|

市場調査レポート

商品コード

1129263

クリオスタットミクロトーム装置の世界市場-規模、シェア、予測(2022-2029年)Global Cryostat Microtome Equipment Market- Size, Share and Forecast (2022-2029) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| クリオスタットミクロトーム装置の世界市場-規模、シェア、予測(2022-2029年) |

|

出版日: 2022年09月29日

発行: DataM Intelligence

ページ情報: 英文 180 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 図表

- 目次

概要

クリオスタットミクロトーム(凍結ミクロトーム)は、植物や動物の組織を薄い切片にするクライオセクションを生成するために使用される医療機器の一部です。クリオスタットミクロトームは、様々な医療、生物学、工業用途に使用されています。ミクロトームクリオスタットは、ミクロトームを収納した冷蔵キャビネットで、通常-5℃から-50℃の温度範囲で使用されます。切片作成装置、回転式ミクロトーム、ブレードホルダーまたはナイフ、および試料を凍結させる機構で構成されています。

市場力学

がんマーカーの探索を目的とした免疫組織化学研究所でのクリオスタットミクロトームの使用が増加しており、市場の成長を牽引すると予想されます。

免疫組織化学(IHC)は、抗体を用いて組織スライス中の抗原(タンパク質)を同定する生物学の一分野です。古典的なアプリケーションは、がんマーカーを見つけるための組織サンプルの生検です。免疫組織化学のアプリケーションに必要な微細なスライスを実現するには、凍結温度槽が唯一の手段です(組織サンプルの切片化中)。組織サンプルは非常にデリケートなため、このタイプのチャンバーなしでは薄い切片に切り取ることができません。この冷却チャンバーは、切片作成中の融解からサンプルを保護し、組織サンプルへの微生物によるダメージを軽減します。所見がすぐに求められる場合や、デリケートな分子の抗原性を保持しなければならない場合、この凍結切片は極めて重要な意味を持ちます。これらの材料は、IHCラボでミクロトーム付きのクリオスタットで処理されます。ミクロトームとは、研究用に薄い組織片を切る装置です。クリオスタットで作成された薄切片は、顕微鏡で観察されます。この超薄切片により、科学者は病気の性質についてより正確な判断を短時間で行うことができるようになります。そのため、クリオスタットはヘルスケア事業に大きく貢献しています。患者さんから採取した極小の組織片は、次の治療方針を決定するために頻繁に分析されます。がんなどの場合、免疫細胞化学研究所から生検の結果が返ってくるまで、治療を再開することはできないです。そのため、クリオスタット・ミクロトームを用いた診断が一刻も早く行われなければならないです。以上のことから、同市場は市場の成長を牽引すると考えられます。

抑制要因

クリオスタットミクロトーム装置に関連する高コストとクリオスタットミクロトーム装置を操作する熟練した専門家の不足は、予測期間中に市場が阻害される要因であると予想されます。

産業分析

クリオスタットミクロトーム装置市場は、サプライチェーン分析、価格分析などの様々な産業要因に基づいた市場の詳細な分析を提供します。

COVID-19の影響分析

COVID-19のパンデミックは、ヘルスケアシステムと市場に中程度の影響を与えました。COVID-19の流行期間中は、ウイルス感染のリスクを減らすために、ほとんどの慢性治療が緊急性がないと見なされたため、すべての外来治療が延期または制限されました。組織病理学の研究のために、クリオスタットミクロトーム装置が診断および研究室で頻繁に使用されています。その他の特典として、パンデミックの流行に伴い、COVID-19感染組織の免疫組織化学の研究が盛んに行われるようになりました。一方、パンデミックはサプライチェーンとプロセスを中断させる。多くの企業は、製品の入手可能性を確保し、サプライチェーンを保護するために、他の地域へと変化していくでしょう。したがって、上記の記述から、市場は影響を受け、経済活動の再開とともに急速に牽引されると予想されます。

セグメント別分析

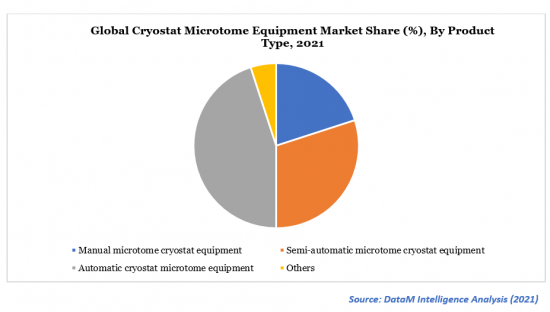

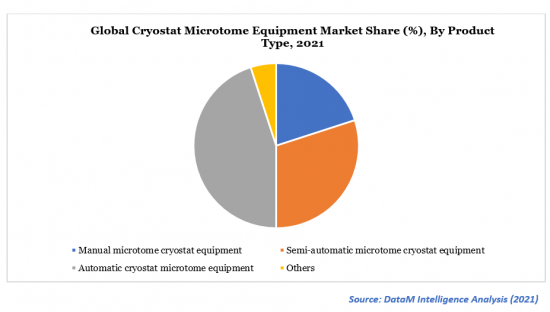

クリオスタットミクロトーム装置市場は、自動クリオスタットミクロトーム装置が最大の市場シェアを占める見込み

2021年の市場シェアは、自動クリオスタットミクロトーム装置セグメントが最大でした。組織切片作成の自動化は、ラボに迅速なセットアップとアライメント、プログラム可能な設定、より迅速な切片作成、電動トリミングを提供できるため、同セグメントは利益を得ることができます。これにより、病理組織医はより多くのサンプルブロックを短時間で処理することが可能になり、患者の診断の迅速化につながります。時間を節約することで、より多くのサンプルを処理し、病理医が組織処理の異なる側面を同時に作業できるようにすることで、病理医のアウトプットを活用することができます。さらに、自動ミクロトームは品質保証にも利用できます。エンジニアや生産者は、人為的なミスや疲労が生産された部分の品質に影響を与えることを知っています。電動送りは、悪性組織、石灰化組織、脱灰歯などの厚い切片や硬い試料でも、毎回同じ速度で連続切片を作製することができます。例えば、Minuxロータリーパラフィンミクロトーム(セミオート・フルオート)と呼ばれる革新的で正確な試料送り機構は、マイクロトミストが卓越した薄い連続切片の結果を得ることを完璧に可能にします。特許取得の可視ポインターは、迅速かつ正確に切片を位置決めするのに役立ちます。解剖学的病理学や病理組織学で頻繁に使用されています。以上のことから、市場セグメンテーションは、予測期間において最大の市場シェアを占めると予想されます。

地域分析

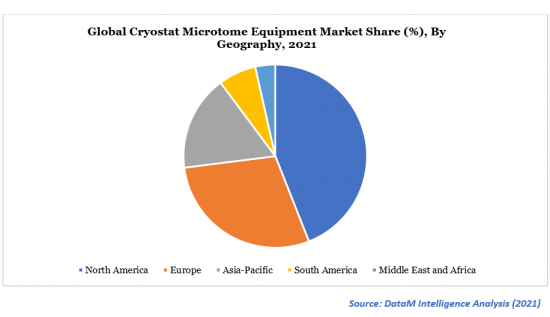

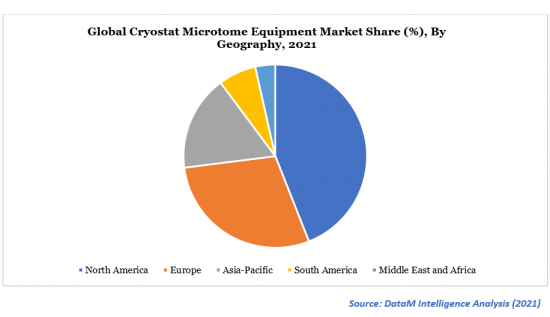

クリオスタットミクロトーム装置の世界市場において、北米地域が最大の市場シェアを占める

2021年の市場シェアは、北米が最大を占めました。癌の有病率の増加、免疫組織化学研究調査における技術の進歩、クリオスタットミクロトーム装置における高度な技術の採用の増加、製品の発売、主要な市場プレイヤーによる買収は、予測期間において市場が駆動するいくつかの要因です。例えば、米国癌協会によると、2020年には米国で新たに180万人の癌患者が発生し、60万6520人が癌で死亡すると推定されています。一方、2021年には、米国で新たに190万人のがん患者が診断され、60万8,570人ががん死亡すると推定されています。そのため、クリオスタットミクロトーム装置の採用が進んでいます。さらに、Precisionary Instruments LLCは、2020年4月に新しい精密クリオスタットの発売を発表しました。(モデルCF-6100)を発表しました。病理学、皮膚科学、組織学の研究室において、CF-6100クリオスタットは、デュアルコンプレッサー、紫外線消毒、LEDタッチスクリーンコントロールパネルを備えた高精度ミクロトームで、高品質の組織切片作成を促しサポートするものです。以上のことから、予測期間において北米地域が最大の市場シェアを占めると予想されます。

競合情勢

クリオスタットミクロトーム装置市場の主な主要プレイヤーは以下の通りです。Amos Scientific Pty Ltd、Avantor, Inc、Thermo Fisher Scientific Inc、Leica Biosystems Nussloch GmbH、Bright Instruments Ltd、Freezers India、Medimeas、SM Scientific Instruments Pvt.Ltd.、India、SLEE medical GmbH、Scientific Instruments Inc. India、SLEE medical GmbH、Tanner Scientific, Inc.

Amos Scientific Pty Ltd:

概要

アモス・サイエンティフィック社は、ヒト組織研究に特化した医療研究企業です。アモス・サイエンティフィック社はオーストラリアのメルボルンで設立され、ミクロトーム、クリオスタットミクロトーム、エンベッディングセンターシステム、真空組織処理装置、イムノヒストステイナーなどの先駆的な装置の製造を担ってきました。同社は、強力な研究開発チームを設立し、組織学の分野で最先端を維持し、自動診断やデジタル診断の開発を進めています。さらに、同社のエンジニアは、2013年に自動ミクロトーム後処理システムや自動液体ベース細胞診スライド染色システムなど、世界の医療産業におけるハイテク製品を発売しました。

製品ポートフォリオ

AST500半自動ミクロトームクリオスタット装置。AST500は、試料を前進・後退させる電動式の半自動クリオスタットミクロトームです。その結果、作業も簡単で、高品質の部品を得ることができます。全体的なエンジニアリングと人間工学的な哲学を念頭に置いて開発されています。コンピュータ数値制御の機械がすべての部品を加工します。引き込み機能により、ブレードによるダメージから試料を保護します。総厚みを計算します。環境に配慮した冷媒R404を使用した低温冷凍システム。毎回、紫外線とO3による30分間の滅菌を行う。ペルチェ式試料クランプの冷凍は手動でON/OFFが可能。デフロスト方法は、自動と手動の2種類。高精度なユニットをクリオスタットチャンバー外に収納し、熱膨張・収縮を防ぎ、メンテナンスを最小限に抑えます。人工知能を搭載したインターフェースは、習得も操作も簡単です。

クリオスタットミクロトーム装置の世界市場レポートでは、約45以上の市場データ表、40以上の図、180ページの構成で提供しています。

目次

第1章 調査手法と範囲

- 調査手法

- 調査の目的と調査範囲

第2章 市場の定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場に影響を与える要因

- 促進要因

- がんマーカーを見つけるための免疫組織化学実験室でのクリオスタットミクロトームの使用の増加は、市場の成長を促進すると予想されます。

- 抑制要因

- クリオスタットミクロトーム装置に関連する高コストは、市場の成長を妨げると予想されます。

- 機会

- 影響分析

- 促進要因

第5章 業界分析

- サプライチェーン分析

- 価格分析

第6章 COVID-19分析

- 市場におけるCOVID-19の分析

- COVID-19以前の市場シナリオ

- 現在のCOVID-19市場シナリオ

- COVID-19後または将来のシナリオ

- COVID-19の中での価格のダイナミクス

- 需給スペクトル

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的イニシアチブ

- 結論

第7章 製品タイプ

- 手動

- 半自動

- 自動

第8章 サンプルタイプ別

- 植物組織

- 動物組織

- その他

第9章 アプリケーション別

- 生物学

- 薬

- 工業用

- その他

第10章 エンドユーザー別

- 外来手術センター

- 診断および調査ラボ

- 病院

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東とアフリカ

第12章 競合情勢

- 主な発展と戦略

- 企業シェア分析

- 製品のベンチマーク

- 注目すべき主要企業のリスト

第13章 企業プロファイル

- Amos Scientific Pty Ltd

- 会社概要

- 製品ポートフォリオと説明

- 主なハイライト

- 財務概況

- Avantor, Inc.

- Thermo Fisher Scientific Inc.

- Leica Biosystems Nussloch GmbH

- Bright Instruments Ltd

- Freezers India

- Medimeas

- SM Scientific Instruments Pvt. Ltd. India.

- SLEE medical GmbH

- Tanner Scientific, Inc.

第14章 世界クリオスタットミクロトーム機器市場-DataM

List of Tables

- Table 1: Global Cryostat Microtome Equipment Market Value, By Product Type, 2021, 2025 & 2029 ($ Million)

- Table 2: Global Cryostat Microtome Equipment Market Value, By Sample Type, 2021, 2025 & 2029 ($ Million)

- Table 3: Global Cryostat Microtome Equipment Market Value, By Application, 2021, 2025 & 2029 ($ Million)

- Table 4: Global Cryostat Microtome Equipment Market Value, By End-user, 2021, 2025 & 2029 ($ Million)

- Table 5: Global Cryostat Microtome Equipment Market Value, By Region, 2021, 2025 & 2029 ($ Million)

- Table 6: Global Cryostat Microtome Equipment Market Value, By Product Type, 2021, 2025 & 2029 ($ Million)

- Table 7: Global Cryostat Microtome Equipment Market Value, By Product Type, 2020-2029 ($ Million)

- Table 8: Global Cryostat Microtome Equipment Market Value, By Sample Type, 2021, 2025 & 2029 ($ Million)

- Table 9: Global Cryostat Microtome Equipment Market Value, By Sample Type, 2020-2029 ($ Million)

- Table 10: Global Cryostat Microtome Equipment Market Value, By Application, 2021, 2025 & 2029 ($ Million)

- Table 11: Global Cryostat Microtome Equipment Market Value, By Application, 2020-2029 ($ Million)

- Table 12: Global Cryostat Microtome Equipment Market Value, By End-user, 2021, 2025 & 2029 ($ Million)

- Table 13: Global Cryostat Microtome Equipment Market Value, By End-user, 2020-2029 ($ Million)

- Table 14: Global Cryostat Microtome Equipment Market Value, By Region, 2021, 2025 & 2029 ($ Million)

- Table 15: Global Cryostat Microtome Equipment Market Value, By Region, 2020-2029 ($ Million)

- Table 16: North America Cryostat Microtome Equipment Market Value, By Product Type, 2020-2029 ($ Million)

- Table 17: North America Cryostat Microtome Equipment Market Value, By Sample Type, 2020-2029 ($ Million)

- Table 18: North America Cryostat Microtome Equipment Market Value, By Application, 2020-2029 ($ Million)

- Table 19: North America Cryostat Microtome Equipment Market Value, By End-user, 2020-2029 ($ Million)

- Table 20: North America Cryostat Microtome Equipment Market Value, By Country, 2020-2029 ($ Million)

- Table 21: South America Cryostat Microtome Equipment Market Value, By Product Type, 2020-2029 ($ Million)

- Table 22: South America Cryostat Microtome Equipment Market Value, By Sample Type, 2020-2029 ($ Million)

- Table 23: South America Cryostat Microtome Equipment Market Value, By Application, 2020-2029 ($ Million)

- Table 24: South America Cryostat Microtome Equipment Market Value, By End-user, 2020-2029 ($ Million)

- Table 25: South America Cryostat Microtome Equipment Market Value, By Country, 2020-2029 ($ Million)

- Table 26: Europe Cryostat Microtome Equipment Market Value, By Product Type, 2020-2029 ($ Million)

- Table 27: Europe Cryostat Microtome Equipment Market Value, By Sample Type, 2020-2029 ($ Million)

- Table 28: Europe Cryostat Microtome Equipment Market Value, By Application, 2020-2029 ($ Million)

- Table 29: Europe Cryostat Microtome Equipment Market Value, By End-user, 2020-2029 ($ Million)

- Table 30: Europe Cryostat Microtome Equipment Market Value, By Country, 2020-2029 ($ Million)

- Table 31: Asia-Pacific Cryostat Microtome Equipment Market Value, By Product Type, 2020-2029 ($ Million)

- Table 32: Asia-Pacific Cryostat Microtome Equipment Market Value, By Sample Type, 2020-2029 ($ Million)

- Table 33: Asia-Pacific Cryostat Microtome Equipment Market Value, By Application, 2020-2029 ($ Million)

- Table 34: Asia-Pacific Cryostat Microtome Equipment Market Value, By End-user, 2020-2029 ($ Million)

- Table 35: Asia-Pacific Cryostat Microtome Equipment Market Value, By Country, 2020-2029 ($ Million)

- Table 36: Middle East & Africa Cryostat Microtome Equipment Market Value, By Product Type, 2020-2029 ($ Million)

- Table 37: Middle East & Africa Cryostat Microtome Equipment Market Value, By Sample Type, 2020-2029 ($ Million)

- Table 38: Middle East & Africa Cryostat Microtome Equipment Market Value, By Application, 2020-2029 ($ Million)

- Table 39: Middle East & Africa Cryostat Microtome Equipment Market Value, By End-user, 2020-2029 ($ Million)

- Table 40: Amos Scientific Pty Ltd: Overview

- Table 41: Amos Scientific Pty Ltd: Product Portfolio

- Table 42: Amos Scientific Pty Ltd: Key Developments

- Table 43: Avantor, Inc.: Overview

- Table 44: Avantor, Inc.: Product Portfolio

- Table 45: Avantor, Inc.: Key Developments

- Table 46: Thermo Fisher Scientific Inc.: Overview

- Table 47: Thermo Fisher Scientific Inc.: Product Portfolio

- Table 48: Thermo Fisher Scientific Inc.: Key Developments

- Table 49: Leica Biosystems Nussloch GmbH: Overview

- Table 50: Leica Biosystems Nussloch GmbH: Product Portfolio

- Table 51: Leica Biosystems Nussloch GmbH: Key Developments

- Table 52: Bright Instruments Ltd: Overview

- Table 53: Bright Instruments Ltd: Product Portfolio

- Table 54: Bright Instruments Ltd: Key Developments

- Table 55: Freezers India: Overview

- Table 56: Freezers India: Product Portfolio

- Table 57: Freezers India: Key Developments

- Table 58: Medimeas: Overview

- Table 59: Medimeas: Product Portfolio

- Table 60: Medimeas: Key Developments

- Table 61: SM Scientific Instruments Pvt. Ltd. India: Overview

- Table 62: SM Scientific Instruments Pvt. Ltd. India: Product Portfolio

- Table 63: SM Scientific Instruments Pvt. Ltd. India: Key Developments

- Table 64: SLEE medical GmbH: Overview

- Table 65: SLEE medical GmbH: Product Portfolio

- Table 66: SLEE medical GmbH: Key Developments

- Table 67: Tanner Scientific, Inc.: Overview

- Table 68: Tanner Scientific, Inc.: Product Portfolio

- Table 69: Tanner Scientific, Inc.: Key Developments

List of Figures

- Figure 1: Global Cryostat Microtome Equipment Market Share, By Product Type, 2021 & 2029 (%)

- Figure 2: Global Cryostat Microtome Equipment Market Share, By Sample Type, 2021 & 2029 (%)

- Figure 3: Global Cryostat Microtome Equipment Market Share, By Application, 2021 & 2029 (%)

- Figure 4: Global Cryostat Microtome Equipment Market Share, By End-user, 2021 & 2029 (%)

- Figure 5: Global Cryostat Microtome Equipment Market Share, By Region, 2021 & 2029 (%)

- Figure 6: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 7: Global Cryostat Microtome Equipment Market Y-o-Y Growth, By Product Type, 2021-2029 (%)

- Figure 8: Manual microtome cryostat equipment: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 9: Semi-automatic microtome cryostat equipment: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 10: Automatic cryostat microtome equipment: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 11: Global Cryostat Microtome Equipment Market Y-o-Y Growth, By Sample Type, 2021-2029 (%)

- Figure 12: Plant Tissue: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 13: Animal Tissue: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 14: Others: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 15: Global Cryostat Microtome Equipment Market Y-o-Y Growth, By Application, 2021-2029 (%)

- Figure 16: Biology: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 17: Medicine: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 18: Industrial: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 19: Others: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 20: Global Cryostat Microtome Equipment Market Y-o-Y Growth, By End-user, 2021-2029 (%)

- Figure 21: Ambulatory Surgical Centers: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 22: Diagnostic & Research Laboratories: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 23: Hospitals: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 24: Others: Global Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 25: Global Cryostat Microtome Equipment Market Y-o-Y Growth, By Region, 2021-2029 (%)

- Figure 26: North America Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 27: North America Cryostat Microtome Equipment Market Share, By Product Type, 2021 & 2029 (%)

- Figure 28: North America Cryostat Microtome Equipment Market Share, By Sample Type, 2021 & 2029 (%)

- Figure 29: North America Cryostat Microtome Equipment Market Share, By Application, 2021 & 2029 (%)

- Figure 30: North America Cryostat Microtome Equipment Market Share, By End-user, 2021 & 2029 (%)

- Figure 31: North America Cryostat Microtome Equipment Market Share, By Country, 2021 & 2029 (%)

- Figure 32: South America Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 33: South America Cryostat Microtome Equipment Market Share, By Product Type, 2021 & 2029 (%)

- Figure 34: South America Cryostat Microtome Equipment Market Share, By Sample Type, 2021 & 2029 (%)

- Figure 35: South America Cryostat Microtome Equipment Market Share, By Application, 2021 & 2029 (%)

- Figure 36: South America Cryostat Microtome Equipment Market Share, By End-user, 2021 & 2029 (%)

- Figure 37: South America Cryostat Microtome Equipment Market Share, By Country, 2021 & 2029 (%)

- Figure 38: Europe Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 39: Europe Cryostat Microtome Equipment Market Share, By Product Type, 2021 & 2029 (%)

- Figure 40: Europe Cryostat Microtome Equipment Market Share, By Sample Type, 2021 & 2029 (%)

- Figure 41: Europe Cryostat Microtome Equipment Market Share, By Application, 2021 & 2029 (%)

- Figure 42: Europe Cryostat Microtome Equipment Market Share, By End-user, 2021 & 2029 (%)

- Figure 43: Europe Cryostat Microtome Equipment Market Share, By Country, 2021 & 2029 (%)

- Figure 44: Asia-Pacific Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 45: Asia-Pacific Cryostat Microtome Equipment Market Share, By Product Type, 2021 & 2029 (%)

- Figure 46: Asia-Pacific Cryostat Microtome Equipment Market Share, By Sample Type, 2021 & 2029 (%)

- Figure 47: Asia-Pacific Cryostat Microtome Equipment Market Share, By Application, 2021 & 2029 (%)

- Figure 48: Asia-Pacific Cryostat Microtome Equipment Market Share, By End-user, 2021 & 2029 (%)

- Figure 49: Asia-Pacific Cryostat Microtome Equipment Market Share, By Country, 2021 & 2029 (%)

- Figure 50: Middle East & Africa Cryostat Microtome Equipment Market Value, 2020-2029 ($ Million)

- Figure 51: Middle East & Africa Cryostat Microtome Equipment Market Share, By Product Type, 2021 & 2029 (%)

- Figure 52: Middle East & Africa Cryostat Microtome Equipment Market Share, By Sample Type, 2021 & 2029 (%)

- Figure 53: Middle East & Africa Cryostat Microtome Equipment Market Share, By Application, 2021 & 2029 (%)

- Figure 54: Middle East & Africa Cryostat Microtome Equipment Market Share, By End-user, 2021 & 2029 (%)

- Figure 55: Amos Scientific Pty Ltd: Financials

- Figure 56: Avantor, Inc.: Financials

- Figure 57: Thermo Fisher Scientific Inc.: Financials

- Figure 58: Leica Biosystems Nussloch GmbH: Financials

- Figure 59: Bright Instruments Ltd: Financials

- Figure 60: Freezers India: Financials

- Figure 61: Medimeas: Financials

- Figure 62: SM Scientific Instruments Pvt. Ltd. India.: Financials

- Figure 63: SLEE medical GmbH: Financials

- Figure 64: Tanner Scientific, Inc.: Financials

Overview

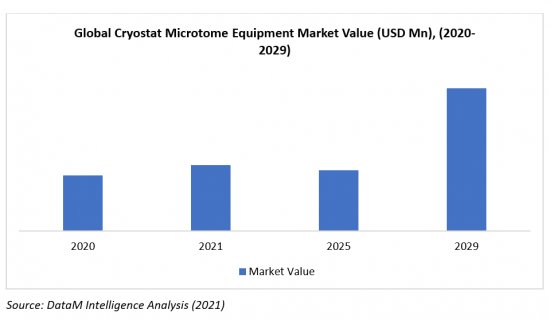

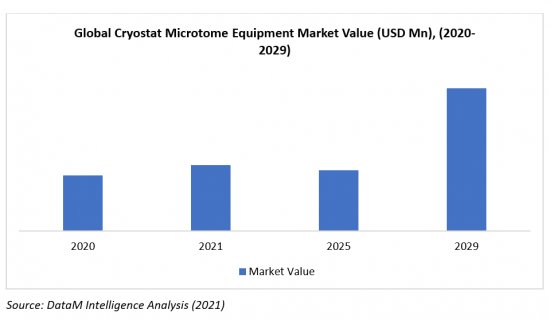

The global cryostat microtome equipment market size was valued US$ XX million in 2021 and is estimated to reach US$ XX million by 2029, growing at a CAGR of XX % during the forecast period (2022-2029).

A cryostat microtome, a freezing microtome, is a piece of medical equipment used to generate cryo-sections of plant and animal tissues into thin sections. Microtome cryostats are used in various medicinal, biological, and industrial applications. A microtome cryostat is a refrigerated cabinet containing a microtome that is normally operated at temperatures ranging from -5°C to -50°C. It consists of a sectioning device, a rotary microtome, a blade holder or knife, and a mechanism to freeze the samples.

Market Dynamics

The increasing use of cryostat-microtomes in immunohistochemistry laboratories to find cancer markers is expected to drive market growth.

Immunohistochemistry (IHC) is a branch of biology that uses antibodies to identify antigens (proteins) in tissue slices. A classic application is the biopsy of tissue samples to find cancer markers. A freezing temperature chamber is the only means to achieve fine slices, which are necessary for immunohistochemistry applications (while sectioning the tissue sample). Tissue samples are too delicate to cut into thin sections without this type of chamber. This cool chamber protects the sample from thawing while sectioning, as well as reduces microbial damage to the tissue sample. When findings are expected immediately, and the antigenicity of delicate molecules must be retained, this cryo-section is vitally necessary. These materials are processed in an IHC laboratory in a cryostat with a microtome. A microtome is a device that cuts thin tissue pieces for study. Cryo-sections are thin slices generated by the cryostat that is then examined under a microscope. These ultra-thin slices allow scientists to make a more accurate judgment about the nature of a disease in a shorter amount of time. Therefore, cryostats make a substantial contribution to the healthcare business. A tiny tissue piece from the patient is frequently analyzed to determine the next course of treatment. In cases of diseases such as cancer, treatment cannot resume until the immunocytochemistry lab returns the results of a tissue biopsy. As a result, the diagnosis must be completed as soon as possible using techniques involving the cryostat-microtome. Thus, from the above statements, the market is expected to drive market growth.

Restraint

The high cost associated with the cryostat microtome equipment and the lack of skilled professionals to operate cryostat microtome equipment are the factors the market is expected to get hampered in the forecast period.

Industry Analysis

The cryostat microtome equipment market provides in-depth analysis of the market based on various industry factors such as supply chain analysis, pricing analysis etc.

COVID-19 Impact Analysis

The COVID-19 pandemic has moderately impacted healthcare systems and the market. All outpatient treatments were postponed or limited during the COVID-19 pandemic because most chronic therapies were seen as non-urgent to reduce the risk of viral transmission. For the study of tissue histopathology, cryostat microtome equipment is frequently employed in diagnostic and research laboratories. In addition, as the pandemic spread, the market for cryostat microtome equipment has benefited from an increased study into the immunohistochemistry of COVID-19-infected tissues. In contrast, the pandemic interrupts the supply chain and process. Many companies will vary to other geographic regions to ensure that products remain available and protect their supply chain. Thus, from the above statements, the market got affected, and it is expected to gain traction quickly with the resumption of economic activities.

Segment Analysis

Automatic cryostat microtome equipment segment is expected to hold the largest market share in cryostat microtome equipment market

The automatic cryostat microtome equipment segment accounted for the largest market share in 2021. The segment benefits because tissue sectioning automation can provide labs with faster setup and alignment, programmable settings, speedier sectioning, and motorized trimming. This makes it possible for histopathologists to process more sample blocks in a shorter time, leading to faster patient diagnosis. Saving time allows for processing more samples and using pathologists' output by allowing them to work on different aspects of tissue processing simultaneously. Moreover, automated microtomes can also be used for quality assurance. Engineers and producers know the impact human error and weariness can have on the quality of produced portions. The motorized feed can produce the same velocity each time to cut continuous sections of the same quality for thicker sections and harder specimens, including malignant tissue, calcified tissue, and decalcified teeth. For instance, an innovative, precise specimen feeding mechanism called the Minux Rotary Paraffin Microtomes (Semi-Auto / Fully Auto) perfectly enables microtomists to get outstanding, thin serial section results. A patented visible pointer helps you position sections quickly and precisely. It is frequently employed in anatomical pathology and histopathology. Thus, from the above statements, the market segment is expected to hold the largest market share in the forecast period.

Geographical Analysis

North America region holds the largest market share in the global cryostat microtome equipment market

North America accounted for the largest market share in 2021. The increasing prevalence of cancer, technological advancements in immunohistochemistry research studies, and increasing adoption of highly advanced techniques in cryostat microtome equipment, product launches, and acquisitions by the key market players are some factors the market is driven in the forecast period. For instance, according to the American Cancer Society, in 2020, an estimated 1.8 million new cancer cases and 606,520 cancer deaths in the United States will be diagnosed. In contrast, in 2021, an estimated 1.9 million new cancer cases will be diagnosed and 608,570 cancer deaths in the United States. Therefore, it has increased the adoption of cryostat microtome equipment. Moreover, Precisionary Instruments LLC announced the release of a new precision cryostat in April 2020. (Model CF-6100). In pathology, dermatology, and histology labs, the CF-6100 cryostat is a high-precision microtome with dual compressors, UV light disinfection, and an LED touchscreen control panel that encourages and supports high-quality tissue sectioning. Thus, from the above statements, the North American region is expected to hold the largest market share in the forecast period.

Competitive Landscape

Major key players in the cryostat microtome equipment market are: Amos Scientific Pty Ltd, Avantor, Inc., Thermo Fisher Scientific Inc., Leica Biosystems Nussloch GmbH, Bright Instruments Ltd, Freezers India, Medimeas, SM Scientific Instruments Pvt. Ltd. India, SLEE medical GmbH andTanner Scientific, Inc.

Amos Scientific Pty Ltd:

Overview:

Amos Scientific Pty Ltd is a medical research company specializing in human tissue research. Amos Scientific was founded in Melbourne, Australia, and has been responsible for manufacturing pioneering devices such as the microtome, cryostat microtome, embedding center system, vacuum tissue processor, and immunohisto stainer. The company has established a strong R&D team to maintain a leading edge and develop automatic and digital diagnoses in histology. Moreover, the company's engineers launched high-tech products in the global medical industry, such as an automatic microtome post-processing system and an automatic liquid-based cytology slide staining system in 2013.

Product Portfolio:

AST500 Semi-automatic microtome cryostat equipment: The AST 500 is a semi-automatic cryostat microtome with forwarding and backward movement motorized specimens. As a result, it can obtain a high-quality part that is also simple to work with. It is developed with an overall engineering and ergonomic philosophy in mind. A computer numerically controlled machine processes all of the components. The retraction feature protects the specimen from blade damage. Calculate the total thickness. Low-temperature refrigeration system using the environmentally beneficial refrigerant R404. Every time, use UV and O3 sterilization for 30 minutes. Peltier specimen clamp refrigeration can be manually turned on and off. There are two types of defrosting methods: automatic and manual. The high-precision unit is contained outside the cryostat chamber to avoid thermal expansion and contraction and to keep maintenance to a minimum. The artificial intelligent interface is simple to learn and operate.

The global cryostat microtome equipment market report would provide an access to an approx. 45+ market data table, 40+ figures and 180 pages.

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Market Definition and Overview

3. Executive Summary

4. Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. The increasing use of cryostat-microtomes in immunohistochemistry laboratories to find cancer markers is expected to drive market growth.

- 4.1.2. Restraints:

- 4.1.2.1. The high cost associated with the cryostat microtome equipment is expected to hamper the market growth.

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Supply Chain Analysis

- 5.2. Pricing Analysis

6. COVID-19 Analysis

- 6.1. Analysis of Covid-19 on the Market

- 6.1.1. Before COVID-19 Market Scenario

- 6.1.2. Present COVID-19 Market Scenario

- 6.1.3. After COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid Covid-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Product Type

- 7.1.2. Market Attractiveness Index, By Product Type Segment

- 7.2. Manual microtome cryostat equipment*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis, US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 7.3. Semi-automatic microtome cryostat equipment

- 7.4. Automatic cryostat microtome equipment

8. By Sample Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Sample Type

- 8.1.2. Market Attractiveness Index, By Sample Type Segment

- 8.2. Plant Tissue*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis, US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 8.3. Animal Tissue

- 8.4. Others

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application Segment

- 9.2. Biology*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis, US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 9.3. Medicine

- 9.4. Industrial

- 9.5. Others

10. By End user

- 10.1. Introduction

- 10.1.1. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End user

- 10.1.2. Market Attractiveness Index, By End user Segment

- 10.2. Ambulatory Surgical Centers*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis, US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 10.3. Diagnostic & Research Laboratories

- 10.4. Hospitals

- 10.5. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis, US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029, By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Product Type

- 11.2.4. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Sample Type

- 11.2.5. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End user

- 11.2.7. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Product Type

- 11.3.4. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Sample Type

- 11.3.5. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End user

- 11.3.7. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. U.K.

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Product Type

- 11.4.4. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Sample Type

- 11.4.5. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End user

- 11.4.7. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Product Type

- 11.5.4. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Sample Type

- 11.5.5. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End user

- 11.5.7. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Product Type

- 11.6.4. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Sample Type

- 11.6.5. Market Size Analysis, and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis, and Y-o-Y Growth Analysis (%), By End user

12. Competitive Landscape

- 12.1. Key Developments and Strategies

- 12.2. Company Share Analysis

- 12.3. Product Benchmarking

- 12.4. List of Key Companies to Watch

13. Company Profiles

- 13.1. Amos Scientific Pty Ltd*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Key Highlights

- 13.1.4. Financial Overview

- 13.2. Avantor, Inc.

- 13.3. Thermo Fisher Scientific Inc.

- 13.4. Leica Biosystems Nussloch GmbH

- 13.5. Bright Instruments Ltd

- 13.6. Freezers India

- 13.7. Medimeas

- 13.8. SM Scientific Instruments Pvt. Ltd. India.

- 13.9. SLEE medical GmbH

- 13.10. Tanner Scientific, Inc.

LIST NOT EXHAUSTIVE

14. Global Cryostat Microtome Equipment Market - DataM

- 14.1. Appendix

- 14.2. About Us and Applications

- 14.3. Contact Us