|

市場調査レポート

商品コード

1756514

世界の布張り家具産業The World Upholstered Furniture Industry |

||||||

|

|||||||

| 世界の布張り家具産業 |

|

出版日: 2025年06月25日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 523 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

当レポートでは、世界の布張り家具産業を調査し、主な動向と課題、主要統計と基礎データ (生産、消費、国際貿易) 、市場予測、主要製造業者のプロファイル、世界の布張り家具上位20カ国の詳細分析などを包括的にまとめています。

布張り家具の国際貿易は、米国の関税措置およびそれに対する貿易相手国の対抗措置の結果、これまでにない不確実な状況にあります。貿易政策や関税の不透明性は今後も続く可能性があります。CSILは、布張り家具の国際貿易を継続的に監視し、市場に関する深い知見と継続的な評価に基づいたデータを提供することに尽力しています。

対象国

|

|

|

ハイライト

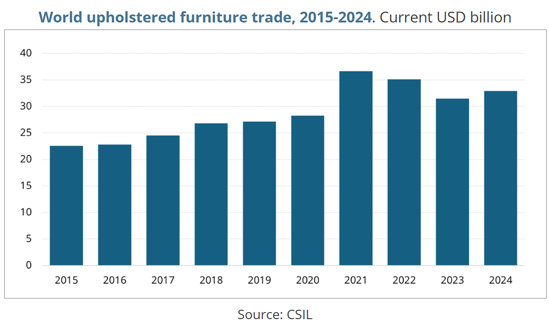

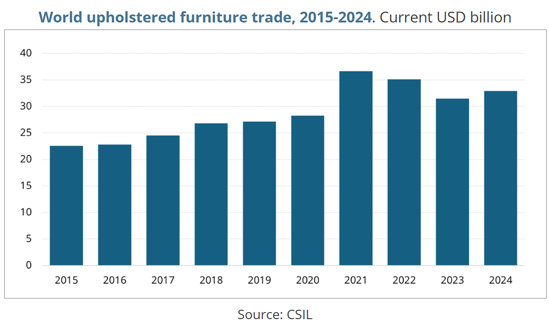

布張り家具産業は、生産量の35%以上が国際的に取引されており、世界的な広がりをますます反映しています。布張り家具の国際貿易は拡大を続け、取引額は約330億米ドルに達しています。

地域間の貿易の全体的な流れはほとんど変わっていないものの、具体的な貿易相手国には変化が見られます。世界最大の布張り家具輸入国である米国は、引き続き外国からの供給に大きく依存しています。2023年以降、米国の布張り家具の主要供給国は中国に代わってベトナムとなりました。2025年の直近数か月では、新たな関税措置の影響により、サプライチェーン全体の企業が調達モデル、生産戦略、投資計画を迅速に見直さざるを得ない状況となっています。

目次 (要約)

イントロダクション

調査範囲・構成

エグゼクティブサマリー:

第1部:布張り家具の消費・生産・国際貿易の推移

- 世界市場

- 世界の消費量

- 世界の輸入動向と市場開放

- 世界の生産量

- 世界の生産量

- 輸出と主要輸出国

- 展望:世界の貿易と消費の見通し

- 貿易相手国・輸入/消費・輸出/生産比率:世界の貿易の推移

- 消費量の予測・実質年間変化予測

第2部布張り家具の指標

- 世界の布張り家具業界の概要

- 70カ国・アルファベット順・ランキング

- 布張り家具の市場開放・輸出入の伸び

- 消費量の予測

第3部布張り家具産業のトップ20カ国

- 消費国上位20か国 (オーストラリア、ブラジル、カナダ、中国、フランス、ドイツ、インド、イタリア、日本、リトアニア、メキシコ、ポーランド、ルーマニア、韓国、スペイン、スウェーデン、トルコ、英国、米国、ベトナム) の詳細な分析:

- 生産量、推定消費量、輸出入の動向、および今後の消費の年間変化予測

- 数量ベースでの生産データ (入手可能な場合)

- 生地素材別(革・布・その他)に分けた生産額の内訳 (入手可能な場合)

- 競合情勢:国内の主要製造業者とその簡易プロファイル

- 輸出:仕向け国別、輸入:原産国別の貿易データ

- 社会経済指標

第4部競合:世界の主要布張り家具製造業者

- 世界のトップ30布張り家具製造業者の詳細プロファイル

第5部国別表

- 70カ国のサマリーテーブル:アルジェリア、アルゼンチン、オーストラリア、オーストリア、バーレーン、ベルギー、ボスニア・ヘルツェゴビナ、ブラジル、ブルガリア、カナダ、チリ、中国、コロンビア、クロアチア、キプロス、チェコ共和国、デンマーク、エジプト、エストニア、フィンランド、フランス、ドイツ、ガーナ、ギリシャ、香港 (中国) 、ハンガリー、アイスランド、インド、インドネシア、アイルランド、イスラエル、イタリア、日本、カザフスタン、クウェート、ラトビア、レバノン、リトアニア、マレーシア、マルタ、メキシコ、モロッコ、オランダ、ニュージーランド、ノルウェー、オマーン、フィリピン、ポーランド、ポルトガル、カタール、ルーマニア、ロシア、サウジアラビア、セルビア、シンガポール、スロバキア、スロベニア、南アフリカ、韓国、スペイン、スウェーデン、スイス、台湾 (中国) 、タイ、トルコ、ウクライナ、アラブ首長国連邦、英国、米国、ベトナム

- 生産量、見かけの消費量、輸出量、輸入量、年次変化の予測

- 主要貿易相手国 (輸入原産国と輸出先国)

付録

CSIL's Research Report "The world upholstered furniture industry" offers a comprehensive sector's picture through key statistics and basic data (production, consumption, and international trade of upholstered furniture 2015-2024), market forecasts for 2025 and 2026, detailed profiles of the leading manufacturers, and a focus on the Top 20 world's upholstered furniture countries.

International trade of upholstered furniture is in a state of unprecedented uncertainty as a consequence of the USA's tariff measures and countermeasures by its trading partners. Trade policy and tariff unpredictability may continue. CSIL is committed to constantly monitoring the international trade of upholstered furniture to provide data that reflects its in-depth knowledge of the markets and their ongoing evaluation.

INTRODUCTION AND EXECUTIVE SUMMARY

An executive summary introduces the analysis and outlines CSIL's assessments regarding the upholstered furniture market, including regional and country analysis, competitive landscape, globalization, nearshoring, trade tensions, and market scenario.

Additionally, the report presents key topics and manufacturers' strategies to address the recent market challenges based on CSIL's surveys and interviews conducted from March to June 2025, targeting the major global manufacturers in the upholstered furniture industry.

This part also analyses recent M&A transactions, examines corporate strategies, and reviews the Q1 2025 financial performance of publicly listed companies operating in the upholstered furniture market.

UPHOLSTERED FURNITURE: WORLD MARKET OUTLOOK

This part highlights the largest upholstered furniture markets, the growth and openness to imports, and the role of major exporting countries in the world marketplace.

The analysis of the global production of upholstered furniture outlines the major producing countries and provides a breakdown by covering material (leather, fabric, other).

Forecasts of the world trade of upholstered furniture and market scenarios 2025 and 2026 are based on CSIL analysis of industry dynamics and macroeconomic indicators.

World consumption and production of upholstered furniture are broken down by geographical area: European Union (27) + UK, Norway, Switzerland, and Iceland; Central and Eastern Europe outside the EU & Russia; Asia and Pacific; the Middle East and Africa; North America; South America.

The breakdown of upholstered furniture production by covering material (leather, fabric, and other covering) is provided by geographical area (European Union (27) + UK, Norway, Switzerland, North America, Asia, and Pacific) and for a selection of major producing countries.

KEY MARKETS AND COUNTRIES IN THE GLOBAL UPHOLSTERED FURNITURE SECTOR

The chapter focuses on the Top 20 world upholstered furniture countries (Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Lithuania, Mexico, Poland, Romania, South Korea, Spain, Sweden, Turkiye, United Kingdom, United States, Vietnam), providing:

- Upholstered furniture production, apparent consumption, exports, and imports for the years 2015-2024 and forecasts of yearly changes in upholstered furniture consumption in 2025 and 2026.

- Production of upholstered furniture in quantity: 2019-2024 for China, United States, Vietnam, Poland, Italy, India, United Kingdom, Germany, Mexico, Turkiye, Romania, Canada, Brazil, Spain, France, Lithuania, Sweden, and Japan.

- Breakdown of production value by covering material (leather, fabric, and other) for China, the United States, Vietnam, Poland, Italy, India, the United Kingdom, Germany, Mexico, Canada, Spain, France, and Lithuania.

- Competitive landscape: Major upholstered furniture manufacturers in the country, with short profiles (for a total of around 800 considered firms) providing Company name, Headquarters/Main Location, Telephone, Web, Email address, Activity,

- Product Portfolio, Total Turnover range, Employees range, Exports share on total turnover, Manufacturing plants, Upholstered furniture production of total revenues.

- Upholstered furniture exports by country of destination and imports by country of origin.

- Socio-economic indicators, including population (total and by age group), forecasts up to 2035.

Moreover, for the 70 most important countries for upholstery production, consumption, and trade, including the Top 20, the study provides summary tables including upholstered furniture production, consumption, imports and exports data (2015-2024), the openness of the sector to foreign trade, consumption growth (2025 and 2026 forecasts), origin of imports, destination of exports and country rankings to place all statistics in a broader worldwide context.

LEADING MANUFACTURERS IN THE WORLD UPHOLSTERED FURNITURE INDUSTRY

A special section offers detailed company profiles for the 30 leading upholstered furniture manufacturers worldwide: headquarters, activity and product portfolio, turnover (last available year), controlled companies and subsidiaries, brands, financial performance (last 3 years for total revenues and employees), recent M&A operations, export sales, production facilities.

CONSIDERED COUNTRIES:

|

|

|

What is the scope of the CSIL report "The World Upholstered Furniture Industry"?

This study aims to analyse the current state and future outlook of the sector by answering the following questions:

- What is the market size of the global upholstered furniture industry?

- What are the largest and fastest-growing upholstered furniture markets worldwide?

- What are the market forecasts for upholstered furniture for 2025 and 2026?

- What are the leading upholstered furniture manufacturers worldwide, and how are they performing?

- How is international trade in upholstered furniture evolving? How are companies responding to new trade policies?

- What are the main trends and challenges shaping the upholstered furniture sector?

Highlights:

With over 35% of its production traded internationally, the upholstered furniture sector reflects a growing global dimension. International trade of upholstered furniture has increased, reaching nearly US$ 33 billion.

While the overall directions of trade flows between regions have remained largely unchanged, the specific partner countries involved have shifted. The US, the world's largest importer of upholstered furniture, has continued to be highly reliant on foreign supply. Since 2023, Vietnam has overtaken China as the United States' main supplier of upholstered furniture. In recent months of 2025, due to a new wave of tariffs, companies across the supply chain have been forced to rapidly reassess their sourcing models, production strategies, and investment plans.

TABLE OF CONTENTS (ABSTRACT)

INTRODUCTION

SCOPES AND STRUCTURE OF THE RESEARCH REPORT

EXECUTIVE SUMMARY:

- Market overview, Regional and country analysis, Competitive landscape, Globalization, nearshoring and trade tensions, Market Outlook

- Upholstered manufacturers' strategies.

- Overview of the competitive system in the upholstered furniture industry

- M&A deals and companies' strategies

- Publicly listed companies. Financial performance in Q1 2025

PART I. CONSUMPTION, PRODUCTION, AND INTERNATIONAL TRADE OF UPHOLSTERED FURNITURE 2015 - 2024

- 1.1. THE WORLD MARKET FOR UPHOLSTERED FURNITURE

- World consumption of upholstered furniture

- Imports and opening of the world upholstery market

- 1.2. WORLD PRODUCTION OF UPHOLSTERED FURNITURE

- World production of upholstered furniture

- Upholstered furniture exports and major exporting countries

- 1.3. THE OUTLOOK: prospects of the global upholstered furniture trade and consumption

- Trading partners, imports/consumption and exports/production ratios, and World upholstered furniture trade, 2015-2024

- Upholstered furniture consumption 2025-2026. Forecasts of yearly changes in real terms

PART II. UPHOLSTERED FURNITURE INDICATORS

- Overview of the world upholstered furniture sector

- The 70 Countries, alphabetical order, and rankings

- Opening Of Upholstered Furniture Markets. Growth of exports and imports

- Forecasts. Upholstered furniture consumption 2025-2026

PART III. TOP 20 COUNTRIES FOR THE UPHOLSTERED FURNITURE INDUSTRY

- A detailed analysis of the top 20 upholstered furniture consuming countries in the world (Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Lithuania, Mexico, Poland, Romania, South Korea, Spain, Sweden, Turkiye, United Kingdom, United States, Vietnam) including:

- Upholstered furniture production, apparent consumption, exports, imports for the years 2015-2024, and forecasts of yearly changes in upholstered furniture consumption in 2025 and 2026

- Production of upholstered furniture in quantity (when available)

- Breakdown of production value by covering material (leather, fabric, and other), when available

- Competitive landscape: Major upholstered furniture manufacturers in the country, with short profiles

- Upholstered furniture exports by country of destination and imports by country of origin

- Socio-economic indicators

PART IV. COMPETITION: TOP UPHOLSTERED FURNITURE MANUFACTURERS IN THE WORLD

- Detailed profiles of the Top 30 world's Manufacturers of upholstered furniture

PART V. COUNTRY TABLES

- Summary tables for 70 countries (Algeria, Argentina, Australia, Austria, Bahrain, Belgium, Bosnia-Herzegovina, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Ghana, Greece, Hong Kong (China), Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Kazakhstan, Kuwait, Latvia, Lebanon, Lithuania, Malaysia, Malta, Mexico, Morocco, Netherlands, New Zealand, Norway, Oman, Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan (China), Thailand, Turkey, Ukraine, United Arab Emirates, United Kingdom, United States, Vietnam) including:

- Upholstered furniture production, apparent consumption, exports, and imports for the years 2015-2024, and forecasts of yearly changes

- Major trading partners (countries of origin of imports and destination of exports of upholstered furniture).

APPENDIX

- Notes, presentation conventions, classification of countries