|

|

市場調査レポート

商品コード

1176604

リハビリテーション機器の世界市場-2022-2029Global Rehabilitation Equipment Market - 2022-2029 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| リハビリテーション機器の世界市場-2022-2029 |

|

出版日: 2022年12月26日

発行: DataM Intelligence

ページ情報: 英文 200 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

市場概要

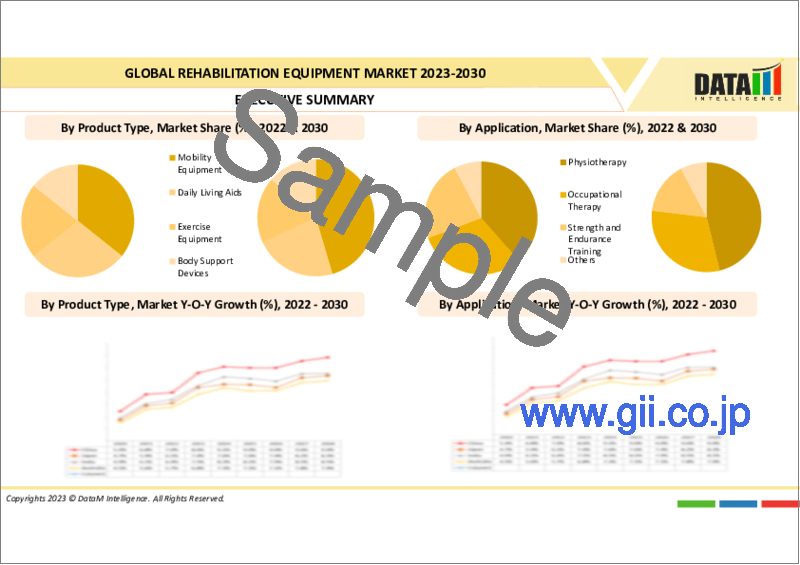

リハビリテーション機器の世界市場規模は、予測期間中(2023~2030年)にCAGR4.6%で成長するとされています。

リハビリ用補助具や機器の最も重要な点は、すでに痛みを感じている患者にさらなる不快感を与えることなく、最高のサポートを提供する機器の能力です。様々なサポート&ブレースは、痛みを伴う状態を効率的に修正または治療するための支援を提供します。

市場力学

リハビリテーション機器市場は、障がい者や糖尿病などの慢性疾患患者の増加、先端技術の台頭、治療に対する需要の増加、新興市場における医療インフラへの投資の増加などにより、拡大が見込まれています。

技術的進歩の高まりとヘルスケア・インフラへの投資の増加は、市場の成長を促進すると予想されます。

リハビリテーション機器市場は、技術の進歩の高まり、理学療法機器の需要の増加、研究開発投資の急増、神経変性疾患や糖尿病などの慢性疾患の増加、新興市場における医療インフラの進歩に伴う最新技術を用いた新規製品の改良などが要因となっています。慢性疾患は世界中で数百万人が罹患しており、糖尿病だけでも4億2,200万人が罹患していると言われています。このような疾病の罹患者数が世界的に増加する中、リハビリテーション機器の需要も高まっています。

技術の進歩により、リハビリテーション機器の導入が進んでいます。外科手術の増加、理学療法や作業療法に関する認知度の向上、政府や民間企業による医療費の増加は、インフラ投資の増加につながり、リハビリテーション機器市場を促進する可能性があります。

様々な新規製品の発売や調査研究は、市場の成長に寄与しています。例えば、2022年5月24日、Invacare Corporationは、米国で革新的なリフトBirdie Evo XPLUSの導入を発表しました。急性期後のケア環境にとって、Birdie Evoは最新の新規利用者リフトソリューションとなります。モダンで洗練されたデザインのバーディー・エボXPLUSは、椅子、ベッドあるいは床への利用者の移動あるいは持ち上げの際に、安全性と快適性を最大化する革新的な技術を提供します。使いやすい人間工学に基づいたスリングフックと、揺れの動きを最小限に抑える革新的なハードウェアであるSlow'R一体型ダンパーを備えています。

リハビリテーション機器に関連する高コストが市場成長の妨げになることが予想されます。

リハビリテーション機器の世界市場は、作業療法だけでなく、理学療法や運動療法などの機器が3,029ドル前後と高額なことが抑制要因となっています。電動車いすの価格は、およそ1,000ドルから15,000ドルの間です。ポータブルモビリティスクーターの価格帯は、ほぼ700ドルになります。

これらの機器のコストは非常に高く、低所得国や中所得国の人々はこれらの製品を購入することができません。これらの機器は高価であるため、これらは複雑なシステムを持っており、したがって、より良い機能のために適切なメンテナンスを必要とするため、彼らはまた、膨大なメンテナンス投資を必要とします。したがって、このリハビリテーション機器の全体的な費用は、市場の成長を阻害する可能性があります。

COVID-19インパクト分析

パンデミックは、世界の財政的な期待、オペレーション、危機対応戦略にマイナスの影響を与えています。COVID-19の発生はヘルスケア産業に深刻な影響を及ぼしています。リハビリテーション機器市場は、COVIDの増加により様々な研究および臨床試験が遅延・延期されたため、COVIDによる巨額の損失を経験しました。主要メーカーは、様々な研究や臨床試験を開始しました。複数のイニシアチブ、製品の発売、コラボレーション、合併が世界中で起こっており、市場の成長を後押ししています。例えば、2021年1月28日、アスレチックトレーニング、リハビリテーション製品、理学療法メーカーのダイナトロニクス株式会社は、プレミアムラミネートHブレース治療台と電動患者リフトとともに、新規の肥満用スタンドインテーブルを発表しました。

目次

第1章 調査手法と調査範囲

- 調査手法

- 調査目的および調査範囲

第2章 市場の定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場影響要因

- 促進要因

- 大規模市場における有利な診療報酬政策と医療制度改革

- 高齢者人口の急増と障害者の増加

- 技術的進歩の高まり

- 抑制要因

- リハビリテーション機器の高いコストとメンテナンス費用

- ビジネスチャンス

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- プライシング分析

第6章 COVID-19の分析

- COVID-19の市場分析

- COVID-19以前の市場シナリオ

- COVID-19の現在の市場シナリオ

- COVID-19の後、または将来のシナリオ

- COVID-19の中での価格ダイナミクス

- 需要-供給スペクトラム

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的取り組み

- まとめ

第7章 製品タイプ別

- 日常生活用具

- 医療用ベッド

- 浴室・トイレ補助機器

- 読書・書斎・計算機用具

- モビリティ機器

- 車いす・スクーター

- 歩行補助器

- 運動器具

- 上半身用エクササイズ器具

- 下半身用エクササイズ機器

- 全身運動機器

- 身体支持具

- 医療用吊り具

- 介助用リフト

第8章 アプリケーション別

- 理学療法

- 作業療法

- 筋力・持久力トレーニング

- その他

第9章 エンドユーザー別

- 病院・クリニック

- 外来手術センター

- ホームケア施設

- リハビリテーションセンター、理学療法センター

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ地域

第11章 競合情勢

- 主な展開と戦略

- 企業シェア分析

- 製品ベンチマーク

- 注目の主要企業リスト

第12章 企業プロファイル

- Invacare Corporation

- 企業概要

- 製品ポートフォリオと説明

- 主なハイライト

- 財務概要

- Medline Industries, LP

- Dynatronics Corporation

- Ekso Bionics

- GF Health Products, Inc.

- Drive DeVilbiss Healthcare

- Maddak

- Savaria

- Etac AB

- Sunrise Medical

- TecnoBody

第13章 リハビリテーション機器の世界市場-DataM

Market Overview

The Global Rehabilitation Equipment Market size was valued at US$ XX million in 2023 and is estimated to reach US$ XX million by 2030, growing at a CAGR of 4.6% during the forecast period (2023-2030).

The most crucial aspect of any rehabilitation aid or equipment is the ability of the equipment to offer the highest support without causing any additional discomfort to the patients who are already in pain. Various support & braces provide help for correcting or treating painful conditions efficiently.

Market Dynamics

The market for rehabilitation equipment is driven by the increase in the number of people with disabilities and people affected with chronic diseases such as diabetes, rising advanced technology, increasing demand for therapies and the rising investment in healthcare infrastructure in emerging markets.

The rising technological advancements and increasing investment in healthcare infrastructure are expected to drive the market's growth.

The rehabilitation equipment market is driven by rising advancements in technology, an increase in demand for physical therapy equipment, a surge in research and development investments, an increasing number of chronic disorders such as neurodegenerative disorders or diabetes, and improvements in novel products using the latest technology along with advances in medical infrastructure in emerging markets. Chronic diseases affect millions worldwide, with diabetes alone affecting 422 million people. With the number of people affected by these disorders increasing worldwide, the demand for rehabilitation equipment.

Technological advances have resulted in increasing rehabilitation equipment adoption. The rising number of surgical procedures, increasing awareness about physiotherapy or occupational therapy and rising healthcare expenditure by governments and the private sector could lead to higher infrastructure investments and drive the rehabilitation equipment market.

Various novel product launches and research studies contribute to the market's growth. For instance, in May 24, 2022, Invacare Corporation announced the introduction of its innovative lift Birdie Evo XPLUS in the U.S. For the post-acute care setting, Birdie Evo is the latest novel patient lift solution. Birdie Evo XPLUS, with its modern and sleek design, offers innovative technology that maximizes security and comfort during transferring or lifting a patient to or from a chair, bed or floor. It has a user-friendly ergonomic sling hook and Slow'R integrated dampener, an innovative hardware piece that minimizes the rocking movement.

The high cost associated with rehabilitation equipment is expected to hamper the market's growth.

The global market for rehabilitation equipment is restrained by the high cost of rehabilitation equipment, including occupational therapy, as well as physical therapy or exercise equipment which costs around $3,029. The cost of an electric wheelchair can range between $1,000- $15,000 approximately. The price range for a portable mobility scooter will be nearly $700.

The cost of this equipment is so high that people from low or middle-income countries can't buy these products. As these devices are expensive, they also need huge maintenance investment as these have a complex system and hence need proper maintenance for better functioning. Hence, the overall expenses of this rehabilitation equipment can hinder the market's growth.

COVID-19 Impact Analysis

The pandemic has negatively impacted global financial expectations, operations and crisis response strategy. The COVID-19 outbreak has severely affected the healthcare industry. The rehabilitation equipment market has experienced huge losses due to COVID as various research, and clinical trials got delayed and postponed due to the increasing cases of COVID. Key manufacturers have started various research and clinical trials. Multiple initiatives, product launches, collaborations and mergers are happening worldwide, boosting the market's growth. For instance, in January 28, 2021, Dynatronics Corporation, athletic training, rehabilitation products, and physical therapy manufacturer, introduced its novel bariatric stand-in table along with a premium laminated H-brace treatment table and a motorized patient lift.

Segment Analysis

The mobility rehabilitation equipment segment is expected to grow at the fastest CAGR during the forecast period (2022-2029)

The mobility rehabilitation equipment segment is the highest market holder in the global rehabilitation equipment market. The global rehabilitation equipment market is segmented based on product type in daily living aids, mobility equipment, exercise equipment and body support devices. The mobility equipment segment is the largest market shareholder due to its rising adoption and demand owing to increasing disabilities, increase in technological advancements and novel product launches.

Mobility aids devices are specially developed to help people facing moving around issues and enjoy freedom and independence. Generally, people who are injured or disabled, or older adults with an increased risk of falling, use these mobility aids. These mobility devices offer several advantages to users, such as reduced pain, more independence, and boosted self-esteem and confidence. The mobility equipment segment is further sub-segmented into wheelchairs & scooters, and walking assist devices.

The growing number of regulatory approvals, technological advancements, product launches, and research/clinical trial studies drive the market's growth. For instance, in Feb 7, 2022, Invacare Corporation introduced its next-generation e-fix eco, a power assist device. A manual wheelchair gets transformed into a portable power chair via a battery, joystick, and in-wheel motors. Alber e-fix eco power assist is furnished with a novel modern design for the color display, wheel hub, battery, and bag. The e-fix eco displays a significant upgrade or advancement from the previous generation.

Geographical Analysis

North America holds the largest market share in the global rehabilitation equipment market.

North America dominates the global rehabilitation equipment market primarily due to its large population, excellent medical infrastructure, and high-income levels. The market is expected to grow at a relatively high pace during the forecast period due to healthcare expenditure in the US. The market's significant size is attributed to the high medical expenditure. The number of people affected with chronic disease is projected to rise to 629 million by 2045, as per the International Diabetes Federation.

Increasing expenditure on healthcare and raising awareness among people is also contributing to the market's growth in this region. Advancement of applications of rehabilitation equipment in physiotherapy or occupational therapy, increase in pharmaceutical establishment across the region and government approvals, and the presence of key players in the region are contributing to the growth of the rehabilitation equipment market.

Moreover, the growing number of product launches is responsible for the market's growth. Many key developments, technological advancements, collaborations, and agreements are taking place in this region. For instance, in August 8, 2022, Sunrise Medical announced the launch of RGK, a premium and advanced made-to-measure manual wheelchair range in North America. RGK wheelchairs develop every day and made-to-measure sports wheelchairs. The chair is built individually to suit its rider's unique individuality and requirements.

Competitive Landscape

The rehabilitation equipment market is moderately competitive with local and global companies' presence. Invacare Corporation, Medline Industries, LP, Dynatronics Corporation, Ekso Bionics, GF Health Products, Inc., Drive DeVilbiss Healthcare, Maddak, Savaria, Etac AB, Sunrise Medical and more. The key players are adopting various growth strategies such as product launches, mergers & acquisitions, partnerships, and collaborations, contributing to the market's growth. For instance, in February 24, 2021, Dynatronics Corporation, a company manufacturing athletic training, rehabilitation products and physical therapy, announced that Bird & Cronin, LLC, its wholly-owned subsidiary, has renewed its purchasing agreement with Intalere, a national group purchasing healthcare industry organizations. The novel agreement extends the partnership through January 2024.

Invacare Corporation.

Overview: Invacare Corporation is a developer and distributor of medical equipment utilized in non-acute care settings. The company develops, manufactures and commercializes medical devices to help people breathe, move, rest and perform necessary hygiene. Invacare offers clinically complex medical devices for degenerative and congenital ailments.

Product Portfolio:

UltraLow Maxx System: Ultra Low Maxx is a power mobility product of power positioning systems that combines durability and function with the sleek novel Ultra Rail, offering a broad range of accessory mounting possibilities and approximately four inches of several seat depth adjustments.

Key Development: In January 13, 2022, Invacare Corporation announced its exciting novel features in LiNX electronics which integrates Invacare's well-known MK6 features. The LiNX system controls a power wheelchair making it easy to operate for end users.

The global rehabilitation equipment market report would provide access to approx.: 45+ market data tables, 40+ figures and 200 (approximate) pages.

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Market Definition and Overview

3. Executive Summary

4. Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Favorable reimbursement policies and health reforms in large markets

- 4.1.1.2. Rapid growth in the geriatric population and rise in the incidence of disabilities

- 4.1.1.3. Rising technological advancements

- 4.1.2. Restraints:

- 4.1.2.1. High costs & maintenance expenses of rehabilitation equipment

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1 Porter's Five Forces Analysis

- 5.2 Supply Chain Analysis

- 5.3 Pricing Analysis

6. COVID-19 Analysis

- 6.1. Analysis of Covid-19 on the Market

- 6.1.1. Before COVID-19 Market Scenario

- 6.1.2. Present COVID-19 Market Scenario

- 6.1.3. After COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid Covid-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturer's Strategic Initiatives

- 6.6. Conclusion

7. By Product Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 7.1.2. Market Attractiveness Index, By Product Type

- 7.2. Daily Living Aids *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 7.2.3. Medical Beds

- 7.2.4. Bathroom & Toilet Assist Devices

- 7.2.5. Reading, Writing & Computing Aids

- 7.3. Mobility Equipment

- 7.3.1. Wheelchairs & Scooters

- 7.3.2. Walking Assist Devices

- 7.4. Exercise Equipment

- 7.4.1. Upper Body Exercise Equipment

- 7.4.2. Lower Body Exercise Equipment

- 7.4.3. Total Body Exercise Equipment

- 7.5. Body Support Devices

- 7.5.1. Medical Lifting Slings

- 7.5.2. Patient Lifts

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Physiotherapy *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 8.3. Occupational Therapy

- 8.4. Strength & Endurance Training

- 8.5. Others

9. By End-User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.1.2. Market Attractiveness Index, By End-User

- 9.2. Hospitals and Clinics *

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 9.3. Ambulatory Surgery Centers

- 9.4. Homecare Setting

- 9.5. Rehabilitation and Physiotherapy Centers

- 9.6. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029, By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. U.K.

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

- 11.1. Key Developments and Strategies

- 11.2. Company Share Analysis

- 11.3. Products Benchmarking

- 11.4. List of Key Companies to Watch

12. Company Profiles

- 12.1. Invacare Corporation *

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Key Highlights

- 12.1.4. Financial Overview

- 12.2. Medline Industries, LP

- 12.3. Dynatronics Corporation

- 12.4. Ekso Bionics

- 12.5. GF Health Products, Inc.

- 12.6. Drive DeVilbiss Healthcare

- 12.7. Maddak

- 12.8. Savaria

- 12.9. Etac AB

- 12.10. Sunrise Medical

- 12.11. TecnoBody

LIST NOT EXHAUSTIVE

13. Global Rehabilitation Equipment Market - DataM

- 13.1. Appendix

- 13.2. About Us and Application

- 13.3. Contact Us