|

|

市場調査レポート

商品コード

1597613

ベトナムのコークス&セミコークス輸入:2024-2033年Vietnam Coke & Semi-coke Import Research Report 2024-2033 |

||||||

|

|||||||

| ベトナムのコークス&セミコークス輸入:2024-2033年 |

|

出版日: 2024年11月22日

発行: China Research and Intelligence

ページ情報: 英文 80 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

インフォグラフィックス

ベトナムのコークス&セミコークスの市場規模は、鉄鋼産業の成長とともに着実に増加しています。

世界の主要生産国は、中国、インド、ロシア、オーストラリアなどの石炭の豊富な国であり、コークス産業は石炭資源に大きく依存しているため、これらの国から輸出されることが多いです。ベトナムにも石炭資源はありますが、高品質の原料炭や高度な生産技術がないため、国内の鉄鋼や工業のニーズを満たすために主に輸入に頼っています。ベトナムの鉄鋼産業が急速に拡大する中で、高炉用高品質コークスの需要が高まっていますが、国内生産が困難なため、ベトナム市場は輸入に大きく依存しています。

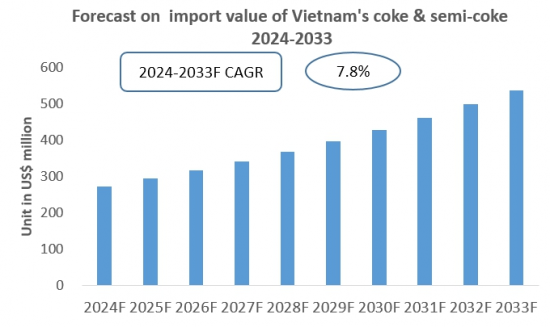

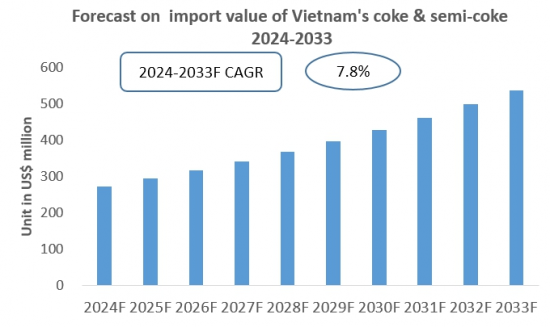

2023年、ベトナムのコークス&セミコークスの輸入総額は約2億5,000万米ドルに達しました。2024年1月から8月にかけて、ベトナムのコークス&セミコークスの輸入額はほぼ2億米ドルに達し、前年同期比で約9%増加しています。ベトナムのコークス&セミコークス市場は今後も成長を続けると予測されています。

全体として、ベトナムの経済成長、工業化の進展、継続的なインフラ整備により、同国のコークス&セミコークスの需要は今後数年間拡大し続けると予測されています。この需要に応じてベトナムのコークス&セミコークスの輸入も増加すると予想されています。

当レポートでは、ベトナムのコークス&セミコークス輸入の動向を調査し、国の概要、輸入額・輸入量・輸入価格などの推移・予測、輸入元の上位国別の詳細分析、主要バイヤーおよびサプライヤーの分析、主な影響因子の分析などをまとめています。

目次

第1章 ベトナムの概要

- 地域

- 経済状況

- 人口統計

- 国内市場

- 輸入市場に参入する外国企業への推奨事項

第2章 ベトナムのコークス&セミコークス輸入の分析 (2021-2024年)

- 輸入規模

- 輸入額と輸入量

- 輸入価格

- 消費量

- 輸入依存度

- 主な輸入元

第3章 ベトナムのコークス&セミコークスの主な輸入元の分析 (2021-2024年)

- 中国

- 輸入量・輸入額の分析

- 平均輸入価格の分析

- 日本

- 輸入量・輸入額の分析

- 平均輸入価格の分析

- シンガポール

- 輸入量・輸入額の分析

- 平均輸入価格の分析

- インドネシア

- 香港

- スイス

第4章 ベトナムのコークス&セミコークス輸入市場の主要サプライヤーの分析 (2021-2024年)

- SUMMIT CRM LTD

- DAICHU CORP

- TRAFIGURA PTE LTD

- その他

- 会社概要

- コークス&セミコークス輸出の分析

第5章 ベトナムのコークス&セミコークス輸入市場における主要輸入業者の分析 (2021-2024年)

- NHA MAY LUYEN PHOI THEP CHI NHANH CONG TY CO PHAN THEP POMINA

- VIET PHAT IMPORT EXPORT TRADING INVESTMENT JSC

- TRUNG THANH(VN) PTE

- その他

- 会社概要

- コークス&セミコークス輸入の分析

第6章 ベトナムのコークス&セミコークス輸入の月次分析 (2021-2024年)

- 月別輸入額・輸入量の分析

- 月平均輸入価格の予測

第7章 ベトナムのコークス&セミコークス輸入に影響を与える主な要因

- 政策

- 現在の輸入政策

- 輸入政策の動向予測

- 経済

- 市場価格

- 生産能力の成長動向

- 技術

第8章 ベトナムのコークス&セミコークスの輸入予測:2024-2033年

Coke and semi-coke are solid carbonaceous products obtained through the carbonization or pyrolysis of coal at high temperatures. Coke is primarily used in the steel industry as a fuel and reducing agent in blast furnaces, while semi-coke is often used in energy production or the chemical industry. Unlike other coal products, coke is valued for its low sulfur content, high fixed carbon, and low volatile matter, which allow it to provide stable heat and excellent mechanical strength at high temperatures.

INFOGRAPHICS

The coke industry relies on upstream sectors such as the extraction and processing of high-quality coking coal, while downstream applications include steelmaking, foundries, and chemical industries. Coke is essential in steelmaking, as it helps reduce iron ore into iron in blast furnaces and is also used in producing chemical products like calcium carbide and syngas. Semi-coke, with lower density and volatile matter, is typically used in power stations as a fuel or in gas production. The coke market fluctuates with changes in global steel demand and energy industry conditions. According to CRI, Vietnam's coke and semi-coke market size has been steadily increasing alongside its growing steel industry.

Major global producers are located in coal-rich countries such as China, India, Russia, and Australia, and exporters often come from these countries due to the coke industry's heavy reliance on coal resources. Although Vietnam has coal resources, it lacks high-quality coking coal and advanced production technology, relying primarily on imports to meet domestic steel and industrial needs. CRI reports that, with Vietnam's rapidly expanding steel industry, there is a growing demand for high-quality metallurgical coke for blast furnace use, which cannot be locally produced, making the Vietnamese market highly dependent on imports.

CRI data shows that in 2023, Vietnam's total coke and semi-coke imports reached approximately USD 250 million. From January to August 2024, Vietnam's coke and semi-coke imports had nearly reached USD 200 million, an increase of about 9% over the same period in the previous year. CRI forecasts that Vietnam's coke and semi-coke market will continue growing in the coming years.

Based on CRI analysis, between 2021 and 2024, Vietnam's primary sources for coke and semi-coke imports have included China, Japan, and Singapore, with major suppliers such as Summit CRM Ltd, Daichu Corp, and Trafigura Pte Ltd. The main Vietnamese importers of coke and semi-coke are steel industry manufacturers and distributors, with major companies including Nha may luyen phoi thep (a branch of Pomina Steel Corporation), Viet Phat Import Export Trading Investment JSC, and Trung Thanh (VN) Pte, according to CRI.

Overall, with Vietnam's economic growth, advancing industrialization, and ongoing infrastructure improvements, the country's demand for coke and semi-coke is projected to continue expanding over the next few years. CRI expects Vietnam's imports of coke and semi-coke to increase in response to this demand.

Topics covered:

The Import and Export of Coke & Semi-coke in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Coke & Semi-coke in Vietnam (2021-2024)

Total Import Value and Percentage Change of Coke & Semi-coke in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Coke & Semi-coke in Vietnam (2024)

Total Import Value and Percentage Change of Coke & Semi-coke in Vietnam (2024)

Average Import Price of Coke & Semi-coke in Vietnam (2021-2024)

Top 10 Sources of Coke & Semi-coke Imports in Vietnam and Their Supply Volume

Top 10 Suppliers in the Import Market of Coke & Semi-coke in Vietnam and Their Supply Volume

Top 10 Importers of Coke & Semi-coke in Vietnam and Their Import Volume

How to Find Distributors and End Users of Coke & Semi-coke in Vietnam

How Foreign Enterprises Enter the Coke & Semi-coke Market of Vietnam

Forecast for the Import of Coke & Semi-coke in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Coke & Semi-coke Imports Market

2 Analysis of Coke & Semi-coke Imports in Vietnam (2021-2024)

- 2.1 Import Scale of Coke & Semi-coke in Vietnam

- 2.1.1 Import Value and Volume of Coke & Semi-coke in Vietnam

- 2.1.2 Import Prices of Coke & Semi-coke in Vietnam

- 2.1.3 Apparent Consumption of Coke & Semi-coke in Vietnam

- 2.1.4 Import Dependency of Coke & Semi-coke in Vietnam

- 2.2 Major Sources of Coke & Semi-coke Imports in Vietnam

3 Analysis of Major Sources of Coke & Semi-coke Imports in Vietnam (2021-2024)

- 3.1 China

- 3.1.1 Analysis of Vietnam's Coke & Semi-coke Import Volume and Value from China

- 3.1.2 Analysis of Average Import Price

- 3.2 Japan

- 3.2.1 Analysis of Vietnam's Coke & Semi-coke Import Volume and Value from Japan

- 3.2.2 Analysis of Average Import Price

- 3.3 Singapore

- 3.3.1 Analysis of Vietnam's Coke & Semi-coke Import Volume and Value from Singapore

- 3.3.2 Analysis of Average Import Price

- 3.4 Indonesia

- 3.5 Hong Kong

- 3.6 Switzerland

4 Analysis of Major Suppliers in the Import Market of Coke & Semi-coke in Vietnam (2021-2024)

- 4.1 SUMMIT CRM LTD

- 4.1.1 Company Introduction

- 4.1.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.2 DAICHU CORP

- 4.2.1 Company Introduction

- 4.2.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.3 TRAFIGURA PTE LTD

- 4.3.1 Company Introduction

- 4.3.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.4 Exporter 4

- 4.4.1 Company Introduction

- 4.4.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.5 Exporter 5

- 4.5.1 Company Introduction

- 4.5.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.6 Exporter 6

- 4.6.1 Company Introduction

- 4.6.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.7 Exporter 7

- 4.7.1 Company Introduction

- 4.7.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.8 Exporter 8

- 4.8.1 Company Introduction

- 4.8.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.9 Exporter 9

- 4.9.1 Company Introduction

- 4.9.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.10 Exporter 10

- 4.10.1 Company Introduction

- 4.10.2 Analysis of Coke & Semi-coke Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Coke & Semi-coke in Vietnam (2021-2024)

- 5.1 NHA MAY LUYEN PHOI THEP CHI NHANH CONG TY CO PHAN THEP POMINA

- 5.1.1 Company Introduction

- 5.1.2 Analysis of Coke & Semi-coke Imports

- 5.2 VIET PHAT IMPORT EXPORT TRADING INVESTMENT JSC

- 5.2.1 Company Introduction

- 5.2.2 Analysis of Coke & Semi-coke Imports

- 5.3 TRUNG THANH(VN) PTE

- 5.3.1 Company Introduction

- 5.3.2 Analysis of Coke & Semi-coke Imports

- 5.4 Importer 4

- 5.4.1 Company Introduction

- 5.4.2 Analysis of Coke & Semi-coke Imports

- 5.5 Importer 5

- 5.5.1 Company Introduction

- 5.5.2 Analysis of Coke & Semi-coke Imports

- 5.6 Importer 6

- 5.6.1 Company Introduction

- 5.6.2 Analysis of Coke & Semi-coke Imports

- 5.7 Importer 7

- 5.7.1 Company Introduction

- 5.7.2 Analysis of Coke & Semi-coke Imports

- 5.8 Importer 8

- 5.8.1 Company Introduction

- 5.8.2 Analysis of Coke & Semi-coke Imports

- 5.9 Importer 9

- 5.9.1 Company Introduction

- 5.9.2 Analysis of Coke & Semi-coke Imports

- 5.10 Importer 10

- 5.10.1 Company Introduction

- 5.10.2 Analysis of Coke & Semi-coke Imports

6. Monthly Analysis of Coke & Semi-coke Imports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Import Value and Volume

- 6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Coke & Semi-coke Imports in Vietnam

- 7.1 Policy

- 7.1.1 Current Import Policies

- 7.1.2 Trend Predictions for Import Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Coke & Semi-coke Production Capacity in Vietnam

- 7.3 Technology