|

|

市場調査レポート

商品コード

1854885

マットレス業界におけるeコマースE-commerce in the Mattress Industry |

||||||

|

|||||||

| マットレス業界におけるeコマース |

|

出版日: 2025年10月28日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 131 Pages

納期: 即日から翌営業日

|

概要

当レポートでは、世界3地域 (北米、欧州、アジア太平洋) に焦点を当てたオンラインマットレス市場の詳細な分析、同分野の最新データ・統計を提供しています。

本レポートが答える主な質問:

- 世界のeコマースマットレス市場の現状は?

- 2020年から2025年にかけて、オンラインマットレス産業はどのように進化したか?

- 北米、欧州、アジア太平洋地域におけるオンラインマットレス販売の主要動向は何か?

- オンラインでマットレスを販売している主要企業はどこか?

- 大手マットレス企業は、eコマースの動向にどのように対応しているか?

- オンラインでマットレスを販売する際の主な課題は何か?

- 大手企業は、eコマースでの存在感を高めるためにどのような投資を行っているか?

主要企業

|

|

ハイライト

世界のeコマースマットレスの市場規模は現在150億米ドルを超え、世界全体のマットレス市場の約4分の1を占めています。製造技術の進歩、革新的な小売戦略、オンライン購入を好む消費者嗜好の変化などにより、このセグメントは近年著しい成長を遂げています。

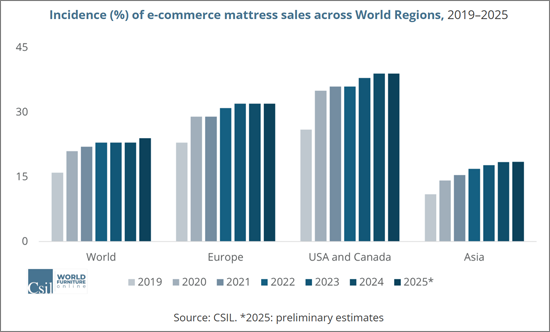

地域によって成長パターンは異なるものの、eコマースの浸透はすでに多くの地域で定着しています。具体的には、北米および欧州ではパンデミック期のピーク以降、安定的な成長を維持している一方で、アジア太平洋地域では引き続き拡大傾向にあり、特にインドではオンラインマットレス市場の急成長が顕著です。

この分野で見られる顕著な動向として、実店舗を持つ小売業者とDTC (Direct to Consumer:消費者直販) ブランドの双方が、オムニチャネル戦略を採用している点が挙げられます。オンライン発のブランドはショールームやポップアップストアを開設し、逆に従来型の小売業者はeコマース分野を強化して、オンラインとオフラインのシームレスな統合を進めています。

目次 (要約)

イントロダクション

エグゼクティブサマリー

- マットレス業界におけるeコマースの業績と市場特性、2025年上半期の企業洞察

第1章 マットレス市場におけるeコマース:世界市場の概要

- 世界のマットレス市場の概要:マットレスの消費量・国別消費量・国際貿易

- マットレス市場におけるeコマース:国/地域別の販売・eコマース販売・eコマース販売のシェア

- eコマースビジネスモデルの分類

- Eテーラー (純粋なオンライン専業小売業者)

- ブリック&クリック企業 (Brick-and-Click) :実店舗とオンライン店舗を併せ持つ販売業者

- 家具専門店以外のチェーン店

- オンラインマットレス企業 (消費者直販)

- マットレスメーカーの自社オンライン販売:メーカーが自社ウェブサイトを通じて販売

第2章 オンラインマットレスビジネスの特徴

- ビジネスの進化と組織

- 配送オプション

- サービスと返品方針

- ベッド・イン・ア・ボックス (Bed-in-a-Box) モデル

- 産業サプライヤーの役割

- 支払い方法

第3章 米国とカナダのeコマースマットレス市場

- 小売およびeコマースの売上:概要と需要促進要因

- 米国とカナダにおけるeコマースマットレス販売

- 競合:サンプル企業の流通チャネル別オンライン販売と米国およびカナダの大手小売業者別オンライン販売

- eコマース小売業者 (Eテーラーおよびオンライン販売を行う小売業者)

- オンラインマットレス会社 (D2C) :主要オンライン企業の供給特性比較およびツインサイズ価格比較

- マットレスメーカーのオンライン販売動向

第4章 欧州のeコマースマットレス市場:フランス、ドイツ、イタリア、スペイン、英国

- 小売およびeコマースの売上:概要と需要促進要因

- 欧州におけるeコマースマットレス販売

- 競合:サンプル企業の流通チャネル別オンライン販売と欧州の主要小売業者別オンライン販売

- eコマース小売業者 (Eテーラーおよびオンライン販売を行う小売業者)

- オンラインマットレス会社 (D2C) :主要オンライン企業の供給特性比較およびツインサイズ価格比較

- マットレスメーカーのオンライン販売動向

第5章 アジア太平洋地域のeコマースマットレス市場:中国、インド、韓国

- 小売およびeコマースの売上:概要と需要促進要因

- アジア太平洋におけるeコマースマットレス販売

- eコマース小売業者 (Eテーラーおよびオンライン販売を行う小売業者)

- オンラインマットレス会社 (D2C)

- マットレスメーカーのオンライン販売動向

第6章 付録:CSILの世界のeコマースマットレス市場の調査結果

- 調査結果:世界のeコマースマットレス市場

第7章 掲載企業

- マットレスのオンライン販売を行う企業リスト:国、小売業態、事業内容、ウェブサイト