|

|

市場調査レポート

商品コード

1656917

先端医療医薬品(ATMP)の世界市場 - 市場考察、競合情勢、市場予測(2032年)Advanced Therapy Medicinal Products - Market Insights, Competitive Landscape, and Market Forecast - 2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 先端医療医薬品(ATMP)の世界市場 - 市場考察、競合情勢、市場予測(2032年) |

|

出版日: 2025年01月01日

発行: DelveInsight

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

世界の先端医療医薬品(ATMP)の市場規模は、2024年に307億7,872万米ドルであり、2025年~2032年の予測期間にCAGRで14.17%の成長が見込まれます。市場の成長は、主に慢性疾患の有病率の増加によってもたらされます。遺伝性疾患やがん患者の増加、研究開発活動の活発化、主要企業間の提携は、2025年~2032年の予測期間に先端医療医薬品(ATMP)市場のプラス成長に寄与する主な要因です。

先端医療医薬品(ATMP)の市場力学

米国疾病予防管理センター(CDC)が2024年2月に発表したデータによると、米国では2024年時点で推定1億2,900万人が心臓病、がん、糖尿病、肥満、高血圧など少なくとも1つの主要な慢性疾患に罹患しています。

がんは世界中の人々に影響を及ぼしている主な慢性疾患です。International Agency for Research on Cancerが2020年12月に実施した調査によると、2020年に世界中で新たに1,930万人のがん患者が発生すると推定されています。細胞療法は、がん細胞を効果的に破壊するために身体の免疫細胞を使用するがん免疫療法に使用されます。そのため、細胞療法や遺伝子治療の需要を生み出しているがんなどの慢性疾患の有病率の上昇は、市場の成長を促進すると予測されています。

2023年2月に発表されたWorld Economic Forumのレポートによると、2021年に世界中で約4億7,500万人が希少遺伝性疾患を抱えて生活しています。今後5年以内に、約1,520万人が希少疾患の特定を目的とした臨床ゲノム検査を受けると予測されています。遺伝子治療は、疾患を治したり、疾患に対抗する体の能力を高めたりするために、異常な遺伝子を修正したり、健康な遺伝子に置き換えたりするために開発されます。したがって、遺伝性疾患の患者数の増加が市場成長を促進すると予測されます。

市場の主要企業は、がんや神経変性疾患などの慢性疾患の治療に向け、精密細胞・遺伝子治療開発の研究パートナーシップを確立しています。例えば2021年4月、Spark Therapeuticsは、遺伝子治療研究を強化するため、Senti Biosciencesとの研究協力を発表しました。この共同研究は、Senti Bioの先進の遺伝子回路技術プラットフォームとハイスループット合成プロモーター設計の専門知識を、Spark Therapeuticsの中枢神経系、眼、肝臓を標的とした治験中の遺伝子治療薬に統合するものです。先進の遺伝子治療を開発するためのこのような研究協力は、開発を後押しすると予測されます。

しかし、細胞・遺伝子治療の高いコストや、先端医療医薬品(ATMP)に関連する安全性への懸念などが、先端医療医薬品(ATMP)市場の成長を妨げる可能性のある主な抑制要因となっています。

先端医療医薬品(ATMP)市場のセグメント分析

製品タイプ別では、疾患治療を一変させる可能性があることから、細胞治療薬カテゴリが2024年の先端医療医薬品(ATMP)市場において最大の市場シェアを占めると推定されます。細胞療法は、生存可能で機能的な細胞を患者の体内に導入し、損傷した組織を強化または置換する革新的な医療アプローチであり、特に細胞の機能不全や喪失が特定の疾患の進行に重要な役割を果たしている場合に有益です。細胞療法は成功を収めており、主要企業はこの分野でがんなどのさまざまな疾患の治療に向けた次世代プログラム細胞療法の開発に取り組んでいます。例えば2024年2月、BioNTechは細胞療法の開発と商業化に向けたAutolus Therapeuticsとの提携を発表しました。この戦略的提携は、複数のがんを適応症とする両社の自己CAR-Tプログラムを推進することを目的としています。

CAR-T細胞療法は、患者のT細胞を抽出、遺伝子改変、活性化、拡大、精製し、患者の体内に再導入する個別化アプローチの代表例です。このような利点が、この分野の主要企業による研究活動を後押ししています。2024年3月、Bristol-Myers Squibb Companyは、再発または難治性の慢性リンパ性白血病(CLL)または小リンパ球性リンパ腫(SLL)の成人患者に対する治療薬として、CD19指向性CAR-T細胞治療薬であるBreyanzi(R)(lisocabtagene maraleucel、liso-cel)が米国食品医薬品局(FDA)から早期承認されたと発表しました。

当レポートでは、世界の先端医療医薬品(ATMP)市場について調査分析し、市場規模と予測、過去3年の製品/技術開発、市場の主要企業、利用可能な機会などの情報を提供しています。

目次

第1章 先端医療医薬品(ATMP)市場レポートのイントロダクション

第2章 先端医療医薬品(ATMP)市場のエグゼクティブサマリー

- 市場の概要

第3章 競合情勢

第4章 規制分析

- 米国

- 欧州

- 日本

- 中国

第5章 先端医療医薬品(ATMP)市場の主な要因の分析

- 先端医療医薬品(ATMP)市場の促進要因

- 先端医療医薬品(ATMP)市場の抑制要因と課題

- 先端医療医薬品(ATMP)市場の機会

第6章 先端医療医薬品(ATMP)市場におけるポーターのファイブフォース分析

第7章 先端医療医薬品(ATMP)市場の評価

- タイプ別

- 遺伝子治療薬

- 細胞治療薬

- 組織工学製品

- 複合ATMP

- 適応症別

- 腫瘍

- 心臓

- 神経

- 遺伝性疾患

- 感染症

- 代謝性疾患

- その他

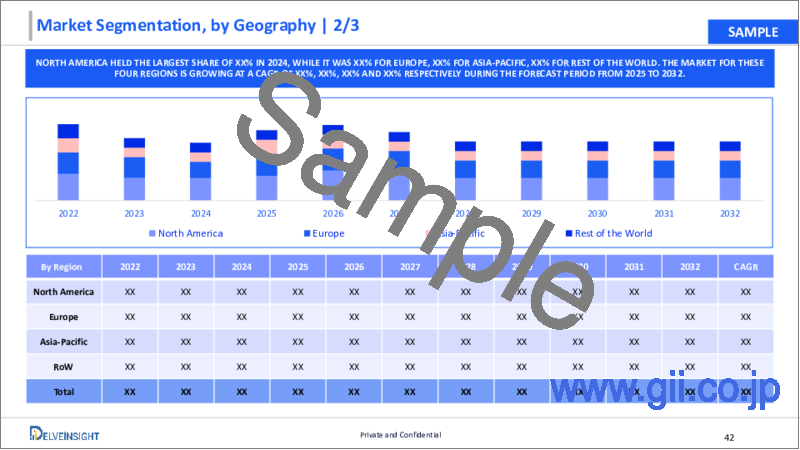

- 地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第8章 先端医療医薬品(ATMP)市場の企業と製品のプロファイル

- Pfizer Inc.

- Novartis AG

- Gilead Sciences, Inc.

- Kolon TissueGene, Inc.

- Bluebird Bio, Inc.

- F. Hoffmann-La Roche Ltd

- Bristol-Myers Squibb Company

- Organogenesis Inc.

- BioNTech

- Regeneron Pharmaceuticals Inc.

- ALLOGENE THERAPEUTICS

- CRISPR Therapeutics

- Autolus Therapeutics

- Anixa Biosciences, Inc.

- Amgen Inc.

- Intellia Therapeutics, Inc.

- Adaptimmune

- Voyager Therapeutics, Inc.

- Sangamo Therapeutics, Inc.

- Biogen

第9章 KOLの見解

第10章 プロジェクトのアプローチ

第11章 DelveInsightについて

第12章 免責事項、お問い合わせ

List of Tables

- Table 1: Competitive Analysis

- Table 2: Advanced Therapy Medicinal Products Market in Global (2022-2032)

- Table 3: Advanced Therapy Medicinal Products Market in Global by Type (2022-2032)

- Table 4: Advanced Therapy Medicinal Products Market in Global by Indication (2022-2032)

- Table 5: Advanced Therapy Medicinal Products Market in Global by Geography (2022-2032)

- Table 6: Advanced Therapy Medicinal Products Market in North America (2022-2032)

- Table 7: Advanced Therapy Medicinal Products Market in the US (2022-2032)

- Table 8: Advanced Therapy Medicinal Products Market in Canada (2022-2032)

- Table 9: Advanced Therapy Medicinal Products Market in Mexico (2022-2032)

- Table 10: Advanced Therapy Medicinal Products Market in Europe (2022-2032)

- Table 11: Advanced Therapy Medicinal Products Market in France (2022-2032)

- Table 12: Advanced Therapy Medicinal Products Market in Germany (2022-2032)

- Table 13: Advanced Therapy Medicinal Products Market in the United Kingdom (2022-2032)

- Table 14: Advanced Therapy Medicinal Products Market in Italy (2022-2032)

- Table 15: Advanced Therapy Medicinal Products Market in Spain (2022-2032)

- Table 16: Advanced Therapy Medicinal Products Market in Rest of Europe (2022-2032)

- Table 17: Advanced Therapy Medicinal Products Market in Asia-Pacific (2022-2032)

- Table 18: Advanced Therapy Medicinal Products Market in China (2022-2032)

- Table 19: Advanced Therapy Medicinal Products Market in Japan (2022-2032)

- Table 20: Advanced Therapy Medicinal Products Market in India (2022-2032)

- Table 21: Advanced Therapy Medicinal Products Market in Australia (2022-2032)

- Table 22: Advanced Therapy Medicinal Products Market in South Korea (2022-2032)

- Table 23: Advanced Therapy Medicinal Products Market in Rest of Asia-Pacific (2022-2032)

- Table 24: Advanced Therapy Medicinal Products Market in Rest of the World (2022-2032)

- Table 25: Advanced Therapy Medicinal Products Market in the Middle East (2022-2032)

- Table 26: Advanced Therapy Medicinal Products Market in Africa (2022-2032)

- Table 27: Advanced Therapy Medicinal Products Market in South America (2022-2032)

List of Figures

- Figure 1: Competitive Analysis

- Figure 2: Advanced Therapy Medicinal Products Market in Global (2022-2032)

- Figure 3: Advanced Therapy Medicinal Products Market in Global by Type (2022-2032)

- Figure 4: Advanced Therapy Medicinal Products Market in Global by Indication (2022-2032)

- Figure 5: Advanced Therapy Medicinal Products Market in Global by Geography (2022-2032)

- Figure 6: Advanced Therapy Medicinal Products Market in North America (2022-2032)

- Figure 7: Advanced Therapy Medicinal Products Market in the US (2022-2032)

- Figure 8: Advanced Therapy Medicinal Products Market in Canada (2022-2032)

- Figure 9: Advanced Therapy Medicinal Products Market in Mexico (2022-2032)

- Figure 10: Advanced Therapy Medicinal Products Market in Europe (2022-2032)

- Figure 11: Advanced Therapy Medicinal Products Market in France (2022-2032)

- Figure 12: Advanced Therapy Medicinal Products Market in Germany (2022-2032)

- Figure 13: Advanced Therapy Medicinal Products Market in the United Kingdom (2022-2032)

- Figure 14: Advanced Therapy Medicinal Products Market in Italy (2022-2032)

- Figure 15: Advanced Therapy Medicinal Products Market in Spain (2022-2032)

- Figure 16: Advanced Therapy Medicinal Products Market in Rest of Europe (2022-2032)

- Figure 17: Advanced Therapy Medicinal Products Market in Asia-Pacific (2022-2032)

- Figure 18: Advanced Therapy Medicinal Products Market in China (2022-2032)

- Figure 19: Advanced Therapy Medicinal Products Market in Japan (2022-2032)

- Figure 20: Advanced Therapy Medicinal Products Market in India (2022-2032)

- Figure 21: Advanced Therapy Medicinal Products Market in Australia (2022-2032)

- Figure 22: Advanced Therapy Medicinal Products Market in South Korea (2022-2032)

- Figure 23: Advanced Therapy Medicinal Products Market in Rest of Asia-Pacific (2022-2032)

- Figure 24: Advanced Therapy Medicinal Products Market in Rest of the World (2022-2032)

- Figure 25: Advanced Therapy Medicinal Products Market in the Middle East (2022-2032)

- Figure 26: Advanced Therapy Medicinal Products Market in Africa (2022-2032)

- Figure 27: Advanced Therapy Medicinal Products Market in South America (2022-2032)

- Figure 28: Market Drivers

- Figure 29: Market Barriers

- Figure 30: Marker Opportunities

- Figure 31: PORTER'S Five Force Analysis

Advanced Therapy Medicinal Products Market by Type (Gene-Therapy Medicines, Cell Therapy Medicines, Tissue Engineered Products, Combined ATMPs), Indication (Oncology, Cardiology, Neurology, Genetic Disorders, Infectious Diseases, Metabolic Disease, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the growing prevalence of chronic disease and rising number of genetic disease and cancer cases

The advanced therapy medicinal products (ATMP) market was valued at USD 30,778.72 million in 2024, growing at a CAGR of 14.17% during the forecast period from 2025 to 2032. The growth of the advanced therapy medicinal products market is mainly driven by the growing prevalence of chronic diseases. The rising number of genetic diseases, and cancer cases, increasing R&D activities, and partnerships among key players are key factors responsible for contributing to the positive growth of the advanced therapy medicinal products market during the forecast period from 2025 to 2032.

Advanced Therapy Medicinal Products Market Dynamics:

According to the data published by the Centers for Disease Control and Prevention (CDC) in February 2024, an estimated 129 million people were suffering from at least 1 major chronic disease such as heart disease, cancer, diabetes, obesity, and hypertension in the United States as of 2024.

Cancer is a major chronic disease affecting people around the world. The study conducted by the International Agency for Research on Cancer in December 2020, mentioned that an estimated 19.3 million new cancer cases were reported in 2020 across the globe. Cell therapy is used in cancer immunotherapy which uses the immune cells of the body to destroy cancer cells effectively. Thereby, the rising prevalence of chronic diseases such as cancer which is creating the demand for cell and gene therapy is expected to drive the market growth.

A report by the World Economic Forum published in February 2023, stated that approximately 475 million individuals were living with genetic rare conditions in 2021 across the globe. Within the upcoming five years, it was anticipated that around 15.2 million people were expected to undergo clinical genomic testing specifically aimed at identifying rare conditions. Gene therapy is developed to correct or replace abnormal genes with healthy ones to cure diseases or enhance the body's ability to combat them. Thus, the rising number of genetic disease cases is expected to propel the market growth.

Key players in the market are establishing research partnerships for the development of precision cell and gene therapies for the treatment of chronic diseases such as cancer and neurodegenerative diseases. For instance, in April 2021, Spark Therapeutics announced a research collaboration with Senti Biosciences to enhance its gene therapy research. The collaboration integrates Senti Bio's advanced gene circuit technology platform and expertise in high-throughput synthetic promoter design with Spark Therapeutics' investigational gene therapies targeting the central nervous system, eye, or liver. Such research collaborations to develop advanced gene therapies are expected to boost market expansion.

However, the high cost of cell and gene therapies, and the safety concerns associated with advanced therapy medicinal products, among others are some of the key constraints that may hinder the growth of the advanced therapy medicinal products market.

Advanced Therapy Medicinal Products Market Segment Analysis:

Advanced Therapy Medicinal Products Market by Type (Gene-Therapy Medicines, Cell Therapy Medicines, Tissue Engineered Products, Combined ATMPs), Indication (Oncology, Cardiology, Neurology, Genetic Disorders, Infectious Diseases, Metabolic Disease, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the type segment, the cell therapy medicines category is estimated to account for the largest market share in the advanced therapy medicinal products market in 2024 due to the potential of cell therapies to transform disease treatment. Cell therapy is an innovative medical approach involving the introduction of viable and functional cells into a patient's body to enhance or replace damaged tissues, particularly beneficial when cell dysfunction or loss plays a crucial role in the progression of a specific disease. Cell therapies have shown success due to which key players are working in this area to develop next-generation programmed cell therapies for the treatment of various diseases such as cancer. For instance, in February 2024, BioNTech announced its partnership with Autolus Therapeutics to develop and commercialization of cell therapies. This strategic collaboration aimed at advancing both companies' autologous CAR-T programs for the treatment of multiple cancer indications.

CAR-T cell therapy exemplifies this personalized approach where a patient's T cells are extracted, genetically modified, activated, expanded, purified, and then reintroduced into the patient's body. Such advantages have boosted the research activities made by key players in this area. In March 2024, Bristol-Myers Squibb Company announced that the U.S. Food and Drug Administration (FDA) has granted accelerated approval for Breyanzi(R) (lisocabtagene maraleucel; liso-cel), a CD19-directed CAR T cell therapy, for treating adult patients with relapsed or refractory chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL).

Further, cell therapy leverages the body's natural systems such as the cellular immune system and the capacity to repair or replace faulty genes making them preferred choices for personalized medicine. Therefore, the growing use and development of cell therapies, including stem cell therapy, CAR-T cell therapy, and tissue engineering contribute to the growth of the segment, thereby driving the growth of the advanced therapy medicinal products market during the forecast period.

North America Is Expected To Dominate The Overall Advanced Therapy Medicinal Products Market:

North America is expected to account for the largest market share of the advanced therapy medicinal products market in 2024. This can be attributed to the rising number of cancer cases and the rise in the R&D activities by key players in the region, thus driving the growth of the advanced therapy medicinal products market in North America.

According to the American Cancer Society's Cancer Facts & Figures published in 2024, nearly 2 million new cancer cases were expected to be diagnosed in the United States in 2024, up from 1.9 million in 2023. Cell therapy genetically modifies a patient's cells to express a particular receptor that targets cancer cells. These altered cells are then injected into the patient's body, where they can identify tumor antigens and destroy cancer cells expressing the targeted antigen. Therefore, the rising cancer cases that create demand for advanced therapies will drive market growth.

The data published by the National Cancer Institute in May 2024 indicated that there were an estimated 18.1 million cancer patients in the United States in 2022 and this number of cancer patients is expected to increase reaching 22.5 million by 2032 and 26 million by 2040.

Rising R&D activities of key players in the region to innovative advanced therapy medicinal products for the treatment of chronic diseases are contributing to the positive growth of the market. For instance, in February 2022, Janssen Pharmaceuticals announced that the U.S. Food and Drug Administration (FDA) approved CARVYKTI (ciltacabtagene autoleucel; cilta-cel) for the treatment of patients with relapsed or refractory multiple myeloma (RRMM). CARVYKTI(TM) is a type of CAR-T therapy that utilizes two single-domain antibodies targeting B-cell maturation antigen (BCMA). Therefore, the rising number of cancer cases and surge in R&D activities by key players in the region is expected to propel the growth of North America advanced therapy medicinal products market.

Advanced Therapy Medicinal Products Market Key Players:

Some of the key market players operating in the advanced therapy medicinal products market include Pfizer Inc., Novartis AG, Gilead Sciences, Inc., Kolon TissueGene, Inc., Bluebird Bio, Inc., F. Hoffmann-La Roche Ltd, Bristol-Myers Squibb Company, Organogenesis Inc., BioNTech, Regeneron Pharmaceuticals Inc., ALLOGENE THERAPEUTICS, CRISPR Therapeutics, Autolus Therapeutics, Anixa Biosciences, Inc., Amgen Inc., Intellia Therapeutics, Inc., Adaptimmune, Voyager Therapeutics Inc., Sangamo Therapeutics, Inc., Biogen, and others.

Recent Developmental Activities in the Advanced Therapy Medicinal Products Market:

- In April 2024, Pfizer Inc. announced that it received US FDA approval for BEQVEZ (fidanacogene elaparvovec-dzkt) for the treatment of adults with moderate to severe hemophilia B. BEQVEZ is an adeno-associated virus (AAV)-based one-time treatment gene therapy developed for patients suffering from hemophilia B.

- In February 2024, BioNTech and Autolus Therapeutics announced a strategic collaboration to develop CAR-T cell therapy aimed at advancing their pipeline and expanding late-stage programs. Through this partnership, both companies focused on accelerating pipeline programs to develop advanced therapies for multiple cancer indications.

- In January 2022, Fate Therapeutics announced that it received FDA clearance for an Investigational New Drug (IND) application for FT536. FT536 is a chimeric antigen receptor (CAR) NK cell product candidate for the treatment of advanced solid tumors.

- In June 2022, Bristol Myers Squibb announced that the FDA approved Breyanzi (lisocabtagene maraleucel). Breyanzi is a chimeric antigen receptor (CAR) T-cell therapy for the treatment of adult patients with large B-cell lymphoma (LBCL) and other lymphatic cancers.

Key Takeaways from the Advanced Therapy Medicinal Products Market Report Study

- Market size analysis for current Advanced Therapy Medicinal Products Market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened for the last 3 years

- Key companies dominating the global Advanced Therapy Medicinal Products market.

- Various opportunities available for the other competitors in the Advanced Therapy Medicinal Products Market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current Advanced Therapy Medicinal Products market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for Advanced Therapy Medicinal Products market growth in the coming future?

Target Audience who can be benefited from this Advanced Therapy Medicinal Products Market Report Study

- Advanced Therapy Medicinal Products product providers

- Research organizations and consulting companies

- Advanced Therapy Medicinal Products related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders dealing in Advanced Therapy Medicinal Products

- Various end-users who want to know more about the Advanced Therapy Medicinal Products Market and the latest technological developments in the Advanced Therapy Medicinal Products Market.

Frequently Asked Questions for the Advanced Therapy Medicinal Products Market:

1. What are Advanced Therapy Medicinal Products?

- Advanced Therapy Medicinal Products are innovative therapeutic drugs that utilize advanced technologies to manipulate cells, tissues, or genes for the purpose of diagnosis, prevention and treatment of chronic diseases.

2. What is the market for Advanced Therapy Medicinal Products?

- The advanced therapy medicinal products (ATMP) market was valued at USD 30,778.72 million in 2024, growing at a CAGR of 14.17% during the forecast period from 2025 to 2032.

3. What are the drivers for the global Advanced Therapy Medicinal Products market?

- The advanced therapy medicinal products market is expected to grow at a rapid pace due to the increasing prevalence of chronic diseases. Factors such as the rising occurrences of genetic diseases and cancers, along with increasing research and development initiatives and collaborations among major industry players, are pivotal in driving the growth of the market during the forecast period from 2025 to 2032.

4. Who are the key players operating in the global Advanced Therapy Medicinal Products market?)

- Some of the key market players operating in the advanced therapy medicinal products market include Pfizer Inc., Novartis AG, Gilead Sciences, Inc., Kolon TissueGene, Inc., Bluebird Bio, Inc., F. Hoffmann-La Roche Ltd, Bristol-Myers Squibb Company, Organogenesis Inc., BioNTech, Regeneron Pharmaceuticals Inc., ALLOGENE THERAPEUTICS, CRISPR Therapeutics, Autolus Therapeutics, Anixa Biosciences, Inc., Amgen Inc., Intellia Therapeutics, Inc., Adaptimmune, Voyager Therapeutics Inc., Sangamo Therapeutics, Inc., Biogen, and others.

5. Which region has the highest share in the global Advanced Therapy Medicinal Products market?

- North America is expected to account for the largest market share of the advanced therapy medicinal products market in 2024. This can be attributed to the rising number of cancer cases and the rise in the R&D activities by key players in the region, thus driving the growth of the advanced therapy medicinal products market in North America.

Table of Contents

1. Advanced Therapy Medicinal Products Market Report Introduction

- 1.1 Scope of the Study

- 1.2 Market Segmentation

- 1.3 Market Assumption

2. Advanced Therapy Medicinal Products Market Executive Summary

- 2.1 Market at Glance

3. Competitive Landscape

4. Regulatory Analysis

- 4.1 The United States

- 4.2 Europe

- 4.3 Japan

- 4.4 China

5. Advanced Therapy Medicinal Products Market Key Factors Analysis

- 5.1 Advanced Therapy Medicinal Products Market Drivers

- 5.1.1 The growing prevalence of chronic diseases

- 5.1.2 The rising number of genetic diseases and cancer cases

- 5.1.3 Increasing R&D activities and partnerships among key players

- 5.2 Advanced Therapy Medicinal Products Market Restraints and Challenges

- 5.2.1 High cost of cell and gene therapies

- 5.2.2 Safety concerns associated with advanced therapy medicinal products

- 5.3 Advanced Therapy Medicinal Products Market Opportunity

- 5.3.1 Focus on advanced personalized cell & gene therapy development

- 5.3.2 Integration of AI in advanced therapy drug discovery and development

6. Advanced Therapy Medicinal Products Market Porter's Five Forces Analysis

- 6.1 Bargaining Power of Suppliers

- 6.2 Bargaining Power of Consumers

- 6.3 Threat of New Entrants

- 6.4 Threat of Substitutes

- 6.5 Competitive Rivalry

7. Advanced Therapy Medicinal Products Market Assessment

- 7.1 By Type

- 7.1.1 Gene-Therapy Medicines

- 7.1.2 Cell Therapy Medicines

- 7.1.3 Tissue Engineered Products

- 7.1.4 Combined ATMPs

- 7.2 By Indication

- 7.2.1 Oncology

- 7.2.2 Cardiology

- 7.2.3 Neurology

- 7.2.4 Genetic Disorders

- 7.2.5 Infectious Diseases

- 7.2.6 Metabolic Disease

- 7.2.7 Others

- 7.3 By Geography

- 7.3.1 North America

- 7.3.1.1 United States Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.1.2 Canada Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.1.3 Mexico Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.2 Europe

- 7.3.2.1 France Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.2.2 Germany Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.2.3 United Kingdom Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.2.4 Italy Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.2.5 Spain Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.2.6 Rest of Europe Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.3 Asia-Pacific

- 7.3.3.1 China Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.3.2 Japan Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.3.3 India Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.3.4 Australia Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.3.5 South Korea Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.3.6 Rest of Asia-Pacific Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.4 Rest of the World (RoW)

- 7.3.4.1 Middle East Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.4.2 Africa Advanced Therapy Medicinal Products Market Size in USD million (2022-2032)

- 7.3.4.3 South America Advanced Therapy Medicinal Products Market Size In USD Million (2022-2032)

- 7.3.1 North America

8. Advanced Therapy Medicinal Products Market Company and Product Profiles

- 8.1 Pfizer Inc.

- 8.1.1 Company Overview

- 8.1.2 Company Snapshot

- 8.1.3 Financial Overview

- 8.1.4 Product Listing

- 8.1.5 Entropy

- 8.2 Novartis AG

- 8.2.1 Company Overview

- 8.2.2 Company Snapshot

- 8.2.3 Financial Overview

- 8.2.4 Product Listing

- 8.2.5 Entropy

- 8.3 Gilead Sciences, Inc.

- 8.3.1 Company Overview

- 8.3.2 Company Snapshot

- 8.3.3 Financial Overview

- 8.3.4 Product Listing

- 8.3.5 Entropy

- 8.4 Kolon TissueGene, Inc.

- 8.4.1 Company Overview

- 8.4.2 Company Snapshot

- 8.4.3 Financial Overview

- 8.4.4 Product Listing

- 8.4.5 Entropy

- 8.5 Bluebird Bio, Inc.

- 8.5.1 Company Overview

- 8.5.2 Company Snapshot

- 8.5.3 Financial Overview

- 8.5.4 Product Listing

- 8.5.5 Entropy

- 8.6 F. Hoffmann-La Roche Ltd

- 8.6.1 Company Overview

- 8.6.2 Company Snapshot

- 8.6.3 Financial Overview

- 8.6.4 Product Listing

- 8.6.5 Entropy

- 8.7 Bristol-Myers Squibb Company

- 8.7.1 Company Overview

- 8.7.2 Company Snapshot

- 8.7.3 Financial Overview

- 8.7.4 Product Listing

- 8.7.5 Entropy

- 8.8 Organogenesis Inc.

- 8.8.1 Company Overview

- 8.8.2 Company Snapshot

- 8.8.3 Financial Overview

- 8.8.4 Product Listing

- 8.8.5 Entropy

- 8.9 BioNTech

- 8.9.1 Company Overview

- 8.9.2 Company Snapshot

- 8.9.3 Financial Overview

- 8.9.4 Product Listing

- 8.9.5 Entropy

- 8.10 Regeneron Pharmaceuticals Inc.

- 8.10.1 Company Overview

- 8.10.2 Company Snapshot

- 8.10.3 Financial Overview

- 8.10.4 Product Listing

- 8.10.5 Entropy

- 8.11 ALLOGENE THERAPEUTICS

- 8.11.1 Company Overview

- 8.11.2 Company Snapshot

- 8.11.3 Financial Overview

- 8.11.4 Product Listing

- 8.11.5 Entropy

- 8.12 CRISPR Therapeutics

- 8.12.1 Company Overview

- 8.12.2 Company Snapshot

- 8.12.3 Financial Overview

- 8.12.4 Product Listing

- 8.12.5 Entropy

- 8.13 Autolus Therapeutics

- 8.13.1 Company Overview

- 8.13.2 Company Snapshot

- 8.13.3 Financial Overview

- 8.13.4 Product Listing

- 8.13.5 Entropy

- 8.14 Anixa Biosciences, Inc.

- 8.14.1 Company Overview

- 8.14.2 Company Snapshot

- 8.14.3 Financial Overview

- 8.14.4 Product Listing

- 8.14.5 Entropy

- 8.15 Amgen Inc.

- 8.15.1 Company Overview

- 8.15.2 Company Snapshot

- 8.15.3 Financial Overview

- 8.15.4 Product Listing

- 8.15.5 Entropy

- 8.16 Intellia Therapeutics, Inc.

- 8.16.1 Company Overview

- 8.16.2 Company Snapshot

- 8.16.3 Financial Overview

- 8.16.4 Product Listing

- 8.16.5 Entropy

- 8.17 Adaptimmune

- 8.17.1 Company Overview

- 8.17.2 Company Snapshot

- 8.17.3 Financial Overview

- 8.17.4 Product Listing

- 8.17.5 Entropy

- 8.18 Voyager Therapeutics, Inc.

- 8.18.1 Company Overview

- 8.18.2 Company Snapshot

- 8.18.3 Financial Overview

- 8.18.4 Product Listing

- 8.18.5 Entropy

- 8.19 Sangamo Therapeutics, Inc.

- 8.19.1 Company Overview

- 8.19.2 Company Snapshot

- 8.19.3 Financial Overview

- 8.19.4 Product Listing

- 8.19.5 Entropy

- 8.20 Biogen

- 8.20.1 Company Overview

- 8.20.2 Company Snapshot

- 8.20.3 Financial Overview

- 8.20.4 Product Listing

- 8.20.5 Entropy