|

市場調査レポート

商品コード

1578766

ベトナムの希土類永久磁石輸出:2024-2033年Vietnam Rare Earth Permanent Magnets Export Research Report 2024-2033 |

||||||

|

|||||||

| ベトナムの希土類永久磁石輸出:2024-2033年 |

|

出版日: 2024年10月24日

発行: China Research and Intelligence

ページ情報: 英文 80 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

インフォグラフィックス

CRIによると、希土類永久磁石の上流部門には主に希土類鉱石の採掘と加工、特にネオジム、サマリウム、コバルトなどの希土類金属の製錬と精製が含まれます。川下分野には、電子機器、自動車、風力発電、医療機器、家電製品など幅広い応用分野があります。電気自動車や風力発電の分野では、希土類永久磁石はモーターの効率を大幅に向上させ、エネルギー消費を削減する重要な部品です。また、スマートフォンやノートパソコンなどの最新の電子消費財では、より軽量でコンパクトな設計を実現するために希土類永久磁石が必要とされています。

産業界では、希土類永久磁石はさまざまな電動機や発電機、特に電気エネルギーと運動エネルギーの効率的な変換が不可欠な電気自動車、風力タービン、産業用オートメーション機器に広く使用されています。さらに、磁気浮上式鉄道、ロボット工学、航空宇宙などのハイテク分野や、スピーカー、MRI装置などの民生・医療機器にも使用されています。希土類永久磁石は、その高い性能と汎用性により、多くの主要技術機器に不可欠な部品となっています。

ベトナムの希土類永久磁石産業は中国や日本ほど発展していませんが、豊富な鉱物資源と費用対効果の高い労働力により、徐々に希土類磁石の輸出国になりつつあります。CRIは、ベトナムには推定2,200万トンの希土類資源があり、これは世界の既知埋蔵量の19%を占め、同国の希土類永久磁石産業に十分な原材料を提供すると分析しています。さらに、ベトナム政府は外国からの投資を積極的に誘致し、ハイテク産業の発展を促進しているため、ベトナムにおける希土類永久磁石の生産に有利な政策環境が整っています。その結果、ベトナムは徐々に希土類資源の重要な世界的供給国になりつつあり、大量の希土類加工原料も輸出しています。

さらに、ベトナムの他国との自由貿易協定は、輸出市場の拡大、輸出関税の削減、国際市場における製品の競合力強化に役立っています。CRIによると、ベトナムの良好な政策環境、強力な生産能力、柔軟な輸出戦略により、ベトナムの希土類永久磁石産業は、世界の電力・電子機器サプライチェーンにおいてますます重要な役割を担うようになっています。

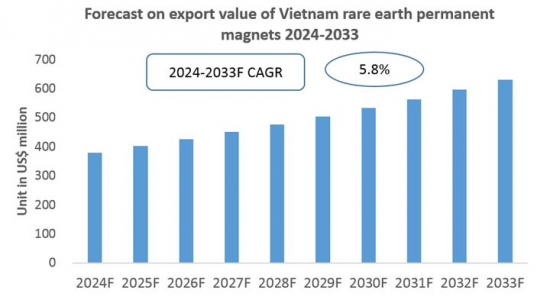

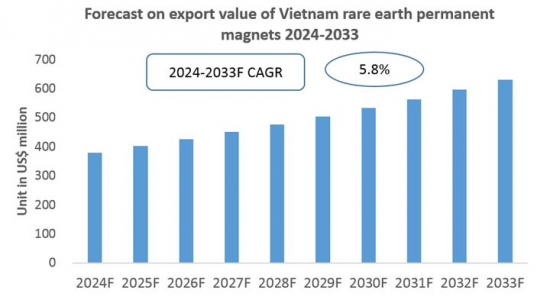

CRIのデータによると、ベトナムの希土類永久磁石の総輸出額は2023年に約3億7,000万米ドルに達し、増加傾向にあります。2024年1月から7月にかけての希土類永久磁石の輸出額はすでに2億米ドルを超えています。

全体として、世界の希土類永久磁石産業は、特に再生可能エネルギー部門の急成長に伴い、幅広い発展の見通しを持っています。電気自動車や風力タービンの需要は、永久磁石市場の拡大をさらに促進するでしょう。CRIは、ベトナムの希土類永久磁石産業の発展に伴い、ベトナムからの輸出は今後数年間成長を続けると予測しています。

当レポートでは、ベトナムの希土類永久磁石輸出の動向を調査し、国の概要、輸出入額・輸出量・輸出価格などの推移・予測、輸出先の上位国別の詳細分析、主要バイヤーおよびサプライヤーの分析、木製家具輸出への主な影響因子の分析などをまとめています。

目次

第1章 ベトナムの概要

- 地域

- 経済状況

- 人口統計

- 国内市場

- 希土類永久磁石輸出市場に参入する外国企業への推奨事項

第2章 ベトナムの希土類永久磁石輸出の分析 (2021~2024年)

- 輸出規模

- 輸出額

- 輸出価格

- 輸出量

- ベトナムの希土類永久磁石の輸出依存度

- 希土類永久磁石の主要輸出先

第3章 ベトナムの希土類永久磁石の主要輸出先の分析 (2021~2024年)

- 日本

- 輸出額・輸出量の分析

- 平均輸出価格の分析

- フィリピン

- 輸出額・輸出量の分析

- 平均輸出価格の分析

- マレーシア

- 輸出額・輸出量の分析

- 平均輸出価格の分析

- 中国

- ドイツ

- タイ

第4章 ベトナムの希土類永久磁石輸出市場における主要バイヤーの分析 (2021-2024年)

- SHIN-ETSU CHEMICAL CO, LTD

- UNION MATERIALS CORPORATION

- KOREA MIKASA CORPORATION

- その他

- 会社概要

- 希土類永久磁石輸入の分析

第5章 ベトナムの希土類永久磁石輸出市場における主要サプライヤーの分析 (2021-2024年)

- SHIN-ETSU VIETNAM

- MAGTRON VINA

- UNION MATERIALS VIETNAM

- その他

- 会社概要

- 希土類永久磁石輸出の分析

第6章 ベトナムの希土類永久磁石輸出の月次分析 (2021-2024年)

- 月間輸出額と輸出量の分析

- 月平均輸出価格の予測

第7章 ベトナムの希土類永久磁石輸出に影響を与える主な要因

- 政策

- 現在の輸出政策

- 輸出政策の動向予測

- 経済

- 市場価格

- 生産能力の成長動向

- 技術

第8章 ベトナムの希土類永久磁石の輸出予測 (2024~2033年)

免責事項

サービス保証

List of Charts

- Chart 2021-2024 Export Value and Volume of Rare Earth Permanent Magnets in Vietnam

- Chart 2021-2024 Average Export Price of Rare Earth Permanent Magnets in Vietnam

- Chart 2021-2024 Export Dependency of Rare Earth Permanent Magnets in Vietnam

- Chart Top 10 Export Destinations for Rare Earth Permanent Magnets in Vietnam (2021-2024)

- Chart Top 10 Export Destinations for Rare Earth Permanent Magnets in Vietnam (2022)

- Chart Top 10 Export Destinations for Rare Earth Permanent Magnets in Vietnam (2023)

- Chart Top 10 Export Destinations for Rare Earth Permanent Magnets in Vietnam (2024)

- Chart Top 10 Buyers of Rare Earth Permanent Magnets Exports from Vietnam (2021-2024)

- Chart Top 10 Buyers of Rare Earth Permanent Magnets Exports from Vietnam (2022)

- Chart Top 10 Buyers of Rare Earth Permanent Magnets Exports from Vietnam (2023)

- Chart Top 10 Buyers of Rare Earth Permanent Magnets Exports from Vietnam (2024)

- Chart Volume and Value of Rare Earth Permanent Magnets Exports from Vietnam to Japan (2021-2024)

- Chart Volume and Value of Rare Earth Permanent Magnets Exports from Vietnam to the Philippines (2021-2024)

- Chart Volume and Value of Rare Earth Permanent Magnets Exports from Vietnam to Malaysia (2021-2024)

- Chart Volume and Value of Rare Earth Permanent Magnets Exports from Vietnam to China (2021-2024)

- Chart Top 10 Exporters of Rare Earth Permanent Magnets in Vietnam (2021-2024)

- Chart Top 10 Exporters of Rare Earth Permanent Magnets in Vietnam (2022)

- Chart Top 10 Exporters of Rare Earth Permanent Magnets in Vietnam (2023)

- Chart Top 10 Exporters of Rare Earth Permanent Magnets in Vietnam (2024)

- Chart Forecast for the Export of Rare Earth Permanent Magnets in Vietnam (2024-2033)

Rare earth permanent magnets are high-performance magnetic materials made from rare earth elements, characterized by their extremely strong magnetism and excellent resistance to demagnetization. They are among the most important permanent magnet materials globally and are widely used in modern industry.

INFOGRAPHICS

According to CRI, the upstream sectors of rare earth permanent magnets primarily include the mining and processing of rare earth ores, especially the smelting and purification of rare earth metals such as neodymium, samarium, and cobalt. Downstream sectors encompass a wide range of application fields, including electronic devices, automobiles, wind power generation, medical equipment, and household appliances. In the electric vehicle and wind power generation sectors, rare earth permanent magnets are key components that can significantly improve motor efficiency and reduce energy consumption. Modern electronic consumer products such as smartphones and laptops also require rare earth permanent magnets to achieve lighter and more compact designs.

In industry, rare earth permanent magnets are widely used in various electric motors and generators, particularly in electric vehicles, wind turbines, and industrial automation equipment, where efficient conversion of electrical and kinetic energy is essential. Additionally, they are used in high-tech fields including maglev trains, robotics, and aerospace, as well as in consumer and medical devices like speakers and MRI machines. Due to their high performance and versatility, rare earth permanent magnets have become indispensable components in many key technological devices.

According to CRI, the major global producers of rare earth permanent magnets include China's JL MAG, Ningbo Yunsheng, and Zhong Ke San Huan, as well as Japan's Hitachi Metals and TDK.

Although Vietnam's rare earth permanent magnet industry is not as developed as that of China or Japan, Vietnam is gradually becoming an exporter of rare earth magnets due to its abundant mineral resources and cost-effective labor. CRI has analyzed that Vietnam has an estimated 22 million tons of rare earth resources, accounting for 19% of the world's known reserves, providing ample raw materials for the country's rare earth permanent magnet industry. Additionally, the Vietnamese government actively attracts foreign investment and promotes the development of high-tech industries, creating a favorable policy environment for the production of rare earth permanent magnets in Vietnam. As a result, Vietnam is gradually becoming an important global supplier of rare earth resources and is also exporting a large amount of processed rare earth materials.

Furthermore, Vietnam's free trade agreements with other countries help expand its export markets, reduce export tariffs, and increase the competitiveness of its products in the international market. According to CRI, due to its favorable policy environment, strong production capacity, and flexible export strategies, Vietnam's rare earth permanent magnet industry is becoming an increasingly important part of the global power and electronics supply chain.

CRI data shows that in 2023, Vietnam's total export value of rare earth permanent magnets reached approximately USD 370 million, with a growing trend. From January to July 2024, the export value of rare earth permanent magnets from Vietnam had already exceeded USD 200 million.

According to CRI, between 2021 and 2024, the main export destinations for Vietnam's rare earth permanent magnets were Japan, the Philippines, and Malaysia. Major companies importing rare earth permanent magnets from Vietnam include SHIN-ETSU CHEMICAL CO, LTD and its subsidiaries or partner logistics companies, UNION MATERIALS CORPORATION, and KOREA MIKASA CORPORATION.

Among Vietnam's rare earth permanent magnet exporters, foreign-invested companies dominate, especially subsidiaries of international electronics or chemical companies established in Vietnam. Key exporters of rare earth permanent magnets in Vietnam include SHIN-ETSU VIETNAM, MAGTRON VINA, and UNION MATERIALS VIETNAM.

Overall, the global rare earth permanent magnet industry has broad development prospects, particularly with the rapid growth of the renewable energy sector. The demand for electric vehicles and wind turbines will further drive the expansion of the permanent magnet market. CRI predicts that with the development of Vietnam's rare earth permanent magnet industry, exports from Vietnam are expected to continue growing in the coming years.

Topics covered:

The Import and Export of Rare Earth Permanent Magnets in Vietnam (2021-2024)

Total Export Volume and Percentage Change of Rare Earth Permanent Magnets in Vietnam (2021-2024)

Total Export Value and Percentage Change of Rare Earth Permanent Magnets in Vietnam (2021-2024)

Total Export Volume and Percentage Change of Rare Earth Permanent Magnets in Vietnam (January-July 2024)

Total Export Value and Percentage Change of Rare Earth Permanent Magnets in Vietnam (January-July 2024)

Average Export Price of Rare Earth Permanent Magnets in Vietnam (2021-2024)

Top 10 Export Destinations for Vietnam Rare Earth Permanent Magnets and Their Import Volume

Top 10 Suppliers in the Export Market of Rare Earth Permanent Magnets in Vietnam and Their Export Volume

Top 10 Buyers in the Export Market of Rare Earth Permanent Magnets in Vietnam and Their Import Volume

How to Find International Distributors and End Users of Rare Earth Permanent Magnets in Vietnam

How Foreign Enterprises Enter the Rare Earth Permanent Magnets Export Market of Vietnam

Forecast for the Export of Rare Earth Permanent Magnets in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Rare Earth Permanent Magnets Export Market

2 Analysis of Rare Earth Permanent Magnets Exports in Vietnam (2021-2024)

- 2.1 Export Scale of Rare Earth Permanent Magnets in Vietnam

- 2.1.1 Export Value of Rare Earth Permanent Magnets in Vietnam

- 2.1.2 Export Prices of Rare Earth Permanent Magnets in Vietnam

- 2.1.3 Export Volume of Rare Earth Permanent Magnets in Vietnam

- 2.1.4 Export Dependency of Rare Earth Permanent Magnets in Vietnam

- 2.2 Major Destination for Rare Earth Permanent Magnets Exports in Vietnam

3 Analysis of Major Destination for Rare Earth Permanent Magnets Exports in Vietnam (2021-2024)

- 3.1 Japan

- 3.1.1 Analysis of Vietnam's Rare Earth Permanent Magnets Export Value and Volume to Japan

- 3.1.2 Analysis of Average Export Price

- 3.2 the Philippines

- 3.2.1 Analysis of Vietnam's Rare Earth Permanent Magnets Export Value and Volume to the Philippines

- 3.2.2 Analysis of Average Export Price

- 3.3 Malaysia

- 3.3.1 Analysis of Vietnam's Rare Earth Permanent Magnets Export Value and Volume to Malaysia

- 3.3.2 Analysis of Average Export Price

- 3.4 China

- 3.5 Germany

- 3.6 Thailand

4 Analysis of Major Buyer in the Export Market of Rare Earth Permanent Magnets in Vietnam (2021-2024)

- 4.1 SHIN-ETSU CHEMICAL CO, LTD

- 4.1.1 Company Introduction

- 4.1.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.2 UNION MATERIALS CORPORATION

- 4.2.1 Company Introduction

- 4.2.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.3 KOREA MIKASA CORPORATION

- 4.3.1 Company Introduction

- 4.3.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.4 Importer 4

- 4.4.1 Company Introduction

- 4.4.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.5 Importer 5

- 4.5.1 Company Introduction

- 4.5.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.6 Importer 6

- 4.6.1 Company Introduction

- 4.6.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.7 Importer 7

- 4.7.1 Company Introduction

- 4.7.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.8 Importer 8

- 4.8.1 Company Introduction

- 4.8.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.9 Importer 9

- 4.9.1 Company Introduction

- 4.9.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

- 4.10 Importer 10

- 4.10.1 Company Introduction

- 4.10.2 Analysis of Rare Earth Permanent Magnets Imports from Vietnam

5 Analysis of Major Suppliers in the Export Market of Rare Earth Permanent Magnets in Vietnam (2021-2024)

- 5.1 SHIN-ETSU VIETNAM

- 5.1.1 Company Introduction

- 5.1.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.2 MAGTRON VINA

- 5.2.1 Company Introduction

- 5.2.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.3 UNION MATERIALS VIETNAM

- 5.3.1 Company Introduction

- 5.3.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.4 Exporter 4

- 5.4.1 Company Introduction

- 5.4.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.5 Exporter 5

- 5.5.1 Company Introduction

- 5.5.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.6 Exporter 6

- 5.6.1 Company Introduction

- 5.6.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.7 Exporter 7

- 5.7.1 Company Introduction

- 5.7.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.8 Exporter 8

- 5.8.1 Company Introduction

- 5.8.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.9 Exporter 9

- 5.9.1 Company Introduction

- 5.9.2 Analysis of Rare Earth Permanent Magnets Exports

- 5.10 Exporter 10

- 5.10.1 Company Introduction

- 5.10.2 Analysis of Rare Earth Permanent Magnets Exports

6. Monthly Analysis of Rare Earth Permanent Magnets Exports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Export Value and Volume

- 6.2 Forecast of Monthly Average Export Prices

7. Key Factors Affecting Rare Earth Permanent Magnets Exports in Vietnam

- 7.1 Policy

- 7.1.1 Current Export Policies

- 7.1.2 Trend Predictions for Export Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Rare Earth Permanent Magnets Production Capacity in Vietnam

- 7.3 Technology

8. Forecast for the Export of Rare Earth Permanent Magnets in Vietnam, 2024-2033

Disclaimer

Service Guarantees