|

|

市場調査レポート

商品コード

1133468

心臓MRI検査の世界市場-2022-2029Global Cardiac MRI Testing Market - 2022-2029 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 心臓MRI検査の世界市場-2022-2029 |

|

出版日: 2022年10月11日

発行: DataM Intelligence

ページ情報: 英文 200 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

市場力学

心臓MRI検査市場の成長は、心血管疾患の有病率の上昇、老年人口の増加、技術的進歩、研究活動によってもたらされます。

心血管疾患の有病率上昇は、市場成長の原動力になると予想されます。

座りがちなライフスタイルの増加は、予測期間中に市場を押し上げると予想されます。世界保健機関(WHO)によると、心血管疾患(CVD)は世界の主な死因となっています。2021年6月のデータでは、毎年1790万人が死亡していると推定されています。運動不足、不健康な食事、タバコの使用、アルコールの有害作用は、すべて心臓病や脳卒中の危険因子となります。これらの危険因子は、高血圧、血糖値のアンバランス、血中脂質のアンバランス、過体重、肥満と関連しています。MRI検査は、これらのCVDの高次のリスクを特定するために使用されます。

さらに、2022年4月、Journal of the American College of Cardiologyに掲載された研究報告によると、2060年までに、米国では心血管危険因子と疾病の割合が著しく増加すると予想されています。心血管疾患の動向の大幅な増加は、米国の医療制度の負担増に寄与する可能性があり、将来の疾患を予防するために、予防教育や治療への公平なアクセスを今すぐ行う必要性にスポットライトを当てています。さらに、2021年6月にWHOは、医療用画像診断のためのMRIを含む、心血管疾患の管理のための優先医療機器のリストを発表し、世界の心臓MRI市場を押し上げました。

他のイメージングオプションの利用可能性が市場成長の妨げとなる

しかし、心血管イメージングモダリティなどの代替イメージングオプションが市場に存在することが、心臓MRI検査市場を制限しています。また、ヘルスケア技術の進歩により、医療費は増加傾向にあります。

COVID-19の影響分析

COVID-19の出現は、世界の心臓MRI検査市場にかなりの影響を与えました。COVID-19感染は世界中に野火のように広がりました。それは主に呼吸器系に影響を与えます。COVID-19は心筋損傷と関連しており、ウイルス感染によって直接的に、あるいは全身性の炎症や内皮の活性化によって間接的に起こることが多くなっています。心臓MRIは心筋炎患者の診断に重要であるため、パンデミック時には心臓MRI検査の需要が高まります。パンデミックの患者数が増加するにつれて、心臓MRI検査の需要も増加しました。しかし、パンデミック時には、強制的な封鎖や交通規制により、医療機関へのアクセスが困難となりました。一方、COVID-19患者については、高齢者が心臓病の診断や定期的な治療が受けられないという問題に直面しています。心臓MRI検査市場の大小の市場プレーヤーに影響を与えます。しかし、2022年の半ばには、COVID-19から状況が回復しています。市場成長の機会が訪れると思われます。

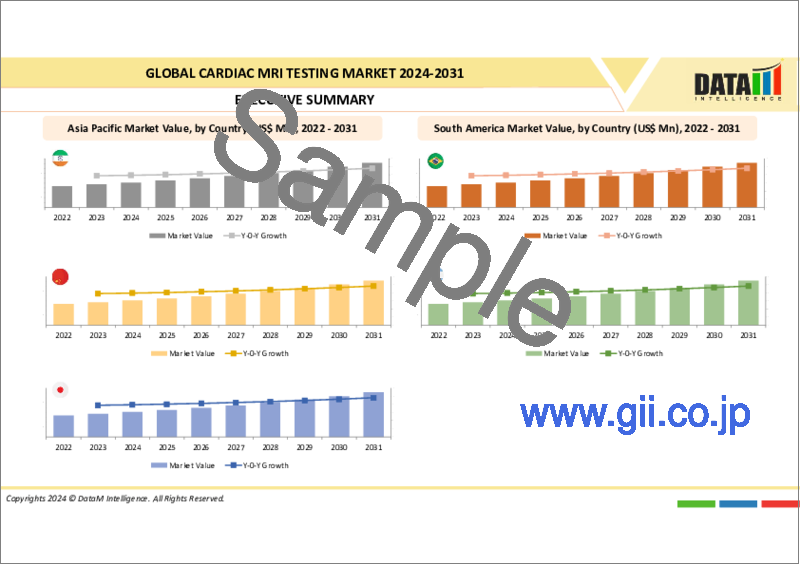

世界の心臓MRI検査市場レポートでは、約40以上の市場データ表、45以上の図、200ページ(概算)の範囲でのアクセスを提供することになります。

目次

第1章 市場調査手法とスコープ

- 調査手法

- 調査目的および調査範囲

第2章 市場の定義と概要

第3章 エグゼクティブサマリー

- アプリケーション別市場内訳

- エンドユーザー別市場内訳

- 地域別市場内訳

第4章 市場の力学

- 市場影響要因

- 促進要因

- 心血管疾患の発生率の上昇

- 研究活動の増加

- 抑制要因

- 他のイメージングオプションの利用可能性

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 規制分析

- プライシング分析

- アンメットニーズ分析

第6章 COVID-19分析

- COVID-19の市場分析

- COVID-19以前の市場シナリオ

- COVID-19の現在の市場シナリオ

- COVID-19の後、あるいは将来のシナリオ

- COVID-19の中での価格ダイナミクス

- 需要-供給スペクトラム

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的取り組み

- まとめ

第7章 アプリケーション別

- 画像診断

- 患者モニタリング

- 画像誘導治療

第8章 エンドユーザー別

- 病院・クリニック

- 循環器クリニック

- 外来手術センター

- 診断センター

- その他

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ地域

第10章 競合情勢

- 主な展開と戦略

- 企業シェア分析

- アプリケーションベンチマーキング

第11章 企業プロファイル

- Koninklijke Philips N.V.

- 企業概要

- アプリケーションのポートフォリオと説明

- 主なハイライト

- 財務概要

- FUJIFILM Corporation

- Canon Inc.

- NeoSoft LLC

- Siemens Healthcare Private Limited

- Pie Medical Imaging

- Medis Medical Imaging

- Symphony Innovation, LLC

- Circle Cardiovascular Imaging Inc

- GE Healthcare

第12章 心臓MRI検査の世界市場-DataM

Market Overview

Cardiac MRI Testing Market Size was valued at US$ XX million in 2021 and is estimated to reach US$ XX million by 2029, growing at a CAGR of X% during the forecast period (2022-2029).

Cardiac MRI testing is a scan of a patient's heart in which radio waves and magnets build images without any side effects for the patient's body. An MRI scan is able to show parts of the heart, including chambers and valves, and how they are working. A cardiac MRI scan can diagnose heart problems such as heart failure, heart valve disease, heart muscle inflammation or infection, and other conditions.

Market Dynamics

The cardiac MRI testing market growth is driven by the rise in the prevalence of cardiovascular diseases, the increase in the geriatric population, technological advancements, and research activities.

The rising prevalence of the cardiovascular disease is expected to drive the market growth

The rising sedentary lifestyle is expected to boost the market over the forecast period. As per the World Health Organization, cardiovascular diseases (CVD) are the main cause of death worldwide. As per the June 2021 data, It is estimated that 17.9 million die each year. Physical inactivity, an unhealthy diet, tobacco use, and the harmful effects of alcohol are all risk factors for heart disease and stroke. These risk factors are associated with high blood pressure, blood glucose imbalance, blood lipid imbalance, overweight, and obesity. MRI testing is used to identify these high-level risks of CVDs.

Furthermore, in the April 2022, as per the study published report in the Journal of the American College of Cardiology, By the year 2060, it is expected that rates of cardiovascular risk factors and disease will increase significantly in the United States. Considerable increases in cardiovascular trends may contribute to an increasing burden on the U.S. health care system and spotlight the necessity for impartial access to precaution education and treatments now to prevent future disease. Moreover, in June 2021, the WHO published a list of priority medical devices for management of cardiovascular diseases, including MRI for medical imaging, which boosted the cardiac MRI market worldwide.

The availability of other imaging options will hamper the growth of the market

However, the availability of alternative imaging options such as cardiovascular imaging modalities in the market limits the cardiac MRI testing market. In addition, healthcare costs are increasing due to the advancement in healthcare technology.

COVID-19 Impact Analysis

The appearance of COVID-19 considerably impacted the global cardiac MRI testing market. COVID-19 infection spread like wildfire around the world. It primarily affects the respiratory system. COVID-19 is associated with myocardial injury, which is more common and can occur directly due to viral infection or indirectly due to systemic inflammation or endothelial activation. As cardiac MRI is important for the diagnostic process of patients with myocarditis, results in an increasing demand for cardiac MRI testing during a pandemic. As the pandemic's case count increased, so did the demand for cardiac MRI testing. However, due to the enforced lockdown and transportation restrictions, access to the health care system was difficult during the pandemic. On the Other hand, for COVID-19 patients, the elderly population faces a lack of diagnosis and regular treatment for heart disease. It has an impact on the large and small market players in the cardiac MRI testing market. But, in the middle of 2022, the situation is recovering from COVID-19. There will be an opportunity for market growth.

Segment Analysis

The patient monitoring segment is expected to grow at the fastest CAGR during the forecast period (2022-2029)

The patient monitoring segment is expected to boost the market over the period of the forecast. This is owing to the increased prevalence of cardiovascular disease, a rise in the geriatric population, and health issues occurring in the COVID-19 pandemic, which results in an increasing demand for monitoring of patients to diagnose the diseases. Cardiac MRI is an accurate and effective solution for monitoring the heart health of patients with different diseases such as arrhythmias, abnormal heartbeats, and heart failure.

According to Census Bureau estimations, by 2030, the number of people aged 65 and older in the United States will increase faster than the young population (aged 18 and under). The older population suffers from a greater degree of health issues than the younger population, resulting in shifting demand for monitoring solutions to diagnose, track and treat health issues such as cardiovascular disease.

Geographical Analysis

North American region holds the largest market share of the global Cardiac MRI testing market

North America dominates the market for cardiac MRI testing and is expected to show a similar trend over the forecast period. It is estimated to hold a significant market size over the forecast period (2022-2029) owing to advancements in healthcare infrastructure and the availability of diagnostic imaging systems for heart disease. According to the centers of disease control and prevention, heart disease is the leading cause of death in people in different age groups in the United States region. One person dies every 34 seconds because of cardiac disease.

In 2020, around 697,000 people in the United States die from heart disease. In the population with Cardiac Artery Disease (CAD), about 20.1 million adults age 20 and older have CAD (about 7.2%). In the United States, 805,000 have heart attacks every year. As the population with CVD increases in the North American region, the demand to diagnose the disease results in an increasing demand for MRI testing in the region. Technological advancements boost the market growth in the North American region. For instance, in September 2022, University of Minnesota Twin Cities scientists and their team found a solution to upgrade the performance of traditional (MRI) reconstruction techniques, enabling faster MRIs to improve healthcare.

Competitive Landscape

The cardiac MRI testing market is a moderately competitive presence of local as well as global companies. Some of the key players which are contributing to the growth of the market are Koninklijke Philips N.V, FUJIFILM Corporation, Canon Inc., NeoSoft LLC, Siemens Healthcare Private Limited, Pie Medical Imaging, Medis Medical Imaging, Symphony Innovation, LLC, Circle Cardiovascular Imaging Inc., and GE Healthcare among others. The major players are adopting several growth strategies such as new product launches, acquisitions, and collaborations, which are contributing to the growth of the cardiac MRI testing market globally.

For instance,

- In February 2022, GE Healthcare received approval from the European Medicines Agency (EMA) for additional imaging modalities for its stress agent Rapiscan (Regadenoson). Rapiscan is approved for use in Magnetic Resonance Imaging (MRI) as well as Computed Tomography (CT) and Positron Emission Tomography (PET).

Canon Medical Systems Corporation

Overview:

Canon Medical Systems Corporation is a Japanese multinational corporation headquartered in Tokyo, Japan. The company offers a broad range of diagnostic medical imaging solutions, including CT, MR, X-Ray, ultrasound, and healthcare informatics, across the globe. It offers imaging solutions for ischemic heart disease, structural heart disease, and congenital heart disease.

Product Portfolio:

k-t SPEEDER: This MR imaging technology provides up to 8x faster frame rate cardiac cine and perfusion with free breathing. It is easy to use for patients and offers images a wide range of heart patients. In addition, it also helps to acquire high temporal resolution cardiac cine without compromising patient comfort.

The global cardiac MRI testing market report would provide access to approximately 40+ market data tables, 45+ figures, and in the range of 200 (approximate) pages.

Table of Contents

1. Market Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Market Definition and Overview

3. Executive Summary

- 3.1. Market Snippet By Application

- 3.2. Market snippet By End User

- 3.3. Market Snippet by Region

4. Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. The rising incidences of cardiovascular diseases

- 4.1.1.2. The increasing number of research activities

- 4.1.2. Restraints:

- 4.1.3. Availability of other imaging options

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Regulatory Analysis

- 5.4. Pricing Analysis

- 5.5. Unmet Needs

6. COVID-19 Analysis

- 6.1. Analysis of Covid-19 on the Market

- 6.1.1. Before COVID-19 Market Scenario

- 6.1.2. Present COVID-19 Market Scenario

- 6.1.3. After COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid Covid-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturer's Strategic Initiatives

- 6.6. Conclusion

7. By Application

- 7.1. Introduction

- 7.1.1. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application Segment

- 7.1.2. Market Attractiveness Index, By Application Segment

- 7.2. Diagnostic Imaging*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis, US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 7.3. Patient Monitoring

- 7.4. Image Guided Treatment

8. By End User

- 8.1. Introduction

- 8.1.1. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End User

- 8.1.2. Market Attractiveness Index, By End User

- 8.2. Hospitals and Clinics*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis, US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 8.3. Cardiovascular Clinics

- 8.4. Ambulatory Surgical Centers

- 8.5. Diagnostics Centres

- 8.6. Others

9. By Region

- 9.1. Introduction

- 9.1.1. Market Size Analysis, US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029, By Region

- 9.1.2. Market Attractiveness Index, By Region

- 9.2. North America

- 9.2.1. Introduction

- 9.2.2. Key Region-Specific Dynamics

- 9.2.3. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application

- 9.2.4. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End User

- 9.2.5. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1. The U.S.

- 9.2.5.2. Canada

- 9.2.5.3. Mexico

- 9.3. Europe

- 9.3.1. Introduction

- 9.3.2. Key Region-Specific Dynamics

- 9.3.3. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application

- 9.3.4. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End User

- 9.3.5. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1. Germany

- 9.3.5.2. U.K.

- 9.3.5.3. France

- 9.3.5.4. Italy

- 9.3.5.5. Spain

- 9.3.5.6. Rest of Europe

- 9.4. South America

- 9.4.1. Introduction

- 9.4.2. Key Region-Specific Dynamics

- 9.4.3. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application

- 9.4.4. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End User

- 9.4.5. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1. Brazil

- 9.4.5.2. Argentina

- 9.4.5.3. Rest of South America

- 9.5. Asia Pacific

- 9.5.1. Introduction

- 9.5.2. Key Region-Specific Dynamics

- 9.5.3. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application

- 9.5.4. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End User

- 9.5.5. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1. China

- 9.5.5.2. India

- 9.5.5.3. Japan

- 9.5.5.4. Australia

- 9.5.5.5. Rest of Asia Pacific

- 9.6. Middle East and Africa

- 9.6.1. Introduction

- 9.6.2. Key Region-Specific Dynamics

- 9.6.3. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application

- 9.6.4. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End User

10. Competitive Landscape

- 10.1. Key Developments and Strategies

- 10.2. Company Share Analysis

- 10.3. Application Benchmarking

11. Company Profiles

- 11.1. Koninklijke Philips N.V.*

- 11.1.1. Company Overview

- 11.1.2. Application Portfolio and Description

- 11.1.3. Key Highlights

- 11.1.4. Financial Overview

- 11.2. FUJIFILM Corporation

- 11.3. Canon Inc.

- 11.4. NeoSoft LLC

- 11.5. Siemens Healthcare Private Limited

- 11.6. Pie Medical Imaging

- 11.7. Medis Medical Imaging

- 11.8. Symphony Innovation, LLC

- 11.9. Circle Cardiovascular Imaging Inc

- 11.10. GE Healthcare

LIST NOT EXHAUSTIVE

12. Global Cardiac MRI Testing Market- DataM

- 12.1. Appendix

- 12.2. About Us and Services

- 12.3. Contact Us