|

|

市場調査レポート

商品コード

1656898

認知症治療薬:市場洞察・競合情勢・市場予測 (~2032年)Dementia Drugs - Market Insights, Competitive Landscape, and Market Forecast - 2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 認知症治療薬:市場洞察・競合情勢・市場予測 (~2032年) |

|

出版日: 2025年01月01日

発行: DelveInsight

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

認知症治療薬の市場規模は、2024年の98億2,524万米ドルから、予測期間中はCAGR 6.06%で推移し、2032年には155億9,717万米ドルの規模に成長すると予測されています。

認知症治療薬の世界市場は、世界の認知症有病率の増加により拡大しています。研究開発の進歩と新薬の承認により、治療の選択肢が拡大し、多様な認知症のタイプや病期に対応する、より的を絞った効果的な治療が可能となっています。また、早期診断を促進する啓発プログラムやイニシアチブの高まりは、タイムリーな介入を促し、治療を求める患者層を増加させることで市場をさらに押し上げています。これらの要因から、2025年から2032年までの予測期間中に、認知症治療薬市場にとって有利な環境が整う見通しです。

認知症治療薬の市場力学:

2023年の世界保健機関 (WHO) の報告によると、世界全体で5,500万人以上が認知症を患っており、毎年1,000万人近くが新たに認知症と診断されています。認知症患者の60%以上は低・中所得国に居住しており、ヘルスケアインフラは限られていることが多いです。国際アルツハイマー病協会 (Alzheimer's Disease International) は、2050年までに世界の認知症人口が1億3,900万人に達すると予測しており、その中で最も増加が著しいのは低・中所得地域です。また、3秒に1人が新たに認知症と診断されており、効果的な治療法に対するニーズが加速していることを示しています。

認知症の患者数が増加し続ける中、患者の認知機能低下に対処するための薬剤に対する需要も高まっています。認知症治療薬は、認知機能障害の軽減と心理・行動症状の管理に重点を置き、患者のQOL維持に重要な役割を果たしています。こうした薬剤の需要拡大が、2024年から2030年にかけて認知症治療薬市場の大幅な拡大を牽引すると予想されます。

薬剤クラス別では、アセチルコリンエステラーゼ阻害薬 (AChEI) が2024年に75.24%のシェアを占め、市場を独占すると推定されています。これは、複数の認知症型に対する治療のアドヒアランス、特異性、この阻害剤が提供する他の様々な利点に起因しています。AChEIは、アセチルコリンエステラーゼの作用を阻害することにより、シナプス間隙のアセチルコリン濃度を高めます。コリン作動性ニューロンの変性はアセチルコリンレベルの低下を引き起こし、認知機能低下の一因となるため、この方法は認知症において特に有利です。

地域別では、北米が2024年に44.45%で最大シェアを占め、予測期間中はCAGR 6.23%で成長すると予測されています。これは、同地域における認知症有病率の上昇に起因しています。さらに、同地域の認知症治療薬として承認された医薬品数の増加、認知症に関連するさまざまな医薬品開発プロジェクトに対する政府の取り組みや資金提供の増加も、今後数年間、同地域の認知症治療薬市場を牽引すると予想されています。

当レポートでは、世界の認知症治療薬の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 認知症治療薬市場レポート:イントロダクション

- 調査範囲

- 市場セグメンテーション

- 市場の前提因子

第2章 認知症治療薬市場:エグゼクティブサマリー

- 市場概要

第3章 競合情勢

第4章 規制分析

- 米国

- 欧州

- 日本

- 中国

第5章 認知症治療薬市場:主要要因分析

- 市場促進要因

- 認知症の罹患率の増加

- 認知症の新薬の研究開発と承認の進歩

- 啓発プログラムと早期診断の向上

- 市場抑制要因と課題

- 臨床試験の失敗率の高さ

- 認知症治療薬の重篤な副作用

- 市場機会

- より広範な研究開発活動のための資金と投資の増加

第6章 認知症治療薬市場:ポーターのファイブフォース分析

第7章 認知症治療薬市場の評価

- 薬剤クラス別

- アセチルコリンエステラーゼ阻害剤

- アミロイドβ標的モノクローナル抗体

- 抗精神病薬

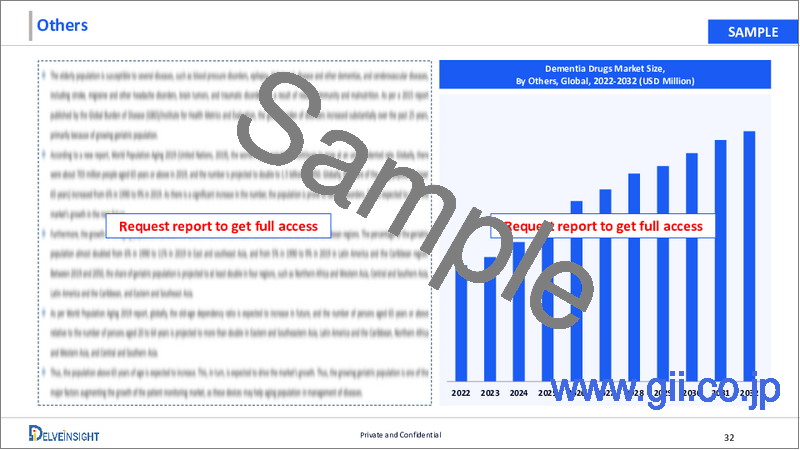

- その他

- 適応症別

- アルツハイマー病

- パーキンソン病認知症

- レビー小体型認知症

- 流通チャネル別

- 病院および薬局

- オンライン薬局

- 地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第8章 認知症治療薬市場:企業・製品プロファイル

- Eli Lilly and Company

- Aurobindo Pharma

- Essential Pharma

- Biogen

- Novartis AG

- Zydus Group

- Corium, LLC

- Apotex Inc.

- Luye Pharma Group

- H. Lundbeck A/S

- Sun Pharmaceutical Industries Ltd.

- Green Valley Inc.

- Sumitomo Pharma Co., Ltd.

第9章 KOLの見解

第10章 プロジェクトのアプローチ

第11章 DelveInsightについて

第12章 免責事項・問い合わせ

List of Tables

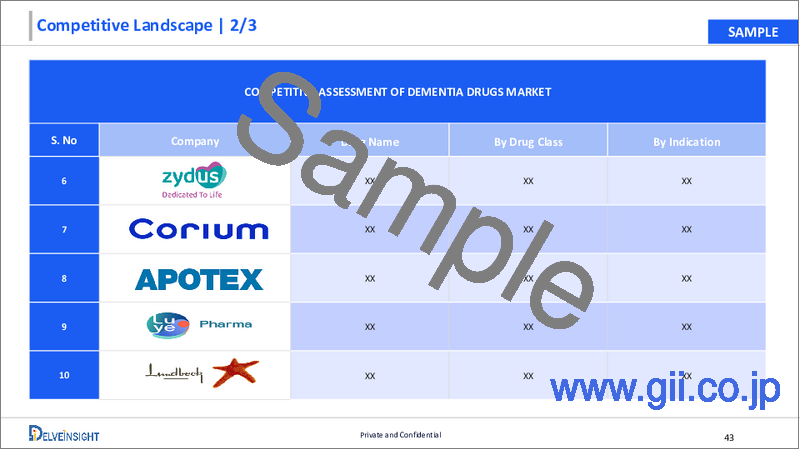

- Table 1: Competitive Analysis

- Table 2: Dementia Drugs Market in Global (2022-2032)

- Table 3: Dementia Drugs Market in Global by Drug Class (2022-2032)

- Table 4: Dementia Drugs Market in Global by Indication (2022-2032)

- Table 5: Dementia Drugs Market in Global by Distribution Channel (2022-2032)

- Table 6: Dementia Drugs Market in Global by Geography (2022-2032)

- Table 7: Dementia Drugs Market in North America (2022-2032)

- Table 8: Dementia Drugs Market in the United States (2022-2032)

- Table 9: Dementia Drugs Market in Canada (2022-2032)

- Table 10: Dementia Drugs Market in Mexico (2022-2032)

- Table 11: Dementia Drugs Market in Europe (2022-2032)

- Table 12: Dementia Drugs Market in France (2022-2032)

- Table 13: Dementia Drugs Market in Germany (2022-2032)

- Table 14: Dementia Drugs Market in the United Kingdom (2022-2032)

- Table 15: Dementia Drugs Market in Italy (2022-2032)

- Table 16: Dementia Drugs Market in Spain (2022-2032)

- Table 17: Dementia Drugs Market in the Rest of Europe (2022-2032)

- Table 18: Dementia Drugs Market in Asia-Pacific (2022-2032)

- Table 19: Dementia Drugs Market in China (2022-2032)

- Table 20: Dementia Drugs Market in Japan (2022-2032)

- Table 21: Dementia Drugs Market in India (2022-2032)

- Table 22: Dementia Drugs Market in Australia (2022-2032)

- Table 23: Dementia Drugs Market in South Korea (2022-2032)

- Table 24: Dementia Drugs Market in Rest of Asia-Pacific (2022-2032)

- Table 25: Dementia Drugs Market in the Rest of the World (2022-2032)

- Table 26: Dementia Drugs Market in the Middle East (2022-2032)

- Table 27: Dementia Drugs Market in Africa (2022-2032)

- Table 28: Dementia Drugs Market in South America (2022-2032)

List of Figures

- Figure 1: Competitive Analysis

- Figure 2: Dementia Drugs Market in Global (2022-2032)

- Figure 3: Dementia Drugs Market in Global by Drug Class (2022-2032)

- Figure 4: Dementia Drugs Market in Global by Indication (2022-2032)

- Figure 5: Dementia Drugs Market in Global by Distribution Channel (2022-2032)

- Figure 6: Dementia Drugs Market in Global by Geography (2022-2032)

- Figure 7: Dementia Drugs Market in North America (2022-2032)

- Figure 8: Dementia Drugs Market in the United States (2022-2032)

- Figure 9: Dementia Drugs Market in Canada (2022-2032)

- Figure 10: Dementia Drugs Market in Mexico (2022-2032)

- Figure 11: Dementia Drugs Market in Europe (2022-2032)

- Figure 12: Dementia Drugs Market in France (2022-2032)

- Figure 13: Dementia Drugs Market in Germany (2022-2032)

- Figure 14: Dementia Drugs Market in the United Kingdom (2022-2032)

- Figure 15: Dementia Drugs Market in Italy (2022-2032)

- Figure 16: Dementia Drugs Market in Spain (2022-2032)

- Figure 17: Dementia Drugs Market in the Rest of Europe (2022-2032)

- Figure 18: Dementia Drugs Market in Asia-Pacific (2022-2032)

- Figure 19: Dementia Drugs Market in China (2022-2032)

- Figure 20: Dementia Drugs Market in Japan (2022-2032)

- Figure 21: Dementia Drugs Market in India (2022-2032)

- Figure 22: Dementia Drugs Market in Australia (2022-2032)

- Figure 23: Dementia Drugs Market in South Korea (2022-2032)

- Figure 24: Dementia Drugs Market in Rest of Asia-Pacific (2022-2032)

- Figure 25: Dementia Drugs Market in the Rest of the World (2022-2032)

- Figure 26: Dementia Drugs Market in the Middle East (2022-2032)

- Figure 27: Dementia Drugs Market in Africa (2022-2032)

- Figure 28: Dementia Drugs Market in South America (2022-2032)

- Figure 29: Market Drivers

- Figure 30: Market Barriers

- Figure 31: Market Opportunities

- Figure 32: PORTER'S Five Force Analysis

Dementia Drugs Market by Drug Class (Acetylcholinesterase Inhibitors, Amyloid Beta-directed Monoclonal Antibody, Antipsychotics, and Others), Indication (Alzheimer's disease, Parkinson's Disease Dementia, and Lewy Body Dementia), Distribution Channel (Hospital & Retail Pharmacies and Online Pharmacies), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the increasing prevalence of dementia, increasing advances in R&D and approval of new dementia drugs, rising awareness programs and early diagnosis across the globe.

The dementia drugs market was valued at USD 9,825.24 million in 2024, growing at a CAGR of 6.06% during the forecast period from 2025 to 2032 to reach USD 15,597.17 million by 2032. The global dementia drugs market is growing due to the increasing prevalence of dementia worldwide. Additionally, advances in R&D, coupled with the approval of new drugs, are expanding therapeutic options, enabling more targeted and efficacious treatments that address diverse dementia types and stages. Furthermore, the rising awareness programs and initiatives promoting early diagnosis are encouraging timely intervention, which boosts the market further by increasing the patient base seeking treatment. Together, these factors are creating a favorable environment for the dementia drug market, during the forecast period from 2025 to 2032.

Dementia Drugs Market Dynamics:

According to the World Health Organization (WHO) in 2023, over 55 million people were living with dementia globally, with nearly 10 million new cases diagnosed each year. More than 60% of people with dementia live in low- and middle-income countries, where healthcare infrastructure is often limited. By 2050, Alzheimer's Disease International projects that the global dementia population will reach 139 million, with the most significant increases occurring in low- and middle-income regions. Additionally, a new case of dementia is diagnosed every 3 seconds, indicating an accelerating need for effective treatment options.

As the number of people living with dementia continues to rise, the demand for drugs to manage cognitive decline among patients intensifies. Dementia medications, which focus on reducing cognitive impairment and managing psychological and behavioral symptoms, play a critical role in maintaining the quality of life for patients. The growth in the demand for these medications is expected to drive significant expansion in the dementia drugs market from 2024 to 2030.

Aging is the most significant risk factor for dementia, with the probability of developing dementia doubling approximately every five years after age 65. For instance, the Alzheimer's Society of the UK reports that around 2 in 100 people aged 65 to 69 have dementia, a figure that climbs to 33 in 100 for individuals over the age of 90. Neurodegenerative diseases, such as Alzheimer's and vascular dementia, gradually develop over the years, so the longer a person lives, the higher their risk of cognitive decline and dementia.

In addition to age, genetic factors are critical in influencing dementia risk. Genes associated with dementia are categorized as either familial or risk genes. Familial genes guarantee dementia development if inherited, typically leading to early-onset symptoms in a person's 50s or 60s. Although rare, these genes account for about one-third of frontotemporal dementia cases. Risk genes, however, only increase the likelihood of developing dementia without assuring it. Over 20 risk genes have been identified to date, with most contributing to an elevation in dementia risk. The growing understanding of genetic risk factors is expected to drive the development of personalized treatments and the dementia drug market in the coming years.

Additionally, the recent advances in dementia research and the approval of new dementia drugs are fundamentally reshaping the treatment landscape, marking a shift towards addressing underlying disease mechanisms and significantly boosting the global dementia drug market. Over the past few years, the emergence of innovative therapies like lecanemab and donanemab has been groundbreaking, particularly for Alzheimer's disease, spurring global demand for these treatments. For instance, in January 2023, the FDA granted accelerated approval to Leqembi (lecanemab), a drug targeting amyloid beta plaques, one of the key pathological hallmarks of Alzheimer's. This medication has shown effectiveness in slowing cognitive decline in patients with early-stage Alzheimer's, offering renewed hope for the long-term management of dementia. Thus, the factors mentioned above are expected to boost the overall market of dementia drugs across the globe during the forecast period from 2025 to 2032.

However, high clinical trial failure rates and severe side effects of dementia drugs may hinder the future market of dementia drugs across the globe during the forecasted period.

Dementia Drugs Market Segment Analysis:

Dementia Drugs Market by Drug Class (Acetylcholinesterase Inhibitors, Amyloid Beta-directed Monoclonal Antibody, Antipsychotics, and Others), Indication (Alzheimer's disease, Parkinson's Disease Dementia, and Lewy Body Dementia), Distribution Channel (Hospital & Retail Pharmacies and Online Pharmacies), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

The acetylcholinesterase inhibitors category in the dementia drugs market is estimated to dominate the market with a market share of 75.24% in 2024. This can be attributed to its treatment adherence for multiple forms of dementia, its specificity, and various other advantages that these inhibitors provide, during the forecast period. AChEIs work by inhibiting the action of acetylcholinesterase, resulting in higher acetylcholine concentrations in the synaptic cleft. This method is especially advantageous in dementia, as cholinergic neuron degeneration causes lower acetylcholine levels, which contributes to cognitive loss.

AChEIs have been proven to improve cognitive performance to a minor degree. According to studies, people on AChEIs may exhibit less cognitive decline than those who do not receive these medicines. Further, research has shown that AChEI therapy is associated with decreased all-cause mortality rates in dementia patients. For example, galantamine is known for its potential to lower the chance of acquiring severe dementia. It was related to a considerable reduction in progression to severe dementia stages when compared to non-users. In July 2024, the U.S. FDA approved ALPHA-1062 (Zunveyl(R)), an Acetylcholinesterase (AChE) inhibitor, for treating mild-to-moderate Alzheimer's disease. With further research on AChEIs advancing, the importance of ALPHA-1062 and similar molecules as therapeutic options for dementia becomes increasingly evident.

Thus, the factors mentioned above are expected to boost the segment thereby boosting the overall market of dementia drugs across the globe.

North America is expected to dominate the overall dementia drugs market:

Among all regions, North America is estimated to hold the largest share of 44.45% in the global dementia drugs market in 2024, growing at a CAGR of 6.23% during the forecast period from 2025 to 2032. This can be attributed to the rising prevalence of dementia in the region. Moreover, the rise in the number of drug approvals granted to the key manufacturers as a treatment for dementia in the region, increasing government initiatives and funding to various drug developmental projects associated with dementia, are expected to drive the regional dementia drugs market in the forthcoming years.

According to the data provided by the Alzheimer's Association 2024, it was estimated that nearly 7 million people in the United States are living with Alzheimer's, and by 2050 this number is projected to rise to nearly 13 million by 2050.

Additionally, as per the recent data provided by the Centre for Disease Control and Prevention (2024), in 2021, there were more than 586 traumatic brain injury-related hospitalizations per day in the United States. The increasing prevalence of Alzheimer's disease and cases of traumatic brain injury (TBI), both known to heighten the risk of dementia, contribute to greater demand for dementia drugs. As more individuals are diagnosed due to these factors, the need for medications that manage symptoms and slow cognitive decline rises, boosting the dementia drug market.

Further, various product approvals and product launches in the domain of dementia drugs will also help to boost the growth of the dementia drugs market in the region. For instance, in January 2023, the U.S. Food and Drug Administration approved Leqembi via the accelerated approval pathway for the treatment of Alzheimer's disease.

Thus, the above-mentioned factors are expected to escalate the market of dementia drugs in the region.

Dementia Drugs Market Key Players:

Some of the key market players operating in the dementia drugs market include Eli Lilly and Company, Aurobindo Pharma, Essential Pharma, Biogen, Novartis AG, Zydus Group, Corium, LLC, Apotex Inc., Luye Pharma Group, H. Lundbeck A/S, Sun Pharmaceutical Industries Ltd., Green Valley Inc., Sumitomo Pharma Co., Ltd., and others.

Recent Developmental Activities in the Dementia Drugs Market:

- In July 2024, Eli Lilly's Kisunla (donanemab) was approved for adults in the early stages of Alzheimer's, encompassing those with mild cognitive impairment (MCI) and mild dementia with confirmed amyloid pathology. By targeting amyloid plaques, Kisunla presents a shift towards treatments that address disease progression rather than simply managing symptoms, thus broadening therapeutic options.

- In July 2024, Alpha Cognition's ZUNVEYL(R) (benzgalantamine), formerly known as ALPHA-1062, was approved by the FDA for treating mild to moderate Alzheimer 's-related dementia. This drug is designed to manage cognitive symptoms effectively in adults, providing a new treatment avenue for patients in early disease stages, and contributing to the growing demand for dementia therapeutics.

- In May 2023, the FDA approved Rexulti (brexpiprazole) specifically to manage agitation symptoms associated with Alzheimer 's-related dementia. This approval expanded the treatment options available for managing behavioral symptoms, which forms a critical unmet need for both patients and caregivers.

Key Takeaways From the Dementia Drugs Market Report Study

- Market size analysis for current dementia drugs size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the dementia drugs market.

- Various opportunities available for the other competitors in the dementia drugs market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current dementia drugs market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for dementia drugs market growth in the coming future?

Target Audience Who Can be Benefited From This Dementia Drugs Market Report Study

- Dementia drug product providers

- Research organizations and consulting companies

- Dementia drugs-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in dementia drugs

- Various end-users who want to know more about the dementia drugs market and the latest technological developments in the dementia drugs market.

Frequently Asked Questions for the Dementia Drugs Market:

1. What are dementia drugs?

- Peptide-drug conjugates (PDCs) are an innovative class of targeted therapeutics designed for precise drug delivery, particularly in cancer treatment. They consist of three key components: a peptide, a linker, and a cytotoxic or radioactive drug. The peptide, a short amino acid sequence, selectively binds to specific receptors on target cells, enabling enhanced tissue penetration and targeted delivery.

2. What is the market for dementia drugs?

- The dementia drugs market was valued at USD 9,825.24 million in 2024, growing at a CAGR of 6.06% during the forecast period from 2025 to 2032 to reach USD 15,597.17 million by 2032.

3. What are the drivers for the global dementia drugs market?

- The global dementia drugs market is growing due to the increasing prevalence of dementia worldwide. Additionally, advances in R&D, coupled with the approval of new drugs, are expanding therapeutic options, enabling more targeted and efficacious treatments that address diverse dementia types and stages. Furthermore, the rising awareness programs and initiatives promoting early diagnosis are encouraging timely intervention, which boosts the market further by increasing the patient base seeking treatment. Together, these factors are creating a favorable environment for the dementia drug market, during the forecast period from 2025 to 2032.

4. Who are the key players operating in the global dementia drugs market?

- Some of the key market players operating in dementia drugs are Eli Lilly and Company, Aurobindo Pharma, Essential Pharma, Biogen, Novartis AG, Zydus Group, Corium, LLC, Apotex Inc., Luye Pharma Group, H. Lundbeck A/S, Sun Pharmaceutical Industries Ltd., Green Valley Inc., Sumitomo Pharma Co., Ltd., and others.

5. Which region has the highest share in the global dementia drugs market?

- North America region is anticipated to dominate the overall dementia drugs market due to the rising prevalence of dementia in the region. Moreover, the rise in the number of drug approvals granted to the key manufacturers as a treatment for dementia in the region, increasing government initiatives and funding to various drug developmental projects associated with dementia, are expected to drive the regional dementia drugs market in the forthcoming years.

Table of Contents

1. Dementia Drugs Market Report Introduction

- 1.1. Scope of the Study

- 1.2. Market Segmentation

- 1.3. Market Assumption

2. Dementia Drugs Market Executive Summary

- 2.1. Market at Glance

3. Competitive Landscape

4. Regulatory Analysis

- 4.1. The United States

- 4.2. Europe

- 4.3. Japan

- 4.4. China

5. Dementia Drugs Market Key Factors Analysis

- 5.1. Dementia Drugs Market Drivers

- 5.1.1. Increasing prevalence of dementia

- 5.1.2. Increasing advances in R&D and approval of new dementia drugs

- 5.1.3. Rising awareness programs and early diagnosis

- 5.2. Dementia Drugs Market Restraints and Challenges

- 5.2.1. High clinical trial failure rates

- 5.2.2. Severe side effects of dementia drugs

- 5.3. Dementia Drugs Market Opportunities

- 5.3.1. Increased funding and investment for more extensive research and development activities

6. Dementia Drugs Market Porter's Five Forces Analysis

- 6.1. Bargaining Power of Suppliers

- 6.2. Bargaining Power of Consumers

- 6.3. Threat of New Entrants

- 6.4. Threat of Substitutes

- 6.5. Competitive Rivalry

7. Dementia Drugs Market Assessment

- 7.1. By Drug Class

- 7.1.1. Acetylcholinesterase Inhibitors

- 7.1.2. Amyloid Beta-directed Monoclonal Antibody

- 7.1.3. Antipsychotics

- 7.1.4. Others

- 7.2. By Indication

- 7.2.1. Alzheimer's disease

- 7.2.2. Parkinson's Disease Dementia

- 7.2.3. Lewy Body Dementia

- 7.3. By Distribution Channel

- 7.3.1. Hospital & Retail Pharmacies

- 7.3.2. Online Pharmacies

- 7.4. By Geography

- 7.4.1. North America

- 7.4.1.1. United States Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.1.2. Canada Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.1.3. Mexico Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.2. Europe

- 7.4.2.1. France Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.2.2. Germany Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.2.3. United Kingdom Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.2.4. Italy Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.2.5. Spain Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.2.6. Rest of Europe Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.3. Asia-Pacific

- 7.4.3.1. China Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.3.2. Japan Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.3.3. India Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.3.4. Australia Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.3.5. South Korea Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.3.6. Rest of Asia-Pacific Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.4. Rest of the World (RoW)

- 7.4.4.1. Middle East Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.4.2. Africa Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.4.3. South America Dementia Drugs Market Size in USD Million (2022-2032)

- 7.4.1. North America

8. Dementia Drugs Market Company and Product Profiles

- 8.1. Eli Lilly and Company

- 8.1.1. Company Overview

- 8.1.2. Company Snapshot

- 8.1.3. Financial Overview

- 8.1.4. Product Listing

- 8.1.5. Entropy

- 8.2. Aurobindo Pharma

- 8.2.1. Company Overview

- 8.2.2. Company Snapshot

- 8.2.3. Financial Overview

- 8.2.4. Product Listing

- 8.2.5. Entropy

- 8.3. Essential Pharma

- 8.3.1. Company Overview

- 8.3.2. Company Snapshot

- 8.3.3. Financial Overview

- 8.3.4. Product Listing

- 8.3.5. Entropy

- 8.4. Biogen

- 8.4.1. Company Overview

- 8.4.2. Company Snapshot

- 8.4.3. Financial Overview

- 8.4.4. Product Listing

- 8.4.5. Entropy

- 8.5. Novartis AG

- 8.5.1. Company Overview

- 8.5.2. Company Snapshot

- 8.5.3. Financial Overview

- 8.5.4. Product Listing

- 8.5.5. Entropy

- 8.6. Zydus Group

- 8.6.1. Company Overview

- 8.6.2. Company Snapshot

- 8.6.3. Financial Overview

- 8.6.4. Product Listing

- 8.6.5. Entropy

- 8.7. Corium, LLC

- 8.7.1. Company Overview

- 8.7.2. Company Snapshot

- 8.7.3. Financial Overview

- 8.7.4. Product Listing

- 8.7.5. Entropy

- 8.8. Apotex Inc.

- 8.8.1. Company Overview

- 8.8.2. Company Snapshot

- 8.8.3. Financial Overview

- 8.8.4. Product Listing

- 8.8.5. Entropy

- 8.9. Luye Pharma Group

- 8.9.1. Company Overview

- 8.9.2. Company Snapshot

- 8.9.3. Financial Overview

- 8.9.4. Product Listing

- 8.9.5. Entropy

- 8.10. H. Lundbeck A/S

- 8.10.1. Company Overview

- 8.10.2. Company Snapshot

- 8.10.3. Financial Overview

- 8.10.4. Product Listing

- 8.10.5. Entropy

- 8.11. Sun Pharmaceutical Industries Ltd.

- 8.11.1. Company Overview

- 8.11.2. Company Snapshot

- 8.11.3. Financial Overview

- 8.11.4. Product Listing

- 8.11.5. Entropy

- 8.12. Green Valley Inc.

- 8.12.1. Company Overview

- 8.12.2. Company Snapshot

- 8.12.3. Financial Overview

- 8.12.4. Product Listing

- 8.12.5. Entropy

- 8.13. Sumitomo Pharma Co., Ltd.

- 8.13.1. Company Overview

- 8.13.2. Company Snapshot

- 8.13.3. Financial Overview

- 8.13.4. Product Listing

- 8.13.5. Entropy