|

|

市場調査レポート

商品コード

1783763

配線用遮断器の世界市場:市場規模の分析 (用途別、最終用途別、地域別) と将来予測 (2025~2035年)Global Molded Case Circuit Breakers Market Size Study & Forecast, by Application (Industrial, Commercial, Residential, Institutional), by End Use (Power Distribution, Motor Control, Lighting Control), and Regional Forecasts 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 配線用遮断器の世界市場:市場規模の分析 (用途別、最終用途別、地域別) と将来予測 (2025~2035年) |

|

出版日: 2025年08月04日

発行: Bizwit Research & Consulting LLP

ページ情報: 英文 285 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界の配線用遮断器(モールドケース遮断器)の市場規模は2024年に約65億8,000万米ドルとなり、予測期間中(2025~2035年)にCAGR4.01%で成長する見通しです。

電化が進む電力依存の世界では、配線用遮断器(MCCB)は過負荷や短絡から電気回路を保護する上で極めて重要な役割を果たしています。これらのデバイスは、安全で中断のないオペレーションを保証するため、集合住宅、商業ビル、工業製造プラント、および施設インフラへの統合が進んでいます。世界のインフラ開発が加速し、電気規格が強化されるにつれて、MCCBの需要は従来の用途だけでなく、スマートグリッド統合や持続可能なエネルギーシステム向けにも急増しています。

MCCBの台頭の顕著なきっかけとなったのは、従来のインフラから最新のインフラまで、エネルギー効率の高いインテリジェントな電気システムを求める動きが強まっていることです。アーキテクチャは自動エネルギー制御へと移行しており、MCCBは、特にIoT対応機能を組み込んだMCCBは、こうした新しいアーキテクチャに不可欠なコンポーネントとなっています。スマートビルディング技術の進歩とエネルギー監視システムの普及に伴い、MCCBは単純な保護装置から多機能な制御コンポーネントへと進化しています。産業運営において、これらのブレーカは、高圧電力システムの管理、稼働時間の向上、ダウンタイムに関連するコストの削減において重要な役割を果たしており、事業継続のために不可欠なものとなっています。

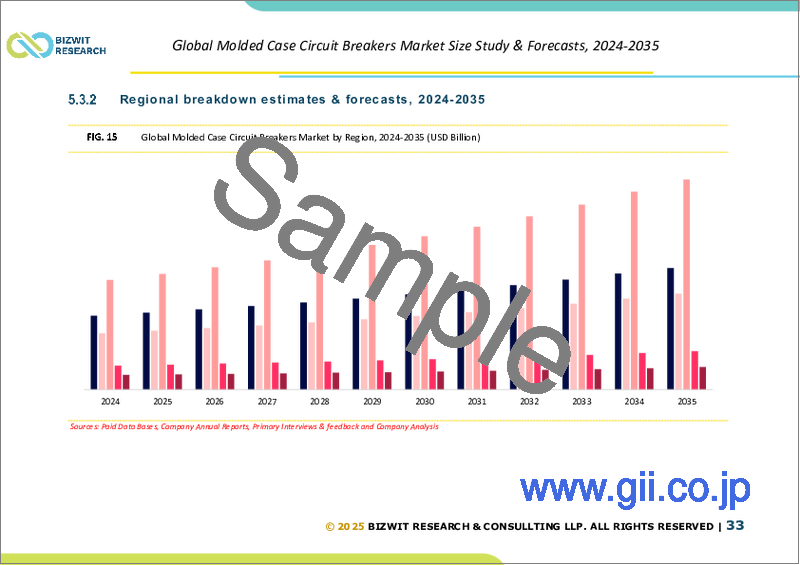

地域別では、北米が市場シェアの大部分を占めると予想されます。これは、成熟した産業部門と、商業および住宅環境における高度な回路保護システムの広範な採用によるものです。米国は、電力網の近代化が進んでおり、データセンターや再生可能エネルギー設備への投資が活発であるため、依然として最前線にあります。ドイツと英国に代表される欧州は、電気安全に関する厳しい規制の枠組みと、エネルギー効率の高い建物へのシフトの増加により、力強い上昇傾向を示しています。一方、アジア太平洋は、大規模な都市化、工業生産高の増加、中国、インド、東南アジアのエネルギーインフラに対する政府の大規模な投資を原動力として、予測期間中に最も速いペースで成長すると予測されています。

当レポートの目的は、近年のさまざまなセグメントと国の市場規模を明らかにし、今後数年間の市場規模を予測することです。当レポートは、分析対象国における業界の質的・量的側面の両方を盛り込むよう設計されています。また、市場の将来的な成長を規定する促進要因や課題などの重要な側面に関する詳細な情報も提供しています。さらに、主要企業の競合情勢や製品提供の詳細な分析とともに、利害関係者が投資するためのミクロ市場における潜在的な機会も組み込んでいます。

市場の詳細なセグメントとサブセグメントは以下の通りです:

目次

第1章 世界の配線用遮断器市場:分析範囲・手法

- 分析目的

- 分析手法

- 予測モデル

- 机上分析

- トップダウンとボトムアップのアプローチ

- 分析の属性

- 分析範囲

- 市場の定義

- 市場区分

- 分析前提条件

- 包含と除外

- 制限事項

- 分析対象期間

第2章 エグゼクティブサマリー

- CEO/CXOの立場

- 戦略的洞察

- ESG分析

- 主な分析結果

第3章 世界の配線用遮断器市場:力学分析

- 世界の配線用遮断器市場を左右する市場力学(2024~2035年)

- 促進要因

- エネルギー効率の高い電力インフラへの需要の急増

- 産業オートメーションとスマートグリッドシステムの統合の増加

- 抑制要因

- 初期コストの高さと、老朽化インフラへの実装の複雑さ

- 規制されていない市場では、安価な偽造品が入手可能

- 機会

- 遮断器におけるIoTとデジタル制御の統合

- 新興経済諸国における再生可能エネルギープロジェクトの拡大

第4章 世界の配線用遮断器産業の分析

- ポーターのファイブフォース分析

- 買い手の交渉力

- サプライヤーの交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- ポーターのファイブフォース:予測モデル(2024~2035年)

- PESTEL分析

- 政治的

- 経済的

- 社会的

- 技術的

- 環境的

- 法的

- 主な投資機会

- 主要成功戦略(2025年)

- 市場シェア分析(2024~2025年)

- 世界の価格分析と動向(2025年)

- アナリストの提言と結論

第5章 世界の配線用遮断器の市場規模・予測:用途別(2025~2035年)

- 市場概要

- 産業用

- 商業用

- 家庭用

- 公共用

第6章 世界の配線用遮断器の市場規模・予測:最終用途別(2025~2035年)

- 市場概要

- 配電

- モーター制御

- 照明制御

第7章 世界の配線用遮断器の市場規模・予測:構造の種類別(2025~2035年)

- 固定型

- 引き出し型

第8章 世界の配線用遮断器の市場規模・予測:定格電流別(2025~2035年)

- 100A以下

- 101~250A

- 251~630A

- 630A以上

第9章 世界の配線用遮断器の市場規模・予測:地域別(2025~2035年)

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他アジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ

第10章 競合情報

- 主要市場の戦略

- ABB Ltd.

- 企業概要

- 主要幹部

- 企業のスナップショット

- 財務実績(データの入手可能性によります)

- 製品/サービスポートフォリオ

- 最近の開発

- 市場戦略

- SWOT分析

- Schneider Electric SE

- Eaton Corporation plc

- Mitsubishi Electric Corporation

- Siemens AG

- LS Electric Co., Ltd.

- Fuji Electric Co., Ltd.

- CHINT Group

- General Electric Company

- Legrand SA

- Rockwell Automation, Inc.

- Hitachi Ltd.

- NOARK Electric

- Toshiba Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

The Global Molded Case Circuit Breakers Market is valued at approximately USD 6.58 billion in 2024 and is poised to grow at a compound annual growth rate (CAGR) of 4.01% during the forecast period 2025-2035. In a power-dependent world that is constantly transitioning toward electrification, molded case circuit breakers (MCCBs) play a pivotal role in safeguarding electrical circuits against overloads and short circuits. These devices are increasingly being integrated into residential complexes, commercial buildings, industrial manufacturing plants, and institutional infrastructures to ensure safe and uninterrupted operations. As global infrastructure development accelerates and electrical standards tighten, demand for MCCBs is surging-not just for conventional applications but also for smart grid integration and sustainable energy systems.

A notable catalyst in the rise of MCCBs is the mounting push for energy-efficient and intelligent electrical systems across both legacy and modern infrastructure. Industries are shifting toward automated energy control, and MCCBs-particularly those embedded with IoT-enabled features-are becoming integral components in these new architectures. With the advancement of smart building technologies and the proliferation of energy monitoring systems, MCCBs are evolving from simple protective devices into multifunctional control components. In industrial operations, these breakers play a critical role in managing high-voltage power systems, enhancing uptime, and lowering downtime-related costs-making them indispensable for operational continuity.

From a regional perspective, North America is expected to retain a significant portion of the market share, driven by a matured industrial sector and widespread adoption of advanced circuit protection systems in commercial and residential settings. The United States remains at the forefront due to ongoing modernization of its electrical grid and strong investment in data centers and renewable energy installations. Europe, led by Germany and the UK, is demonstrating a strong upward trend due to strict regulatory frameworks on electrical safety and an increasing shift toward energy-efficient buildings. Meanwhile, the Asia Pacific region is anticipated to grow at the fastest pace over the forecast period, powered by large-scale urbanization, rising industrial output, and significant governmental investment in energy infrastructure across China, India, and Southeast Asia.

Major market players included in this report are:

- ABB Ltd.

- Schneider Electric SE

- Eaton Corporation plc

- Mitsubishi Electric Corporation

- Siemens AG

- LS Electric Co., Ltd.

- Fuji Electric Co., Ltd.

- CHINT Group

- General Electric Company

- Legrand SA

- Rockwell Automation, Inc.

- Hitachi Ltd.

- NOARK Electric

- Toshiba Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

Global Molded Case Circuit Breakers Market Report Scope:

- Historical Data - 2023, 2024

- Base Year for Estimation - 2024

- Forecast period - 2025-2035

- Report Coverage - Revenue forecast, Company Ranking, Competitive Landscape, Growth factors, and Trends

- Regional Scope - North America; Europe; Asia Pacific; Latin America; Middle East & Africa

- Customization Scope - Free report customization (equivalent up to 8 analysts' working hours) with purchase. Addition or alteration to country, regional & segment scope*

The objective of the study is to define market sizes of different segments & countries in recent years and to forecast the values for the coming years. The report is designed to incorporate both qualitative and quantitative aspects of the industry within the countries involved in the study. The report also provides detailed information about crucial aspects, such as driving factors and challenges, which will define the future growth of the market. Additionally, it incorporates potential opportunities in micro-markets for stakeholders to invest, along with a detailed analysis of the competitive landscape and product offerings of key players.

The detailed segments and sub-segments of the market are explained below:

By Application:

- Industrial

- Commercial

- Residential

- Institutional

By End Use:

- Power Distribution

- Motor Control

- Lighting Control

By Construction Type:

- Fixed

- Drawout

By Rated Current:

- Up to 100A

- 101A to 250A

- 251A to 630A

- Above 630A

By Region:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Key Takeaways:

- Market Estimates & Forecast for 10 years from 2025 to 2035.

- Annualized revenues and regional level analysis for each market segment.

- Detailed analysis of geographical landscape with Country level analysis of major regions.

- Competitive landscape with information on major players in the market.

- Analysis of key business strategies and recommendations on future market approach.

- Analysis of competitive structure of the market.

- Demand side and supply side analysis of the market.

Table of Contents

Chapter 1. Global Molded Case Circuit Breakers Market Report Scope & Methodology

- 1.1. Research Objective

- 1.2. Research Methodology

- 1.2.1. Forecast Model

- 1.2.2. Desk Research

- 1.2.3. Top Down and Bottom-Up Approach

- 1.3. Research Attributes

- 1.4. Scope of the Study

- 1.4.1. Market Definition

- 1.4.2. Market Segmentation

- 1.5. Research Assumption

- 1.5.1. Inclusion & Exclusion

- 1.5.2. Limitations

- 1.5.3. Years Considered for the Study

Chapter 2. Executive Summary

- 2.1. CEO/CXO Standpoint

- 2.2. Strategic Insights

- 2.3. ESG Analysis

- 2.4. Key Findings

Chapter 3. Global Molded Case Circuit Breakers Market Forces Analysis

- 3.1. Market Forces Shaping the Global Molded Case Circuit Breakers Market (2024-2035)

- 3.2. Drivers

- 3.2.1. Surge in demand for energy-efficient electrical infrastructure

- 3.2.2. Rising industrial automation and integration of smart grid systems

- 3.3. Restraints

- 3.3.1. High initial costs and complex installation in legacy infrastructure

- 3.3.2. Availability of low-cost counterfeit products in unregulated markets

- 3.4. Opportunities

- 3.4.1. Integration of IoT and digital control in circuit breakers

- 3.4.2. Expansion of renewable energy projects across developing economies

Chapter 4. Global Molded Case Circuit Breakers Industry Analysis

- 4.1. Porter's Five Forces Model

- 4.1.1. Bargaining Power of Buyer

- 4.1.2. Bargaining Power of Supplier

- 4.1.3. Threat of New Entrants

- 4.1.4. Threat of Substitutes

- 4.1.5. Competitive Rivalry

- 4.2. Porter's Five Force Forecast Model (2024-2035)

- 4.3. PESTEL Analysis

- 4.3.1. Political

- 4.3.2. Economical

- 4.3.3. Social

- 4.3.4. Technological

- 4.3.5. Environmental

- 4.3.6. Legal

- 4.4. Top Investment Opportunities

- 4.5. Top Winning Strategies (2025)

- 4.6. Market Share Analysis (2024-2025)

- 4.7. Global Pricing Analysis and Trends 2025

- 4.8. Analyst Recommendation & Conclusion

Chapter 5. Global Molded Case Circuit Breakers Market Size & Forecasts by Application 2025-2035

- 5.1. Market Overview

- 5.2. Industrial

- 5.2.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 5.2.2. Market Size Analysis, by Region, 2025-2035

- 5.3. Commercial

- 5.3.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 5.3.2. Market Size Analysis, by Region, 2025-2035

- 5.4. Residential

- 5.4.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 5.4.2. Market Size Analysis, by Region, 2025-2035

- 5.5. Institutional

- 5.5.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 5.5.2. Market Size Analysis, by Region, 2025-2035

Chapter 6. Global Molded Case Circuit Breakers Market Size & Forecasts by End Use 2025-2035

- 6.1. Market Overview

- 6.2. Power Distribution

- 6.2.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 6.2.2. Market Size Analysis, by Region, 2025-2035

- 6.3. Motor Control

- 6.3.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 6.3.2. Market Size Analysis, by Region, 2025-2035

- 6.4. Lighting Control

- 6.4.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 6.4.2. Market Size Analysis, by Region, 2025-2035

Chapter 7. Global Molded Case Circuit Breakers Market Size & Forecasts by Construction Type 2025-2035

- 7.1. Fixed

- 7.1.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 7.1.2. Market Size Analysis, by Region, 2025-2035

- 7.2. Drawout

- 7.2.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 7.2.2. Market Size Analysis, by Region, 2025-2035

Chapter 8. Global Molded Case Circuit Breakers Market Size & Forecasts by Rated Current 2025-2035

- 8.1. Up to 100A

- 8.1.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 8.1.2. Market Size Analysis, by Region, 2025-2035

- 8.2. 101A to 250A

- 8.2.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 8.2.2. Market Size Analysis, by Region, 2025-2035

- 8.3. 251A to 630A

- 8.3.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 8.3.2. Market Size Analysis, by Region, 2025-2035

- 8.4. Above 630A

- 8.4.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 8.4.2. Market Size Analysis, by Region, 2025-2035

Chapter 9. Global Molded Case Circuit Breakers Market Size & Forecasts by Region 2025-2035

- 9.1. North America

- 9.1.1. U.S.

- 9.1.2. Canada

- 9.2. Europe

- 9.2.1. UK

- 9.2.2. Germany

- 9.2.3. France

- 9.2.4. Spain

- 9.2.5. Italy

- 9.2.6. Rest of Europe

- 9.3. Asia Pacific

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. South Korea

- 9.3.6. Rest of Asia Pacific

- 9.4. Latin America

- 9.4.1. Brazil

- 9.4.2. Mexico

- 9.5. Middle East & Africa

- 9.5.1. UAE

- 9.5.2. Saudi Arabia

- 9.5.3. South Africa

- 9.5.4. Rest of Middle East & Africa

Chapter 10. Competitive Intelligence

- 10.1. Top Market Strategies

- 10.2. ABB Ltd.

- 10.2.1. Company Overview

- 10.2.2. Key Executives

- 10.2.3. Company Snapshot

- 10.2.4. Financial Performance (Subject to Data Availability)

- 10.2.5. Product/Services Port

- 10.2.6. Recent Development

- 10.2.7. Market Strategies

- 10.2.8. SWOT Analysis

- 10.3. Schneider Electric SE

- 10.4. Eaton Corporation plc

- 10.5. Mitsubishi Electric Corporation

- 10.6. Siemens AG

- 10.7. LS Electric Co., Ltd.

- 10.8. Fuji Electric Co., Ltd.

- 10.9. CHINT Group

- 10.10. General Electric Company

- 10.11. Legrand SA

- 10.12. Rockwell Automation, Inc.

- 10.13. Hitachi Ltd.

- 10.14. NOARK Electric

- 10.15. Toshiba Corporation

- 10.16. Hyundai Electric & Energy Systems Co., Ltd.