|

|

市場調査レポート

商品コード

1231836

東南アジアのペイデイローン業界(2023年~2032年)Research Report on Southeast Asia Payday Loan Industry 2023-2032 |

||||||

| 東南アジアのペイデイローン業界(2023年~2032年) |

|

出版日: 2023年03月01日

発行: China Research and Intelligence

ページ情報: 英文 80 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

東南アジア経済の急速な発展に伴い、中小企業や零細企業の数が増加しており、運転資本に対する需要も高まっています。

当レポートでは、東南アジアのペイデイローン業界について調査分析し、主な促進要因、課題と機会、COVID-19の影響などの情報を提供しています。

サンプルビュー

目次

第1章 シンガポールのペイデイローン業界の分析

- シンガポールのペイデイローン業界の開発環境

- 地域

- 人口

- 経済

- シンガポールの最低賃金

- シンガポールのペイデイローン業界の経営(2023年~2032年)

- 供給

- 需要

- シンガポールの主なペイデイローン企業の分析

第2章 タイのペイデイローン業界の分析

- タイのペイデイローン業界の開発環境

- 地域

- 人口

- 経済

- タイの最低賃金

- タイのペイデイローン業界の経営(2023年~2032年)

- 供給

- 需要

- タイの主なペイデイローン企業の分析

第3章 フィリピンのペイデイローン業界の分析

- フィリピンのペイデイローン業界の開発環境

- 地域

- 人口

- 経済

- フィリピンの最低賃金

- フィリピンのペイデイローン業界の経営(2023年~2032年)

- 供給

- 需要

- フィリピンの主なペイデイローン企業の分析

第4章 マレーシアのペイデイローン業界の分析

- マレーシアのペイデイローン業界の開発環境

- 地域

- 人口

- 経済

- マレーシアの最低賃金

- マレーシアのペイデイローン業界の経営(2023年~2032年)

- 供給

- 需要

- マレーシアの主なペイデイローン企業の分析

第5章 インドネシアのペイデイローン業界の分析

- インドネシアのペイデイローン業界の開発環境

- 地域

- 人口

- 経済

- インドネシアの最低賃金

- インドネシアのペイデイローン業界の経営(2023年~2032年)

- 供給

- 需要

- インドネシアの主なペイデイローン企業の分析

第6章 ベトナムのペイデイローン業界の分析

- ベトナムのペイデイローン業界の開発環境

- 地域

- 人口

- 経済

- ベトナムの最低賃金

- ベトナムのペイデイローン業界の経営(2023年~2032年)

- 供給

- 需要

- ベトナムの主なペイデイローン企業の分析

第7章 ミャンマーのペイデイローン業界の分析

- ミャンマーのペイデイローン業界の開発環境

- 地域

- 人口

- 経済

- ミャンマーの最低賃金

- ミャンマーのペイデイローン業界の経営(2023年~2032年)

- 供給

- 需要

- ミャンマーの主なペイデイローン企業の分析

第8章 ブルネイのペイデイローン業界の分析

- ブルネイのペイデイローン業界の開発環境

- 地域

- 人口

- 経済

- ブルネイの最低賃金

- ブルネイのペイデイローン業界の経営(2023年~2032年)

- 供給

- 需要

- 輸出入状況

- ブルネイの主なペイデイローン企業の分析

第9章 ラオスのペイデイローン業界の分析

- ラオスのペイデイローン業界の開発環境

- 地域

- 人口

- 経済

- ラオスの最低賃金

- ラオスのペイデイローン業界の経営(2023年~2032年)

- 供給

- 需要

- ラオスの主なペイデイローン企業の分析

第10章 カンボジアのペイデイローン業界の分析

- カンボジアのペイデイローン業界の開発環境

- 地域

- 人口

- 経済

- カンボジアの最低賃金

- カンボジアのペイデイローン業界の経営(2023年~2032年)

- 供給

- 需要

- カンボジアの主なペイデイローン企業の分析

第11章 東南アジアのペイデイローン業界の見通し(2023年~2032年)

- 東南アジアのペイデイローン業界の発展に影響を与える要因の分析

- 有利な要因

- 不利な要因

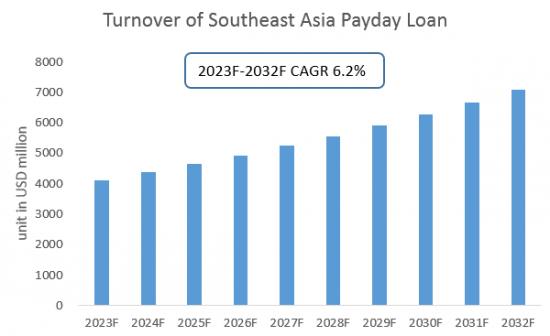

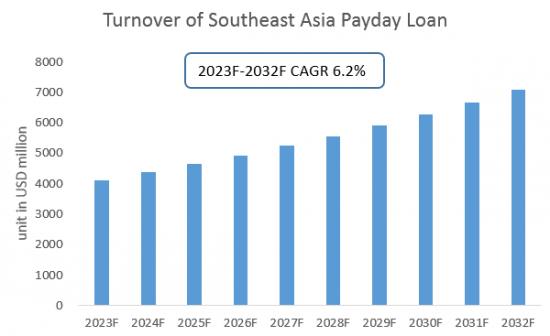

- 東南アジアのペイデイローン業界の規模の予測(2023年~2032年)

- 東南アジアのペイデイローン業界の需要の分析(2023年~2032年)

- ペイデイローン業界に対するCOVID-19の流行の影響

Payday loans, short for small cash loans, are small loans, usually within US$1,000 for a single loan. The loan period is short, generally less than one year, or even less than one month. The borrower does not need collateral to borrow money, and there is no restriction on the purpose of borrowing. Payday loans are fast and easy to borrow money.

SAMPLE VIEW

Southeast Asia region has a huge population base with a young demographic structure. According to statistics, there are about 160 million new generation people in Southeast Asia, accounting for about 24% of the total population in Southeast Asia. With the rapid development of Southeast Asia's economy, the number of small and micro businesses is also growing, and the demand for working capital is also on the rise.

At the same time, smartphone penetration in Southeast Asia is gradually growing and mobile Internet is booming. However, most countries in Southeast Asia are still cash-based, with generally poor basic financial facilities and low credit card penetration rates, such as Vietnam where credit card penetration is only about 4%, and huge demand for financial lending has yet to be met. As countries accelerate the construction of digital economy, the payday loan industry in Southeast Asia has great room for growth.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of over 600 million by the end of 2021, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI's analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021. The most economically advanced countries in Southeast Asia do not have a set minimum wage, with the actual minimum wage exceeding US$400/month (for foreign maids), while the lowest minimum wage level in Myanmar is only about US$93/month.

CRI expects the cash lending industry in Southeast Asia to continue to grow from 2023-2032, despite the tightening of government regulations on Internet financial products.

Topics covered:

- Southeast Asia Payday Loan Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Payday Loan Industry?

- Which Companies are the Major Players in Southeast Asia Payday Loan Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Payday Loan Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Payday Loan Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Payday Loan Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Payday Loan Industry Market?

- Which Segment of Southeast Asia Payday Loan Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Payday Loan Industry?

Table of Contents

1 Analysis of the Payday Loan Industry in Singapore

- 1.1 Singapore Payday Loan Industry Development Environment

- 1.1.1 Geography

- 1.1.2 Population

- 1.1.3 Economy

- 1.1.4 Minimum Wage in Singapore

- 1.2 Singapore Payday Loan Industry Operation 2023-2032

- 1.2.1 Supply

- 1.2.2 Demand

- 1.3 Analysis of Major Payday Loan Companies in Singapore

2 Analysis of the Payday Loan Industry in Thailand

- 2.1 Thailand Payday Loan Industry Development Environment

- 2.1.1 Geography

- 2.1.2 Population

- 2.1.3 Economy

- 2.1.4 Thailand Minimum Wage

- 2.2 Thailand Payday Loan Industry Operation 2023-2032

- 2.2.1 Supply

- 2.2.2 Demand

- 2.3 Analysis of Major Payday Loan Companies in Thailand

3 Analysis of the Payday Loan Industry in the Philippines

- 3.1 Development Environment of the Payday Loan Industry in the Philippines

- 3.1.1 Geography

- 3.1.2 Population

- 3.1.3 Economy

- 3.1.4 Minimum Wage in the Philippines

- 3.2 Philippine Payday Loan Industry Operation 2023-2032

- 3.2.1 Supply

- 3.2.2 Demand

- 3.3 Analysis of Major Payday Loan Companies in the Philippines

4 Malaysia Payday Loan Industry Analysis

- 4.1 Malaysia Payday Loan Industry Development Environment

- 4.1.1 Geography

- 4.1.2 Population

- 4.1.3 Economy

- 4.1.4 Minimum Wage in Malaysia

- 4.2 Malaysia Payday Loan Industry Operation 2023-2032

- 4.2.1 Supply

- 4.2.2 Demand

- 4.3 Analysis of Major Payday Loan Companies in Malaysia

5 Indonesia Payday Loan Industry Analysis

- 5.1 Indonesia Payday Loan Industry Development Environment

- 5.1.1 Geography

- 5.1.2 Population

- 5.1.3 Economy

- 5.1.4 Minimum Wage in Indonesia

- 5.2 Indonesia Payday Loan Industry Operation 2023-2032

- 5.2.1 Supply

- 5.2.2 Demand

- 5.3 Analysis of Major Payday Loan Companies in Indonesia

6 Vietnam Payday Loan Industry Analysis

- 6.1 Vietnam Payday Loan Industry Development Environment

- 6.1.1 Geography

- 6.1.2 Population

- 6.1.3 Economy

- 6.1.4 Minimum Wage in Vietnam

- 6.2 Vietnam Payday Loan Industry Operation 2023-2032

- 6.2.1 Supply

- 6.2.2 Demand

- 6.3 Analysis of Major Payday Loan Companies in Vietnam

7 Myanmar Payday Loan Industry Analysis

- 7.1 Development Environment of Payday Loan Industry in Myanmar

- 7.1.1 Geography

- 7.1.2 Population

- 7.1.3 Economy

- 7.1.4 Myanmar Minimum Wage

- 7.2 Myanmar Payday Loan Industry Operation 2023-2032

- 7.2.1 Supply

- 7.2.2 Demand

- 7.3 Analysis of Major Payday Loan Companies in Myanmar

8 Brunei Payday Loan Industry Analysis

- 8.1 Brunei Payday Loan Industry Development Environment

- 8.1.1 Geography

- 8.1.2 Population

- 8.1.3 Economy

- 8.1.4 Brunei Minimum Wage

- 8.2 Brunei Payday Loan Industry Operation 2023-2032

- 8.2.1 Supply

- 8.2.2 Demand

- 8.2.3 Import and Export Situation

- 8.3 Analysis of Major Payday Loan Companies in Brunei

9 Analysis of the Payday Loan Industry in Laos

- 9.1 Development Environment of Laos Payday Loan Industry

- 9.1.1 Geography

- 9.1.2 Population

- 9.1.3 Economy

- 9.1.4 Minimum Wage in Laos

- 9.2 Laos Payday Loan Industry Operation 2023-2032

- 9.2.1 Supply

- 9.2.2 Demand

- 9.3 Analysis of Major Payday Loan Companies in Laos

10 Analysis of the Payday Loan Industry in Cambodia

- 10.1 Cambodia Payday Loan Industry Development Environment

- 10.1.1 Geography

- 10.1.2 Population

- 10.1.3 Economy

- 10.1.4 Minimum Wage in Cambodia

- 10.2 Cambodia Payday Loan Industry Operation in 2023-2032

- 10.2.1 Supply

- 10.2.2 Demand

- 10.3 Analysis of Major Payday Loan Companies in Cambodia

11 Southeast Asia Payday Loan Industry Outlook 2023-2032

- 11.1 Analysis of Factors Influencing the Development of Payday Loan Industry in Southeast Asia

- 11.1.1 Favorable Factors

- 11.1.2 Unfavorable Factors

- 11.2 Southeast Asia Payday Loan Industry Size Forecast 2023-2032

- 11.3 Southeast Asia Payday Loan Industry Demand Analysis 2023-2032

- 11.4 Impact of COVID -19 Epidemic on Payday Loan Industry