|

|

市場調査レポート

商品コード

1695949

欧州の業務用家具および調度品市場The Contract Furniture and Furnishings Market in Europe |

||||||

|

|||||||

| 欧州の業務用家具および調度品市場 |

|

出版日: 2025年03月31日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 240 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

当レポートは、欧州の業務用家具および調度品の市場についての包括的な情報を提供し、市場規模、製造統計、市場の発展と予測、需要促進要因、プロジェクト、主要企業の売上高と市場シェア、導入先別の売上高、主要製品カテゴリー別の売上高などを掲載しています。

欧州の業務用家具および調度品産業の概要:国別の市場の推移・業績

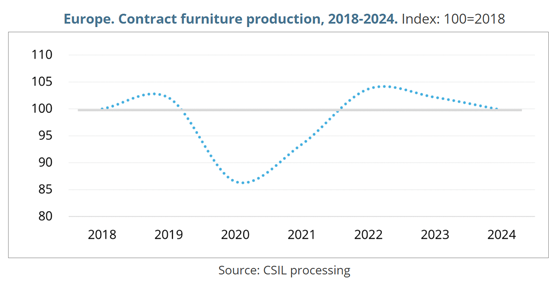

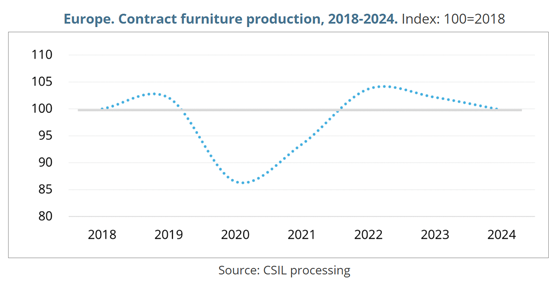

2024年の製造量と、2018年から2024年にかけての市場規模を、地域別および国別に分類しています。

対象地域:北欧 (デンマーク、フィンランド、ノルウェー、スウェーデン、中欧 (オーストリア、ドイツ、スイス、西欧 (ベルギー・ルクセンブルク、フランス、アイルランド、オランダ、英国、南欧 (ギリシャ、イタリア、ポルトガル、スペイン、中欧・東欧 (ポーランド、リトアニア、チェコ、ルーマニア、その他)

欧州の業務用家具および調度品市場の予測は2025年・2026年の予測が提供されます。

本レポートでは、欧州の業務用家具および調度品製造業者100社以上を対象に実施した最新調査に基づき、”ターンキー" vs "ソフトコントラクト"、自社製品 vs 流通製品、流通チャネルなどの観点から、今後増加が見込まれるセグメントと各社の市場アプローチも示しています。

欧州における業務用家具の製造・消費は、導入先別にも分類されています:

|

|

また、欧州における業務用家具の製造は、製品カテゴリー別にも提供されています:

|

|

主要企業:

本レポートで取り上げた主な企業Ahrend Group, Flos B&B Italia Group, Geberit, HMY Group Hermes Metal & Yudigar, Input Interior, Interna, Itab Shop Concept, Kinnarps, Lifestyle Design, Marine Interiors, MillerKnoll, Nobia Group, Nowy Styl, Overbury, Pedrali, Stamhuis Groep, Steelcase, Tegometall International Sales, Umdasch ShopFitting Group, Yachtline 1618, Villeroy & Boch, Vitra, VS Mobel

ハイライト

欧州における業務用家具の製造額は約135億ユーロを示し、これらは主として国内市場向けであり、北米、中東、アジア太平洋など他のターゲット市場には約20%が輸出されています。EUの主な製造国は英国、イタリア、ドイツ、ポーランド、スウェーデンです。

厳しい市場環境にもかかわらず、欧州の業務用家具セクターは、過去2年間、家具セクター全体を上回る業績を上げ、その強さを証明してきました。

目次 (要約)

調査手法と注釈

エグゼクティブサマリー

- 欧州の業務用家具および調度品市場:シナリオと動向

第1章 欧州の業務用家具市場

- 業務用家具市場の進化:欧州における業務用家具の製造と消費の動向

- 2024年までの製造・消費:国別

- 業務用家具の製造・消費:導入先別

- 業務用家具の製造:製品カテゴリー別

- 業務用家具および調度品の消費:2025年・2026年の予測

- 市場アプローチ:欧州におけるターンキー vs ソフト契約、自社製品 vs 取引製品、流通チャネル

- 欧州の大手業務用家具グループ:市場集中度と総製造シェア

第2章 業務用家具市場のパフォーマンス:国別

- オーストリア、ベルギー、チェコ共和国、デンマーク、フィンランド、フランス、ドイツ、ギリシャ、アイルランド、イタリア、リトアニア、オランダ、ノルウェー、ポーランド、ポルトガル、ルーマニア、スペイン、スウェーデン、スイス、英国

第3章 業務用家具市場:セグメント別

- 需要促進要因・市場価値・プロジェクト:

- 小売業 (量販店および高級店)

- ホスピタリティ

- オフィススペース

- レストランとバー

- 不動産

- 教育

- エンターテインメント

- 海洋

- ヘルスケア

- 空港

第4章 競合情勢:大手業務用家具製造業者の売上とターゲットセグメント

- サンプル企業における契約家具販売:欧州の大手製造業者

- 欧州の大手業務用家具および調度品企業のプロファイル

- 主要企業の業務用家具の販売:小売、ホスピタリティ、オフィス、レストランとバー、不動産、教育、エンターテイメント、アート&ミュージアム、ヘルスケア、海洋、空港の各分野

第5章 競合情勢:大手業務用家具製造業者の売上高:製品別

- 業務用家具販売:バスルーム家具および設備、寝室家具およびマットレス、キッチン家具、照明器具、オフィス家具、屋外用家具、テーブルおよび椅子、布張り家具

第6章 財務分析

- 業務用家具事業を展開する60社の財務データ

第7章 付録

- 建築家、デザイナー、ホテル会社、展示会、製造業者のリスト

CSIL's Research Report 'The contract furniture and furnishings market in Europe' offers a comprehensive picture of the European contract furniture business providing contract furniture market size, statistics for contract furniture and furnishings production, market development and forecasts, demand drivers and projects, sales and market shares of the leading players, sales by destination segment and by the main product categories.

CONTRACT FURNITURE AND FURNISHING SECTOR OVERVIEW IN EUROPE: MARKET EVOLUTION AND PERFORMANCE BY COUNTRY

The European Contract furniture and furnishings production in 2024 and market size for the time series 2018-2024 are broken down by area and by European country.

The geographical coverage includes: Northern Europe (Denmark, Finland, Norway, Sweden); Central Europe (Austria, Germany, Switzerland); Western Europe (Belgium-Lux, France, Ireland, the Netherlands, the United Kingdom); Southern Europe (Greece, Italy, Portugal, Spain), Central-Eastern Europe (Poland, Lithuania, Czech Republic, Romania, Other Central-Eastern European countries).

The European contract furniture and furnishing market forecasts are provided for the years 2025 and 2026.

Based on a recent survey conducted by CSIL on a sample of over 100 contract furniture and furnishing manufacturers in Europe, this report also shows the segments that are expected to increase faster and companies' market approach in terms of "turn-key" Vs "soft contract", own product Vs traded products, and distribution channels.

The Contract furniture production and consumption in Europe are broken down by destination segment:

|

|

Contract furniture production in Europe is also provided by product category:

|

|

FEATURES OF THE CONTRACT FURNITURE BUSINESS: DESTINATION SEGMENTS AND PRODUCT CATEGORIES

An overview of the main demand drivers and projects in the Retail, Hospitality, Office space, Real estate, Educational and entertainment, Marine, and Healthcare segments is also provided.

THE COMPETITIVE LANDSCAPE FEATURES: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES

For the Top 100 companies operating in the European contract furniture sector, this report includes sales of contract furniture, incidence of the contract business on total company sales, and the company's share of total European production, with short profiles of selected firms.

Contract furniture sales are provided for a sample of companies even by destination segment and by product category.

This study overall considers over 400 firms operating in the contract furniture sector.

FINANCIAL ANALYSIS: a set of financial indicators (Operating Revenue -Turnover-, Added Value, P/L for Period -Net Income-, Shareholders Funds, Cash Flow, ROI, ROE, EBITDA margin, EBIT margin, Solvency Ratio, Current Ratio, Number of Employees, Turnover per Employee, Added value per Employee) are reported for 60 companies operating in the contract furniture business.

ANNEX: List of about 50 architect and design studios, List of relevant trade exhibitions for Hospitality, Building, Architectural and Design, Interiors, List of the major hotel companies at a global level, Contact details for around 400 contract furniture and furnishing manufacturers mentioned in the research.

Selected companies:

Among the main companies considered in this report: Ahrend Group, Flos B&B Italia Group, Geberit, HMY Group Hermes Metal & Yudigar, Input Interior, Interna, Itab Shop Concept, Kinnarps, Lifestyle Design, Marine Interiors, MillerKnoll, Nobia Group, Nowy Styl, Overbury, Pedrali, Stamhuis Groep, Steelcase, Tegometall International Sales, Umdasch ShopFitting Group, Yachtline 1618, Villeroy & Boch, Vitra, VS Mobel.

Highlights:

Contract furniture production in Europe amounts to approximately EUR 13.5 billion, which is primarily destined for the domestic market and exported for around 20% to other target markets, as North America, the Middle East and Asia-Pacific. The main EU manufacturing countries are the UK, Italy, Germany, Poland, and Sweden.

Despite difficult market conditions, the European contract furniture sector has proved its strength performing better than the entire furniture sector in the last 2 years, supported by a high level of integration and market concentration.

Contract furniture destination segments are evolving at a different speed further to a deep transformation of public and commercial furniture demand drivers: Marine and Education represents the fastest growing segments; Hospitality expanded and is considered the most prominent business in the near future; Office and Retail, instead, are progressively slowing down.

TABLE OF CONTENTS (ABSTRACT)

METHODOLOGY & NOTES

- Introduction, Research Tools, Considered segments, and Sample.

EXECUTIVE SUMMARY

- The contract furniture and furnishings sector in Europe. Scenario and Trends

1. THE CONTRACT FURNITURE MARKET IN EUROPE

- 1.1. Contract furniture market evolution: Trends in the European production and consumption of contract furniture

- Production and consumption of contract furniture by country up to 2024

- Production and consumption of contract furniture by destination segment

- Production of contract furniture by product category

- 1.2. Contract furniture and furnishing consumption. Market forecasts for the years 2025 and 2026

- 1.3. The market approach: Turn-key vs soft contract in Europe and Own product vs traded products, Distribution channels

- 1.4. Leading contract furniture groups in Europe: Market concentration and shares on total production

2. CONTRACT FURNITURE MARKET PERFORMANCE BY COUNTRY

- Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Lithuania, Netherlands, Norway, Poland, Portugal, Romania, Spain, Sweden, Switzerland, United Kingdom.

3. CONTRACT FURNITURE MARKET BY SEGMENT

- Demand drivers, market values, and projects in the:

- Retail (mass market & luxury shops)

- Hospitality

- Office spaces

- Restaurants and bars

- Real estate

- Education

- Entertainment

- Marine

- Healthcare

- Airports

4. THE COMPETITIVE LANDSCAPE: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES AND DESTINATION SEGMENTS

- Contract furniture sales in a sample of companies: leading manufacturers in Europe

- Profiles of the leading contract furniture and furnishings companies in Europe

- Sales of contract furniture for selected leading players in the Retail, Hospitality, Office, Restaurants and bars, Real estate, Education, Entertainment, Art & Museum, Healthcare, Marine, and Airports segments

5. THE COMPETITIVE LANDSCAPE: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES BY PRODUCT

- Contract furniture sales of Bathroom furniture and equipment, Bedroom furniture and mattress, Kitchen furniture, Lighting fixtures, Office furniture, Outdoor furniture, Tables and chairs, and Upholstered furniture

6. FINANCIAL ANALYSIS

- Financial figures of 60 companies active in the contract furniture business

7. APPENDIX

- List of Architects and Designers, Hotel Companies, Trade exhibitions and Manufacturers