|

|

市場調査レポート

商品コード

1439535

外科用シーラントおよび接着剤の世界市場:洞察、競合情勢、市場予測:2030年Surgical Sealant and Adhesives - Market Insights, Competitive Landscape, and Market Forecast - 2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 外科用シーラントおよび接着剤の世界市場:洞察、競合情勢、市場予測:2030年 |

|

出版日: 2024年02月01日

発行: DelveInsight

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

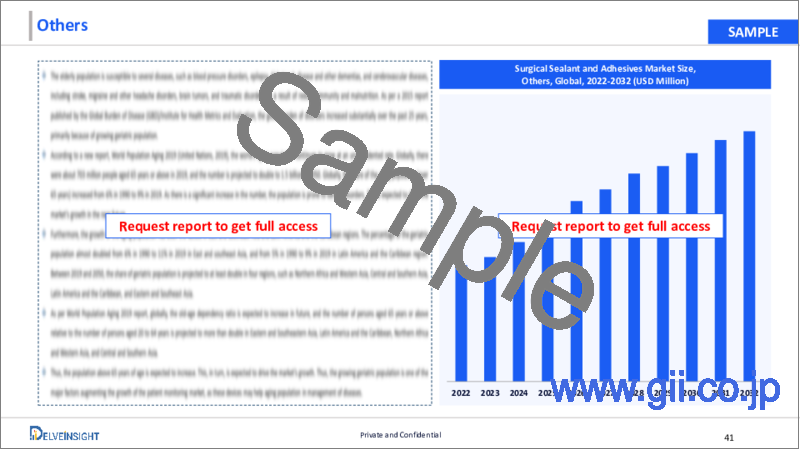

世界の外科用シーラントおよび接着剤の市場規模は、2023年に21億8,000万米ドルとなりました。同市場は、2024年から2030年までの予測期間中に7.58%のCAGRで拡大し、2030年には33億9,000万米ドルに達すると予測されています。外科用シーラントおよび接着剤市場は、心臓血管の問題、腎臓の問題、神経の問題などの慢性的な健康問題の有病率の上昇により、拡大するとみられています。緊急手術を必要とする交通事故の増加も、外科用シーラントおよび接着剤市場の成長要因です。美容外科手術の継続的な増加や、外科用シーラントおよび接着剤の安全性、手頃な価格、使いやすさの改善への注目の高まりは、予測期間における外科用シーラントおよび接着剤市場の収益成長につながると期待されています。

外科用シーラントおよび接着剤市場の注目すべき促進要因には、慢性的な健康問題の有病率の上昇、交通事故の増加、美容外科手術のブーム、年齢の増加、従来の方法の限界などがあります。

心臓移植、バイパス手術、心臓弁修復などの手術を必要とする心血管系疾患の有病率の上昇は、市場成長の重要な促進要因です。例えば、世界保健機関(WHO)の2022年によると、2019年には世界で約1,790万人が心血管疾患で死亡しています。これは、死亡率を低下させることができるように、シーラントおよび接着剤が広く使用されている心臓血管手術の必要性が高まっていることを示しており、したがって、外科用シーラントおよび接着剤市場にプラスの影響を与えています。がんは、腫瘍を除去するために手術が行われることが多いため、市場成長のもう一つの主要因となっています。世界保健機関(WHO)の2020年版によると、2020年には約19,292,789件のがん患者が報告され、乳がんは世界全体の11.7%を占めています。

当レポートでは、世界の外科用シーラントおよび接着剤市場について調査し、市場の概要とともに、製品タイプ別、用途別、部位別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 外科用シーラントおよび接着剤市場レポートのイントロダクション

第2章 外科用シーラントおよび接着剤市場のエグゼクティブサマリー

第3章 規制分析

- 米国

- 欧州

- 日本

- 中国

第4章 外科用シーラントおよび接着剤市場の主な要因分析

- 外科用シーラントおよび接着剤市場の促進要因

- 外科用シーラントおよび接着剤市場の抑制要因と課題

- 外科用シーラントおよび接着剤市場の機会

第5章 外科用シーラントおよび接着剤市場におけるポーターのファイブフォース分析

第6章 外科用シーラントおよび接着剤市場に対するCOVID-19の影響分析

第7章 外科用シーラントおよび接着剤の市場概要

- 製品タイプ別

- 用途別

- 部位別

- エンドユーザー別

- 地域別

第8章 外科用シーラントおよび接着剤市場の世界企業シェア分析-主要3~5社

第9章 外科用シーラントおよび接着剤市場の企業および製品プロファイル

- Baxter

- BD

- CryoLife, Inc.

- Integra LifeSciences

- Ocular Therapeutix, Inc.

- Vivostat A/S

- Advanced Medical Solutions Israel (Sealantis) Ltd

- CSL

- B. Braun Melsungen AG

- Gem srl

- Adhezion Biomedical, LLC

- Terumo Europe NV

- TISSIUM

- Grunenthal

- Advamedica Inc.

- Polyganics

- SkinStitch, LLC

- Cardinal Health

- Cohera Medical

- Connexicon medical

第10章 KOL の見解

第11章 プロジェクトのアプローチ

第12章 DelveInsightについて

第13章 免責事項とお問い合わせ

List of Tables

- Table 1: Competitive Analysis

- Table 2: COVID-19 Impact Analysis on Surgical Sealant and Adhesives Market

- Table 3: Surgical Sealant And Adhesives Market in Global (2021-2030)

- Table 4: Surgical Sealant And Adhesives Market in Global by Product Type (2021-2030)

- Table 5: Surgical Sealant And Adhesives Market in Global by Application (2021-2030)

- Table 6: Surgical Sealant And Adhesives Market in Global by Site (2021-2030)

- Table 7: Surgical Sealant And Adhesives Market in Global by End User (2021-2030)

- Table 8: Surgical Sealant And Adhesives Market in Global by Geography (2021-2030)

- Table 9: Surgical Sealant And Adhesives Market in North America (2021-2030)

- Table 10: Surgical Sealant And Adhesives Market in North America by Country (2021-2030)

- Table 11: Surgical Sealant And Adhesives Market in the US (2021-2030)

- Table 12: Surgical Sealant And Adhesives Market in Canada (2021-2030)

- Table 13: Surgical Sealant And Adhesives Market in Mexico (2021-2030)

- Table 14: Surgical Sealant And Adhesives Market in Europe (2021-2030)

- Table 15: Surgical Sealant And Adhesives Market in Europe by Country (2021-2030)

- Table 16: Surgical Sealant And Adhesives Market in France (2021-2030)

- Table 17: Surgical Sealant And Adhesives Market in Germany (2021-2030)

- Table 18: Surgical Sealant And Adhesives Market in the United Kingdom (2021-2030)

- Table 19: Surgical Sealant And Adhesives Market in Italy (2021-2030)

- Table 20: Surgical Sealant And Adhesives Market in Spain (2021-2030)

- Table 21: Surgical Sealant And Adhesives Market in Russia (2021-2030)

- Table 22: Surgical Sealant And Adhesives Market in Rest of Europe (2021-2030)

- Table 23: Surgical Sealant And Adhesives Market in APAC (2021-2030)

- Table 24: Surgical Sealant And Adhesives Market in APAC by Country (2021-2030)

- Table 25: Surgical Sealant And Adhesives Market in China (2021-2030)

- Table 26: Surgical Sealant And Adhesives Market in Japan (2021-2030)

- Table 27: Surgical Sealant And Adhesives Market in India (2021-2030)

- Table 28: Surgical Sealant And Adhesives Market in Australia (2021-2030)

- Table 29: Surgical Sealant And Adhesives Market in South Korea (2021-2030)

- Table 30: Surgical Sealant And Adhesives Market in Rest of APAC (2021-2030)

- Table 31: Surgical Sealant And Adhesives Market in Rest of World (2021-2030)

- Table 32: Surgical Sealant And Adhesives Market in RoW by Region (2021-2030)

- Table 33: Surgical Sealant And Adhesives Market in Middle East (2021-2030)

- Table 34: Surgical Sealant And Adhesives Market in Africa (2021-2030)

- Table 35: Surgical Sealant And Adhesives Market in South America (2021-2030)

List of Figures

- Figure 1: Competitive Analysis

- Figure 2: COVID-19 Impact Analysis on Surgical Sealant and Adhesives Market

- Figure 3: Surgical Sealant And Adhesives Market in Global (2021-2030)

- Figure 4: Surgical Sealant And Adhesives Market in Global by Product Type (2021-2030)

- Figure 5: Surgical Sealant And Adhesives Market in Global by Application (2021-2030)

- Figure 6: Surgical Sealant And Adhesives Market in Global by Site (2021-2030)

- Figure 7: Surgical Sealant And Adhesives Market in Global by End-user (2021-2030)

- Figure 8: Surgical Sealant And Adhesives Market in Global by Geography (2021-2030)

- Figure 9: Surgical Sealant And Adhesives Market in North America (2021-2030)

- Figure 10: Surgical Sealant And Adhesives Market in North America by Country (2021-2030)

- Figure 11: Surgical Sealant And Adhesives Market in the US (2021-2030)

- Figure 12: Surgical Sealant And Adhesives Market in Canada (2021-2030)

- Figure 13: Surgical Sealant And Adhesives Market in Mexico (2021-2030)

- Figure 14: Surgical Sealant And Adhesives Market in Europe (2021-2030)

- Figure 15: Surgical Sealant And Adhesives Market in Europe by Country (2021-2030)

- Figure 16: Surgical Sealant And Adhesives Market in France (2021-2030)

- Figure 17: Surgical Sealant And Adhesives Market in Germany (2021-2030)

- Figure 18: Surgical Sealant And Adhesives Market in the United Kingdom (2021-2030)

- Figure 19: Surgical Sealant And Adhesives Market in Italy (2021-2030)

- Figure 20: Surgical Sealant And Adhesives Market in Spain (2021-2030)

- Figure 21: Surgical Sealant And Adhesives Market in Russia (2021-2030)

- Figure 22: Surgical Sealant And Adhesives Market in Rest of Europe (2021-2030)

- Figure 23: Surgical Sealant And Adhesives Market in APAC (2021-2030)

- Figure 24: Surgical Sealant And Adhesives Market in APAC by Country (2021-2030)

- Figure 25: Surgical Sealant And Adhesives Market in China (2021-2030)

- Figure 26: Surgical Sealant And Adhesives Market in Japan (2021-2030)

- Figure 27: Surgical Sealant And Adhesives Market in India (2021-2030)

- Figure 28: Surgical Sealant And Adhesives Market in Australia (2021-2030)

- Figure 29: Surgical Sealant And Adhesives Market in South Korea (2021-2030)

- Figure 30: Surgical Sealant And Adhesives Market in Rest of APAC (2021-2030)

- Figure 31: Surgical Sealant And Adhesives Market in Rest of World (2021-2030)

- Figure 32: Surgical Sealant And Adhesives Market in RoW by Region (2021-2030)

- Figure 33: Surgical Sealant And Adhesives Market in Middle East (2021-2030)

- Figure 34: Surgical Sealant And Adhesives Market in Africa (2021-2030)

- Figure 35: Surgical Sealant And Adhesives Market in South America (2021-2030)

- Figure 36: Market Drivers

- Figure 37: Market Barriers

- Figure 38: Marker Opportunities

- Figure 39: PORTER'S Five Force Analysis

Surgical Sealant And Adhesives Market By Product Type (Natural [Fibrin, Gelatin, Collagen, And Others], Semi-Synthetic And Synthetic [Cyanoacrylates, Polyurethane-Based, Polyethylene Glycol, And Others]), By Application (General Surgery, Cardiovascular Problems, Cosmetic Surgery, And Others), By Site (Internal And Topical), By End-User (Hospitals, Clinics, Ambulatory Surgical Care Centers, And Others), by geography is estimated to register growth at a remarkable CAGR during the forecast period from 2024-2030 owing to increase in prevalence of chronic diseases and rise in road traffic accidents

The global surgical sealant and adhesives market was valued at USD 2.18 billion in 2023, growing at a CAGR of 7.58% during the forecast period from 2024 to 2030 to reach USD 3.39 billion by 2030. The surgical sealant and adhesives market is slated to witness prosperity owing to the growing prevalence of chronic health problems such as cardiovascular problems, kidney problems, neurological issues, and others. The rise in road accidents requiring urgent surgeries is another factor in the growth of the surgical sealant and adhesives market. The continuous rise in cosmetic surgeries and growing focus on improving the safety, affordability, and usability of surgical sealants and adhesives are further expected to result in appreciable revenue growth in the Surgical Sealant and Adhesives Market during the forecast period (2024-2030).

Surgical Sealant and Adhesives Market Dynamics:

The noteworthy drivers of the Surgical Sealant and Adhesives Market include the rising prevalence of chronic health issues, rise in road accidents, boom in cosmetic surgeries, increasing age, and limitations of traditional methods among others.

The rising prevalence of cardiovascular problems requiring surgeries including heart transplantation, bypass surgery, heart valve repair, and others is an important driver for the market growth. For instance, according to the World Health Organization (WHO) 2022, globally around 17.9 million people died from cardiovascular diseases in 2019. This indicates the growing need for cardiovascular surgeries to be performed where sealants and adhesives are widely used so that the mortality rate can be reduced and therefore positively impacting the surgical sealants and adhesives market. Cancer is another leading cause of the growth of the market as surgeries are often performed for the removal of the tumor. According to World Health Organization (WHO) 2020, around 19,292,789 cancer cases were reported in 2020 with Breast cancer accounting for 11.7% of the total cases globally.

Additionally, the rise in road traffic accidents is another major concern for the growth of the market. The light and fatal injuries owing to sudden road accidents need immediate surgeries and thus increase the growth of the surgical sealants and adhesives market. According to World Health Organization (WHO), in 2022, worldwide approximately 1.3 million people die each year because of road traffic accidents and around 20-50 million individuals suffer from non-fatal injuries or some sort of disability.

The boom in cosmetic surgeries is another major factor driving the growth of the surgical sealants and adhesives market where adhesives are often used for attachment. Cosmetic procedures like rhytidectomy (face-lift), abdominoplasty (tummy tuck) and others are often performed and thus assist the overall growth of the market. According to the American Society of Plastic Surgeons 2020, a total number of 2,678,302 cosmetic surgical procedures were performed in the year 2019.

The complications associated with traditional surgical wound closures and the advantages of sealants and adhesives over them are other noteworthy drivers for the growth of the Surgical Sealant and Adhesives market. The regular methods are time-consuming and can cause potential damage and infection to the nearby body tissues. Surgical sealants and adhesives offer comparatively lesser operation time and a low rate of infection.

However, the availability of alternative products, high cost, and complications associated with the surgical sealant and adhesives may act as restraining factors to the Surgical Sealant and Adhesives market growth.

The Surgical Sealant and Adhesives Market reported a short period of a setback in the market growth due to the implementation of lockdown as a necessary step to stop the spread of COVID-19 infection. Many countries suspended medical procedures based on the need for urgent medical care to streamline the workflow during the COVID-19 crisis. This led to a decline in surgeries thereby decreasing the demand for Surgical Sealant and Adhesives products. However, with the resumption of activities across industries including the healthcare sector, there has been a rising demand for surgical sealants and adhesives owing to the resumption of suspended surgeries and related procedures. The post-COVID scenario is going to uplift the Surgical Sealant and Adhesives Market growth during the forecast period from 2024-2030.

Surgical Sealant and Adhesives Market Segment Analysis:

Surgical Sealant and Adhesives Market by Product Type (Natural and Semi-Synthetic & Synthetic), Application (General Surgery, Cardiovascular Problems, Cosmetic Surgery, and Others), Site (Internal and Topical), End-User (Hospitals, Clinics, Ambulatory Surgical Care Centers, and Others), Geography (North America, Europe, Asia-Pacific, and Rest of the World).

Based on the product type segment naturally derived Surgical Sealants and Adhesives are expected to register significant growth in coming years owing to their numerous advantages over synthetic-based sealants and adhesives. Natural surgical sealants and adhesives such as fibrin, collagen, and gelatin among others are highly compatible with the living tissue and do not induce an immune response. They are fully biodegradable owing to their natural composition of proteins and are not time-consuming when used in surgeries.

The broad application of natural sealants and adhesives is another reason for its popularity. Natural sealants and adhesives are widely used in different surgical procedures including cardiovascular, orthopedic, ophthalmic, cosmetic, and neurosurgeries among others.

In December 2019, Ethicon (Johnson & Johnson) launched VISTASEAL Fibrin Sealant (Human) which is composed of clotting proteins fibrinogen and thrombin and can form clots rapidly to control surgical bleeding. It comes in pre-filled syringes and can be sprayed without the usage of gas set-up on open and minimally invasive procedures.

North America is expected to dominate the overall Surgical Sealant and Adhesives Market:

Among all the regions, North America is expected to lead in revenue generation in the global surgical sealant and adhesives market. This can be due to factors including the prevalence of chronic health problems, increasing age-related health issues, the presence of key companies in the region involved in the production of surgical sealant and adhesives, high-tech medical facilities, and others.

One of the prominent factors supporting the growth of the North America Surgical Sealant and Adhesives market is the rising prevalence of chronic diseases requiring surgeries, majorly in the United States. As per the Centers for Disease Control and Prevention (CDC) 2020, approximately 659,000 in the U.S. die from heart disease each year, around 18.2 million adults suffered from Coronary Artery Disease in the year 2019 and around 805,000 people in the U.S. suffer from a heart attack every year. This explains the growth of the surgical sealant and adhesives market owing to the growing prevalence of heart diseases in the region.

The increasing age makes one susceptible to several health issues including heart diseases, bone disease, eye problems, and others requiring immediate surgeries, which is another driver for the growth of the surgical sealants and adhesives market. The increase in age-related eye disorders will lead to positive growth in the surgical sealants and adhesives market. For instance, the Ocular Therapeutix's surgical sealant ReSure is used for preventing postoperative fluid egress from incisions after cataract surgery. Therefore, the presence of key companies in the region offering high-quality products is further driving the growth of the surgical sealant and adhesives market in the United States.

Surgical Sealant and Adhesives Market Key Players:

Some of the key market players operating in the Surgical Sealant and Adhesives Market include Baxter, BD, Johnson & Johnson, CryoLife, Inc., Integra LifeSciences, Ocular Therapeutix, Inc., Vivostat A/S, Advanced Medical Solutions Israel (Sealantis) Ltd, B. Braun Melsungen AG, CSL, Gem srl, Adhezion Biomedical, LLC, Terumo Europe NV, TISSIUM, Grunenthal, Advamedica Inc., Polyganics, SkinStitch, LLC, Cardinal Health, Cohera Medical, Connexicon medical, and others.

Recent Developmental Activities in the Surgical Sealant and Adhesives Market:

In November 2020, TISSIUM received U.S. Food and Drug Administration (FDA) approval for its Investigational Device Exemption application for its vascular sealant.

In January 2020, Terumo, a manufacturer of medical devices launched a novel surgical sealant AQUABRID® for aortic procedures.

In December 2019, BD (Becton, Dickinson, and Company) a leading medical technology company acquired Tissuemed, Ltd., the experts in developing self-adhesive surgical sealant films.

Key Takeaways from the Surgical Sealant and Adhesives Market Report Study

- Market size analysis for current Surgical Sealant And Adhesives Market size (2023), and market forecast for 5 years (2024-2030)

- The effect of the COVID-19 pandemic on this market is significant. To capture and analyze suitable indicators, our experts are closely watching the Surgical Sealant and Adhesives Market.

- Top key product/services/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the global Surgical Sealant and Adhesives Market.

- Various opportunities available for the other competitor in the Surgical Sealant and Adhesives Market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030.

- Which are the top-performing regions and countries in the current Surgical Sealant and Adhesives Market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for Surgical Sealant and Adhesives Market growth in the coming future?

Target Audience who can be benefited from this Surgical Sealant and Adhesives Market Report Study

- Surgical Sealant And Adhesives Market products providers

- Research organizations and consulting companies

- Surgical Sealant And Adhesives Market-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders dealing in Surgical Sealant and Adhesives

- Various end-users who want to know more about the Surgical Sealant and Adhesives Market and the latest technological developments in the Surgical Sealant and Adhesives Market.

Frequently Asked Questions for Surgical Sealant and Adhesives Market:

1. What are Surgical Sealant and Adhesives Market?

Surgical sealants and adhesives are the products used during surgical procedures particularly for repairing injured tissues and wounds to prevent any kind of post-surgical complications such as leakage and loss of blood, fluids, and air.

2. What is the market for the global Surgical Sealant and Adhesives Market?

The global surgical sealant and adhesives market was valued at USD 2.18 billion in 2023, growing at a CAGR of 7.58% during the forecast period from 2024 to 2030 to reach USD 3.39 billion by 2030.

3. What are the drivers for the global Surgical Sealant and Adhesives Market?

The Surgical Sealant and Adhesives Market are slated to witness prosperity owing to factors such as the growing prevalence of chronic diseases such as cancer, and heart and kidney disease among others. The rise in injuries owing to road traffic accidents along with the growing aging population base which is susceptible to the development of multiple health problems including cardiovascular problems, bone disease, eye problems, and the growing focus on improving the safety and usability, affordability of surgical sealant and adhesives market for end-users are further expected to result in the appreciable revenue growth in the Surgical Sealant And Adhesives Market during the forecast period (2024-2030).

4. Who are the key players operating in the global Surgical Sealant and Adhesives Market?

Some of the key market players operating in the Surgical Sealant and Adhesives Market Baxter, BD, Johnson & Johnson, CryoLife, Inc., Integra LifeSciences, Ocular Therapeutix, Inc., Vivostat A/S, Advanced Medical Solutions Israel (Sealantis) Ltd, B. Braun Melsungen AG, CSL, Gem srl, Adhezion Biomedical, LLC, Terumo Europe NV, TISSIUM, Grunenthal, Advamedica Inc., Polyganics, SkinStitch, LLC, Cardinal Health, Cohera Medical, Connexicon medical, and others.

5. Which region has the highest share in the Surgical Sealant and Adhesives Market?

North America is expected to dominate the overall Surgical Sealant and Adhesives Market during the forecast period, 2024 to 2030. This can be ascribed to the presence of a large patient pool associated with cardiovascular disease and other chronic health problems which need immediate treatment in form of surgeries. The age-related health problems and local presence of key market players are other factors for the positive growth of the Surgical Sealant and Adhesives in the region.

Table of Contents

1.Surgical Sealant And Adhesives Market Report Introduction

2.Surgical Sealant And Adhesives Market Executive Summary

- 2.1. Scope of the Study

- 2.2. Market at Glance

- 2.3. Competitive Assessment

- 2.4. Financial Benchmarking

3. Regulatory Analysis

- 3.1. The United States

- 3.2. Europe

- 3.3. Japan

- 3.4. China

4. Surgical Sealant And Adhesives Market Key Factors Analysis

- 4.1. Surgical Sealant And Adhesives Market Drivers

- 4.1.1. Limitations associated with Traditional Methods

- 4.1.2. Increasing Prevalence of Chronic Health Problems

- 4.1.3. Rise in Road Traffic Accidents

- 4.1.4. Increase in Cosmetic Surgeries

- 4.2. Surgical Sealant And Adhesives Market Restraints and Challenges

- 4.2.1. Availability of Alternative Products

- 4.2.2. Complications associated with surgical sealant and adhesives

- 4.3. Surgical Sealant And Adhesives Market Opportunities

- 4.3.1. Improving Product Safety

- 4.3.2. Affordable Surgical Sealant And Adhesives

5. Surgical Sealant And Adhesives Market Porter's Five Forces Analysis

- 5.1. Bargaining Power of Suppliers

- 5.2. Bargaining Power of Consumers

- 5.3. Threat of New Entrants

- 5.4. Threat of Substitutes

- 5.5. Competitive Rivalry

6. COVID-19 Impact Analysis on Surgical Sealant And Adhesives Market

7. Surgical Sealant and Adhesives Market Layout

- 7.1. By Product Type

- 7.1.1. Natural

- 7.1.1.1. Fibrin

- 7.1.1.2. Gelatin

- 7.1.1.3. Collagen

- 7.1.1.4. Others

- 7.1.2. Semi-synthetic & Synthetic

- 7.1.2.1. Cyanoacrylates

- 7.1.2.2. Polyurethane based

- 7.1.2.3. Polyethylene glycol

- 7.1.2.4. Others

- 7.1.1. Natural

- 7.2. By Application

- 7.2.1. General Surgery

- 7.2.2. Cosmetic Surgery

- 7.2.3. Cardiovascular Surgery

- 7.2.4. Others

- 7.3. By Site

- 7.3.1. Internal

- 7.3.2. Topical

- 7.4. By End-User

- 7.4.1. Hospitals and Clinics

- 7.4.2. Ambulatory Surgical Care Centers

- 7.4.3. Others

- 7.5. By Geography

- 7.5.1. North America

- 7.5.1.1. United States Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.1.2. Canada Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.1.3. Mexico Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.2. Europe

- 7.5.2.1. France Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.2.2. Germany Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.2.3. United Kingdom Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.2.4. Italy Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.2.5. Spain Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.2.6. Russia Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.2.7. Rest of Europe Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.3. Asia-Pacific

- 7.5.3.1. China Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.3.2. Japan Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.3.3. India Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.3.4. Australia Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.3.5. South Korea Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.3.6. Rest of Asia Pacific Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.4. Rest of the World (RoW)

- 7.5.4.1. Middle East Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.4.2. Africa Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.4.3. South America Surgical Sealants and Adhesives Market in USD million (2021-2030)

- 7.5.1. North America

8. Surgical Sealant and Adhesives Market Global Company Share Analysis - Key 3-5 Companies

9. Surgical Sealant and Adhesives Market Company and Product Profiles

- 9.1. Baxter

- 9.1.1. Company Overview

- 9.1.2. Company Snapshot

- 9.1.3. Financial Overview

- 9.1.4. Product Listing

- 9.1.5. Entropy

- 9.2. BD

- 9.2.1. Company Overview

- 9.2.2. Company Snapshot

- 9.2.3. Financial Overview

- 9.2.4. Product Listing

- 9.2.5. Entropy

- 9.3. CryoLife, Inc.

- 9.3.1. Company Overview

- 9.3.2. Company Snapshot

- 9.3.3. Financial Overview

- 9.3.4. Product Listing

- 9.3.5. Entropy

- 9.4. Integra LifeSciences

- 9.4.1. Company Overview

- 9.4.2. Company Snapshot

- 9.4.3. Financial Overview

- 9.4.4. Product Listing

- 9.4.5. Entropy

- 9.5. Ocular Therapeutix, Inc.

- 9.5.1. Company Overview

- 9.5.2. Company Snapshot

- 9.5.3. Financial Overview

- 9.5.4. Product Listing

- 9.5.5. Entropy

- 9.6. Vivostat A/S

- 9.6.1. Company Overview

- 9.6.2. Company Snapshot

- 9.6.3. Financial Overview

- 9.6.4. Product Listing

- 9.6.5. Entropy

- 9.7. Advanced Medical Solutions Israel (Sealantis) Ltd

- 9.7.1. Company Overview

- 9.7.2. Company Snapshot

- 9.7.3. Financial Overview

- 9.7.5. Product Listing

- 9.7.5. Entropy

- 9.8. CSL

- 9.8.1. Company Overview

- 9.8.2. Company Snapshot

- 9.8.3. Financial Overview

- 9.8.4. Product Listing

- 9.8.5. Entropy

- 9.9. B. Braun Melsungen AG

- 9.9.1. Company Overview

- 9.9.2. Company Snapshot

- 9.9.3. Financial Overview

- 9.9.4. Product Listing

- 9.9.5. Entropy

- 9.10. Gem srl

- 9.10.1. Company Overview

- 9.10.2. Company Snapshot

- 9.10.3. Financial Overview

- 9.10.4. Product Listing

- 9.10.5. Entropy

- 9.11. Adhezion Biomedical, LLC

- 9.11.1. Company Overview

- 9.11.2. Company Snapshot

- 9.11.3. Financial Overview

- 9.11.4. Product Listing

- 9.11.5. Entropy

- 9.12. Terumo Europe NV

- 9.12.1. Company Overview

- 9.12.2. Company Snapshot

- 9.12.3. Financial Overview

- 9.12.4. Product Listing

- 9.12.5. Entropy

- 9.13. TISSIUM

- 9.13.1. Company Overview

- 9.13.2. Company Snapshot

- 9.13.3. Financial Overview

- 9.13.4. Product Listing

- 9.13.5. Entropy

- 9.14. Grunenthal

- 9.14.1. Company Overview

- 9.14.2. Company Snapshot

- 9.14.3. Financial Overview

- 9.14.4. Product Listing

- 9.14.5. Entropy

- 9.15. Advamedica Inc.

- 9.15.1. Company Overview

- 9.15.2. Company Snapshot

- 9.15.3. Financial Overview

- 9.15.4. Product Listing

- 9.15.5. Entropy

- 9.16. Polyganics

- 9.16.1. Company Overview

- 9.16.2. Company Snapshot

- 9.16.3. Financial Overview

- 9.16.4. Product Listing

- 9.16.5. Entropy

- 9.17. SkinStitch, LLC

- 9.17.1. Company Overview

- 9.17.2. Company Snapshot

- 9.17.3. Financial Overview

- 9.17.5. Product Listing

- 9.17.5. Entropy

- 9.18. Cardinal Health

- 9.18.1. Company Overview

- 9.18.2. Company Snapshot

- 9.18.3. Financial Overview

- 9.18.4. Product Listing

- 9.18.5. Entropy

- 9.19. Cohera Medical

- 9.19.1. Company Overview

- 9.19.2. Company Snapshot

- 9.19.3. Financial Overview

- 9.19.4. Product Listing

- 9.19.5. Entropy

- 9.20. Connexicon medical

- 9.20.1. Company Overview

- 9.20.2. Company Snapshot

- 9.20.3. Financial Overview

- 9.20.4. Product Listing

- 9.20.5. Entropy