|

市場調査レポート

商品コード

1667207

RTA (組み立て式) 家具の欧州市場The European Market for RTA Furniture |

||||||

|

|||||||

| RTA (組み立て式) 家具の欧州市場 |

|

出版日: 2025年03月03日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 141 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

ハイライト

RTA (組み立て式) 家具は、欧州の家具市場において重要性を増しており、総消費量の平均20%以上を占めています。

その重要性の要因のひとつはeコマースの急速な拡大で、欧州のRTA家具市場全体の15%を占めると推定されています。これは、純粋なeリテーラーによるオンライン販売、マーケットプレース、実店舗の家具小売店などを含む横断的なチャネルです。オンライン販売へのシフトは、DIY小売業者にも利益をもたらしています。オンライン需要の高まりを受けて、RTA家具メーカーは、より軽量でコンパクトなデザインを開発し、梱包数を合理化し、迅速な配送を確保することで、製品と梱包の両面から供給を再構築しています。

当レポートでは、欧州のRTA (組み立て式) 家具の市場を調査し、地域および主要国における製造量・消費量の推移・予測、輸出入の動向、各種製品タイプ・補助材料・仕上げの観点から見た供給の特徴、各国の競合情勢、流通システムの分析などをまとめています。

目次 (要約)

調査手法・注記

第1章 エグゼクティブサマリー:RTA (組み立て式) 家具の欧州市場の概要

- 製造・消費の推移

- 欧州におけるRTA家具の製造・消費:国別内訳

第2章 欧州におけるRTA家具の消費

- 市場の進化・データ:国別

- RTA家具の消費量

- 家具総消費量に対するRTA家具消費量

- RTA家具市場:2025年と2026年の予測

- RTA家具の輸入

- 輸入浸透率:国別

第3章 欧州におけるRTA家具の製造

- 市場の進化・データ:国別

- RTA家具の製造量

- 家具総製造量に対するRTA家具製造量

- RTA家具の輸出

- 輸出動向:国別

第4章 競合システム:欧州最大のRTA家具メーカー

- 進化と企業の戦略

- 主要RTA家具メーカー

- 上位メーカー:製造量別

- 主要メーカーのM&A取引

- 主要輸出業者

- 輸出量でトップのRTA家具メーカー

- RTA家具業界での雇用

第5章 供給構造:製品・材料・仕上げ

- 製品タイプ

- 製品タイプ別内訳:リビングルーム、寝室、子供用家具、テーブルと椅子、キッチン家具、バスルーム家具、オフィス家具、その他

- サンプルメーカーにおけるRTA家具製造:製品別

- 補助材料

- 補助材料別内訳:無垢材、木質パネル、ハニカムパネル、その他

- サンプルメーカーにおけるRTA家具製造の補助材料別内訳

- 仕上げ:熱可塑性フォイル/シート、塗装/ラッカー仕上げ、ラミネート加工 (HPL、CPL)、メラミン化粧板、その他

- サンプルメーカーにおけるRTA家具製造の仕上げ別の内訳

第6章 流通チャネル

- RTA家具市場における流通チャネル

- 流通チャネル別内訳:組織化専門流通、DIY、eコマース、その他)

- サンプルメーカーにおけるR流通チャネル別の売上内訳

- 欧州の主要RTA家具小売業者のプロファイル

第7章 欧州のRTA家具産業:上位15カ国

- ベルギー、チェコ共和国、デンマーク、フランス、ドイツ、イタリア、リトアニア、オランダ、ノルウェー、ポーランド、ルーマニア、スロバキア、スペイン、スウェーデン、英国

各国について:

- RTA家具製造量と家具総量に対する消費量、欧州平均との比較

- マクロ経済指標

- 競合システム:主要なRTA家具メーカー、市場シェア (ノルウェーとオランダを除く)、短いプロファイル

- 流通システム:流通チャネル別の市場内訳 (リトアニア、ルーマニア、スロバキアを除く) と総売上別の主要RTA家具小売業者

第8章 欧州のその他のRTA家具メーカー

付録:記載メーカー一覧

The CSIL report "The European market for RTA furniture" offers a detailed analysis of the ready-to-assemble (RTA) furniture sector in Europe, with a focus on 15 countries (Belgium, Czech Republic, Denmark, France, Germany, Italy, Lithuania, Netherlands, Norway, Poland, Romania, Slovakia, Spain, Sweden, United Kingdom) selected by their representativeness in terms of production and consumption of RTA furniture within Europe.

This report aims to provide information on the following topics:

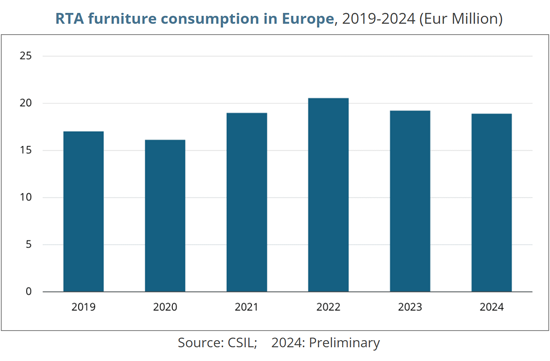

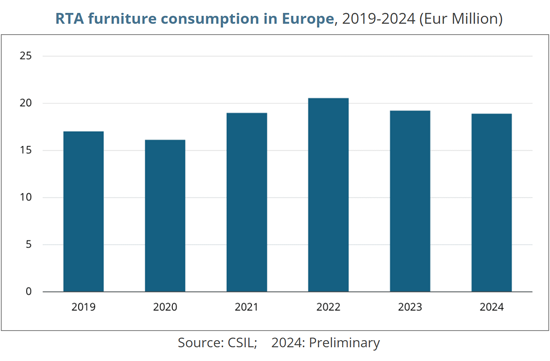

- The value of the RTA furniture consumption and production (2019-2024) in each market and in Europe

- The main supply features of the industry in terms of product type, support materials, finishing

- The main features shaping the competitive system of each country: leading manufacturers for RTA furniture production, sector concentration, mergers & acquisitions operations

- The analysis of the distribution system for RTA furniture: breakdown of the market by distribution channels and listing of leading RTA furniture retailers (large-scale furniture distribution, DIY, e-commerce, non-specialized distribution)

STRUCTURE OF THE REPORT

The first part of the study shows the main sector figures of the European RTA furniture industry (production, consumption, exports, imports values), highlighting the most important features of the industry in terms of competitive system and distribution.

Production and consumption of RTA furniture in Europe:

- The value of the RTA furniture consumption from 2019 to 2024, and an overview of the European RTA furniture market through tables, graphs, and maps for Europe and by country.

- Forecasts for RTA furniture consumption in 2025 and 2026

- Value of the European RTA furniture production (2019 and 2024) and by country.

The competitive landscape analysis identifies and analyses the Top 50 European RTA furniture manufacturers, ranked by values of RTA furniture turnover, exports, and the number of employees. A list of leading players' major M&A operations from 2003 to 2025 is also provided. Profiles of the leading 20 RTA furniture manufacturers are also included.

The supply structure analysis deals with the type of products produced by the European RTA furniture manufacturers, with tables and information on companies operating in each segment:

- product segment (Living room, Bedrooms, Kids Furniture, Tables and chairs, Kitchen Furniture, Bathroom Furniture, Office Furniture, Other)

- support materials (Solid wood, Wood-based panels, Honeycomb panels, Other)

- finishings (Thermoplastic foil/sheets, Painted / Lacquered, Laminated -HPL, CPL-, Melamine faced chipboard, Other)

The distribution channels analysis includes a breakdown of the European RTA furniture market by distribution channel (large-scale furniture distribution, DIY, e-commerce, non-specialized distribution), with profiles of the main RTA furniture retailers in Europe (Web, Group, Activity, Product specialization, Furniture retail brands, Retailing format, Key figures and Revenues, Group information).

COUNTRY ANALYSIS

For the Top 15 countries for the RTA furniture industry (Belgium, Czech Republic, Denmark, France, Germany, Italy, Lithuania, Netherlands, Norway, Poland, Romania, Slovakia, Spain, Sweden, United Kingdom):

- RTA furniture production and consumption values (2019-2024)

- Macroeconomic indicators

- Rankings of the leading RTA furniture manufacturers (excluding Norway and Netherlands)

- Short Profiles of the leading players (Web, Activity, Product portfolio, Manufacturing plants)

- Distribution system: breakdown of the RTA furniture market by distribution channel (excluding Lithuania, Romania, Slovakia)

- Rankings of leading RTA furniture retailers by total turnover

Around 230 RTA furniture manufacturers are considered in the report.

TERMINOLOGY AND PRODUCTS

By RTA furniture we mean the group of furnishing products which, according to the country of reference, are defined as flat-pack, ready-to-assemble (RTA), knockdown (KD), DIY (do it yourself), self-assembly or kit furniture that comes in flat-packs and includes all the hardware and instructions necessary for assembly.

Considered products: Living/dining room furniture (including sets for living/dining room, bookshelves, tables, and chairs); bedroom furniture; children furniture; furniture for office/home office; kitchen furniture; other furniture (occasional furniture, bathroom furniture, outdoor furniture, etc.). Soft furniture (upholstered furniture and mattresses) is excluded.

GEOGRAPHICAL COVERAGE

European Union (27) +UK+NO+CH with detailed analysis for 15 countries (Belgium, Czech Republic, Denmark, France, Germany, Italy, Lithuania, Netherlands, Norway, Poland, Romania, Slovakia, Spain, Sweden, United Kingdom)

THROUGH THIS STUDY, CSIL GIVES AN ANSWER TO THE FOLLOWING QUESTIONS:

- What is the RTA furniture market size and how has this segment developed in Europe?

- What are the leading manufacturers of RTA furniture in Europe?

- How the supply system for the flat pack furniture industry is structured?

- What are the main channels and the leading RTA furniture retailers in Europe?

Selected companies

Among the considered companies: 3B, Alsapan, BRW Black Red White, Burstadt, Composad, Crown Products, Fabryki Mebli Forte, Friul Intagli, Gautier, Gyllensvaans Mobler, HTH Kokkenner, IKEA, Kvik, Media Profili, Meubles Demeyere, Nolte Mobel, P3G Parisot, Rauch Mobelwerke, SBA Baldu, Stokke, Szynaka Meble, Tvilum, Vivonio.

Highlights:

Ready-to-assemble (RTA) furniture is gaining importance within the European furniture market, covering on average over 20% of the total consumption.

One of the key factors contributing to its relevance is the rapid expansion of e-commerce, which accounts for an estimated 15% of the total RTA furniture market in Europe. This is a transversal channel that includes online sales of pure e-tailers, marketplaces, and brick-and-click furniture retailers. The shift toward online sales is also benefiting DIY retailers. In response to rising online demand, RTA furniture manufacturers have re-engineered their supply both in terms of products and packaging by developing lighter, more compact designs, streamlining the number of packages, and ensuring rapid delivery.

Table of Contents (Abstract)

Methodology and Notes

1. Executive Summary: The European market for Ready-to-Assemble (RTA) Furniture figures at a glance

- RTA furniture production and consumption. Historical series 2019-2024

- RTA furniture production and consumption in Europe. Breakdown by countries

2. Consumption of RTA furniture in Europe

- 2.1. RTA Furniture market evolution and figures by country

- Consumption of RTA furniture by European Country

- RTA furniture consumption on total furniture consumption by Country

- 2.2. RTA Furniture Market: Forecasts 2025 and 2026

- 2.3. RTA furniture imports

- Import penetration of RTA furniture in Europe ane by country

3. Production of RTA furniture in Europe

- 3.1. RTA Furniture production evolution and figures by country

- Production of RTA furniture by European Country

- RTA furniture production on total furniture production in Europe by country

- 3.2. RTA furniture exports

- Export orientation of RTA furniture by country

4. The competitive system. The largest RTA Furniture manufacturers in Europe

- 4.1. Evolution and companies' strategies

- 4.2. Leading RTA furniture manufacturers

- Leading RTA furniture manufacturers by production

- Merger&acquisitions deals of leading RTA furniture manufacturers

- 4.3. Leading RTA furniture exporters

- Leading RTA furniture manufacturers by exports

- 4.4 Employment in the RTA furniture industry

5. The Supply structure: Products, Materials and Finishings

- 5.1. Product type

- RTA furniture production breakdown by product type (Living room, Bedrooms, Kids Furniture, Tables and chairs, Kitchen Furniture, Bathroom Furniture, Office Furniture, Other)

- RTA furniture production by product in a sample of manufacturers

- 5.2. Support materials

- RTA furniture production breakdown by main support material (Solid wood, Wood-based panels, Honeycomb panels, Other)

- RTA furniture production breakdown by main support material in a sample of manufacturers

- 5.3. Finishing (Thermoplastic foil/sheets, Painted / Lacquered, Laminated -HPL, CPL-, Melamine faced chipboard, Other finiture)

- RTA furniture. Breakdown of production by finishing in a sample of manufacturers

6. Distribution channels

- 6.1. Distribution channels in the RTA furniture market

- RTA furniture consumption breakdown by distribution channel (Organized specialist distribution, DIY, E-commerce, Other)

- RTA furniture breakdown of sales by distribution channel in a sample of manufacturers

- 6.2. Profiles of leading RTA Furniture Retailers in Europe

7. The Top 15 Countries in Europe for the RTA furniture industry (Belgium, Czech Republic, Denmark, France, Germany, Italy, Lithuania, Netherlands, Norway, Poland, Romania, Slovakia, Spain, Sweden, United Kingdom)

For each Country:

- RTA furniture production and consumption on total furniture and comparison with the European average

- Macroeconomic indicators

- Competitive system: selected leading RTA furniture manufacturers, market shares (excluding Norway and the Netherlands) and short profiles

- Distribution system: breakdown of the RTA furniture market by distribution channel (excluding Lithuania, Romania, Slovakia) and leading RTA furniture retailers by total turnover