|

|

市場調査レポート

商品コード

1247429

電動工具の世界市場-2023-2030Global Power Tools Market - 2023-2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 電動工具の世界市場-2023-2030 |

|

出版日: 2023年03月28日

発行: DataM Intelligence

ページ情報: 英文 200 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

市場概要

電動工具の世界市場は、予測期間(2023年~2030年)に7.2%のCAGRで成長しています。

電動工具は、電気モーター、圧縮空気モーター、ガソリンエンジンを動力源としています。電動工具は、組み立てや生産ライン、DIYプロジェクト、修理やメンテナンス、その他多くの梱包作業など、さまざまな機能や用途で広く活用されています。その電動工具は、様々な作業において、より効果的なハンドリングと操作を可能にし、時間を短縮し、様々な労働需要を満たすことができます。さらに、生産性と収益性の向上にも大きく貢献しています。いくつかの大きな力が、予測期間中、さまざまな産業で業界を前進させています。

世界中の鉄道、空港、道路、商業施設や住宅などの建設業界の成長は、電動工具の需要を増加させています。このように、建設分野での需要の高まりは、主要企業の事業への投資を促しています。例えば、2023年1月、木工、建設、金属加工業界向けの電動工具のサプライヤーとして成長を続けるボッシュ・パワー・ツールズ・インドは、アングルグラインダーの堅牢な製品ラインに加え、新しい電動工具「GWS 800 Professional」を発表しました。この製品の発売により、インドにおけるBosch Power Toolsの現地化シェアは2023年に55%に達すると予想されます。

市場力学

建設業界における先進技術の導入が進んでいること

ここ数年、建設業界では、電動工具の成長見通しが高まっています。建設業界における電動工具の需要の要因は、これらの工具をより強力で効率的かつ多用途なものにする新技術の開発です。例えば、コードレス電動工具は、使い勝手がよく、コンセントを必要としないため、ますます人気が高まっています。さらに、多くの電動工具にBluetooth接続などのスマート機能が搭載され、スマートフォンから工具を監視・制御できるようになりました。新興国における建設業の成長も、電動工具の需要を後押ししています。新興経済諸国の発展に伴い、建設プロジェクトが増加し、その結果、電動工具のニーズが高まっています。

高い製品コストとメンテナンスコスト

電動工具のメンテナンスコストは、定期的なメンテナンスと部品交換が必要なため、高くなります。例えば、コードレス工具の電池は数回の充電で交換する必要があり、メンテナンス費用がかさみます。同様に、モーター、ギア、ベアリングなど他の部品も消耗により交換が必要な場合があり、メンテナンスコストはさらに増加します。

また、修理やメンテナンスには、熟練した技術者でなければできない専門的な訓練や知識が必要であるため、個人で修理することが難しく、メンテナンスコストがさらに増加します。

COVID-19影響度分析

COVID-19分析では、COVID前シナリオ、COVIDシナリオ、COVID後シナリオに加え、価格力学(パンデミック時やCOVID前シナリオとの比較による価格変動を含む)、需要-供給スペクトラム(取引制限や封鎖、その後の問題による需要と供給のシフト)、政府の取り組み(政府機関による市場、セクター、産業の活性化に関する取り組み)、メーカーの戦略的取り組み(COVID問題を軽減するためのメーカーの取り組み)についても解説しています。

目次

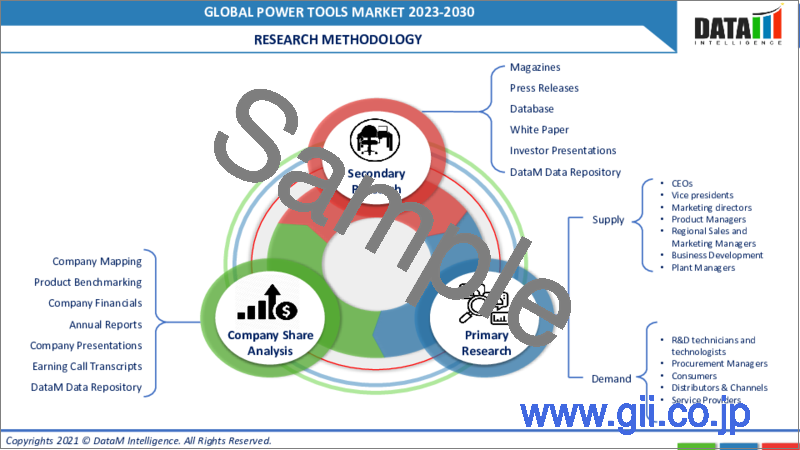

第1章 調査手法とスコープ

- 調査手法

- 調査目的および調査範囲について

第2章 定義と概要

第3章 エグゼクティブサマリー

- ツール別スニペット

- モード別スニペット

- アプリケーション別スニペット

- 地域別スニペット

第4章 ダイナミックス

- インパクトのあるファクター

- 促進要因

- 建設業界における先進技術の導入が進んでいること

- 抑制要因

- 高い製品コストとメンテナンスコスト

- 機会

- 影響度分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格アナリシス

- レギュラトリー・アナリシス

第6章 COVID-19の分析

- COVID-19の解析について

- COVID-19シナリオ前

- 現在のCOVID-19シナリオ

- ポストCOVID-19またはフューチャーシナリオ

- COVIDの中での価格ダイナミクス-19

- 需給スペクトル

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的な取り組み

- 結論

第7章 ツール別

- ドリル&ファスニングツール

- インパクトドライバ

- ドリル

- インパクトレンチ

- ドライバーとナットランナー

- 解体用工具

- 鋸・切削工具

- ジグソーパズル

- レシプロジョー

- サーキュラーソー

- バンドソー

- 材料除去ツール

- ルーティングツール

- その他

第8章 動作モード別

- 電気

- ニューマチック

- その他

第9章 アプリケーション別

- 非住宅用

- 住宅用

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ地域

第11章 競合情勢について

- 競合シナリオ

- 市況分析・シェア分析

- M&A分析

第12章 企業プロファイル

- Robert Bosch GmbH

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な展開

- Techtronic Industries

- Stanley Black & Decker, Inc.

- Emerson Electric Co

- Hilti Group

- Koki Holdings Co., Ltd.

- Panasonic

- Husqvarna Group

- Apex Tool Group, LLC

- Makita

第13章 付録

Market Overview

The global power tools market reached US$ XX million in 2022 and is projected to witness lucrative growth by reaching up to US$ XX million by 2030. The market is growing at a CAGR of 7.2% during the forecast period (2023-2030).

Power tools are powered by an electric motor, a compressed air motor or a petrol engine. Power tools are extensively utilized in various functions and applications, including assembly and production lines, DIY projects, repair and maintenance and many other packaging tasks. Its power tools enable more effective handling and operation across various tasks while reducing time and fulfilling various labor demands. Additionally, it greatly aids in increasing production and profitability. A few major forces are driving the industry forward across various industries in the forecast period.

Growing the construction industry, including railways, airports, roads and commercial and residential buildings across the globe, has increased the demand for power tools. Thus, growing demand for the construction sector has encouraged key players to invest in the business. For instance, in January 2023, Bosch Power Tools India, a growing supplier of power tools for the woodworking, construction and metalworking industry, introduced its new power tool, the GWS 800 Professional, adding to its robust line of angle grinders. The product launch is expected to increase the localization share of Bosch Power Tools in India will reach 55% in 2023.

Market Dynamics

The growing adoption of advanced technologies in the construction industry

In the past few years, the construction industry has shown incremental growth prospects for power tools. The factor contributing to the demand for power tools in the construction industry is the development of new technologies that make these tools more powerful, efficient and versatile. For example, cordless power tools are becoming increasingly popular because they are easy to use and don't require a power outlet. Additionally, many power tools now come with smart features such as Bluetooth connectivity, which allows users to monitor and control their tools from a smartphone. The growth in the construction industry in emerging economies also drives the demand for power tools. As these economies continue to develop, more and more construction projects are being undertaken, which results in a greater need for power tools.

High product and maintenance cost

Power tool maintenance costs are high due to the need for regular maintenance and replacement of parts. For instance, the batteries of cordless tools need to be replaced after a few charges, adding to the maintenance costs. Similarly, other parts such as motors, gears and bearings may also need to be replaced due to wear and tear, further increasing maintenance costs.

Moreover, the need for skilled technicians to maintain and repair these tools adds to the maintenance costs because specialized training and knowledge are required to repair and maintain these tools, which skilled technicians can only provide; this makes it difficult for individuals to repair their tools, further increasing maintenance costs.

COVID-19 Impact Analysis

The COVID-19 Analysis includes Pre-COVID Scenario, COVID Scenario and Post-COVID Scenario along with Pricing Dynamics (Including pricing change during and post-pandemic comparing it with pre-COVID scenarios), Demand-Supply Spectrum (Shift in demand and supply owing to trading restrictions, lockdown and subsequent issues), Government Initiatives (Initiatives to revive market, sector or Industry by Government Bodies) and Manufacturers Strategic Initiatives (What manufacturers did to mitigate the COVID issues will be covered here).

Segment Analysis

The global power tools market is segmented by tool, mode of operation, application and region.

Rising demand for portable power drills for light-duty work and do-it-yourself projects

Drilling and fastening tools in the power tools market are expected to hold a significant global market share. For many construction and maintenance operations, drilling and fastening equipment are vital because they make holes and hold materials in place. Its tools include drilling holes in walls & floors, attaching frames to concrete and fastening wood & metal materials together and available in various sizes and varieties.

Hammer drills, rotary hammers and hand-held power drills are examples of drilling tools. The devices make holes in various materials, including concrete, metal and wood. Portable power drills are useful instruments for light-duty work and do-it-yourself projects. On the other hand, hammer drills and rotary hammers are more potent and are frequently employed for labor-intensive activities like drilling holes in concrete. Major tools include impact drivers, drills, impact wrenches and screwdriver & nut runners.

Geographical Analysis

Asia-Pacific's swift-paced growth in the construction market

Developing the construction industry in emerging Asian-Pacific economies drives the demand for drilling and fastening tools. Countries such as India, China and Indonesia are undertaking large-scale infrastructure development projects, which require using these tools.

The government initiatives to promote the Asian-Pacific construction industry are also boosting the demand for drilling and fastening tools. For example, the Indian government's 'Housing for All' initiative, which aims to provide affordable housing to the country's population, is expected to drive the demand for these tools.

Major power tool manufacturers are investing in Asia-Pacific due to the abovementioned factors. They also adopt major market tactics to achieve a substantial market presence in the region. For instance, Bosch Power Tools India added the GWS 800 Professional to their extensive line of angle grinders on January 19, 2023. Additionally, Bosch Power Tools' localization share in India will increase to 55% with this launch in 2023. The new grinder offers consumers a superior experience for grinding and cutting thanks to its high material removal rate, 800W motor, lightweight, ergonomic body with back switch and dual air intake cooling system.

Competitive Landscape

The major global players in the market include Robert Bosch GmbH, Techtronic Industries, Stanley Black & Decker, Inc, Emerson Electric Co, Hilti Group, Koki Holdings Co., Ltd, Panasonic, Husqvarna Group, Apex Tool Group, LLC and Makita.

Why Purchase the Report?

- To visualize the global power tools market segmentation based on tool, mode of operation, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of Power Tools market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global Power Tools market report would provide approximately 61 tables, 58 figures and 200 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Tool

- 3.2. Snippet by Mode of Operation

- 3.3. Snippet by Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. The growing adoption of advanced technologies in the construction industry

- 4.1.1.2. XX

- 4.1.2. Restraints

- 4.1.2.1. High product and maintenance cost

- 4.1.2.2. XX

- 4.1.3. Opportunity

- 4.1.3.1. XX

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Before COVID-19 Scenario

- 6.1.2. Present COVID-19 Scenario

- 6.1.3. Post COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Tool

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tool

- 7.1.2. Market Attractiveness Index, By Tool

- 7.2. Drilling and Fastening Tools*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.3. Impact Drivers

- 7.2.4. Drills

- 7.2.5. Impact Wrenches

- 7.2.6. Screwdriver and Nut runners

- 7.3. Demolition Tools

- 7.3.1. Sawing and Cutting Tools

- 7.3.2. Jigsaws

- 7.3.3. Reciprocating Jaws

- 7.3.4. Circular Saws

- 7.3.5. Band Saws

- 7.4. Material Removal Tools

- 7.5. Routing Tools

- 7.6. Others

8. By Mode of Operation

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Mode of Operation

- 8.1.2. Market Attractiveness Index, By Mode of Operation

- 8.2. Electric*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Pneumatic

- 8.4. Others

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Non-residential*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Residential

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tool

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Mode of Operation

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tool

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Mode of Operation

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Russia

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tool

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Mode of Operation

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tool

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Mode of Operation

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tool

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Mode of Operation

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Robert Bosch GmbH*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Techtronic Industries

- 12.3. Stanley Black & Decker, Inc.

- 12.4. Emerson Electric Co

- 12.5. Hilti Group

- 12.6. Koki Holdings Co., Ltd.

- 12.7. Panasonic

- 12.8. Husqvarna Group

- 12.9. Apex Tool Group, LLC

- 12.10. Makita

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us