|

|

市場調査レポート

商品コード

1776198

ミクロトームの世界市場 - 市場考察、競合情勢、市場予測(2032年)Microtome - Market Insights, Competitive Landscape, and Market Forecast - 2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ミクロトームの世界市場 - 市場考察、競合情勢、市場予測(2032年) |

|

出版日: 2025年07月01日

発行: DelveInsight

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

世界のミクロトームの市場規模は、2025年~2032年の予測期間にCAGRで6.13%の成長が見込まれます。ミクロトームの需要は主に、がん、感染症、アテローム性動脈硬化症、心筋梗塞、心筋症などの心血管疾患、喘息、慢性閉塞性肺疾患(COPD)などの呼吸器疾患などの慢性疾患の症例の増加によって後押しされています。さらに、世界中での生物医学研究と医薬品開発活動の拡大が、ミクロトームの需要を促進しています。研究者は、分子診断、創薬、個別化医療に用いる高品質な組織切片を必要としており、このことが2025年~2032年の予測期間のミクロトーム市場を押し上げています。

ミクロトームの市場力学

International Agency for Research on Cancer(2024)が提供したデータによると、2022年に世界で約2,000万件のがん症例が新たに登録されました。また、同資料によると、登録された新規がん症例のうち、肺がんは世界で250万件の新規症例を占め、もっとも一般的ながんとなっています。次いで、乳がんが230万件、大腸がんが190万件、胃がんが97万件となっています。

Global Cancer Observatory(2024)は、2030年までに世界で新たに発生するがん症例は2,000万件~2,410万件になると推定しています。さらに、アジアが982万6,539人、欧州が447万1,422人、ラテンアメリカ・カリブが155万1,060人、アフリカが118万5,216人であるとしています。

がんの診断と治療は正確な組織検査に大きく依存しているため、がん罹患率の上昇に伴い、顕微鏡分析に用いる高品質な組織切片を作成するためにミクロトームを広く使用する必要があります。このようながん患者の急増は、ミクロトーム市場の拡大につながります。

さらに、結核、肝炎、COVID-19、真菌感染症などの感染症の発生時には、病原体を特定し、組織損傷の程度を評価し、疾患の進行をモニターするために、生検組織の病理組織学的評価が不可欠となります。世界保健機関(WHO)が提供したデータによると、2023年に世界で推定1,080万人が結核に罹患し、その内訳は男性600万人、女性360万人、子供130万人でした。さらに、同じ資料によれば、2022年に世界中で推定2億5,400万人がB型肝炎に、5,000万人がC型肝炎に罹患しており、毎日6,000人が新たにウイルス性肝炎に感染しています。ミクロトームは、確定診断のために顕微鏡で染色・検査される、薄く均一な組織切片の作成において非常に重要であり、それによってミクロトーム市場全体を押し上げています。

したがって、上記のすべての要因が、予測期間のミクロトーム市場を牽引する見込みです。

しかし、クライオセクショニングやレーザーマイクロダイセクションなどの代替サンプル調製技術の利用可能性によって従来のミクロトームへの依存度が低下する可能性があり、これがエンドユーザー基盤を制限する要因として作用し、予測期間のミクロトーム市場の成長は抑制される見込みです。

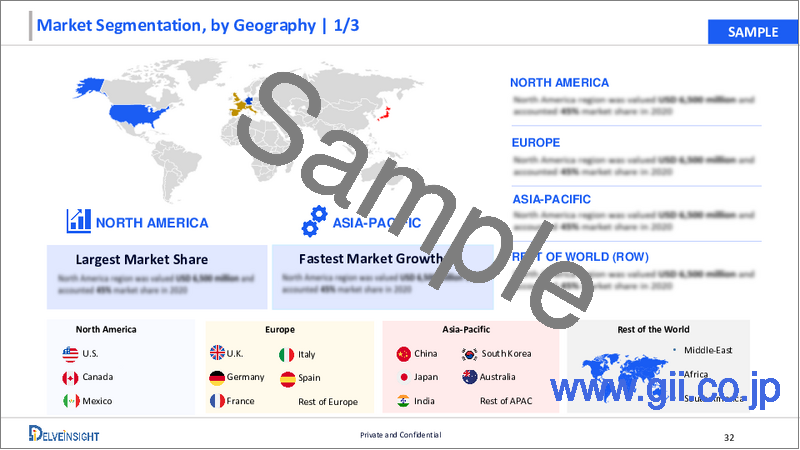

北米がミクロトーム市場全体を独占すると予測される

北米が2024年のミクロトーム市場において、全地域の中でもっとも高いシェアを占めると予測されています。これは、北米におけるがん患者や感染症の継続的な増加によるものです。さらに、ハイエンドの医療インフラとすでに利用可能なハイテク装置、先進のがん診断検査とスクリーニングの見通しの拡大、病理検査室に対する有利な償還政策、医療費の増加、この地域における多数の市場企業プレゼンスが、北米のミクロトーム市場の成長を促進すると予測されます。

National Cancer Institute(2024)は、2024年末までに米国で新たに200万人のがん患者が診断されると推定しています。さらに、前立腺がん、肺がん、大腸がんが男性のがん診断全体の約48%を占めると推定されています。もっとも罹患率の高いがんは乳がん、肺がん、大腸がんで、新規がん診断全体の約51%を占めると予測されています。

当レポートでは、世界のミクロトーム市場について調査分析し、市場規模と予測、過去3年の製品/技術開発、市場の主要企業、利用可能な機会などの情報を提供しています。

目次

第1章 ミクロトーム市場レポートのイントロダクション

第2章 ミクロトーム市場のエグゼクティブサマリー

- 市場の概要

第3章 競合情勢

第4章 規制分析

- 米国

- 欧州

- 日本

- 中国

第5章 ミクロトーム市場の主な要因の分析

- ミクロトーム市場の促進要因

- ミクロトーム市場の抑制要因と課題

- ミクロトーム市場の機会

第6章 ミクロトーム市場のポーターのファイブフォース分析

第7章 ミクロトーム市場の評価

- 製品別

- 機器

- アクセサリ

- 技術別

- 全自動

- 半自動

- 手動

- エンドユーザー別

- 病院

- 診断クリニック

- 学術研究所

- その他

- 地域

- 北米

- 欧州

- アジア太平洋

- その他の地域

第8章 ミクロトーム市場の企業と製品のプロファイル

- Thermo Fisher Scientific Inc

- AGD Biomedicals Pvt. Ltd.

- SLEE medical GmbH

- Diapath S.p.A.

- Leica Biosystems Nussloch GmbH

- Green Leaf Scientific

- MEDITE Medical GmbH

- LLS ROWIAK LaserLabSolutions GmbH

- Amos Scientific PTY. LTD

- RWD Life Science Co

- Sakura Finetek

- Boeckeler Instruments, Inc.

- HACKER Instruments & Industries Inc

- microTec Laborgerate GmbH

- Bright Instrument Co Limited.

- JINHUA YIDI MEDICAL APPLIANCES CO., LTD

- FEATHER Safety Razor Co., Ltd

- Precisionary Instruments

- Powered Milestone S.r.l.

- Weinkauf Medizintechnik

第9章 KOLの見解

第10章 プロジェクトアプローチ

第11章 DelveInsightについて

第12章 免責事項、お問い合わせ

List of Tables

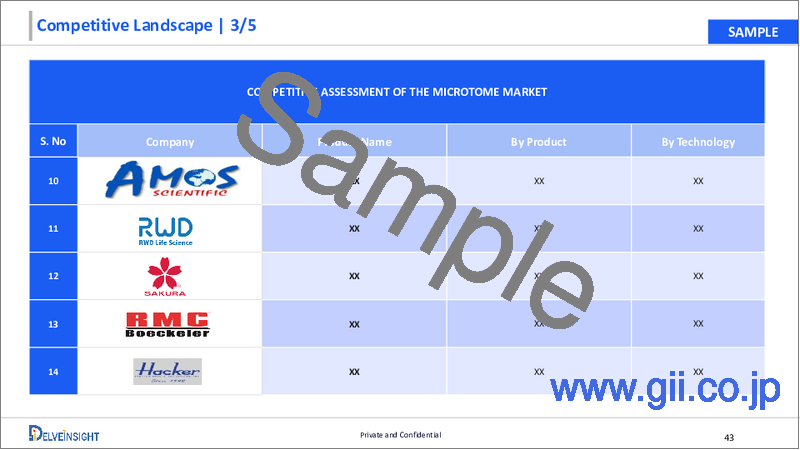

- Table 1: Competitive Analysis

- Table 2: Microtome Market in Global (2022-2032)

- Table 3: Microtome Market in Global by Product (2022-2032)

- Table 4: Microtome Market in Global by Technology (2022-2032)

- Table 5: Microtome Market in Global by End-User (2022-2032)

- Table 6: Microtome Market in Global by Geography (2022-2032)

- Table 7: Microtome Market in North America (2022-2032)

- Table 8: Microtome Market in the United States (2022-2032)

- Table 9: Microtome Market in Canada (2022-2032)

- Table 10: Microtome Market in Mexico (2022-2032)

- Table 11: Microtome Market in Europe (2022-2032)

- Table 12: Microtome Market in France (2022-2032)

- Table 13: Microtome Market in Germany (2022-2032)

- Table 14: Microtome Market in United Kingdom (2022-2032)

- Table 15: Microtome Market in Italy (2022-2032)

- Table 16: Microtome Market in Spain (2022-2032)

- Table 17: Microtome Market in the Rest of Europe (2022-2032)

- Table 18: Microtome Market in Asia-Pacific (2022-2032)

- Table 19: Microtome Market in China (2022-2032)

- Table 20: Microtome Market in Japan (2022-2032)

- Table 21: Microtome Market in India (2022-2032)

- Table 22: Microtome Market in Australia (2022-2032)

- Table 23: Microtome Market in South Korea (2022-2032)

- Table 24: Microtome Market in Rest of Asia-Pacific (2022-2032)

- Table 25: Microtome Market in the Rest of the World (2022-2032)

- Table 26: Microtome Market in the Middle East (2022-2032)

- Table 27: Microtome Market in Africa (2022-2032)

- Table 28: Microtome Market in South America (2022-2032)

List of Figures

- Figure 1: Competitive Analysis

- Figure 2: Microtome Market in Global (2022-2032)

- Figure 3: Microtome Market in Global by Product (2022-2032)

- Figure 4: Microtome Market in Global by Technology (2022-2032)

- Figure 5: Microtome Market in Global by End-User (2022-2032)

- Figure 6: Microtome Market in Global by Geography (2022-2032)

- Figure 7: Microtome Market in North America (2022-2032)

- Figure 8: Microtome Market in the United States (2022-2032)

- Figure 9: Microtome Market in Canada (2022-2032)

- Figure 10: Microtome Market in Mexico (2022-2032)

- Figure 11: Microtome Market in Europe (2022-2032)

- Figure 12: Microtome Market in France (2022-2032)

- Figure 13: Microtome Market in Germany (2022-2032)

- Figure 14: Microtome Market in the United Kingdom (2022-2032)

- Figure 15: Microtome Market in Italy (2022-2032)

- Figure 16: Microtome Market in Spain (2022-2032)

- Figure 17: Microtome Market in the Rest of Europe (2022-2032)

- Figure 18: Microtome Market in Asia-Pacific (2022-2032)

- Figure 19: Microtome Market in China (2022-2032)

- Figure 20: Microtome Market in Japan (2022-2032)

- Figure 21: Microtome Market in India (2022-2032)

- Figure 22: Microtome Market in Australia (2022-2032)

- Figure 23: Microtome Market in South Korea (2022-2032)

- Figure 24: Microtome Market in Rest of Asia-Pacific (2022-2032)

- Figure 25: Microtome Market in the Rest of the World (2022-2032)

- Figure 26: Microtome Market in the Middle East (2022-2032)

- Figure 27: Microtome Market in Africa (2022-2032)

- Figure 28: Microtome Market in South America (2022-2032)

- Figure 29: Market Drivers

- Figure 30: Market Barriers

- Figure 31: Marker Opportunities

- Figure 32: PORTER'S Five Force Analysis

Microtome Market by Product (Microtome [Rotary Microtome, Vibrating Microtome, and Others] and Accessories [Blades and Knives, Cooling Clamp, and Others]), Technology (Fully Automated, Semi-Automated, and Manual), End-User (Hospitals, Diagnostic Clinics, Academic and Research Laboratories, and Others), and Geography (North America, Europe, Asia-Pacific, and rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the growing cases of chronic disorders, increase in research and development activities, among others globally.

The microtome market is estimated to grow at a CAGR of 6.13% during the forecast period from 2025 to 2032. The demand for microtomes is primarily being boosted by the increasing cases of chronic disorders such as cancer, infectious disease, cardiovascular diseases, including atherosclerosis, myocardial infarction, and cardiomyopathies, respiratory disorders like asthma, chronic obstructive pulmonary disease (COPD), and others. Additionally, the expansion of biomedical research and pharmaceutical development activities worldwide is fueling the demand for microtomes. Researchers require high-quality tissue sections for molecular diagnostics, drug discovery, and personalized medicine, thus boosting the market for microtomes during the forecast period from 2025 to 2032.

Microtome Market Dynamics:

According to data provided by the International Agency for Research on Cancer (2024), in 2022, approximately 20 million new instances of cancer were registered globally. Additionally, as per the same source, lung cancer accounted for 2.5 million new cases globally, of all the registered new cancer cases, making it the most common cancer. Next in order of incidence were breast cancer with 2.3 million cases, colon cancer with 1.9 million cases, and stomach cancer with 0.97 million cases globally.

The Global Cancer Observatory (2024) estimated that the new instances of cancer globally would range from 20 million to 24.1 million by the year 2030. Moreover, it stated that Asia accounted for 9,826,539 cancer cases, Europe accounted for 4,471,422 cancer cases, LAC accounted for 1,551,060 cancer cases, and Africa accounted for 1,185,216 cancer cases.

Since cancer diagnosis and treatment rely heavily on accurate tissue examination, the rising cancer rates necessitate the widespread use of microtomes to prepare high-quality tissue sections for microscopic analysis. This surge in cancer cases translates into a larger market for microtomes.

Additionally, during outbreaks of infectious diseases such as tuberculosis, hepatitis, COVID-19, and fungal infections, histopathological evaluation of biopsied tissues becomes essential to identify the pathogen, assess the extent of tissue damage, and monitor disease progression. According to the data provided by the World Health Organization, in 2023, an estimated 10.8 million people fell ill with TB worldwide, including 6.0 million men, 3.6 million women, and 1.3 million children. Additionally, as per the same source, in 2022, an estimated 254 million people were living with hepatitis B and 50 million people were living with hepatitis C worldwide, and 6000 people were newly infected with viral hepatitis each day. Microtomes are crucial in preparing thin, uniform tissue sections that are stained and examined under microscopes for definitive diagnosis, thereby boosting the overall market of microtomes.

Therefore, all the above-mentioned factors are expected to drive the market for microtomes during the given forecast period.

However, the availability of alternative sample preparation technologies, such as cryo-sectioning and laser microdissection, could reduce the reliance on traditional microtomes, acting as factors that are expected to limit their end-user base, thus restricting the growth of the microtome market during the forecast period.

Microtome Market Segment Analysis:

Microtome Market by Product (Microtome [Rotary Microtome, Vibrating Microtome, and Others] and Accessories [Blades and Knives, Cooling Clamp, and Others]), Technology (Fully Automated, Semi-Automated, and Manual), End-User (Hospital, Diagnostic Clinics, Academic and Research Laboratories, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the technology segment of the microtome market, the fully automated category of microtome is estimated to amass a significant revenue share in the microtome market in 2024. This can be attributed to the large patient population associated with various chronic disorders and the presence of a variety of products available to this category.

Fully automated microtomes offer several advantages and diverse applications, significantly enhancing the field of histopathology. Their primary benefits are to produce consistent high quality tissue sections with minimal user intervention, ensuring precision and reproducibility. This automation reduces the risk of human error and variability, which is crucial for accurate diagnosis.

In terms of applications, fully automated microtomes are invaluable in cancer diagnostics, where they provide fine tissue sections needed for detailed examination of tumor morphology and margins. They are also extensively used in research settings to study disease mechanisms at the cellular level, contributing to the development of new treatments and therapies. These advanced instruments are employed in various medical fields, including neuropathology, dermatopathology, and cardiovascular pathology, where precise tissue sectioning is critical for studying complex structures and diagnosing conditions.

Additionally, the presence of a huge number of commercially available fully automated systems and the increasing demand for digitalization in tissue diagnostic procedures are some of the crucial factors anticipated to boost the market in the next few years. Some of the key automated products include Microtome A550, Tissue-Tek Genie, and Leica Biosystems HistoCore AUTOCUT 2550.

Therefore, the various advantages and applications provided by fully automated microtomes will contribute to the growth of this category, thereby driving the growth of the overall microtome market during the forecast period.

North America is expected to dominate the overall microtome market:

North America is expected to account for the highest proportion of the microtome market in 2024, out of all regions. This is owing to the continual increase in cancer cases and infectious diseases in the North America region. Moreover, the high-end medical infrastructure paired with readily available high-tech equipment, expanding prospects for sophisticated cancer diagnostic testing and screening, favorable reimbursement policies for pathology labs, rise in healthcare spending, presence of a large number of market players in the region are expected to drive the growth of the microtome market in North America.

The National Cancer Institute (2024) estimated that 2 million new cases of cancer will be diagnosed in the US by the end of 2024. Furthermore, it was estimated that prostate, lung, and colorectal cancers were expected to represent approximately 48% of all cancer diagnoses in men. The most prevalent cancers are breast, lung, and colorectal, which are expected to account for about 51% of all new cancer diagnoses.

According to Global Cancer Observatory's data (2024), in 2022, the US represented 89.1% of all cancer cases, and Canada represented 10.9% of all cancer cases. The reliance on microtomes for accurate tissue sectioning in cancer diagnosis and research is paramount. Microtomes are essential for producing high-quality tissue samples for identifying cancer types, understanding disease progression, and tailoring treatment plans. Consequently, the rising instances of cancer catalyze the demand for microtomes, hence propelling market growth.

According to the recently updated data provided by the Centers for Disease Control and Prevention (CDC) (2024), it was stated that 805,000 people in the US have a myocardial infarction (heart attack) every year on average. The high incidence of myocardial infarctions necessitates extensive histological examination of cardiac tissues to understand the underlying causes. Microtomes are essential in preparing thin, detailed sections of heart tissue for microscopic analysis, enabling pathologists to examine cellular structures, detect abnormalities, and evaluate the effectiveness of treatment, therefore boosting its market growth.

According to the American Lung Association data updated in April 2024, it stated that more than 34 million people were living in the US with chronic lung diseases like asthma and COPD. These disorders underscore the growing need for microtomes in diagnostic pathology because of their ability to produce high-quality lung tissue sections for microscopic analysis, which is vital for diagnosing, understanding, and treating these conditions, consequently boosting the market for microtomes.

Thus, due to the interplay of all the above-mentioned factors, it will lead to an increase in the North America microtome market growth during the forecast period from 2025 to 2032.

Microtome Market Key Players:

Some of the key market players operating in the microtome market include Thermo Fisher Scientific Inc., AGD Biomedicals Pvt. Ltd., SLEE medical GmbH, Diapath S.p.A., Leica Biosystems Nussloch GmbH, Green Leaf Scientific, MEDITE Medical GmbH, LLS ROWIAK LaserLabSolutions GmbH, Amos Scientific PTY. LTD, RWD Life Science Co., Sakura Finetek, Boeckeler Instruments, Inc., HACKER Instruments & Industries Inc., microTec Laborgerate GmbH, Bright Instrument Co Limited, JINHUA YIDI MEDICAL APPLIANCES CO., LTD, FEATHER Safety Razor Co., Ltd., Precisionary Instruments, Powered Milestone Srl, Weinkauf Medizintechnik, and others.

Recent Developmental Activities in the Microtome Market:

- In February 2023, Precisionary Instruments launched a brand new line of rotatory microtomes and offered 3 models for the same; RF-600: Manual model, RF-800: Semi-automated model, RF-1000: Fully automated model.

Key takeaways from the microtome market report study

- Market size analysis for current microtome market size (2024), and market forecast over 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the global microtome market

- Various opportunities available for the other competitors in the microtome market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current microtome market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for microtome market growth in the future?

Target audience who can benefit from this microtome market report study

- Microtome product providers

- Research organizations and consulting companies

- Microtome-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in microtomes

- Various end-users who want to know more about the microtome market and the latest technological developments in the microtome market.

Frequently Asked Questions for the Microtome Market:

1. What is a microtome?

- Microtomes are specialized devices designed to create thin, uniform sections of tissue or other samples, typically ranging from a few micrometers to tens of micrometers in thickness.

2. What is the market for microtomes?

- The microtome market is estimated to grow at a CAGR of 6.13% during the forecast period from 2025 to 2032.

3. What are the drivers for the global microtome market?

- The microtome market is primarily being boosted by the increasing cases of chronic disorders such as cancer, infectious diseases, cardiovascular diseases, including atherosclerosis, myocardial infarction, and cardiomyopathies, respiratory disorders like asthma, chronic obstructive pulmonary disease (COPD), among others. Additionally, the expansion of biomedical research and pharmaceutical development activities worldwide is fueling the demand for microtomes. Researchers require high-quality tissue sections for molecular diagnostics, drug discovery, and personalized medicine, thus boosting the market for microtomes during the forecast period from 2025 to 2032.

4. Who are the key players operating in the microtome market?

- Some of the key market players operating in microtome include Thermo Fisher Scientific Inc., AGD Biomedicals Pvt. Ltd., SLEE medical GmbH, Diapath S.p.A., Leica Biosystems Nussloch GmbH, Green Leaf Scientific, MEDITE Medical GmbH, LLS ROWIAK LaserLabSolutions GmbH, Amos Scientific PTY. LTD, RWD Life Science Co, Sakura Finetek, Boeckeler Instruments, Inc., HACKER Instruments & Industries Inc., microTec Laborgerate GmbH, Bright Instrument Co Limited, JINHUA YIDI MEDICAL APPLIANCES CO., LTD, FEATHER Safety Razor Co., Ltd., Precisionary Instruments, Powered Milestone Srl, Weinkauf Medizintechnik, and others.

5. Which region has the highest share in the microtome market?

- North America is expected to account for the highest proportion of the microtome market in 2024, out of all regions. This is owing to the continual increase in cancer cases and infectious diseases in the North America region. Moreover, the high-end medical infrastructure paired with readily available high-tech equipment, expanding prospects for sophisticated cancer diagnostic testing and screening, favorable reimbursement policies for pathology labs, a rise in healthcare spending, presence of a large number of market players in the region are expected to drive the growth of the microtome market in North America.

Table of Contents

1. Microtome Market Report Introduction

- 1.1. Scope of the Study

- 1.2. Market Segmentation

- 1.3. Market Assumption

2. Microtome Market Executive Summary

- 2.1. Market at Glance

3. Competitive Landscape

4. Regulatory Analysis

- 4.1. The United States

- 4.2. Europe

- 4.3. Japan

- 4.4. China

5. Microtome Market Key Factors Analysis

- 5.1. Microtome Market Drivers

- 5.1.1. Growing cases of chronic disorders

- 5.1.2. Rise in research and development activities

- 5.2. Microtome Market Restraints and Challenges

- 5.2.1. Availability of alternative sample preparation technologies, such as cryo-sectioning and laser microdissection

- 5.3. Microtome Market Opportunities

- 5.3.1. Development of AI-integrated microtomes for efficiency, fewer human errors, and better reproducibility in tissue sectioning

6. Microtome Market Porter's Five Forces Analysis

- 6.1. Bargaining Power of Suppliers

- 6.2. Bargaining Power of Consumers

- 6.3. Threat of New Entrants

- 6.4. Threat of Substitutes

- 6.5. Competitive Rivalry

7. Microtome Market Assessment

- 7.1. By Product

- 7.1.1. Devices

- 7.1.1.1. Rotary Microtome

- 7.1.1.2. Vibrating Microtome

- 7.1.1.3. Others

- 7.1.2. Accessories

- 7.1.2.1. Blades and Knives

- 7.1.2.2. Cooling Clamp

- 7.1.2.3. Others

- 7.1.1. Devices

- 7.2. By Technology

- 7.2.1. Fully Automated

- 7.2.2. Semi-Automated

- 7.2.3. Manual

- 7.3. By End-User

- 7.3.1. Hospitals

- 7.3.2. Diagnostic Clinics

- 7.3.3. Academic and Research Laboratories

- 7.3.4. Others

- 7.4. By Geography

- 7.4.1. North America

- 7.4.1.1. United States Microtome Market Size in USD million (2022-2032)

- 7.4.1.2. Canada Microtome Market Size in USD million (2022-2032)

- 7.4.1.3. Mexico Microtome Market Size in USD million (2022-2032)

- 7.4.2. Europe

- 7.4.2.1. France Microtome Market Size in USD million (2022-2032)

- 7.4.2.2. Germany Microtome Market Size in USD million (2022-2032)

- 7.4.2.3. United Kingdom Microtome Market Size in USD million (2022-2032)

- 7.4.2.4. Italy Microtome Market Size in USD million (2022-2032)

- 7.4.2.5. Spain Microtome Market Size in USD million (2022-2032)

- 7.4.2.6. Rest of Europe Microtome Market Size in USD million (2022-2032)

- 7.4.3. Asia-Pacific

- 7.4.3.1. China Microtome Market Size in USD million (2022-2032)

- 7.4.3.2. Japan Microtome Market Size in USD million (2022-2032)

- 7.4.3.3. India Microtome Market Size in USD million (2022-2032)

- 7.4.3.4. Australia Microtome Market Size in USD million (2022-2032)

- 7.4.3.5. South Korea Microtome Market Size in USD million (2022-2032)

- 7.4.3.6. Rest of Asia-Pacific Microtome Market Size in USD million (2022-2032)

- 7.4.4. Rest of the World (RoW)

- 7.4.1. North America

8. Microtome Market Company and Product Profiles

- 8.1. Thermo Fisher Scientific Inc

- 8.1.1. Company Overview

- 8.1.2. Company Snapshot

- 8.1.3. Financial Overview

- 8.1.4. Product Listing

- 8.1.5. Entropy

- 8.2. AGD Biomedicals Pvt. Ltd.

- 8.2.1. Company Overview

- 8.2.2. Company Snapshot

- 8.2.3. Financial Overview

- 8.2.4. Product Listing

- 8.2.5. Entropy

- 8.3. SLEE medical GmbH

- 8.3.1. Company Overview

- 8.3.2. Company Snapshot

- 8.3.3. Financial Overview

- 8.3.4. Product Listing

- 8.3.5. Entropy

- 8.4. Diapath S.p.A.

- 8.4.1. Company Overview

- 8.4.2. Company Snapshot

- 8.4.3. Financial Overview

- 8.4.4. Product Listing

- 8.4.5. Entropy

- 8.5. Leica Biosystems Nussloch GmbH

- 8.5.1. Company Overview

- 8.5.2. Company Snapshot

- 8.5.3. Financial Overview

- 8.5.4. Product Listing

- 8.5.5. Entropy

- 8.6. Green Leaf Scientific

- 8.6.1. Company Overview

- 8.6.2. Company Snapshot

- 8.6.3. Financial Overview

- 8.6.4. Product Listing

- 8.6.5. Entropy

- 8.7. MEDITE Medical GmbH

- 8.7.1. Company Overview

- 8.7.2. Company Snapshot

- 8.7.3. Financial Overview

- 8.7.4. Product Listing

- 8.7.5. Entropy

- 8.8. LLS ROWIAK LaserLabSolutions GmbH

- 8.8.1. Company Overview

- 8.8.2. Company Snapshot

- 8.8.3. Financial Overview

- 8.8.4. Product Listing

- 8.8.5. Entropy

- 8.9. Amos Scientific PTY. LTD

- 8.9.1. Company Overview

- 8.9.2. Company Snapshot

- 8.9.3. Financial Overview

- 8.9.4. Product Listing

- 8.9.5. Entropy

- 8.10. RWD Life Science Co

- 8.10.1. Company Overview

- 8.10.2. Company Snapshot

- 8.10.3. Financial Overview

- 8.10.4. Product Listing

- 8.10.5. Entropy

- 8.11. Sakura Finetek

- 8.11.1. Company Overview

- 8.11.2. Company Snapshot

- 8.11.3. Financial Overview

- 8.11.4. Product Listing

- 8.11.5. Entropy

- 8.12. Boeckeler Instruments, Inc.

- 8.12.1. Company Overview

- 8.12.2. Company Snapshot

- 8.12.3. Financial Overview

- 8.12.4. Product Listing

- 8.12.5. Entropy

- 8.13. HACKER Instruments & Industries Inc

- 8.13.1. Company Overview

- 8.13.2. Company Snapshot

- 8.13.3. Financial Overview

- 8.13.4. Product Listing

- 8.13.5. Entropy

- 8.14. microTec Laborgerate GmbH

- 8.14.1. Company Overview

- 8.14.2. Company Snapshot

- 8.14.3. Financial Overview

- 8.14.4. Product Listing

- 8.14.5. Entropy

- 8.15. Bright Instrument Co Limited.

- 8.15.1. Company Overview

- 8.15.2. Company Snapshot

- 8.15.3. Financial Overview

- 8.15.4. Product Listing

- 8.15.5. Entropy

- 8.16. JINHUA YIDI MEDICAL APPLIANCES CO., LTD

- 8.16.1. Company Overview

- 8.16.2. Company Snapshot

- 8.16.3. Financial Overview

- 8.16.4. Product Listing

- 8.16.5. Entropy

- 8.17. FEATHER Safety Razor Co., Ltd

- 8.17.1. Company Overview

- 8.17.2. Company Snapshot

- 8.17.3. Financial Overview

- 8.17.4. Product Listing

- 8.17.5. Entropy

- 8.18. Precisionary Instruments

- 8.18.1. Company Overview

- 8.18.2. Company Snapshot

- 8.18.3. Financial Overview

- 8.18.4. Product Listing

- 8.18.5. Entropy

- 8.19. Powered Milestone S.r.l.

- 8.19.1. Company Overview

- 8.19.2. Company Snapshot

- 8.19.3. Financial Overview

- 8.19.4. Product Listing

- 8.19.5. Entropy

- 8.20. Weinkauf Medizintechnik

- 8.20.1. Company Overview

- 8.20.2. Company Snapshot

- 8.20.3. Financial Overview

- 8.20.4. Product Listing

- 8.20.5. Entropy