|

|

市場調査レポート

商品コード

1625352

甲状腺機能亢進症 - 市場考察、疫学、市場予測(2034年)Graves' Disease - Market Insight, Epidemiology, and Market Forecast - 2034 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 甲状腺機能亢進症 - 市場考察、疫学、市場予測(2034年) |

|

出版日: 2024年11月01日

発行: DelveInsight

ページ情報: 英文 177 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

主なハイライト

- 主要7市場の甲状腺機能亢進症の市場規模は2023年に約44億米ドルであり、予測期間に大幅なCAGRで増加する見込みです。主要7市場中では米国が最大の市場規模を占め、2023年に市場全体の約72%を占めました。

- 主要7市場の甲状腺機能亢進症の患者の総数は、2023年に最大713万4,600人でした。日本の甲状腺機能亢進症の有病率は、欧米に比べて著しく低いです。

- 甲状腺機能亢進症の現在の治療動向は、甲状腺機能亢進症の初発・再発のいずれに対しても抗甲状腺薬(ATD)が支持されており、特定の患者集団に対する長期的な安全性と有効性を裏付ける強力なエビデンスがあります。欧州と日本では、甲状腺機能亢進症に対する第一選択療法はATD療法です。

- 甲状腺機能亢進症に対する標的治療、特に標準治療に抵抗性を示す患者やATDを使用しても症状が続く患者に対する標的治療の必要性は大きいです。

- TEPEZZAは、甲状腺眼症(TED)に対して承認された唯一の治療薬であり、甲状腺機能亢進症に関連する眼の問題を管理する上で大きな進歩を示しています。現在、この領域で承認されている薬剤は1つしかないため、甲状腺機能亢進症市場に参入する企業には大きな機会があります。

- 甲状腺機能亢進症甲状腺機能亢進症の子供や青少年は、ATD、放射性ヨード、甲状腺切除術で治療され、個々のリスクベネフィット評価に基づいて治療法が選択されます。すべての患者に対して、生涯にわたるモニタリングが必要です。

- 甲状腺機能亢進症の開発パイプラインは、Immunovant、Viridian Therapeutics、Argenx、Tourmaline Bio、Hoffmann-La Roche、Sling Therapeuticsなど、甲状腺疾患の標的治療法の開発の最前線にいる企業によって拡大しています。Viridian Therapeuticsは、中等度から重度の活動性TEDと慢性TEDの両方の治療法を開発している唯一の企業として際立っています。一方、Kriya Therapeutics、Septerna、Crinetics Pharmaceuticalsは、この分野で初期段階の製品を開発中です。

- 潜在的な新薬候補としては、veligrotug(VRDN-001)、VRDN-003、batoclimab、Efgartigimod PH20 SC、ENSPRYNG(satralizumab、RG6168)、LASN01、linsitinib、AP-PA02、Lonigutamab(抗IGF-1R)などがあります。

- 甲状腺機能亢進症治療市場は、疾患の認知度の向上、診断ツールの改良、標的生物学的製剤の拡大により、拡大が見込まれています。

甲状腺機能亢進症市場の見通し

甲状腺機能亢進症には主に3つの治療法があります。ATD投与、甲状腺摘出術、放射性ヨード療法です。ATD投与は、ヨウ素の塩化物または還元型であるヨウ化物がサイログロブリンと相互作用するのを阻害することにより、甲状腺ホルモンの生合成を阻害し、ホルモンの産生量を減少させます。methimazoleはもっとも広く使われているATD薬で、半減期が長く副作用が少ないです。もう1つのcarbimazoleは欧州諸国で承認されていますが、米国では承認されていません。carbimazoleは不活性薬で、血液中で代謝されて活性のあるmethimazoleに変わるため、作用は弱いです。最後にpropylthiouracilですが、これは使用可能な抗甲状腺薬の中でもっとも効力が弱いです。米国と欧州で承認されており、propylthiouracilは胎盤移行性が低いため、妊娠初期の最初の治療薬として選択されています。propylthiouracilは長い間、アメリカでも南米でも第一選択のATDでした。しかし、現在ではAmerican Thyroid Association(ATA)はpropylthiouracilよりmethimazoleを推奨しています。methimazoleはほとんどの欧州諸国と日本で使われていますが、carbimazoleは主に英国で使われています。

当レポートでは、甲状腺機能亢進症の主要7市場(米国、ドイツ、スペイン、イタリア、フランス、英国、日本)について調査分析し、各地域の市場規模、現在の治療法、アンメットニーズ、新薬などの情報を提供しています。

目次

第1章 重要考察

第2章 レポートのイントロダクション

第3章 甲状腺機能亢進症のエグゼクティブサマリー

第4章 疫学と市場の分析の調査手法

第5章 甲状腺機能亢進症市場の概要

- 主要7市場の甲状腺機能亢進症の市場シェアの分布:治療法別(2020年)

- 主要7市場の甲状腺機能亢進症の市場シェアの分布:治療法別(2034年)

第6章 重要な出来事

第7章 疾患の背景と概要

- イントロダクション

- 症状

- 兆候と症状

- 原因

- 危険因子

- バイオマーカー

- 診断

- 鑑別診断

第8章 治療と管理

- 治療ガイドライン

第9章 疫学と患者人口

- 主な調査結果

- 前提条件と根拠

- 主要7市場の甲状腺機能亢進症の患者の総数

- 主要7市場の甲状腺機能亢進症の診断された患者の総数

- 米国

- 欧州4ヶ国・英国

- 日本

第10章 ペイシェントジャーニー

- 概要

第11章 上市済み薬品

- TEPEZZA(Teprotumumab-Trbw):Amgen(Horizon Therapeutics)

第12章 新治療法

- 主な競合

- IMVT-1401(batoclimab、RVT-1401):Immunovant、Samsung Biologics、HanAll Biopharma、Roivant Sciences

- VRDN-001(veligrotug):Viridian Therapeutics

- VRDN-003:Viridian Therapeutics

- Pacibekitug(TOUR006):Tourmaline Bio

- LASN01:Lassen Therapeutics

- Lonigutamab:ACELYRIN

- ENSPRYNG(satralizumab、RG6168):Hoffmann-La Roche

- Linsitinib:Sling Therapeutics

- Efgartigimod PH20 SC:Argenx

第13章 甲状腺機能亢進症:主要7市場の分析

- 主な調査結果

- 市場見通し

- コンジョイント分析

- 主な市場予測の前提条件

- コストの想定とリベート

- 価格動向

- アナログの評価

- 上市年と治療の普及

- 主要7市場の甲状腺機能亢進症の総市場規模

- 米国

- 米国の甲状腺機能亢進症の総市場規模

- 米国の甲状腺機能亢進症の市場規模:治療法別

- 欧州4ヶ国・英国

- 欧州4ヶ国・英国の甲状腺機能亢進症の総市場規模

- 欧州4ヶ国・英国の甲状腺機能亢進症の市場規模:治療法別

- 日本

- 日本の甲状腺機能亢進症の総市場規模

- 日本の甲状腺機能亢進症の市場規模:治療法別

第14章 アンメットニーズ

第15章 SWOT分析

第16章 KOLの見解

第17章 市場参入と償還

- 米国

- 欧州4ヶ国・英国

- ドイツ

- フランス

- イタリア

- スペイン

- 英国

- 日本

- 甲状腺機能亢進症の市場参入と償還

第18章 付録

第19章 DelveInsightのサービス内容

第20章 免責事項

第21章 DelveInsightについて

List of Tables

- Table 1: Summary of Graves' Disease - Market and Epidemiology (2020-2034)

- Table 2: Key Events for Graves' Disease

- Table 3: ETA 2022 Recommendations for the Management of Pediatric Graves' Disease

- Table 4: Clinical Situations That Favor a Particular Modality as Treatment for Graves' Hyperthyroidism

- Table 5: Thyroid Storm: Drugs and Doses

- Table 6: Total Prevalent Cases of Graves' Disease in the 7MM in Thousands (2020-2034)

- Table 7: Total Diagnosed Prevalent Cases of Graves' Disease in the 7MM in Thousands (2020-2034)

- Table 8: Total Prevalent Cases of Graves' Disease in the US in Thousands (2020-2034)

- Table 9: Total Diagnosed Prevalent Cases of Graves' Disease in the US in Thousands (2020-2034)

- Table 10: Gender-specific Cases of Graves' Disease in the US in Thousands (2020-2034)

- Table 11: Graves' Disease Cases by Manifestations in the US in Thousands (2020-2034)

- Table 12: Total Prevalent Cases of Graves' Disease in EU4 and the UK in Thousands (2020-2034)

- Table 13: Total Diagnosed Prevalent Cases of Graves' Disease in EU4 and the UK in Thousands (2020-2034)

- Table 14: Gender-specific Cases of Graves' Disease in EU4 and the UK in Thousands (2020-2034)

- Table 15: Graves' Disease Cases by Manifestations in EU4 and the UK in Thousands (2020-2034)

- Table 16: Total Prevalent Cases of Graves' Disease in Japan in Thousands (2020-2034)

- Table 17: Total Diagnosed Prevalent Cases of Graves' Disease in Japan in Thousands (2020-2034)

- Table 18: Gender-specific Cases of Graves' Disease in Japan in Thousands (2020-2034)

- Table 19: Graves' Disease Cases by Manifestations in Japan in Thousands (2020-2034)

- Table 20: TEPEZZA (teprotumumab), Clinical Trial Description, 2024

- Table 21: Efficacy Results of TEPEZZA in Patients with Graves' Ophthalmopathy in Studies 1 and 2

- Table 22: Comparison of Emerging Drugs Under Development

- Table 23: IMVT-1401 (batoclimab, RVT-1401), Clinical Trial Description, 2024

- Table 24: VRDN-001 (veligrotug), Clinical Trial Description, 2024

- Table 25: VRDN-003, Clinical Trial Description, 2024

- Table 26: Pacibekitug (TOUR006), Clinical Trial Description, 2024

- Table 27: LASN01, Clinical Trial Description, 2024

- Table 28: Lonigutamab, Clinical Trial Description, 2024

- Table 29: ENSPRYNG (satralizumab, RG6168), Clinical Trial Description, 2024

- Table 30: Linsitinib, Clinical Trial Description, 2024

- Table 31: Efgartigimod PH20 SC, Clinical Trial Description, 2024

- Table 32: Key Market Forecast Assumption of Graves' Disease in the United States

- Table 33: Key Market Forecast Assumption of Graves' Disease in EU4 and the UK

- Table 34: Key Market Forecast Assumption of Graves' Disease in Japan

- Table 35: Total Market Size of Graves' Disease in the 7MM, in USD million (2020-2034)

- Table 36: Total Market Size of Graves' Disease in the US, in USD million (2020-2034)

- Table 37: Market Size of Graves' Disease by Therapies in the US, in USD million (2020-2034)

- Table 38: Total Market Size of Graves' Disease in EU4 and the UK, in USD million (2020-2034)

- Table 39: Market Size of Graves' Disease by Therapies in EU4 and the UK, in USD million (2020-2034)

- Table 40: Total Market Size of Graves' Disease in Japan, in USD million (2020-2034)

- Table 41: Market Size of Graves' Disease by Therapies in Japan, in USD million (2020-2034)

- Table 42: NHI Pricing for Graves' Disease Therapies

List of Figures

- Figure 1: Graves' Disease

- Figure 2: Signs and Symptoms of Graves' Disease

- Figure 3: Management of Graves' disease

- Figure 4: Total Prevalent Cases of Graves' Disease in the 7MM in Thousands (2020-2034)

- Figure 5: Total Diagnosed Prevalent Cases of Graves' Disease in the 7MM in Thousands (2020-2034)

- Figure 6: Total Prevalent Cases of Graves' Disease in the US in Thousands (2020-2034)

- Figure 7: Total Diagnosed Prevalent Cases of Graves' Disease in the US in Thousands (2020-2034)

- Figure 8: Gender-specific Cases of Graves' Disease in the US in Thousands (2020-2034)

- Figure 9: Graves' Disease Cases by Manifestations in the US in Thousands (2020-2034)

- Figure 10: Total Prevalent Cases of Graves' Disease in EU4 and the UK in Thousands (2020-2034)

- Figure 11: Total Diagnosed Prevalent Cases of Graves' Disease in EU4 and the UK in Thousands (2020-2034)

- Figure 12: Gender-specific Cases of Graves' Disease in EU4 and the UK in Thousands (2020-2034)

- Figure 13: Graves' Disease Cases by Manifestations in EU4 and the UK in Thousands (2020-2034)

- Figure 14: Total Prevalent Cases of Graves' Disease in Japan in Thousands (2020-2034)

- Figure 15: Total Diagnosed Prevalent Cases of Graves' Disease in Japan in Thousands (2020-2034)

- Figure 16: Gender-specific Cases of Graves' Disease in Japan in Thousands (2020-2034)

- Figure 17: Graves' Disease Cases by Manifestations in Japan in Thousands (2020-2034)

- Figure 18: Total Market Size of Graves' Disease in the 7MM, in USD million (2020-2034)

- Figure 19: Total Market Size of Graves' Disease in the US, in USD million (2020-2034)

- Figure 20: Market Size of Graves' Disease by Therapies in the US, in USD million (2020-2034)

- Figure 21: Total Market Size of Graves' Disease in EU4 and the UK, in USD million (2020-2034)

- Figure 22: Market Size of Graves' Disease by Therapies in EU4 and the UK, in USD million (2020-2034)

- Figure 23: Total Market Size of Graves' Disease in Japan, in USD million (2020-2034)

- Figure 24: Market Size of Graves' Disease by Therapies in Japan, in USD million (2020-2034)

- Figure 25: Health Technology Assessment

- Figure 26: Reimbursement Process in Germany

- Figure 27: Reimbursement Process in France

- Figure 28: Reimbursement Process in Italy

- Figure 29: Reimbursement Process in Spain

- Figure 30: Reimbursement Process in the United Kingdom

- Figure 31: Reimbursement Process in Japan

Key Highlights:

- The market size of Graves' disease in the 7MM was around USD 4,400 million in 2023 and is expected to increase with a significant CAGR during the forecast period. Among the 7MM, the United States accounted for the largest market size, i.e., approximately 72% of the overall market in 2023.

- The total prevalent cases of Graves' disease in the 7MM were ~7,134,600 in 2023. The prevalence of Graves' disease in Japan is significantly lower than in Europe and the United States.

- Current treatment trends for Graves' disease are favoring antithyroid drug (ATDs) for both initial and relapsed cases of Graves' disease, which have strong evidence supporting their long-term safety and effectiveness for certain patient groups. In Europe and Japan, ATD has been the preferred first-line therapy for Graves' disease.

- There is a significant need for targeted therapies for Graves' disease, especially for patients who are resistant to standard treatments or continue to experience symptoms despite ATD use.

- TEPEZZA is the only approved treatment for thyroid eye disease (TED), representing a major advancement in managing Graves' disease-related eye issues. With only one drug currently approved in this area, there is a significant opportunity for companies to enter the Graves' disease market.

- Children and adolescents with Graves' hyperthyroidism can be treated with ATDs, radioactive iodine, or thyroidectomy, with therapy choice based on individual risk-benefit assessment. Lifelong monitoring is required for all.

- The pipeline for Graves' disease is growing with companies such as Immunovant, Viridian Therapeutics, Argenx, Tourmaline Bio, Hoffmann-La Roche, and Sling Therapeutics, at the forefront of developing targeted therapies for thyroid disorders. Viridian Therapeutics stands out as the only company developing treatments for both moderate to severe active TED and chronic TED. Meanwhile, Kriya Therapeutics, Septerna, and Crinetics Pharmaceuticals are progressing with earlier-stage products in this area.

- Few of the potential emerging candidates include veligrotug (VRDN-001), VRDN-003, batoclimab, Efgartigimod PH20 SC, ENSPRYNG (satralizumab, RG6168), LASN01, linsitinib, AP-PA02, and Lonigutamab (anti-IGF-1R), among others.

- The market for Graves' disease treatments is anticipated to increase, driven by increasing disease awareness, better diagnostic tools, and the expansion of targeted biologic therapies.

DelveInsight's " Graves' Disease - Market Insight, Epidemiology, and Market Forecast - 2034" report delivers an in-depth understanding of Graves' disease, historical and forecasted epidemiology as well as the Graves' disease market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Graves' disease market report provides current treatment practices, emerging drugs, Graves' disease market share of individual therapies, and current and forecasted Graves' disease market size from 2020 to 2034, segmented by seven major markets. The report also covers current Graves' disease treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Geography Covered:

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020-2034

Graves' Disease Understanding and Treatment Algorithm

Graves' Disease Overview

Graves' disease is a disease affecting the thyroid and often the skin and eyes. Graves' disease is characterized by abnormal enlargement of the thyroid (goiter) and increased secretion of thyroid hormone (hyperthyroidism). Thyroid hormones are involved with many different systems of the body, and consequently, the specific symptoms and signs of Graves' disease can vary widely from one person to another.

Graves' disease is further categorized into three distinct subtypes, each characterized by specific clinical features and variations in pathophysiology:

- Graves' Dermopathy

- Graves' Orbitopathy

- Graves' Acropachy

Graves' Disease Diagnosis

A diagnosis of Graves' disease is made based upon a detailed patient and family history, a thorough clinical evaluation, identification of characteristic findings, and specialized tests such as blood tests that measure the levels of thyroid hormone and thyroid-stimulating hormone. Blood tests to detect the presence of specific antibodies that cause Graves' disease can be performed to confirm a diagnosis but are usually not necessary.

Computed tomography or Magnetic Resonance Imaging (MRI) of orbits can be performed to diagnose Graves' orbitopathy in patients who present with orbitopathy without hyperthyroidism. Patients with hyperthyroidism can have microcytic anemia, thrombocytopenia, bilirubinemia, high transaminases, hypercalcemia, high alkaline phosphatase, Low-density Lipoprotein (LDL) and High-density Lipoprotein (HDL) cholesterol.

Graves' Disease Treatment

Treatment of Graves' disease usually involves one of three methods: antithyroid drugs (thionamides), use of radioactive iodine, or surgery. The specific form of treatment recommended may be based on the age of an affected individual and the degree of the illness. Furthermore, treatment for Graves' disease depends on its presentation. Treatment consists of rapid symptom control and reduction of thyroid hormone secretion.

A beta-adrenergic blocker should be started for symptomatic patients, specifically for patients with heart rates more than 90 beats/min, patients with a history of cardiovascular disease, and elderly patients. Atenolol 25-50 mg orally once daily may be considered the preferred beta blocker due to its convenience of daily dosing, and it is cardioselective (beta-1 selective). Some prescribers recommend Propranolol 10-40 mg orally every 6-8 h, due to its potential effect to block peripheral conversion of T4 to T3 if a beta blocker after that, calcium channel blockers like diltiazem and verapamil can be used to control heart rate.

In January 2020, the US FDA approved TEPEZZA for the treatment of TED after an accelerated Priority Review. TEPEZZA is the only approved treatment for thyroid eye disease (TED), representing a major advancement in managing Graves' disease-related eye issues

Graves' Disease Epidemiology

The Graves' disease epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the Total Prevalent Cases of Graves' Disease, Total Diagnosed Prevalent Cases of Graves' Disease, Gender-specific Cases of Graves' Disease, and Graves' Disease Cases by Manifestations in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- Among the 7MM, the US accounted for approximately 48%, EU4 and the UK for 46%, and Japan for 6% of the total prevalent cases of Graves' disease in 2023.

- As per the DelveInsight estimates, it has been found that there were approximately 3,720,200 diagnosed prevalent cases of Graves' disease in the 7MM in 2023.

- In 2023, the manifestation of Graves' disease in the US showed that Graves' Ophthalmopathy captured the highest number of cases, i.e., approximately 584,400 cases.

- In 2023, the gender-specific diagnosed prevalent cases of Graves' disease in Japan were approximately 80,450 cases for males and approximately 321,800 cases for females.

Graves' Disease Drug Chapters

Marketed Drugs

TEPEZZA (Teprotumumab-Trbw): Amgen (Horizon Therapeutics)

Teprotumumab, an insulin-like Growth Factor-1 receptor (IGF-1R) inhibitor, is a fully human IgG1 monoclonal antibody produced in Chinese hamster ovary (CHO-DG44) cells with a molecular weight of approximately 148 KD.

In January 2020, the US FDA approved TEPEZZA for the treatment of TED after an accelerated Priority Review. And recently, in September 2024, the drug was approved by Japan's Ministry of Health, Labour, and Welfare (MHLW) for the treatment of active Graves' orbitopathy. Additionally, in April 2024, Amgen announced its plans to submit a Marketing Authorization Application (MAA) for teprotumumab to the European Medicines Agency (EMA) in the near future.

TEPEZZA is currently under investigation in Phase III clinical trials for patients with moderate-to-severe active Graves' orbitopathy as well as those with chronic TED characterized by a low Clinical Activity Score (CAS). Additionally, Amgen is exploring its potential for subcutaneous administration. To be continued in the report....

Emerging Drugs

IMVT-1401 (batoclimab, RVT-1401): Immunovant, Samsung Biologics, HanAll Biopharma, and Roivant Sciences

Immunovant's first investigational product, batoclimab (IMVT-1401), is a novel, fully human monoclonal antibody targeting the neonatal FcRn. In nonclinical studies and clinical trials, batoclimab has been observed to reduce IgG antibody levels. High levels of pathogenic IgG antibodies drive a variety of autoimmune diseases, and, as a result, this product candidate has the potential to address a variety of IgG-mediated autoimmune diseases as a self-administered SC injection.

Currently, batoclimab is being developed as a low-volume SC injection for the treatment of a variety of IgG-mediated autoimmune disorders, including myasthenia gravis, TED, chronic inflammatory demyelinating polyneuropathy, and Graves' disease. The drug is currently in Phase III developmental stage.

Recently, in September 2024, Immunovant received Investigational New Drug (IND) clearance from the US FDA for IMVT-1402 in Graves' disease patients who remain hyperthyroid despite treatment with antithyroid drugs. Furthermore, Immunovant plans to initiate clinical trials of IMVT-1402 in a total of ten indications by March 2026.

In November 2024, additional data on the efficacy and safety of batoclimab in Graves' thyroidal and extrathyroidal disease were presented in an oral presentation at the ATA 2024 Annual Meeting held in Chicago.

VRDN-001 (veligrotug): Viridian Therapeutics

Viridian's lead product candidate, VRDN-001, is a differentiated monoclonal antibody targeting Insulin-like Growth Factor-1 Receptor (IGF-1R), a clinically and commercially validated target for the treatment of Graves' ophthalmopathy. In preclinical studies, VRDN-001 had shown to be a full antagonist of IGF-1R, with complete receptor blockade than other anti-IGF-1R antibodies, including the only approved Graves' Ophthalmopathy therapy.

Currently, the drug is currently being evaluated in various Phase III trials for the treatment of Graves' ophthalmopathy. According to a corporate presentation published in November 2024, the potential PDUFA date and launch of veligrotug are expected in 2H 2026.

Drug Class Insight

IGF-1R Inhibitor

The use of IGF-1R inhibitors such as teprotumumab and linsitinib, represents an innovative therapeutic strategy for the management of Graves' disease and its associated ocular manifestations. These inhibitors work by selectively targeting and modulating key signaling pathways that are central to the progression of the disease. In doing so, they not only help alleviate the symptoms of the disorder but also address the underlying pathophysiological mechanisms that contribute to the damaging effects on ocular and orbital tissues. This dual action offers a promising approach for more effective disease management, potentially reducing both the clinical manifestations and the long-term consequences of Graves' disease.

Neonatal FcRn inhibitor

Neonatal FcRn inhibitors, such as batoclimab, represent a novel therapeutic strategy for Graves' disease by specifically targeting the autoimmune mechanisms that drive the condition. These inhibitors work by blocking the neonatal Fc receptor, which plays a key role in prolonging the half-life of pathogenic antibodies, including thyroid-stimulating immunoglobulins (TRAb). By inhibiting this receptor, batoclimab can rapidly normalize thyroid hormone levels and reduce TRAb concentrations, offering significant therapeutic benefits. This makes it a promising treatment option, particularly for patients who do not respond to conventional therapies, providing a new avenue for managing this challenging autoimmune disorder.

Graves' Disease Market Outlook

There are three main treatments for Graves' disease: ATD medications, thyroidectomy, and radioactive iodine therapy. ATD medications prevent the biosynthesis of the thyroid hormone by blocking iodide, the salted or reduced form of iodine, from interacting with thyroglobulin, thus diminishing the amount of hormone produced. Methimazole is the most widely used ATD medication, with a long half-life and low side effects. Another is carbimazole has been approved in European countries but is not approved in the United States. It is an inactive drug that is metabolized in the blood into the active methimazole thus it is less potent. And the last is propylthiouracil, which is the least potent of the available antithyroid medications. Approved in the United States and Europe, propylthiouracil is the initial treatment choice during the first trimester of pregnancy because of the low placental transfer. Propylthiouracil was, for many years, the first-choice ATD in both the USA and South America. But now the American Thyroid Association (ATA) recommends Methimazole over Propylthiouracil. Methimazole is used in most European countries and Japan, whereas carbimazole is mainly used in the UK.

Currently, TEPEZZA is the only approved therapy specifically indicated for the treatment of active Graves' orbitopathy, underscoring a significant unmet need in the market. While various pharmacological agents, including glucocorticoids, rituximab, and tocilizumab, are utilized off-label, their efficacy remains inconsistent, and none have achieved regulatory approval for this indication. The limited options highlight a critical gap in targeted, effective, and approved therapies for managing the disease, particularly in severe or refractory cases.

This scarcity leads to gaps in understanding the current treatment scenario. However, certain studies help extrapolate the current scenario, where teprotumumab and glucocorticoids remain the mainstay.

The emerging treatments, while targeting different mechanisms or molecular pathways, provide promising alternatives to current therapies by offering novel approaches to managing autoimmune diseases like thyroid eye disease. Their development reflects a growing focus on more precise, targeted treatments for these complex conditions.

- Among the 7MM, the US accounted for the largest market size of Graves' disease. i.e., USD ~3,180 million in 2023.

- Among EU4 and the UK, Germany accounted for the highest market size in 2023, while Spain occupied the lowest.

- The pipeline for Graves' disease consists of neonatal FcRn inhibitor, IGF-1R Inhibitor, Interleukin-6 (IL-6) receptor blocker, anti-interleukin-11 receptor (IL-11R), and others.

- In 2034, among all the emerging therapies, the highest revenue is expected to be generated by TEPEZZA in the US.

Key Updates

- In August 2024, despite ACELYRIN's izokibep maintaining its strong performance in clinical trials, the company shifted its focus away from the drug, laying off about 40 of its 135 employees-roughly 33% of its workforce-to prioritize the development of lonigutamab, which is poised to compete directly with Amgen's blockbuster drug, TEPEZZA.

- In August 2023, Tourmaline Bio announced that the US Food and Drug Administration (FDA) had cleared the IND application for TOUR006.

- As per the Q3 2024 annual report published in November, Immunovant anticipates data from batoclimab trials in TED in 2H 2025.

- As per the June 2024 Sec filing, following a recently completed Type B meeting with the US FDA, the company is on track to initiate four to five potentially registrational programs for IMVT-1402 in several therapeutic areas, including endocrinology and neurology, by March 2025.

- Viridian Therapeutics anticipates submitting a BLA for veligrotug for the treatment of TED in 2H 2025.

- Viridian Therapeutics anticipates topline data from the REVEAL-1 and REVEAL-2 trials of VRDN-003 in active and chronic TED in the first half of 2026.

Graves' Disease Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020-2034. The landscape of Graves' disease treatment has experienced a profound transformation with the uptake of novel drugs. These innovative therapies are redefining standards of care. Furthermore, the increased uptake of these transformative drugs is a testament to the unwavering dedication of physicians, oncology professionals, and the entire healthcare community in their tireless pursuit of advancing cancer care. This momentous shift in treatment paradigms is a testament to the power of research, collaboration, and human resilience.

Pacibekitug has the potential to emerge as an ideal first-line therapy and market leader in TED, offering patient-friendly subcutaneous injections with a convenient dosing schedule of once every eight weeks, significantly reducing the treatment burden.

Graves' Disease Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II/III, Phase II, and Phase I/II. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for Graves' disease emerging therapies.

KOL- Views

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders like MD, PhD, Research Project Manager, Director, and others. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or Graves' disease market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Delveinsight's analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the University of Michigan Kellogg Eye Center, Cedars-Sinai Medical Center, Laboratory of Endocrinology and Receptor Biology at NIDDK, University of Amsterdam, Cedars-Sinai Medical Center, Temple University School of Podiatric Medicine, Basedowian Ophthalmopathy Center, etc., were contacted. Their opinion helps understand and validate Graves' disease epidemiology and market trends.

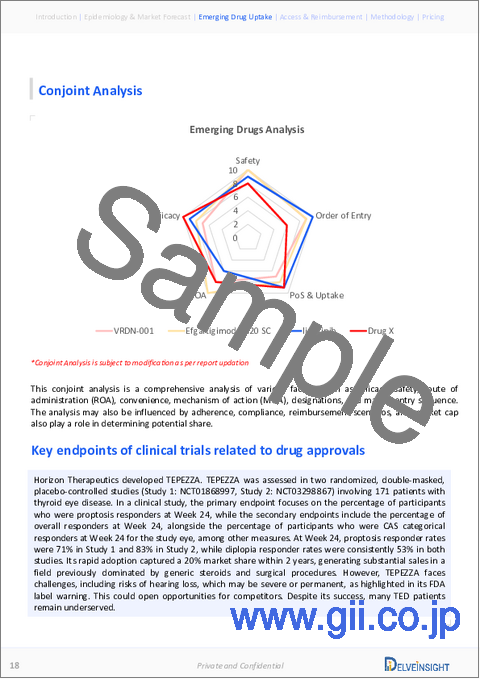

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst's discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial's primary and secondary outcome measures are evaluated.

Further, the therapies' safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Market Access and Reimbursement

- The United States

- Horizon Commercial Copay Program

Horizon is committed to ensuring that patients pay the lowest possible amount for their medications. Eligible patients may qualify for a USD 0 copay, covering both the medication and intravenous infusion costs.

To be eligible for the Horizon Commercial Copay Program, patients must meet the following criteria:

The prescription cannot be covered, in part or in full, by any government-funded program, including but not limited to Medicare, Medicare Part D, Medicaid, Medigap, VA, CHAMPUS, Department of Defense (DoD), TRICARE, or any state, patient foundation, or other pharmaceutical assistance program.

The patient must be prescribed a Horizon rare disease medication for an FDA-approved indication, as specified in the prescribing information.

The patient must reside in the US.

The patient must have commercial insurance and be financially responsible for a portion of the medication and/or infusion costs, if applicable.

- The United Kingdom

Currently, the guidelines for the use of TEPEZZA in the United Kingdom are under development. NICE anticipates that these guidelines will be finalized and published by August 2025, providing much-needed clarity on the drug's recommended use in clinical practice.

Scope of the Report:

- The report covers a descriptive overview of Graves' disease, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into Graves' disease epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for Graves' disease is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape.

- A detailed review of the Graves' disease market; historical and forecasted is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM Graves' disease market.

Graves' disease Report Insights

- Patient Population

- Therapeutic Approaches

- Graves' disease Pipeline Analysis

- Graves' disease Market Size and Trends

- Market Opportunities

- Impact of Upcoming Therapies

Graves' disease Report Key Strengths

- Eleven Years Forecast

- 7MM Coverage

- Graves' disease Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Drugs Uptake

Graves' disease Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs:

- What was the Graves' disease market share (%) distribution in 2020 and what it would look like in 2034?

- What would be the Graves' disease total market size as well as market size by therapies across the 7MM during the study period (2020-2034)?

- Which country will have the largest Graves' disease market size during the study period (2020-2034)?

- What are the disease risks, burdens, and unmet needs of Graves' disease?

- What is the historical Graves' disease patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan?

- What will be the growth opportunities across the 7MM concerning the patient population of Graves' disease?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of Graves' disease?

- What are the key collaborations (Industry-Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to Graves' disease therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for Graves' disease and their status?

- What are the key designations that have been granted for the emerging therapies for Graves' disease?

Reasons to buy:

- The report will help in developing business strategies by understanding trends shaping and driving Graves' disease.

- To understand the future market competition in the Graves' disease market and Insightful review of the SWOT analysis of Graves' disease.

- Organize sales and marketing efforts by identifying the best opportunities for Graves' disease in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

Table of Contents

1. Key Insights

2. Report Introduction

3. Executive Summary of Graves' Disease

4. Epidemiology and Market Methodology

5. Graves' Disease Market Overview at a Glance

- 5.1. Market Share (%) Distribution of Graves' Disease by Therapies in 2020 in the 7MM

- 5.2. Market Share (%) Distribution of Graves' Disease by Therapies in 2034 in the 7MM

6. Key Events

7. Disease Background and Overview

- 7.1. Introduction

- 7.2. Manifestations

- 7.3. Sign and Symptoms

- 7.4. Causes

- 7.5. Risk Factors

- 7.6. Biomarkers

- 7.7. Diagnosis

- 7.7.1. Differential Diagnosis

8. Treatment and Management

- 8.1. Treatment Guidelines

- 8.1.1. European Thyroid Association (ETA) Guideline for the Management of Pediatric Graves' Disease (2022)

- 8.1.2. Clinical Practice Guidelines for the Medical Management of Graves' Orbitopathy: European Group on Graves' Orbitopathy (EUGOGO) (2021)

- 8.1.3. NICE Guideline for Thyroid Assessment and Management (2019)

- 8.1.4. ETA Guideline for the Management of Graves' Hyperthyroidism (2018)

- 8.1.5. Guidelines for the Treatment of Childhood-onset Graves' disease in Japan (2016)

- 8.1.6. Guidelines for Diagnosis and Management of Hyperthyroidism: American Thyroid Association (ATA) (2016)

9. Epidemiology and Patient Population

- 9.1. Key Findings

- 9.2. Assumptions and Rationale

- 9.3. Total Prevalent Cases of Graves' Disease in the 7MM

- 9.4. Total Diagnosed Prevalent Cases of Graves' Disease in the 7MM

- 9.5. The United States

- 9.5.1. Total Prevalent Cases of Graves' Disease in the US

- 9.5.2. Total Diagnosed Prevalent Cases of Graves' Disease in the US

- 9.5.3. Gender-specific Cases of Graves' Disease in the US

- 9.5.4. Graves' Disease Cases by Manifestations in the US

- 9.6. EU4 and the UK

- 9.6.1. Total Prevalent Cases of Graves' Disease in EU4 and the UK

- 9.6.2. Total Diagnosed Prevalent Cases of Graves' Disease in EU4 and the UK

- 9.6.4. Gender-specific Cases of Graves' Disease in EU4 and the UK

- 9.6.5. Graves' Disease Cases by Manifestations in EU4 and the UK

- 9.7. Japan

- 9.7.1. Total Prevalent Cases of Graves' Disease in Japan

- 9.7.2. Total Diagnosed Prevalent Cases of Graves' Disease in Japan

- 9.7.3. Gender-specific Cases of Graves' Disease in Japan

- 9.7.4. Graves' Disease Cases by Manifestations in Japan

10. Patient Journey

- 10.1. Description

11. Marketed Drug

- 11.1. TEPEZZA (Teprotumumab-Trbw): Amgen (Horizon Therapeutics)

- 11.1.1. Product Description

- 11.1.2. Regulatory Milestone

- 11.1.3. Other Developmental Activities

- 11.1.4. Clinical Trials Information

- 11.1.5. Safety and Efficacy

12. Emerging Therapies

- 12.1. Key Cross Competition

- 12.2. IMVT-1401 (batoclimab, RVT-1401): Immunovant, Samsung Biologics, HanAll Biopharma, and Roivant Sciences

- 12.2.1. Product Description

- 12.2.2. Other Developmental Activities

- 12.2.3. Clinical Development

- 12.2.4. Safety and Efficacy

- 12.2.5. Analyst Views

- 12.3. VRDN-001 (veligrotug): Viridian Therapeutics

- 12.3.1. Product Description

- 12.3.2. Other development activities

- 12.3.3. Clinical Development

- 12.3.4. Safety and efficacy

- 12.3.5. Analyst Views

- 12.4. VRDN-003: Viridian Therapeutics

- 12.4.1. Product Description

- 12.4.2. Other development activities

- 12.4.3. Clinical Development

- 12.4.4. Analyst Views

- 12.5. Pacibekitug (TOUR006): Tourmaline Bio

- 12.5.1. Product Description

- 12.5.2. Other development activities

- 12.5.3. Clinical Development

- 12.5.4. Analyst Views

- 12.6. LASN01: Lassen Therapeutics

- 12.6.1. Product Description

- 12.6.2. Other development activities

- 12.6.3. Clinical Development

- 12.6.4. Safety and efficacy

- 12.6.5. Analyst Views

- 12.7. Lonigutamab: ACELYRIN

- 12.7.1. Product Description

- 12.7.2. Other development activities

- 12.7.3. Clinical Development

- 12.7.4. Safety and efficacy

- 12.7.5. Analyst Views

- 12.8. ENSPRYNG (satralizumab, RG6168): Hoffmann-La Roche

- 12.8.1. Drug Description

- 12.8.2. Other Developmental Activities

- 12.8.3. Clinical Trials Information

- 12.8.4. Analyst Views

- 12.9. Linsitinib: Sling Therapeutics

- 12.9.1. Drug Description

- 12.9.2. Clinical Trials Development

- 12.9.3. Analyst Views

- 12.1. Efgartigimod PH20 SC: Argenx

- 12.10.1. Drug Description

- 12.10.2. Clinical Trials Information

- 12.10.3. Analyst Views

13. Graves' disease: Seven Major Market Analysis

- 13.1. Key Findings

- 13.2. Market Outlook

- 13.3. Conjoint Analysis

- 13.4. Key Market Forecast Assumptions

- 13.4.1. Cost Assumptions and Rebates

- 13.4.2. Pricing Trends

- 13.4.3. Analogue Assessment

- 13.4.4. Launch Year and Therapy Uptake

- 13.5. Total Market Size of Graves' Disease in the 7MM

- 13.6. The United States

- 13.6.1. Total Market Size of Graves' Disease in the US

- 13.6.2. Market Size of Graves' Disease by Therapies in the US

- 13.7. EU4 and the UK

- 13.7.1. Total Market Size of Graves' Disease in the EU4 and the UK

- 13.7.2. Market Size of Graves' Disease by Therapies in EU4 and the UK

- 13.8. Japan

- 13.8.1. Total Market Size of Graves' Disease in Japan

- 13.8.2. Market Size of Graves' Disease by Therapies in Japan

14. Unmet Needs

15. SWOT Analysis

16. KOL Views

17. Market Access and Reimbursement

- 17.1. United States

- 17.1.1. Centre for Medicare and Medicaid Services (CMS)

- 17.2. EU4 and the UK

- 17.2.1. Germany

- 17.2.2. France

- 17.2.3. Italy

- 17.2.4. Spain

- 17.2.5. United Kingdom

- 17.3. Japan

- 17.3.1. MHLW

- 17.4. Market Access and Reimbursement of Graves' Disease

18. Appendix

- 18.1. Bibliography

- 18.2. Report Methodology