|

|

市場調査レポート

商品コード

1439608

血管内超音波(IVUS)- 世界市場の考察、競合情勢、市場予測(2030年)Intravascular Ultrasound (IVUS) - Market Insights, Competitive Landscape, and Market Forecast - 2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 血管内超音波(IVUS)- 世界市場の考察、競合情勢、市場予測(2030年) |

|

出版日: 2024年02月01日

発行: DelveInsight

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

世界の血管内超音波(IVUS)の市場規模は、2023年に7億1,485万米ドル、2030年までに10億6,526万米ドルに達し、2024年~2030年の予測期間にCAGRで7.10%の成長が見込まれます。血管内超音波(IVUS)の需要は主に、心血管疾患(CVDs)と肥満、糖尿病、高血圧などの危険因子の有病率の上昇や、技術の進歩と製品の発売の増加によって後押しされており、これらが2024年~2030年の予測期間に市場成長にプラスの影響を与える見込みです。

血管内超音波(IVUS)の市場力学

血管内超音波(IVUS)市場は、冠動脈性心疾患、末梢動脈疾患、脳血管疾患などの心血管疾患の有病率の上昇に起因する製品需要の伸びを示しており、血管内超音波(IVUS)市場の主な市場促進要因となっています。

American Heart Association(2022)によると、2020年に世界で約2億4,410万人が冠動脈(虚血)性心疾患を患っています。同じ資料によると、北アフリカ、中東、中央アジア、南アジア、東欧は2020年の冠動脈(虚血)性心疾患の有病率が世界でもっとも高かったです。

British Heart Foundation(2022)のデータによると、2019年に全世界で約5億5,000万人(14人に1人)が心臓および循環器の疾患を患っており、この中には約2億9,000万人の女性と約2億6,000万人の男性が含まれています。

肥満、高血圧、糖尿病、喫煙、高齢、飲酒、不健康なライフスタイル、アテローム性動脈硬化症などの危険因子の増加が心血管疾患の発症の主な理由であり、血管内超音波(IVUS)市場の成長をさらに促進しています。

WHO(2023)のデータによると、2020年に全世界で約10億人が60歳以上でした。60歳以上の老年人口は2050年までに倍増し、約21億人に達すると予測されています。また、80歳以上の高齢者は2020年~2050年に3倍に増え、4億2,600万人に達すると推定されています。

さらに、国際糖尿病連合(2022)が発表したデータによると、2022年に20歳~79歳の成人の約5億3,700万人が糖尿病に罹患しています。World Obesity Federationが提供した最新のデータによると、肥満は2020年に世界で約7億7,000万人に影響を及ぼし、この数は2030年までに10億人を超えると予測されています。

このように、上記の心血管疾患とそれに関連する危険因子の増加により、CVDの有病率は増加し、2024年~2030年の調査期間に血管内超音波(IVUS)市場の成長を促進する見込みです。

さらに、IVUSの新製品の上市に向けた承認などの製品開発活動が、世界の血管内超音波(IVUS)市場の成長をさらに後押しすると予測されています。2020年2月、Conavi Medical Inc.とJapan Lifelineは、Novasight Hybrid血管内イメージングシステムについて、日本の厚生労働省から規制当局の承認を取得したと発表しました。

しかし、光コヒーレンストモグラフィ(OCT)や血管造影などの代替技術の存在や、複数の製品リコールが血管内超音波(IVUS)装置市場の成長を抑制する可能性があります。

COVID-19パンデミックは血管内超音波(IVUS)市場の成長に若干のマイナスの影響を及ぼし、最初の数ヶ月間は、ロックダウン指令と国境閉鎖のために、IVUS市場の製造、供給、輸出入、その他の関連活動が妨げられました。

COVID-19以外の心血管疾患を含む健康問題の診断や治療も世界中で中断されました。

病院、診療所などの医療施設はCOVID-19患者の管理と治療に過重な負担を強いられました。このため、主なIVUSベースの診断サービスが停止し、血管内超音波(IVUS)市場の成長に悪影響を及ぼしました。重症のCOVID-19患者では、心血管系に影響を及ぼす追加の肺の症状が見られましたが、IVUSよりもX線やCTなど、入手が容易でアクセスしやすいその他のイメージングモダリティの使用が目立っていました。しかし、ワクチンの導入や大衆へのCOVID-19ワクチンの接種、医療部門を含む産業活動の再開により、血管内超音波(IVUS)市場は今後数年で回復し、IVUS市場の予測は明るいものとなる見込みです。

当レポートでは、世界の血管内超音波(IVUS)市場について調査分析し、市場規模と予測、促進要因と課題、企業と製品のプロファイルなどを提供しています。

目次

第1章 血管内超音波(IVUS)市場レポートのイントロダクション

第2章 血管内超音波(IVUS)市場のエグゼクティブサマリー

- 調査範囲

- 市場の概要

- 競合の評価

第3章 規制分析

- 米国

- 欧州

- 日本

- 中国

第4章 血管内超音波(IVUS)市場の主な要因の分析

- 血管内超音波(IVUS)市場の促進要因

- さまざまな危険因子の結果として心血管疾患(CVD)の罹患率が上昇

- 近年の技術の進歩によるIVUSの良好な採用

- PCI処置の結果としてのIVUSの使用の普及

- 血管内超音波(IVUS)市場の抑制要因と課題

- 光コヒーレンストモグラフィ(OCT)や血管造影などの代替手段の存在

- 市場成長を妨げている複数の製品リコール

- 血管内超音波(IVUS)市場の機会

- 血管内超音波へのAIの進歩の組み込み

- 主要企業による買収、提携、研究開発などの戦略的活動の急増

第5章 血管内超音波(IVUS)市場のポーターのファイブフォース分析

第6章 血管内超音波(IVUS)市場に対するCOVID-19の影響分析

第7章 血管内超音波(IVUS)市場レイアウト

- タイプ別

- IVUSコンソール

- IVUSカテーテル

- 用途別

- 冠動脈インターベンション

- 末梢血管インターベンション

- エンドユーザー別

- 病院、診療所

- 画像診断センター

- その他

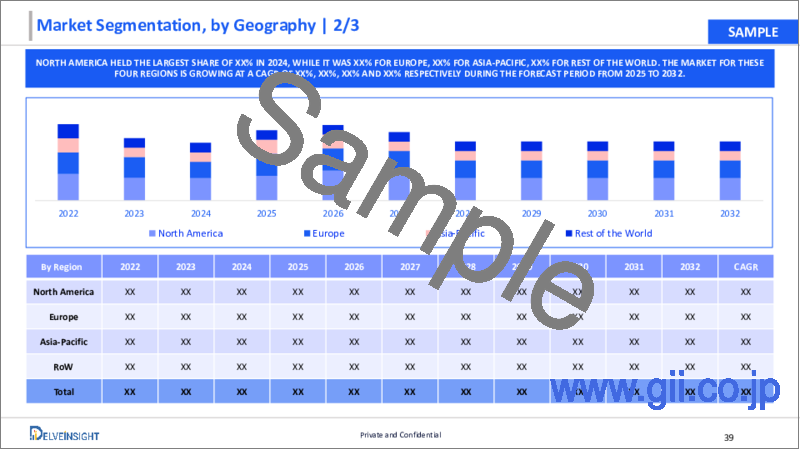

- 地域別

- 北米の血管内超音波(IVUS)の市場規模(2021年~2030年)

- 欧州の血管内超音波(IVUS)の市場規模(2021年~2030年)

- アジア太平洋の血管内超音波(IVUS)の市場規模(2021年~2030年)

- その他の地域の血管内超音波(IVUS)の市場規模(2021年~2030年)

第8章 血管内超音波(IVUS)市場の企業と製品のプロファイル

- Koninklijke Philips N.V

- Boston Scientific Corporation

- Terumo Corporation

- Nipro

- Conavi Medical

- Bracco

- Intravascular Imaging Incorporated (i3)

- Insight Lifetech Co., Ltd.

- Shanghai Pulse Medical Technology Inc.

第9章 KOLの見解

第10章 プロジェクトのアプローチ

第11章 DelveInsightについて

第12章 免責事項とお問い合わせ

List of Tables

- Table 1: Competitive Analysis

- Table 2: COVID-19 Impact Analysis

- Table 3: Intravascular Ultrasound (IVUS) Market in Global (2021-2030)

- Table 4: Intravascular Ultrasound (IVUS) Market in Global by Type (2021-2030)

- Table 5: Intravascular Ultrasound (IVUS) Market in Global by Application (2021-2030)

- Table 6: Intravascular Ultrasound (IVUS) Market in Global by End-User (2021-2030)

- Table 7: Intravascular Ultrasound (IVUS) Market in Global by Geography (2021-2030)

- Table 8: Intravascular Ultrasound (IVUS) Market in North America (2021-2030)

- Table 9: Intravascular Ultrasound (IVUS) Market in North America by Country (2021-2030)

- Table 10: Intravascular Ultrasound (IVUS) Market in the US (2021-2030)

- Table 11: Intravascular Ultrasound (IVUS) Market in Canada (2021-2030)

- Table 12: Intravascular Ultrasound (IVUS) Market in Mexico (2021-2030)

- Table 13: Intravascular Ultrasound (IVUS) Market in Europe (2021-2030)

- Table 14: Intravascular Ultrasound (IVUS) Market in Europe by Country (2021-2030)

- Table 15: Intravascular Ultrasound (IVUS) Market in France (2021-2030)

- Table 16: Intravascular Ultrasound (IVUS) Market in Germany (2021-2030)

- Table 17: Intravascular Ultrasound (IVUS) Market in the United Kingdom (2021-2030)

- Table 18: Intravascular Ultrasound (IVUS) Market in Italy (2021-2030)

- Table 19: Intravascular Ultrasound (IVUS) Market in Spain (2021-2030)

- Table 20: Intravascular Ultrasound (IVUS) Market in the Rest of Europe (2021-2030)

- Table 21: Intravascular Ultrasound (IVUS) Market in Asia-Pacific (2021-2030)

- Table 22: Intravascular Ultrasound (IVUS) Market in Asia-Pacific by Country (2021-2030)

- Table 23: Intravascular Ultrasound (IVUS) Market in China (2021-2030)

- Table 24: Intravascular Ultrasound (IVUS) Market in Japan (2021-2030)

- Table 25: Intravascular Ultrasound (IVUS) Market in India (2021-2030)

- Table 26: Intravascular Ultrasound (IVUS) Market in Australia (2021-2030)

- Table 27: Intravascular Ultrasound (IVUS) Market in South Korea (2021-2030)

- Table 28: Intravascular Ultrasound (IVUS) Market in Rest of Asia-Pacific (2021-2030)

- Table 29: Intravascular Ultrasound (IVUS) Market in the Rest of the World (2021-2030)

List of Figures

- Figure 1: Competitive Analysis

- Figure 2: COVID-19 Impact Analysis

- Figure 3: Intravascular Ultrasound (IVUS) Market in Global (2021-2030)

- Figure 4: Intravascular Ultrasound (IVUS) Market in Global by Type (2021-2030)

- Figure 5: Intravascular Ultrasound (IVUS) Market in Global by Application (2021-2030)

- Figure 6: Intravascular Ultrasound (IVUS) Market in Global by End-User (2021-2030)

- Figure 7: Intravascular Ultrasound (IVUS) Market in Global by Geography (2021-2030)

- Figure 8: Intravascular Ultrasound (IVUS) Market in North America (2021-2030)

- Figure 9: Intravascular Ultrasound (IVUS) Market in North America by Country (2021-2030)

- Figure 10: Intravascular Ultrasound (IVUS) Market in the US (2021-2030)

- Figure 11: Intravascular Ultrasound (IVUS) Market in Canada (2021-2030)

- Figure 12: Intravascular Ultrasound (IVUS) Market in Mexico (2021-2030)

- Figure 13: Intravascular Ultrasound (IVUS) Market in Europe (2021-2030)

- Figure 14: Intravascular Ultrasound (IVUS) Market in Europe by Country (2021-2030)

- Figure 15: Intravascular Ultrasound (IVUS) Market in France (2021-2030)

- Figure 16: Intravascular Ultrasound (IVUS) Market in Germany (2021-2030)

- Figure 17: Intravascular Ultrasound (IVUS) Market in the United Kingdom (2021-2030)

- Figure 18: Intravascular Ultrasound (IVUS) Market in Italy (2021-2030)

- Figure 19: Intravascular Ultrasound (IVUS) Market in Spain (2021-2030)

- Figure 20: Intravascular Ultrasound (IVUS) Market in the Rest of Europe (2021-2030)

- Figure 21: Intravascular Ultrasound (IVUS) Market in Asia-Pacific (2021-2030)

- Figure 22: Intravascular Ultrasound (IVUS) Market in Asia-Pacific by Country (2021-2030)

- Figure 23: Intravascular Ultrasound (IVUS) Market in China (2021-2030)

- Figure 24: Intravascular Ultrasound (IVUS) Market in Japan (2021-2030)

- Figure 25: Intravascular Ultrasound (IVUS) Market in India (2021-2030)

- Figure 26: Intravascular Ultrasound (IVUS) Market in Australia (2021-2030)

- Figure 27: Intravascular Ultrasound (IVUS) Market in South Korea (2021-2030)

- Figure 28: Intravascular Ultrasound (IVUS) Market in Rest of Asia-Pacific (2021-2030)

- Figure 29: Intravascular Ultrasound (IVUS) Market in the Rest of the World (2021-2030)

- Figure 30: Market Drivers

- Figure 31: Market Barriers

- Figure 32: Marker Opportunities

- Figure 33: PORTER'S Five Force Analysis

Intravascular Ultrasound (IVUS) Market By Type (IVUS Consoles And IVUS Catheters), By Application (Coronary And Peripheral Interventions), By End-User (Hospitals And Clinics, Diagnostic Imaging Centers, And Others), and by geography is expected to grow at a steady CAGR forecast till 2030 owing to the rising prevalence of cardiovascular diseases and its associated risk factors such as obesity, diabetes, high blood pressure, among others

Global Intravascular Ultrasound (IVUS) Market was valued at USD 714.85 million in 2023, growing at a CAGR of 7.10% during the forecast period from 2024 to 2030 to reach USD 1,065.26 million by 2030. The demand for Intravascular Ultrasound (IVUS) is primarily being boosted due to the rising prevalence of cardiovascular diseases (CVDs) and its risk factors such as obesity, diabetes, and high blood pressure, increasing technological advancements coupled with increasing product launches, that are expected to create a positive impact on the market growth during the forecast period from 2024-2030.

Intravascular Ultrasound (IVUS) Market Dynamics:

The Intravascular Ultrasound (IVUS) market is witnessing a growth in product demand owing to the rising prevalence of cardiovascular diseases including coronary heart disease, peripheral arterial disease, and cerebrovascular disease, among others, becoming a major market driver for the intravascular ultrasound (IVUS) market.

According to the American Heart Association 2022, globally, about 244.1 million people were living with coronary (ischemic) heart disease in 2020. As per the same source, North Africa, the Middle East, Central and South Asia, and Eastern Europe had the highest prevalence rates of coronary (ischemic) heart disease in the world in 2020.

As per the data provided by British Heart Foundation 2022, worldwide around 550 million which stands for 1 in 14 people were living with heart and circulatory diseases in 2019 and this includes about 290 million women and around 260 million men.

The increasing number of risk factors such as obesity, hypertension, diabetes, smoking, old age, alcohol consumption, unhealthy lifestyle, atherosclerosis, and others is the main reason for the development of cardiovascular diseases further driving the market growth for intravascular ultrasound (IVUS).

According to the data provided by the WHO (2023), in 2020, about one billion people across the world were over the age of 60. The elderly population aged 60 and above is expected to double in number representing about 2.1 billion people by 2050. Also, people in the age group of 80 and above are estimated to triple between 2020 and 2050 to reach 426 million.

Furthermore, the data published by International Diabetes Federation 2022 stated that around 537 million adults aged between 20 and 79 years were suffering from diabetes in 2022. As per the latest data provided by World Obesity Federation, obesity affected about 770 million people globally in 2020 and this number is expected to exceed one billion by 2030.

Thus, owing to the increased cases of cardiovascular diseases and their associated risk factors mentioned above, the prevalence of CVD will increase, which will drive the intravascular ultrasound (IVUS) market growth during the study period from 2024-2030.

Moreover, product development activities such as approvals for new IVUS launched products are further expected to aid in the growth of the global Intravascular Ultrasound (IVUS) market. In February 2020, Conavi Medical Inc. and Japan Lifeline announced that they received regulatory approval from the Ministry of Health, Labor and Welfare (MHLW) in Japan for the Novasight Hybrid intravascular imaging system.

However, the presence of alternatives such as optical coherence tomography (OCT) and angiography, along with multiple product recalls may restrict the intravascular ultrasound (IVUS) devices market growth.

The COVID-19 pandemic had a slightly negative impact on the market growth of intravascular ultrasound (IVUS) as during the initial few months owing to the lockdown impositions, border closures, the manufacturing, supply, import, export, and other related activities of the IVUS market was hampered.

The diagnosis as well as treatment for health problems including cardiovascular diseases, other than COVID-19 was also suspended around the globe.

The hospitals, clinics, and other medical facilities were overburdened with managing and treating patients affected with COVID-19. This caused a halt on major IVUS based diagnostic services, thereby negatively affecting the intravascular ultrasound (IVUS) market growth. Though, in severe COVID cases extra pulmonary manifestations affecting cardiovascular system were observed, but the use of other easily available and accessible imaging modalities such as X-ray and CT were more prominent than IVUS. However, with the introduction of vaccines and masses being vaccinated against COVID- 19 and owing to the resumption of activities in industries including the healthcare sector, the market for intravascular ultrasound (IVUS) is set to recover in the upcoming years displaying a positive forecast for the IVUS market.

Intravascular Ultrasound (IVUS) Market Segment Analysis:

Intravascular Ultrasound (IVUS) Market by Type (IVUS Consoles and IVUS Catheters), Application (Coronary and Peripheral Interventions), End-User (Hospitals and Clinics, Diagnostic Imaging Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the type segment, IVUS catheters segment is expected to have a revenue share of 66.65% in the year 2023. This can be ascribed to the applications of IVUS catheters in interventional cardiology and the recent product launches in the IVUS catheters sector.

IVUS catheters are composed of miniaturized transducer that via the use of sound waves helps in obtaining the images of coronary and peripheral arteries and then transmits the image to a dedicated console for image analysis.

These IVUS catheters can be either solid state (phased electronic array) or rotational (mechanical). Solid state IVUS catheters offer advantage for a broad depth of field and are suitable for analysis of larger vessels such as for peripheral interventions. These solid state multiple element catheters are composed mainly of mobile parts, are easy to set up and use. For example, Eagle eye(TM) by Koninklijke Philips N.V., is a solid state catheter with 64 separate transducer elements.

In addition, recent product launches in this sector are also expected to drive the demand for IVUS catheters in the upcoming years. In July 2022, I3 launched its proprietary 3-French NIRF-IVUS Catheter designed in collaboration with Massachusetts General Hospital; combining intravascular ultrasound, the dominant imaging approach used for coronary stent optimization during percutaneous coronary intervention (PCI), with near-infrared fluorescence imaging.

Therefore, the various advantages offered by IVUS catheters along with product launches, are predicted to contribute to increase in the overall demand for this product type, thereby driving the growth of the overall intravascular ultrasound (IVUS) market during the forecast period.

North America is expected to dominate the overall Intravascular Ultrasound (IVUS) Market:

Among all the regions, North America is expected to hold the largest share of 44.65% in the Intravascular Ultrasound (IVUS) market in 2022. This can be ascribed to the increasing prevalence of various cardiovascular diseases such as peripheral artery disease (PAD), coronary artery disease (CAD), arteriosclerosis, blood clots, among others across the region. The rising research and development activities in the region associated with the launch of new intravascular ultrasound devices, and the strategic business activities by the key players to expand their product portfolio, and others are also driving the market growth in North America.

For instance, the American Heart Association in 2022 projected that by 2035, more than 130 million US adults will have some type of heart disease. PAD which is one of the most prevalent in the US affected around 8.5 million U.S. adults over the age of 40, in 2022. As per the same source, African Americans are twice more likely to screen positive for PAD than non-Hispanic adults.

According to the latest study conducted by Centre of Disease Control and Prevention (CDC), one person dies every 34 seconds in the United States from cardiovascular disease. Also, as per the same source, about 697,000 people in the United States died from heart disease in 2020, in the United States and about 20.1 million adults aged 20 and above had coronary artery disease (CAD).

Along with this, in December 2022, Royal Philips announced that it signed an agreement to acquire Vesper Medical Inc., a developer of minimally invasive peripheral vascular devices based in the United States. Philips stated that the acquisition complements its intravascular ultrasound (IVUS) products for venous imaging.

Thus, the increasing prevalence of various cardiovascular diseases and developmental activities such as merger acquisitions by key players in the IVUS segment will increase the demand for intravascular ultrasound in the North American region, during the forecast period from 2024-2030.

Intravascular Ultrasound (IVUS) Market Key Players:

Some of the key market players operating in the Intravascular Ultrasound (IVUS) market include Koninklijke Philips N.V., Boston Scientific Corporation, Terumo Corporation, Nipro, Conavi Medical, Bracco, Intravascular Imaging Incorporated (i3), Insight Lifetech Co., Ltd., Shanghai Pulse Medical Technology Inc., and others.

Recent Developmental Activities in the Intravascular Ultrasound (IVUS) Market:

In September 2022, Insight Lifetech was granted NMPA (National Medical Products Administration) approval for its first self-designed and developed IVUS (Intravascular Ultrasound) systems- VivoHeart IVUS console and TrueVision IVUS Imaging Catheter.

In December 2022, Conavi Medical Inc., entered into agreements for over $20 million in funding to support commercialization and growth of its innovative Novasight Hybrid® System for market. The company aimed to raise an additional $10 million as part of an ongoing financing effort.

In April 2022, Nipro Medical Corporation (NMC), announced the creation of a Vascular Division in the U.S. The division included several cutting-edge technologies, innovative vascular and cardiovascular products to provide clinicians with procedural and imaging solutions that enhance patient care. The division will include intravascular imaging technologies, vascular therapies, and breakthrough technologies.

Key Takeaways from the Intravascular Ultrasound (IVUS) Market Report Study

Market size analysis for current Intravascular Ultrasound (IVUS) market size (2023), and market forecast for 5 years (2024-2030)

The effect of the COVID-19 pandemic on this market is significant. To capture and analyze suitable indicators, our experts are closely watching the Intravascular Ultrasound (IVUS) market.

Top key product/services/technology developments, mergers, acquisitions, partnerships, and joint ventures happened for the last 3 years

Key companies dominating the Global Intravascular Ultrasound (IVUS) Market.

Various opportunities available for the other competitor in the Intravascular Ultrasound (IVUS) Market space.

What are the top-performing segments in 2023? How these segments will perform in 2030.

Which are the top-performing regions and countries in the current Intravascular Ultrasound (IVUS) market scenario?

Which are the regions and countries where companies should have concentrated on opportunities for Intravascular Ultrasound (IVUS) market growth in the coming future?

Target Audience who can be benefited from this Intravascular Ultrasound (IVUS) Market Report Study

Intravascular Ultrasound (IVUS) products providers

Research organizations and consulting companies

Intravascular Ultrasound (IVUS)-related organizations, associations, forums, and other alliances

Government and corporate offices

Start-up companies, venture capitalists, and private equity firms

Distributors and Traders dealing in Intravascular Ultrasound (IVUS)

Various End-users who want to know more about the Intravascular Ultrasound (IVUS) market and the latest technological developments in the Intravascular Ultrasound (IVUS) market.

Frequently Asked Questions For The Intravascular Ultrasound (IVUS) Market:

1. What is Intravascular Ultrasound?

Intravascular ultrasound (IVUS), is a catheter-based invasive imaging modality that has applications in interventional cardiology for the characterization of lesion morphology, quantification of plaque burden, stent size guidance, assessment of stent expansion, and in the identification of procedural complications.

2. What is the market for Global Intravascular Ultrasound (IVUS)?

The global Intravascular Ultrasound (IVUS) Market was valued at USD 714.85 million in 2023, growing at a CAGR of 7.10% during the forecast period from 2024 to 2030 to reach USD 1,065.26 million by 2030.

3. What are the drivers for Global Intravascular Ultrasound (IVUS) Market?

The demand for Intravascular Ultrasound (IVUS) is expected to increase substantially due to the rising prevalence of cardiovascular diseases (CVDs) and its risk factors such as obesity, diabetes, and high blood pressure, increasing technological advancements coupled with increasing product launches that are expected to create a positive impact on the market growth during the forecast period 2024-2030.

4. Who are the key players operating in Global Intravascular Ultrasound (IVUS) Market?

Some of the key market players operating in the Intravascular Ultrasound (IVUS) market include Koninklijke Philips N.V., Boston Scientific Corporation, Terumo Corporation, Nipro, Conavi Medical, Bracco, Intravascular Imaging Incorporated (i3), Insight Lifetech Co., Ltd., Shanghai Pulse Medical Technology Inc., and others.

5. Which region has the highest share in the Intravascular Ultrasound (IVUS) market?

North America is expected to dominate the overall Intravascular Ultrasound (IVUS) market during the forecast period from 2024-2030. This can be ascribed to the increasing prevalence of various cardiovascular diseases such as peripheral artery disease (PAD), coronary artery disease (CAD), arteriosclerosis, blood clots, among others across the region. The rising research and development activities in the region associated with the launch of new intravascular ultrasound devices, and the strategic business activities by the key players to expand their product portfolio, and others are also driving the market growth in North America.

Table of Contents

1.Intravascular Ultrasound (IVUS) Market Report Introduction

2. Intravascular Ultrasound (IVUS) Market Executive Summary

- 2.1. Scope of the Study

- 2.2. Market at Glance

- 2.3. Competitive Assessment

3. Regulatory Analysis

- 3.1. The United States

- 3.2. Europe

- 3.3. Japan

- 3.4. China

4. Intravascular Ultrasound (IVUS) Market Key Factors Analysis

- 4.1. Intravascular Ultrasound (IVUS) Market Drivers

- 4.1.1. Rising incidence of cardiovascular diseases (CVDs) as a result of various risk factors

- 4.1.2. Better adoption of IVUS owing to recent technological advancements

- 4.1.3. More prevalent use of IVUS as a result of PCI procedures

- 4.2. Intravascular Ultrasound (IVUS) Market Restraints and Challenges

- 4.2.1. Presence of alternatives such as Optical coherence tomography (OCT) and angiography

- 4.2.2. Multiple product recalls hampering market growth

- 4.3. Intravascular Ultrasound (IVUS) Market Opportunities

- 4.3.1. Incorporation of technological AI advances for Intravascular Ultrasound

- 4.3.2. Surging strategic activities such as acquisitions, partnerships, R&D, and others by key players

5. Intravascular Ultrasound (IVUS) Market Porter's Five Forces Analysis

- 5.1. Bargaining Power of Suppliers

- 5.2. Bargaining Power of Consumers

- 5.3. Threat of New Entrants

- 5.4. Threat of Substitutes

- 5.5. Competitive Rivalry

6. COVID-19 Impact Analysis on Intravascular Ultrasound (IVUS) Market

7. Intravascular Ultrasound (IVUS) Market Layout

- 7.1. By Type

- 7.1.1. IVUS Consoles

- 7.1.2. IVUS Catheters

- 7.2. By Application

- 7.2.1. Coronary Interventions

- 7.2.2. Peripheral Interventions

- 7.3. By End-User

- 7.3.1. Hospitals and Clinics

- 7.3.2. Diagnostic Imaging Centers

- 7.3.3. Others

- 7.4. By Geography

- 7.4.1. North America Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.1.1. United States Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.1.2. Canada Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.1.3. Mexico Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.2. Europe Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.2.1. France Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.2.2. Germany Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.2.3. United Kingdom Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.2.4. Italy Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.2.5. Spain Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.2.6. Rest of Europe Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.3. Asia-Pacific Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.3.1. China Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.3.2. Japan Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.3.3. India Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.3.4. Australia Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.3.5. South Korea Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.3.6. Rest of Asia-Pacific Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.4. Rest of the World (RoW) Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

- 7.4.1. North America Intravascular Ultrasound (IVUS) Market Size in USD million (2021-2030)

8. Intravascular Ultrasound (IVUS) Market Company and Product Profiles

- 8.1. Koninklijke Philips N.V

- 8.1.1. Company Overview

- 8.1.2. Company Snapshot

- 8.1.3. Financial Overview

- 8.1.4. Product Listing

- 8.1.5. Entropy

- 8.2. Boston Scientific Corporation

- 8.2.1. Company Overview

- 8.2.2. Company Snapshot

- 8.2.3. Financial Overview

- 8.2.4. Product Listing

- 8.2.5. Entropy

- 8.3. Terumo Corporation

- 8.3.1. Company Overview

- 8.3.2. Company Snapshot

- 8.3.3. Financial Overview

- 8.3.4. Product Listing

- 8.3.5. Entropy

- 8.4. Nipro

- 8.4.1. Company Overview

- 8.4.2. Company Snapshot

- 8.4.3. Financial Overview

- 8.4.4. Product Listing

- 8.4.5. Entropy

- 8.5. Conavi Medical

- 8.5.1. Company Overview

- 8.5.2. Company Snapshot

- 8.5.3. Financial Overview

- 8.5.4. Product Listing

- 8.5.5. Entropy

- 8.6. Bracco

- 8.6.1. Company Overview

- 8.6.2. Company Snapshot

- 8.6.3. Financial Overview

- 8.6.4. Product Listing

- 8.6.5. Entropy

- 8.7. Intravascular Imaging Incorporated (i3)

- 8.7.1. Company Overview

- 8.7.2. Company Snapshot

- 8.7.3. Financial Overview

- 8.7.4. Product Listing

- 8.7.5. Entropy

- 8.8. Insight Lifetech Co., Ltd.

- 8.8.1. Company Overview

- 8.8.2. Company Snapshot

- 8.8.3. Financial Overview

- 8.8.4. Product Listing

- 8.8.5. Entropy

- 8.9. Shanghai Pulse Medical Technology Inc.

- 8.9.1. Company Overview

- 8.9.2. Company Snapshot

- 8.9.3. Financial Overview

- 8.9.4. Product Listing

- 8.9.5. Entropy