Route

10. By Drug Class

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Class

- 10.1.2. Market Attractiveness Index, By Drug Class

- 10.2. Aminosalicylates*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Corticosteroids

- 10.4. TNF inhibitors

- 10.5. IL inhibitors

- 10.6. Anti-integrin

- 10.7. JAK inhibitors

- 10.8. Others

11. By Distribution Channel

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.1.2. Market Attractiveness Index, By Distribution Channel

- 11.2. Hospital Pharmacies*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Retail Pharmacies

- 11.4. Online Pharmacies

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Class

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.7.1. The U.S.

- 12.2.7.2. Canada

- 12.2.7.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Class

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.7.1. Germany

- 12.3.7.2. The U.K.

- 12.3.7.3. France

- 12.3.7.4. Italy

- 12.3.7.5. Spain

- 12.3.7.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Class

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.7.1. Brazil

- 12.4.7.2. Argentina

- 12.4.7.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Class

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.7.1. China

- 12.5.7.2. India

- 12.5.7.3. Japan

- 12.5.7.4. Australia

- 12.5.7.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Class

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Product Benchmarking

- 13.3. Company Share Analysis

- 13.4. Key Developments and Strategies

14. Company Profiles

- 14.1. AbbVie Inc.*

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. Takeda Pharmaceutical Company Limited

- 14.3. Pfizer Inc

- 14.4. Biogen

- 14.5. Novartis AG

- 14.6. Eli Lilly Company

- 14.7. Merck & Co., Inc

- 14.8. Johnson & Johnson

- 14.9. Biocon Ltd.

- 14.10. Sanofi

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us