|

|

市場調査レポート

商品コード

1208643

タイヤコードの世界市場-2022-2029Global Tire Cord Market - 2022-2029 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| タイヤコードの世界市場-2022-2029 |

|

出版日: 2023年02月01日

発行: DataM Intelligence

ページ情報: 英文 214 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

市場の概要

タイヤコードの世界市場規模は、予測期間(2022-2029年)内にCAGR17.6%で成長すると予測されています。

タイヤコードは、タイヤの形状を維持するために使用されるタイヤを補強するものです。タイヤコードの主な素材は、ナイロン、アラミド、ポリエステル、スチール、レーヨン、ハイブリッドです。これらの材料は、変形や耐摩耗性の制御、高い引張強度など、いくつかの有益な特性を備えており、コア部品としての使用に寄与しています。タイヤコードは、ゴムタイヤを強力にサポートする重要な部品です。タイヤの形状を維持し、車両全体の重量を支え、伸びと吸収性能を提供するため、タイヤコードは重要なタイヤ部品となっています。

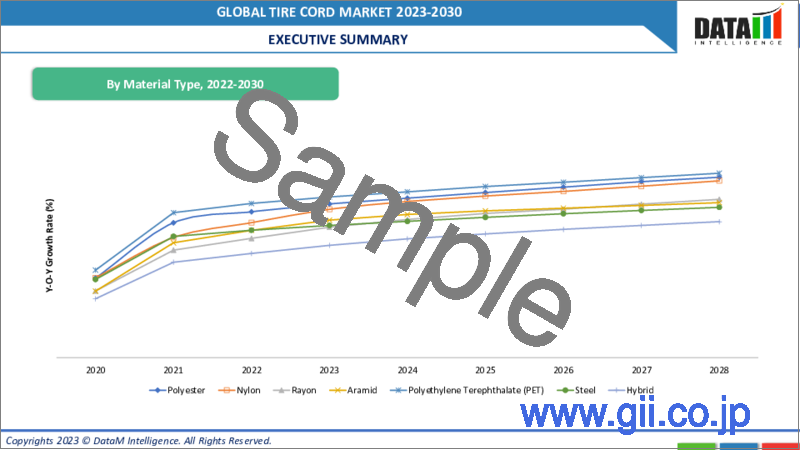

タイヤコード市場は、材料の種類によって、ナイロン、ポリエステル、レーヨン、ハイブリッド、ポリエチレンテレフタレート(PET)に区分されます。ナイロンは、高い強靭性、靭性、優れた耐疲労性、ゴムとの優れた接着性により、最も高い市場成長の可能性を示しています。タイヤカテゴリー別では、世界の乗用車の生産台数の増加により、ラジアルタイヤが最も速いペースで成長しています。ラジアルタイヤはバイアスプライタイヤとは異なるバネ性を持ち、ステアリングスリップの度合いも異なります。

市場力学

環境に優しい製造業への需要の高まりが、タイヤコードの市場シェアを拡大しています。

環境に配慮した製造への需要が、世界のタイヤコードを牽引しています。さらに、持続可能な製造技術は、多くのメーカーに財政的、環境的、製品品質的な大きなメリットをもたらします。そのため、コンチネンタル、コルサ、帝人などの大手企業は、持続可能性と環境のために環境に優しいタイヤを製造し、規制機関を遵守するために、さまざまなサステナブルな実践に取り組んできました。

例えば、帝人ファイバー株式会社は2008年、東洋ゴムの環境対応型乗用車用タイヤ「Proxes Ne」のコードにケミカルリサイクルされたポリエステル繊維「エコペットプラス」の供給を開始すると発表しています。環境に配慮した持続可能なタイヤ製造の採用は、コストや廃棄物の削減による経営効率の向上、新規顧客への対応や競争力の強化、ブランドや評判の保護・強化、社会的信頼の構築、環境破壊を引き起こすことなく規制の制約やチャンスに対応することに貢献します。

政府の継続的な支援を受けて、廃棄物の新たな機会を創出するために、研究開発の驚異的な成長が行われています。2019年、Kordsa Technik Teksil A.S.とContinental A.G.は、繊維補強材を接着するためのゴム化合物による持続可能な技術を開発しました。この技術は、タイヤコード材料への使用を目的としています。さらに2016年には、Kordsa Teknik Tekstil A.S.が、人体に影響を与える有害化学物質を関与させない持続可能で革新的なアプローチに基づくグリーンタイヤコード生地製品を発売しました。

さらに、企業は、2021年9月6日、コンチネンタルはIAA MOBILITY 2021で革新的なConti GreenConceptタイヤコンセプトを発表するなど、新しい持続可能な技術をもたらしています。持続可能性を追求するコンチネンタルの幅広い活動を示すもう一つの例として、このプレミアムタイヤメーカーによるコンセプト研究は、乗用車用の持続可能なタイヤを製造するための現行技術と新技術のアプローチを組み合わせています。

厳しい規制の高まりとタイヤコードの普及率の低さがタイヤコード市場の成長を制限する

タイヤコード市場は、タイヤの製造に必要な原材料のコストシフトに大きく影響されます。メーカーは、コスト構造を確立する際に、原材料のコストと入手可能性を慎重に検討する必要があります。

タイヤコードの原材料であるナイロンやポリエチレンは、石油由来の原料から生産されているため、価格変動の影響を受けます。原油価格は過去10年間高いボラティリティで推移しており、世界の需要増がタイヤコード市場のコスト構造に影響を及ぼしています。

さらに、タイヤが自治体の固形廃棄物全体に占める割合は2%未満ですが、米国環境保護庁によると、2007年だけで約500万トンのタイヤゴミが発生し、平均してタイヤゴムの約35%しかリサイクルされていません。11の州だけが、すべてのタイヤゴミを埋立地に捨てることを禁止しており、その結果、すでに負担の大きい埋立地に何百万トンものタイヤゴミが投棄されているのです。しかし、タイヤは技術の進歩により小型化し、耐久性も向上したため、リサイクルされるタイヤの量は増え、埋立地は減少しています。

COVID-19影響度分析

COVID-19のパンデミックは世界中に大きな被害をもたらし、これまでに5,500万人以上の感染が報告され、その数はさらに増えています。中国やシンガポールなどの東南アジア諸国では流行を抑えていますが、欧州のいくつかの国では第二波、第三波の影響を受け、閉鎖的な状況になっています。米国は世界で最も被害が大きい国の一つで、2021年10月まで患者数が増加しています。

長期化が予想される景気後退の影響は、自動車業界にも波及し、サプライチェーンやオペレーションに大きな打撃を与えています。COVID-19の流行により、2020年の世界の商用車生産台数(GVW4-8)は2019年比で22%(65万台以上)減少し、260万台になると予想されます。

個々の地域の予測は減少傾向にあり、ウイルスの影響により、世界各地で生産拠点やサプライヤー拠点が閉鎖されるなど、サプライチェーンへの影響が見られます。

中国の自動車産業は、いくつかの浮き沈みを示してきました。多くの自動車ディーラーがパンデミックの初期に廃業を余儀なくされ、その結果、顧客訪問数が前年比60%減となりました。中国の自動車OEM工場の閉鎖は、最終的に世界のサプライチェーン全体に波及しました。

このように自動車産業の生産量と需要の大幅な落ち込みは、特に2019-2020年の期間、タイヤコード市場に直接影響を及ぼしました。しかし、状況は正常な状態に戻りつつあります。予測期間中のタイヤコードの改善と相まって、自動車産業市場の復活が予想されます。

目次

第1章 タイヤコードの世界市場の調査手法と範囲

- 調査手法

- 調査目的・調査範囲

第2章 タイヤコードの世界市場-市場の定義と概要

第3章 タイヤコードの世界市場- エグゼクティブサマリー

- 素材別市場内訳

- プロセス別市場内訳

- タイヤ別市場内訳

- 用途別市場内訳

- 地域別市場内訳

第4章 タイヤコードの世界市場-市場力学

- 市場影響要因

- 促進要因

- 環境に優しい製造への要求の高まりがタイヤコード市場のシェアを拡大

- 抑制要因

- 厳しい規制の高まりとタイヤコードの普及率の低さが、タイヤコード市場の成長を制限しています。

- ビジネスチャンス

- 影響分析

- 促進要因

第5章 タイヤコードの世界市場-産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格設定分析

- 規制分析

第6章 タイヤコードの世界市場-COVID-19分析

- COVID-19の市場分析

- COVID-19市場参入前のシナリオ

- COVID-19の現在の市場シナリオ

- COVID-19の後、または将来のシナリオ

- COVID-19の中での価格ダイナミクス

- 需要-供給スペクトラム

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的な取り組み

- まとめ

第7章 タイヤコードの世界市場- 素材別

- ポリエステル

- ナイロン

- レーヨン

- アラミド

- ポリエチレンテレフタレート(PET)

- スチール

- ハイブリッド

第8章 タイヤコードの世界市場- 加工別

- 繊維

- 糸撚り

- 織布

- ディッピング

第9章 タイヤコードの世界市場-タイヤ別

- ラジアル

- バイアス

第10章 タイヤコードの世界市場-用途別

- 小型商用車

- 乗用車

- 大型車

- その他

第11章 タイヤコードの世界市場-地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ地域

第12章 タイヤコードの世界市場- 競争情勢

- 競合シナリオ

- 市況分析/シェア分析

- M&A(合併・買収)分析

第13章 タイヤコードの世界市場-企業プロファイル

- Indorama Ventures

- 企業概要

- エンドユーザー向けポートフォリオと説明

- 主なハイライト

- 財務概要

- SRF Limited

- Kolon Industries Inc

- Tire Cord USA

- TEIJIN LIMITED

- HYOSUNG

- Kordsa Teknik Tekstil A.S.

- Toray Hybrid Cord, Inc

- Century Enka Limited

- Firestone Fibers & Textile Company

第14章 タイヤコードの世界市場-重要考察

第15章 タイヤコードの世界市場- DataM

Market Overview

The global tire cord market size was worth US$ XX million in 2021 and is estimated to reach US$ XX million by 2029, growing at a CAGR of 17.6% within the forecast period (2022-2029).

Tire cords reinforce the tired used to maintain a tire's shape. Tire cords are primarily made of nylon, aramid, polyester, steel, rayon and hybrid. These materials offer several beneficial properties: controlled deformation and abrasion resistance and high tensile strength, contributing to their use as core components. The tire cord is crucial in providing strong support to rubber tires. It offers support and aids in the maintenance of tire form, handles a vehicle's overall weight & provides elongation and absorption performance, thus, making it a crucial tire element.

Based on material type, the tire cord market is segmented into Nylon, Polyester, Rayon, Hybrid and Polyethylene Terephthalate (PET). Nylon has shown the highest market growth potential due to its high tenacity, toughness, superior fatigue resistance and good adhesion to rubber. Based on the Tire category, the Radial segment is growing at the fastest pace in the market owing to the rising production of passenger cars across the globe. Radial tires have different springiness characteristics than bias-ply tires and a different degree of steering slip.

Market Dynamics

Growing demand for eco-friendly manufacturing has escalated the tire cord market share.

Growing demand for eco-friendly manufacturing has escalated the tire cord market share

The demand for eco-friendly manufacturing is driving the global tire cord. Furthermore, Sustainable manufacturing technologies provide significant financial, environmental and product quality benefits to many manufacturers. Therefore, leading companies such as Continental, Kordsa and Teijin have been working on various sustainable practices to manufacture eco-friendly tires for sustainability and the environment and adhere to the regulatory bodies.

For instance, long back (2008), Teijin Fibers Limited announced to start of supplying chemically recycled Ecopet Plus polyester fibers for the cords of Toyo Tire & Rubber's Proxes Ne tires, which are special tires designed for environmentally oriented passenger cars. Adopting eco-friendly and sustainable tire manufacturing helps to improve operational efficiency by reducing costs and waste, responding to or reaching new customers and increasing competitive advantage, protecting and strengthening brand and reputation, building public trust and responding to regulatory constraints and opportunities without causing environmental damage.

Tremendous growth in research and development is being conducted to create new opportunities for waste with continuous government support. In 2019, Kordsa Technik Teksil A.S. and Continental A.G. developed a sustainable technology with rubber compounds for bonding textile reinforcing materials. The technology is aimed at use in tire cord materials. Moreover, in 2016, Kordsa Teknik Tekstil A.S. launched its green tire cord fabric product based on its sustainable and innovative approach without the involvement of toxic chemicals that affect human health.

Furthermore, companies are also bringing new sustainable technologies such as; on September 6, 2021; Continental unveiled its innovative Conti GreenConcept tire concept at IAA MOBILITY 2021. As another illustration of Continental's wide-ranging operations in pursuit of sustainability, this conceptual study by the premium tire maker combines current and new technology approaches to producing sustainable tires for passenger cars.

Growing stringent regulations and lesser penetration of tire cords restrict the growth of the tire cord market

The market for tire cords is significantly affected by shifts in the cost of the raw materials required to make tires. Manufacturers must carefully consider the cost and availability of raw materials when establishing their cost structure.

Tire cords' raw materials, such as nylon and polyethylene, are produced from petroleum-based derivatives and, therefore, are subject to price changes. Oil prices have been high volatility for the past decade, with increasing demand globally affecting the cost structure of the tire cord market.

Furthermore, While tires account for less than 2% of total municipal solid waste, approximately 5 million tons of tire garbage were generated in 2007 alone, according to U.S. Environmental Protection Agency; on average, only around 35% of tire rubber is recycled. Only 11 states prohibit all tire trash from being disposed of in landfills, resulting in millions of tons of tire waste being dumped in already overburdened landfills. However, tires have become smaller and more durable due to technological advancements, resulting in more recycled tires and fewer landfills.

COVID-19 Impact Analysis

The COVID-19 pandemic has wreaked devastation worldwide, with over 55 million infections reported so far - and counting. While the pandemic has been controlled in China and Southeast Asian countries like Singapore, several countries in Europe have been affected by the second and even third waves, resulting in lockdowns. U.S. is among the world's worst-affected countries and the number of patients is rising till October 2021.

The impact of the economic slowdown, expected to last for a long time, has swept across the automobile industry, with supply chains and operations taking a huge hit. Due to the COVID-19 pandemic, global commercial vehicle production (GVW 4-8) is expected to drop 22% (more than 650,000 units) to 2.6 million units in 2020 compared to 2019.

Individual regional forecasts are on the decline and supply chain implications are being seen as a result of the virus's effects, resulting in the closure of production and supplier sites worldwide.

The automotive industry in China has witnessed several ups and downs. Many car dealers were forced to close their business in the early months of the pandemic, resulting in a 60% drop in customer visits compared to the previous year. The closure of Chinese auto OEM factories had a rippling effect that was eventually felt throughout the global supply chain.

Thus the significant drop in production volume and demand of the automotive industry has directly impacted the tire cord market, especially during the 2019-2020 period. However, the conditions are getting back to normal. The automotive industry market revival is expected in the forecast period, coupled with an improvement in tire cords during the forecast period.

Segment Analysis

The global tire cord market is segmented by material, process, tire, application and region.

Nylon material offers excellent strength in tire cords which has escalated the product's demand in the tire cord industry

Based on material, the global tire cord market is segmented into polyester, nylon, rayon, aramid, polyethylene terephthalate (PET), steel and hybrid. The nylon segment is a major type of tire cord market. The nylon tire cord fabric provides the necessary strength to a tire. The tire industry is the largest consumer and utilizes 98% of all nylon tire cords produced globally.

In the tire industry, nylon tire cable fabric gradually replaced rayon and polyester cords. Nylon tire cord is manufactured from high-tenacity constant filament yarn by twisting and then plying. Two (2) major types of nylons are used as tire cords, i. e. nylon-6 and nylon-6,6. The properties of nylon-6 and nylon-6,6 vary marginally and are controlled by the manufacturing process, type of stabilizers and additives used. In India, only nylon-6 is produced commercially for tire cords.

Nylon-6 is utilized in Europe and other developing countries, while nylon-6,6 is more prominent in U.S. mainly due to the availability of basic raw materials and established manufacturing facilities. During the last ten to twelve years, developers have been largely evolutionary, aiming to overcome the limitations of existing tire fibers and make them acceptable for wider use. The tenacity of NTC locally available to Indian tire manufacturers varies from 8. 4 to 9. 4 with an average value of 9. 2 gpd.

Nylon 6 grey and dipped tire cord fabrics are mostly used to reinforce bus or truck tires because of their high strength, fatigue resistance, impact resistance and strong adhesion qualities.

Geographical Analysis

Expanding automotive and electronics industry of Asia-Pacific boosts the market share for tire cord market in the region

Asia-Pacific holds the largest market share for the tire cord market globally due to the region's expanding automotive and electronics industry. Furthermore, the growing demand for automobiles, mainly in China and India, will boost the tire cord market.

China has shown the largest automobile market worldwide in terms of supply and demand. The emerging demand for heavy commercial vehicles will steadily improve the demand for tire cords in the region. For instance, In 2019, China produced nearly 21 million cars and 4.36 million commercial vehicles, making it the world's largest vehicle manufacturer. Moreover, over 2.9 million commercial vehicles and passenger cars in India were sold in 2020.

The recent initiatives are further enhancing the growth of the tire cord market in the region. For instance, in 2020, India's Central Board of Indirect Taxes and Customs (CBIC) announced revoking anti-dumping duty on nylon tire cord fabric imported from China.

The leading players have expanded their regional production facilities to satisfy the end-user's needs. For instance, in 2021, Kolon Industries expanded its polyester tire cord plant in Vietnam to expand its annual volume by 19,200 tons. The company had a PET tire cord plant with 16,800 tons capacity in Binh Duong Province of Vietnam in 2018.

Competitive Landscape

The global tire cord market is highly competitive with local and global key players. The key players contributing to the market's growth are Indorama Ventures, SRF Limited, Kolon Industries Inc, Tire Cord USA, TEIJIN LIMITED, HYOSUNG, Kordsa Teknik Tekstil A.S., Toray Hybrid Cord, Inc, Century Enka Limited, Firestone Fibers & Textile Company, among others.

The major companies are adopting several growth strategies, such as product launches, acquisitions and collaborations, contributing to the global growth of the tire cord market.

- On January 12, 2021, Kolon Industries announced on January 12 that it has decided to expand its polyester tire cables production plant in Vietnam to increase its annual production capacity by 19,200 tons. The company built a PET tire line factory with an annual capacity of 16,800 tons in Binh Duong province of Vietnam in 2018. Kolon Industries will spend 68 billion won (US$ 62 million) in its fully-owned Kolon Industries Binh Duong Company Ltd. to assist the Vietnamese affiliate in expanding the factory by September 2022. The expansion works will be completed in September 2022. Once completed, the company's total tire production capacity will be increased to 103,200 tons per year.

Kolon Industries Inc

Overview: Since the first production of nylon in Korea in 1957, KOLON Industries, Inc. has grown considerably and is now an independent company after the KOLON Group adopted a joint-stock structure in 2010. The company focuses on four main business divisions: industrial materials, chemicals, film / electronic materials and fashion

KOLON Industries, Inc. plans to globalize its automotive materials, advanced materials, optical film, chemical and fashion industries by increasing investment in high-value products. KOLON Industries, Inc. has been identified for its quality and technology by national and international companies such as Michelin, Bridgestone, Goodyear and Continental.

Product Portfolio: Elemental Fluorine (F2): The company produces high dimensional stability, few flat marks, excellent heat resistance and controllable tire belts, Mainly used in passenger car travel tires.

Key Development

- On September 28, 2022, Kolon Industries Inc announced it has completed the expansion of its tire cord production plant in Binh Duong Province, Vietnam and is planning to speed up to boost its global competitiveness.

Why Purchase the Report?

- Visualize the global tire cord market segmentation by material, process, tire, application and region, highlighting key commercial assets and players.

- Identify commercial opportunities in the tire cord market by analyzing trends and co-development deals.

- Excel data sheet with thousands of global tire cord market-level 4/5 segmentation points.

- PDF report with the most relevant analysis cogently put together after exhaustive qualitative interviews and in-depth market study.

- Product mapping in excel for the key product of all major market players

The global tire cord market report would provide approximately 69 market data tables, 67 figures and 214 pages.

Target Audience 2022

- Service Providers/ Buyers

- Residential

- Research Laboratory

- Restaurant Business

- Energy & Utilities Companies

- Distributors

Table of Contents

1. Global Tire Cord Market Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Global Tire Cord Market - Market Definition and Overview

3. Global Tire Cord Market - Executive Summary

- 3.1. Market Snippet by Material

- 3.2. Market Snippet by Process

- 3.3. Market Snippet by Tire

- 3.4. Market Snippet by Application

- 3.5. Market Snippet by Region

4. Global Tire Cord Market-Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing demand for eco-friendly manufacturing has escalated the tire cord market share

- 4.1.1.2. XX

- 4.1.2. Restraints

- 4.1.2.1. Growing stringent regulations and lesser penetration of tire cords restrict the growth of the tire cord market

- 4.1.2.2. XX

- 4.1.3. Opportunity

- 4.1.3.1. XX

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Global Tire Cord Market - Industry Analysis

- 5.1. Porter's Five Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. Global Tire Cord Market - COVID-19 Analysis

- 6.1. Analysis of COVID-19 on the Market

- 6.1.1. Before COVID-19 Market Scenario

- 6.1.2. Present COVID-19 Market Scenario

- 6.1.3. After COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. Global Tire Cord Market - By Material

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 7.1.2. Market Attractiveness Index, By Material

- 7.2. Polyester *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Nylon

- 7.4. Rayon

- 7.5. Aramid

- 7.6. Polyethylene Terephthalate (PET)

- 7.7. Steel

- 7.8. Hybrid

8. Global Tire Cord Market - By Process

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 8.1.2. Market Attractiveness Index, By Process

- 8.2. Fiber *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Yarn Twisting

- 8.4. Weaving

- 8.5. Dipping

9. Global Tire Cord Market - By Tire

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tire

- 9.1.2. Market Attractiveness Index, By Tire

- 9.2. Radial *

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Biased

10. Global Tire Cord Market - By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Light Commercial Vehicles*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Passenger Cars

- 10.4. Heavy-Duty Vehicles

- 10.5. Others

11. Global Tire Cord Market - By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tire

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tire

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tire

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tire

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. South Korea

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tire

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12. Global Tire Cord Market - Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Global Tire Cord Market- Company Profiles

- 13.1. Indorama Ventures *

- 13.1.1. Company Overview

- 13.1.2. End-User Portfolio and Description

- 13.1.3. Key Highlights

- 13.1.4. Financial Overview

- 13.2. SRF Limited

- 13.3. Kolon Industries Inc

- 13.4. Tire Cord USA

- 13.5. TEIJIN LIMITED

- 13.6. HYOSUNG

- 13.7. Kordsa Teknik Tekstil A.S.

- 13.8. Toray Hybrid Cord, Inc

- 13.9. Century Enka Limited

- 13.10. Firestone Fibers & Textile Company

LIST NOT EXHAUSTIVE

14. Global Tire Cord Market - Premium Insights

15. Global Tire Cord Market - DataM

- 15.1. Appendix

- 15.2. About Us and Services

- 15.3. Contact Us