|

|

市場調査レポート

商品コード

1705105

潰瘍性大腸炎市場 - 市場の洞察、疫学、市場予測:2034年Ulcerative Colitis - Market Insight, Epidemiology, and Market Forecast - 2034 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 潰瘍性大腸炎市場 - 市場の洞察、疫学、市場予測:2034年 |

|

出版日: 2025年04月01日

発行: DelveInsight

ページ情報: 英文 200 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

主なハイライト

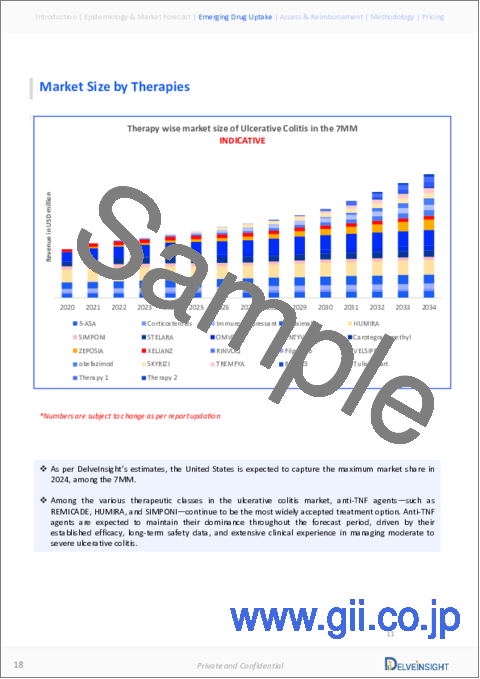

- 2023年の潰瘍性大腸炎の市場規模は主要7ヶ国で約84億米ドルとなりました。同市場は、既存薬の普及と認知度の向上によりプラスに転じると予測されます。

- 潰瘍性大腸炎の治療は複雑で、薬物療法、食事療法、栄養療法、時には外科的処置別消化管の患部の修復や切除などが行われます。

- 現在、治療にはアミノサリチル酸塩、コルチコステロイド、免疫調節薬、生物学的製剤、S1P調節薬、ヤヌスキナーゼ阻害薬など数種類の薬剤が使用されています。しかし、潰瘍性大腸炎治療の状況は、多くの新しい治療薬別進化しています。

- しかし、好ましくない臨床的特徴や既存の治療法の限られた有効性により、多くの患者が反応を示さなくなり、そのため新たな治療管理の選択肢が必要とされています。

- 米国では、抗TNF製剤(アダリムマブ、インフリキシマブ、ゴリムマブ)、インターロイキン拮抗薬(ウステキヌマブ、ミリキズマブ)、抗インテグリン薬(ベドリズマブ)、S1P受容体モジュレーター(オザニモド)、JAK阻害薬(トファシチニブ、ウパダシチニブ)が中等症から重症の潰瘍性大腸炎患者の治療薬として承認されています。

- 2023年、潰瘍性大腸炎の市場規模は主要7ヶ国の中で米国が最も大きく、約59億米ドルを占め、2034年までに拡大する見込みです。

- 新たな治療薬としては、obefazimod(Abivax)、Risankizumab(AbbVie/Boehringer Ingelheim)、guselkumab(Janssen)などが潰瘍性大腸炎の治療展望を広げると予想されます。

当レポートは、米国、EU4ヶ国(ドイツ、フランス、イタリア、スペイン)、英国、日本の潰瘍性大腸炎市場の動向とともに、潰瘍性大腸炎の歴史的および予測疫学を深く理解することができます。

実際の処方パターン分析、新薬評価、市場シェア、個々の治療法の取り込み/採用パターン、2020年から2034年までの潰瘍性大腸炎市場規模実績と予測を主要7ヶ国で提供します。また、潰瘍性大腸炎治療市場の現在の慣行/アルゴリズムと潰瘍性大腸炎のアンメットニーズを網羅し、最良の機会を発掘し、市場の潜在力を評価します。

潰瘍性大腸炎は、炎症性腸疾患と呼ばれる消化管の慢性炎症性疾患の2つの主要な形態の1つであり、もう1つはクローン病です。潰瘍性大腸炎は大腸粘膜の特発性慢性炎症性疾患であり、臨床的には下痢、腹痛、血便を特徴とします。

潰瘍性大腸炎を診断するための検査は一つではなく、炎症性腸疾患の症状と内視鏡検査、生検、便検査、X線検査、画像検査(単純X線写真、X線透視、CT、MRI)の結果を合わせて検討します。このほか、全血球数、炎症マーカー検査、肝機能検査、尿素、電解質などの臨床検査も行われます。

軟性S状結腸鏡検査と大腸内視鏡検査は、潰瘍性大腸炎を診断し、クローン病、憩室性疾患、がんなど他の可能性のある疾患を除外するための最も正確な方法です。抗体の同定に基づく高度な血液検査も鑑別診断に使用できます。潰瘍性大腸炎患者の多くは血液中に抗好中球周囲抗体を有しており、クローン病患者は抗出芽酵母抗体を有している可能性が高いです。

病態生理学、診断アプローチ、詳細な治療アルゴリズムの概要を、最初の症状から始まり、診断に要した時間、治療プロセス全体にわたる患者の動向の実際のシナリオとともに提供します。

潰瘍性大腸炎の治療は、疾患とその症状の重症度に応じて、患者の特定のニーズに個別に対応します。治療には、薬物療法、食事療法、栄養療法、時には外科的処置による消化管の患部の修復や切除が行われます。

治療には、アミノサリチル酸塩、副腎皮質ステロイド、免疫調節薬、ヤヌスキナーゼ(JAK)阻害薬、生物学的製剤など数種類の薬剤クラスが使用されます。これに加え、潰瘍性大腸炎患者は、下痢止め、鎮痛剤、鉄サプリメント、栄養補助食品による治療も受けます。

2024年の臨床および登録に関する最新情報

- 2025年1月、Rise Therapeuticsは、R-5780の第1相がん試験を開始するためのIND申請がFDAに受理されたことを発表しました。他の製品タイプでは、潰瘍性大腸炎、関節リウマチ、1型糖尿病を対象とした試験が進行中です。

- 2024年12月、Biocon Ltdの子会社であるBiocon Biologics Ltd(BBL)は、ステラーラ(R)(一般名:ウステキヌマブ)のバイオシミラーであるYESINTEK(TM)(一般名:ウステキヌマブ-kfce)がFDAより承認されたと発表しました。YESINTEK(TM)はモノクローナル抗体で、クローン病、潰瘍性大腸炎、尋常性乾癬、関節症性乾癬の治療薬として承認されています。

- 2024年11月、Johnson & Johnsonは、中等症から重症の活動期潰瘍性大腸炎(UC)の成人患者を対象としたトレンフィア(R)(一般名:グセルクマブ)の皮下導入療法の承認を求める生物製剤追加承認申請(sBLA)をFDAに提出したと発表しました。

- 2024年2月、欧州委員会(EC)は、VELSIPITY(R)(一般名:エラシモド)について、欧州連合(EU)における16歳以上の中等度から重度の活動期潰瘍性大腸炎(UC)患者を対象とした販売承認を付与しました。また、VELSIPITYは2023年10月に米国FDA、2024年1月にカナダで中等度から重度の活動期潰瘍性大腸炎の成人患者を適応症として承認されています。

- 主要7ヶ国Mにおける潰瘍性大腸炎の診断有病者総数は2023年に約311万4,000人であり、予測期間中に増加すると予測されます。

- 米国は潰瘍性大腸炎と診断された有病者数で最も多く、2023年には主要7ヶ国の47%を占めています。一方、ドイツと日本は、2023年に主要7ヶ国の総人口シェアの約10%ずつを占めています。

- DelveInsightの推計別と、2023年における潰瘍性大腸炎の重症度別診断有病者数は、EU4ヶ国と英国で軽症が約52万1,000人、中等症から重症が合計86万人でした。これらの症例は予測期間中に増加すると予測されます。

- 2023年、日本における潰瘍性大腸炎の総治療患者数のうち、ファーストラインで治療された中等症から重症の患者が最も多く、予測期間(2024年~2034年)には増加すると予測されます。

潰瘍性大腸炎の最近の動向

- 2024年12月、Celltrionはステララ(R)(一般名:ウステキヌマブ)のバイオシミラーであるSTEQEYMA(R)(一般名:ウステキヌマブ-stba)が皮下注射または点滴静注用としてFDAより承認されたと発表しました。本剤は、尋常性乾癬および関節症性乾癬の成人および小児患者、ならびにクローン病および潰瘍性大腸炎の成人患者を適応症として承認されています。

- 2024年12月、Accropeutics Inc.はRIPK2阻害剤AC-101の中等度から重度の潰瘍性大腸炎を対象とした第II相試験のFDA認可を発表しました。12週間の多地域無作為化試験で安全性と有効性を評価します。

- 2024年10月7日、Spherix Global Insightsは、潰瘍性大腸炎市場においてAbbVieのスカイライジがEli Lillyのオムボーを急速に追い抜き、発売後わずか2ヶ月で競合品の2倍以上の市場シェアを確保したと報告しました。しかし、SpherixはJohnson & JohnsonのTremfyaも同様に迅速に市場参入すると予想しており、AbbVie社は現在、新たな競合に直面しています。

当レポートでは、主要7ヶ国における潰瘍性大腸炎市場について調査し、市場の概要とともに、疫学、患者動向、新たな治療法、2034年までの市場規模予測、および医療のアンメットニーズなどを提供しています。

目次

第1章 重要な洞察

第2章 報告書のイントロダクション

第3章 潰瘍性大腸炎市場概要

- 2020年の主要7ヶ国における潰瘍性大腸炎の薬剤クラス別市場シェア(%)分布

- 2034年の主要7ヶ国における潰瘍性大腸炎の薬剤クラス別市場シェア(%)分布

第4章 疫学と市場調査手法

第5章 潰瘍性大腸炎エグゼクティブサマリー

- 主なイベント

第6章 潰瘍性大腸炎市場の疾患背景と概要

- イントロダクション

- 潰瘍性大腸炎の種類

- 潰瘍性大腸炎の分類

- 潰瘍性大腸炎の兆候と症状

- 潰瘍性大腸炎の危険因子と原因

- 潰瘍性大腸炎の病態生理学

- 潰瘍性大腸炎の合併症

- 重症度スコアリングシステム

- 診断

- 鑑別診断

- 抗体血液検査(バイオマーカー)

- 潰瘍性大腸炎の診断ガイドライン

- 治療

- 治療アルゴリズム

- 潰瘍性大腸炎の治療と管理ガイドライン

第7章 潰瘍性大腸炎の疫学と患者人口

- 主な調査結果

- 仮定と根拠

- 主要7ヶ国における潰瘍性大腸炎の診断済み有病症例の総数

- 米国における疫学シナリオ

- EU4ヶ国と英国における疫学シナリオ

- 日本における疫学シナリオ

第8章 患者動向

第9章 潰瘍性大腸炎の市販治療薬

- キークロス競合

- SIMPONI(ゴリムマブ):Janssen Pharmaceuticals

- ENTYVIO(ベドリズマブ):Takeda Pharmaceuticals

- ゼルヤンツ/ゼルヤンツXR(トファシチニブ):Pfizer

- ステラーラ(ウステキヌマブ):Janssen Pharmaceuticals

- カログラ(AJM300):EA Pharma/Kissei Pharma

- JYSELECA(GS-6034;フィルゴチニブ):Gilead Sciences and Galapagos NV

- RINVOQ(ABT 494;ウパダシチニブ):AbbVie

- ZEPOSIA(RPC1063;オザニモド):Celgene (Bristol-Myers Squibb)

- REMICADE(インフリキシマブ):Janssen Pharmaceuticals

- ヒュミラ(アダリムマブ):AbbVie

- OMVOH(ミリキズマブ):Eli Lilly

- SKYRIZI(リサンキズマブ):AbbVie/Boehringer Ingelheim

第10章 潰瘍性大腸炎の新薬

- キークロス競合

- エトラシモド(APD334):Arena Pharmaceuticals/Pfizer

- ABX464(オベファジモド):Abivax

- SHR0302(イバルマシチニブ):Reistone Biopharma

- コビトリモド:InDex Pharmaceuticals

- TREMFYA(グセルクマブ):Janssen Pharmaceuticals

- BT-11(オミランコール):Landos Biopharma/NImmune

- PRA023:Merck

- レメステムセルL:Mesoblast

- PF-06651600(リトレシチニブ)およびPF-06700841(ブレポシチニブ):Pfizer

第11章 潰瘍性大腸炎:主要7ヶ国分析

- 主な調査結果

- 市場見通し

- コンジョイント分析

- 主要な市場予測の前提条件

- 主要7ヶ国における潰瘍性大腸炎の市場規模

- 米国の市場規模

- EU4ヶ国と英国の市場規模

- 日本の市場規模

第12章 潰瘍性大腸炎の市場アクセスと償還

- 米国

- EU4ヶ国と英国

- 日本

- 潰瘍性大腸炎治療薬の市場アクセスと償還

第13章 潰瘍性大腸炎KOLの見解

第14章 潰瘍性大腸炎のSWOT分析

第15章 潰瘍性大腸炎のアンメットニーズ

第16章 付録

第17章 DelveInsightのサービス内容

第18章 免責事項

List of Tables

- Table 1: Summary of Ulcerative Colitis Market and Epidemiology (2020-2034)

- Table 2: Difference Between Crohn's Disease and Ulcerative Colitis

- Table 3: Montreal Classification of the Extent of Ulcerative Colitis

- Table 4: Montreal Classification of Severity of Ulcerative Colitis

- Table 5: Mayo Severity Score

- Table 6: Diagnostic Features of Ulcerative Colitis

- Table 7: Differential Diagnosis for Ulcerative Colitis

- Table 8: Medical Therapy for Ulcerative Colitis

- Table 9: Induction of Remission in Mildly-to-Moderately Active Ulcerative Colitis

- Table 10: Maintenance of Remission in Mildly-to-Moderately Active Ulcerative Colitis

- Table 11: Induction of Remission in Moderately-to-Severely Active Ulcerative Colitis

- Table 12: Maintenance of Remission of Moderately-to-Severely Active Ulcerative Colitis

- Table 13: Total Diagnosed Prevalent Cases of Ulcerative Colitis in the 7MM, in thousands (2020-2034)

- Table 14: Total Diagnosed Prevalent Cases of Ulcerative Colitis in the United States, in thousands (2020-2034)

- Table 15: Age-Specific Cases of Ulcerative Colitis in the United States, in thousands (2020-2034)

- Table 16: Severity-specific Cases of Ulcerative Colitis in the United States, in thousands (2020-2034)

- Table 17: Total Treated Patients of Ulcerative Colitis in the United States, in thousands (2020-2034)

- Table 18: Total Diagnosed Prevalent Cases of Ulcerative Colitis in EU4 and the UK, in thousands (2020-2034)

- Table 19: Age-specific Cases of Ulcerative Colitis in EU4 and the UK, in thousands (2020-2034)

- Table 20: Severity-Specific Cases of Ulcerative Colitis in EU4 and the UK, in thousands (2020-2034)

- Table 21: Total Treated Patients of Ulcerative Colitis in EU4 and the UK, in thousands (2020-2034)

- Table 22: Total Diagnosed Prevalent Cases of Ulcerative Colitis in Japan, in thousands (2020-2034)

- Table 23: Age-specific Cases of Ulcerative Colitis in Japan, in thousands (2020-2034)

- Table 24: Severity-specific Cases of Ulcerative Colitis in Japan, in thousands (2020-2034)

- Table 25: Total Treated Patients of Ulcerative Colitis in Japan, in thousands (2020-2034)

- Table 26: Comparison of Marketed Drugs

- Table 27: The Proportion of Patients with Ulcerative Colitis in Clinical Response, Clinical Remission, and Improvement of Endoscopic Appearance of the Mucosa in Trials UC-1 and UC-2

- Table 28: SIMPONI (golimumab), Clinical Trial Description, 2023

- Table 29: Proportion of Patients Meeting Efficacy Endpoints at Week 6 (Ulcerative Colitis Trial I)

- Table 30: Proportion of Patients Meeting Efficacy Endpoints at Week 52* (UC Trial II)

- Table 31: ENTYVIO (vedolizumab), Clinical Trial Description, 2023

- Table 32: Proportion of Patients Meeting Primary and Key Secondary Efficacy Endpoints at Week 8 (Induction Study UC-I and Study UC-II, Central Endoscopy Read)

- Table 33: Proportion of Patients Meeting Primary and Key Secondary Efficacy Endpoints in Maintenance Study UC-III (Central Endoscopy Read)

- Table 34: XELJANZ (tofacitinib), Clinical Trial Description, 2023

- Table 35: Proportion of Patients Meeting Efficacy Endpoints at Week 8 in UC-1

- Table 36: Efficacy Endpoints of Maintenance at Week 44 in UC-2 (52 weeks from Initiation of the Induction Dose)

- Table 37: STELARA (ustekinumab), Clinical Trial Description, 2023

- Table 38: Efficacy Results of AJM300

- Table 39: Proportion of Patients Meeting Efficacy Endpoints at Week 10 in Induction Studies UC-1

- Table 40: Proportion of Patients Meeting Efficacy Endpoints at Week 58 in Maintenance Study UC-3

- Table 41: JYSELECA (filgotinib), Clinical Trial Description, 2023

- Table 42: Patents

- Table 43: Proportion of Patients Meeting Primary and Key Secondary Efficacy Endpoints

- Table 44: Proportion of Patients Meeting Primary and Key Secondary Efficacy Endpoints

- Table 45: RINVOQ (ABT 494; upadacitinib), Clinical Trial Description, 2023

- Table 46: Patents

- Table 47: Proportion of Patients Meeting Efficacy Endpoints in the Induction Period at Week 10 in UC Study 1

- Table 48: Proportion of Patients Meeting Efficacy Endpoints in the Maintenance Period at Week 52 in Ulcerative Colitis Study 2

- Table 49: ZEPOSIA (RPC1063; ozanimod), Clinical Trial Description, 2023

- Table 50: Response, Remission, and Mucosal Healing in Adult Ulcerative Colitis Studies (Studies UC I and UC II)

- Table 51: Proportion of Adult Ulcerative Colitis Patients in Study UC I with Mayo Subscores Indicating Inactive or Mild Disease Through Week 54

- Table 52: Response, Remission, and Mucosal Healing in Adult Ulcerative Colitis Studies (Studies UC I and UC II)

- Table 53: Clinical Remission, Clinical Response, and Endoscopic Improvement at Week 52 in Pediatric Patients with Ulcerative Colitis (Study PUC-1)

- Table 54: HUMIRA (adalimumab), Clinical Trial Description, 2023

- Table 55: Proportion of Subjects in Clinical Remission at Week 40

- Table 56: Frequency of Adverse Events

- Table 57: OMVOH (mirikizumab), Clinical Trial Description, 2023

- Table 58: Comparison of Emerging Drugs Under Development

- Table 59: PRA023, Clinical Trial Description, 2023

- Table 60: Remestemcel-L, Clinical Trial Description, 2023

- Table 61: PF-06651600 and PF-06700841, Clinical Trial Description, 2023

- Table 62: List of REMICADE (infliximab) Biosimilars in the US

- Table 63: List of HUMIRA (adalimumab) Biosimilars in the US

- Table 64: Market Size of Ulcerative Colitis in the 7MM, in USD million (2020-2034)

- Table 65: Market Size of Ulcerative Colitis in the United States, in USD million (2020-2034)

- Table 66: The United States Market Size of Ulcerative Colitis by Therapies, in USD million (2020-2034)

- Table 67: Market Size of Ulcerative Colitis in EU4 and the UK, in USD million (2020-2034)

- Table 68: Market Size of Ulcerative Colitis by Therapies in EU4 and the UK, in USD million (2020-2034)

- Table 69: Japan Market Size of Ulcerative Colitis, in USD million (2020-2034)

- Table 70: Japan Market Size of Ulcerative Colitis by Therapies, in USD million (2020-2034)

- Table 71: Summary of ICER Evidence Ratings

- Table 72: Summary of Recommendations from Different HTA Bodies

List of Figures

- Figure 1: Epidemiology and Market Methodology

- Figure 2: Inflammatory Bowel Disease Subsets

- Figure 3: Difference Between Crohn's Disease and Ulcerative Colitis

- Figure 4: Types of Ulcerative Colitis

- Figure 5: Signs and Symptoms

- Figure 6: Risk Factors of Ulcerative Colitis

- Figure 7: General Factors Associated with Increased Susceptibility of Ulcerative Colitis

- Figure 8: Complications of Ulcerative Colitis

- Figure 9: Biopsy of Colonic Mucosa

- Figure 10: Surgically Created "J" Shaped Reservoir

- Figure 11: Treatment Algorithm of Severe Ulcerative Colitis

- Figure 12: Total Diagnosed Prevalent Cases of Ulcerative Colitis in the 7MM (2020-2034)

- Figure 13: Total Diagnosed Prevalent Cases of Ulcerative Colitis in the United States (2020-2034)

- Figure 14: Age-specific Cases of Ulcerative Colitis in the United States (2020-2034)

- Figure 15: Severity-specific Cases of Ulcerative Colitis in the United States (2020-2034)

- Figure 16: Total Treated Cases of Ulcerative Colitis in the United States (2020-2034)

- Figure 17: Total Diagnosed Prevalent Cases of Ulcerative Colitis in EU4 and the UK (2020-2034)

- Figure 18: Age-specific Cases of Ulcerative Colitis in EU4 and the UK (2020-2034)

- Figure 19: Severity-specific Cases of Ulcerative Colitis in EU4 and the UK (2020-2034)

- Figure 20: Total Treated Cases of Ulcerative Colitis in EU4 and the UK (2020-2034)

- Figure 21: Total Diagnosed Prevalent Cases of Ulcerative Colitis in Japan (2020-2034)

- Figure 22: Age-specific Cases of Ulcerative Colitis in Japan (2020-2034)

- Figure 23: Severity-specific Cases of Ulcerative Colitis in Japan (2020-2034)

- Figure 24: Total Treated Cases of Ulcerative Colitis in Japan (2020-2034)

- Figure 25: Patient Journey

- Figure 26: Market Size of Ulcerative Colitis in the 7MM (2020-2034)

- Figure 27: Market Size of Ulcerative Colitis in the United States (2020-2034)

- Figure 28: Market Size of Ulcerative Colitis in the United States by Therapy (2020-2034)

- Figure 29: Market Size of Ulcerative Colitis in EU4 and the UK (2020-2034)

- Figure 30: Market Size of Ulcerative Colitis by Therapies in EU4 and the UK (2020-2034)

- Figure 31: Market Size of Ulcerative Colitis in Japan (2020-2034)

- Figure 32: Japan Market Size of Ulcerative Colitis by Therapies in USD million (2020-2034)

- Figure 33: Health Technology Assessment

- Figure 34: Reimbursement Process in Germany

- Figure 35: Reimbursement Process in France

- Figure 36: Reimbursement Process in Italy

- Figure 37: Reimbursement Process in Spain

- Figure 38: Reimbursement Process in the United Kingdom

- Figure 39: Reimbursement Process in Japan

- Figure 40: Unmet Needs

Key Highlights:

- The Ulcerative Colitis Market Size in the 7MM was around USD 8,400 Million in 2023. The Ulcerative Colitis Market is anticipated to witness a positive shift owing to better uptake of existing drugs, and raised awareness.

- Ulcerative Colitis treatment is complex and comprises the use of medication, alterations in diet and nutrition, and at times surgical procedures to repair or remove affected portions of the patient's gastrointestinal tract.

- Currently, several types of medications are used for treatments, namely aminosalicylates, corticosteroids, immunomodulators, biologic therapies, S1P modulators, Janus kinase inhibitors, and others. However, the ulcerative colitis treatment landscape is evolving with many emerging therapies.

- However, due to unfavorable clinical characteristics and the limited efficacy of existing therapies, many patients stop responding and thus require new therapeutic management options.

- In the United States, anti-TNFaagents (adalimumab, infliximab, golimumab), interleukin antagonists (ustekinumab, mirikizumab), anti-integrin agents (vedolizumab), S1P receptor modulator (ozanimod), and JAK inhibitors (tofacitinib, upadacitinib), are approved for the treatment of moderate to severe ulcerative colitis patients.

- In 2023, the market size of ulcerative colitis was the highest in the US among the 7MM, accounting for approximately USD 5,900 million, which is expected to increase by 2034.

- Among emerging therapies, obefazimod (Abivax), Risankizumab(AbbVie/Boehringer Ingelheim), guselkumab (Janssen), and others will be expanding the treatment landscape of ulcerative colitis.

DelveInsight's "Ulcerative Colitis Market Insights, Epidemiology and Market Forecast - 2034" report delivers an in-depth understanding of the Ulcerative Colitis, historical and forecasted epidemiology as well as the Ulcerative Colitis market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Ulcerative Colitis Market Research Report provides real-world prescription pattern analysis, emerging drugs assessment, market share, and uptake/adoption pattern of individual therapies, as well as historical and forecasted Ulcerative Colitis market size from 2020 to 2034 in 7MM. The report also covers current Ulcerative Colitis treatment market practices/algorithms and Ulcerative Coliti unmet needs to curate the best opportunities and assess the market's underlying potential.

Ulcerative Colitis Treatment Market: Overview

Ulcerative colitis is one of the two main forms of chronic inflammatory disease of the gastrointestinal tract, called inflammatory bowel disease, the other being Crohn's disease. Ulcerative colitis is an idiopathic, chronic inflammatory disorder of the colonic mucosa and is clinically characterized by diarrhea, abdominal pain, and hematochezia.

There is no one test to diagnose ulcerative colitis; instead, the symptoms of inflammatory bowel diseases are considered together with the results of endoscopies, biopsies, stool tests, x-rays, and imaging procedures (plain radiograph, fluoroscopy, CT, and MRI). Other than this, laboratory tests like full blood count, inflammatory marker tests, liver function tests, urea, electrolytes, etc., are also performed.

Flexible sigmoidoscopy and colonoscopy are the most accurate methods for diagnosing Ulcerative Colitis and ruling out other possible conditions, such as Crohn's disease, diverticular disease, or cancer. Sophisticated blood tests, based on antibody identification can also be used for differential diagnosis. Many patients with Ulcerative Colitis have Perinuclear anti-neutrophil antibodies in their blood, while patients with Crohn's disease are more likely to have Anti-Saccharomyces Cerevisiae antibodies.

The Ulcerative colitis market forecast report provide overview of pathophysiology, diagnostic approaches and detailed treatment algorithm along with real-world scenario of a patient's journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Ulcerative Colitis Treatment

Ulcerative Colitis treatment is individualized to the specific needs of the patient, depending on the severity of the disease and its symptoms. It involves use of medication, alterations in diet and nutrition, and at times surgical procedures to repair or remove affected portions of the patient's gastrointestinal tract.

Several types of drug classes are used in treatment, including Aminosalicylates, Corticosteroids, Immunomodulators, Janus kinase (JAK) inhibitors and Biologics. In addition to this, Ulcerative Colitis patients are also treated with anti-diarrheal medications, painkillers, iron supplements, and dietary supplements.

Clinical and Registrational Updates in 2024

- In January 2025, Rise Therapeutics announced that the FDA has accepted its IND application to begin a Phase 1 cancer trial for R-5780, marking the company's fourth clinical program. Ongoing studies for other products are focused on ulcerative colitis, rheumatoid arthritis, and type 1 diabetes.

- In December 2024, Biocon Biologics Ltd (BBL), a subsidiary of Biocon Ltd, announced that the FDA approved YESINTEK(TM) (Ustekinumab-kfce), a biosimilar to Stelara(R) (Ustekinumab). YESINTEK(TM), a monoclonal antibody, is approved for the treatment of Crohn's disease, ulcerative colitis, plaque psoriasis, and psoriatic arthritis.

- In November 2024, Johnson & Johnson announced the submission of a supplemental Biologics License Application (sBLA) to the FDA, seeking approval for a subcutaneous induction regimen of TREMFYA(R) (guselkumab) to treat adults with moderately to severely active ulcerative colitis (UC).

- In February 2024, The European Commission (EC) has granted marketing authorization for VELSIPITY(R) (etrasimod) in the European Union to treat patients 16 years of age and older with moderately to severely active ulcerative colitis (UC).This decision follows the recommendation by the EMA in December 2023. It also follows VELSIPITY's approval for adults with moderately to severely active UC by the U.S. FDA in October 2023 and Canada in January 2024.

Ulcerative Colitis Epidemiology

The Ulcerative Colitis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Diagnosed Prevalent Cases of Ulcerative Colitis, Age-specific Cases of Ulcerative Colitis, Severity-specific Cases of Ulcerative Colitis, and Total Treated Patients of Ulcerative Colitis, in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2020 to 2034.

- The total Ulcerative Colitis diagnosed prevalent cases in the 7MM comprised approximately 3,114,000 cases in 2023 and are projected to increase during the forecasted period.

- The United States contributed to the largest diagnosed prevalent ulcerative colitis population, acquiring ~47% of the 7MM in 2023. Whereas Germany and Japan accounted for around 10% each of the total 7MM population share in 2023.

- According to DelveInsight estimates, the severity-specific diagnosed prevalent cases of Ulcerative colitis were approximately 521,000 mild and 860,000 total moderate to severe cases in 2023 in EU4 and the UK. These cases are projected to increase during the forecasted period.

- In 2023, among the total number of treated patients of ulcerative colitis in Japan, moderate-to-severe patients treated in first-line were highest and are expected to rise in the forecasted period (2024-2034).

Ulcerative Colitis Recent Developments

- In December 2024, Celltrion announced that the FDA approved STEQEYMA(R) (ustekinumab-stba), a biosimilar to STELARA(R) (ustekinumab), for subcutaneous injection or intravenous infusion. It is approved for adult and pediatric patients with plaque psoriasis and psoriatic arthritis, as well as adult patients with Crohn's disease and ulcerative colitis.

- In December 2024, Accropeutics Inc. announced FDA clearance for a Phase II trial of its RIPK2 inhibitor, AC-101, for moderate-to-severe Ulcerative Colitis. The 12-week, multi-regional, randomized trial will assess its safety and efficacy.

- On October 7, 2024, Spherix Global Insights reported that AbbVie's Skyrizi has rapidly outpaced Eli Lilly's Omvoh in the ulcerative colitis market, securing over double the market share of its competitor just two months post-launch. However, AbbVie is now confronted with a new competitor, as Spherix anticipates a similarly swift market entry for Johnson & Johnson's Tremfya.

Ulcerative Colitis Drug Chapters

The drug chapter segment of the Ulcerative Colitis market outlook report encloses a detailed analysis of Ulcerative Colitis marketed drugs and late-stage (Phase III and Phase II) Ulcerative Colitis pipeline drugs. It also deep dives into the Ulcerative Colitis clinical trials details, recent and expected market approvals, patent details, the latest Ulcerative Colitis news, and recent deals and collaborations.

Ulcerative Colitis Marketed Drugs

- SIMPONI (golimumab): Janssen Pharmaceuticals

SIMPONI is a human monoclonal antibody that targets and neutralizes excess tumor necrosis factor (TNF)-alpha, a protein that, when overproduced in the body due to chronic inflammatory diseases, can cause inflammation and damage to the bones, cartilage, and tissue. SIMPONI is the first subcutaneous anti-tumor necrosis factor (TNF)-alpha treatment administered as an every 4-week maintenance therapy for ulcerative colitis.

It is approved to treat moderately to severely active ulcerative colitis in adults. However, it is also being evaluated in pediatric patients with moderately to severely active ulcerative colitis in currently ongoing trials.

- ENTYVIO (vedolizumab): Takeda Pharmaceuticals

It is a humanized monoclonal antibody designed to antagonize the alpha 4 beta 7 integrin specifically, inhibiting the binding of alpha 4 beta 7 integrins to intestinal mucosal addressin cell adhesion molecule 1 (MAdCAM-1). The alpha 4 beta 7 integrin is expressed on a subset of circulating white blood cells, and these cells have been shown to mediate the inflammatory process in ulcerative colitis and Crohn's disease. By inhibiting alpha 4 beta 7 integrin, vedolizumab may limit the ability of certain white blood cells to infiltrate gut tissues.

Currently, it is approved to treat moderately to severely active ulcerative colitis in adults who have had an inadequate response with, lost response to, or were intolerant to either conventional therapy or a tumor necrosis factor-alpha (TNFa)-antagonist.

- Etrasimod (APD334): Arena Pharmaceuticals/Pfizer

Etrasimod (APD334) is a next-generation, once-daily, oral, highly selective sphingosine 1-phosphate (S1P) receptor modulator discovered by Arena and designed for optimized pharmacology and engagement of S1P receptors 1, 4, and 5 which may lead to an improved efficacy and safety profile. Etrasimod provides systemic and local effects on specific immune cell types and can potentially treat multiple immune-mediated inflammatory diseases, including Crohn's disease and ulcerative colitis.

Currently, it is approved for adults with moderately to severely active UC who have had an inadequate response, lost response, or were intolerant to either conventional therapy or an advanced treatment by US FDA and EMA.

Ulcerative Colitis Emerging Drugs

- ABX464 (obefazimod): Abivax

ABX464 is an oral, first-in-class, small molecule that selectively upregulates miR-124 in immune cells. Because of its ability to greatly upregulate the production of a unique RNA splicing product and anti-inflammatory agent, miR-124, ABX464's mechanism of action is unique. It has shown promise in clinical trials in bringing patients into remission and healing inflammatory lesions in ulcerative colitis.

Currently, obefazimod is being evaluated in various Phase III trials to treat moderately to severely active ulcerative colitis. Expected to be in the US market by 2026 with slow-medium uptake.

- SHR0302 (Ivarmacitinib): Reistone Biopharma

SHR0302 is a novel, potent, orally administered selective JAK 1 inhibitor in development by Reistone Biopharma to treat IBD, such as ulcerative colitis and Crohn's disease. JAK1 selectivity could potentially provide a favorable safety and efficacy profile compared to the pan-JAK inhibitor. Longer-term clinical studies are ongoing to confirm a favorable risk-benefit of JAK1 selectivity by avoiding the hematological side effects of JAK2 inhibition (Reistone Biopharma, 2021a).

SHR0302 is currently being evaluated in a Phase III (NCT05181137) trial to treat moderately to severely active ulcerative colitis in adults.

Drug Class Insights

A diverse class of treatment agents are now been prescribed for Ulcerative Colitis treatment, like anti-TNFa, anti-leukotriene antagonists, anti-integrins, S1P receptor modulators, and JAK inhibitors. Among all classes, anti-TNF alfa is recommended in first-line treatment.

Drugs that block both JAK and tyrosine kinase may also be effective in stopping or slowing the growth of Ulcerative Colitis. Moreover, the upcoming treatment landscape is poised to expand further after new classes emerge, such as toll-like receptor 9 activators, miR-124 enhancers, T-cell therapy, etc.

Ulcerative Colitis Market Outlook

Ulcerative Colitis treatment is complex and comprises the use of medication, alterations in diet and nutrition, and at times surgical procedures to repair or remove affected portions of the patient's gastrointestinal tract. The current treatment landscape of Ulcerative Colitis consists of conventional choices such as aminosalicylates, corticosteroids, thiopurines, calcineurin inhibitors, anti-TNF agents (HUMIRA [adalimumab], REMICADE [infliximab], and SIMPONI [golimumab]), antiadhesion molecules (ENTYVIO [vedolizumab]), and, more recently, small molecule directed against the JAK pathways (XELJANZ [tofacitinib]), anti-IL12/23 (STELARA [ustekinumab]), and S1P receptor modulator (ZEPOSIA [ozanimod]).

Current US guidelines recommend first-line treatment with aminosalicylate or sequential induction with corticosteroids followed by aminosalicylate maintenance therapy in patients with mild-to-moderate Ulcerative Colitis. In patients with moderate-to-severe Ulcerative Colitis, an immunosuppressant such as azathioprine or 6-mercaptopurine may be prescribed as maintenance therapy following corticosteroid induction. Alternatively, a biologic, typically an anti-tumor necrosis factors antibody such as infliximab or adalimumab, can be prescribed with or without a concurrent immunosuppressant to promote and maintain mucosal healing and clinical remission.

The current market has been segmented into different commonly used drugs based on the prevailing treatment pattern across the 7MM, presenting minor variations in the overall prescription pattern. Conventional therapies, anti-TNF agents, anti-adhesion molecules, JAK pathways, and others are the major drug classes covered in the forecast model.

The expected launch of upcoming therapies and greater integration of early patient screening, medication in secondary care and other clinical settings, research on best methods for implementation, and an upsurge in awareness will eventually facilitate the development of effective treatment options. However, the higher cost of new therapies and the higher cost burden of associated complications on patients may hinder the adoption of newer therapies.

Ulcerative Colitis Companies such as obefazimod (Abivax), risankizumab (AbbVie/Boehringer Ingelheim), guselkumab (Janssen), and several others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the Ulcerative Colitis treatment.

- * The total Ulcerative Colitis Market Size in the 7MM was approximately USD 8400 million in 2023 and is projected to increase during the forecast period (2024-2034).

- * The Ulcerative Colitis Market Size in the 7MM will increase due to increased awareness regarding Ulcerative Colitis, and the corresponding rise in product launches, with various awareness campaigns, is expected to increase early diagnosis and Ulcerative Colitis treatment.

- * Among EU4 countries, Germany accounted for the maximum market size in 2023.

- * By 2034, among all the therapies, the highest revenue will be generated by vedolizumab, followed by adalimumab in the United States.

Ulcerative Colitis Drugs Uptake

This section focuses on the uptake rate of potential Ulcerative Colitis drugs expected to be launched in the market during 2024-2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the Ulcerative Colitis companies evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Ulcerative Colitis Pipeline Development Activities

The Ulcerative Colitis pipeline segment provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I stage. It also analyzes Ulcerative Colitis companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Ulcerative Colitis pipeline segment covers information on collaborations, acquisition and merger, licensing, and patent details for Ulcerative Colitis emerging therapies.

KOL Views

To keep up with the real world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on evolving treatment landscape, patient reliance on conventional therapies, patient's therapy switching acceptability, and drug uptake along with challenges related to accessibility, including Medical/scientific writers, Division of Gastroenterology and Hepatology, State Key Laboratory for Oncogenes and Related Genes, Duke Cancer Institute at Duke University School, and others.

Delveinsight's analysts connected with 40+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapy treatment patterns or Ulcerative Colitis market trends.

Qualitative Analysis

We perform qualitative and market intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, treatment duration and frequency of administration, route of administration, patient segment, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial's primary and secondary outcome measures are evaluated; for instance, in Ulcerative Colitis trials, the most important primary outcome measures are overall survival, progression-free survival, and objective response rate.

Further, the therapies' safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

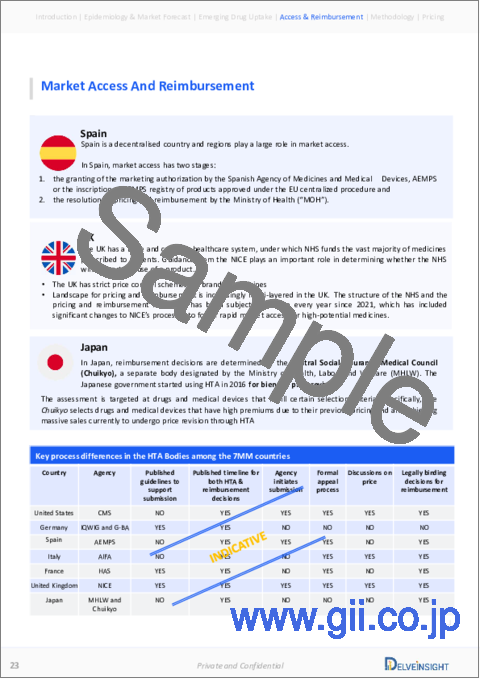

Ulcerative Colitis Market Access and Reimbursement

Reimbursement is a crucial factor affecting the drug's market access. Often, the decision to reimburse comes down to the price of the drug relative to the benefit it produces in treated patients. Drugs approved for Ulcerative Colitis in the United States include SIMPONI (golimumab), ENTYVIO (vedolizumab), XELJANZ (tofacitinib), STELARA (ustekinumab), RINVOQ (upadacitinib), ZEPOSIA (ozanimod), REMICADE (infliximab), and HUMIRA (adalimumab). Market access and reimbursement options can differ depending on regulatory status, the size of the target population, the setting of care, unmet needs, the magnitude of incremental benefit claims, and costs.

Besides the patient assistance programs provided by the companies for their respective drugs, certain organizations also provide reimbursement assistance to Ulcerative Colitis patients. For instance, Medicare reimburses biologics in a clinical setting when used following FDA-approved labeling. Under Section 1861(b) of the statute of Medicare, anti-integrins, such as vedolizumab, are covered.

Additionally, the Health Well Foundation, an independent non-profit, provides a financial lifeline for inadequately insured Americans. The Crohn's & Colitis Foundation provides copayment and premium assistance to eligible Medicare patients. Health Well provides up to USD 10,000 in copayment or premium assistance to individuals with annual household incomes up to 400% of the federal poverty level through the fund.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Ulcerative Colitis Market Forecast Report Scope

- The Ulcerative Colitis Market Forecast report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Ulcerative Colitis market, historical and forecasted Ulcerative Colitis market size, Ulcerative Colitis market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The patient-based Ulcerative Colitis market forecasting report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Ulcerative Colitis market.

Ulcerative Colitis Market Forecast Report Insights

- Patient-based Ulcerative Colitis Market Forecasting

- Therapeutic approaches

- Ulcerative Colitis pipeline analysis

- Ulcerative Colitis Market Size

- Ulcerative Colitis Market Trends

- Existing and future Ulcerative Colitis Market Opportunities

Ulcerative Colitis Market Forecast Report Key Strengths

- 10 years Ulcerative Colitis Market Forecast

- 7MM coverage

- Ulcerative Colitis epidemiology segmentation

- Key cross competition

- Conjoint analysis

- Drugs Uptake and key Ulcerative Colitis Market Forecast Assumptions

Ulcerative Colitis Treatment Market Report Assessment

- Current Ulcerative Colitis Treatment Market practices

- Ulcerative Colitis Unmet needs

- Ulcerative Colitis Pipeline Product profiles

- Ulcerative Colitis Drug Market Attractiveness

- Qualitative analysis (SWOT and Conjoint Analysis)

FAQs:

- What is the historical and forecasted Ulcerative Colitis patient pool/patient buden in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- What was the Ulcerative Colitis market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved therapies?

- How would the Ulcerative Colitis Market Drivers, Barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for the Ulcerative Colitis treatment?

- How many Ulcerative Colitis companies are developing therapies for the Ulcerative Colitis treatment?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitation of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy:

- The Ulcerative Colitis market forecast report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Ulcerative Colitis Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing Ulcerative Colitis market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis, ranking of class-wise potential current, and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the Ulcerative Colitis unmet need of the existing market so that the upcoming players can strengthen their development and launch strategy.

Table of Contents

1. Key Insights

2. Report Introduction

3. Ulcerative Colitis Market Overview at a Glance

- 3.1. Market Share (%) Distribution of Ulcerative Colitis by Drug Class in the 7MM in 2020

- 3.2. Market Share (%) Distribution of Ulcerative Colitis by Drug Class in the 7MM in 2034

4. Epidemiology and Market Methodology

5. Ulcerative Colitis Executive Summary

- 5.1. Key Events

6. Ulcerative Colitis Market Disease Background and Overview

- 6.1. Introduction

- 6.2. Types of Ulcerative Colitis

- 6.3. Classification of Ulcerative Colitis

- 6.4. Signs and Symptoms of Ulcerative Colitis

- 6.5. Risk Factors and Causes of Ulcerative Colitis

- 6.6. Pathophysiology of Ulcerative Colitis

- 6.7. Complications of Ulcerative Colitis

- 6.8. Severity Scoring System

- 6.9. Diagnosis

- 6.9.1. Differential Diagnosis

- 6.9.2. Antibody Blood Tests (Biomarkers)

- 6.10. Diagnostic Guidelines of Ulcerative Colitis

- 6.10.1. American College of Gastroenterology (ACG) Guidelines

- 6.10.2. European Crohn's and Colitis Organization (Journal of Crohn's and Colitis)

- 6.11. Treatment

- 6.11.1. Diet and Nutrition

- 6.11.2. Drug Therapies

- 6.11.2.1. Aminosalicylates

- 6.11.2.2. Corticosteroids

- 6.11.2.3. Immunomodulators

- 6.11.2.4. Janus Kinase (JAK) Inhibitors

- 6.11.2.5. Biologic Therapies

- 6.11.3. Other therapies

- 6.11.4. Surgery

- 6.11.4.1. Proctocolectomy with Ileal Pouch-Anal Anastomosis (IPAA)

- 6.11.4.2. Total Proctocolectomy with End Ileostomy

- 6.11.4.3. Elective Colorectal Cancer Surgery

- 6.12. Treatment Algorithm

- 6.13. Treatment and Management Guidelines of Ulcerative Colitis

- 6.13.1. American Gastroenterological Association (AGA) Clinical Practice Guideline on the Role of Biomarkers for the Management of Ulcerative Colitis

- 6.13.2. Japanese Society of Gastroenterology Evidence-based Clinical Practice Guidelines for Inflammatory Bowel Disease

- 6.13.3. American Gastroenterological Association (AGA) Clinical Practice Guidelines on the Management of Moderate-to-Severe Ulcerative Colitis

- 6.13.4. American College of Gastroenterology (ACG) Clinical Guideline: Ulcerative Colitis in Adults

- 6.13.5. British Society of Gastroenterology (BSG) Consensus Guidelines on the Management of Inflammatory Bowel Disease in Adults

- 6.13.6. The National Institute for Health and Care Excellence (NICE) Guidelines

- 6.13.7. The European Crohn's and Colitis Organisation Guidelines on Therapeutics in Ulcerative Colitis: Medical Treatment

7. Ulcerative Colitis Epidemiology and Patient Population

- 7.1. Key Findings

- 7.2. Assumptions and Rationale

- 7.3. Total Diagnosed Prevalent Cases of Ulcerative Colitis in the 7MM

- 7.4. Epidemiology Scenario in the United States

- 7.4.1. Total Diagnosed Prevalent Cases of Ulcerative Colitis in the United States

- 7.4.2. Age-specific Cases of Ulcerative Colitis in the United States

- 7.4.3. Severity-specific Cases of Ulcerative Colitis in the United States

- 7.4.4. Total Treated Patients of Ulcerative Colitis in the United States

- 7.5. Epidemiology Scenario in EU4 and the UK

- 7.5.1. Total Diagnosed Prevalent Cases of Ulcerative Colitis in EU4 and the UK

- 7.5.2. Age-specific Cases of Ulcerative Colitis in EU4 and the UK

- 7.5.3. Severity-specific Cases of Ulcerative Colitis in EU4 and the UK

- 7.5.4. Total Treated Cases of Ulcerative Colitis in EU4 and the UK

- 7.6. Epidemiology Scenario in Japan

- 7.6.1. Total Diagnosed Prevalent Cases of Ulcerative Colitis in Japan

- 7.6.2. Age-specific Cases of Ulcerative Colitis in Japan

- 7.6.3. Severity-specific Cases of Ulcerative Colitis in Japan

- 7.6.4. Total Treated Cases of Ulcerative Colitis in Japan

8. Patient Journey

9. Ulcerative Colitis Marketed Therapies

- 9.1. Key Cross Competition

- 9.2. SIMPONI (golimumab): Janssen Pharmaceuticals

- 9.2.1. Product Description

- 9.2.2. Regulatory Milestones

- 9.2.3. Other Developmental Activity

- 9.2.4. Pivotal Clinical Trial

- 9.2.4.1. Summary of Pivotal Clinical Trial

- 9.2.5. Ongoing Pipeline Activity

- 9.2.5.1. Clinical Trials Information

- 9.3. ENTYVIO (vedolizumab): Takeda Pharmaceuticals

- 9.3.1. Product Description

- 9.3.2. Regulatory Milestones

- 9.3.3. Other Developmental Activity

- 9.3.4. Pivotal Clinical Trial

- 9.3.4.1. Summary of Pivotal Clinical Trial

- 9.3.5. Ongoing Pipeline Activity

- 9.4. XELJANZ/XELJANZ XR (tofacitinib): Pfizer

- 9.4.1. Product Description

- 9.4.2. Regulatory Milestones

- 9.4.3. Other Developmental Activity

- 9.4.4. Pivotal Clinical Trial

- 9.4.4.1. Summary of Pivotal Clinical Trial

- 9.4.5. Ongoing Pipeline Activity

- 9.5. STELARA (ustekinumab): Janssen Pharmaceuticals

- 9.5.1. Product Description

- 9.5.2. Regulatory Milestones

- 9.5.3. Other Developmental Activity

- 9.5.4. Pivotal Clinical Trial

- 9.5.4.1. Summary of Pivotal Clinical Trial

- 9.5.5. Ongoing Pipeline Activity

- 9.6. CAROGRA (AJM300): EA Pharma/Kissei Pharma

- 9.6.1. Product Description

- 9.6.2. Regulatory Milestones

- 9.6.3. Other Developmental Activity

- 9.6.4. Pivotal Clinical Trial

- 9.6.4.1. Summary of Pivotal Clinical Trial

- 9.7. JYSELECA (GS-6034; filgotinib): Gilead Sciences and Galapagos NV

- 9.7.1. Product Description

- 9.7.2. Regulatory Milestones

- 9.7.3. Other Developmental Activity

- 9.7.4. Pivotal Clinical Trial

- 9.7.4.1. Summary of Pivotal Clinical Trial

- 9.7.5. Ongoing Pipeline Activity

- 9.8. RINVOQ (ABT 494; upadacitinib): AbbVie

- 9.8.1. Product Description

- 9.8.2. Regulatory Milestones

- 9.8.3. Other Developmental Activity

- 9.8.4. Pivotal Clinical Trial

- 9.8.4.1. Summary of Pivotal Clinical Trial

- 9.8.5. Ongoing Pipeline Activity

- 9.9. ZEPOSIA (RPC1063; ozanimod): Celgene (Bristol-Myers Squibb)

- 9.9.1. Product Description

- 9.9.2. Regulatory Milestones

- 9.9.3. Other Developmental Activity

- 9.9.4. Pivotal Clinical Trial

- 9.9.4.1. Summary of Pivotal Clinical Trial

- 9.9.5. Ongoing Pipeline Activity

- 9.10. REMICADE (infliximab): Janssen Pharmaceuticals

- 9.10.1. Product Description

- 9.10.2. Regulatory Milestones

- 9.10.3. Other Developmental Activity

- 9.10.4. Pivotal Clinical Trial

- 9.10.4.1. Summary of Pivotal Clinical Trial

- 9.11. HUMIRA (adalimumab): AbbVie

- 9.11.1. Product Description

- 9.11.2. Regulatory Milestones

- 9.11.3. Other Developmental Activity

- 9.11.4. Pivotal Clinical Trial

- 9.11.4.1. Summary of Pivotal Clinical Trial

- 9.11.5. Ongoing Pipeline Activity

- 9.12. OMVOH (mirikizumab): Eli Lilly

- 9.12.1. Product Description

- 9.12.2. Regulatory Milestones

- 9.12.3. Other Developmental Activity

- 9.12.4. Pivotal Clinical Trial

- 9.12.4.1. Summary of Pivotal Clinical Trial

- 9.12.5. Ongoing Pipeline Activity

- 9.12.6. Safety and Efficacy

- 9.13. SKYRIZI (risankizumab): AbbVie/Boehringer Ingelheim

- 9.13.1. Product Description

- 9.13.2. Other Developmental Activities

- 9.13.3. Clinical Developmental Activities

- 9.13.3.1. Clinical Trials Information

- 9.13.4. Safety and Efficacy

10. Ulcerative Colitis Emerging Drugs

- 10.1. Key Cross Competition

- 10.2. Etrasimod (APD334): Arena Pharmaceuticals/Pfizer

- 10.2.1. Product Description

- 10.2.2. Other Developmental Activities

- 10.2.3. Clinical Development Activities

- 10.2.3.1. Clinical Trials Information

- 10.2.4. Safety and Efficacy

- 10.3. ABX464 (Obefazimod): Abivax

- 10.3.1. Product Description

- 10.3.2. Other Developmental Activities

- 10.3.3. Clinical Developmental Activities

- 10.3.3.1. Clinical Trials Information

- 10.3.4. Safety and Efficacy

- 10.4. SHR0302 (Ivarmacitinib): Reistone Biopharma

- 10.4.1. Product Description

- 10.4.2. Other Developmental Activities

- 10.4.3. Clinical Developmental Activities

- 10.4.3.1. Clinical Trials Information

- 10.4.4. Safety and Efficacy

- 10.5. Cobitolimod: InDex Pharmaceuticals

- 10.5.1. Product Description

- 10.5.2. Other Developmental Activities

- 10.5.3. Clinical Developmental Activities

- 10.5.3.1. Clinical Trials Information

- 10.5.4. Safety and Efficacy

- 10.6. TREMFYA (Guselkumab): Janssen Pharmaceuticals

- 10.6.1. Product Description

- 10.6.2. Clinical Developmental Activities

- 10.6.2.1. Clinical Trials Information

- 10.6.3. Safety and Efficacy

- 10.7. BT-11 (Omilancor): Landos Biopharma/NImmune

- 10.7.1. Product Description

- 10.7.2. Other Developmental Activities

- 10.7.3. Clinical Developmental Activities

- 10.7.3.1. Clinical Trials Information

- 10.7.4. Safety and Efficacy

- 10.8. PRA023: Merck

- 10.8.1. Product Description

- 10.8.2. Other Developmental Activities

- 10.8.3. Clinical Developmental Activities

- 10.8.3.1. Clinical Trial Information

- 10.8.4. Safety and Efficacy

- 10.9. Remestemcel-L: Mesoblast

- 10.9.1. Product Description

- 10.9.2. Other Developmental Activities

- 10.9.3. Clinical Developmental Activities

- 10.9.3.1. Clinical Trial Information

- 10.9.4. Safety and Efficacy

- 10.10. PF-06651600 (ritlecitinib) and PF-06700841 (brepocitinib): Pfizer

- 10.10.1. Product Description

- 10.10.2. Clinical Developmental Activities

- 10.10.2.1. Clinical Trial Information

- 10.10.3. Safety and Efficacy

11. Ulcerative Colitis: The 7MM Analysis

- 11.1. Key Findings

- 11.2. Market Outlook

- 11.3. Conjoint Analysis

- 11.4. Key Market Forecast Assumptions

- 11.5. Market Size of Ulcerative Colitis in the 7MM

- 11.6. The United States Market Size

- 11.6.1. Total Market size of Ulcerative Colitis in the United States

- 11.6.2. Total Market Size of Ulcerative Colitis by Therapies in the United States

- 11.7. EU4 and the UK Market Size

- 11.7.1. The total market size of Ulcerative Colitis in EU4 and the UK

- 11.7.2. Market Size of Ulcerative Colitis by Therapies in EU4 and the UK

- 11.8. Japan Market Size

- 11.8.1. Total Market Size of Ulcerative Colitis in Japan

- 11.8.2. Market Size of Ulcerative Colitis by Therapies in Japan

12. Ulcerative Colitis Market Access and Reimbursement

- 12.1. The United States

- 12.1.1. Centre for Medicare and Medicaid Services (CMS)

- 12.2. In EU4 and the UK

- 12.2.1. Germany

- 12.2.2. France

- 12.2.3. Italy

- 12.2.4. Spain

- 12.2.5. United Kingdom

- 12.3. Japan

- 12.3.1. MHLW

- 12.4. Market Access and Reimbursement of Ulcerative Colitis Drugs

13. Ulcerative Colitis KOL Views

14. Ulcerative Colitis SWOT Analysis

15. Ulcerative Colitis Unmet Needs

16. Appendix

- 16.1. Report Methodology

- 16.2. Bibliography