|

|

市場調査レポート

商品コード

1775078

ハイエンド・高級・デザイン家具の世界市場The World Market for High-End, Luxury & Design Furniture |

||||||

|

|||||||

| ハイエンド・高級・デザイン家具の世界市場 |

|

出版日: 2025年07月23日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 232 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

世界の家具市場の約15%を占めるハイエンド家具セグメントは、世界の家具産業において戦略的かつダイナミックな推進力として浮上しています。なかでも北米は、世界の富裕層の40%以上が集中していることから最大の市場となっており、アジア太平洋地域と欧州がそれに続いています。インドや湾岸諸国は、富の集中、都市開発、野心的な不動産投資、ライフスタイルの変化を背景に、最も急成長している地域として注目されています。

継続する不確実性や急速な変化、地政学的な課題にもかかわらず、このセグメントはたとえば貿易ショックなどの短期的な変動に対して比較的安定しており、むしろ長期的な構造的トレンドによって成長しています。具体的には、高所得者層の増加(世界中に約6,000万人の富裕層が存在し、過去5年間でアジア太平洋地域では30%増加)、富の都市集中(世界の超富裕層の15%以上が上位10都市に居住)、デザイン性・独自性・オーダーメイド家具などへの消費者嗜好の進化が挙げられます。これらの要因が、世界規模での顧客基盤の拡大を後押ししています。

当レポートでは、世界のハイエンド・高級・デザイン家具の市場を調査し、世界・地域・国別の市場規模の推移・予測、主な需要促進要因の分析、製品・エンドユーザー別の市場内訳、競合分析、主要企業の参入状況、M&A活動、小売戦略などをまとめています。

各都市のプロファイル:

- 人口とその成長率

- 国内総生産

- 億万長者、億万長者、億万長者の数

- 各都市を代表する家具旗艦店/モノブランド店の通り/地区の地図

- 市内の高級デザイン家具の旗艦店/モノブランド店

- 市内の高級デザイン家具販売店

流通分析で調査対象としたハイエンドデザイン/ファッションブランド:

|

|

|

目次

調査分野・調査手法

エグゼクティブサマリー:ハイエンド・ラグジュアリー・デザイン家具の世界市場

第1章 世界のシナリオ

- 世界の需要牽引因子:富裕層、億万長者、観光、ブランド住宅、スーパーヨット

- 世界の富の分配と人口に関する主要数値

- 高級ホスピタリティと不動産の動向

第2章 ハイエンド家具の市場規模

- 世界の市場規模の推移:地域・国別

- 市場規模上位10カ国

- 国・地域別の輸入フロー

- 製品とエンドユーザー別の市場内訳

第3章 市場予測

- 世界・地域・国別の成長予測

- 予測される需要要因

第4章 競合情勢

- ハイエンド家具の主要製造業者(セグメント別):超高級/オーダーメイド、高級/ファッションブランド、ハイエンドデザイン/シグネチャー、デザイン重視/アッパーミドル市場

- 流通戦略と旗艦店ネットワーク

- M&A活動

ハイエンド家具:地域分析

第5章 欧州

- 市場促進要因、規模、予測、競合

- 対象国:ドイツ、英国、フランス、イタリア

- 輸入業者、主要製造業者、小売業者

第6章 北米

- 市場促進要因、規模、予測、競合

- 対象国:米国、カナダ

- 輸入業者、主要製造業者、小売業者

第7章 アジア太平洋

- 市場促進要因、規模、予測、競合

- 対象国:中国、日本、インド、韓国

- 輸入業者、主要製造業者、小売業者

第8章 湾岸諸国

- 市場促進要因、規模、予測、競合

- 輸入業者、主要製造業者、小売業者

その他の国

第9章 ロシア

- 市場動向、予測

第10章 ブラジル

- 市場促進要因、輸入、予測、競合

ハイエンド家具市場:世界の都市と旗艦店

- 世界の主要35都市:都市ごとのプロファイル

- 需要の牽引要因:人口、GDP、高所得者数

- 欧州のハイエンド・デザイン家具ブランド45社の流通チャネル別分析

- 旗艦店とモノブランド店(ブランド、店舗名、住所)および販売店(店舗名、提供ブランドの選択肢、住所)のマッピング

- 市内の家具の旗艦店やモノブランド店が最もよく集まる通りや地区を特定の地図で表示

The CSIL's report "The World Market for High-End, Luxury & Design Furniture" offers a comprehensive in-depth analysis of the high-end furniture market worldwide, providing market size (2019-2024) and forecasts 2025, 2025-2028 at world, area and country level; an analysis of the main demand drivers; breakdown of the market by product and by end-user; in-depth analysis of the competition, clustering of main players by their market of reference, M&A activity and retail strategies; selection of potential 35 cities for high-end furniture demand.

REPORT'S STRUCTURE AND CONTENTS

An Executive Summary opens the study with a snapshot of major insights and trends shaping the global high-end furniture sector and the main findings of CSIL's analysis, delving into drivers and key factors fuelling demand, such as global wealth distribution, the number of millionaires and billionaires, luxury tourism, branded residences, and the superyacht industry. Companies features and strategies are summarized.

World Scenario

Comprehensive global analysis of the high-end, design, luxury furniture market, including:

- The size of the high-end furniture market in 2024 and forecasts 2025, 2025-2028, at world, area and country level.

- An analysis of the main demand drivers: global wealth, number of millionaires, luxury hotels, branded residences, superyachts, international tourism

- An import flows analysis: major imports flows from most important countries for high-end furniture production

- The breakdown of the market by product: upholstered furniture, kitchen furniture, dining and living (incl. tables and chairs), outdoor furniture, bedroom furniture, office furniture and bathroom furniture.

- The breakdown of the market by end-user: residential, hospitality, luxury Retail/shopfitting, office, marine (cruises/yachts)

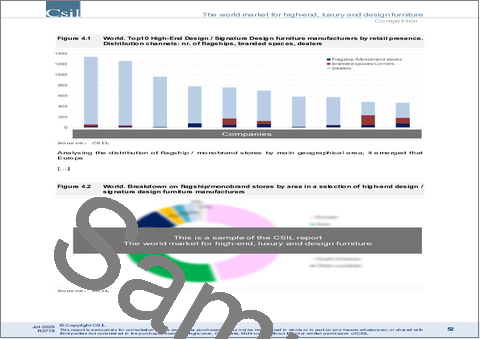

- Competition analysis: identification of main players for each category (ultra-luxury / bespoke furniture, luxury/fashion-branded, high-end design / signature design, design oriented/upper middle). Profiles and distribution channels for main players are provided.

- M&A deals analysis: main deals between 2019-2025

Regional and Country-Level Analysis

The high-end, design, luxury furniture market is analysed by area and for seleceted countries, including:

- The size of the high-end furniture market (2019-2024) and forecasts 2025, 2025-2028.

- An analysis of the main demand drivers

- An import flows analysis: major imports flows from most important countries for high-end furniture production

- Competition analysis: identification of main players for each area / country by total turnover

- Distribution system insights: main trends, selection of high-end furniture dealers

Geographical coverage: European Union + UK, NO, CH; Central Eastern Europe; North America; Asia and Pacific; South America; Middle East and Africa/Gulf countries.

Country level: Germany, UK, France, Italy, USA, Canada, China, Japan, India, South Korea, Gulf Countries, Brazil, Russia. *For Russia only sector basic data available; for South Korea high-end furniture manufacturers not available.

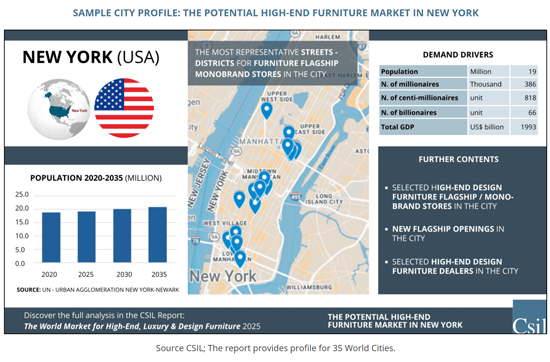

Hot Topic: The Potential High-End Furniture Market in A Selection of Cities Worldwide and Flagship Stores

This part includes CSIL in-depth analysis on the potential high-end furniture markets in a selection of 35 cities worldwide based on criteria such as the number of ultra-rich individuals, economic growth, and the presence of high-end brands, together with the distribution analysis of 45 leading international high-end design brands. More than 500 flagship / monobrand stores have been identified, together with more than 1300 dealers.

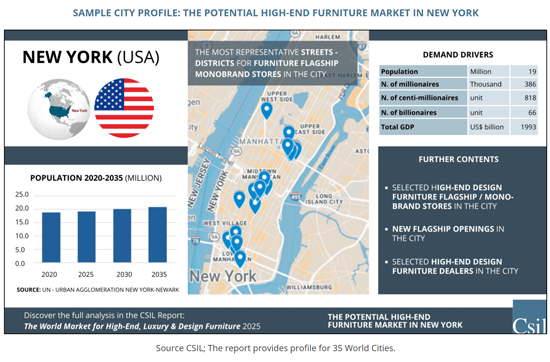

Each city profile includes:

- Population and its growth rate, 2020, 2025, 2030 and 2035

- Total Gross domestic product, US$ billion

- Number of millionaires, centi-millionaires, billionaires

- Maps of most representative streets/districts for furniture flagship/monobrand stores in the city

- High-end design furniture flagship/monobrand stores in the city (brand, store name, address)

- High-end design furniture dealers in the city (store name, selection of brands offered, address)

High-end design /fashion brands considered in the distribution analysis:

|

|

|

Highlights:

Accounting for nearly 15% of the world furniture market, the high-end furniture segment emerges as a strategic and dynamic driver within the global furniture industry. North America is the largest market, largely due to its concentration of affluent consumers, including over 40% of global millionaires. Asia-Pacific and Europe follow in market size, while India and the Gulf countries stand out among the fastest-growing regions, driven by wealth concentration, urban development, ambitious real estate investments and evolving lifestyles.

Despite ongoing uncertainty, rapid transformation, and geopolitical challenges, this segment has demonstrated greater stability and independence from short-term fluctuations, such as trade shocks, and has been driven by long-term structural trends: growth of high-net-worth individuals (nearly 60 million of millionaires worldwide, +30% in Asia and Pacific in the last five years), urban concentration of wealth (top 10 cities in the world are home to more than 15% of global ultra-wealthy individuals), and the evolution of consumer preferences toward design, exclusivity and custom furniture. Those have favoured a customer base expansion globally.

TABLE OF CONTENTS

RESEARCH FIELD AND METHODOLOGY

- Scope of research and definitions

- Product types and geographic coverage

- Data collection and processing methods

- a and presentation notes

EXECUTIVE SUMMARY: The World Market for High-End, Luxury & Design Furniture

1. World Scenario

- Global demand drivers: wealth, millionaires, tourism, branded residences, superyachts

- Key figures on global wealth distribution and population

- Trends in luxury hospitality and real estate

2. High-End Furniture Market Size

- Global market value (2019-2024), by region, country

- Top 10 countries by market size

- Import flows by country and region

- Market breakdown by product and end-user

3. Market Forecasts (2025, 2025-2028)

- Growth projections by world, region, country

- Forecasted demand drivers

4. Competition

- Leading manufacturers of High-End Furniture by segment: Ultra-luxury / Bespoke, Luxury / Fashion-branded, High-end Design / Signature, Design-oriented / Upper-middle market

- Distribution strategies and flagship store networks

- M&A activity (2019-2025)

HIGH END FURNITURE. ANALYSIS BY GEOGRAPHICAL AREA

5. Europe

- Market drivers, size, forecasts, and competition

- Country focus: Germany, UK, France, Italy

- Imports, key manufacturers, and retailers

6. North America

- Market drivers, size, forecasts, and competition

- Country focus: USA and Canada

- Imports, key manufacturers, and retailers

7. Asia-Pacific

- Market drivers, size, forecasts, and competition

- Country focus: China, Japan, India, South Korea

- Imports, key manufacturers, and retailers

8. Gulf Countries

- Market drivers, size, forecasts, and competition

- Imports, key manufacturers, and retailers

OTHER COUNTRIES

9. Russia

- Market trends, forecasts

10. Brazil

- Market drivers, imports, forecasts, and competition

HIGH-END FURNITURE MARKET: GLOBAL CITIES AND FLAGSHIP STORES

- Focus on 35 selected cities worldwide: City-by-city profiles

- Demand drivers: population, GDP, number of millionaires, centi-millionaires, billionaires

- Analysis of 45 leading European high-end / design furniture brands by distribution channels

- Mapping of flagship and mono-brand stores (brand, store name, address) and dealers (store name, selection of brands offered, address)

- Most representative streets/districts for furniture flagship/monobrand stores in the city represented in specific maps