|

|

市場調査レポート

商品コード

1297772

診断機器の世界市場-2023年~2030年Global Diagnostic Device Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 診断機器の世界市場-2023年~2030年 |

|

出版日: 2023年06月15日

発行: DataM Intelligence

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

世界の診断機器市場は、2022年に470億米ドルに達し、2030年には799億米ドルに達する好成長が予測されています。予測期間2023-2030年のCAGRは6.9%と予測されます。

診断機器は、早期発見、正確な診断、疾患のモニタリング、個別化治療、公衆衛生監視、調査を可能にすることで、ヘルスケアにおいて極めて重要な役割を果たしています。診断機器は、客観的で正確な情報を提供し、ヘルスケア専門家が正確な診断を下すのを支援します。診断機器は、長期にわたる疾患や状態のモニタリングを可能にし、ヘルスケアプロバイダーが治療の有効性を評価し、必要な調整を行うのに役立ちます。

市場力学

慢性疾患の増加が診断機器市場の成長を牽引しています

慢性疾患は、継続的な管理と医療を必要とする長期的な健康問題です。慢性疾患は、個人、ヘルスケアシステム、社会に多大な影響を及ぼす世界の健康問題です。慢性疾患は、世界中で死亡や身体障害の最大の原因となっています。

世界保健機関(WHO)によると、心血管疾患、がん、慢性呼吸器疾患、糖尿病などの慢性疾患を含む非感染性疾患(NCDs)は、全世界の死亡原因の75%近くを占めています。一方、糖尿病は血糖値の上昇を特徴とする慢性代謝疾患です。

国際糖尿病連合によると、2019年にはおよそ4億6,300万人の成人(20~79歳)が糖尿病を患っており、現在の動向が続けば、この数字は2045年までに7億人に上ると予想されています。そして、これらの要因が市場拡大に寄与しています。

高価な処置と機器が市場成長の妨げになります

診断機器のコストは、機器の種類、複雑さ、機能、ブランド、購入地域など、さまざまな要因によって大きく変動します。例えば、超音波診断装置は音波を利用して体内構造の画像を生成します。超音波診断装置の価格は、使用目的や機能によって大きく異なります。ポータブルやハンドヘルドの超音波装置は3,000ドルから15,000ドル程度ですが、医療施設で使用されるカートを使ったハイエンドのシステムは数万米ドル以上することもあります。したがって、処置にかかるコストが市場成長の妨げとなります。

COVID-19影響分析

COVID-19のパンデミックは診断機器とその使用に広範な影響を与えました。例えば、パンデミックはCOVID-19診断検査に対するこれまで聞いたことのない需要を促しました。COVID-19感染は、PCR装置や迅速抗原アッセイなどの診断ツールを用いて検出・診断されています。検査需要の増加により、これらの機器の製造と使用が世界中で増加しています。

COVID-19パンデミックは診断機器の状況に大きな影響を与え、需要の増加、技術の進歩、サプライチェーンの問題、焦点の転換、規制手順の変更などをもたらしました。これらの変化は、パンデミック管理に対する短期的な影響と、診断技術とヘルスケア提供に対する長期的な影響を持っています。

ロシア・ウクライナ戦争の影響分析

ロシア・ウクライナ戦争は、この地域における主要な市場プレイヤーの不在と普及率の低さから、世界の診断機器市場に与える影響は最小限と推定されます。しかし、原材料、検査製品、機器の輸出入の影響は、予測期間中、世界の診断機器市場にほとんど影響を与えないと予測されます。

人工知能の影響分析

人工知能は世界の子癇前症市場にプラスの影響を与えると予想されます。AI対応診断ガジェットは、治療結果が通常より良好である早期に疾患を診断することができます。これらの機器は患者データを継続的に監視・分析し、健康指標の異常や変化をリアルタイムで検出することができます。早期発見により迅速な対応が可能となり、病気の発症を抑え、予後を改善することができます。

目次

第1章 調査手法と調査範囲

- 調査手法

- 調査目的と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 慢性疾患の有病率の上昇

- メディカルイメージングにおける先端技術の採用増加

- 抑制要因

- 高価な手順と機器

- 機会

- 技術の進歩が診断機器の新たな可能性を切り開く

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- アンメットニーズ

- 規制分析

第6章 COVID-19分析

第7章 ロシア・ウクライナ戦争分析

第8章 人工知能の影響分析

第9章 製品タイプ別

- X線イメージングシステム

- X線デジタルイメージングシステム

- X線アナログイメージングシステム

- コンピュータ断層撮影(CT)スキャナー

- 従来型CTシステム

- コーンビームCTシステム(CBCT)

- 超音波システム

- 2D超音波

- 3Dおよび4D超音波

- ドップラー超音波

- 磁気共鳴画像(MRI)システム

- クローズドMRI

- オープンMRI

- 核医学イメージング・システム

- SPECTシステム

- ハイブリッドPETシステム

- マンモグラフィ装置

第10章 用途別

- 整形外科

- 神経学

- 腫瘍学

- 産科/婦人科

- 循環器科

- 歯科

- その他

第11章 エンドユーザー別

- 病院

- 画像診断センター

- その他

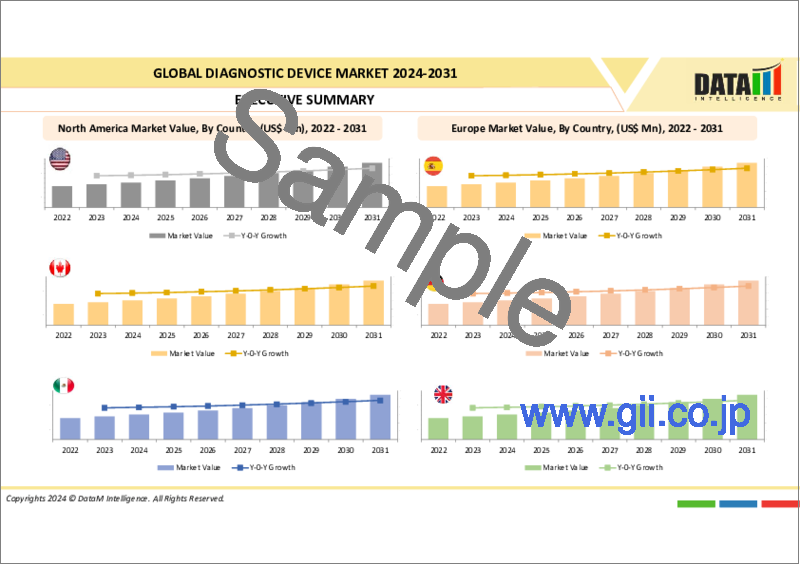

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市場シェア分析

- M&A分析

第14章 企業プロファイル

- GE Healthcare

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Siemens Healthineers

- Koninklijke Philips N.V

- Canon Medical Systems Corporation

- Carestream Health, Inc

- Hologic, Inc

- Allengers Medical Systems

- SternMed

- Neusoft Medical Systems

- Medtronic Plc.

第15章 付録

Market Overview

The Global Diagnostic Device Market reached US$ 47 billion in 2022 and is projected to witness lucrative growth by reaching up to US$ 79.9 billion by 2030. The market is expected to exhibit a CAGR of 6.9% during the forecast period 2023-2030.

Diagnostic devices play a pivotal role in healthcare by enabling early detection, accurate diagnosis, monitoring of diseases, personalized treatment, public health surveillance, and research. Diagnostic devices provide objective and precise information, assisting healthcare professionals in making accurate diagnoses. Diagnostic devices enable the monitoring of diseases and conditions over time, helping healthcare providers assess the effectiveness of treatments and make necessary adjustments.

MarketDynamics

The Rise in chronic disease prevalence is driving the growth of the Diagnostic Device Market.

Chronic diseases are long-term health issues that necessitate continuing management and medical care. They are a major worldwide health concern with far-reaching consequences for individuals, healthcare systems, and society. Chronic diseases are the biggest cause of death and disability around the world.

Noncommunicable diseases (NCDs), which include chronic diseases such as cardiovascular disease, cancer, chronic respiratory diseases, and diabetes, account for nearly 75% of all deaths worldwide, according to the World Health Organisation (WHO). Diabetes, on the other hand, is a chronic metabolic condition characterised by elevated blood sugar levels.

According to the International Diabetes Federation, roughly 463 million adults (20-79 years) had diabetes in 2019, and this figure is expected to climb to 700 million by 2045 if current trends continue. And these factors contribute to market expansion.

Expensive procedures and equipment will hamper the market growth.

The cost of diagnostic devices can vary significantly depending on various factors, including the type of device, its complexity, features, brand, and the region in which it is being purchased. For instance, Ultrasound machines use sound waves to produce images of the body's internal structures. The cost of ultrasound machines can vary significantly depending on their intended use and features. Portable or handheld ultrasound devices may range from $3,000 to $15,000, while high-end, cart-based systems used in medical facilities can cost tens of thousands or more. And thus the cost of procedures will hamper the market growth.

COVID-19 Impact Analysis

The pandemic of COVID-19 has had an extensive effect on diagnostic devices and their use. For example, the pandemic prompted a hitherto unheard-of demand for COVID-19 diagnostic testing. COVID-19 infections have been detected and diagnosed using diagnostic tools such as PCR equipment and rapid antigen assays. The increased demand for testing has increased the manufacturing and use of these devices worldwide.

The COVID-19 pandemic has substantially impacted the diagnostic device landscape, resulting in increased demand, technological advances, supply chain issues, shifts in focus, and regulatory procedure modifications. These changes have short-term ramifications for pandemic management and long-term implications for diagnostic technologies and healthcare delivery.

Russia-Ukraine War Impact Analysis

The Russia-Ukraine is estimated to have a minimal impact on the global diagnostic device market owing to the low prevalence and absence of key market players in this region. However, the effect of the import and export of raw materials, test products, and devices is anticipated to have little influence over the global diagnostic device market in the forecast period.

Artificial Intelligence Impact Analysis

Artificial intelligence is anticipated to impact the global preeclampsia market positively. AI-enabled diagnostic gadgets can diagnose diseases earlier when treatment outcomes are usually better. These devices can continually monitor and analyze patient data, allowing for real-time detection of irregularities or changes in health indices. Early discovery allows quick action, which may reduce illness development and improve prognosis.

Segment Analysis

The Global Diagnostic Device Market is segmented based on product type, application, end-user and region.

The ultrasound systems segment is estimated to hold most of the diagnostic device market share during the forecast period.

The ultrasound systems ' product type holds about 38.6% of the total diagnostic device market in the forecast period. Ultrasound systems are versatile diagnostic equipment that generates real-time images of the body's internal components using high-frequency sound waves.

They are commonly employed in a variety of medical professions and clinical situations. In radiology, ultrasound is commonly used to evaluate various organs and tissues. It's perfect for imaging soft tissues, including the liver, kidneys, gallbladder, spleen, and thyroid.

And manufacturers are launching new products and highly investing by collaborating with other players to expand their portfolio globally.For instance, on August 26, 2021, Probo Medical, a global leader in medical imaging equipment, parts, repair, and service, has agreed to become an authorised distributor of Mindray North America's ultrasound solutions.

Probo will provide clinicians with immediate and direct access to a wide range of Mindray's unique, category-leading ultrasound imaging instruments and accompanying accessories as a result of this collaboration. And as a result, the market is driven by the leading players' product launches.

Geographical Analysis

During the forecast period, Europe is estimated to hold the second-largest Global Diagnostic Device Market share.

Europe holds the second-largest Global Diagnostic Device Market share, accounting for approximately 28.9% in the forecast period. The greying of Europe is a demographic phenomenon typified by a decline in fertility, a decrease in mortality rate, and a higher life expectancy among European populations. Furthermore, Europe's population is quickly aging, with a growing number of older people.

People's chance of developing chronic diseases such as cardiovascular disease, cancer, diabetes, and respiratory ailments rises as they age. The aging population places a substantial strain on healthcare systems in terms of managing and treating chronic illnesses. For instance, according to World Economic Forum 2022, the European Union and other countries will likely face rapidly aging populations. By 2100, more than 30% of the EU population will be 65 or older. This demographic shift can potentially alter the region's economic prospects significantly.

Competitive Landscape

The major global players in the market include: GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V, Canon Medical Systems Corporation, Carestream Health, Inc, Hologic, Inc, Allengers Medical Systems, SternMed, Neusoft Medical Systems, Medtronic Plc, among others.

Why Purchase the Report?

- To visualize the Global Diagnostic Device Market segmentation based on product type, application, end user and region and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous diagnostic device market-level data points with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Diagnostic Device Market Report Would Provide Approximately 53 Tables, 54 Figures And 195 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product type

- 3.2. Snippet by Application

- 3.3. Snippet by End User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rise in the Prevalence of Chronic Diseases

- 4.1.1.2. Increased Adoption of Advanced Technologies in Medical Imaging

- 4.1.2. Restraints

- 4.1.2.1. Expensive Procedures and Equipment

- 4.1.3. Opportunity

- 4.1.3.1. Advances in technology have opened up new possibilities in diagnostic devices

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Unmet Needs

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario before COVID-19

- 6.1.2. Scenario during COVID-19

- 6.1.3. Post COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturers' Strategic Initiatives

- 6.6. Conclusion

7. Russia-Ukraine War Analysis

8. Artificial Intelligence Impact Analysis

9. By Product type Type

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product type

- 9.1.2. Market Attractiveness Index, By Product type

- 9.2. X-ray Imaging Systems

- 9.2.1. X-ray Digital Imaging Systems

- 9.2.2. X-ray Analog Imaging Systems

- 9.2.3. Introduction

- 9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Computed Tomography (CT) Scanners

- 9.3.1. Conventional CT systems

- 9.3.2. Cone Beam CT Systems (CBCT)

- 9.4. Ultrasound Systems

- 9.4.1. 2D Ultrasound

- 9.4.2. 3D and 4D Ultrasound

- 9.4.3. Doppler Ultrasound

- 9.5. Magnetic Resonance Imaging (MRI) Systems

- 9.5.1. Closed MRI

- 9.5.2. Open MRI

- 9.6. Nuclear Imaging Systems

- 9.7. SPECT Systems

- 9.8. Hybrid PET Systems

- 9.9. Mammography Systems

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Orthopedic

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Neurology

- 10.4. Oncology

- 10.5. Obstetrics/Gynecology

- 10.6. Cardiology

- 10.7. Dental

- 10.8. Others

11. By End User

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 11.1.2. Market Attractiveness Index, By End User

- 11.2. Hospitals

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Diagnostic Imaging Centers

- 11.4. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product type

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.6.1. The U.S.

- 12.2.6.2. Canada

- 12.2.6.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product type

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.6.1. Germany

- 12.3.6.2. The U.K.

- 12.3.6.3. France

- 12.3.6.4. Italy

- 12.3.6.5. Spain

- 12.3.6.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product type

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.6.1. Brazil

- 12.4.6.2. Argentina

- 12.4.6.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product type

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.6.1. China

- 12.5.6.2. India

- 12.5.6.3. Japan

- 12.5.6.4. Australia

- 12.5.6.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product type

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. GE Healthcare

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. Siemens Healthineers

- 14.3. Koninklijke Philips N.V

- 14.4. Canon Medical Systems Corporation

- 14.5. Carestream Health, Inc

- 14.6. Hologic, Inc

- 14.7. Allengers Medical Systems

- 14.8. SternMed

- 14.9. Neusoft Medical Systems

- 14.10. Medtronic Plc.

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us