|

市場調査レポート

商品コード

1538938

ベトナムの硫酸塩パルプ輸入:2024-2033年Vietnam Sulphate Pulp Import Research Report 2024-2033 |

||||||

|

|||||||

| ベトナムの硫酸塩パルプ輸入:2024-2033年 |

|

出版日: 2024年08月17日

発行: China Research and Intelligence

ページ情報: 英文 80 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

インフォグラフィックス

硫酸塩パルプはその優れた物理的・化学的特性から、世界の紙パルプ産業において重要な地位を占めており、特に高い紙の強度と耐久性が要求される用途で使用されています。アジア太平洋地域の主な生産者には、Chenming PaperやAsia Pacific Resources International Limited (APRIL) などがあり、世界の生産者には、UPM、Stora Enso、International Paper、Canfor Pulpなどがあります。ベトナムの硫酸塩パルプ生産能力は限られており、毎年大量に輸入する必要があります。

最近の動向では、ベトナムの製造業は急速に発展しており、製紙産業とその川下分野である包装、印刷、広告などは市場拡大の可能性を秘めています。CRIによると、ベトナムは年間300万トン以上の紙を消費しており、そのうち包装用紙が60%以上を占めています。今後数年間、ベトナム経済と製造業の発展に伴い、さまざまな種類の紙、特に包装用紙の需要が伸び続け、硫酸塩パルプの輸入量の増加をもたらす見通しです。

CRIによると、ベトナムは国内での製紙原料の大幅な不足に直面しており、輸入に大きく依存しています。ベトナムのほとんどの製紙工場は生産需要を満たすためにパルプを輸入する必要があり、ベトナムは年間50万トン以上のパルプを輸入しています。CRIのデータによると、2023年のベトナムの硫酸塩パルプの輸入総額は約3億米ドルを記録しました。また、同データによると、2024年1月から5月にかけての輸入総額は1億米ドルを超えており、市場の需要は伸び続けています。

当レポートでは、ベトナムの硫酸塩パルプ輸入の動向を調査し、国の概要、輸入額・輸入量・輸入価格の推移・予測、輸入元の上位国別の詳細分析、主要バイヤーおよびサプライヤーの分析、ドリアン輸出への主な影響因子の分析などをまとめています。

目次

第1章 ベトナムの概要

- 地域

- 経済状況

- 人口統計

- 国内市場

- パルプ、紙、紙製品市場に参入する外国企業への推奨事項

第2章 ベトナムの硫酸塩パルプ輸入の分析 (2021-2024年)

- 輸入規模

- 輸入額・輸入量

- 輸入価格

- 消費量

- 輸入依存度

- 輸入の主な供給源

第3章 ベトナムの硫酸塩パルプの主な供給国の分析 (2021-2024年)

- インドネシア

- 輸入額・輸入量の分析

- 平均輸入価格の分析

- 米国

- 輸入額・輸入量の分析

- 平均輸入価格の分析

- 香港

- 輸入額・輸入量の分析

- 平均輸入価格の分析

- カナダ

- ブラジル

- 日本

第4章 ベトナムの硫酸塩パルプ輸入市場における主要サプライヤーの分析 (2021-2024年)

- Asia Pulp & Paper (APP)

- EKMAN PULP AND PAPER LIMITED

- APRIL Group

第5章 ベトナムの硫酸塩パルプ輸入市場における主要輸入業者の分析 (2021-2024年)

- BACGIANG IMPORT - EXPORT JOINT STOCK COMPANY

- NITTOKU VIETNAM CO, LTD.

- IMEXCO BACGIANG

第6章 ベトナムの硫酸塩パルプ輸入の月次分析 (2021-2024年)

- 月別輸入額・輸入量の分析

- 月平均輸入価格の予測

第7章 ベトナムの硫酸塩パルプ輸入に影響を与える主な要因

- 政策

- 現在の輸入政策

- 輸入政策の動向予測

- 経済

- 市場価格

- 硫酸塩パルプ生産能力の成長動向

- 技術

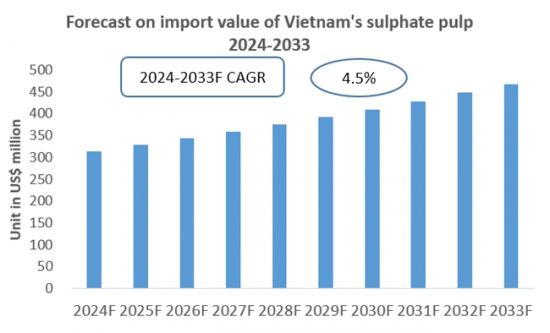

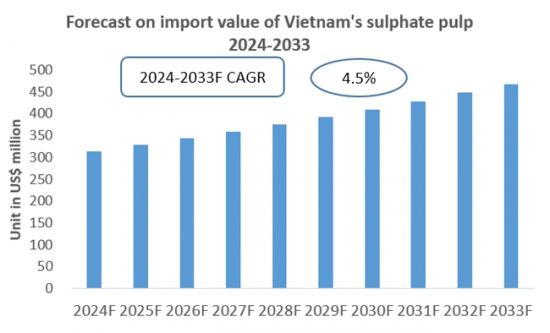

第8章 ベトナムの硫酸塩パルプ輸入の予測 (2024~2033年)

List of Charts

- Chart 2021-2024 Import Value and Volume of Sulphate Pulp in Vietnam

- Chart 2021-2024 Average Import Price of Sulphate Pulp in Vietnam

- Chart 2021-2024 Import Dependency of Sulphate Pulp in Vietnam

- Chart Top 10 Import Sources of Sulphate Pulp in Vietnam (2021-2024)

- Chart Top 10 Import Sources of Sulphate Pulp in Vietnam (2022)

- Chart Top 10 Import Sources of Sulphate Pulp in Vietnam (2023)

- Chart Top 10 Import Sources of Sulphate Pulp in Vietnam (2024)

- Chart Top 10 Suppliers of Sulphate Pulp Imports in Vietnam (2021-2024)

- Chart Top 10 Suppliers of Sulphate Pulp Imports in Vietnam (2022)

- Chart Top 10 Suppliers of Sulphate Pulp Imports in Vietnam (2023)

- Chart Top 10 Suppliers of Sulphate Pulp Imports in Vietnam (2024)

- Chart Value and Volume of Sulphate Pulp Imported from Indonesia to Vietnam (2021-2024)

- Chart Value and Volume of Sulphate Pulp Imported from United States to Vietnam (2021-2024)

- Chart Value and Volume of Sulphate Pulp Imported from Canada to Vietnam (2021-2024)

- Chart Value and Volume of Sulphate Pulp Imported from Hong Kong to Vietnam (2021-2024)

- Chart Top 10 Importers of Sulphate Pulp in Vietnam (2021-2024)

- Chart Top 10 Importers of Sulphate Pulp in Vietnam (2022)

- Chart Top 10 Importers of Sulphate Pulp in Vietnam (2023)

- Chart Top 10 Importers of Sulphate Pulp in Vietnam (2024)

- Chart Forecast for the Import of Sulphate Pulp in Vietnam (2024-2033)

Sulphate pulp, also known as kraft pulp, is a type of chemical pulp produced using the Sulphate process. It is the most widely used and highest-yielding pulp globally. Sulphate pulp is characterized by its high strength, durability, resistance to aging, bleachability, and strong chemical resistance, as well as its wide range of raw material sources. It is used to manufacture high-strength and high-requirement paper products, including kraft paper, paper bags, packaging paper, corrugated cardboard, and cultural paper.

INFOGRAPHICS

Due to its superior physical and chemical properties, sulphate pulp holds a significant position in the global pulp and paper industry, especially for applications requiring high paper strength and durability. Major producers in the Asia-Pacific region include companies such as Chenming Paper and Asia Pacific Resources International Limited (APRIL), while global producers include UPM, Stora Enso, International Paper, and Canfor Pulp. Vietnam has limited sulphate pulp production capacity and needs to import large quantities annually.

In recent years, Vietnam's manufacturing industry has developed rapidly, with the paper industry and its downstream sectors, such as packaging, printing, and advertising, showing considerable market expansion potential. According to CRI, Vietnam consumes over 3 million tons of paper annually, with packaging paper accounting for more than 60%. In the coming years, with the development of Vietnam's economy and manufacturing sectors, the demand for various types of paper, especially packaging paper, will continue to grow, leading to an increase in the import volume of sulphate pulp.

According to CRI, Vietnam faces a significant shortage of domestic raw materials for papermaking, heavily relying on imports. Most paper mills in Vietnam need to import pulp to meet production needs, leading to Vietnam importing more than 500,000 tons of pulp annually. The data of CRI indicates that in 2023, Vietnam's total import value of Sulphate pulp was about US$ 300 million. CRI data also shows that from January to May 2024, Vietnam's total import value of Sulphate pulp has exceeded US$ 100 million, with market demand continuing to grow.

CRI concludes that the main sources of Vietnam's Sulphate pulp imports from 2021 to 2024 include Indonesia, the United States, and Hong Kong. Key exporters of Sulphate pulp to Vietnam include Asia Pulp & Paper (APP), EKMAN PULP AND PAPER LIMITED, and APRIL Group.

The primary importers of sulphate pulp in Vietnam are paper and paper product manufacturers, distributors, and foreign trading companies, primarily foreign-invested enterprises. Many are subsidiaries of multinational companies in the paper industry. CRI identifies that major importer of sulphate pulp in Vietnam includes BACGIANG IMPORT - EXPORT JOINT STOCK COMPANY, NITTOKU VIETNAM CO, LTD., and IMEXCO BACGIANG.

Overall, with Vietnam's population growth and continued advancement of related manufacturing industries, the consumption of sulphate pulp in Vietnam will continue to increase. CRI suggests that in the long term, reducing plastic waste is becoming a global trend, especially in major economies. The sustainable and environmentally friendly trend of replacing plastic waste and plastic bags with paper packaging is growing across all age groups, particularly among young people. Therefore, the market demand for the global and Asian paper and paper products industry is expected to grow continuously. In the coming years, the import of sulphate pulp in Vietnam is expected to maintain its growth trend.

Topics covered:

The Import and Export of Sulphate Pulp in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Sulphate Pulp in Vietnam (2021-2024)

Total Import Value and Percentage Change of Sulphate Pulp in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Sulphate Pulp in Vietnam (January-May 2024)

Total Import Value and Percentage Change of Sulphate Pulp in Vietnam (January-May 2024)

Average Import Price of Sulphate Pulp in Vietnam (2021-2024)

Top 10 Sources of Sulphate Pulp Imports in Vietnam and Their Supply Volume

Top 10 Suppliers in the Import Market of Sulphate Pulp in Vietnam and Their Supply Volume

Top 10 Importers of Sulphate Pulp in Vietnam and Their Import Volume

How to Find Distributors and End Users of Sulphate Pulp in Vietnam

How Foreign Enterprises Enter the Pulp, Paper and Paper Products Market of Vietnam

Forecast for the Import of Sulphate Pulp in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Pulp, Paper and Paper Products Market

2 Analysis of Sulphate Pulp Imports in Vietnam (2021-2024)

- 2.1 Import Scale of Sulphate Pulp in Vietnam

- 2.1.1 Import Value and Volume of Sulphate Pulp in Vietnam

- 2.1.2 Import Prices of Sulphate Pulp in Vietnam

- 2.1.3 Apparent Consumption of Sulphate Pulp in Vietnam

- 2.1.4 Import Dependency of Sulphate Pulp in Vietnam

- 2.2 Major Sources of Sulphate Pulp Imports in Vietnam

3 Analysis of Major Sources of Sulphate Pulp Imports in Vietnam (2021-2024)

- 3.1 Indonesia

- 3.1.1 Analysis of Import Value and Volume

- 3.1.2 Analysis of Average Import Price

- 3.2 United States

- 3.2.1 Analysis of Import Value and Volume

- 3.2.2 Analysis of Average Import Price

- 3.3 Hong Kong

- 3.3.1 Analysis of Import Value and Volume

- 3.3.2 Analysis of Average Import Price

- 3.4 Canada

- 3.5 Brazil

- 3.6 Japan

4 Analysis of Major Suppliers in the Import Market of Sulphate Pulp in Vietnam (2021-2024)

- 4.1 Asia Pulp & Paper (APP)

- 4.1.1 Company Introduction

- 4.1.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.2 EKMAN PULP AND PAPER LIMITED

- 4.2.1 Company Introduction

- 4.2.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.3 APRIL Group

- 4.3.1 Company Introduction

- 4.3.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.4 Exporter 4

- 4.4.1 Company Introduction

- 4.4.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.5 Exporter 5

- 4.5.1 Company Introduction

- 4.5.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.6 Exporter 6

- 4.6.1 Company Introduction

- 4.6.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.7 Exporter 7

- 4.7.1 Company Introduction

- 4.7.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.8 Exporter 8

- 4.8.1 Company Introduction

- 4.8.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.9 Exporter 9

- 4.9.1 Company Introduction

- 4.9.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.10 Exporter 10

- 4.10.1 Company Introduction

- 4.10.2 Analysis of Sulphate Pulp Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Sulphate Pulp in Vietnam (2021-2024)

- 5.1 BACGIANG IMPORT - EXPORT JOINT STOCK COMPANY

- 5.1.1 Company Introduction

- 5.1.2 Analysis of Sulphate Pulp Imports

- 5.2 NITTOKU VIETNAM CO, LTD.

- 5.2.1 Company Introduction

- 5.2.2 Analysis of Sulphate Pulp Imports

- 5.3 IMEXCO BACGIANG

- 5.3.1 Company Introduction

- 5.3.2 Analysis of Sulphate Pulp Imports

- 5.4 Importer 4

- 5.4.1 Company Introduction

- 5.4.2 Analysis of Sulphate Pulp Imports

- 5.5 Importer 5

- 5.5.1 Company Introduction

- 5.5.2 Analysis of Sulphate Pulp Imports

- 5.6 Importer 6

- 5.6.1 Company Introduction

- 5.6.2 Analysis of Sulphate Pulp Imports

- 5.7 Importer 7

- 5.7.1 Company Introduction

- 5.7.2 Analysis of Sulphate Pulp Imports

- 5.8 Importer 8

- 5.8.1 Company Introduction

- 5.8.2 Analysis of Sulphate Pulp Imports

- 5.9 Importer 9

- 5.9.1 Company Introduction

- 5.9.2 Analysis of Sulphate Pulp Imports

- 5.10 Importer 10

- 5.10.1 Company Introduction

- 5.10.2 Analysis of Sulphate Pulp Imports

6. Monthly Analysis of Sulphate Pulp Imports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Import Value and Volume

- 6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Sulphate Pulp Imports in Vietnam

- 7.1 Policy

- 7.1.1 Current Import Policies

- 7.1.2 Trend Predictions for Import Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Sulphate Pulp Production Capacity in Vietnam

- 7.3 Technology

8. Forecast for the Import of Sulphate Pulp in Vietnam, 2024-2033

Disclaimer

Service Guarantees